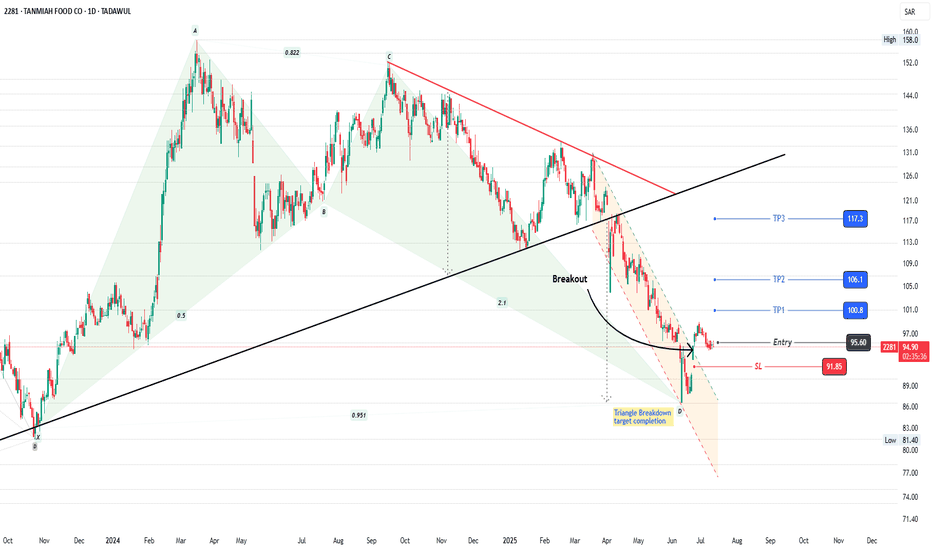

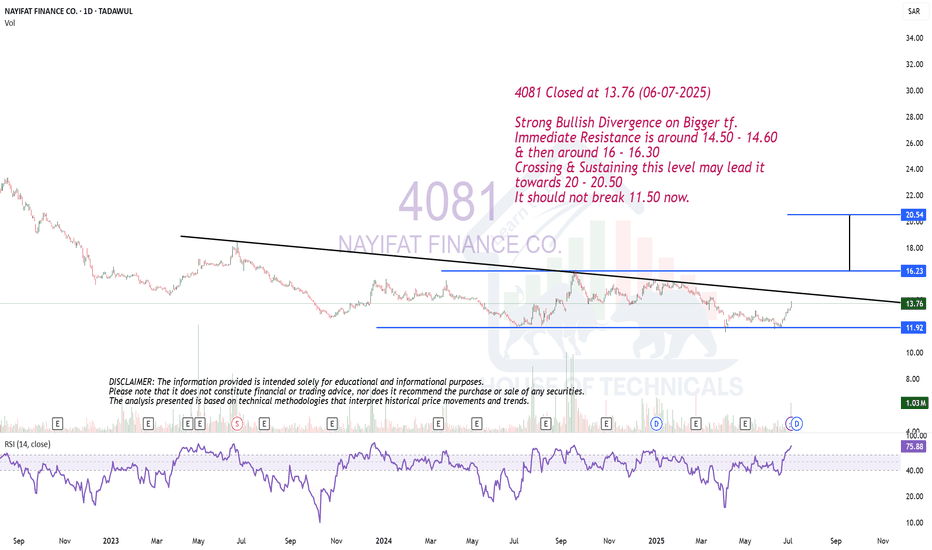

2281: Bullish Harmonic Pattern2281: Bullish Harmonic Pattern

2281 is struggling since last ATH in Sept 2024. Beautifully forming a Bullish harmonic pattern at significant support level.

Breakout of descending parallel channel is observed. Formation of HH and HL confluence is also favoring bulls.

Take Entry now or

After formation of another HH (breakout of psychological support level of 100)

Trail your stop loss accordingly.

Manage your risk.

Enjoy the ride!

