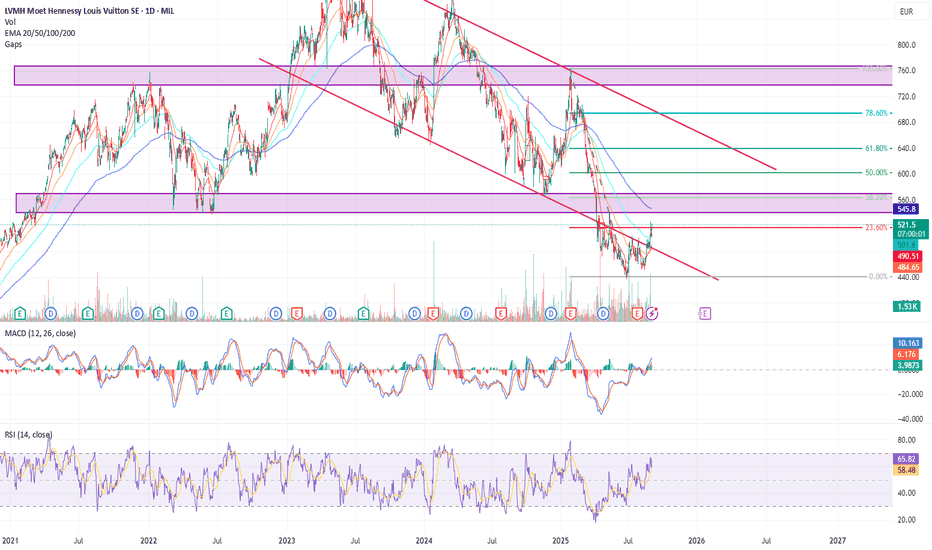

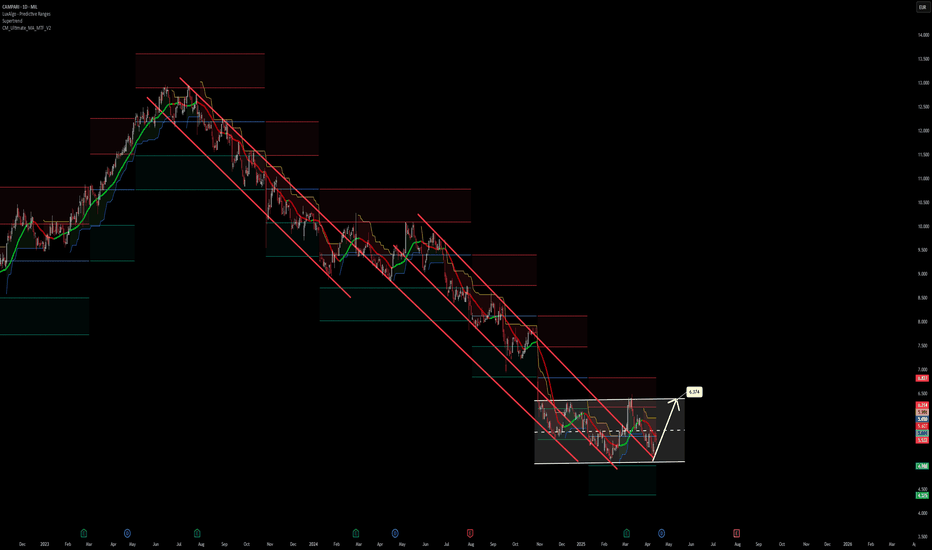

LVMH at a Turning Point: Testing Critical Resistance AheadWith HSBC improving its ratings about the Luxury Sector and upgrading OTC:LVMHF we could see a strong comeback and a great investment opportunity.

Trend:

- Price has been in a downtrend channel (the two pink descending parallel lines) since mid-2021.

