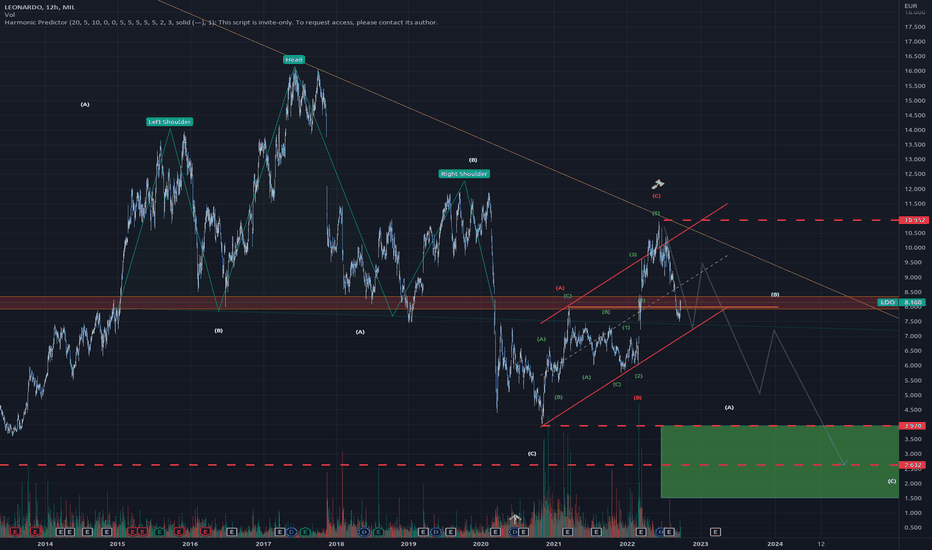

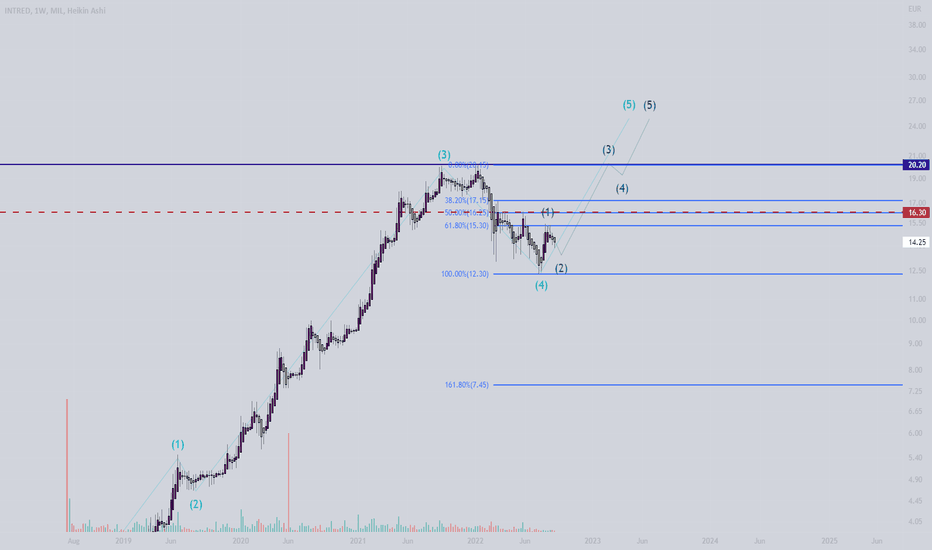

LDO Dont get fooledSpecial Request from one of my fellow followers again:

1) Dont get fooled by a 10% pump

2) Broke the neckline in 2021

3) Just now failed to reclaim it by a drop below and a backtest

Price action since the 2021 low fully corrective in a crystal clear 3-3-5 pattern (just confirmed by breaking 8.02)

=> Retest / Double Bottom 3.97 or lower inevitable

Take-Away:

1) If you can draw a flag, it is a flag.

