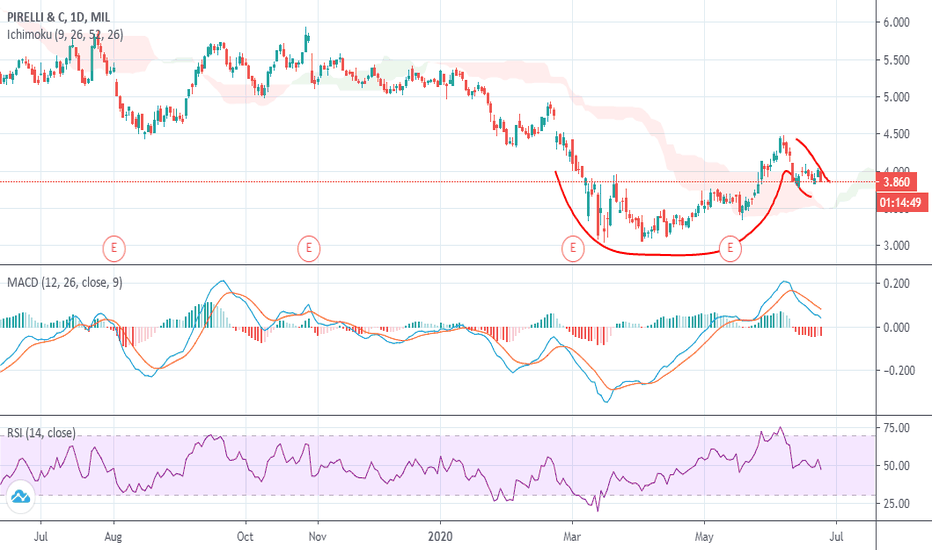

PIRC: Cup and Handle!Hello traders!

The Italian stock Pirelli seems to be forming a nice cup and handle chart pattern! This bullish signal suggests us to wait for the right moment to go long. Besides, the stock price is just above the Ichimoku cloud meaning there are good chances to see a bullish momentum.

Remember to put a stop loss in order to secure your capital!

Not a financial advice.

Enjoy your trade!

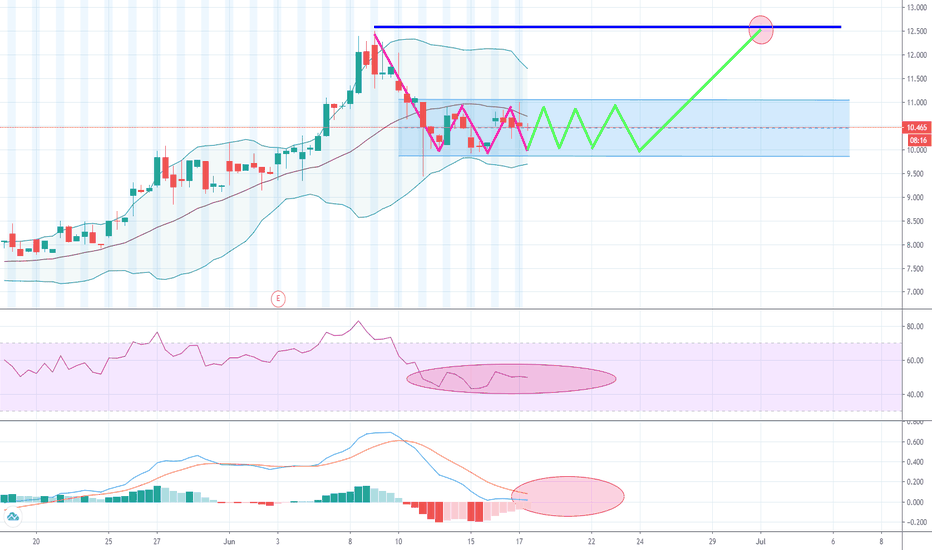

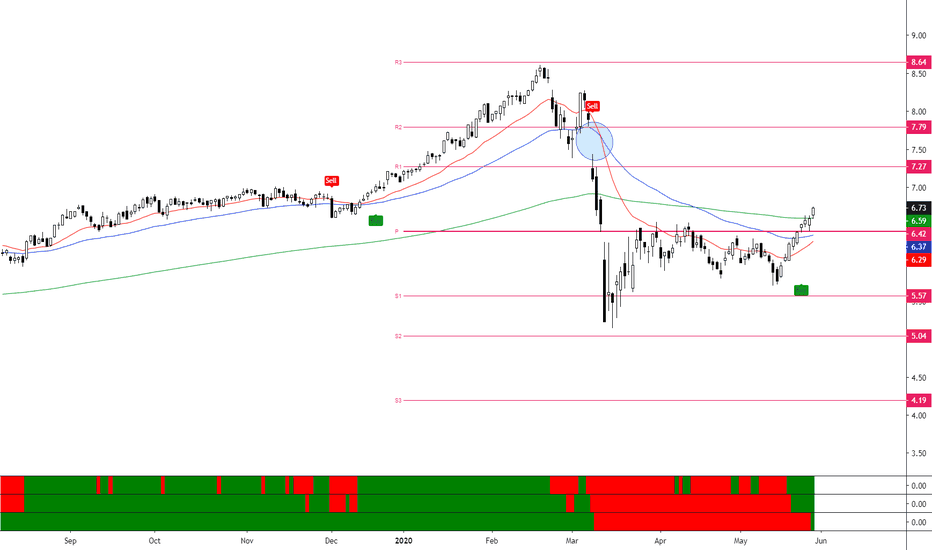

LHA Possible Breakout? Deutsche Lufthansa AG, commonly known as Lufthansa, is the largest German airline which, when combined with its subsidiaries, is the second largest airline in Europe in terms of passengers carried. With the support it received to rescue it during this pandemic, it should be expected that it will definitely survive the pandemic

According to the current trend of LHA, a short term consolidation pattern can be quickly identified from the 4hr time frame. Given that the RSI has been fluctuating between the 40s - 60s range for the past week, short term support and resistance levels have been created at the 11.0 and 9.8 price levels. If a breakout is to happen, this will probably drive up the price to test its previous resistance level from last week at around the 12.5 price level. This can also be predicted from the expected intersection of the MACD which will initiate the trend reversal signal. This should however be confirmed later on using other indicators such as the TD Sequential or Parabolic SAR or fractal strategies which I will do later after the trend becomes more clear within the week.

