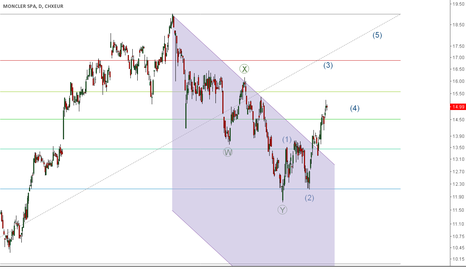

#UNICREDIT - NEXT EUROPEAN BANK WITH A BREAKOUTUnicredit is the next European Bank to stage an impressive base breakout. EU Banks are at a turning point, outperforming, and have a lot of catch-up to do. Technicals look great. Unicredit appears to move into a vacuum and I see immediate upside into 2.75/.77

I'm a chart analyst, not a fundamental analyst, but here are a few thoughts what could drive EU Banks outperformance. Fundamentals continue to look awful, however there are a few tailwinds from:

- bank CEO acknowledging structural weaknesses (DBK CEO y'day)

- serious consolidation talks

- FED rate hikes

LONG Intesa Sanpaolo (ISP)LONG Intesa Sanpaolo (ISP)

Cerchiamo di entrare in acquisto (LONG) con la 1° metà della nostra posizione standard ad un prezzo non più alto di 2,230 euro e con la 2° metà in area 2,16-2,15 euro circa.

Stop Loss tassativo su tutta la posizione sotto 2,112 euro (ovvero prezzo last <= 2,110 euro).

Take Profit in area 2,36-2,38 euro circa

www.tradingbusiness.it

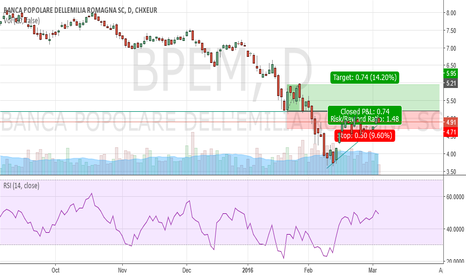

Bpem break out

The RSI shows how much the stock has been oversold. The title in the last few day showed strength and i think that, if it breaks the 5.21 level, it could have the necessary push to have a fast hike, until 6 euro. Pay attention, the banking sector is very volatile in Italy now, not like American's titles maybe, but it is more than in the past. I've also noticed that the Ftse mib is pulled by banks now, so if you see the ftse positive it is at 90% because of them.