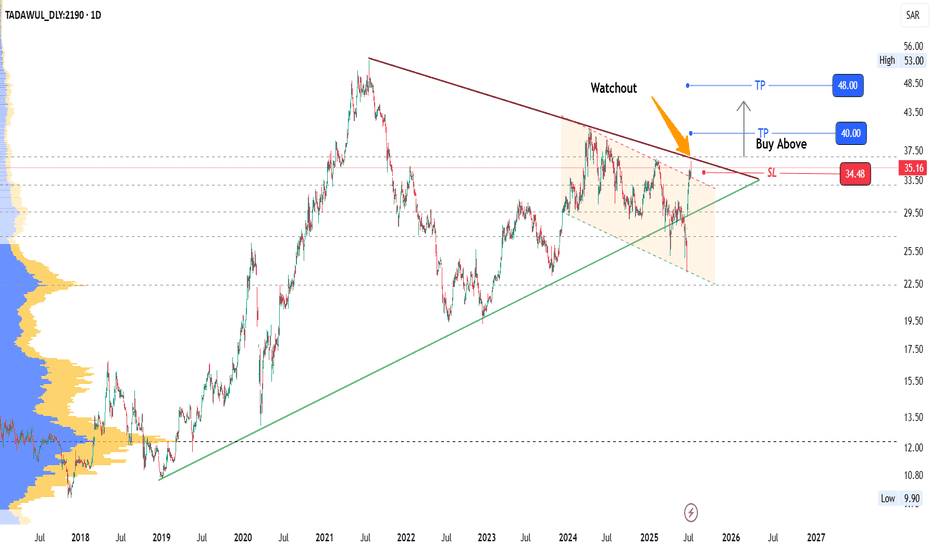

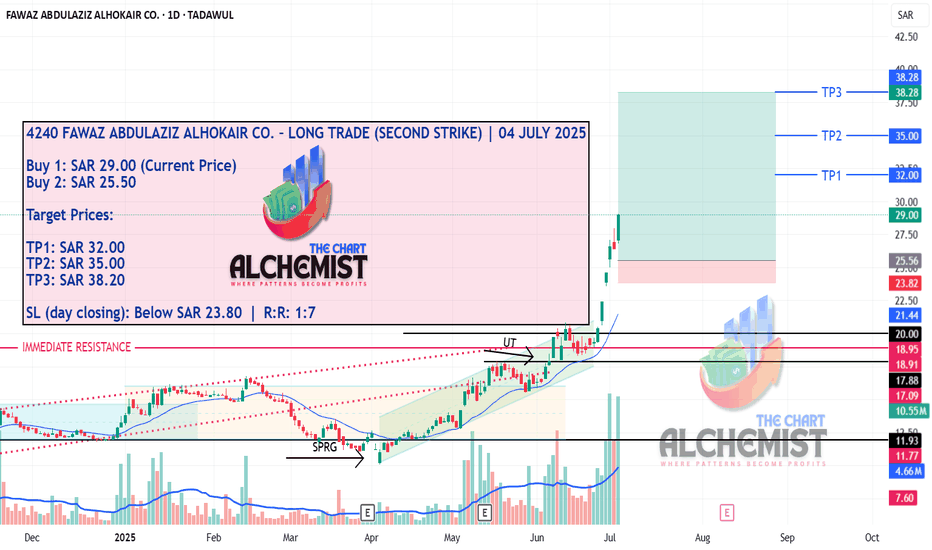

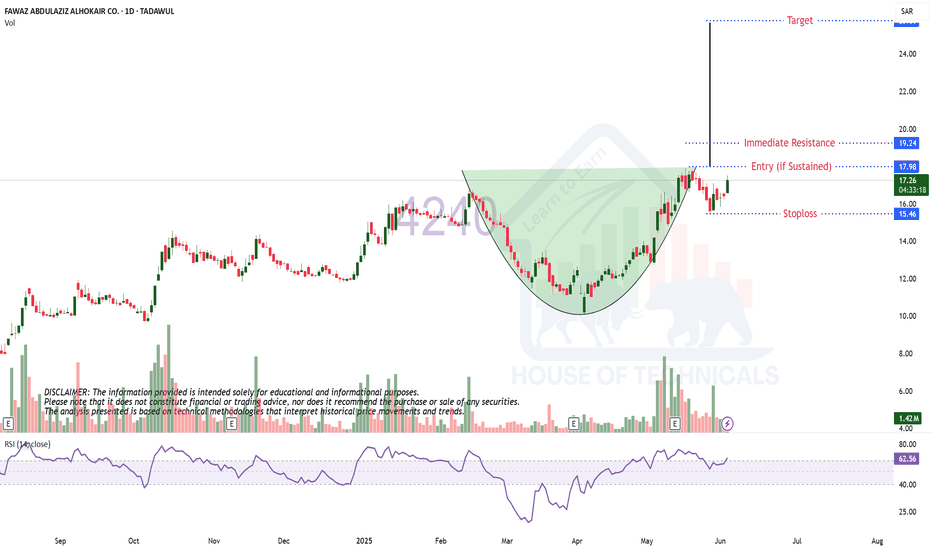

FAWAD ABDULAZIZ ALHOKAIR CO.–LONG TRADE (2nd STRIKE) 4/7/20254240 FAWAZ ABDULAZIZ ALHOKAIR CO. – LONG TRADE (SECOND STRIKE) | 04 JULY 2025

TADAWUL TRADE SIGNAL

After achieving all targets in our previous First Strike call, 4240 has now set up for a compelling Second Strike. The current price structure is showing strong continuation potential, with high-probability momentum likely to resume from this support zone. The risk-reward ratio remains highly favorable.