This is highly probably as more borders in the EU continue to open, a process which is expected to continue until the 1st of July.

Regardless of this, it is hard to predict when the trend will exit consolidation as it is hard to know how fast demand will act to drive up the price, hence this may take more time than expected. Additionally, with more fears of a second wave, this may also act to lower demand, further lengthening the consolidation, hence, this applies to both long and short traders.

Good luck trading!

Of the 15 trades of successful traders and one more thing...JUVE✍ ️ I decided today to write a review of the book by Aleksand elder "inputs And outputs: 15 master classes from trading professionals". And for one thing, tell you about the deal I mentioned earlier, short on Juventus shares.

So it will be TRAINING and ANALYSIS in one post, or interesting thoughts and ideas + a specific signal and action.

👉 I will start with the book and the most important thing, I will tell you 3 TOP ideas of this reading. I usually prefer to identify the most basic of any action (including trading on the stock exchange). Here is an example : out of 100 shares, I choose 10 of the most suitable and make deals on 3 of them, or even better on one (well, this is how it goes). So here, after reading the book, I can say the three best ideas that I learned and use in trading (and not only in trading):

1) the Main secret in trading — there is no secret. Just carefully study the experience of real traders.

2) keeping a diary and analyzing transactions (both unprofitable and profitable) is one of the most important factors for success.

3) it is better Not to tell anyone about your open positions — this greatly affects the result.

👀 Now let's talk briefly about the book "Inputs and outputs: 15 master classes from trading professionals", which is an interview with fifteen traders. Stock traders share their real deals for real money — it is interesting to study the experience of successful, or not so, speculators. It is also interesting to read the opinion of the author of the book, Alexander elder, about each position of these traders. He speaks correctly: "Read, but don't believe traders to the end, they all tend to embellish wins and downplay losses!"

👥 Next I will briefly write about these same traders:

1) sherry Haskell (state of California, trading account in the region of $ 1 million)

2) Fred Schutzman (new York state, trading account over $ 1 million)

3) Andrea Perolo (country of Italy, trading account less than 250,000$)

4) Sohail Rabbani (the country of United Kingdom, the account of the district $1 million)

5) ray Tesla Jr. (Penn state, account in the region of $1 million)

6) James McMahon (Arizona state, account less than$250,000)

7) Gerald Appel (state of new York, the expense of more than$1 million)

8) Michael Brenke (North Carolina state, account less than$250,000)

9) Kerry Lovorn (Alabama, trading account about $ 1 million)

10) Diane Buffalin (Michigan state, account less than$ 250,000)

11) David Weiss (Massachusetts, trading account over $ 1 million)

12) William Doane (Massachusetts, trading account over $ 1 million)

13) Damir Makhmudov (country of Latvia, trading account less than 250,000$)

14) Pascal Villen (country of Belgium, trading account about $ 1 million)

15) Martin Knapp (country Australia, trading account about $ 1 million)

📊 Now about the trades of these traders:

Each trader gives two trades, each with its own charts and indicators. As we understand everything individually and everyone has their own strategy and vision of the market, but the most interesting thing is to watch how Alexander elder passes transactions through his system, shows these entry and exit points on his charts, and tells his vision in detail. I recommend you to study and see — this is an interesting idea.

📘 My conclusions from the book: reading this is both useful and interesting! I recommend it!

It would be great to get this sort of analysis from Alexand elder on your deals.

