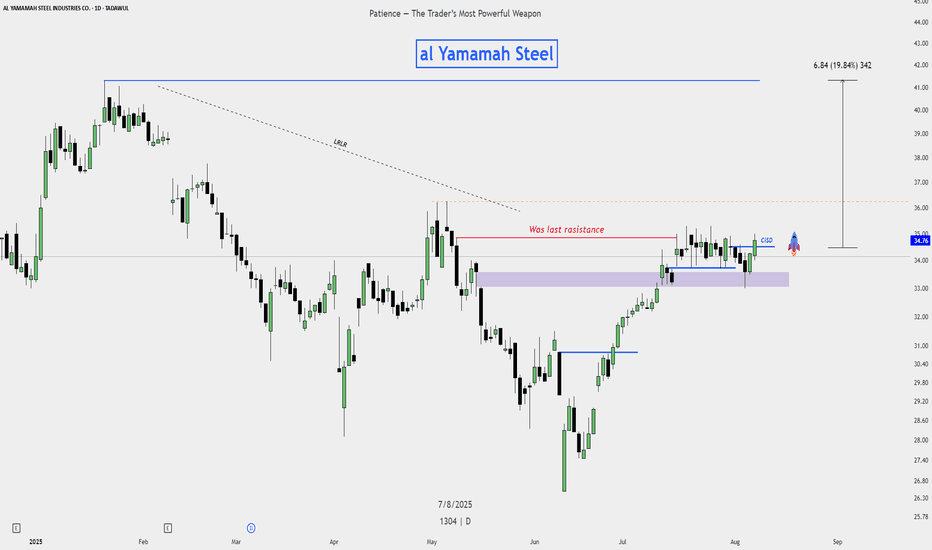

Al Yamamah Steel – Buy Plan Al Yamamah Steel – Buy Plan 🚀

Entry:

Buy on confirmed breakout above the recent consolidation range.

Ideal entry if price retests the breakout level and holds strong.

Stop Loss:

Place stop loss just below the breakout zone to protect against false moves.

Targets:

First target at the next resistance level.

Final target at the previous major swing high for maximum potential gain.

Risk Management:

Risk only a small portion of total capital.

Add positions gradually if price continues to hold above the breakout zone.

Bias:

Price action suggests bullish continuation toward previous highs, with potential for extended rally if momentum remains strong.

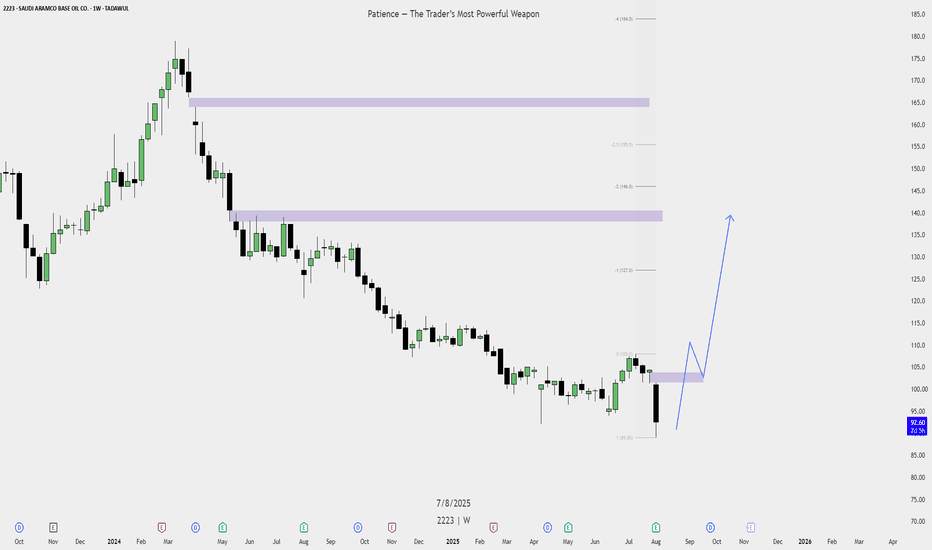

Saudi Aramco Base Oil Co. (2223 – Tadawul)Here’s a **Buy Plan** based on your weekly chart for **Saudi Aramco Base Oil Co. (2223 – Tadawul)**:

---

## 🟢 **Buy Plan: Aramco Base Oil (2223) – Weekly Chart**

### 📊 **Current Market Context:**

* **Current Price:** 92.55 SAR

* **Recent Swing Low:** 89.00 SAR

* **Fair Value Gap (Support Zone):** 100 – 105 SAR (Approximate)

* **Major Resistance Zones:**

* **Zone 1:** 145 – 150 SAR

* **Zone 2:** 165 – 170 SAR

---

### 📝 **Entry Plan:**

* **Entry Zone:** Wait for price to reclaim **100–105 SAR** (the lower Fair Value Gap zone).

