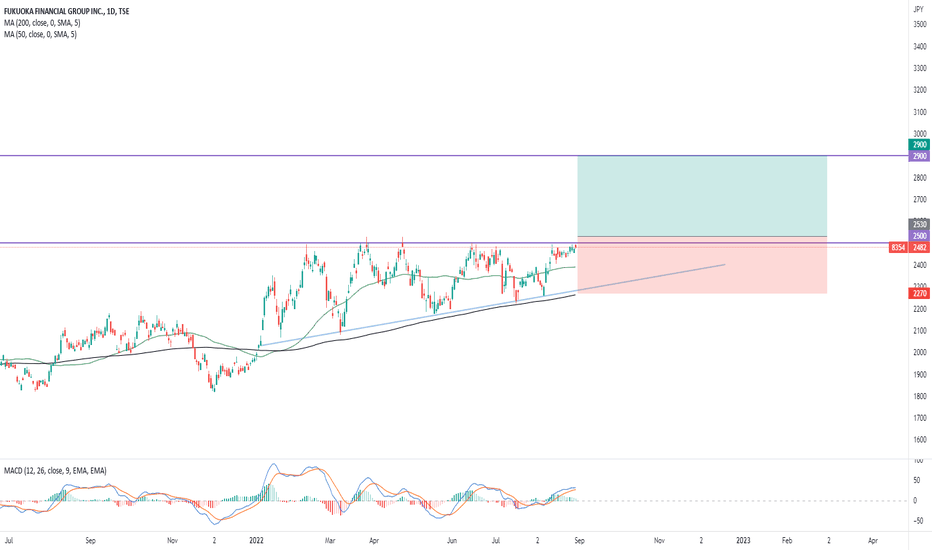

Fukuoka Financial Group IncFukuoka Financial Group Inc is a Japan-based company mainly engaged in the banking business. The Banking business is engaged in the provision of banking services, such as deposits, loans, domestic and foreign exchange, among others.

Over the past 4 months price has formed an ascending triangle pattern with the horizontal boundary acting as strong resistance around the ¥2,500.00 level. A daily close above the ¥2,530.00 to ¥2,575.00 price range will confirm the breakout from the 4-month-long ascending triangle with a possible chart pattern price target around the ¥2,900.00 level.

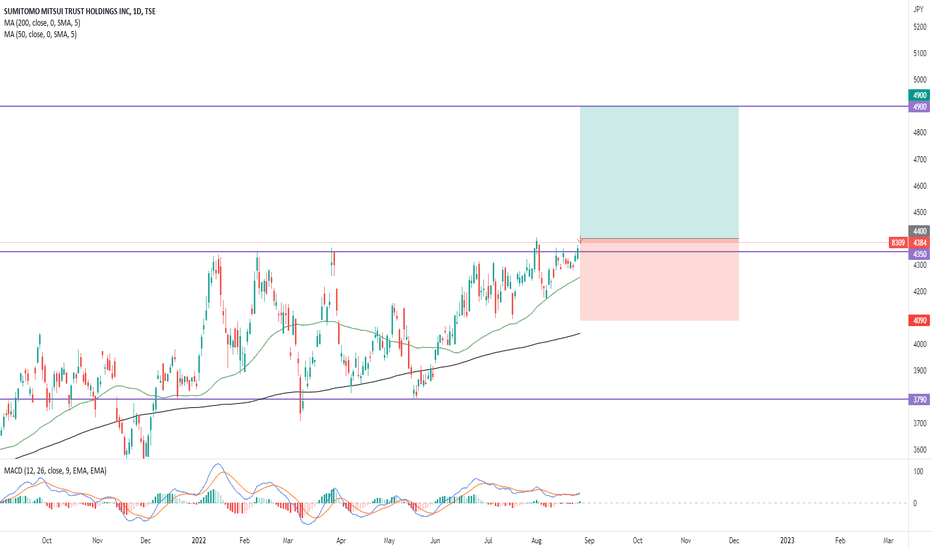

Sumitomo Mitsui Trust Holdings IncSumitomo Mitsui Trust Holdings Inc is a Japan-based company mainly engaged in the financial-related business. The stock is listed on the Tokyo Stock Exchange.

Over the past 7 months, price has formed a rectangle with the horizontal boundary acting as strong resistance around the ¥4,350.00 level. A daily close above ¥4,430.00 will confirm the breakout from the 7-month-long rectangle with a possible chart pattern price target around the ¥4,900.00 level.

Political Attitudes Develop Independently of Personality TraitsI proved to the relationship between personality traits and political attitudes has a long history , but a great deal of confusion about the nature of this relationship has recently surfaced. Early conceptions of personality viewed attitudes and personality traits as independent yet related, through genetic mechanisms . This work was informed by developmental approaches that proposed that political preferences are an integral part of human development . As personality theory and measurement progressed, political values were incorporated into various personality theories in several ways, including several of the dimensions and subfacets of the five-factor model (FFM) as well as Eysenck’s Big 3. For example, liberal and conservative values are explicitly used to define the Values facet of the Openness dimension (S1 File). Tough versus Tendermindedness, originally a measure of political attitudes outlined by Eysenck , is embedded in the FFM trait of Conscientiousness , and moral and economic values are included in Agreeableness (see S2 File for some examples).

Research over the last decade has begun to depart from these original conceptions of personality, and view political attitudes as exogenous to personality measures. Specifically, the overwhelming majority of recent research hypothesizes a strict chain of causality between personality and political values, through explicit theorizing or implied through statistical models . In this way, the same construct may reside on both sides of the predictive equation. Such a view, however, may not be entirely unjustified because modern personality dimensions, even in abbreviated forms, are intended to measure several sub-facets that do not explicitly include political attitudes. For example, in addition to political values, the Openness to Experience dimension measures openness to ideas, aesthetics, fantasy, feelings and actions, all of which are believed to capture the basic motivational states that make a person amenable to novel experiences, influencing their tolerance of ambiguity, and desire for cognitive closure, in order to reduce uncertainty in their environment. These motivational states, so it has been theorized, have an independent causal role in the development of liberal or conservative attitudes .

A third stream of research relying on behavioral genetic methods and developmental theories adds further complexity. These theories suggest that it is unlikely that genetic influences will operate directly on a complex trait. Rather, genetic influences are polygenetic and multifactorial. This approach suggests that although personality traits and attitudes are correlated, they are largely related through a third underlying latent genetic factor .

In summary, hundreds, if not thousands, of papers on personality and political traits have been published claiming causality, while some claim covariation, whereas the foundational literature considers political attitudes to be embedded within personality. The results from these separate research streams provide a considerable amount of empirical content, but are inconsistent in both empirical results and their theoretical underpinnings, resulting in an unclear picture of the relationship between personality and political attitudes. What has so far remained absent is a longitudinal exploration of the causal role of personality on political orientations. That is, a conventional test where changes in variable x (personality) result in a changes in variable y (political attitudes) over the long term, has yet to be presented. Here, we seek to take this