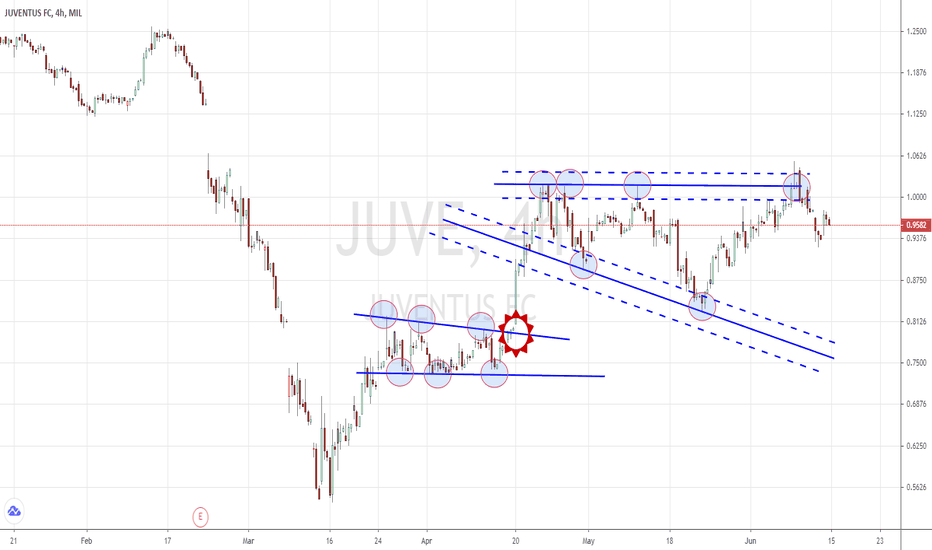

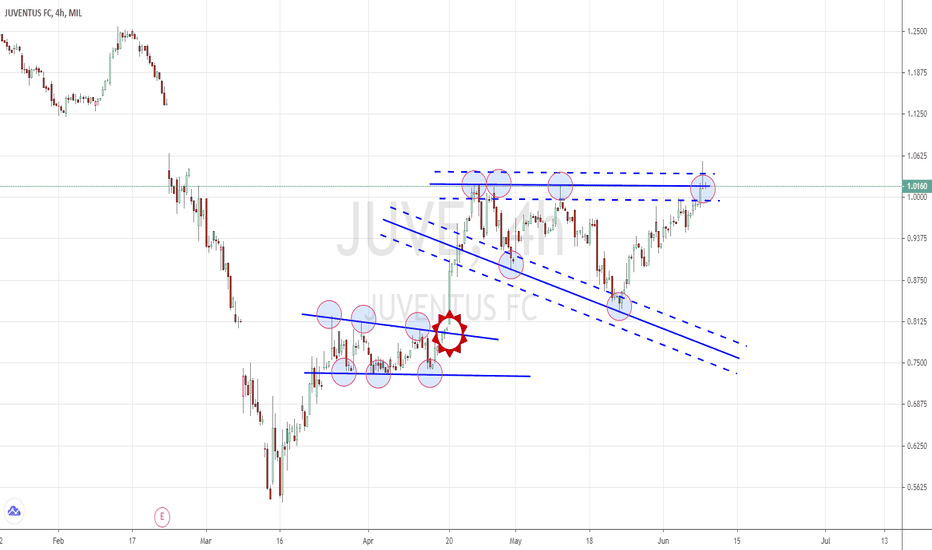

⚽ App now signals for the football club "Juventus". Now this signal has been confirmed and you can enter the position. Our system "4 screens" gives us the go-ahead to enter (by the way, this system is a redesigned system of Alexander elder "3 screens"). Personally, I already entered this position last week. Say guidelines for entry point that are visible on the chart - in € 0.98, stop on 2% of supply in the area of 1,05 Euro, but with a profit and exit point is up to you.

The link to the graph looks like a picture on our system "4 screens" will be in the comments, since the main post is often deleted due to links.

And one more thing, in conclusion, I wanted to add something that I realized from this book — it is better to trade "hidden", not telling anyone about your transactions, as this can greatly affect the results. Recently I watched an interesting movie "money Changers" in which I saw a scene that for me again was like an Epiphany. If you remember the frame where speculators changed rubles for bags of coins and told their "trading idea" to a person from the market, they brought a lot of problems on themselves. So keep your ideas to yourself and share them with your partner investors. That's why I'm tying up with the publication of trading ideas, who is interested, we have an investment Fund Gold_STAR, where all transactions are open and the investor can see everything in their personal account. The results are stable, but remember that this cannot guarantee the same in the future. I will also attach a link to the Fund's statistics in the comments.

I wish you all good reading and good luck in trading!

"Change or die!" - a story about sports. Waiting signal $JUVE Hello everyone Trader and Manager Ivan Kuznetsov are in touch.

I want to tell you an interesting story and share another trading idea.

If you don't want to read about the movie and the ideas from it, I recommend that you scroll down to the trading idea.

about the movie.

I'll start this post by telling you about a movie I recently reviewed. "The man who changed everything" (Moneyball 2011) starring brad pitt.

I got a lot of interesting ideas while watching it, and I definitely recommend it to anyone who connects their fate with trading.

The main and key idea was: "Change or die!". And how else was it possible for a team with the smallest budget in the baseball League to survive, which had already lost leading players?

The team's General Manager was able to find a way out of their situation (or was he lucky?) - he hired an analyst from another team who calculated mathematically the performance of players who were greatly undervalued by the market.

I will not tell you the details, so as not to write spoilers, but I will say that the team showed record results! This once again shows how important it is to look for tools that others underestimate.

Many successful traders calculate their own indicators and indicators, and by checking them on the history, implement them into their system, earn money from this!

In the same way, professional cappers can very likely calculate whether a certain player will score a goal in today's match or not, and use this in their work, earning on betting exchanges.

If you don't believe it, I can prove it to you by experience. But let's talk about business, because we have a great opportunity on the horizon, a sports company, a football club "Juventus" from Italy.

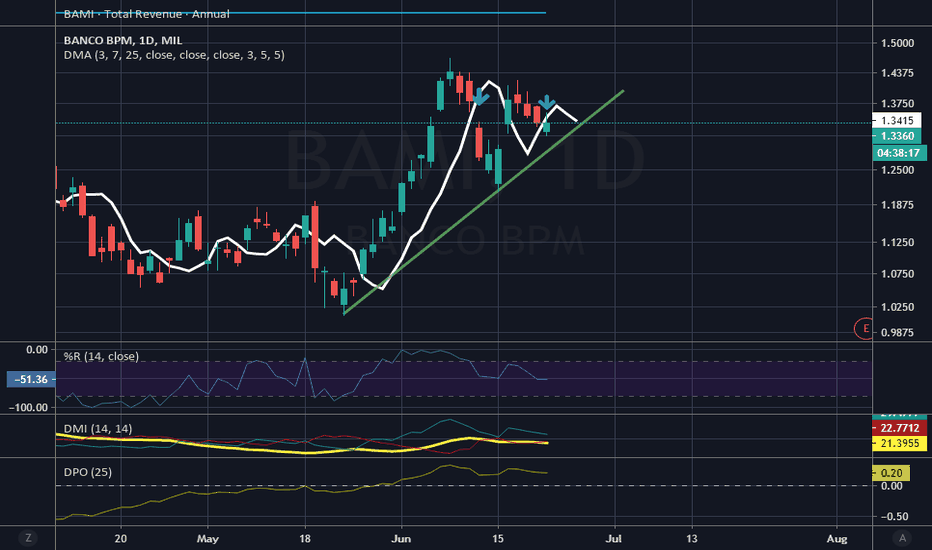

about the $JUVE signal

The technical picture is as follows (see the chart). Quotes came to the "ceiling" at the level of 1 Euro per share and 4 times failed to break them! If we close below 10% of the pullback from this level, it will be a good signal in short.

