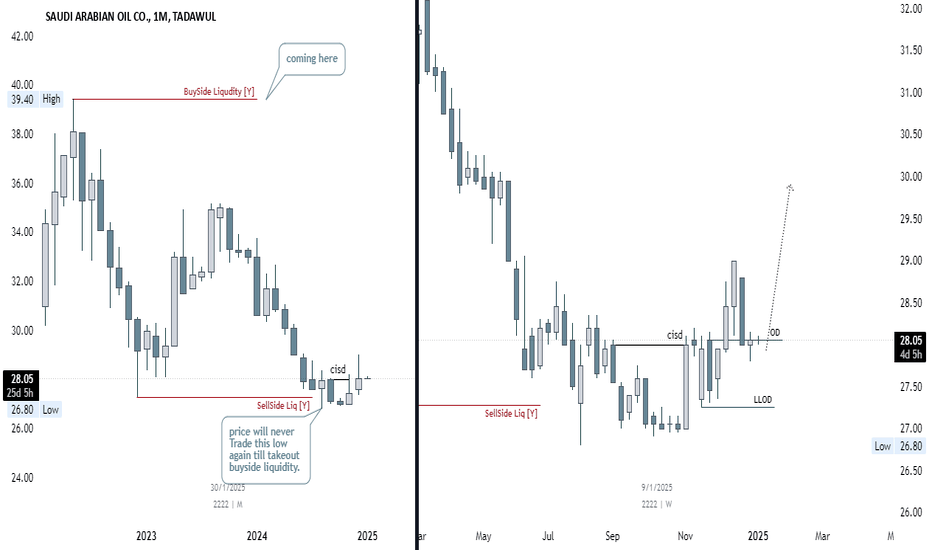

Saudi Arabian Oil Co. (2222)Saudi Arabian Oil Co. (2222)

The yearly sell-side liquidity has been swept, signaling potential exhaustion of bearish momentum. This indicates a strong probability of a bullish reversal. I anticipate buy-side liquidity to be targeted next, given the historical price action and liquidity dynamics.

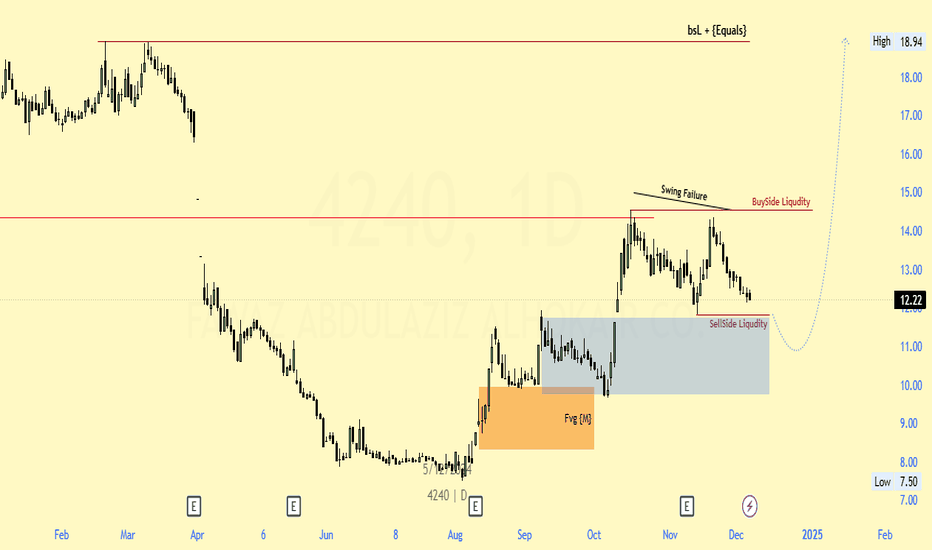

Fawaz Abdulaziz Alhokair 4240 Buying from Below Sell-side Liquidity

Entry:

Looking to buy from the Below Sell-side Liquidity.

Target:

Targeting a move towards Above Buy-side Liquidity at 18.94.

Analysis:

The setup is based on smart money concepts (SMC),(ICT) focusing on liquidity grabs. The sell-side liquidity, expected to act as a reaction point, with a strong potential for price reversal targeting buy-side liquidity levels above.