- It recently bounced from the lower channel

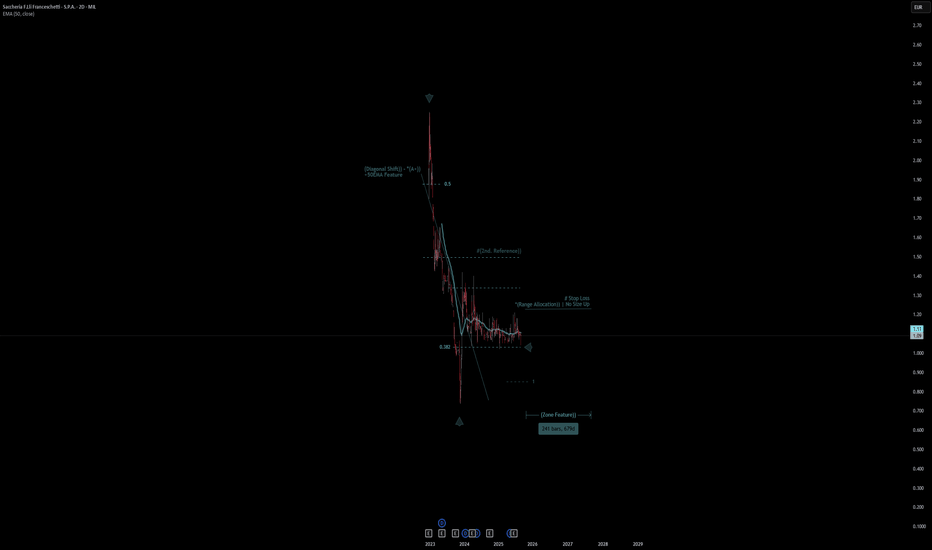

Saccheria F.Lli Franceschetti | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# Saccheria F.Lli Franceschetti

- Double Formation

* (Diagonal Shift)) - *(A+)) - *50EMA - Short Entry - *50EMA | Subdivision 1

* (Range Allocation)) | No Size Up - *1.5RR | Completed

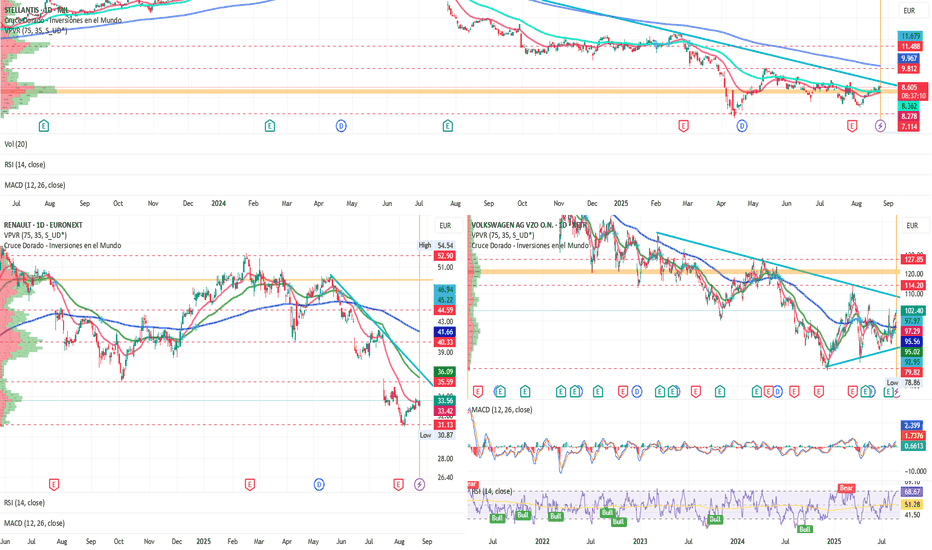

Spain and the European Automobile Industry Under PressureSpain and the European Automobile Industry Under Pressure: China Tightens the Grip as Exports Sink

Ion Jauregui – Analyst at ActivTrades

The engine of the Spanish economy is starting to stall. The automotive industry, which represents 13% of national exports, is facing in 2025 a downturn driven

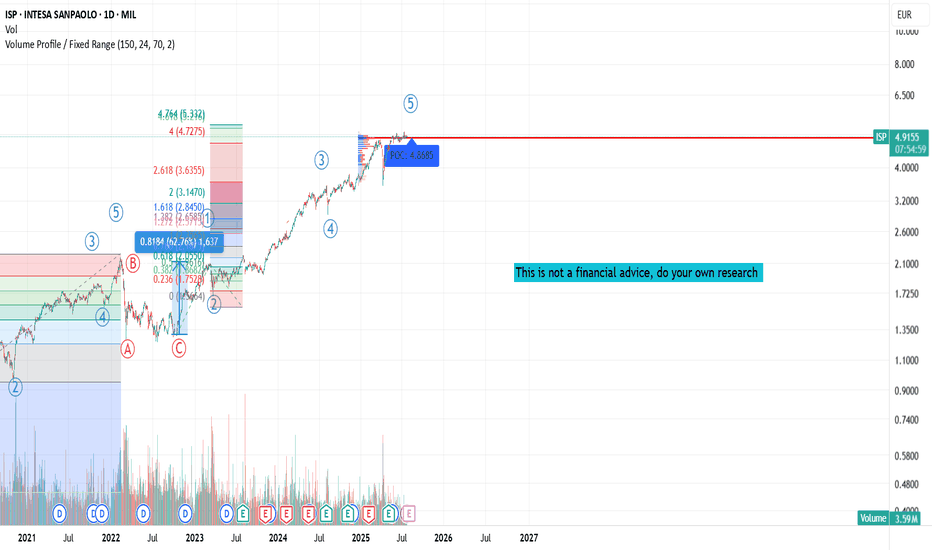

BAMI FOLLOWING UP

Bought more shares – now holding 560 total

Placed a stop-loss at 10.65 on the first 310 shares (average price 10.54)

Remaining shares are protected by long-dated LEAPS puts

No stop needed on those, as they are insured against major drops

How It Works:

If price falls, I secure a gain on the ini

Isp - one of the best ! I've been following Intesa Sanpaolo closely for years.