2) If the 2nd bump fails to break the flag, its going lowaaaa

Hold my beer pls

----

No financial advice, do your own research, don't be stupid

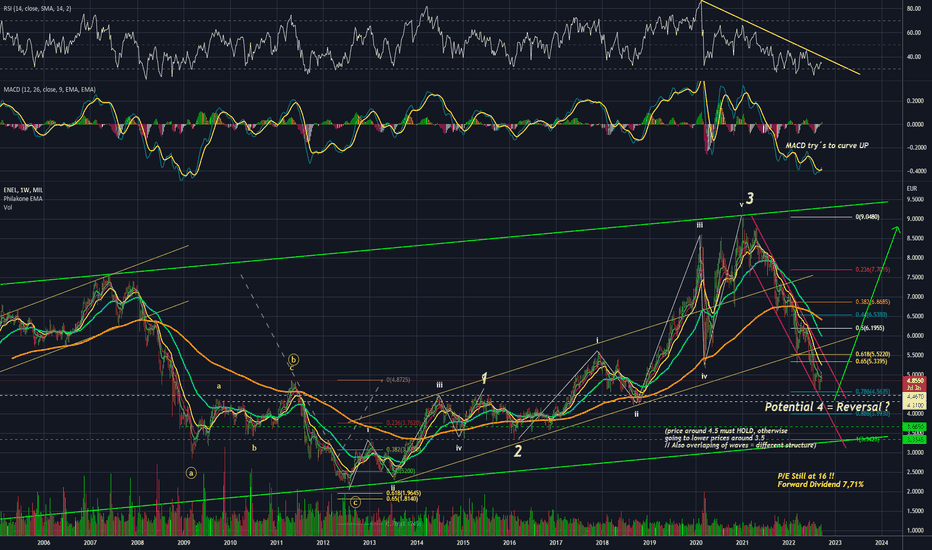

ENEL (1W) Pottential reversal for Enel during winter ? Hello Folks,

Seems like Energy Sector is attractive right now.

Looking at many European companies (Producers and Electricity Suppliers) could reveal interesting bets for mid-term // or several months during Winter.

ENEL is one of Such companies. Need to dig deeper into Fundamentals. BUT for now considering Technical Analysis of Chart. Seems like Stock is down 50% from last year top.

A) If it Holds price around 4.5 and turn up. It could be last impulsive wave UP (Wave 5 of bigger TimeFrame). Which could last 6-12 months. = Back to Price around 9.

Right now the stock can be Attractive with Forward Dividend at 7,71%.

P/E at 16 is probably too expensive (Compared to CEZ at 11.7, which should be way better company)

B) If it drops below, it means Overlaping of waves marked as 1 and 4. (Forbidden in Elliot Wave theory. So it would be completely different structure and its better to stay away.

It could drop to the bottom of GREEN long-term channel at 3.5 or even deeper.

For now I Will not enter position, but will dig deeper into fundamentals and certainly let you know very soon.

Let me know if somebody follow this company or other European Energy companies ;)

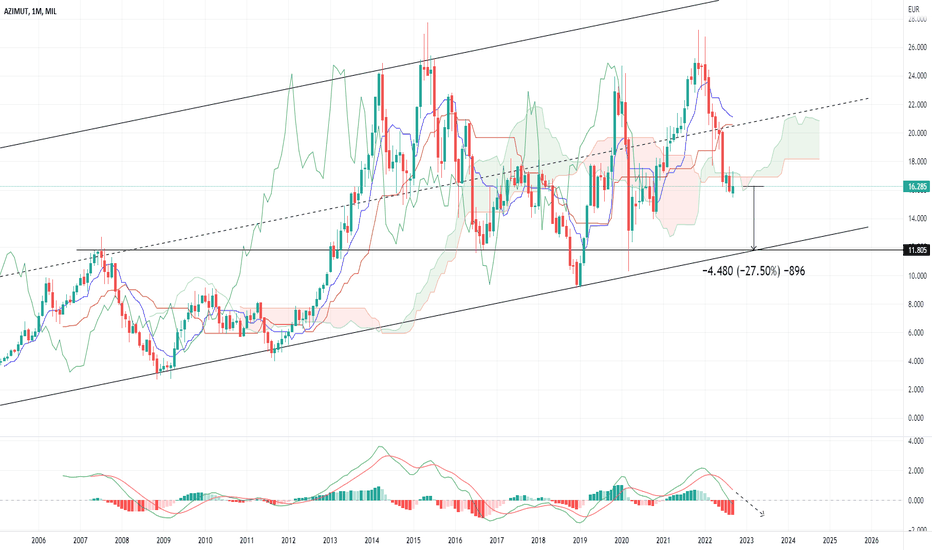

AZIMUT SHARES WILL BE PUMMELED DOWN -27.5%Azimut stock price chart on a monthly scale provides a clear view of the structural price range channel. The stock price has drifted well below the middle line and breaking all support, with a clear SELL SIGNAL where the stock price has drifted below the IKH A/B cloud. The repricing of AZIMUT stock will see AZIMUT pummelled down by -27.5% to €12 euro stock price.