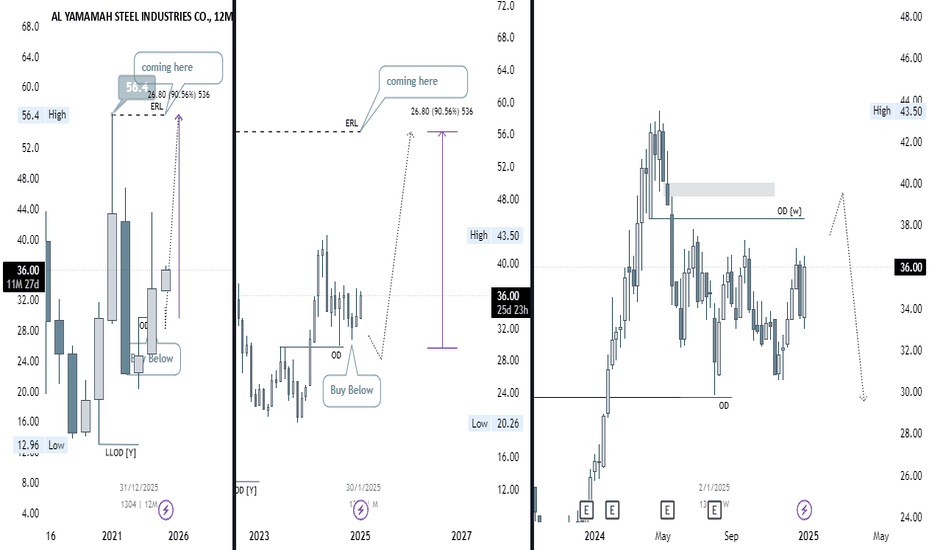

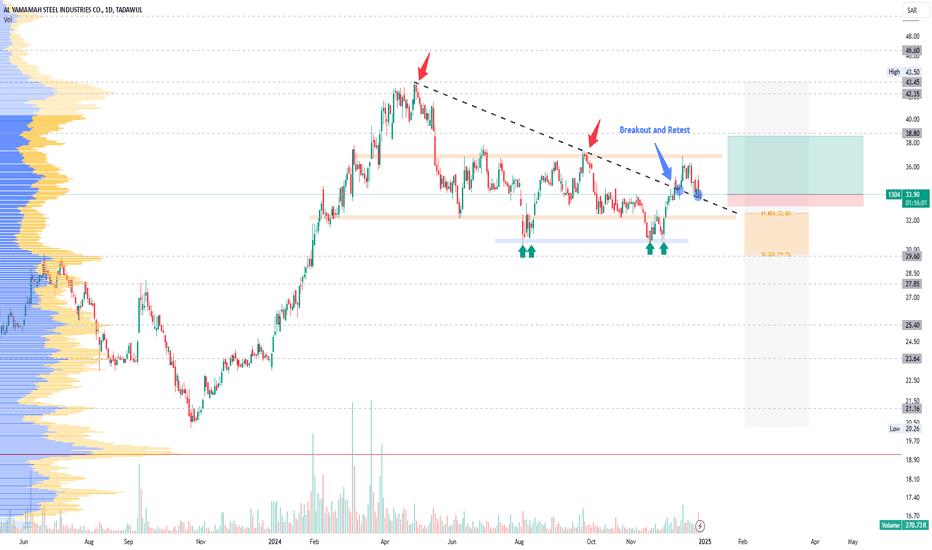

Al Yamama Steel (1305) Analysis: IRL to ERL - All-Time High as T

### **Al Yamama Steel (1305) Analysis: IRL to ERL - All-Time High as Target**

**Timeframe**: Yearly

#### **Overview**:

- **Current Scenario**: Al Yamama Steel is trading below a critical level, providing a potential buy opportunity.

- **Strategy**: Focus on the IRL (Intermediate Range Low) to ERL (Expected Range Level) movement, with the all-time high as the ultimate target.

---

#### **Analysis**:

1. **Order Flow**: Monitor the price action and liquidity levels below the current range. Accumulation at support zones signals bullish intent.

2. **Price Action**: Wait for confirmation (e.g., bullish engulfing or breakout retest) at identified buy zones.

3. **Risk Management**: Place stop-loss just below the IRL to mitigate risks.

💡 **Tip**: Patience is key. Allow the price to dip below for a better risk-reward ratio before targeting ERL and ATH. 😊

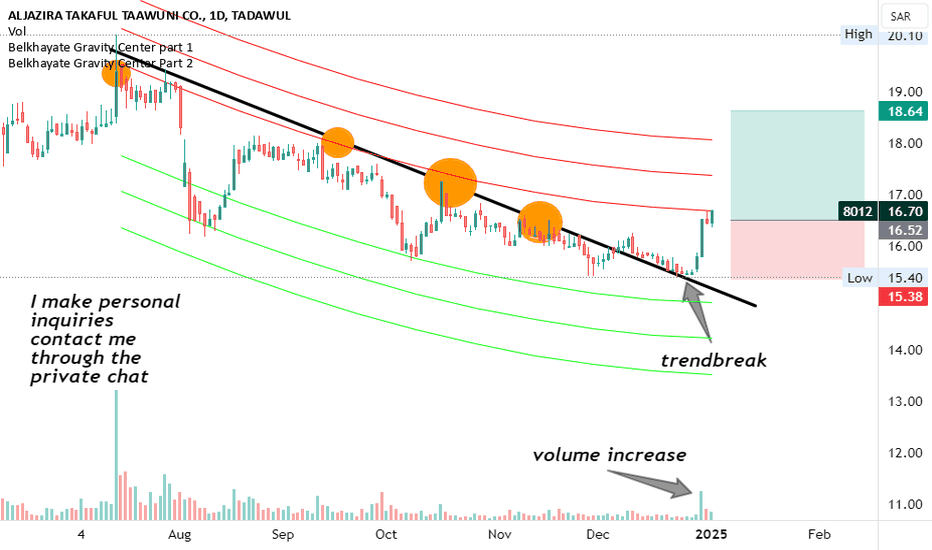

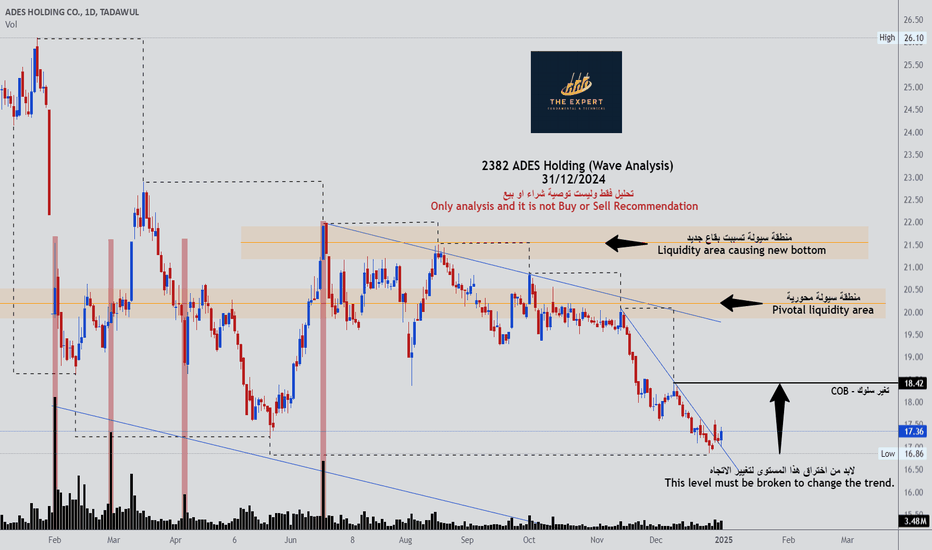

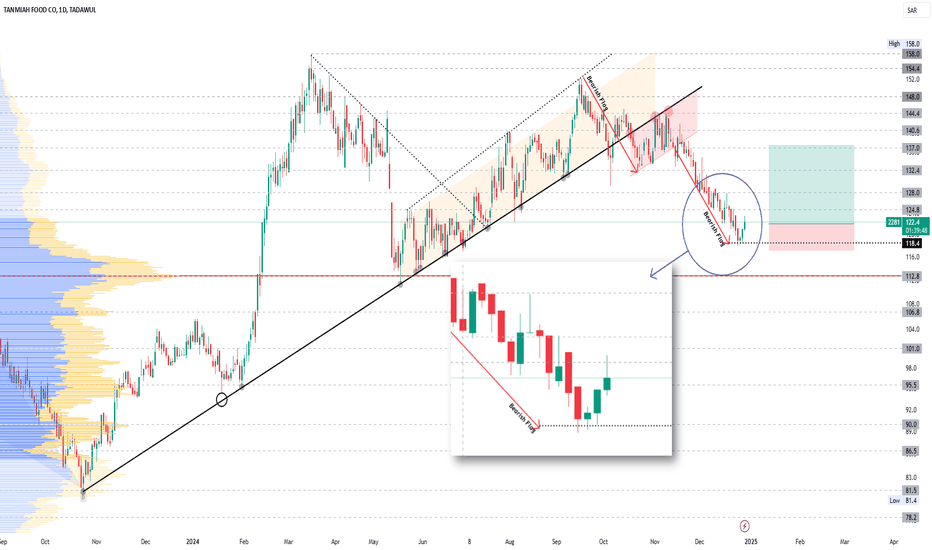

WAIT BEFORE BUYING 2310Months ago I posted about not to buy 2310 since it is coming lower, still some of you bought and lost their money as I saw on other platforms and from people who contacted me.

Now the market reached the level I told you and we will wait for a confirmation of the reversal, as soon as I get it I will post about it and you can take the trade.

Follow so you won't miss the entry!

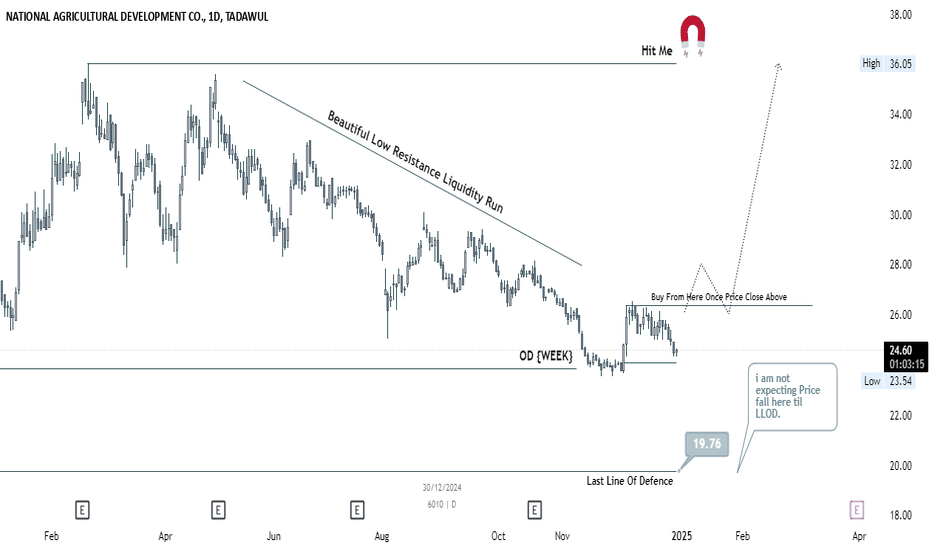

National Agriculture Company 6010

## **Trading Plan: National Agriculture Company**

#### **Concept**: SMC (Smart Money Concepts)

**Key Focus**: Perplution Order Block + Break of Structure (BOS)

---

#### **Market Context**:

1. **Daily/4H Analysis**:

- Identify a bullish/bearish **market structure**.

- Look for the **last valid order block** before the impulse move.

2. **Current Observation**:

- Price is approaching a **Perplution Order Block** (POB).

- Waiting for confirmation of a **Break of Structure (BOS)** to validate the bias.

---

#### **Entry Plan**:

1. **Buy Setup**:

- Wait for price to **break structure upward**.

- Enter on the **retest of the POB** with a valid bullish candle confirmation.

- Use Fibonacci for additional confluence (61.8%–78.6% retracement zone).

---

#### **Risk Management**:

- **Stop Loss**:

- Below the **Order Block's low** or last swing low.

- **Take Profit**:

- First target at the **next liquidity zone** (equal highs or FVG).