I started out as an observer, then became a dedicated analyst, and eventually it turned into an investment opportunity.

Between 2018 and 2020, I bought and sold the stock several times, always guided by objective analysis and medium-term strate

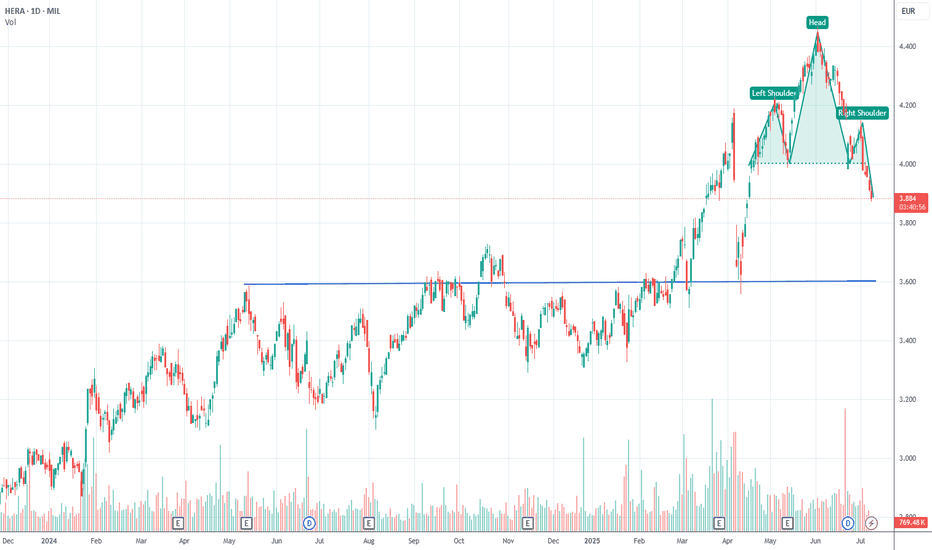

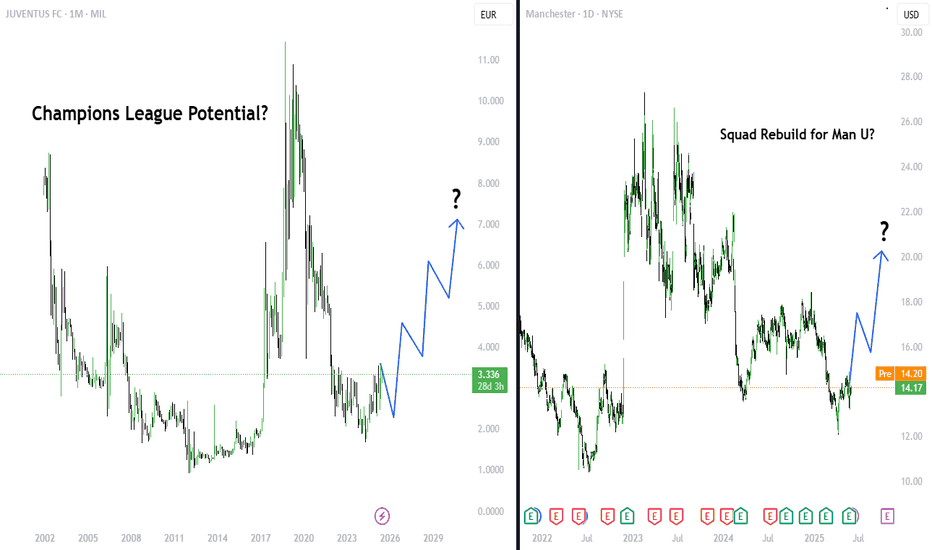

Football season comes to end. Will Juv and Man U be good?Following this season and the last few seasons, we have seen both clubs drop in form. Man U finishing 15th in the prem and Juv finishing 7th in 2022-2023 season, are signs that these 2 clubs are not in the best shape. Currently, we have seen how PSG managed to become the best team in Europe after th