By the way, my first million on the markets in 2010, I earned it on this formation for the currency pair AUD/USD and who read my book, I think remembers how it was (I'll just attach a picture). Do not forget about the rule of 2% per transaction and 6% per month.

Money management is the most important pillar of successful trading!

PS: About a great actor.

🎬 Brad pitt is an American film, television, and voice actor and film producer. Winner of the Academy award.

In the film "the Man who changed everything", he played the main role. The film is based on a book by Michael M. Lewis, published in 2003, about the Oakland baseball team and its General Manager, Billy bean. Its goal is to create a competitive baseball team, despite financial difficulties. Billy Bean is assisted by an assistant who uses mathematical models of calculation and statistical indicators of key players for his work.

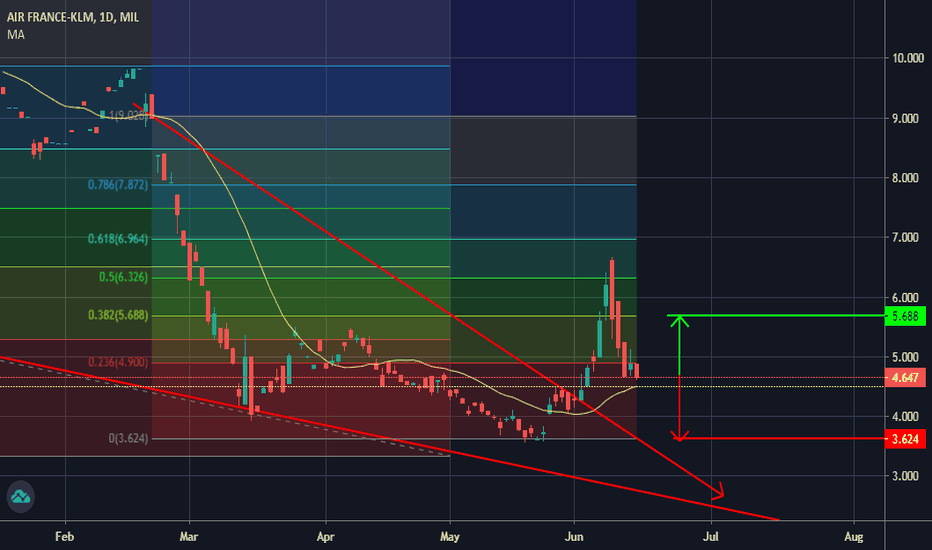

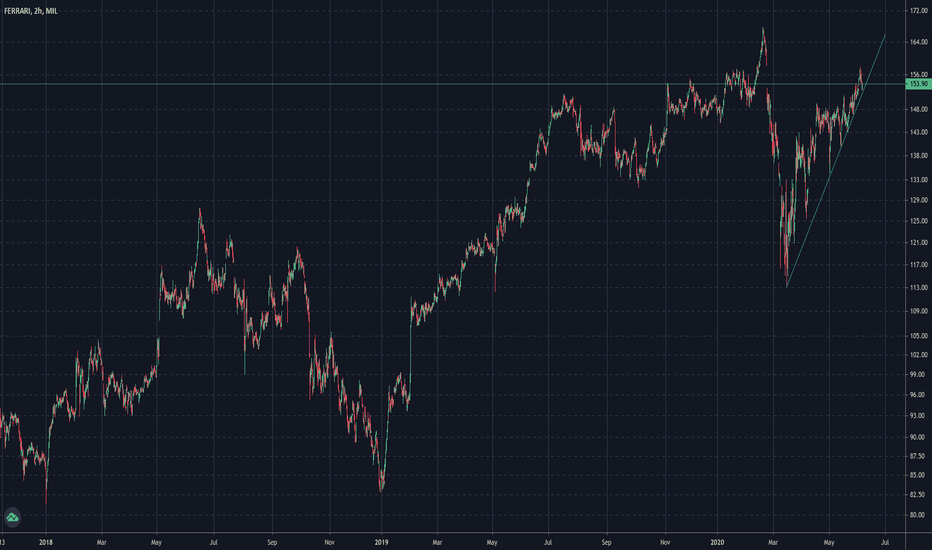

RACE: $165 Long TargetFirst off, please don't take anything I say seriously or as financial advice. As always, this is on an opinion based basis. That being said Ferrari is doing quite well for itself. Among their line of 2020 cars included are the Portofino, GTC4Lusso, F8 Spider, F8 Tributo, 488 Pista, 812 Superfast, SF90 Stradale, etc. The list of new and old cars is ever growing. Many people don't know this, but Ferrari makes alot of different luxury cars. I mean they, just like most car manufacturers, have a long list of product skews. Ferrari's production output of vehicles doesn't have to be that high given the price in comparison to other companies. However, with a nearly $30 billion dollar market cap, they are likely over 8x their yearly revenue in value over the traditional 300 to 330% that goes into valuations. This is because Ferrari unsurprisingly has brand value. Brand value increases equity value. This is why I see (with some resistance), the bullish run continuing to positively retrace towards the $165 price point.

