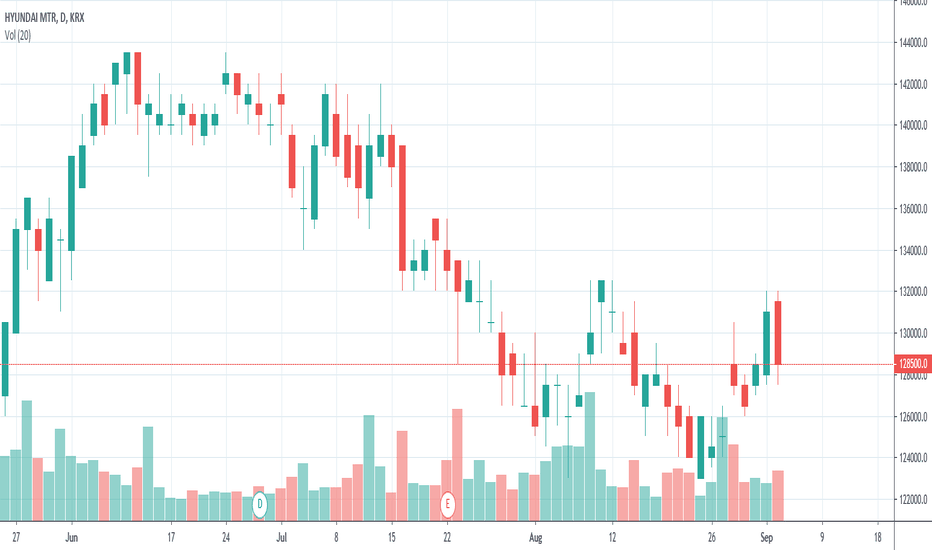

Hyundai Workers on Lowest BonusesThe unionized workers of Hyundai Motor Co. in South Korea on Monday voted to accept the lowest bonus given in almost two decades. And this was due to the widespread restructuring in the auto industry and the harmful trade war with Japan.

On Tuesday, Hyundai announced the approval. And the firm successfully avoided a walkout by workers for the very first time in eight years.

Aside from that, in all but four years since the creation of union in 1987, South Korean workers of Hyundai have staged strikes. As a result, it had drawn media and public criticism for threatening to walk out even though they have a relatively high annual wage of 92 million won or $75,866, on average as of 2018. And this does not yet include benefits and job security.

In addition to that, the deal happened at the same time with tightened export curbs by Japan’s warning to damage Asia’s fourth-biggest economy. And this weighs on the auto industry who’s already struggling with production cuts. Also, it was facing job losses due to a slowdown in exports to the United States, Europe, and other countries.

Hyundai and Other Automakers

Meanwhile, U.S. automaker General Motors Co. closed one of its South Korean factories and reduced headcounts last year. And also, Renault’s South Korean unit is preparing for possible production cuts.

Then, South Korea accounts for 37% of Hyundai Motor’s total production as of last year. And the automaker reduced its exposure to domestic production in favor of overseas output.

Moreover, other automakers are bracing for intense annual wage negotiations. And this year, GM wants to freeze a base wage for two consecutive years. But South Korean union opposed to this plan saying it could cause a full strike this month.

Also, Renault Samsung plans to cut production starting next month.