- Final target at the **premium range** of the market structure.

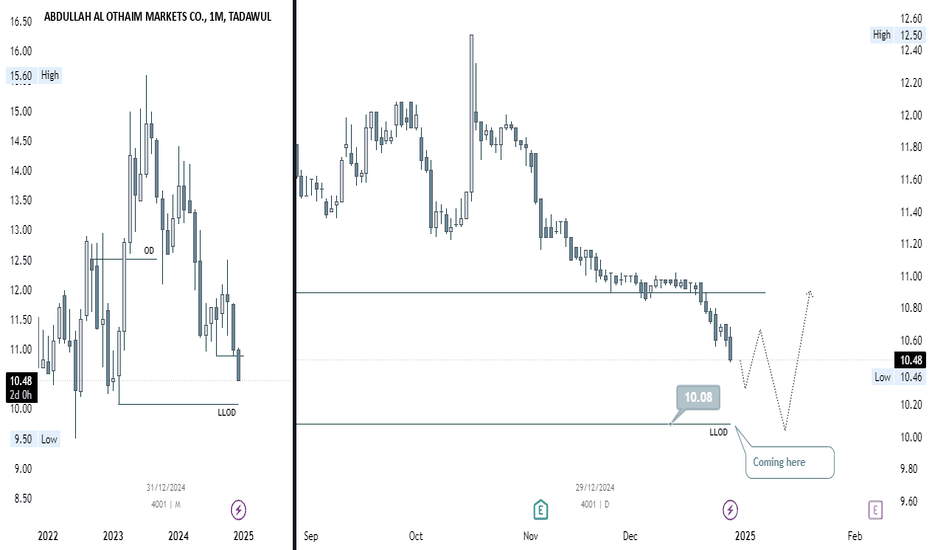

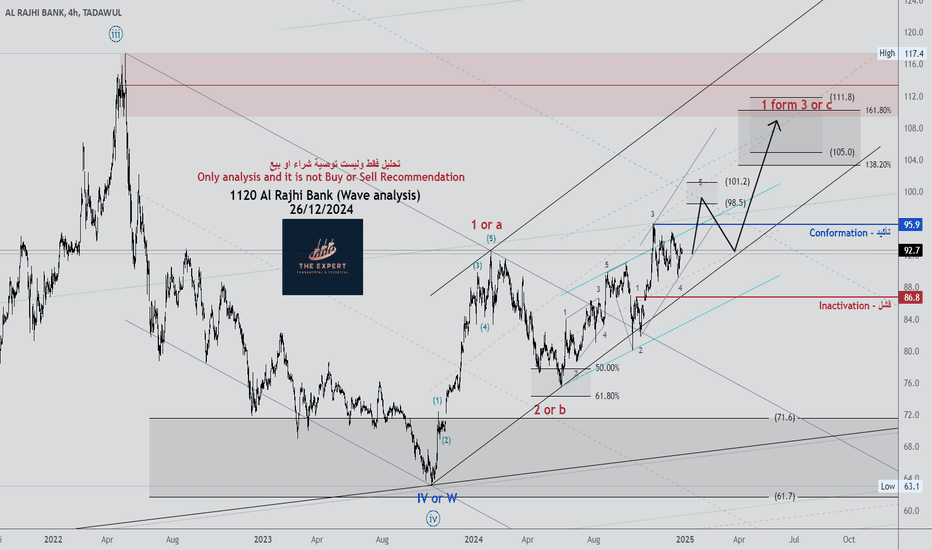

Abdullah Al Othaim Stock Bull Rally Plan (Q1 2025)**Abdullah Al Othaim Stock Bull Rally Plan (Q1 2025):**

- **Anticipation**: A bullish rally is expected to start in Q1 2025.

- **Key Trigger**: Monthly sell-side liquidity grab completed, signaling potential reversal.

- **Strategy**:

- Wait for lower time frame confirmation (e.g., market structure shift or strong bullish candles).

- Enter long positions after a clear breakout or retest of liquidity zones.

- **Targets**: Focus on historical resistance levels or unmitigated FVGs.

- **Risk Management**: Place stop-loss below the confirmed liquidity grab level.

Patience is key—trade only on solid confirmations.

Elm Stock Warning for BuyersElm Stock Warning for Buyers

Reason: No new FVGs, indicating reduced bullish momentum.

Warning: Buyers should be cautious as the price nears mitigated FVGs or Supply Zones.

Action: Avoid new entries until clear confirmation of demand resurgence or breakout above key levels.

Observation: Watch for bearish rejection or price consolidation as signals of a potential reversal.

Stay alert to price action and avoid overexposure.

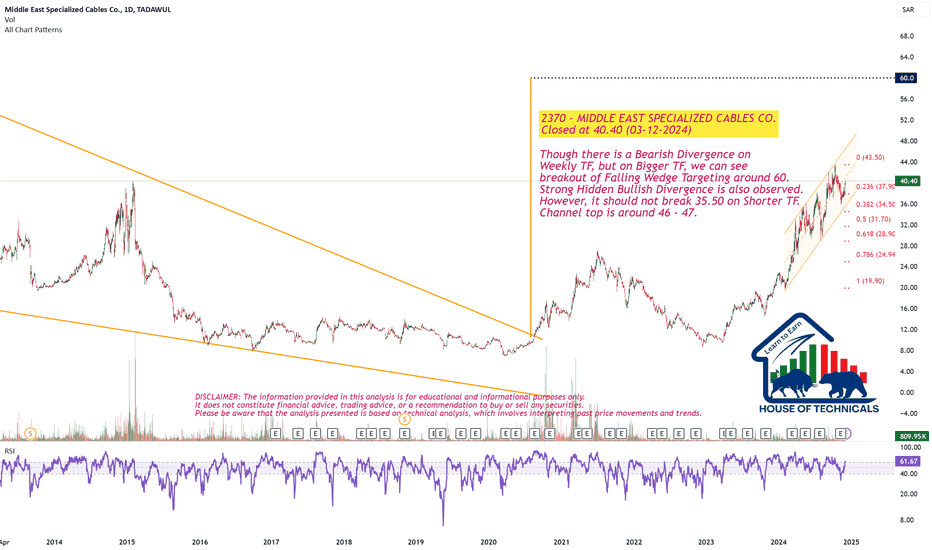

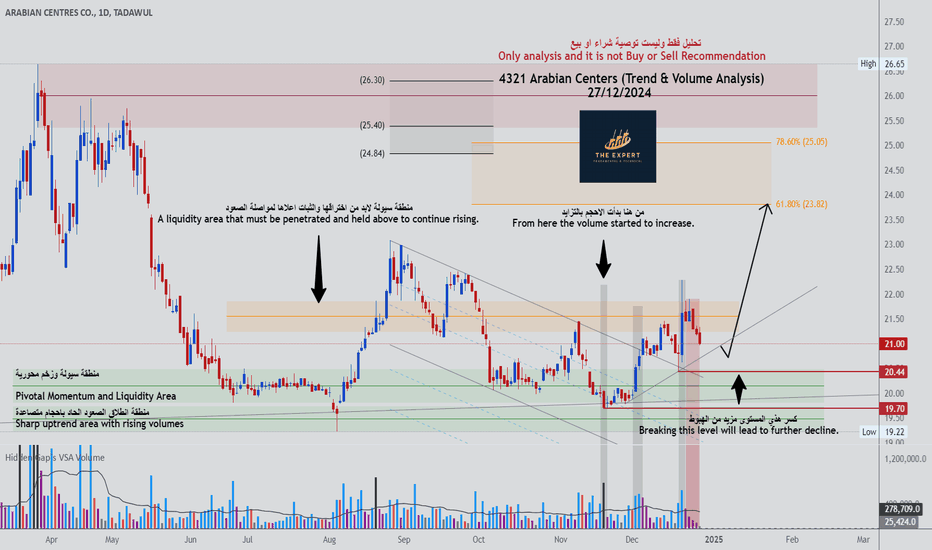

1304: Triangle Breakout and Retest1304 has shown a recent upward movement.

Price was moving within triangle.

A breakdown of triangle was observed but could not sustain. Price took an upside movement after making a double bottom (support zone).

Price is retesting the breakout of triangle.

Entry can be taken with low risk.

Manage your risk and enjoy the ride.