* Entry Trigger: Strong bullish candle close inside or above this FVG zone on the **Weekly timeframe**.

---

### 🎯 **Target Zones:**

1. **Target 1:** 127 SAR (First Fib level; short-term target)

2. **Target 2:** 146 SAR (Previous major resistance zone)

3. **Target 3:** 165 SAR (Higher timeframe FVG + Fib zone)

---

### 🛡️ **Stop Loss:**

* **Below 89.00 SAR** (recent swing low)

* Conservative Stop Loss: 88.50 SAR

* Risk: Reward Ratio = Minimum 1:2

---

### 📌 **Trade Conditions:**

* Price must close above **100–105 SAR zone** with volume confirmation.

* **No entry** if price stays below 100 SAR or forms weak candles.

* Add position only after a **weekly candle closes bullish** in the FVG zone.

---

### 🧠 **Strategy Reminder:**

* **Patience is key** – avoid early entries.

* Wait for **higher timeframe confirmation** before executing.

* Monitor for **lower timeframe bullish structure** after weekly reclaim.

---

Let me know if you'd like this as a **PDF or image** for sharing or record-keeping.

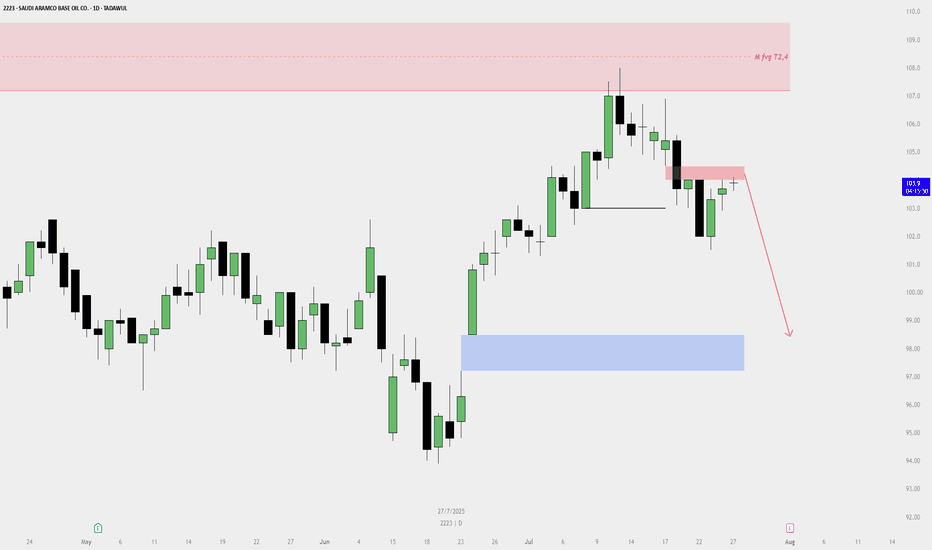

Saudi Aramco Base Oil Co. (Luberef - 2223) on the Daily timefram🔻 Sell Plan Summary

🔴 Key Supply Zones:

Monthly Fair Value Gap (FVG) / Premium Supply Zone — (Red Box around 108–110 SAR)

Labeled as “M fvg T2,4” on your chart.

Price previously reversed from this zone, indicating strong selling pressure.

Daily Bearish FVG / Rejection Zone — (Red Zone around 104.5 SAR)

Price is reacting to this short-term supply area.

It hasn't closed above this zone, showing weak bullish momentum.

🔵 Target Zone:

Daily Bullish Fair Value Gap (FVG) — (Blue Box: 96.5–98.5 SAR)

This is your likely downside target, situated in the discount zone.

A strong demand area where price may find support.

📉 Market Structure:

Price formed a lower high, suggesting bearish structure.

Recent candles show rejections from supply, supporting a short bias.

The chart includes a red arrow showing expected downward movement.

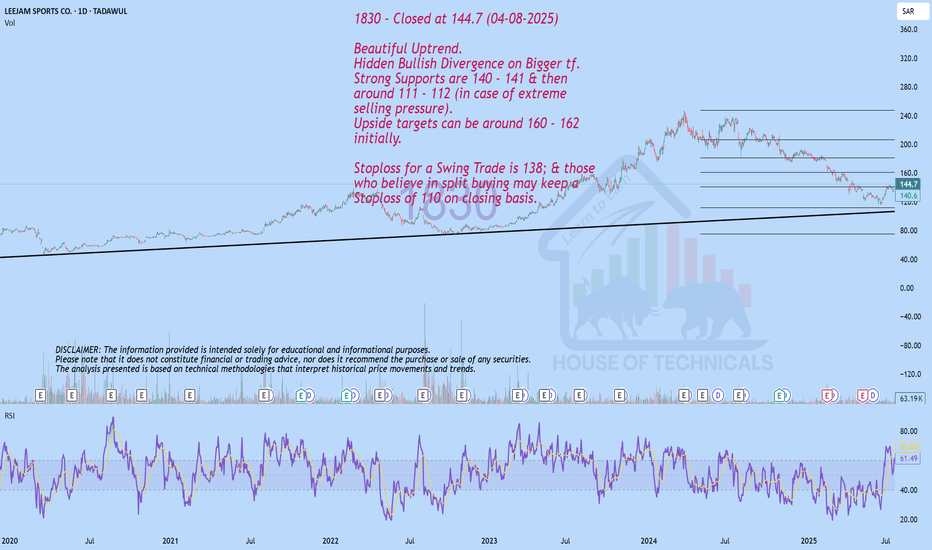

Beautiful Uptrend.1830 - Closed at 144.7 (04-08-2025)

Beautiful Uptrend.

Hidden Bullish Divergence on Bigger tf.

Strong Supports are 140 - 141 & then

around 111 - 112 (in case of extreme

selling pressure).

Upside targets can be around 160 - 162

initially.

Stoploss for a Swing Trade is 138; & those

who believe in split buying may keep a

Stoploss of 110 on closing basis.

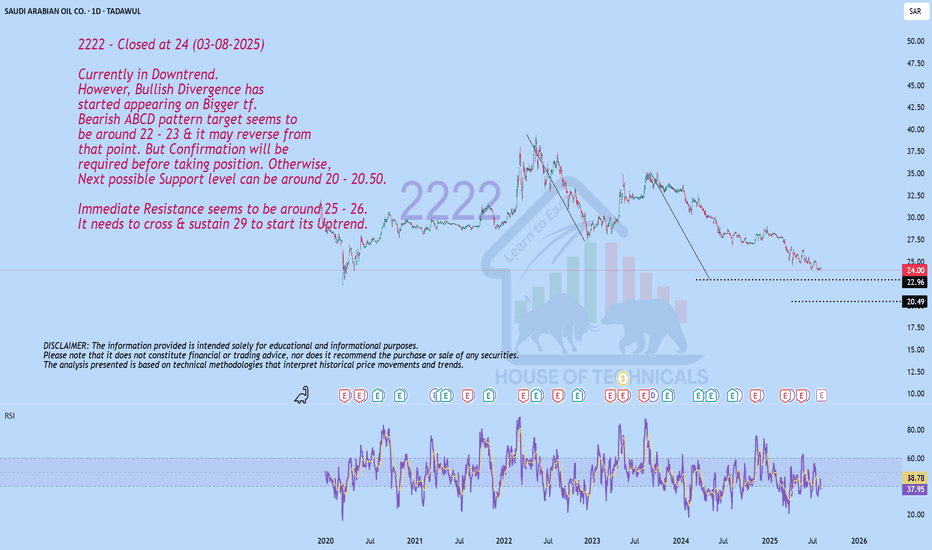

Bullish Divergence appearing!2222 - Closed at 24 (03-08-2025)

Currently in Downtrend.

However, Bullish Divergence has

started appearing on Bigger tf.

Bearish ABCD pattern target seems to

be around 22 - 23 & it may reverse from

that point. But Confirmation will be

required before taking position. Otherwise,

Next possible Support level can be around 20 - 20.50.

Immediate Resistance seems to be around 25 - 26.

It needs to cross & sustain 29 to start its Uptrend.

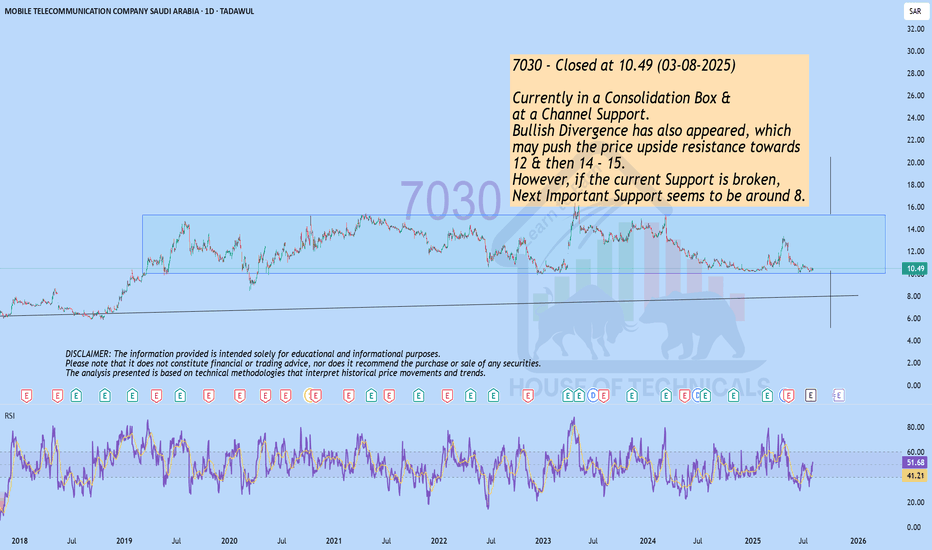

Currently in a Consolidation Box &..7030 - Closed at 10.49 (03-08-2025)

Currently in a Consolidation Box &

at a Channel Support.

