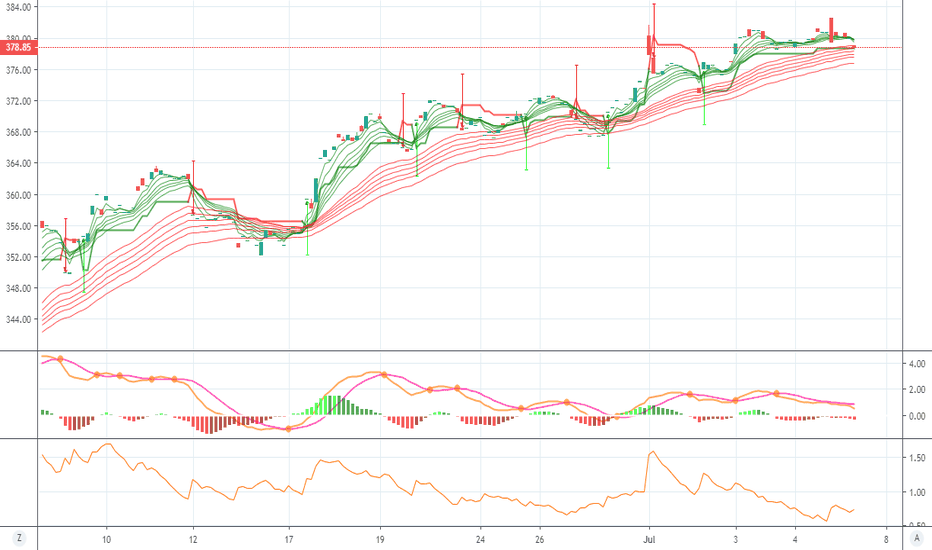

GLOBAL FINANCIAL ENGINEERING SWING TRADING STRATEGY FOR LVMH MoeOur Proprietary Trading System indicates the following:

The Primary Trend (PT) given by the Global Monthly TIME BAR (GMTB) is currently Bullish

The Secondary Trend (ST), given by the Global Weekly TIME BAR (GWTB) is currently Bullish

The Medium Term Trend (MTT), given by the Global Daily TIME BAR (GDTB) is currently Bullish

The Short Term Trend (STT), given by the Global Four Hour TIME BAR (GFHTB) is currently Bullish

We were hoping for a pullback to $343.75, but we might never see this level again within the medium term

In light of the above trend analysis we have started a bullish trade on LVMH Moet Hennessy Louis Vuitton SE using Global Trading Strategy #3 on the Global Automated Trading System #3 which trade in the direction of the Global Daily Time Bars (GDTB).

Global Entry Signal For Trade #1: Buy @ $381.75

Global Trailing Stop Loss Trade #1: @ $354.42

Global Target Profit Trade #1 : @ $600.00

Global Trade Management Strategy: We applied the Global Trailing Stop System for Global Trading Strategy #3.

Check updates

---------

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security.

To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice.

To the extent that it includes references to specific securities, commodities , currencies, or other instruments, those references do not constitute a recommendation by Global Financial Engineering,Inc. to buy, sell or hold such investments.

This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers.

Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

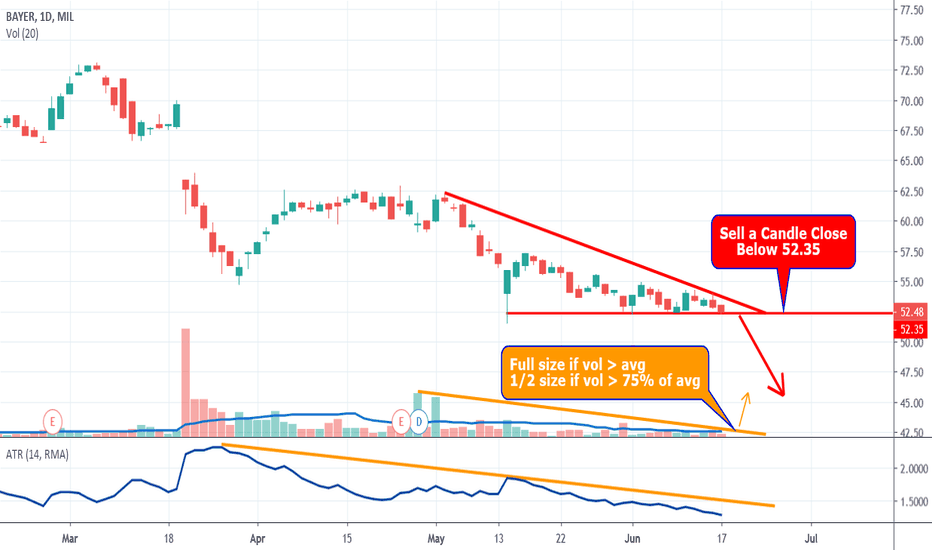

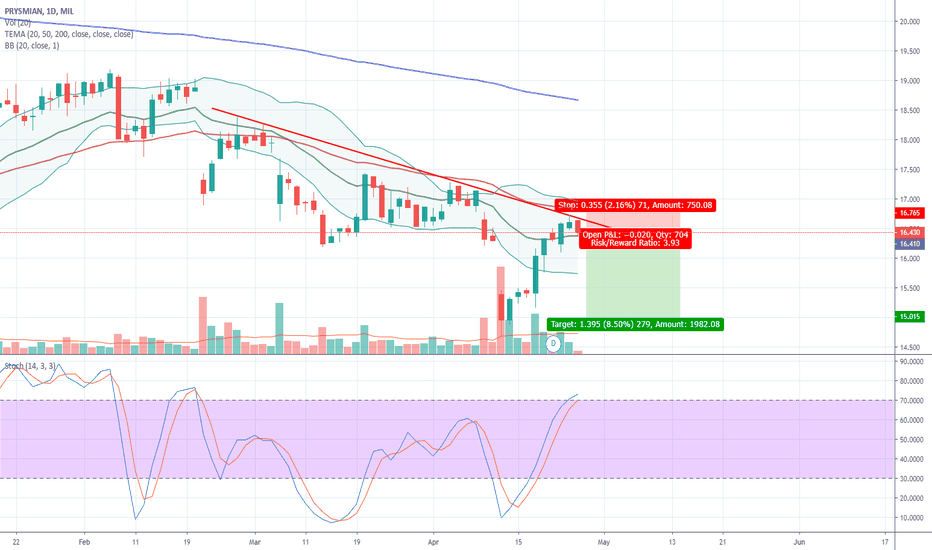

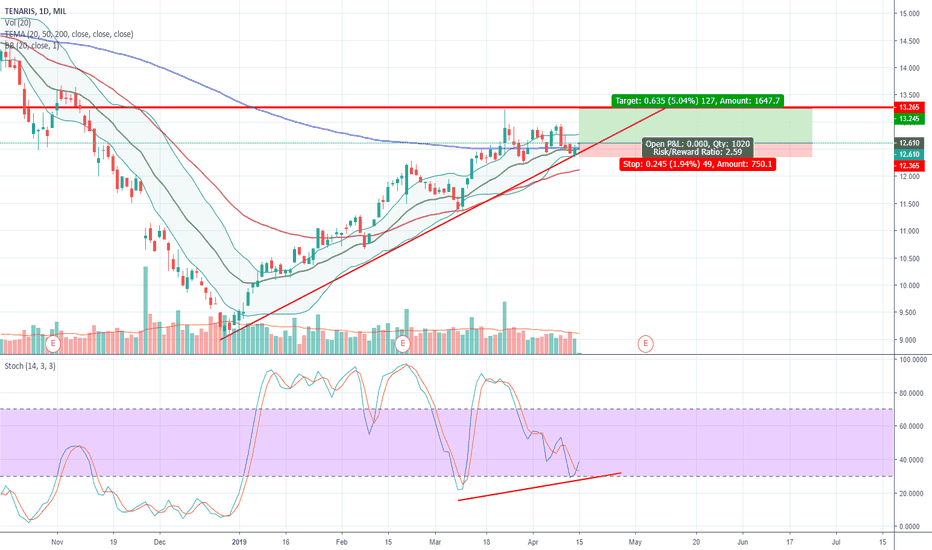

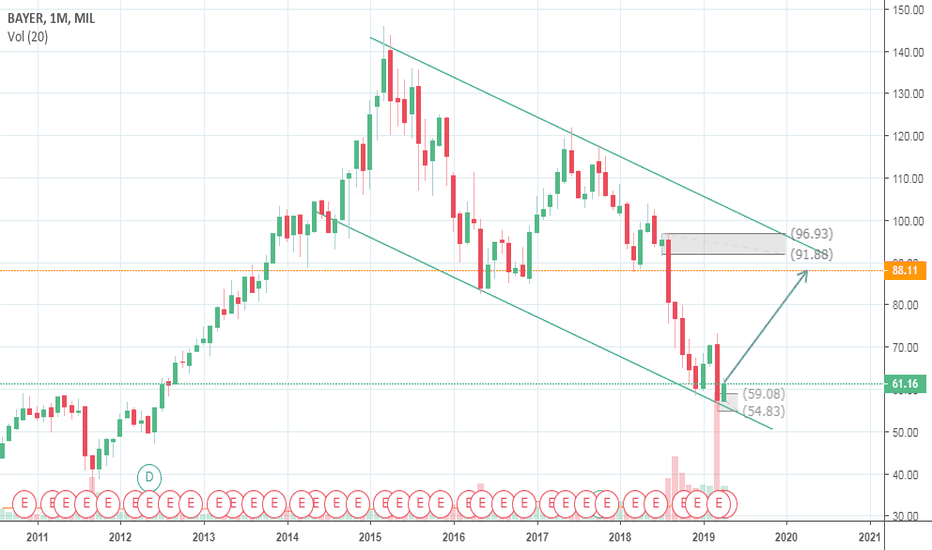

Is Bayer Going To Need Aspirin For Their Roundup Issues?Bayer is a descending Triangle Chart Pattern

Strong support level has been re-tested several times

Continually lower highs puts pressure on this support level

Best patterns have dropping volume and volatility/ATR

Fewer traders are interested in this consolidatation

At some point expect an explosive breakout

Trade Plan

Wait for a close below the support level

Full trade size if volume is at average atr line

1/2 trade size as long as bar has 75% of average volume

Enter two trade

Both trades SL is 1.5xATR

1st trade TP is 1xATR

2nd trade no TP let profit run

When price hits 1st TP move 2nd trade AL to breakeven

Let profit run

If breakout candle is more than 1 ATR wait for price to retrace back towards 1 ATR level to enter