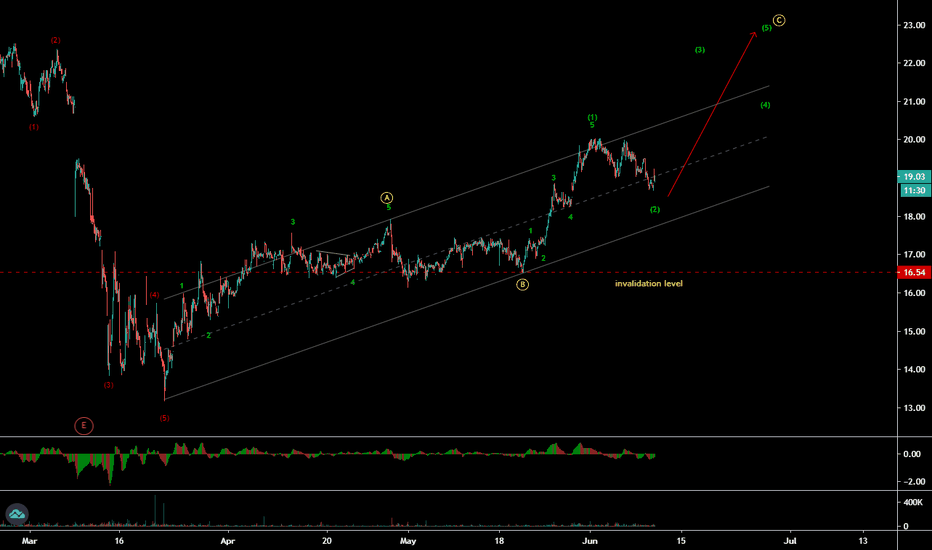

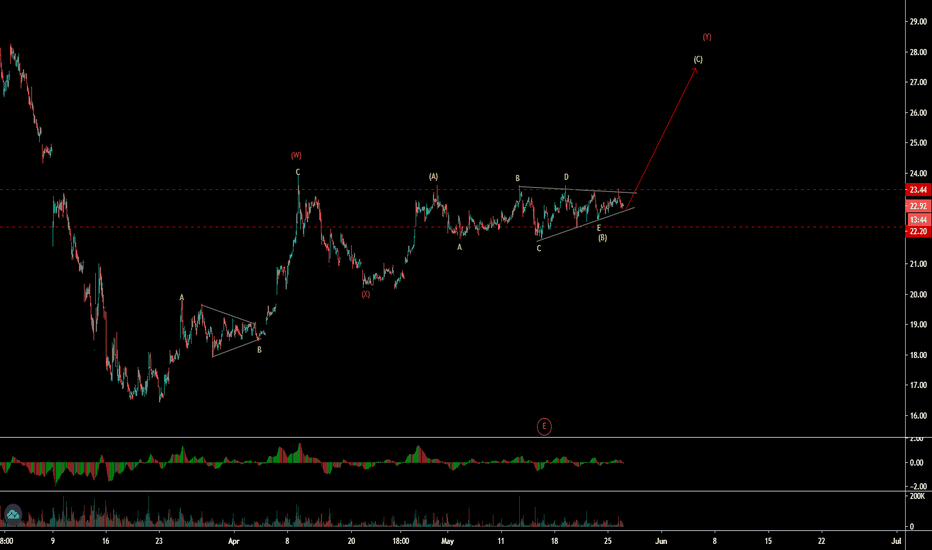

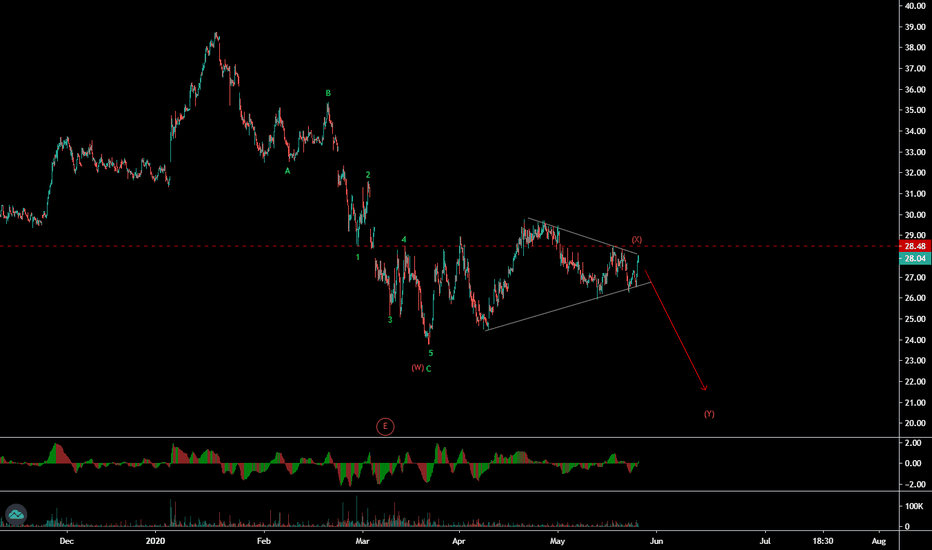

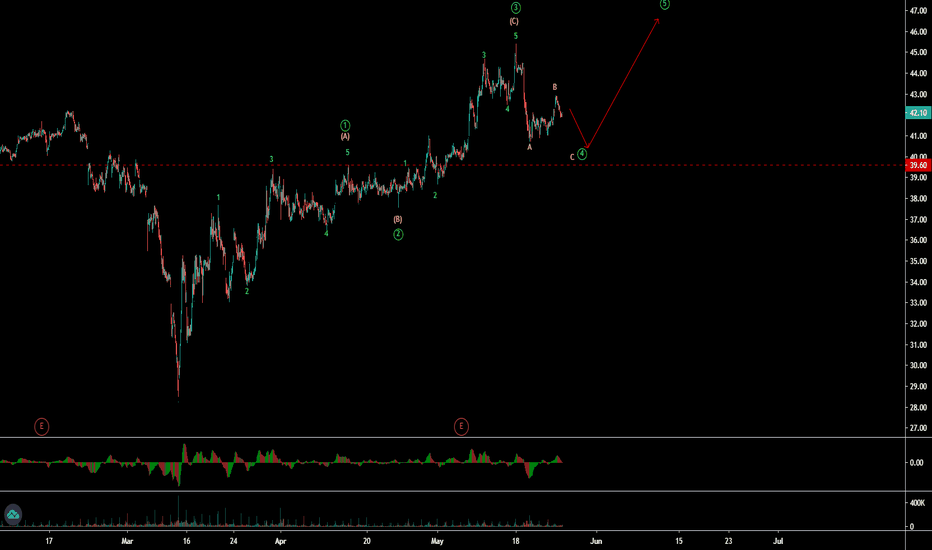

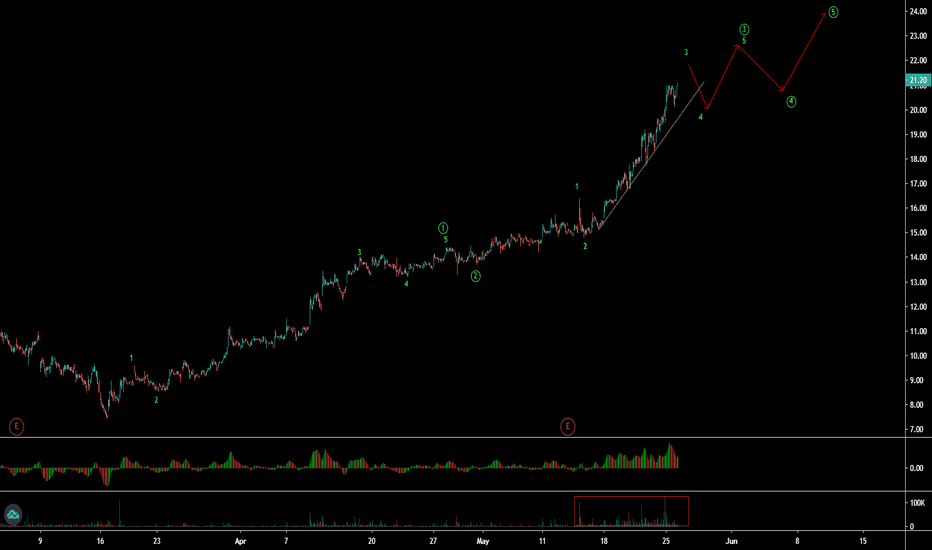

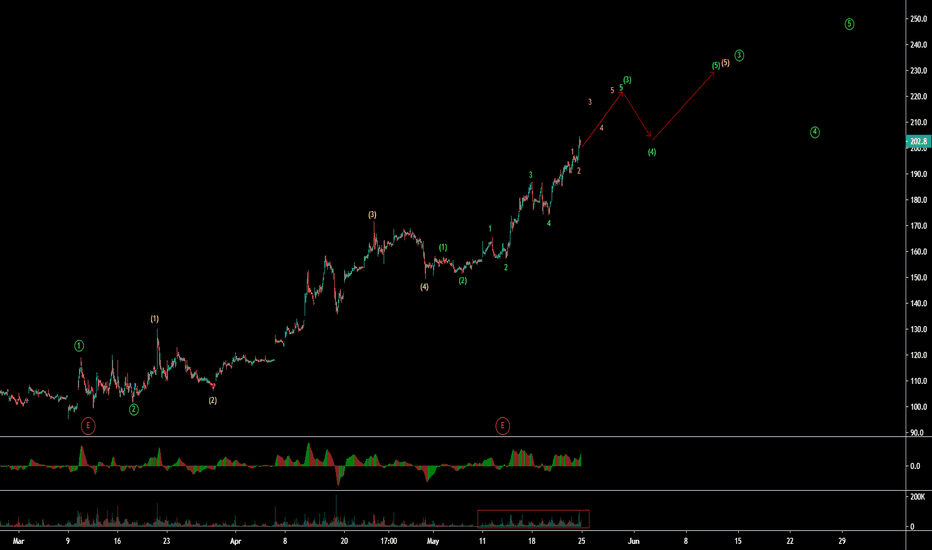

Banca Generali (BGN - Italy) - ABC wave patternBanca Generali (BGN - Italy) is in ABC sequence down after Impulse cycle over in weekly time frame. This is the part of bigger WXY cycle. Currently price is in B wave up as wxy complex wave, where y wave is in progress as abc and b was triangle. Wave C should be fast as the result of triangle, which will complete B wave of major Y wave down.

