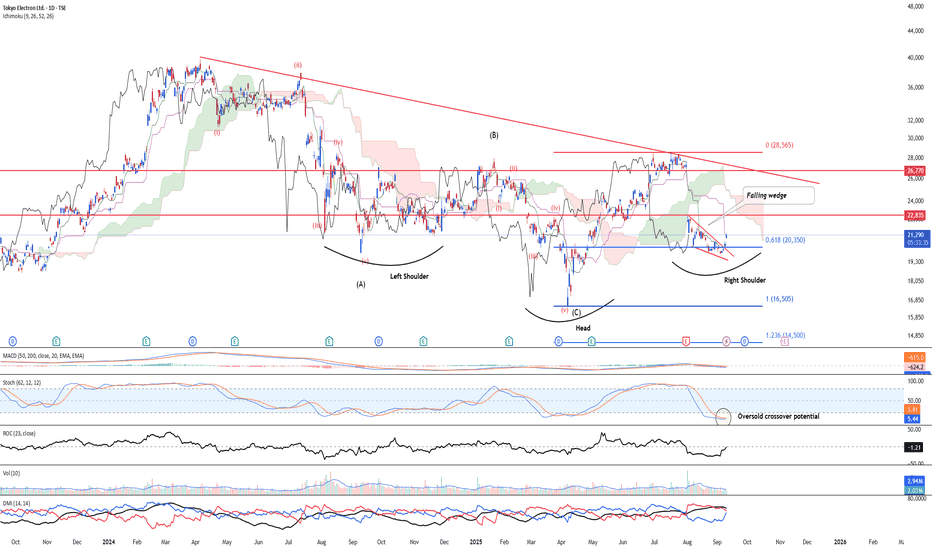

Taking the first bite for potential reversal rallyTSE:8035 is looking at a potential reversal to the upside after elliott wave structure suggest that there is an end to the corrective wave structure. As such, we are looking at a potential reversal. Furthermore, the potential inverted head and shoulder is looking at a potential reversal. While the