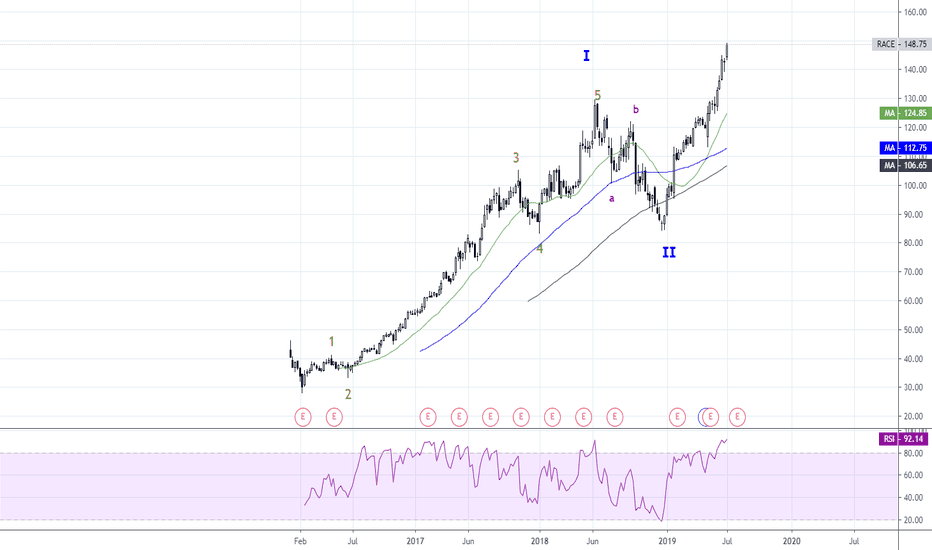

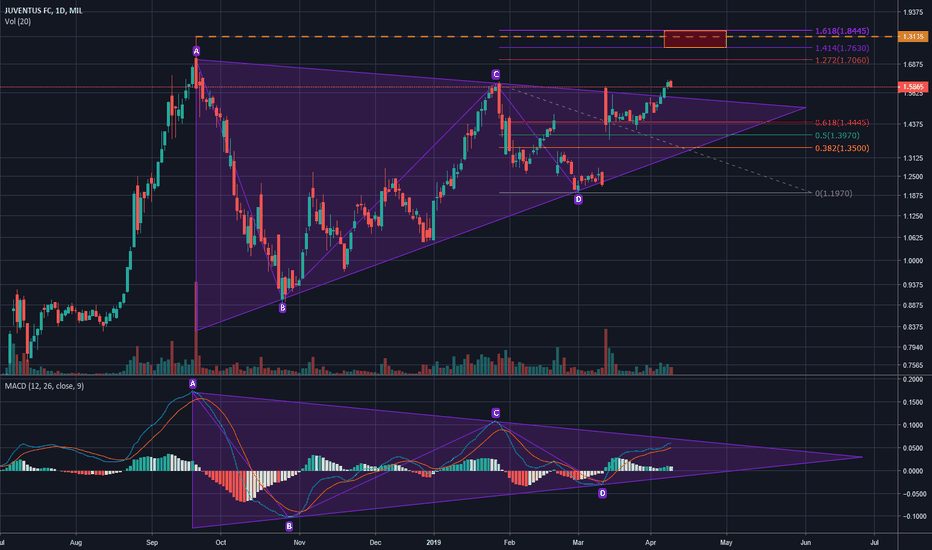

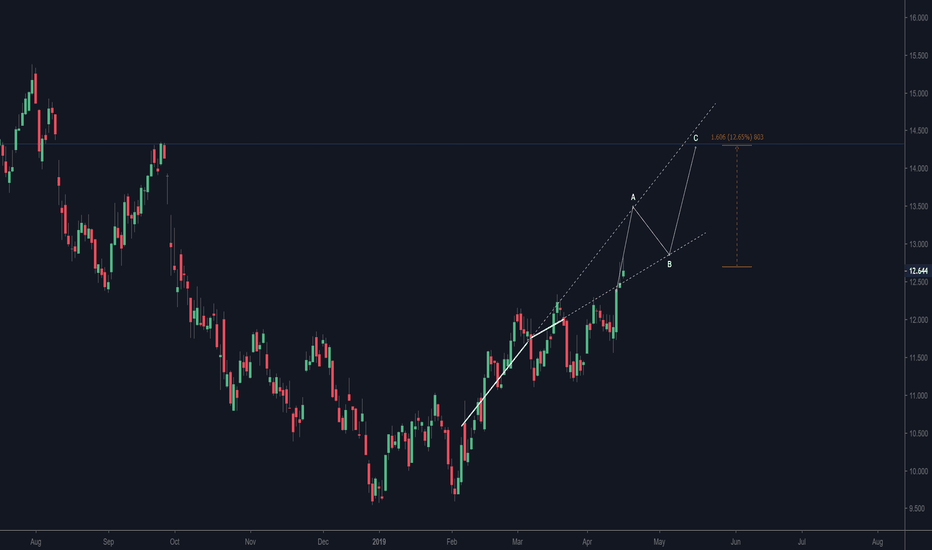

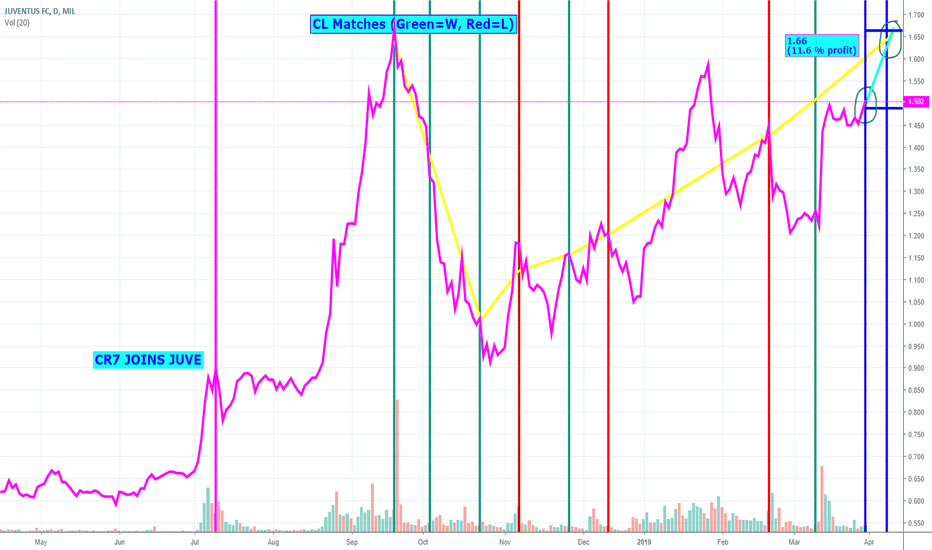

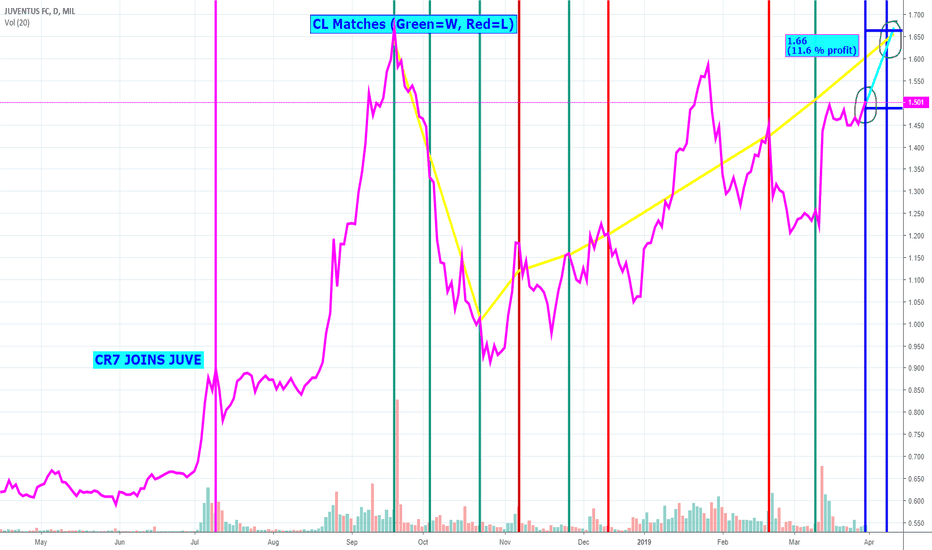

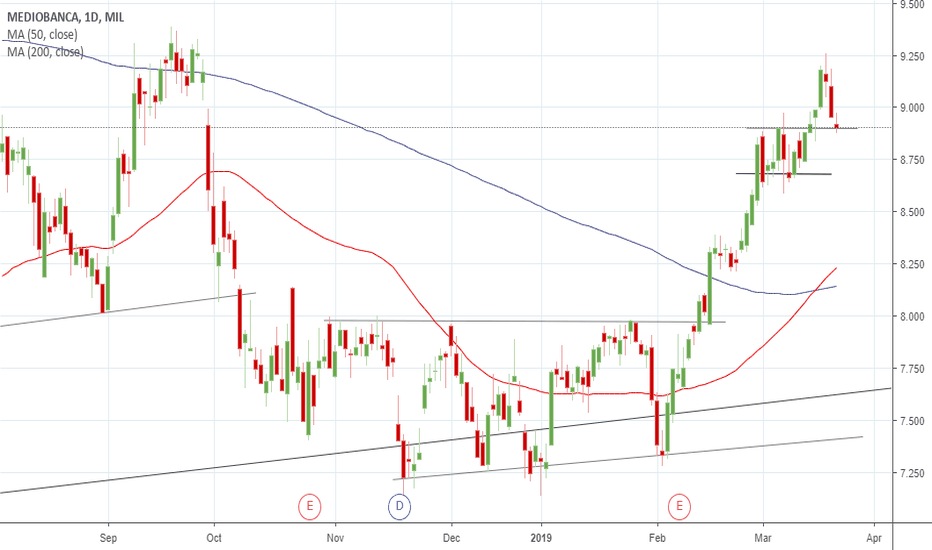

