Bayer Buy IdeaH4 - We have a classical scenario divergence followed by convergence.

We saw two waves up already.

Breakout of the range that formed after the first bullish leg.

Price is now consolidating and divergence has started forming.

H1 - There is a down trend line to follow

There is already continuing divergence forming.

I expect the price to find a bottom around 108.85 - 109.50 zone.

Breakout of the trendline could provide buys but only after the zone mentioned above has been reached

To be more conservative use the double TL principle.

Renault Buy IdeaD1 - Two bigger cycle (Yellow)

Two smaller cycles (Blue) inside each leg of the bigger cycle.

H4 - Price is trading inside a channel. We have divergence.

We will be looking for a breakout above the channel to start looking for buys.

Ideally and most conservatively, we want to see a break above 76.90 zone.

If the stock breaks below, 67 zone will be the next level to follow.

BPER / Banca Popolare Emilia Romagna is a buy. Banca Popolare Emilia Romagna is a s buy. Highly increased volumes are associated with a long white candle. First relative target for the long strategy is at 5.33. Final target at 5.79

Price oscillator is moving above the zero line and now oriented upwards.

BMW Sell IdeaD1 - Price broke out at the bottom of the daily range. We can look for sells, if this breakout doesn't turn into a false break.

H4 - Price has created lower lows.

H1 - Bearish divergence has formed wait for a double wave correction and once the break out of the most recent trend line happens, look for sells.

Siemens Buy IdeaW1 - Potential div started to form already. We get a confirmation on the D1 chart with another bullish divergence

D1 - Following two support zones where we might see a reversal. First zone is around 116 and next one is around 108.50

Remember that we are looking for a breakout above the most recent valid high and the most recent trend line, before we even consider going long here.

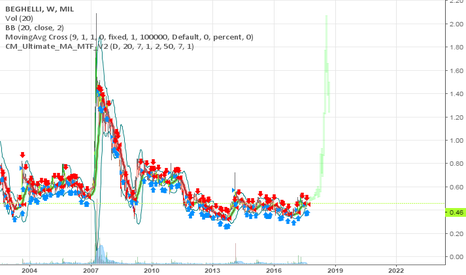

Fincantieri Wave 5 Completed awaiting ABC Correction move SHORT?It seems FCT is in the completion phase of a Wave 5 on the Minor period and has also reached a critical resistance/trendline area and in my opinion, we are nearing the start of a corrective wave/pattern via an ABC wave. I've marked out major support area where I believe is most likely the area where we will see the first part of determining where price action will lead. If Support is broken (which I believe the primary path), the ABC correction could be invalidated and another pattern may form, thus we should see a downward bearish trend, possibly to the lowest trendline/channel area, marked as the primary target zone.

It is also possible that the ABC correction may form and we would see another Impulse move in a bullish direction to continue towards the 1.34 Euro price area, however I see this as a secondary option, only because the primary target, not only presents a structured move, but also because I see a FLAG pattern forming, thus seems to me the most probable move. I don't see much on the fundamentals side regarding this stock, however should more information become available to put FCT in a positive light, I see the primary path being the most probable.

Additionally, Ketchup, Mustard, Water and Mayo EMAs are all flared as well as TDI shows it has almost reached the overbought position as well as a probable Sharkfin forming, which may prove wave 5 / price action to go a little higher before initiating the corrective pattern. In my opinion, this would be a highly probable SHORT before I'd take a LONG and hold long term.

P.S. Saluti a Gino e Valter.

----------------------------------------------------------------------------------------------------------------------------------------------------------

DISCLAIMER: This chart is for sharing and educational purposes only and is not intended to be a signal service or similar.

This chart analysis is only provided as my own opinion, based on my own analysis and comes with absolutely no warranty that this analysis is correct, whatsoever. Do not trade this chart if you do not have your own strategy. Trade only with your own strategy at your own risk. Plan your trade and trade your plan... and IF in doubt, stay out.

.....::::: If you like this chart, please click on the THUMBS UP ! :::::.....

----------------------------------------------------------------------------------------------------------------------------------------------------------