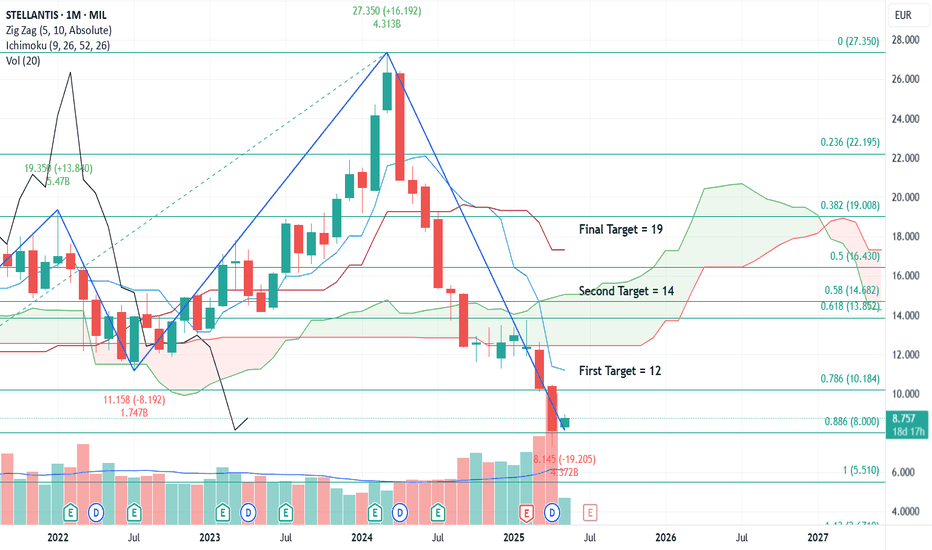

Stellantis a buy idea - May 2025 - 8.757Its still one of the dominant player in EU region and technically now falling into buy zone marking a least of 40% profit from current levels.

Its taking support on monthly Fibonacci levels and harmonic levels.

PS: Please do consider your risk appetite before considering it.

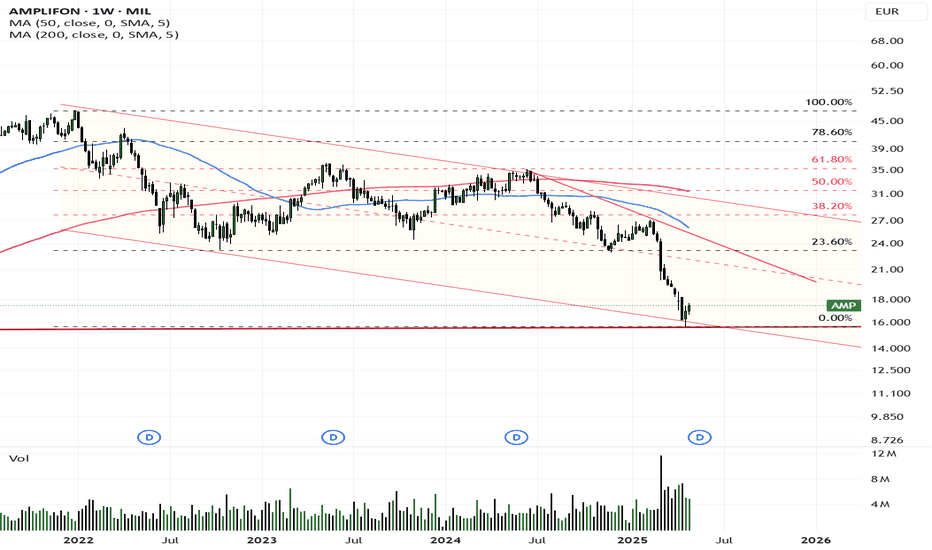

Amplifon potrebbe iniziare un rimbalzo dal livello dei 16/17€Even if the long-term trend is still negative, the prices are at an oversold level and with increasing volumes there is a possibility of a rebound.

1st Target 24% Fibonacci retracement--> area 24€

Excellent Fundamentals

• Solid growth: Revenues +6.6% YoY, with forecast of further growth of 6.3%

Potential Target: €6.3 by Mid-May 2025📈 Trading Idea – Potential Target: €6.3 by Mid-May 2025

The idea of a bullish move toward €6.3 is plausible if:

The price continues to hold the support zone within the current range (around €5.0–€5.2).

We see a strong breakout above the top of the consolidation range, ideally with increased volume.

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Today

SLSanlorenzo S.p.A.

Actual

—

Estimate

—

Today

SOLSOL S.p.A.

Actual

—

Estimate

—

Sep 8

PHNPharmaNutra S.p.A.

Actual

—

Estimate

—

Sep 8

ADBAeroporto Guglielmo Marconi di Bologna S.p.A.

Actual

—

Estimate

—

Sep 8

IOTSECO S.p.A.

Actual

—

Estimate

0.02

EUR

Sep 9

MOLMoltiply Group S.p.A.

Actual

—

Estimate

—

Sep 11

AVIOAvio SpA

Actual

—

Estimate

—

Sep 17

OVSOVS S.p.A.

Actual

—

Estimate

—

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Technology Services | ||||||||

| Electronic Technology | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Retail Trade | ||||||||

| Consumer Non-Durables | ||||||||

| Producer Manufacturing | ||||||||

| Consumer Durables | ||||||||

| Utilities | ||||||||

| Energy Minerals |