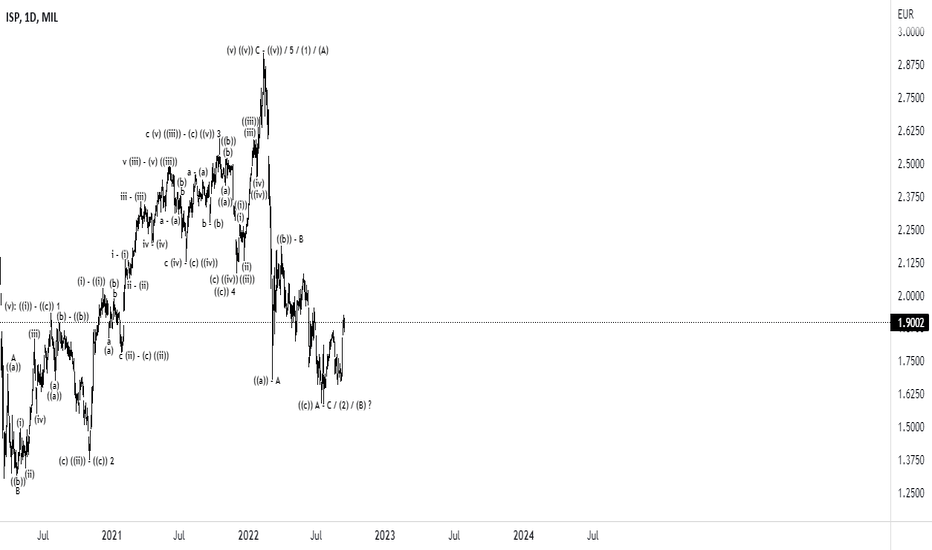

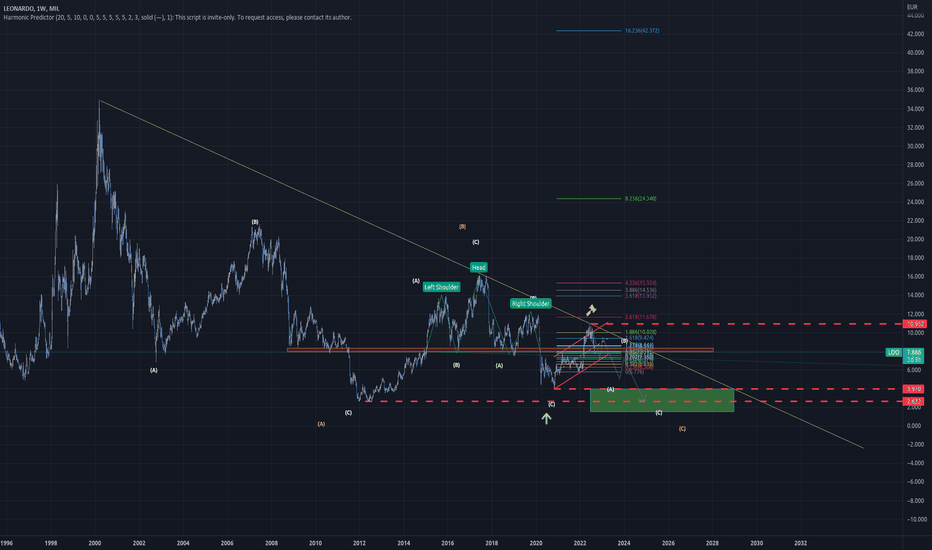

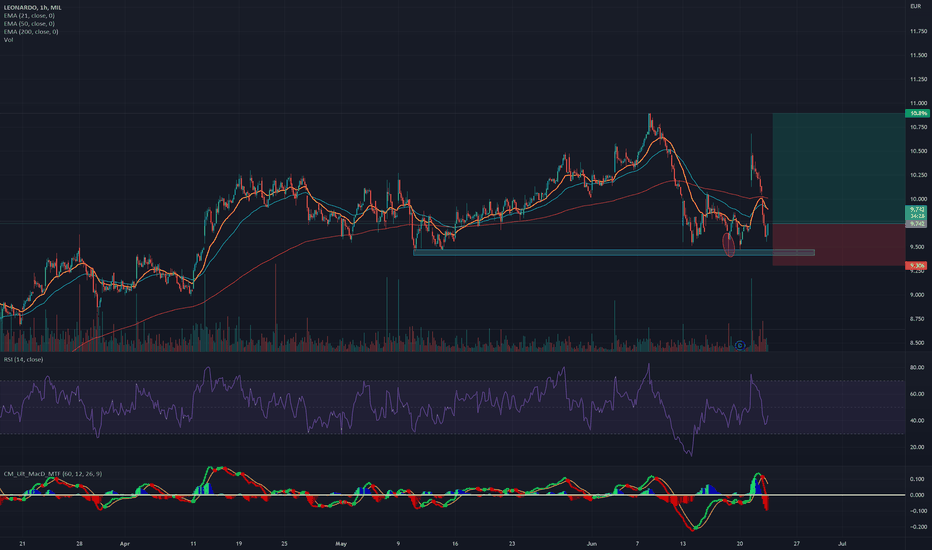

LDO Leonardo: War over?Special request for one of my fellow followers LDO Leonardo

Has been in a bloody downtrend for over 20 years (!)

Lets look at the chart: We are expecting a big ABC correction where as the C wave possibly could have been completed at the yellow arrow but that would be very much truncated.

The recent red (bear) flag most likely is going to resolve to the bottom dictating prices of 4€-6€

One would also argue there is a head n shoulders formation where the neckline just got tested and is heading below confirming lower prices.

In order to really finish this big formation at least a double bottom or a new lower low is required meaning the final target will be below 2.60€

Things will start to look better on a break above 10.95€ and r/s flipping the downtrend.

whether the break of the trend happens around here or later and lower it will require some time, probably years to finish

Hold my beer pls

----

No financial advice, do your own research, don't be stupid

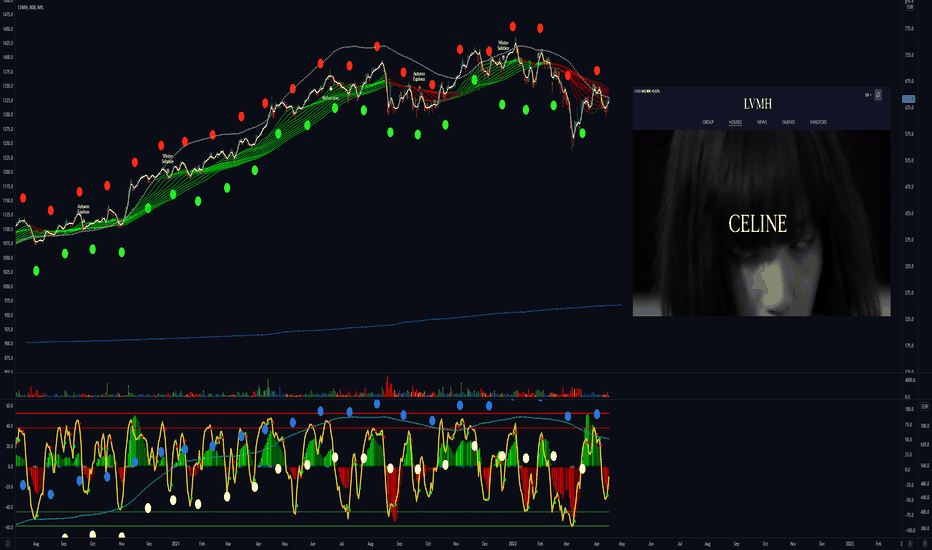

💎Resurrection of Risk 👑 Join the MC House of LV🕊️Old Money Never

Goes Out Of

Style

www.lvmh.com

LVMH is home to 75 distinguished

Houses rooted in six different sectors

True to tradition, each of our

Brands builds on a specialty legacy

While keeping an unwavering focus on

The exquisite caliber of its products.

In The Words

Of

Chairman Bernard Arnault

"Our objective to strive for solid financial performance and our relentless drive for excellence remind us of our daily commitment to act in such a way as to make the world a better place.

The Group and its Maisons carried out numerous actions in 2021 to promote biodiversity, protect nature and to preserve skills and craftsmanship, and will continue to do so in the years to come."

www.lvmh.com

EURONEXT:MC

MIL:LVMH

🎇

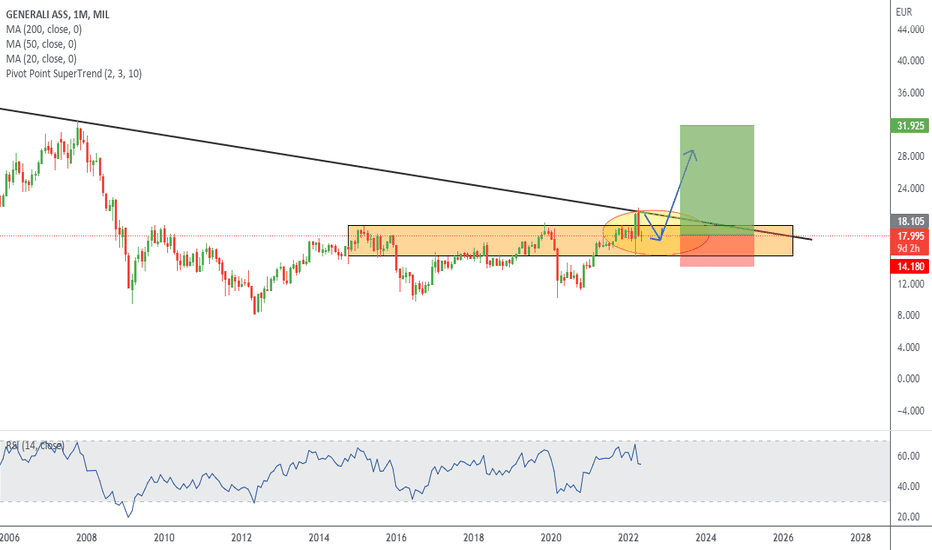

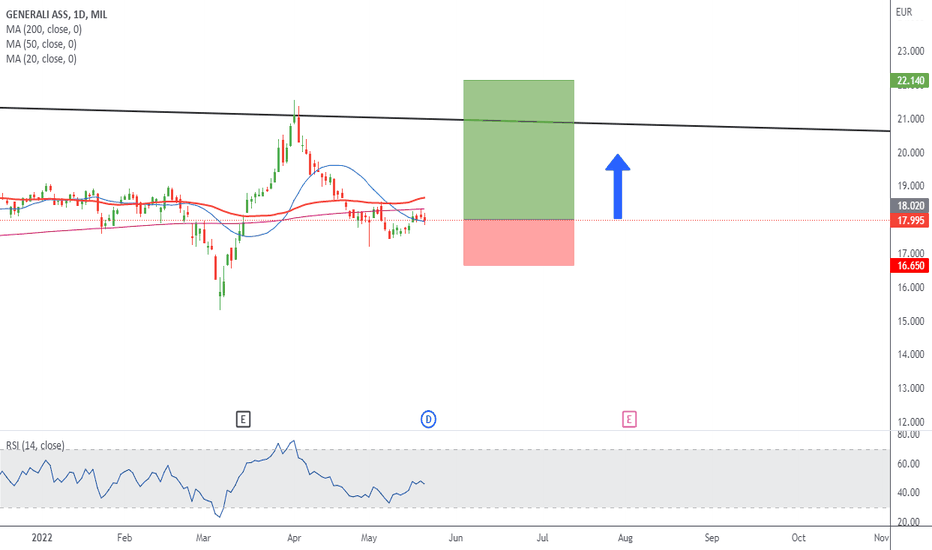

GENERALI ASSFor having a better understading of what is happening on this stock about my last idea, on the Montly chart we see a clear break of structure and a retest of it after testing an important trendline(formed in Oct 07).The price has been bouncing over the last 12 years and now finally we see a strong candle formed in March this year breaking all structure and showing us bullish pressure. We can expect more bullish continuation the next months if price manage to break this trendline. Important monitoring price action in lower timeframes.