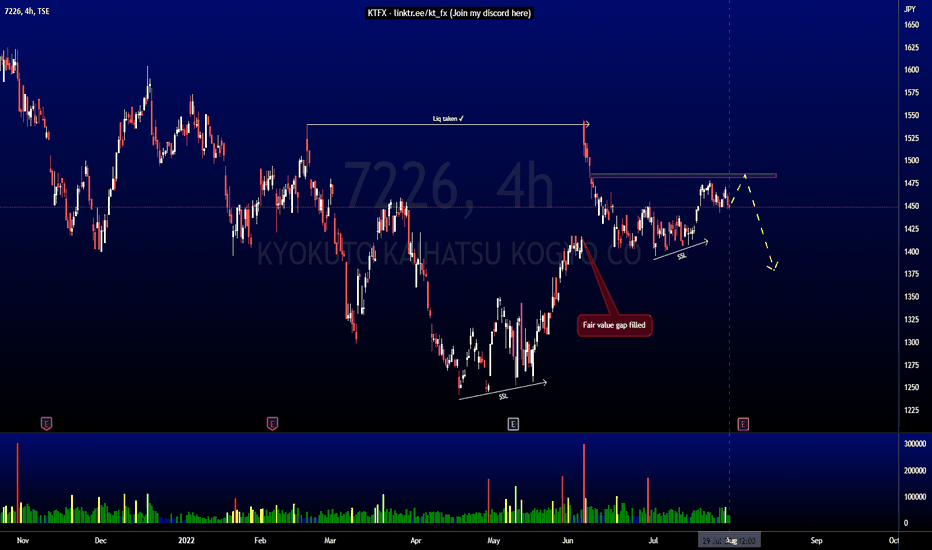

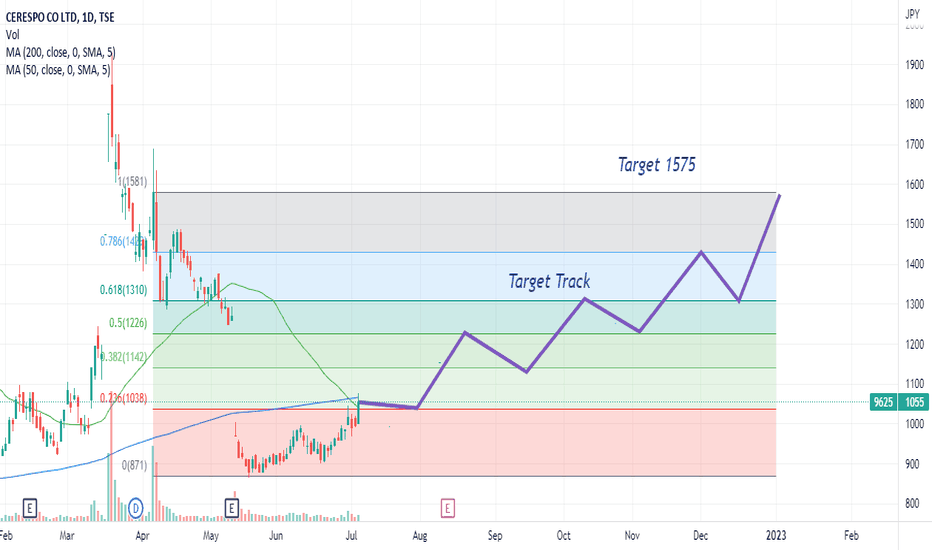

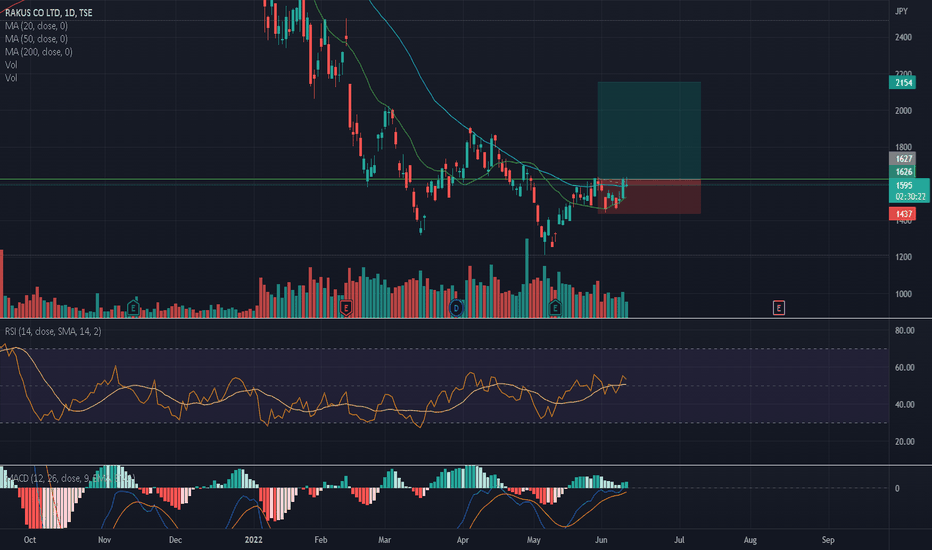

7226 AnalysisPrice has been consolidating for a few months. Price recently gapped above and took liquidity at 1540 but is unable to close above. Price is on a downtrend since then. Right now, we see the price built sell-side liquidity. This might be a short-term bearish target and price might target further to the lows at 1242. But first, price is more likely to fill the fair value gap at 1481 before we see any reaction downside.

Gold Line Resource Canada Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions