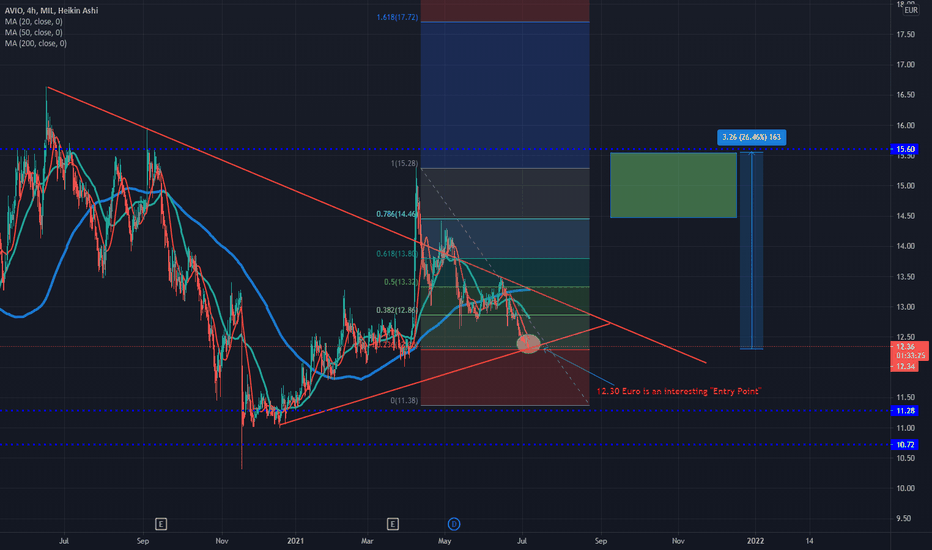

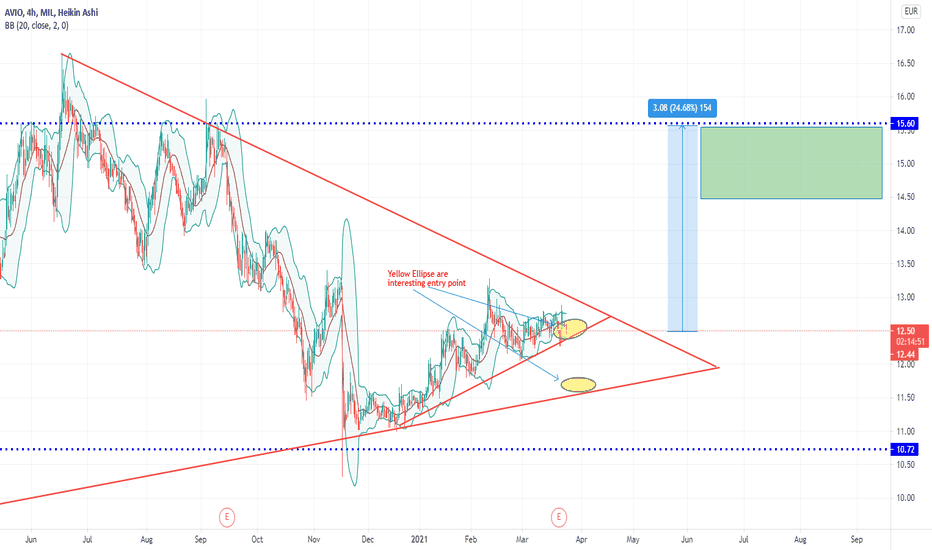

Avio (AVIO)After the interesting jump in April, the stock returns to its old prices. We believe that at these prices it can offer an interesting buying opportunity. In fact, we believe that there are possibilities that the company could be involved in a merger with other operators in the Aerospace/Defense sector. In particular there could be synergies with OHB, RheinMetall and Thales.