📌 Execution Strategy:

Caution: Please buy in 3 parts within the buying range. Close at least 50% of your position at TP1 and trail the stop loss to protect profits in case of unforeseen market conditions.

📢 Disclaimer: Do not copy or redistribute signals without prior consent or proper credit to The Chart Alchemist (TCA).

✨ Kindly support our efforts by boosting and sharing this idea!

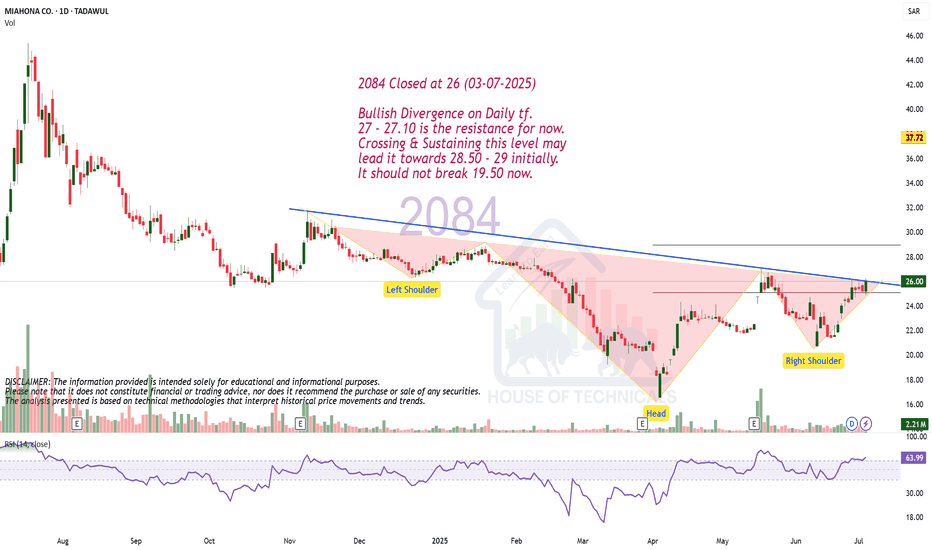

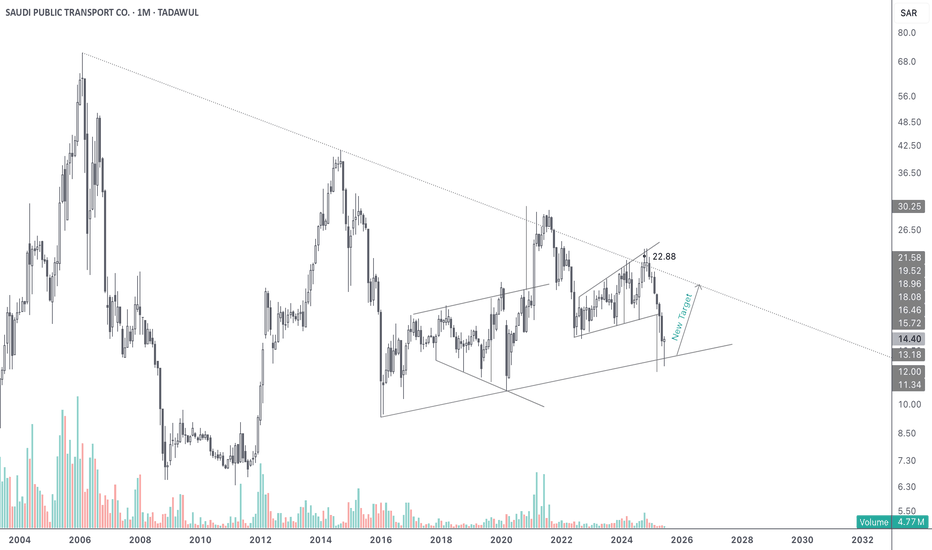

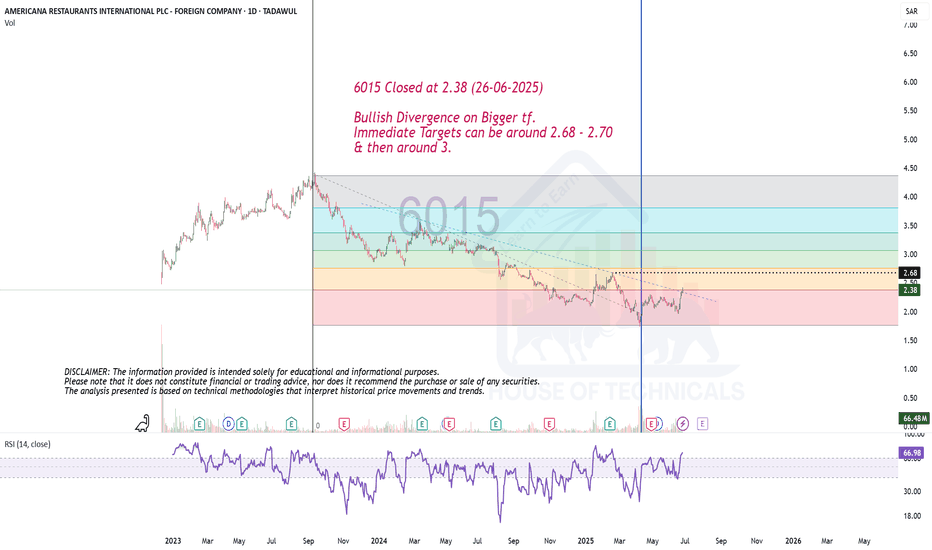

Bullish Monthly Candle Expected?4210 Analysis

Closed at 178 (24-06-2025)

Monthly Closing above 173.20 would be

a very +ve Sign.

Crossing & Sustaining 181 on Weekly Basis, may

result in further upside towards 200 - 205.

However, it should not break 136 now; else we

may witness further selling pressure towards 110 - 111.

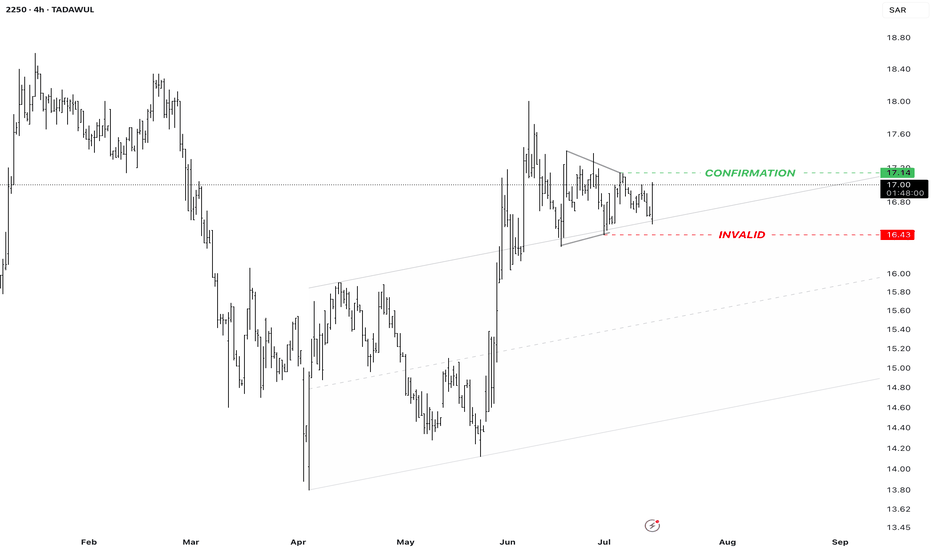

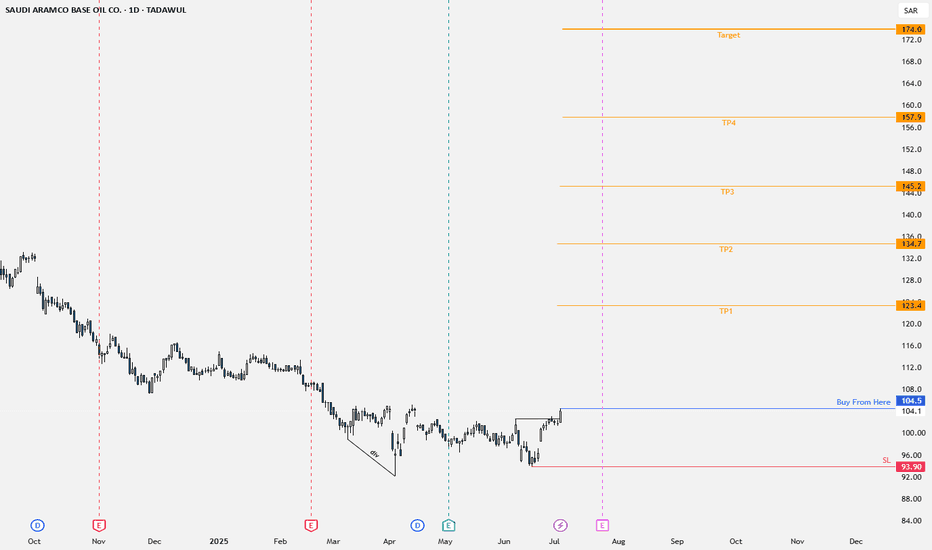

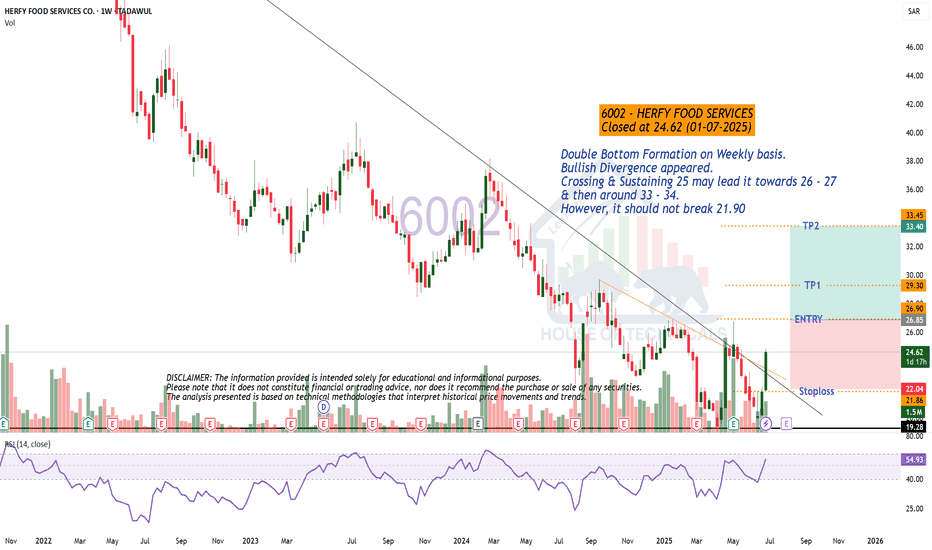

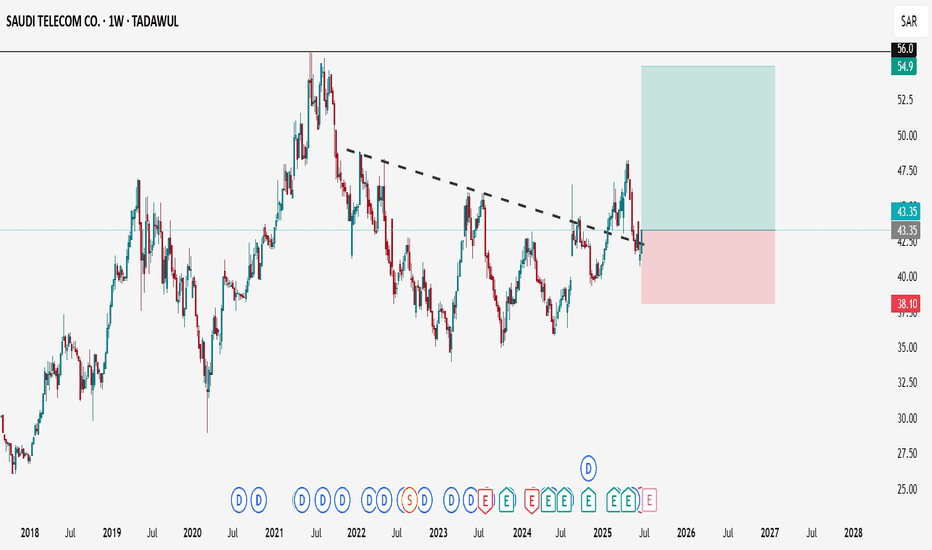

ARAMCO is BullishPrice is in a strong downtrend printing lower lows and lower highs continuously. However, the eight month long trendline seems to be breaking. Moreover, accumulation at current levels is also an indication that bulls are trying to assume control of the price action. If previous lower high is broken with good volume then we can expect a bullish reversal as per Dow theory. Targets are mentioned on the chart.