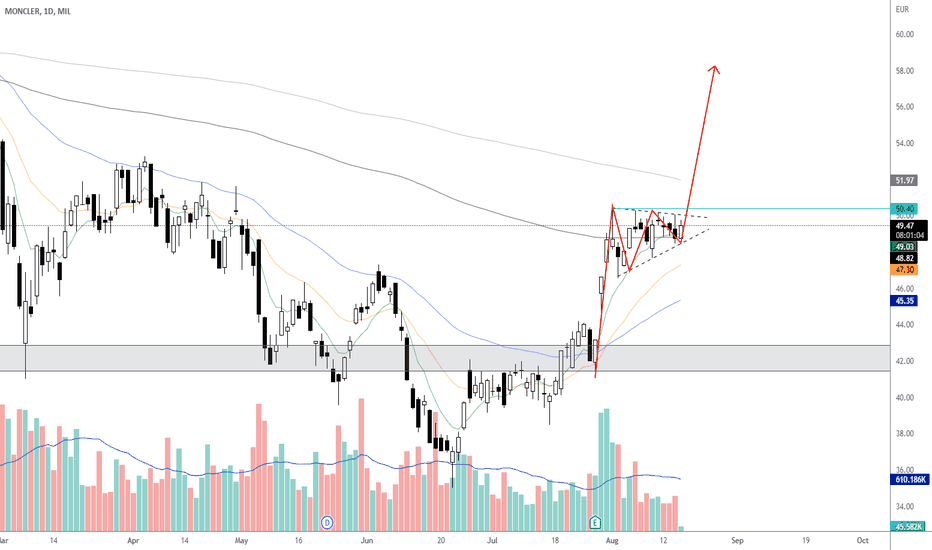

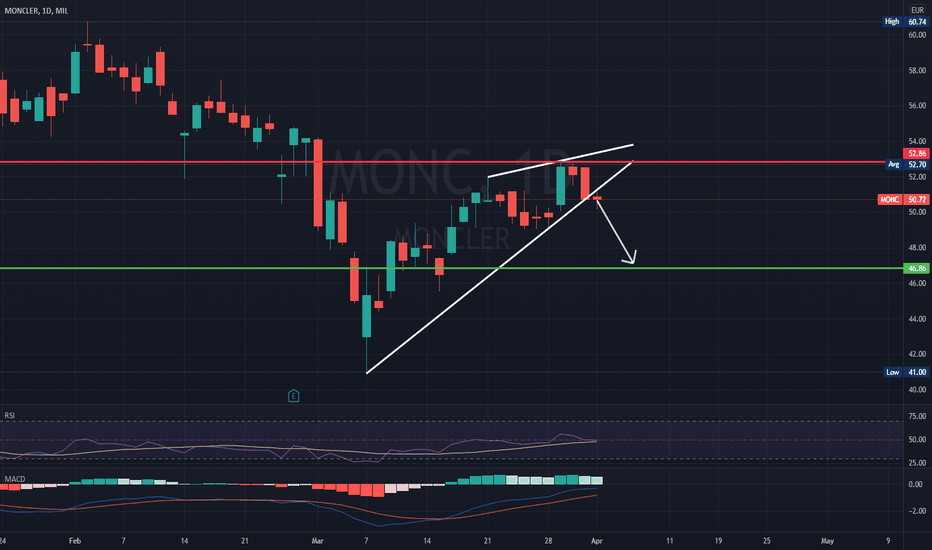

Moncler (MONC.mi) bearish scenario:The technical figure Pennant can be found in the Italian company Moncler (MONC.mi) at daily chart. Moncler is an Italian luxury fashion brand with French origin mostly known for its skiwear. The Pennant has broken through the support line on 02/04/2022, if the price holds below this level you can have a possible bearish price movement with a forecast for the next 6 days towards 46.860 EUR. Your stop loss order according to experts should be placed at 52.86 EUR if you decide to enter this position.

Moncler reported revenues that surpassed the 2-billion-euro mark, rising 44 percent compared with 1.4 billion euros in 2020, eight years after its initial public offering and through a global pandemic. Net profit climbed 37 percent to 411.4 million euros, compared with 300.4 million euros in 2020. Compared with 2019, it grew 14.7 percent from 358.7 million euros. The group also touted a free cash flow of 550.3 million euros, above pre-COVID-19 levels and compared to 195.5 million euros in 2020.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