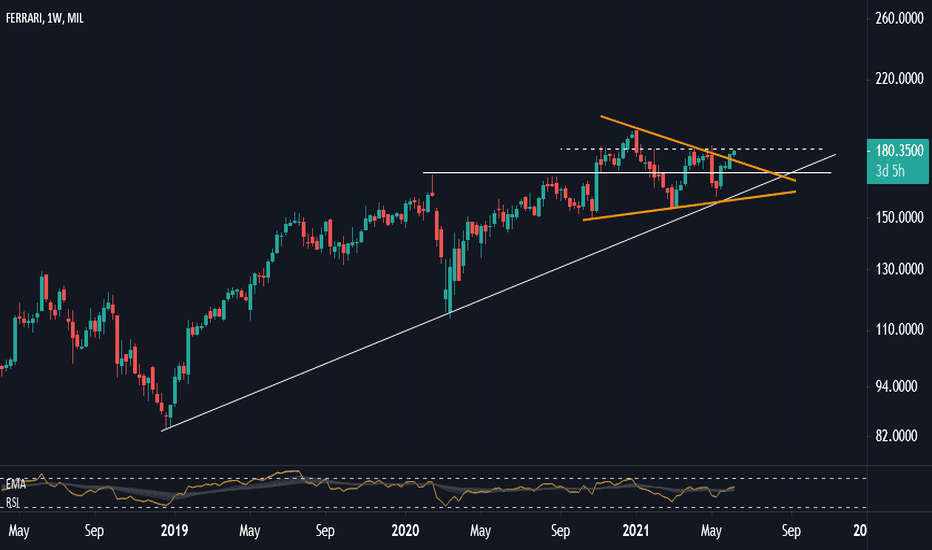

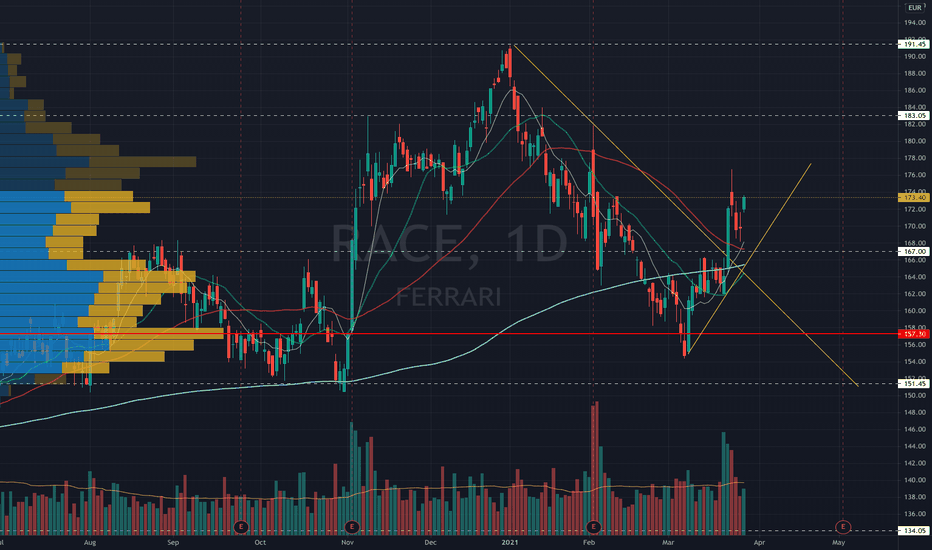

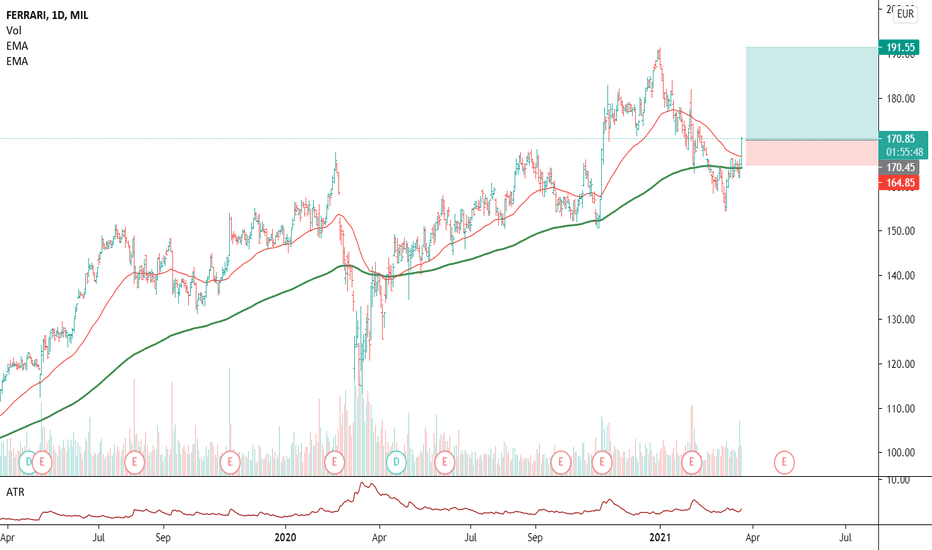

Ferrari: Off To The Races? - Strong Results & Record Order BookPart automobile manufacturer, part luxury stock, the share is looking to breach it's year-to-date overhead supply.

Chart structure similar to that of another luxury goods business, Kering, where €620.00 was a big level in April.

Phase in and add on a close above €182.00

Stop: € 169.00

Weekly Chart.

As per their recent results presentation (via Investor Relations):

STRONG FIRST QUARTER RESULTS AND RECORD ORDER BOOK;DECISIVE MANAGEMENT OF COVID-19 PANDEMIC IMPACTS

Q1 sustained by product mix with EBITDA(1)at €376M, +18.6% vs. Q1 ‘20 and +20.9% vs. Q1 ‘19, with a margin of 37.2%.

Sound industrial FCF at €147M.

Robust net order intake and record order book.

Most profitable models with strongest demand

Confident to reach top end of the 2021 guidance range2022 financial targets postponed by one year due to actions taken in response to Covid-19