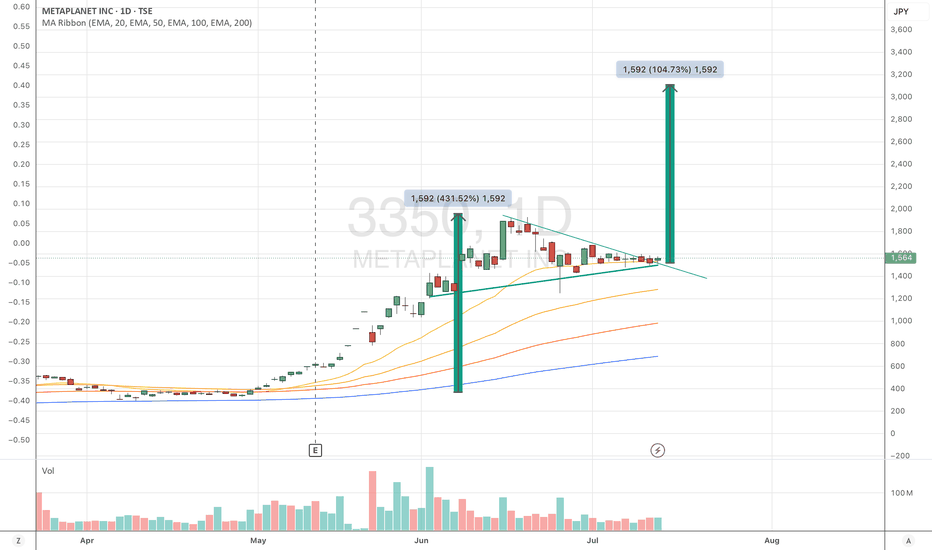

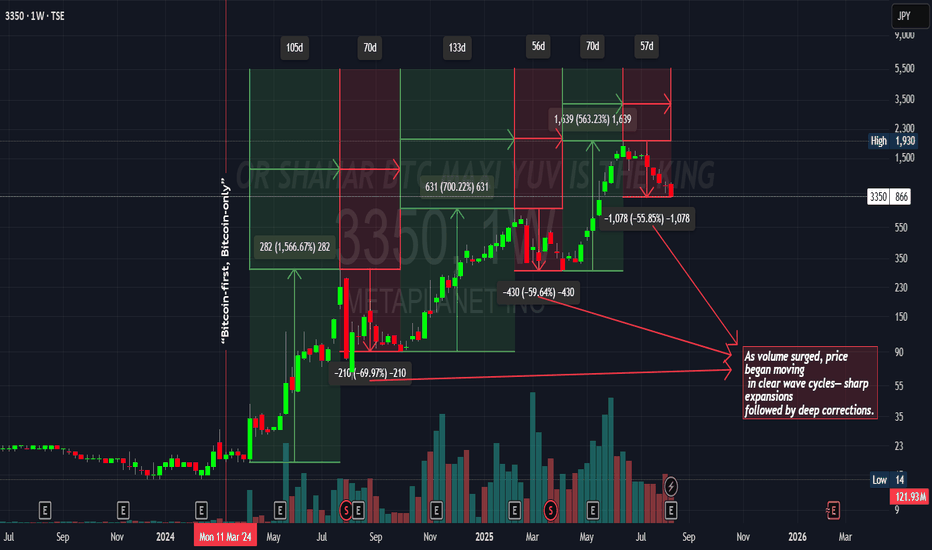

Wave Cycles in Price Action: Expansion and Correction DynamicsThis chart highlights how price action developed in distinct wave cycles once volume surged.

Each expansion phase was sharp, delivering multi-hundred percent gains in relatively short periods.

These expansions were consistently followed by deep corrective pullbacks of 50–70%.

The repeating rhythm

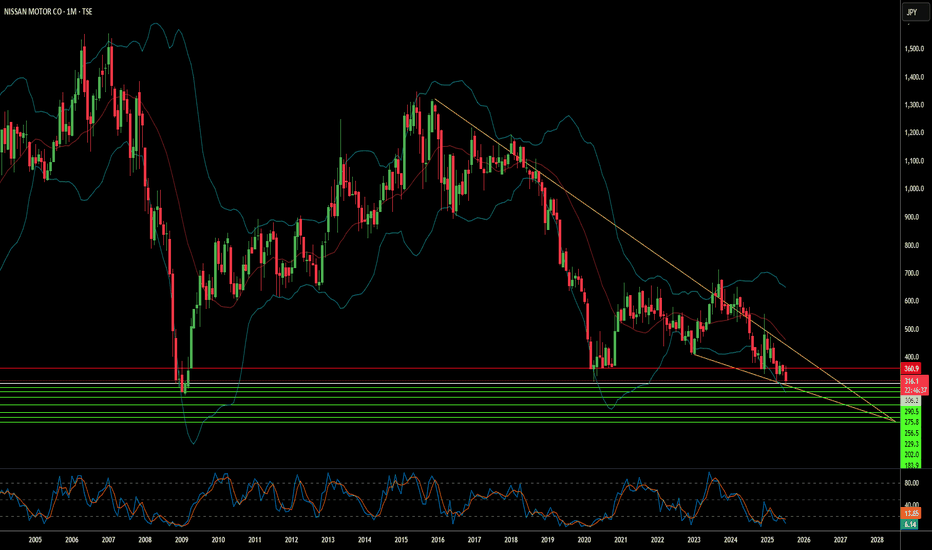

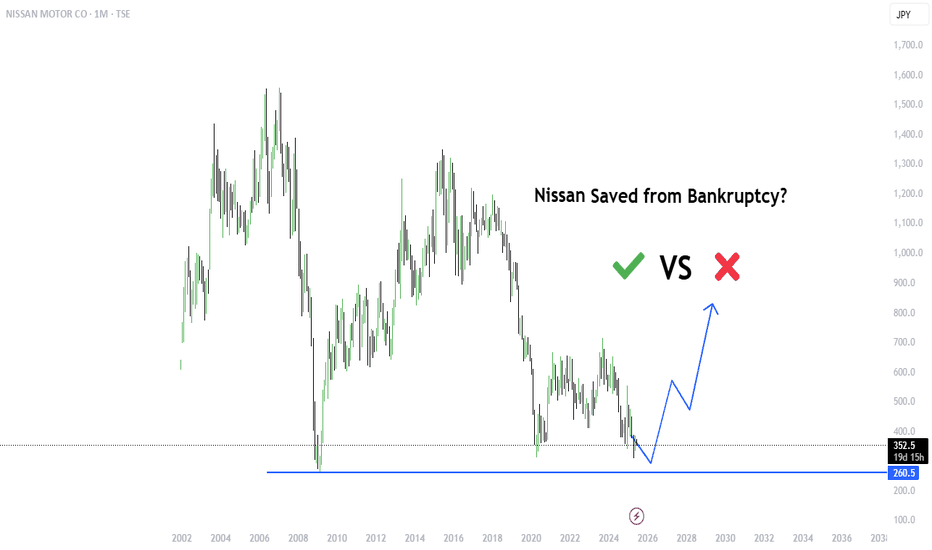

Is Nissan's Future Fading or Forging Ahead?Nissan Motor Company, once a titan of the global automotive industry, navigates a complex landscape. Recent events highlight the immediate vulnerabilities. A powerful 8.8-magnitude earthquake off Russia's Kamchatka Peninsula on July 30, 2025, triggered Pacific-wide tsunami alerts. This seismic event

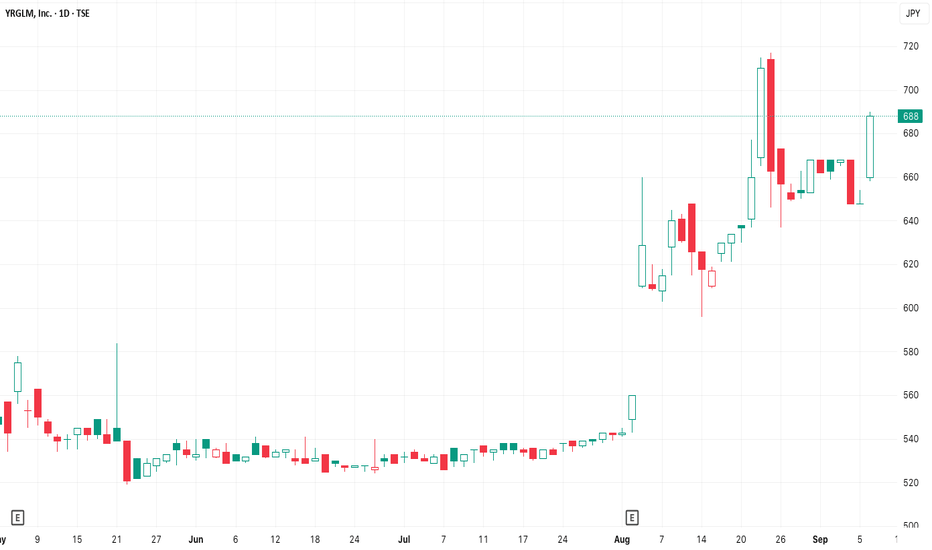

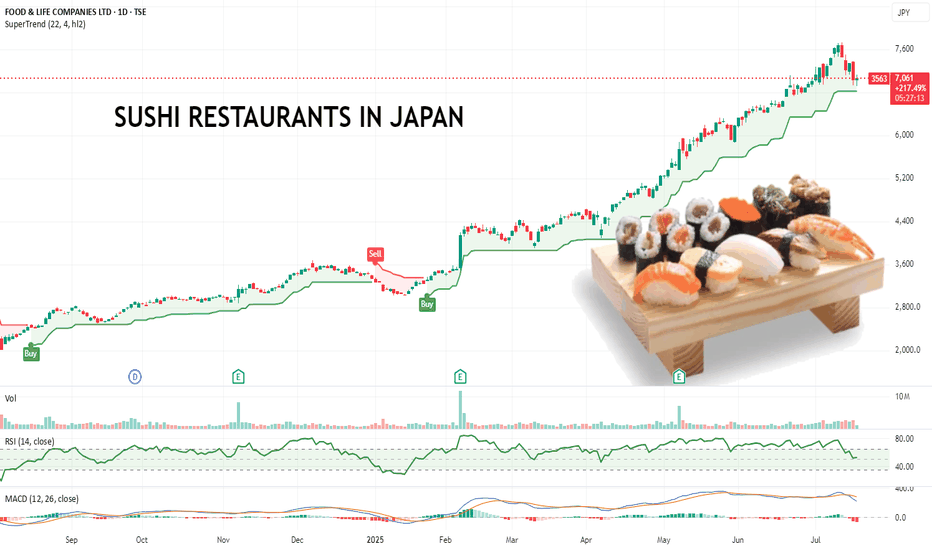

Pullback Over? This Japanese Sushi Chain Might Be Running Again.Food & Life Companies runs a major chain of sushi restaurants and is listed on the Tokyo Stock Exchange under the code 3563.TSE

From July 2025, I’ve started focusing more on scanning for high-momentum stocks globally, regardless of exchange. This one caught my eye with a clean, steady uptrend and a

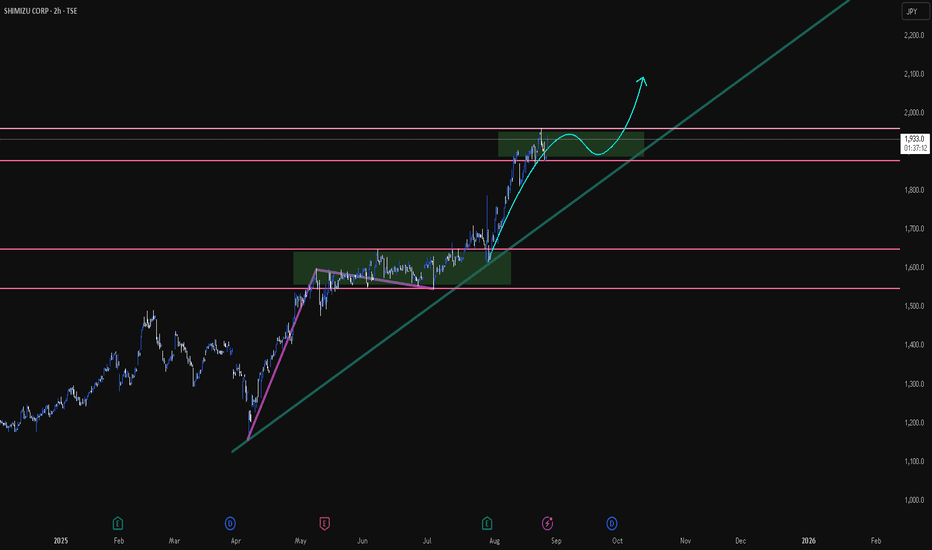

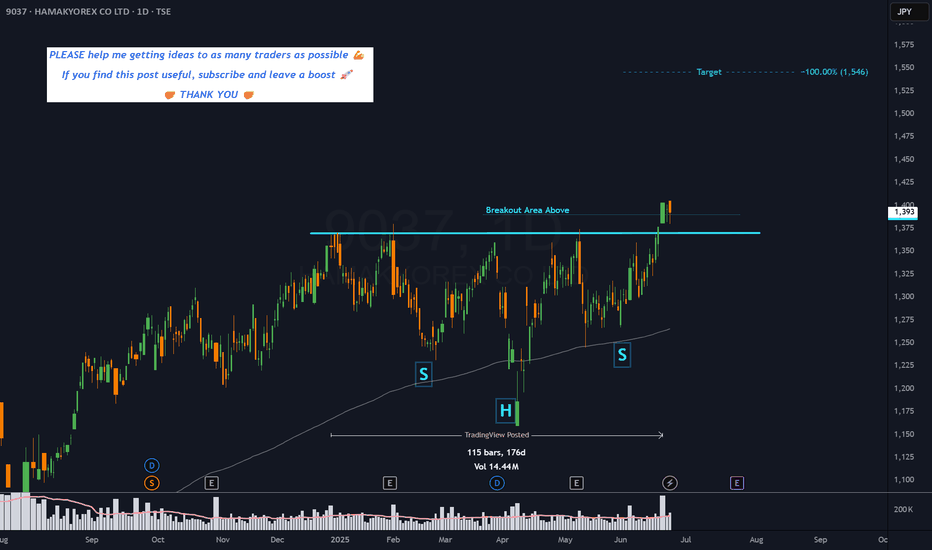

9037 - 6 months HEAD & SHOULDERS CONTINUATION══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

-

Anycolor Inc Trade IdeaShowing strong momentum after a breakout to new all-time highs, driven by robust growth in its VTuber business and digital content ecosystem. The company just reported a 34% YoY revenue increase to ¥42.9 billion and a 31.7% rise in operating profit for FY2025, fueled by expansion in both its domesti

Will Nissan be saved from Bankruptcy?Financial Health & Bankruptcy Risks

Credit ratings in junk territory

Moody’s recently downgraded Nissan’s credit rating to Ba2 (negative outlook), highlighting weak free cash flow and margins. S&P and Fitch have also downgraded Nissan to below investment‑grade with negative outlooks.

Massive

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Tomorrow

3955IMURA & Co.,Ltd.

Actual

—

Estimate

—

Tomorrow

215ATimee, Inc.

Actual

—

Estimate

—

Tomorrow

77773-D Matrix, Ltd.

Actual

—

Estimate

—

Tomorrow

8142TOHO Co.,Ltd.

Actual

—

Estimate

—

Tomorrow

4880CellSource Co., Ltd.

Actual

—

Estimate

—

Tomorrow

9692Computer Engineering & Consulting Ltd.

Actual

—

Estimate

—

Tomorrow

9627Ain Holdings Inc.

Actual

—

Estimate

61.08

JPY

Tomorrow

2929Pharma Foods International Co., Ltd.

Actual

—

Estimate

—

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Finance | ||||||||

| Producer Manufacturing | ||||||||

| Consumer Durables | ||||||||

| Electronic Technology | ||||||||

| Technology Services | ||||||||

| Health Technology | ||||||||

| Process Industries | ||||||||

| Retail Trade | ||||||||

| Communications | ||||||||

| Consumer Non-Durables |