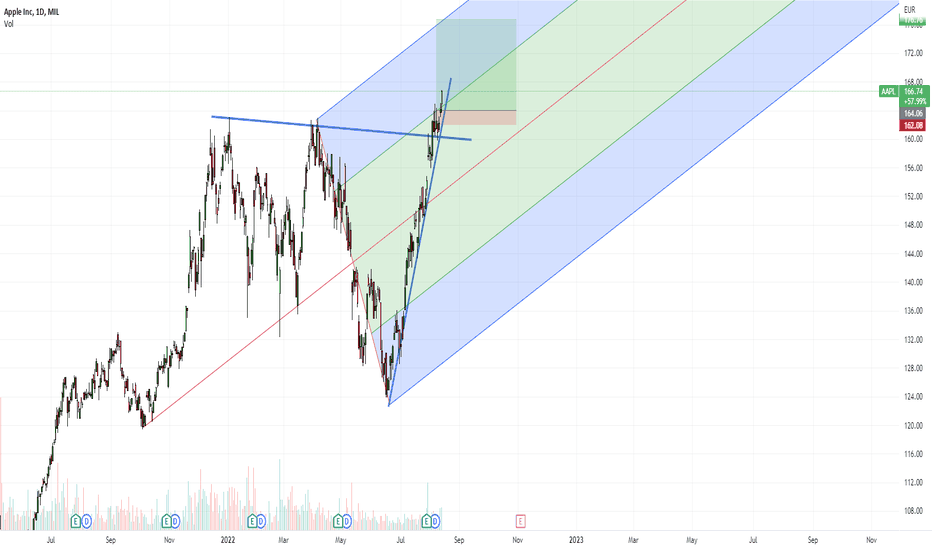

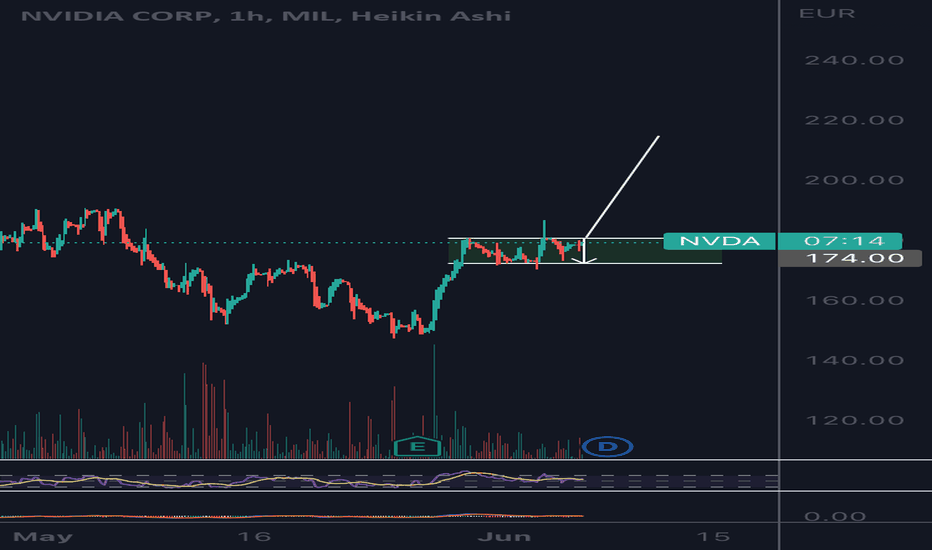

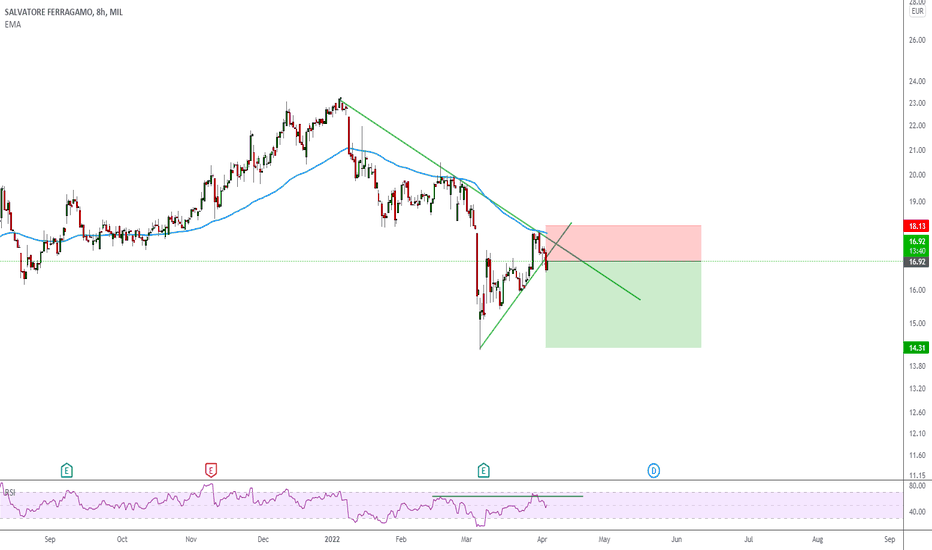

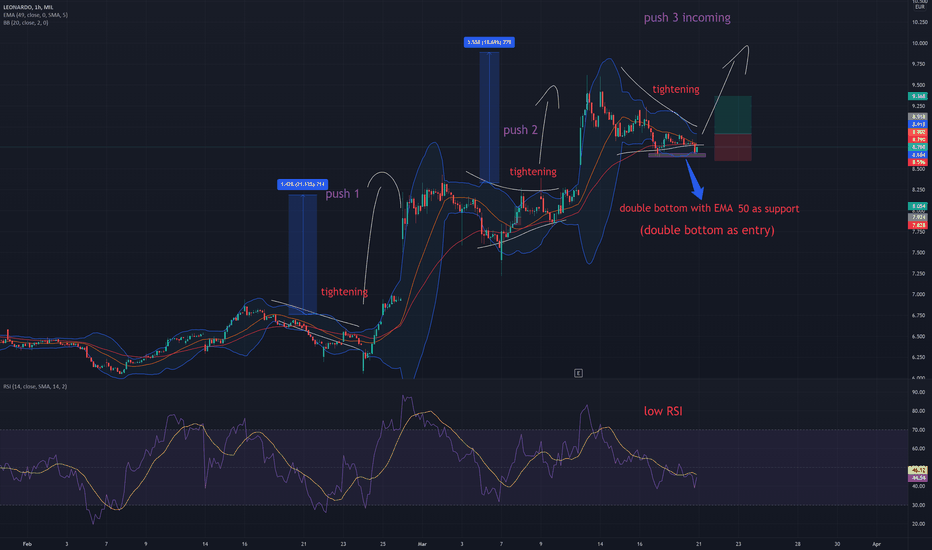

long position idea on about 18% push tightening of Bolinger Bands, double bottom as entry with EMA50 as supporrt, low RSI. expectation of around 18-20% push. On higher (3h,4h) timeframe you can see the pullbacks better.

any thoughts/opinions? hmu

DISCLAIMER: this is only speculative AND SHOULDNT BE TAKEN AS ADVICE OF ANY KIND.

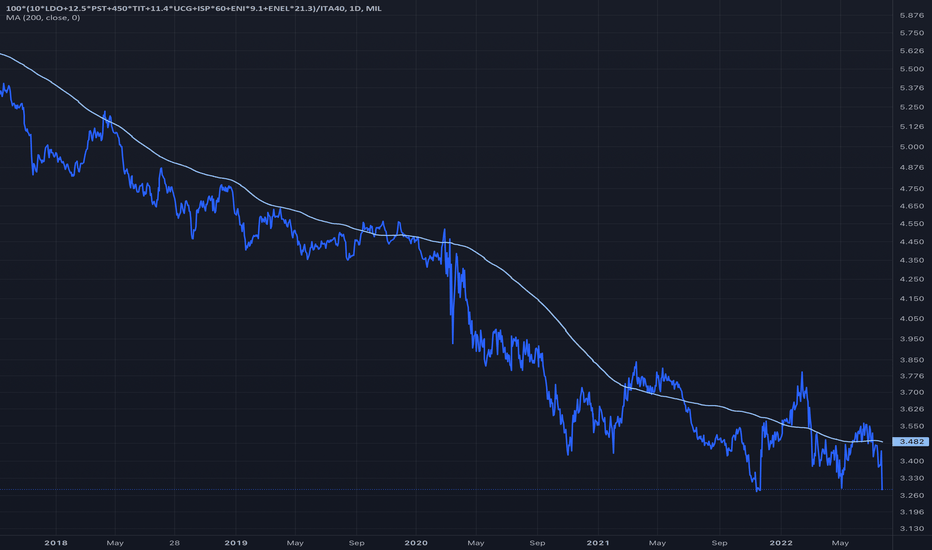

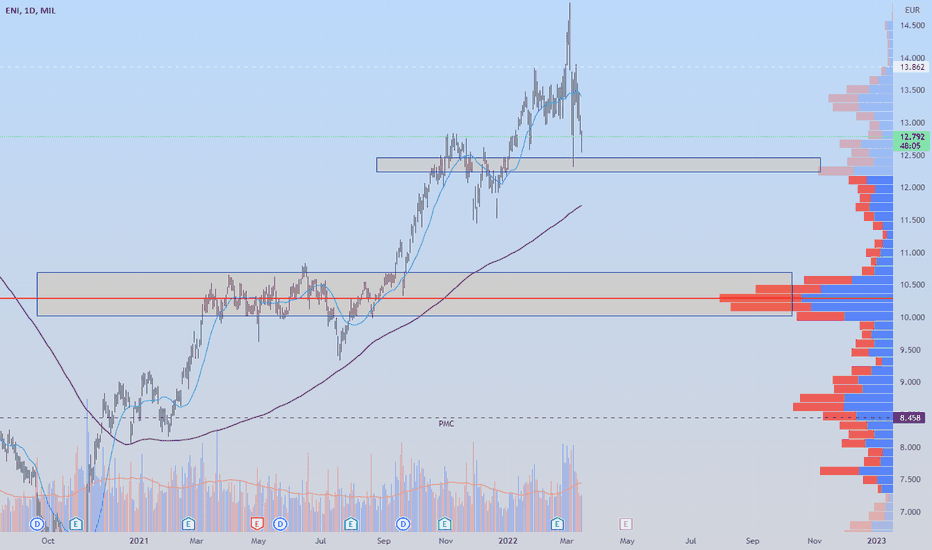

Portfolio and ENI Take profit (+50%)War.

High, very high volatility.

These are times when stocks move from traders to investors.

So it is right to accept drawdowns, obviously not in leverage and weighted, having liquidity to mediate when this problem passes.

However, there are some "favorable" situations even in these times, which help to rebalance the portfolio and create liquidity.

This is the case of Eni, the main Italian energy company, with a strong correlation with oil (sold last week with a profit of 165%, see my previous article), which is obviously retracing, after hitting $ 120 per barrel...

Set a stop profit reached today with an overall profit of just over 50%.

I also rebalanced the very long-term portfolio, selling part of my benchmark energy ETF with a 144% profit. (ALL of these numbers are proven)

Of course not all that glitters is gold; I had to accept a heavy stop-loss on BIDU and PLTR (partial).

I added some more gold and MSCI World for the very long-term portfolio.

The advice I can give to those who are investing and swing trading at the moment is to remain liquid and enter only and only on very extreme levels, already well established through volumetric analysis.

Forget the technical analysis. You know what I think, but particularly in these moments, it is garbage.

Happy trading and God bless all those who are suffering from an absurd war. Of any ethnicity, nationality, or religion.

Peace.

LazyBull

DISCLAIMER: I am not a financial advisor nor a CPA . These posts, videos, and any other contents are for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments.