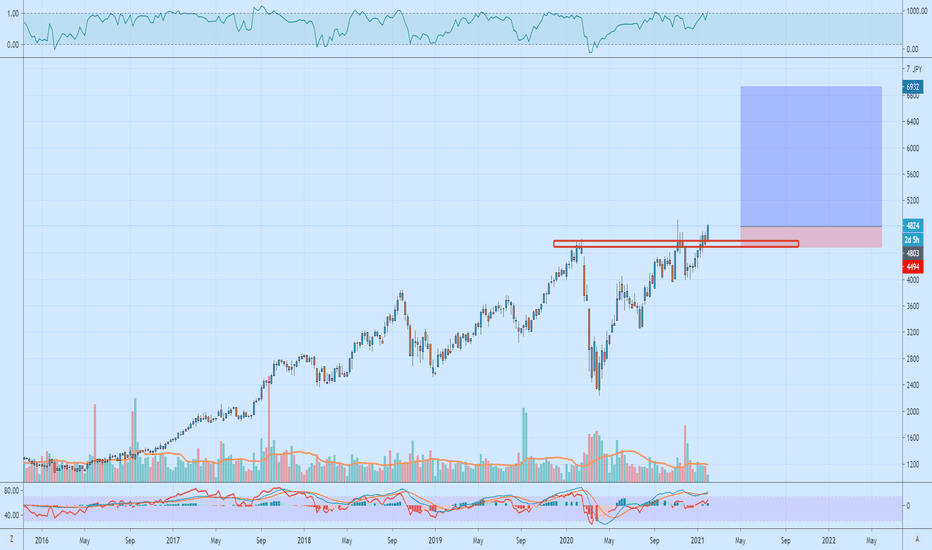

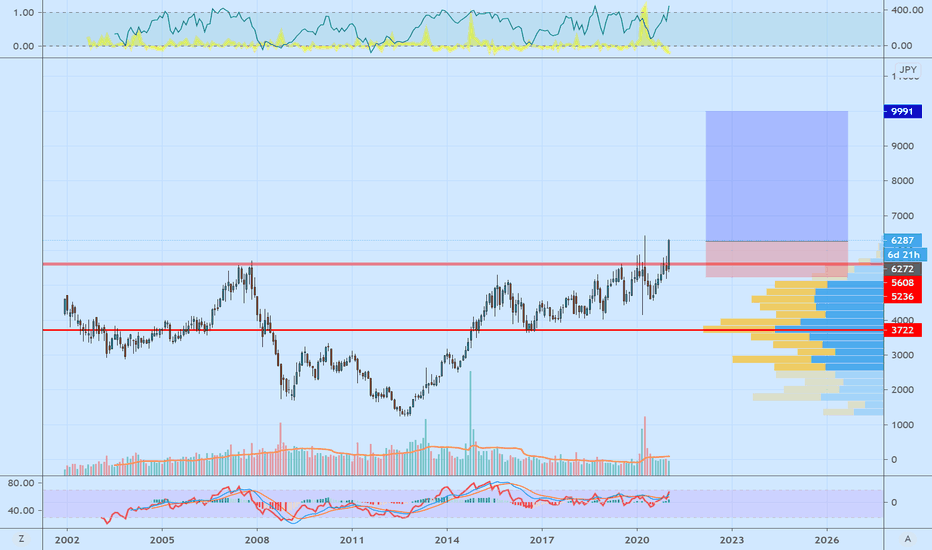

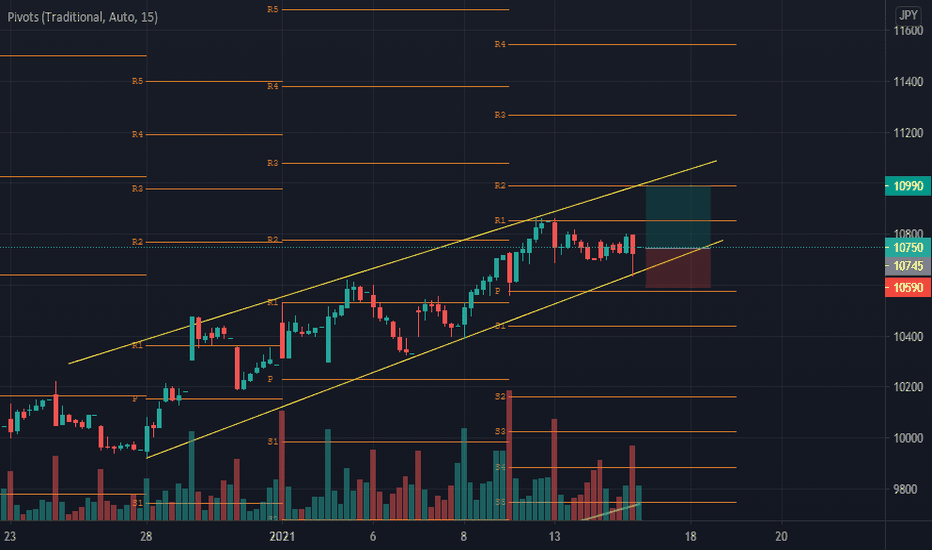

Z holdings skyrocket is inevitableZ holdings holds both Yahoo Japan the biggest portal site in Japan and LINE the largest messenger app in the country.

Both are extremely suitable for large scale monetization.

With NI225 and TOPIX turning bullish, the tech sector will surely benefit from it.

###NOT FINANCIAL ADVICE###

A bright future for NintendoVideo game stocks have proven to be popular this week (GameStop mania). While you won't see the same returns as GME, Nintendo is a more stable investment of the brand that many of us grew up with. This company has potential for further growth in their neighbouring China.

“China is important to Nintendo because the country does not yet have a console culture in the same way that the U.S. or Japan does, which represents a growth opportunity for the company.”

Source:

Search Reuters article titled: Exclusive: Nintendo ships 1 million Switches in China since late-2019 launch. (TradingView doesn't allow me to post the link.)

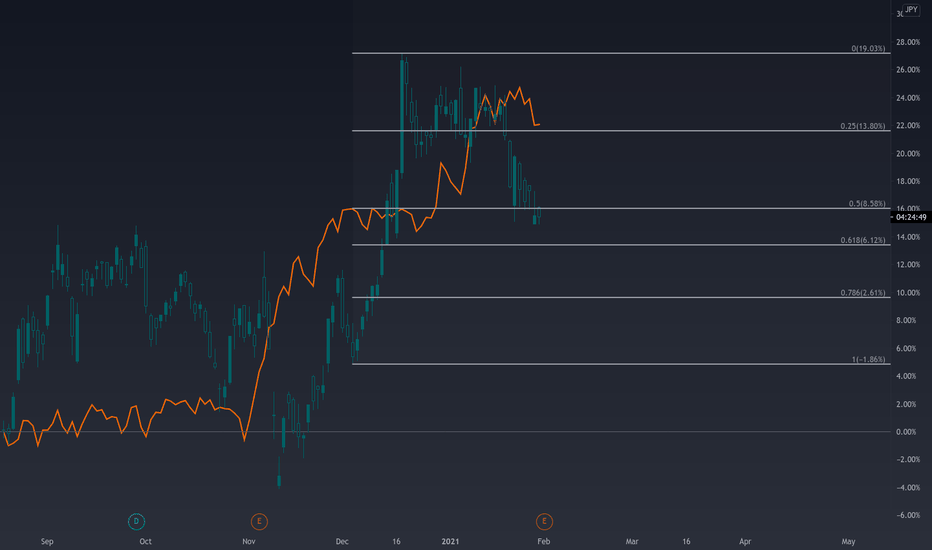

The orange line represents the NIKKEI futures index. Compared to Nintendo there's a short term crack in correlation ("manipulation"), stocks are being suppressed in anticipation for the earnings come February 1st. Historically February has shown to be a bullish month for Japanese equities.

There is an old high at 73 200 yen which will inevitably be traded through. A quick move to the upside is to be expected, while this stock is also an excellent long term hold in your portfolio.

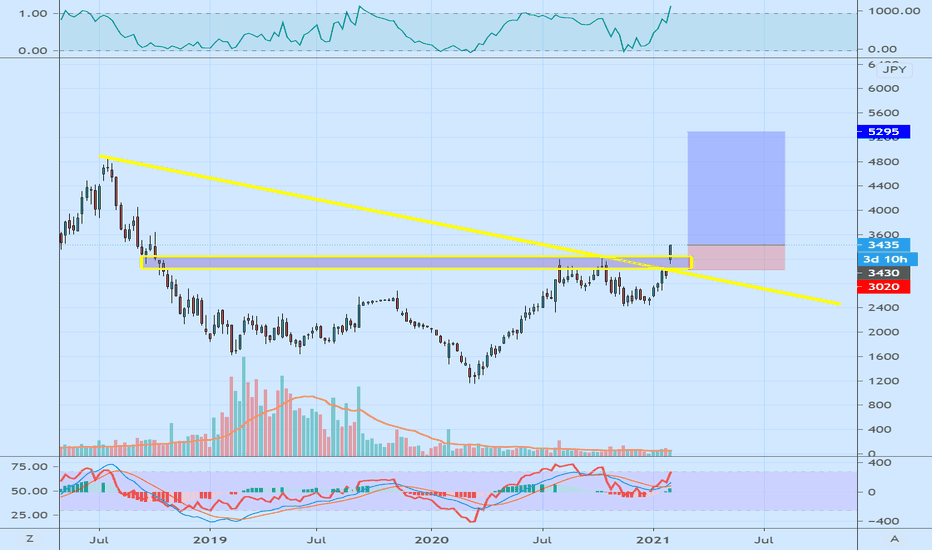

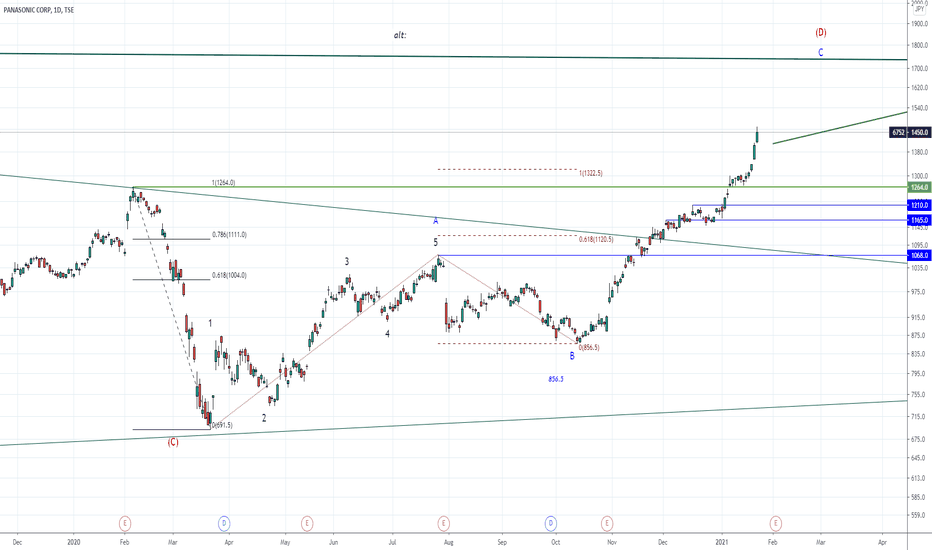

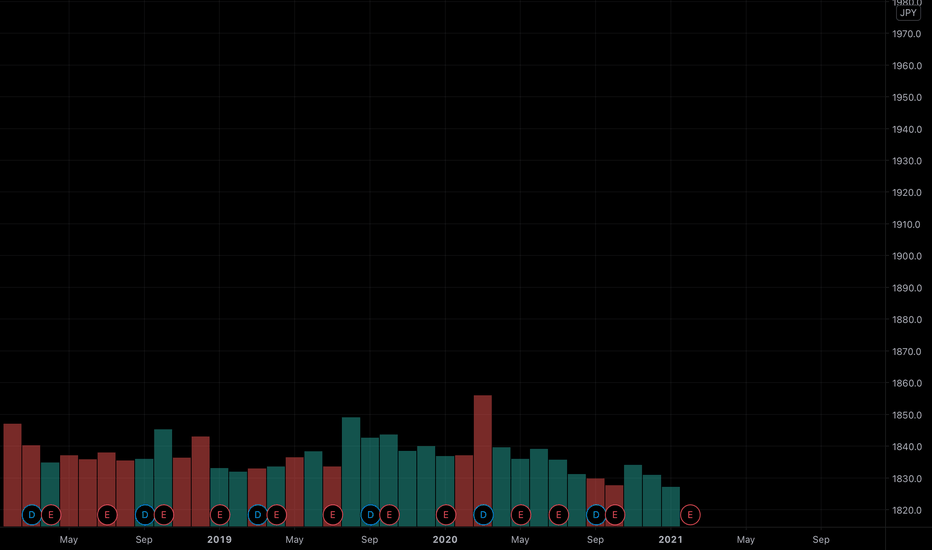

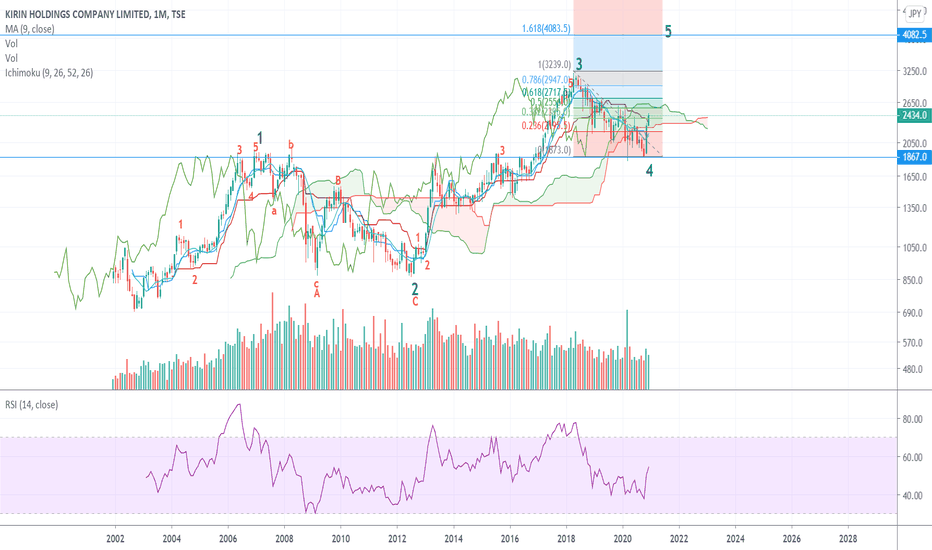

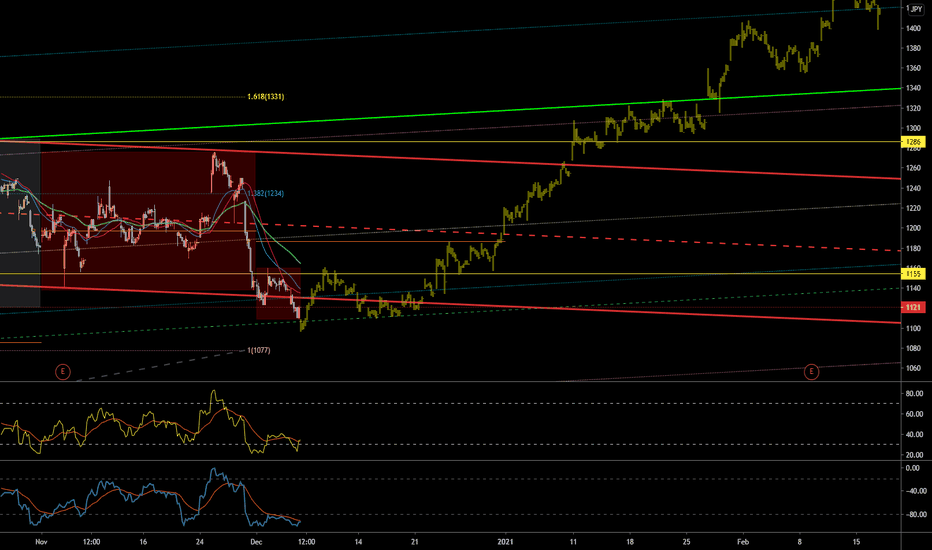

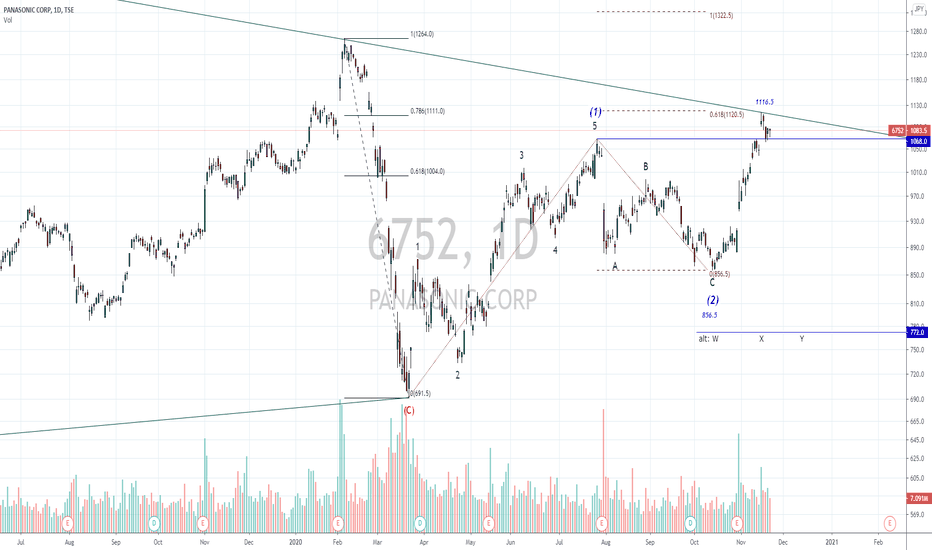

Panasonic.....Big picture viewHello Traders,

Big Picture:Monthly

Panasonic (Ticker:6752) is probably moving in a huge Triangle. At the current move, the stock is on the way to finish wave D of the triangle. This move has a target range around the 1700-1750 JPY, depending on when and if it will achieve. If so to come, after hitting this price target, the stock will decline in a wave E, which has to retrace a 0.618 Fibonacci of waves C and D at minimum!

Weekly:

Here to observe is the pattern coming close to 1.382 Fib.-Extension of wave A. A perfect target should be the 1.618 Fib.-Extension of wave A to ~ 1730.0 to complete wave D!

Daily:

The „breakout“ of the 1264 JPY level and after occurring „kiss-to-say-good-by“ has sent the stock to its highest level since August 2018. Note the bullish gap by trading on January 20-21 and the next gap the day after.

As long as the level of 1264 JPY is valid the outlook is bullish to the mentioned target areas named before.

I will update the count in the coming weeks.

Have a great weekend.....

Feel free to ask or comment!

Trading this analysis is at your own risk!

The editor is invested to this share!

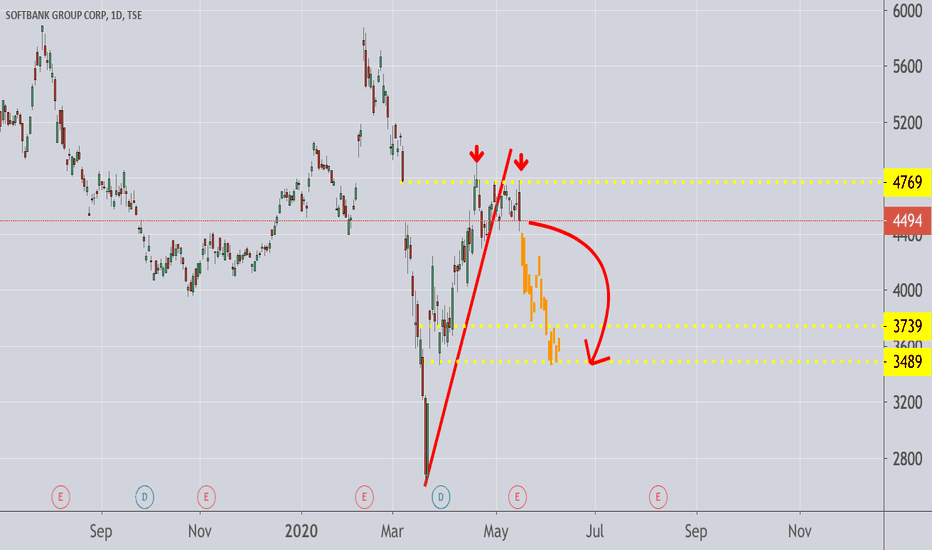

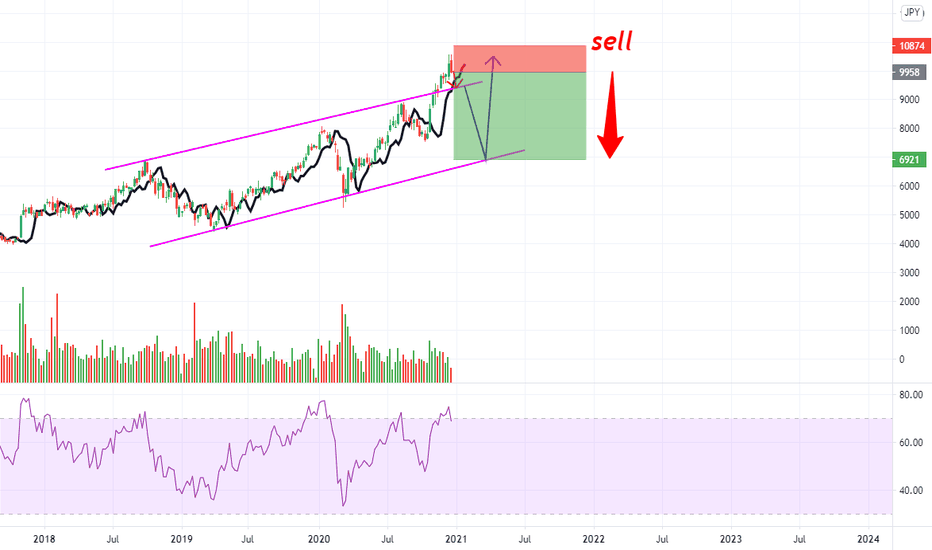

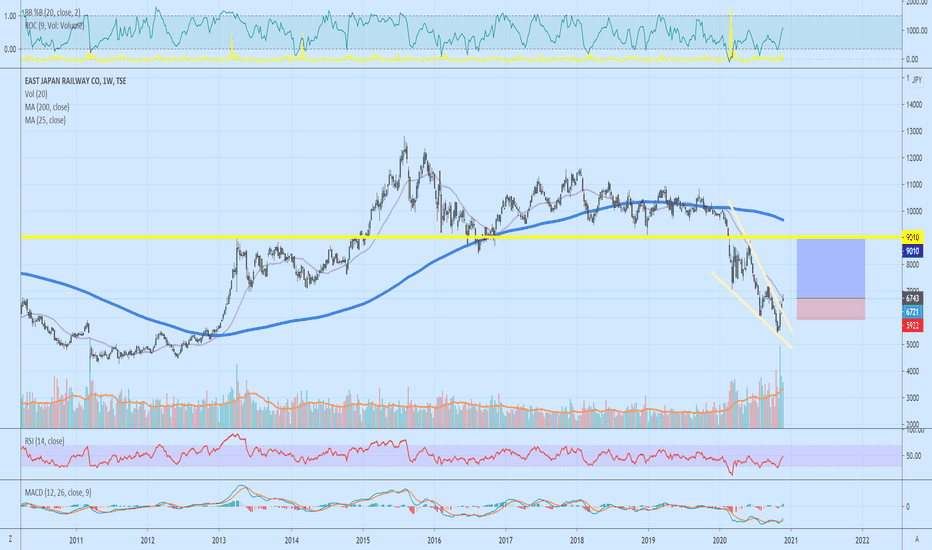

This stock is going downhill from here !Read article here and here

First, the humongous losses that will be hard to explain to the shareholders.......and next come the departure of Jack Ma., leaving the board of directors. This is a double whammy!!!!

I believe the share price over the next few days or weeks will be hammered down.

Let's see how it goes....