Who's gonna win the match?(***DISCLAIMER: I'm not a professional trader, this is not financial advise, you shouldn't make any trade based on this idea***)

Hello everyone!

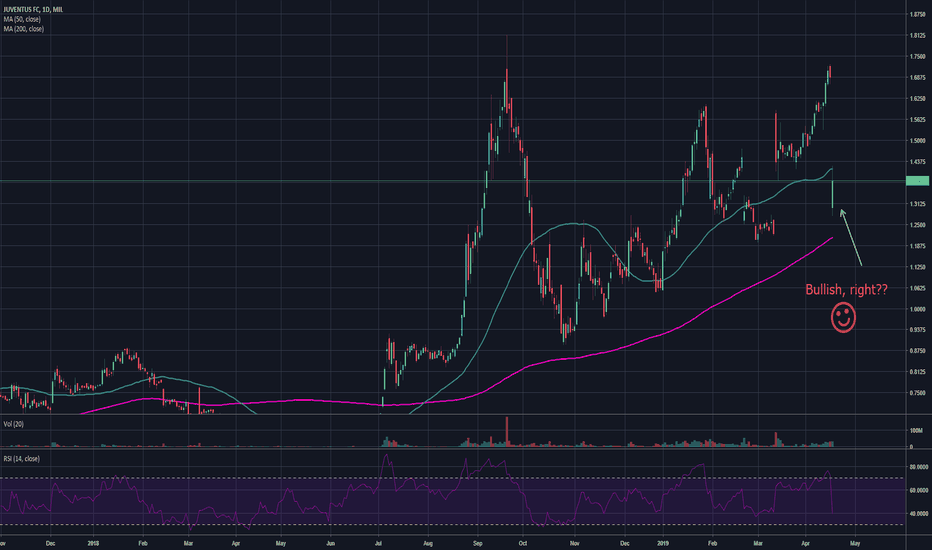

It seems like JUVE broke out of a triangle formation and could easily reach its previous ATH, around 1.80€ range, if it's going

to win tomorrow's match against AJAX FC.

On the fundamental side sentiment (and expectations) are pretty high, especially after Juventus FC last game,

as it is one of the favourite UCL teams.

Let's see how this will play out!

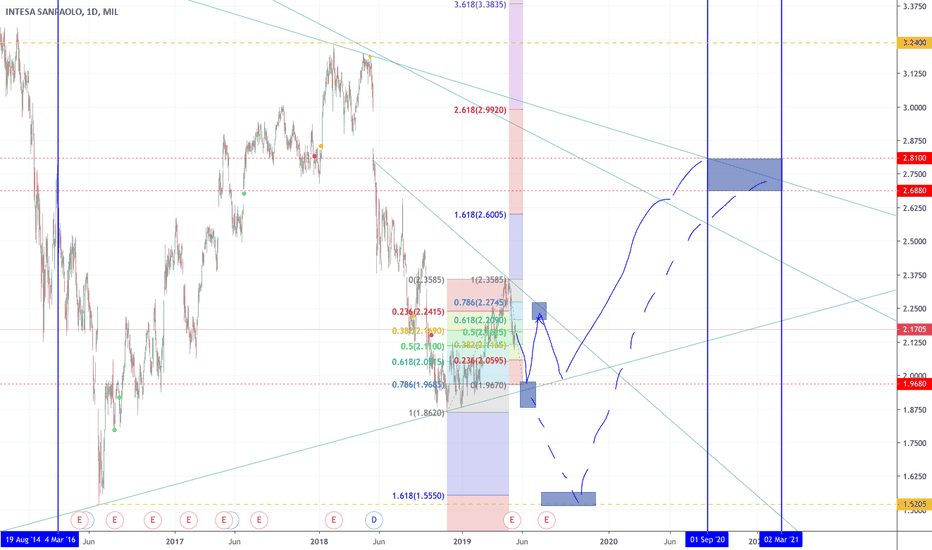

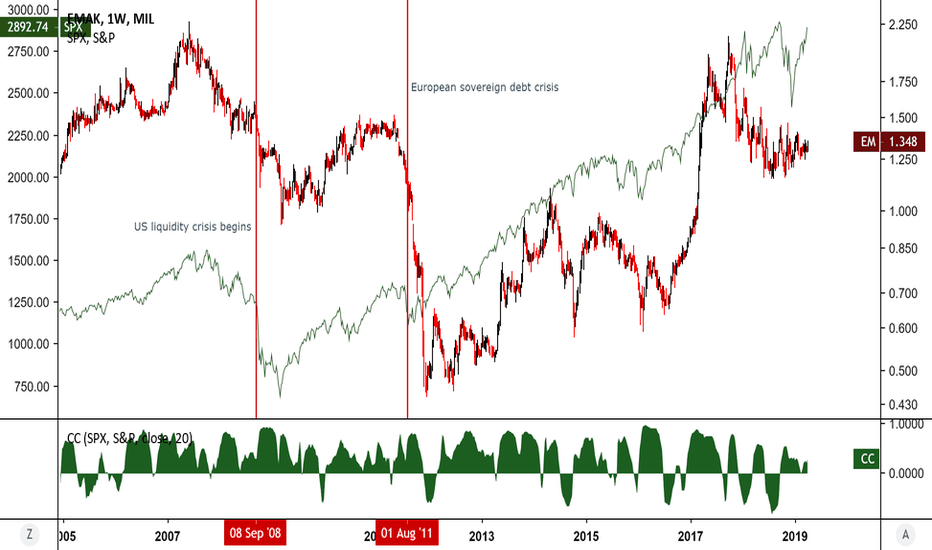

Expect a Downturn in EM If you Expect a Downturn in the USIts not quite a great idea to invest in EM if one is expecting a downturn as EM will be significantly hit from drying up liquidity via outward capital flows and lower investment. Happened in 2008 with the liquidity crisis and again in 2011 with the EU sovereign debt crisis. We can see this relationship between developed markets and emerging markets through a correlation coefficient between the S&P 500 and the most liquid emerging markets ETF in the world EM. Moreover, EM is vulnerable to a Chinese financial crisis as well if the Chinese can't figure out how to lower their debt levels which they really havn't yet. Either way, I would avoid EM at these price levels.