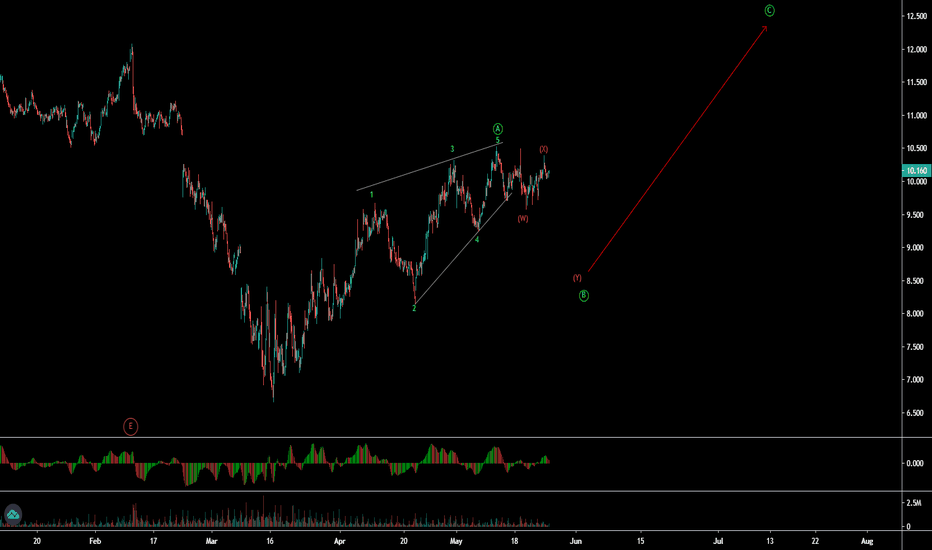

Brunello Cucinelli (BCU - Italy) - WXY wave patternBrunello Cucinelli (BCU - Italy) is in WXY correcting down cycle in 60 min. X wave was completed in triangle, which confirms only when it broke the triangle downside and then Y will down will start as the part of bigger WXY cycle in weekly time frame as complex correction down.

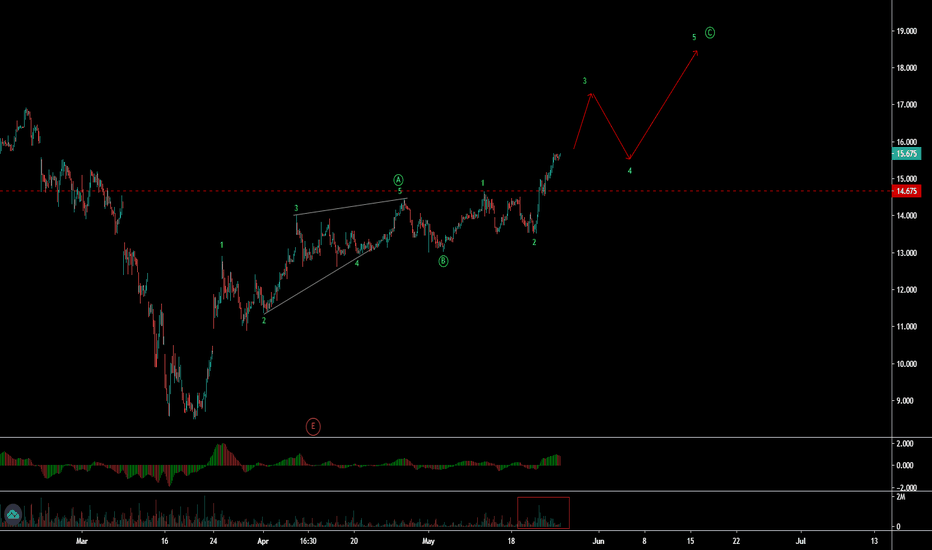

FinecoBank SpA, Banca Fineco (FBK - Italy) - ABC wave patternFinecoBank SpA (FBK - Italy) is in ABC wave pattern in 60 min time frame. Wave A was leading diagonal structure & wave B is complex correction, which is in progress. After that C wave up will start. In daiy time frame, this sequence is either the part of bigger WXY correction or may be the C bigger wave up as impulse, which will be known as time progresses.

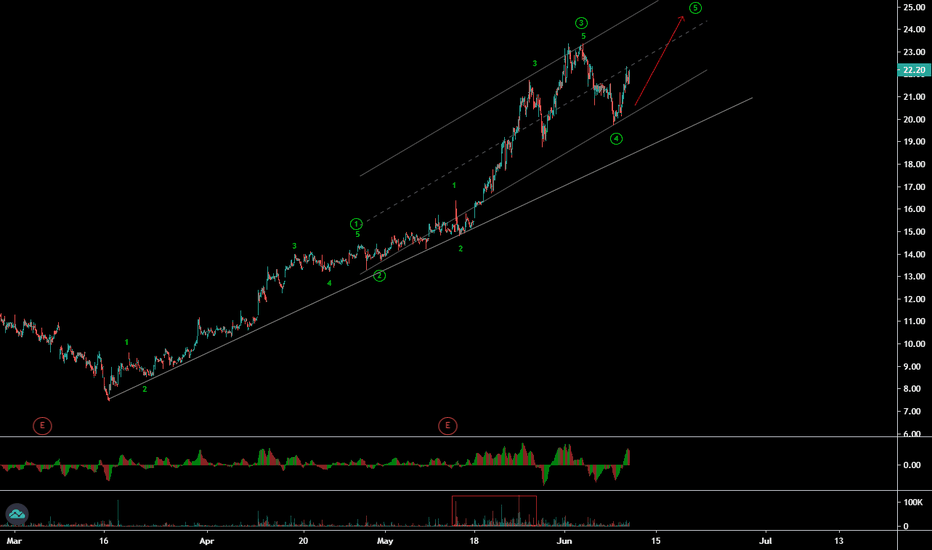

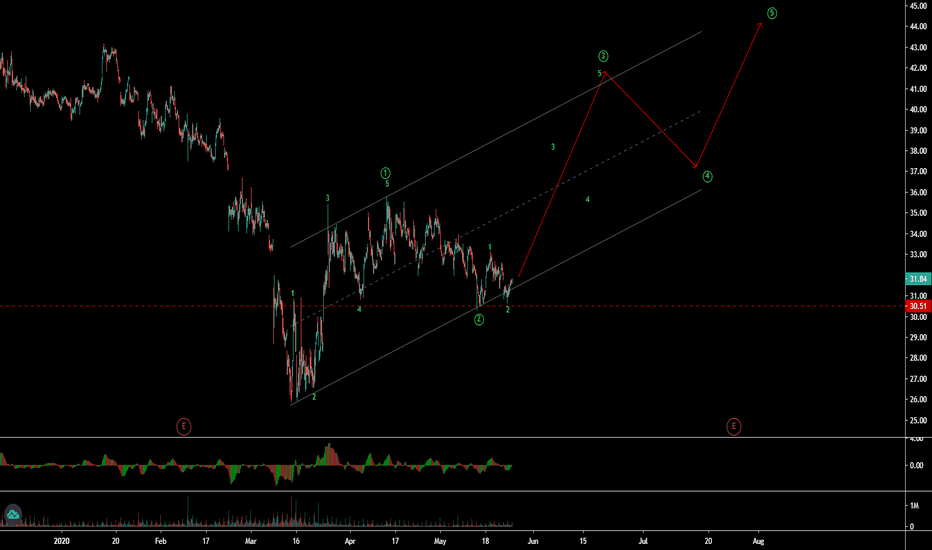

Moncler SpA (MONC - Italy) - Impulse up Moncler SpA (MONC - Italy) is in 3rd wave up of impulse sequence as its the part of 5th wave in daily time frame. It holds the invalidation line, to confirm the move up. In daily time frame it took sufficient time to complete 4th wave correction for next up move to wave 5 for new high.

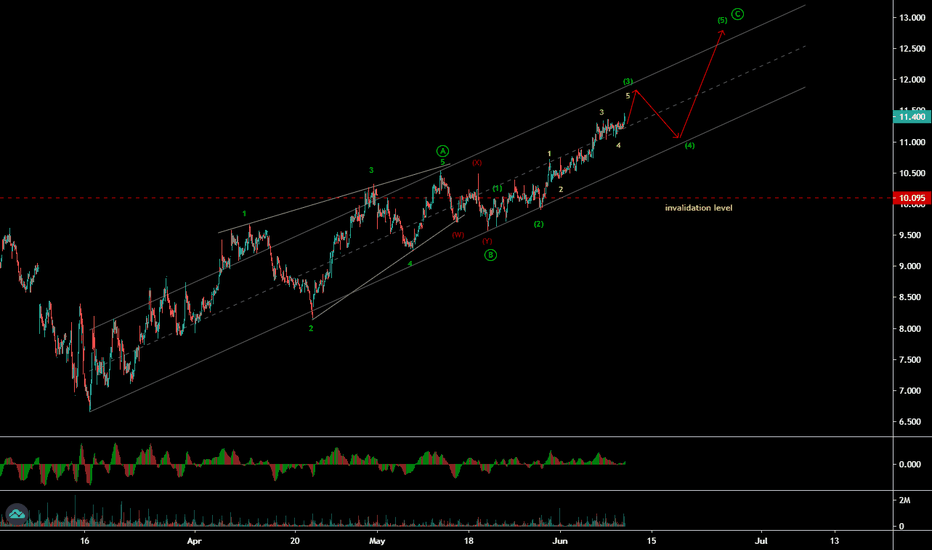

Recordati (RECI - Italy) - 5th wave upRecordati (RECI - Italy) is in 4th wave correction of impulse sequence, which is 5th wave in weekly time frame. It is currently in c wave down of 4th wave. One more possibility also there, as ending diagonal 5th wave if price penetrates wave 1 within invalidation level. Watch it closely, how chart unfolds.

Digital Bros (DIB - Italy) - Impulse 5th wave Digital Bros (DIB - Italy) is in 3rd internal wave of 5th wave up. Currently price is in internal 3rd of 3rd wave up and huge relative volume confirm the move, one more high with indicator divergence will completes wave 3 of 5th wave up as shown in in chart. In weekly time frame its the 5th wave up, which is in 60 min under progress. It is also near all time high, which made in 2001.

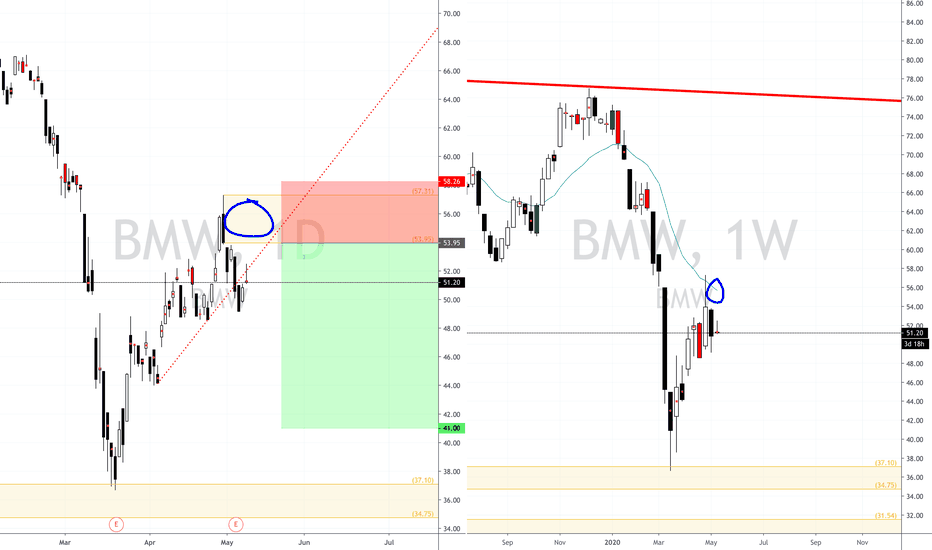

BMW Short BiasBMW price just touched a weekly area of demand, but according to my set of rules. We are still in a downtrend. price approached the 20 ema spotted in the weekly time frame. A supply imbalance was created in the Daily time frame. Allowing us to take the short as a confirmation trade. of course, I'm not right 100% of the time so , use proper risk management if taking the short trade. I recommend 1%.