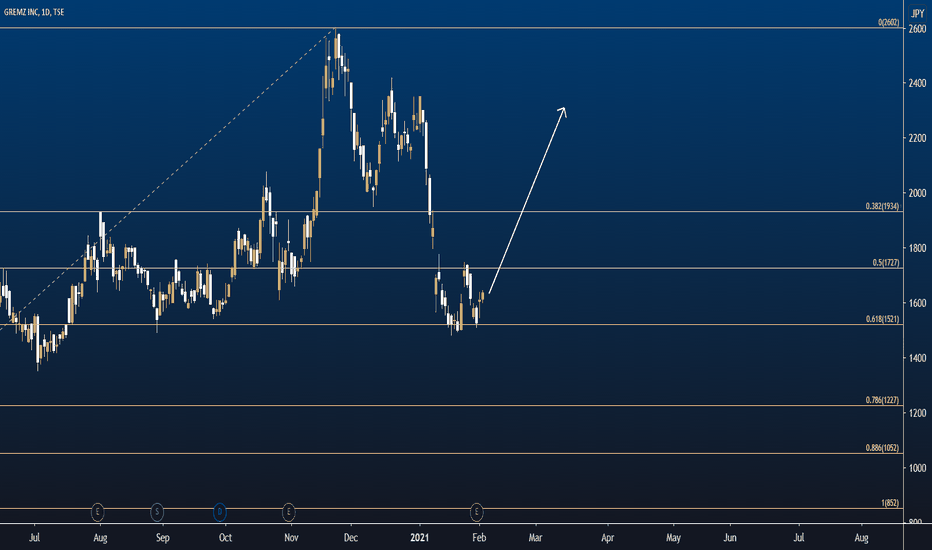

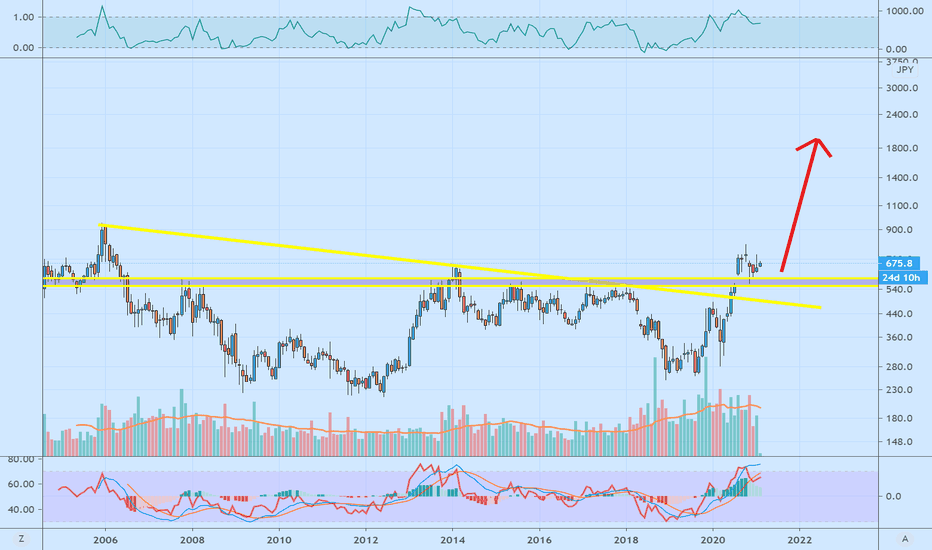

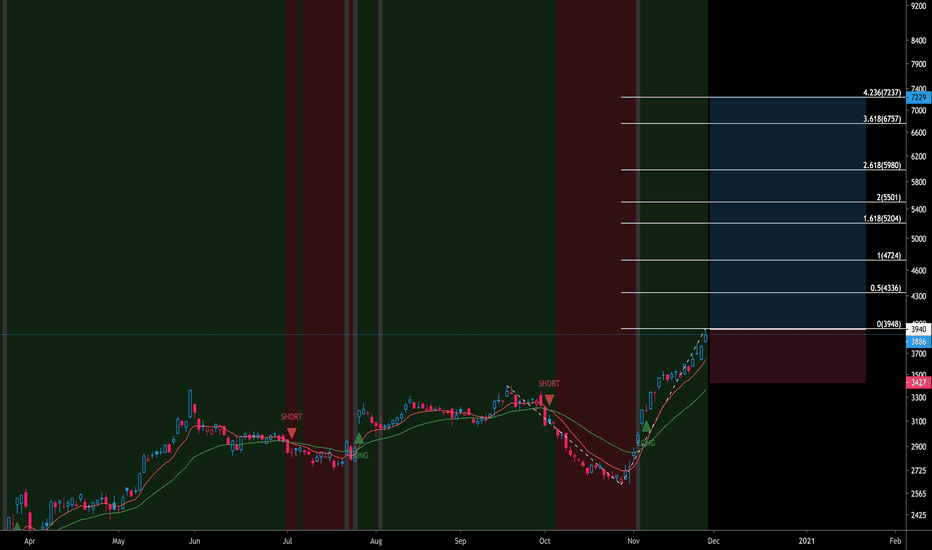

Stock to watch: Daiichi Sankyo (TSE:4568)TSE:4568

An interesting stock to trade short-term and to hold long-term.

The asset had already showed almost +35% growth this month and is still on the move.

Both Buy/Sell Zones and EMA Cross indicate an uptrend.

Short-term trade target is 0,5 Fib.

For the long play may be held up to 4.236 (more as an investment).

Invalidation: breaking the 3500 level and staying there.

Disclaimer: This article should not be considered as financial or investment advice. Trading digital assets involve risk and may resolve in the loss of your capital. Always be sure to understand the amount of risk involved and do your research before taking any trading/investment steps.

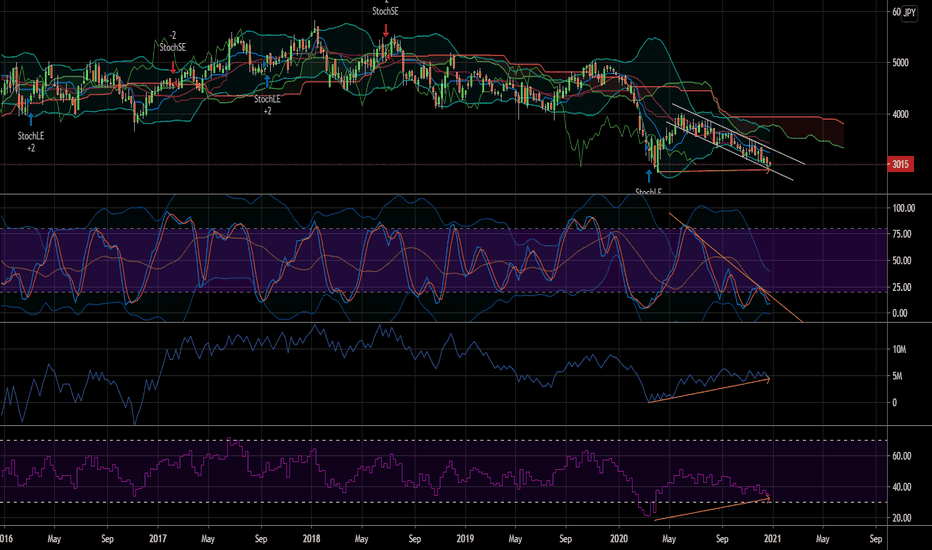

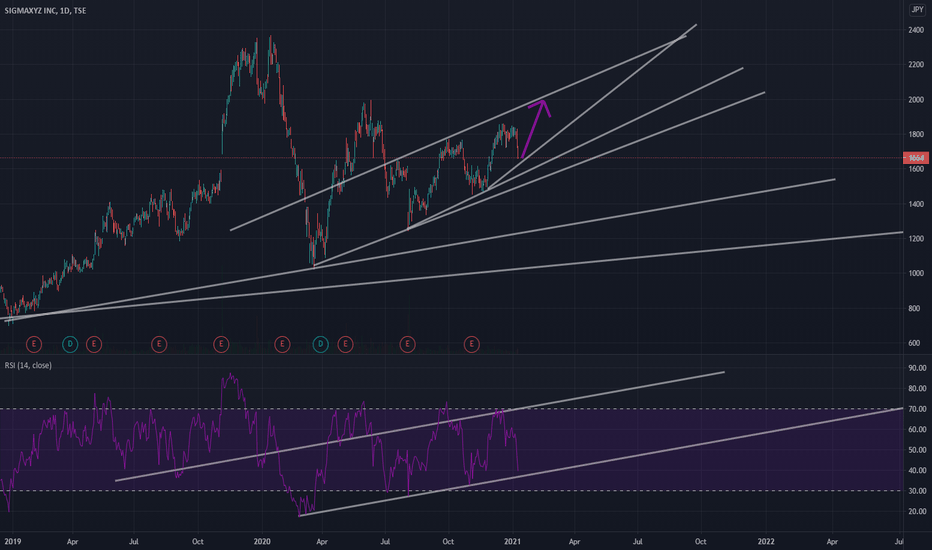

Panasonic...New high`s next or corrective setback?Hello Traders,

what’s next for Panasonic?

I have drawn the alternates at the chart to make my thoughts clear.

The move is either a wave 1 of (3) or it is part of a corrective move, here an „expanding-flat“!

While the stock broke about the latter high at 1068 it could be, that a „retest“ of this area will be next in the coming days and weeks ahead (if it not has happened)!

A break above the declining green trend line would open the door to higher price still, here to possible the 1264 area, the February 6 high.

A

Have a great Sunday.....

Ruebennase

Feel free to ask or comment!

Trading this analysis is at your own risk!

The editor of this note is still invested to this stock!