Bullish Divergence has also appeared, which

may push the price upside resistance towards

12 & then 14 - 15.

However, if the current Support is broken,

Next Important Support seems to be around 8.

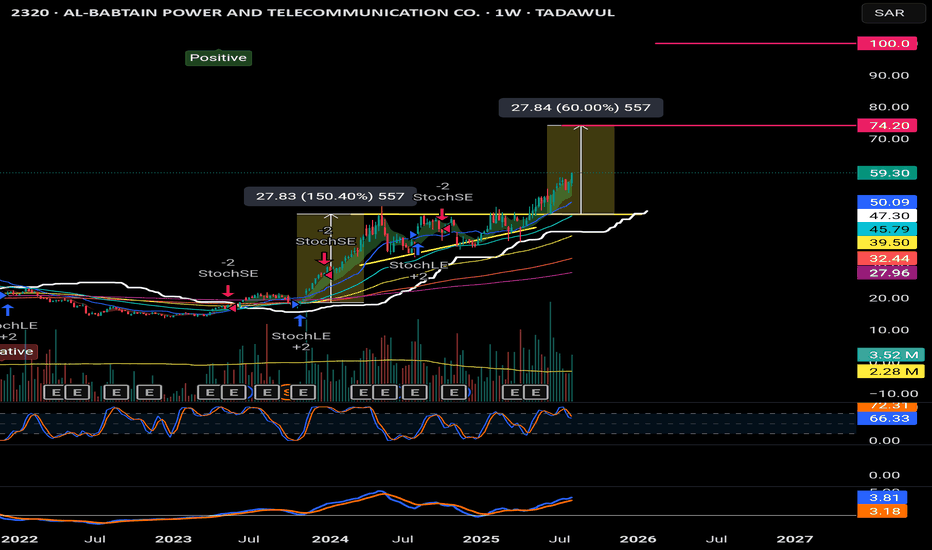

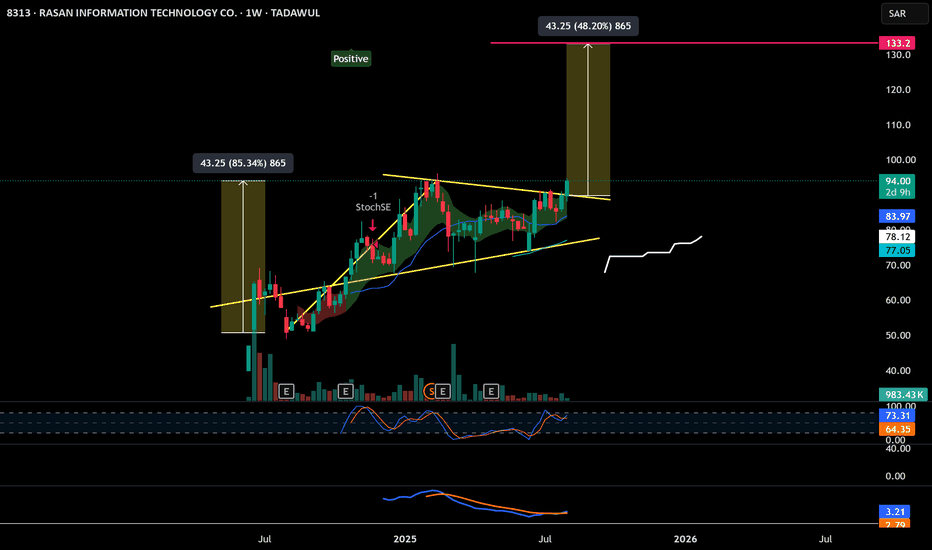

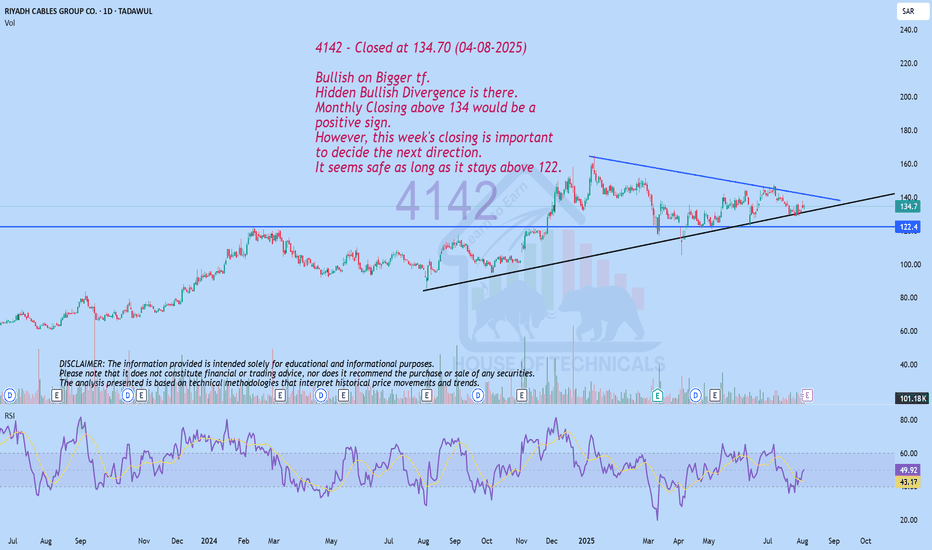

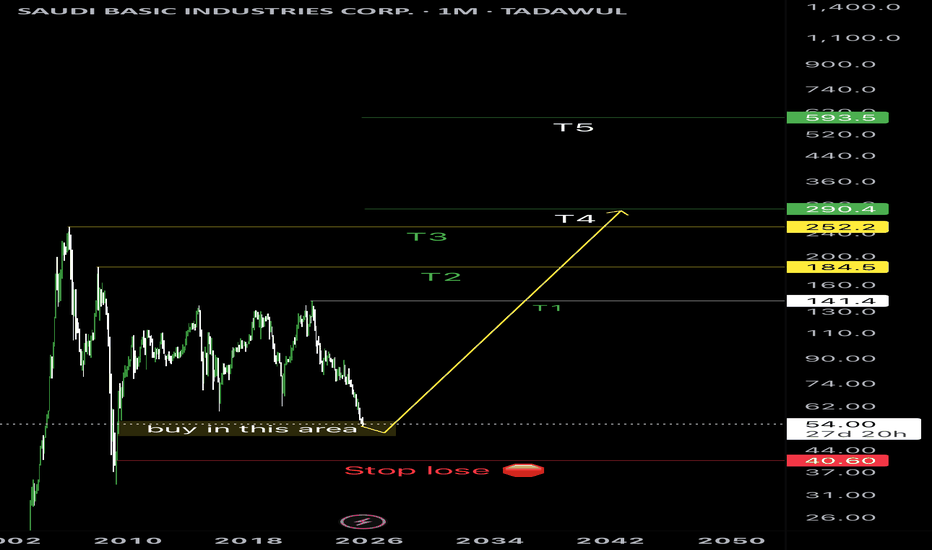

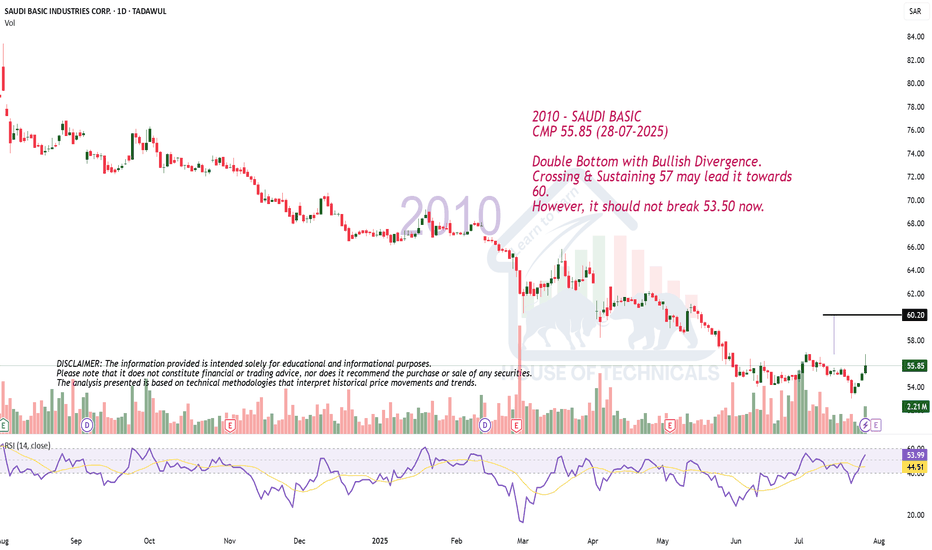

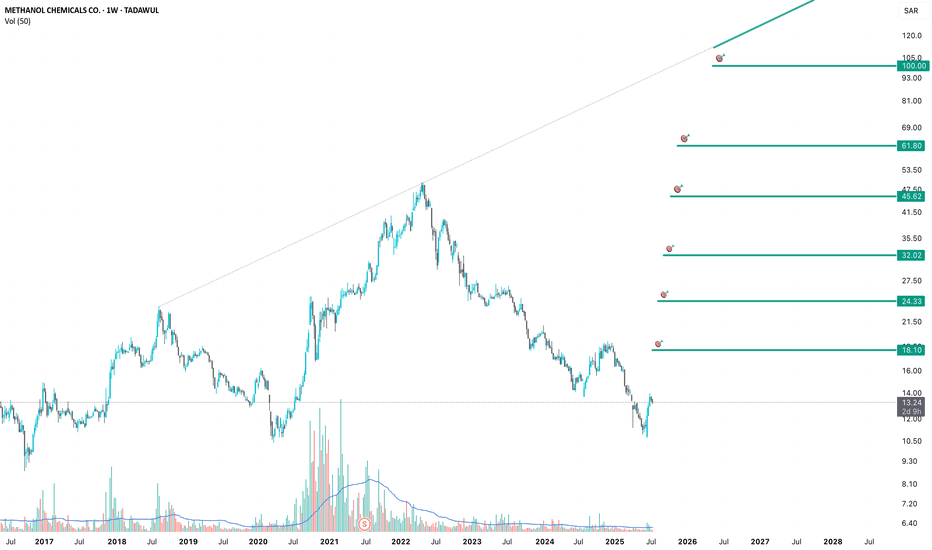

I was waiting this area from long time ago since it was on 140Every thing is clear in the chart, BUT my actual target 🎯 T4

So T1 &T2 & T3 They are just conformation for me for the mine target T4.

T5 is just extra generosity from the market if the economy conditions are good when price reaches T4.

It will be long journey.

Be patient.

Salam

AL JOUF CEMENT – BUY PLAN (TADAWUL: 3091)📈 AL JOUF CEMENT – BUY PLAN (TADAWUL: 3091)

✅ Current Status:

Price: 7.09 SAR

Action: Initial entry taken — some shares added to My portfolio.

🔍 Technical Overview:

Sell-side Liquidity Cleared:

Previous lows taken out, triggering liquidity sweep.

Strong reversal suggests potential shift in market sentiment.

Volume Imbalances (Voids):

Bullish targets marked based on unfilled volume gaps:

📍 Target 1: 8.34 SAR (➕17.63%)

📍 Target 2: 10.01 SAR (➕41.19%)

📍 Target 3: 12.93 SAR (➕82.28%)

Trendline Liquidity Above:

Long-term descending trendline can act as a magnet for price, drawing it upward.

Bullish Confirmation:

Price has reacted from a bearish fair value gap.

Clean bullish engulfing and strong volume — suggests start of reversal.

🎯 Buy Strategy Breakdown:

Step Action

✅ Partial buy/entry completed (accumulation started)

📉 Wait for small pullback or bullish continuation to add more

🛡️ Stop Loss: Below recent swing low (around 6.50 SAR)

🚀 Targets: TP1 – 8.34, TP2 – 10.01, TP3 – 12.93

🔁 Re-evaluate plan if price closes below 6.70 with volume

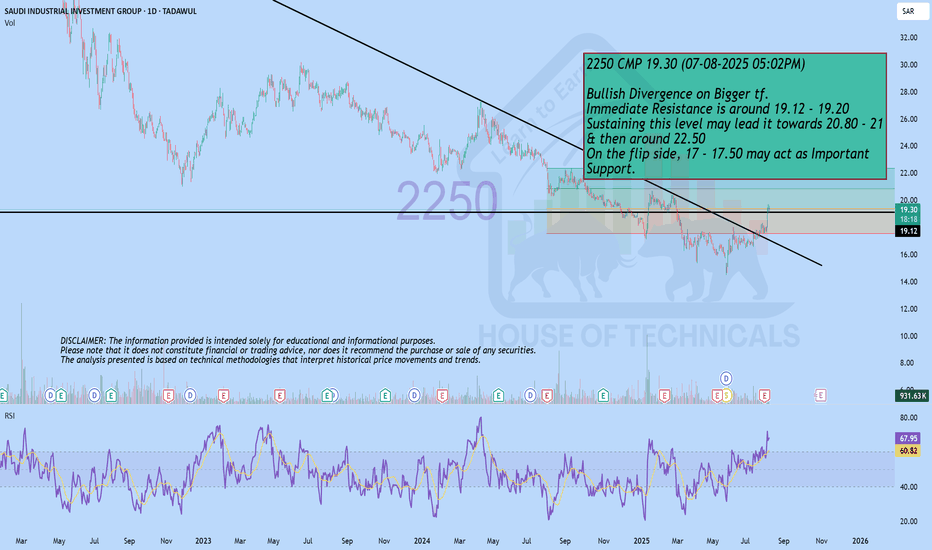

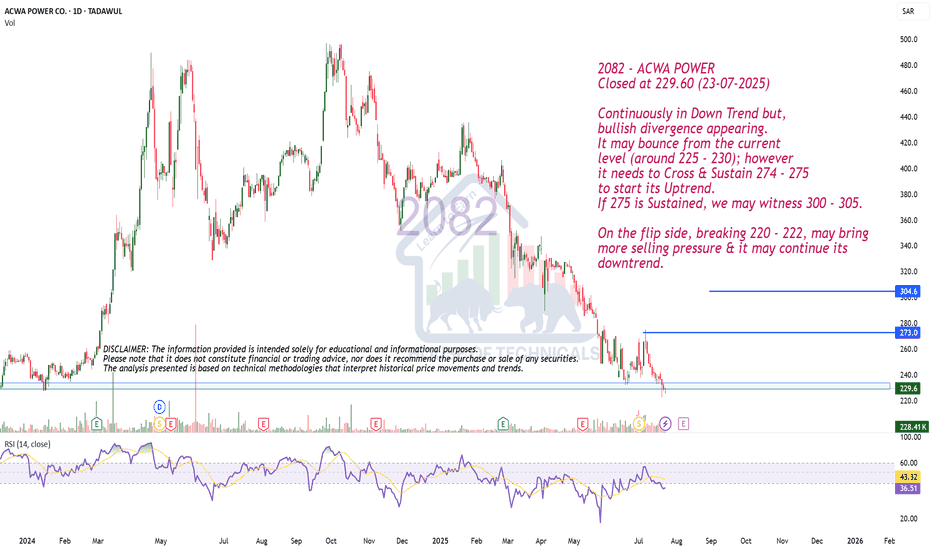

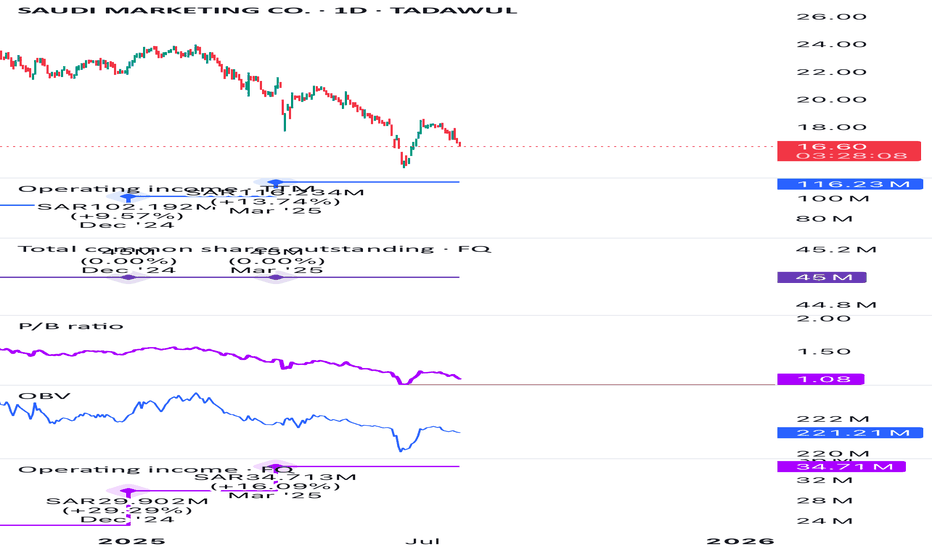

Continuously in Down Trend but..2082 - ACWA POWER

Closed at 229.60 (23-07-2025)

Continuously in Down Trend but,

bullish divergence appearing.

It may bounce from the current

level (around 225 - 230); however

it needs to Cross & Sustain 274 - 275

to start its Uptrend.

If 275 is Sustained, we may witness 300 - 305.

On the flip side, breaking 220 - 222, may bring

more selling pressure & it may continue its

downtrend.

TECHNICAL ANALYSIS: ACWA POWER CO (TADAWUL) 22-07-2025TECHNICAL ANALYSIS: ACWA POWER CO (TADAWUL)

The stock has been in a climatic bearish trend since January this year, trending in a bearish channel marked with light pink colors. The price has continuously been trading under the 20 EMA, and the bearish momentum seems powerful.

The stock has recently broken through a historical major support marked with a red solid line at 236. This broken support is expected to act as a short-term resistance and prohibit any upward movement.

Considering the price action of the last two weeks, we don't expect an immediate upward reversal of the stock before touching the historical measuring gap level located at 201.3.

We expect the stock to touch this level and then consolidate or accumulate in a trading range before showing any signs of upward reversal.

RECOMMENDATION:

Wait for the stock's behavior at the measuring gap before making any new entries. Forecasting an upward reversal at this stage with such powerful bearish momentum would not be accurate.

KEY LEVELS:

201.3 (Historical measuring gap level)

Recent support break level (now resistance) marked with red solid line at 236

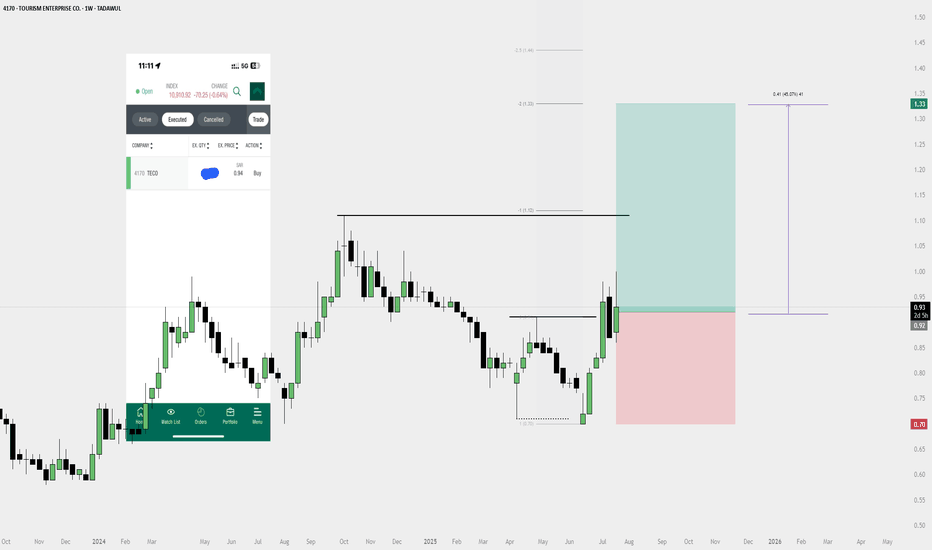

Weekly Buy Plan – 4170 (Tourism Enterprise Co.)📈 Weekly Buy Plan – 4170 (Tourism Enterprise Co.)

Bias: Bullish

Entry: 0.93

Stop Loss: 0.70

Target: 1.33 (2R)

Target Gain: +45%

Reasoning:

✅ Weekly structure break

✅ Bullish FVG respected

✅ Strong impulse move

✅ Pullback to FVG + BOS = High-probability setup

Holding for higher timeframe continuation. Invalidation below 0.70.

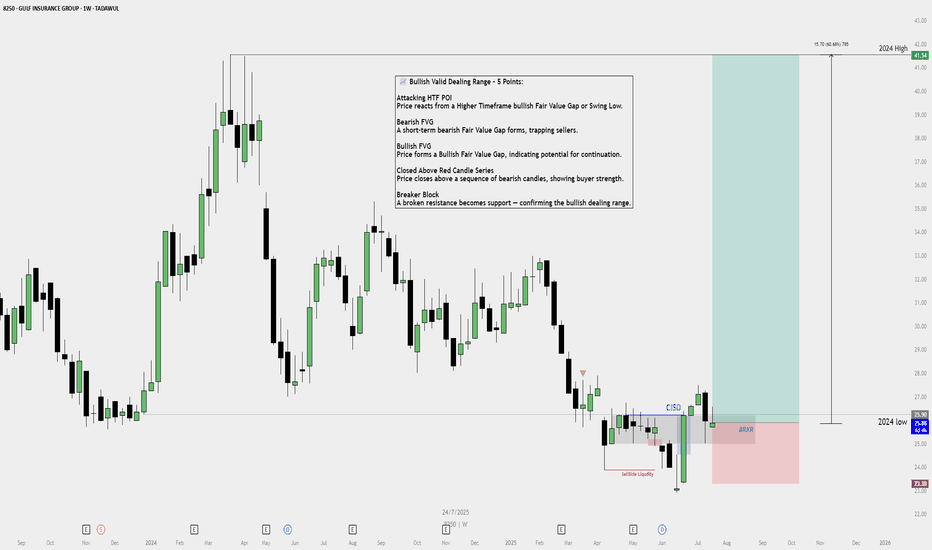

Buy Plan – Gulf Insurance Group (8250)📈 Buy Plan – Gulf Insurance Group (8250)

Bias: Bullish

Timeframe: Weekly

Context: Price reacting from HTF Bullish FVG + Breaker Block

✅ Entry Confirmation – Valid Bullish Dealing Range:

Attacking HTF POI

↳ Price tapped into HTF Bullish Fair Value Gap near 2024 Low.

Bearish FVG Formed

↳ Trap for sellers before reversal.

Bullish FVG Created

↳ Strong bullish impulse confirmed intent.

Closed Above Red Candle Series

↳ Bullish candle closed above multiple bearish candles.

Breaker Block Confirmed

↳ Former resistance now acting as support zone.

🎯 Target:

2024 High at 41.54

~60% potential upside from current price.

🛑 Stop Loss:

Below breaker block: around 23.30

🟩 Risk-Reward:

Reward: ~15.70 points

Risk: ~2.64 points

R:R ≈ 6:1

📌 Plan is active as long as breaker support holds. Monitor for any bearish invalidation signs.