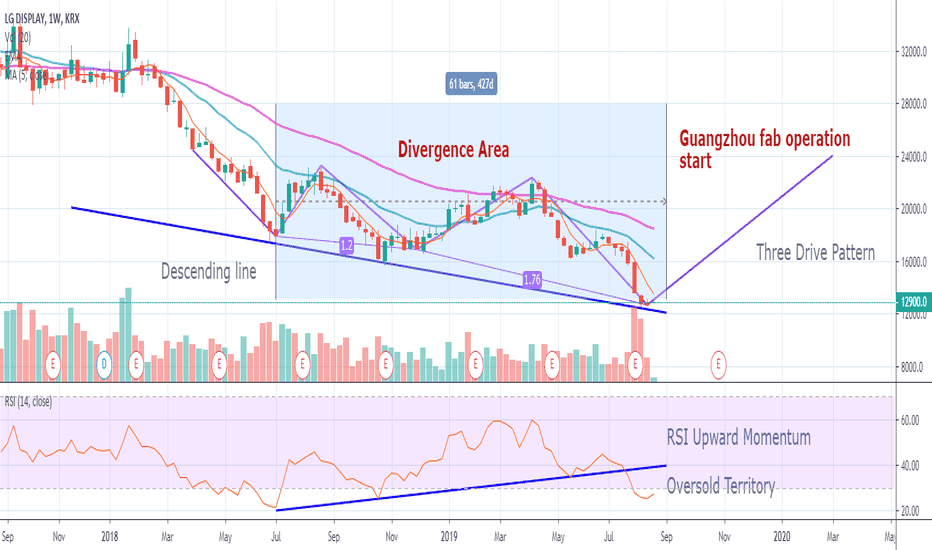

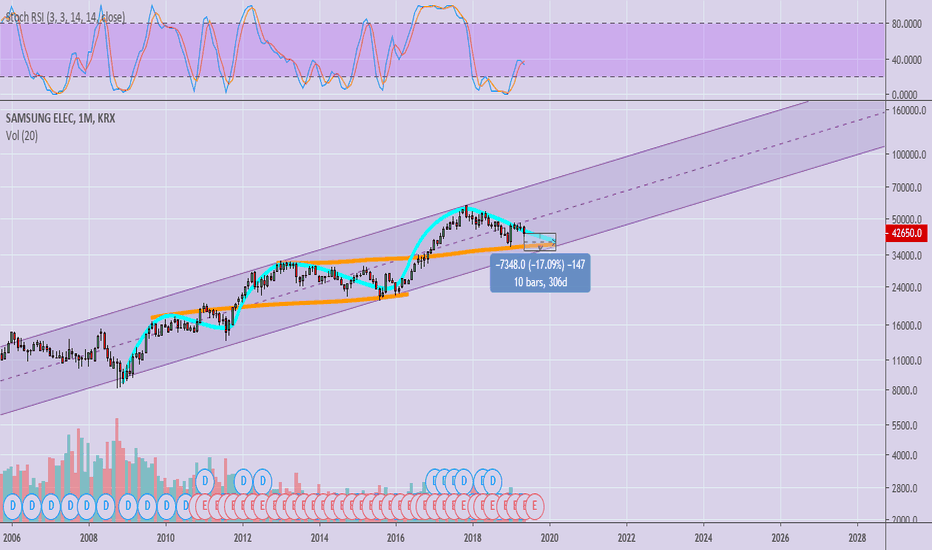

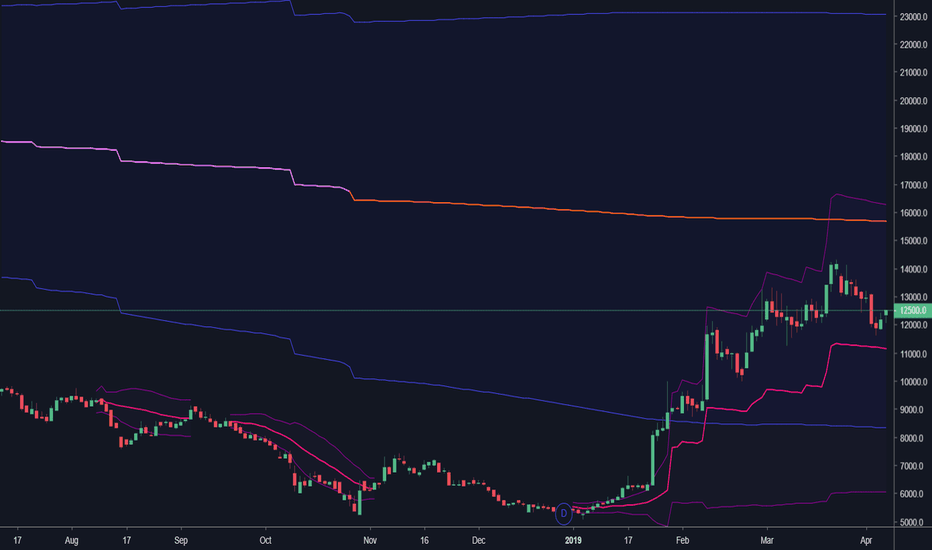

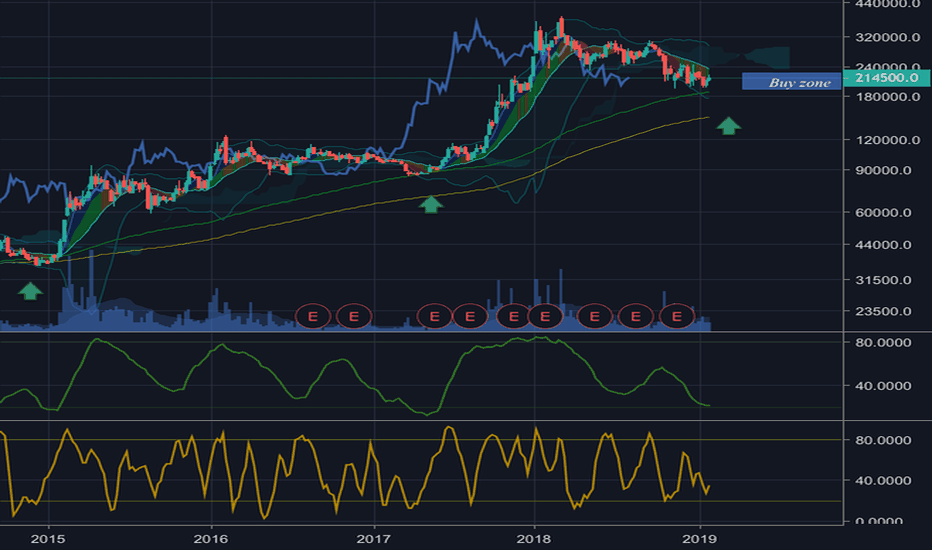

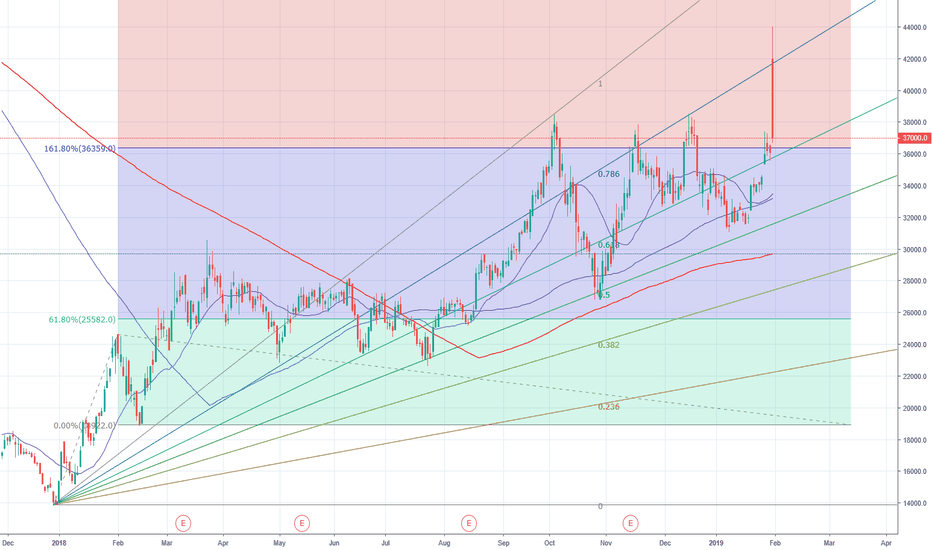

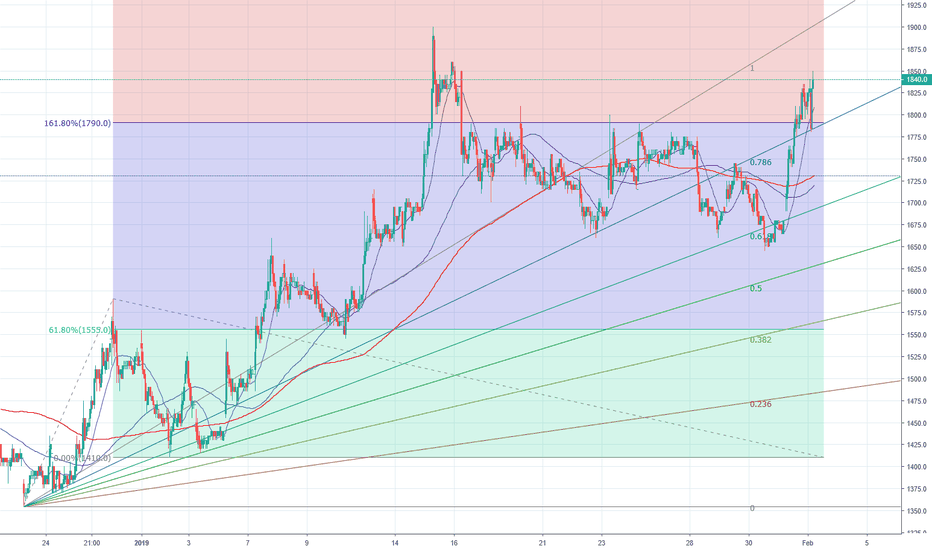

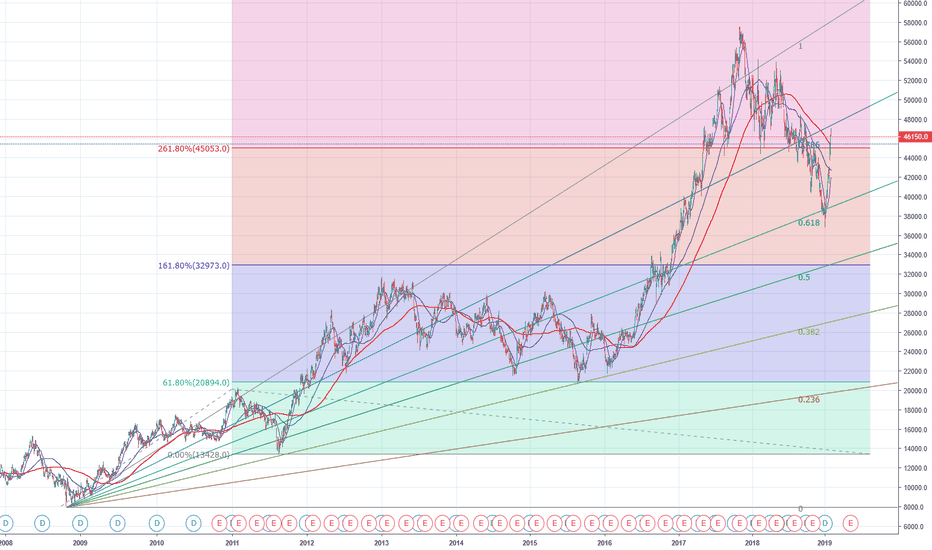

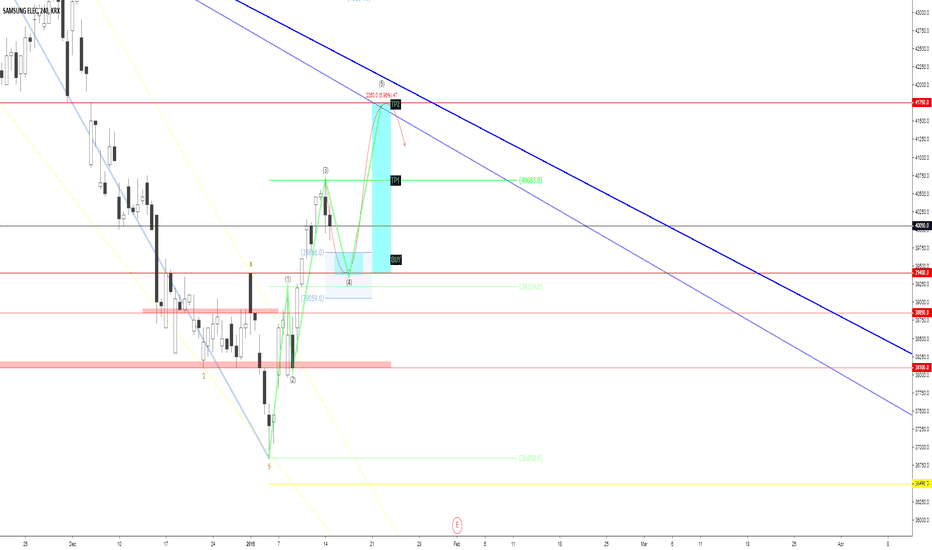

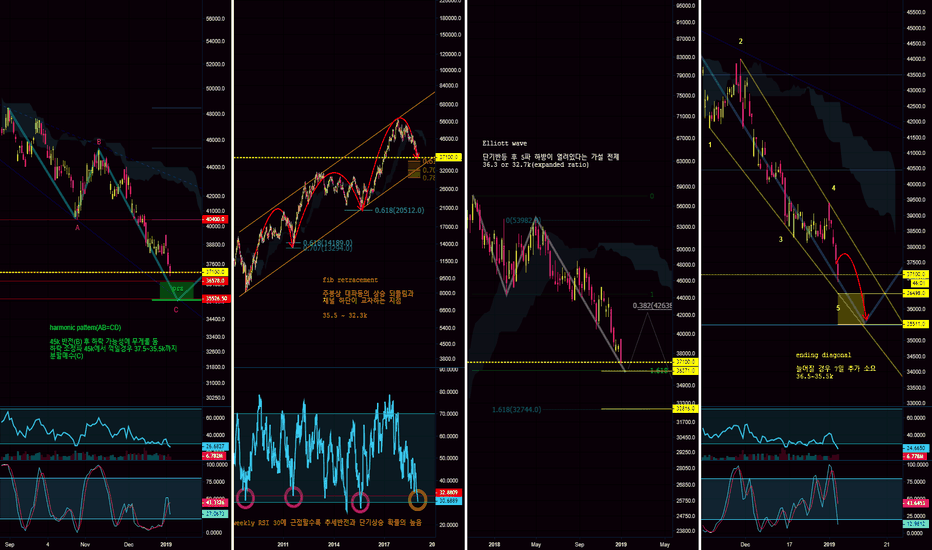

LG Display Price upward moving scenarioLooking at the weekly candle charts, LG display is now at oversold territory.

Divergence between Price and RSI indicator have been exist for the last 1 year of times.

Currently, it seems like that the price of LGD is trying to recover.

Because of Guangzhou fab operation scheduled to start on Aug 31, the stock price is expected to boost upward.

The expected ascending trend will make the three drives pattern.