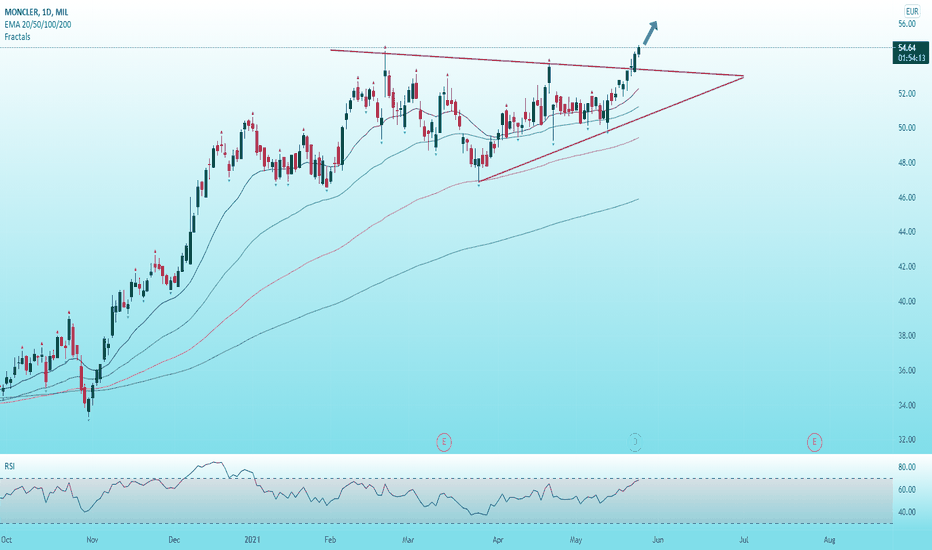

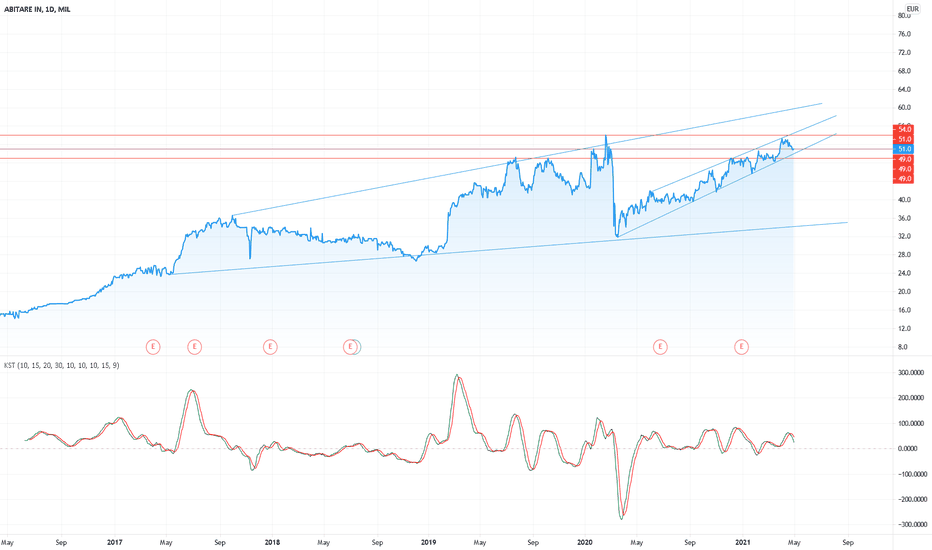

MONCLER BULLISH SCENARIO Technical outlook:

Moncler S.p.A. (MONC.mi) daily chart. Moncler is an Italian luxury ski wear brand. Bought by Italian entrepreneur Remo Ruffini in 2003, who transformed, reinvented the near-bankrupt company which later was listed on the Milan Stock Exchange in 2013. In December 2020, Moncler purchased 100% stake of Italian luxury sportswear brand Stone Island in a reported €1.15 billion acquisition. The Triangle has broken through the resistance line at 22/05/2021, if the price holds above this level experts believe possible bullish price movement may occur for the next 21 days towards 55.60 EUR. The stop loss order should be placed at 49.93 EUR.

Fundamentals:

-Moncler chairman and chief executive officer Remo Ruffini believes 2021 will be a year “of rebirth and fresh energy,” as well as “of great work and zest for new projects.”

-The year has certainly started well, with China, Korea and North America lifting Moncler revenues up 18 percent to 365.5 million euros in the last three months ended March 31, compared with 310.1 million euros in the same period of 2020. At constant exchange rates, sales have risen by 21 %. Compared to the first quarter of 2019, sales dropped by 3 %.

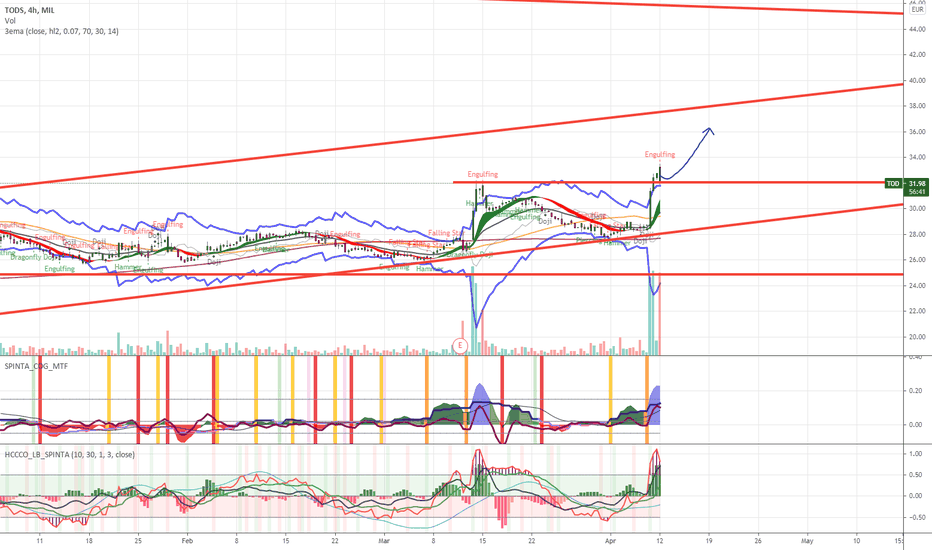

The trend is really strong ... Tod's will rise more The uptrend continue to be very strong, i will monitor the price when it reach the 38 eur level

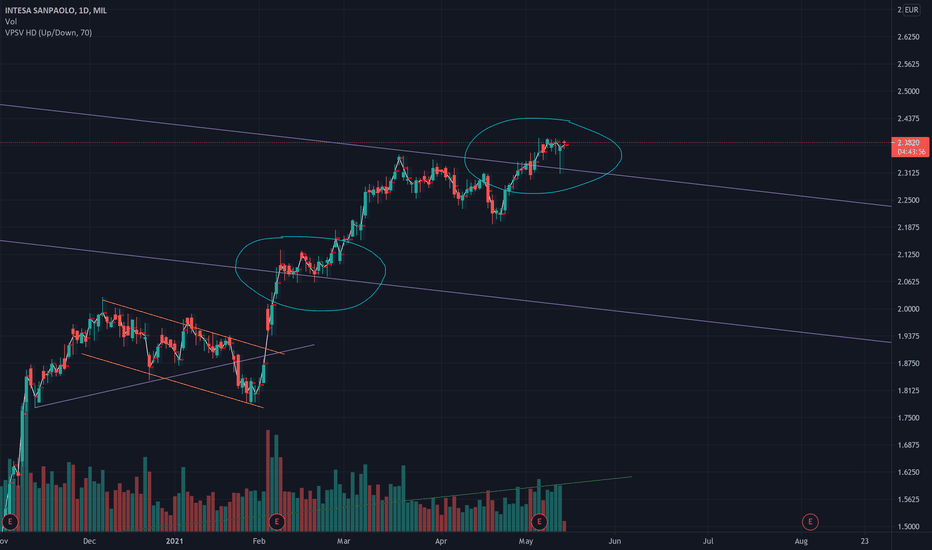

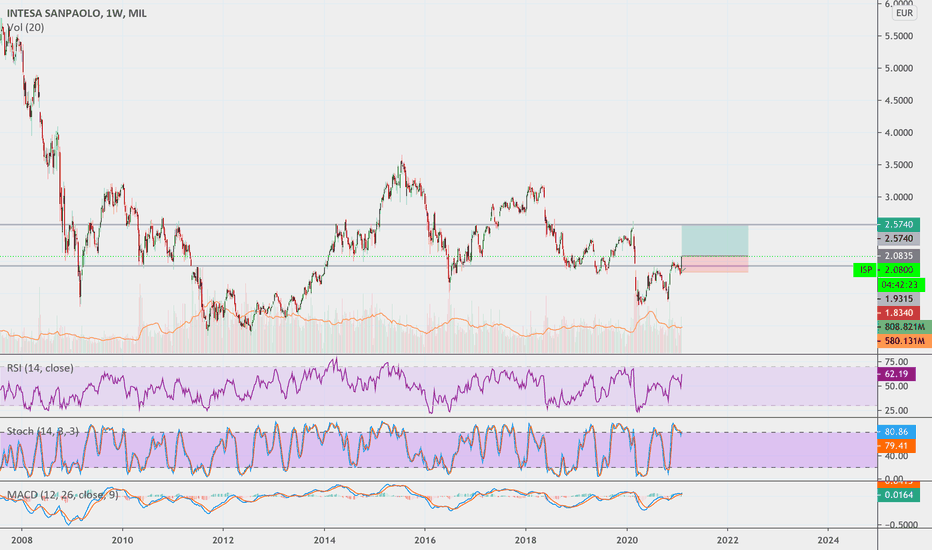

ISP Long TermHi guys, this is my POV on Intesa Sanpaolo, Italian bank that is rushing for the positive sentiment that is driving Italian markets these days, ISP is now breaking resistance so I will expect new highs.

I think a 20 % surge is very likely to happen in the next months, remember to set the stop loss.

DYOR and have a nice day

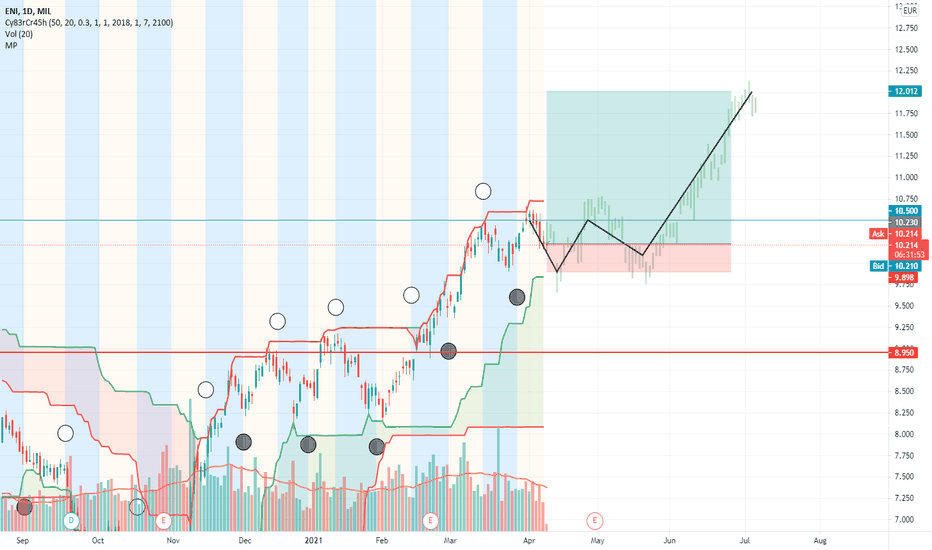

Ferrari (RACE) In a week of uncertainty, especially on the Nasdaq, which is on a critical point, see the article I posted last week for a more in-depth analysis, Ferrari finally seems to have started its bullish phase, after the long decline that the 'led to a loss of 36% from the beginning of 2021 to the beginning of March.

The price strongly breaks the bearish trendline on Monday, then tries to continue quickly on Tuesday, and then retraces with a two-day pullback.

The stock closed up at € 173.40 yesterday.

My idea about Ferrari in the long term, especially after the post-pandemic economic recovery is clearly Bullish, while in the medium term I believe that the title can easily reach the 178-180 area.

If the uptrend line were to keep and the global situation, also thanks to the summer period, were to improve, as we all hope, the second target is in the 190 area.

LazyBull

New brand, eshop and international market help Italian shoes After a good results,

this stock is getting a lot of buyers and the price can rise to the upper border of the triangle, next we will see if it try to break to upper values.

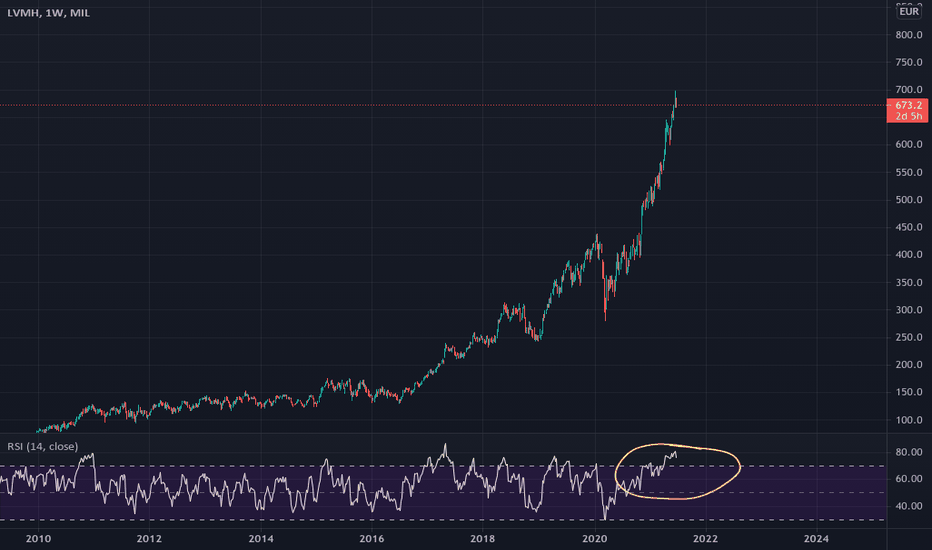

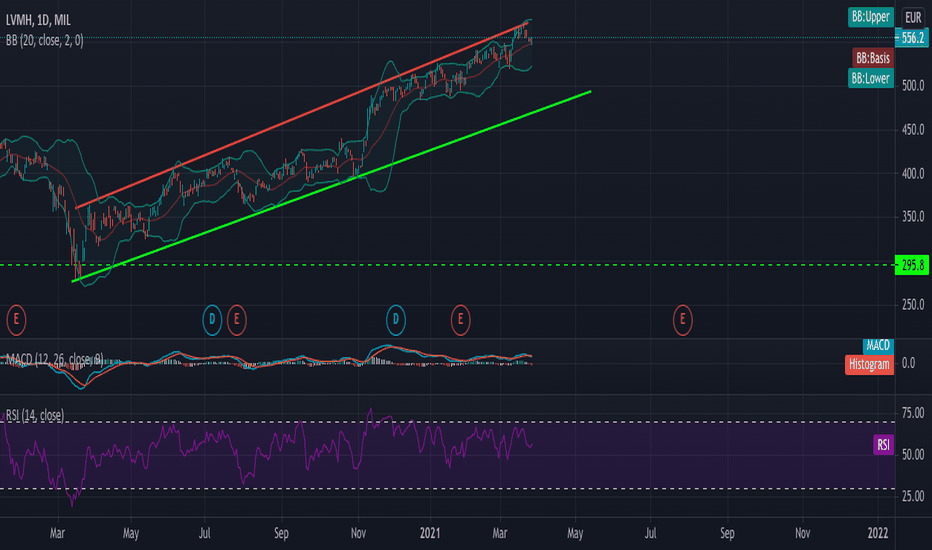

LVMH - fundamental - fair value: 305,8025/03/2021 19:30

-Markey cap: 279,848

Dividend: 279,848 * 1,08% = 3,022B

MC's dividend payments are covered by earnings.

30/06/2020 Dividend yield: 1,2% 30/06/2020

Dividend per share: €4,8

Earnings per share: €8,793

-PE ratio < 25: 59,61

-Profit margin > 10%: 10,53%

-Revenue growth past 5 years: yes (2020) 44,636m - (2016) 37,6m

-Profit growth past 5 years: yes (2020) 4,702m - (2016) 3,981m

-# shares outstanding declining: no. (2020) 504m - (2016) 502m

-Current assets > current liabilities: yes TA 108,671> TC 69,842

-FCF growth: yes (2020) 8,378 - (2016) 3,971

-price to FCF: €305,80

If I missed something pls let me know I'm just 16 and just want to learn as much as I can.

As much as I love LVMH my own research says the stock is overvalued. I hope I can help someone with this.

sources: yahoo finance & documents-financiers-2020_va_v2 (search investor relations lvmh - documents)

AVIO (AVIO)The first contract concerns the supply by Avio to Arianespace of 10 VEGA C launchers in the period 2023-2024, with an option for another 4 launchers. The VEGA C carriers will be used for institutional launches of the EU Commission's 'Copernicus' program and for other needs of the European Space Agency and the Italian Space Agency. On the same occasion, Ariangroup and Europropulsion (an equal joint venture between Avio and Arianegroup) signed a production contract for the supply by Avio of 34 P120 engines for the Ariane 6 carriers over the next two years (contract value ranging between 200 and 400 million). The signing of the two contracts further strengthens the excellent collaboration between France and Italy in the launcher sector which allows Europe to have autonomous access to space, underlined Giorgetti and Le Maire. They also strengthen bilateral cooperation in the most advanced research with important repercussions on the employment front, both in Italy and in France.