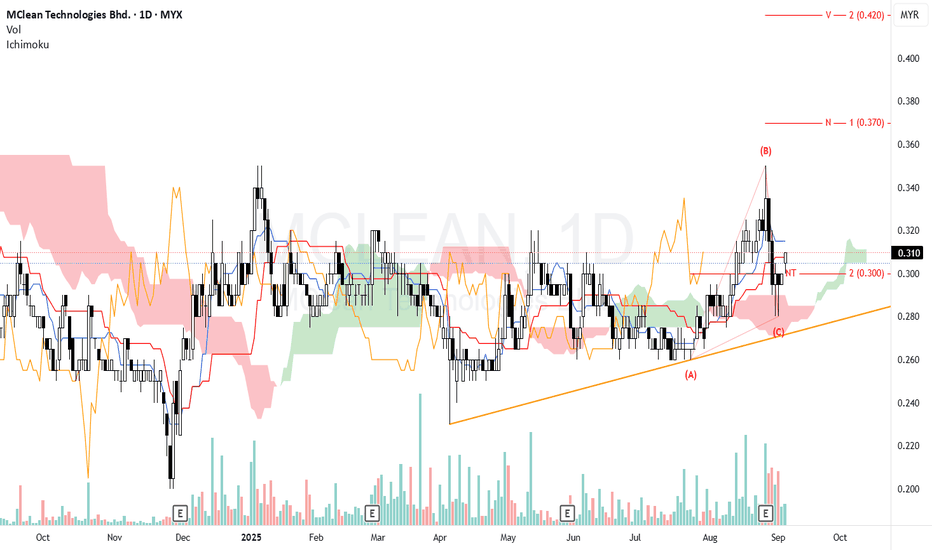

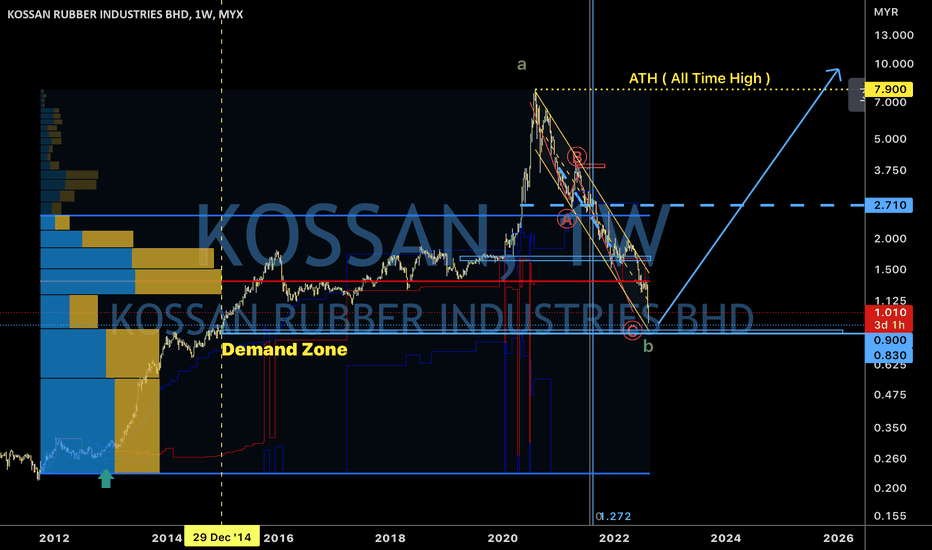

MCLEAN - LOOKING FOR BULLISH SENTIMENTTrend Structure (N Wave)

Price formed an ABC correction (A–B–C) and rebounded from point (C), aligning with the uptrend support line.

The immediate resistance is around 0.320 (Tenkan & Kijun levels).

Ichimoku

Price at 0.310 is sitting just above the NT support (0.300).

Kumo: Price is retesting the top of the thin Kumo area. A close above 0.310–0.315 would strengthen the bullish stance.

Chikou Span: Hovering near candles, needs a clearer breakout to confirm trend continuation.

Bullish Case

If price holds above 0.300 (NT) and breaks 0.315–0.320, momentum could push towards 0.370 (N projection).

Further upside to 0.420 (V projection) if volume expands and Kumo breakout sustains.

Price is showing signs of resuming its uptrend after a corrective ABC wave. The NT level at 0.300 is a key pivot: holding above it maintains the bullish outlook, with 0.370 (N) as the first projection target and 0.420 (V) as an extended target. However, a breakdown below NT and the uptrendline could weaken the bullish scenario.

Bearish Risk

A breakdown below 0.300 (NT) may invalidate the bullish N-wave, with possible retest at the trendline near 0.285–0.290.

Losing that trendline could shift bias to bearish.

Entry Zone: Around 0.305–0.315 (if support holds).

Stop Loss: Below 0.295 (to protect against false breakout).

Targets:

TP1: 0.370 (N)

TP2: 0.420 (V)

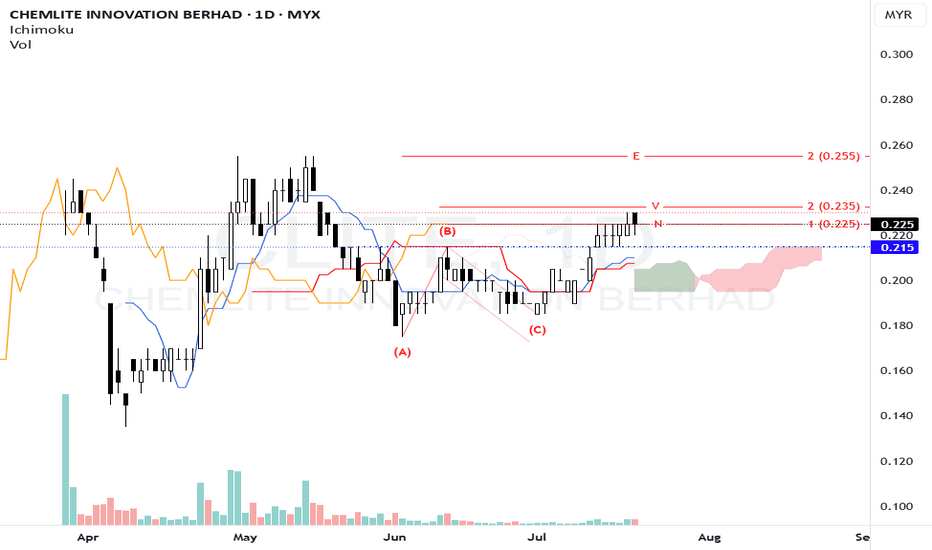

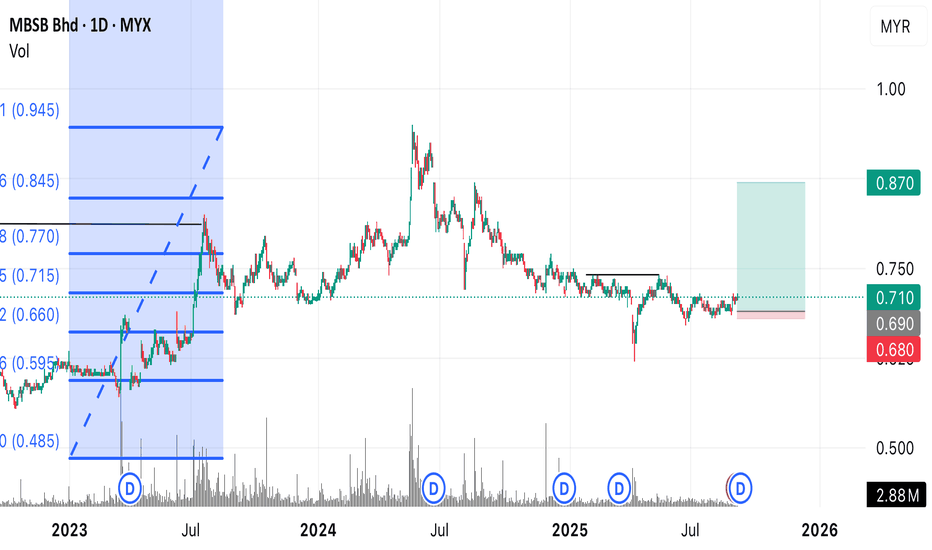

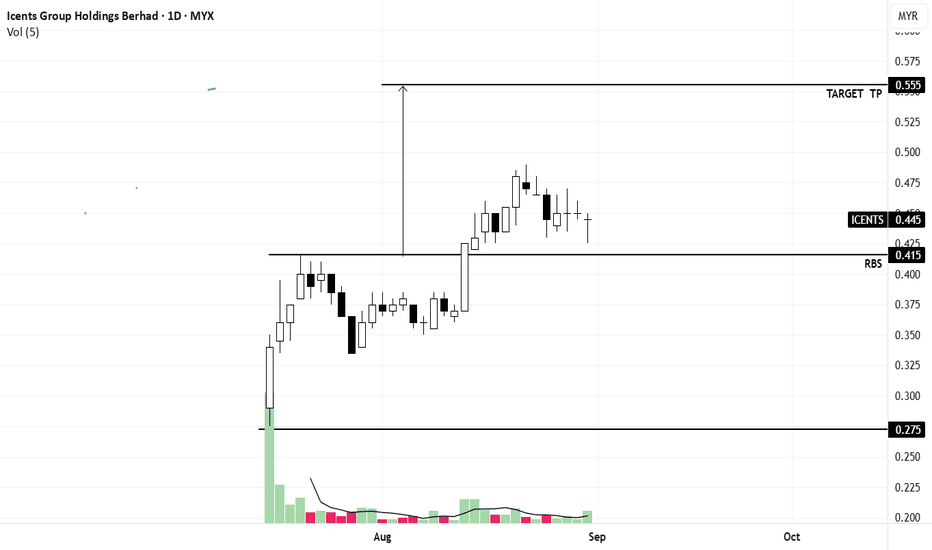

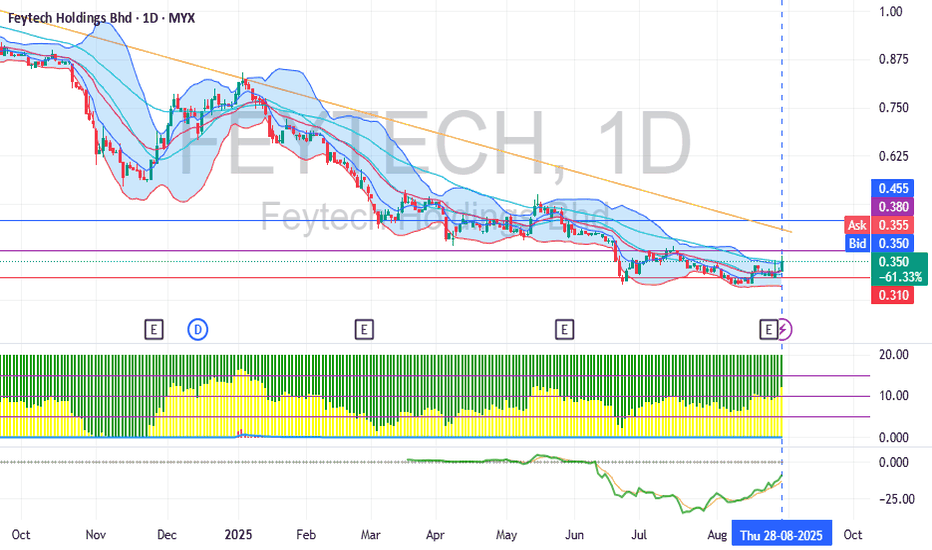

CLITE - LOOKING FOR BULLISH SENTIMENTN wave with E, V & N projection.

The chart shows a recent upward correction after a downtrend, with identifiable wave labels (A, B, C).

Price is above Kumo with N level as immediate support (0.225).

Tenkan-sen above Kijun-sen, showing a bullish sentiment.

Price needs to stay above N level (0.225), confirming the bullish continuation.

Entry: Consider a long position if the price breaks above 0.225 with confirming volume.

Stop Loss: Place SL slightly below recent lows, around 0.210, to limit downside risk.

This setup suggests a potential bullish move if the price successfully breaks above the 0.225 level, targeting the V and E projections. Confirmation through volume and price action is crucial for a successful trade.

Monitor price action and volume during breakout. If the price fails to break above 0.225 or reverses, consider avoiding entry or reversing position.

Note:

1. Analysis for education purpses only.

2. Trade at your own risk.

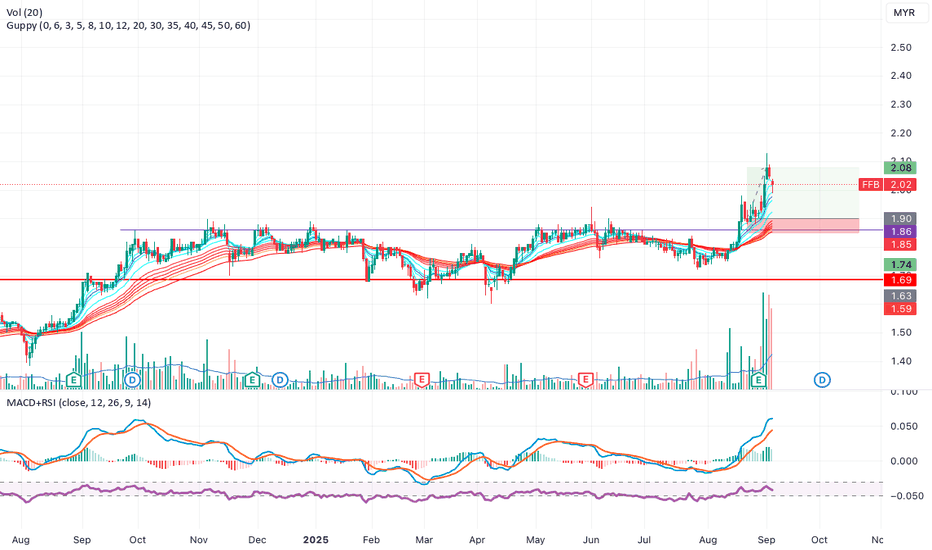

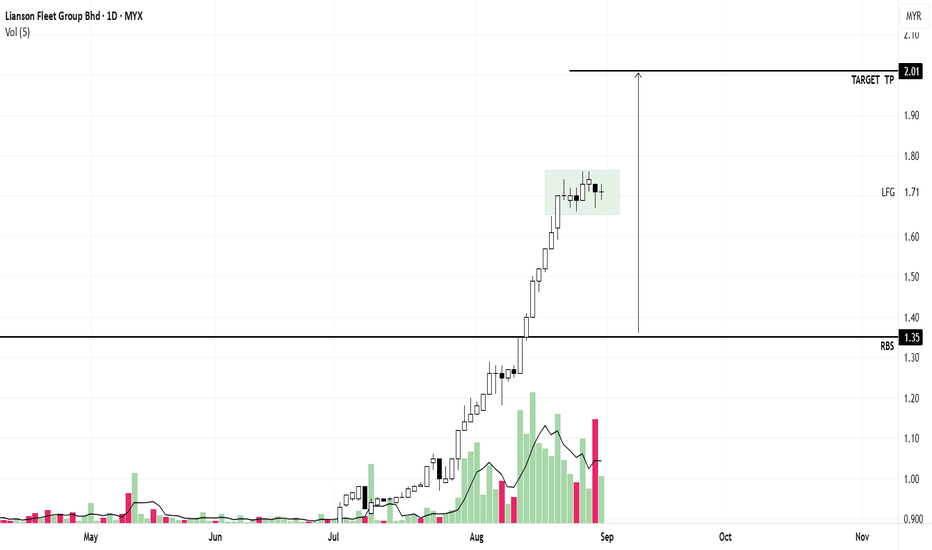

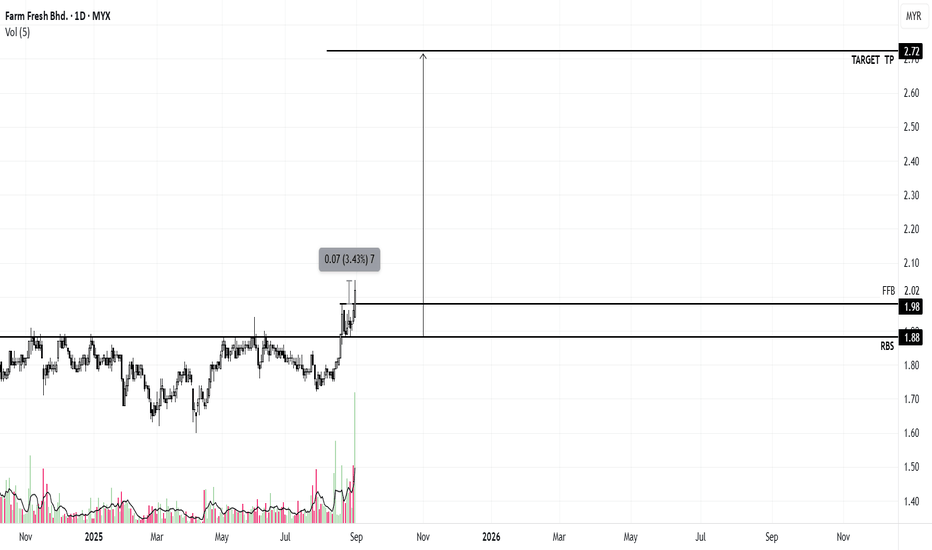

FFB August tradeEP: 1.90 (21.8.2025)

SL: 1.85

TP1: 2.00

Nice consolidation from 25.9.2024 which was above its IPO price.

Stock made a clean breakout on 18 and 19.8 following a spring.

It made a pullback, just hovering above the previous resistance.

MACD golden cross on 4.8.2025 and moved above 0 on the day of breakout.

Market sentiment was bad and defensive stocks were in play.

Holding plan:

Glide along MA15 and once it breaks and closes below, its time to sell.

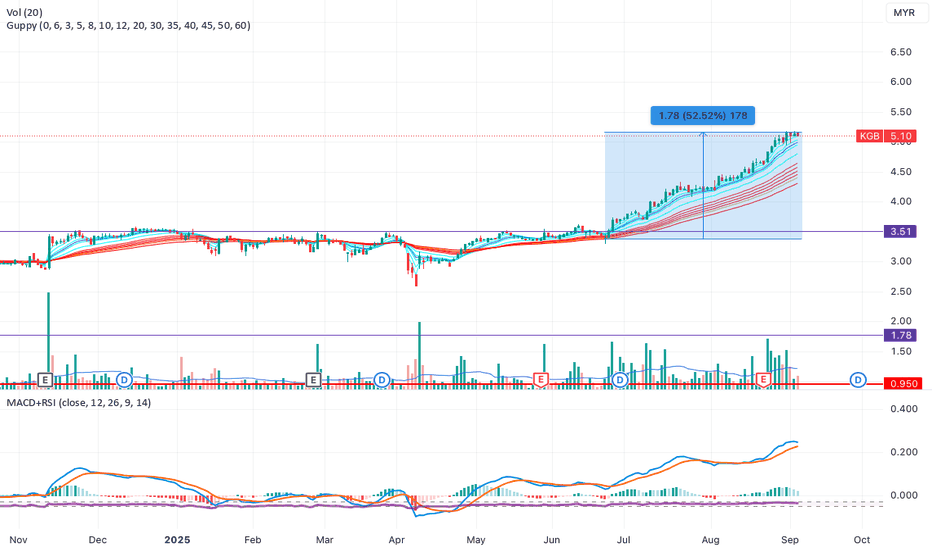

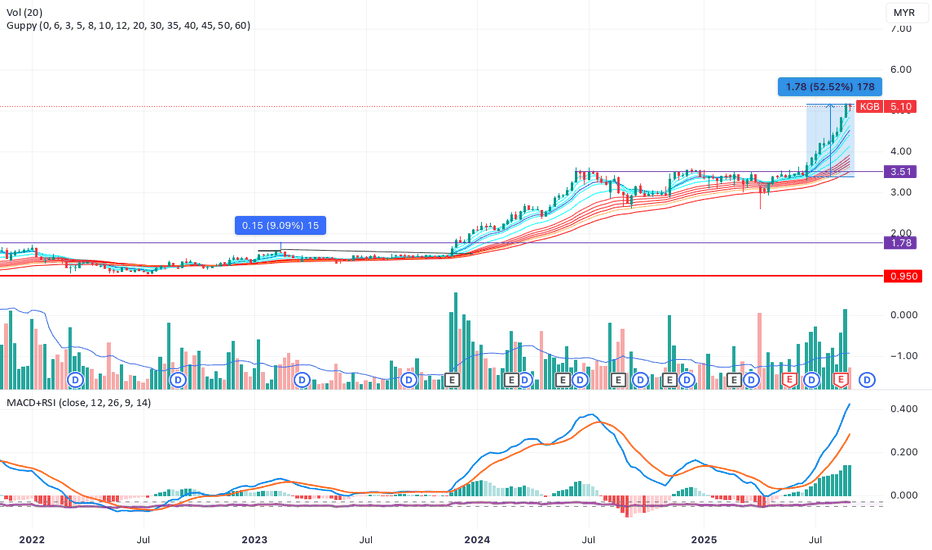

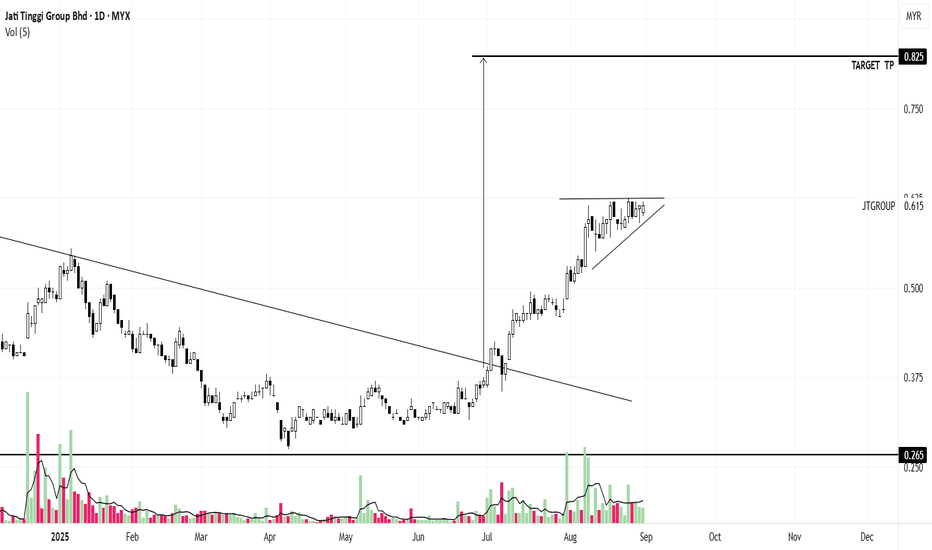

KGB Cont'd - Daily timeframe analysis Potential entries?

After the spring on 9.4.2025, there was gap up with a surge of volume the following day.

By 13.5.2025, there was a green candle with large volume pushing the stock towards the resistance of 3.51 again. It didn't manage to breakout and after 14.5.2025, it pulled back towards support, managed to break out on 11.6.2025, but went on to test the support again with an evil wick to hit stop losses.

On the 24th and 25th, it finally made its move to break previous resistances convincingly and glides along the MA15 as trailing support.

Impression:

Trading this stock purely on technicals is challenging. I'll get stopped out several times honestly if I were to buy early on before it broke out. So will have to base it on fundamentals and the potential of the stock as well. But after reviewing the QR, there was nothing much to show as well. There was reducing revenue for several quarters and only later on in August that we can see the stock increased its revenue.

Perhaps in retrospect, the best time to enter was on 26.6 or 30.6 when it made a flag pattern before marking up. Then again, 30.6.2025 was the ex-dividend date where you'll expect the price to drop first so I won't be touching this stock. So another lesson is maybe an approaching ex-date should not negate the consideration to enter a trade.

KGB - the importance of waiting for a clear breakoutIn the weekly chart, KGB formed a volume contraction pattern (VCP) from 10.6.2024.

The resistance was formed around 3.51.

On 11.11.2024, there was a large green candle with large volume and the following day, another green candle with large volume ensued. But this did not break the resistance.

The MACD also showed a golden cross.

Price consolidated along the resistance line until 30.12.2024, then started to dip by 20% on 7.4.2025. It formed a red hammer but the volume was large and broke the long standing support of this stock. Holders would have cut their positions but this was effectively a spring (wtf?)

Price than steadily climbed back towards the 3.51 resistance, before breaking out on the week of 23.6.2025. Mind you, it was due for a dividend ex-date on 10.7.2025. So I will be put off by this fact.

By then, the stock marked up further until its current price of 5.10 without any significant pullbacks. Thats around 52.5% from the opening candle during the week of its breakout.

Impression:

Buying and holding at the resistance, anticipating a VCP breakout does not usually work in our favour. The ideal situation is to wait for a breakout. But in this case, in the weekly chart at least, the stock didnt give the opportunity to buy by pulling back. But I'm going to have a look at the daily chart next for any realistic opportunities.

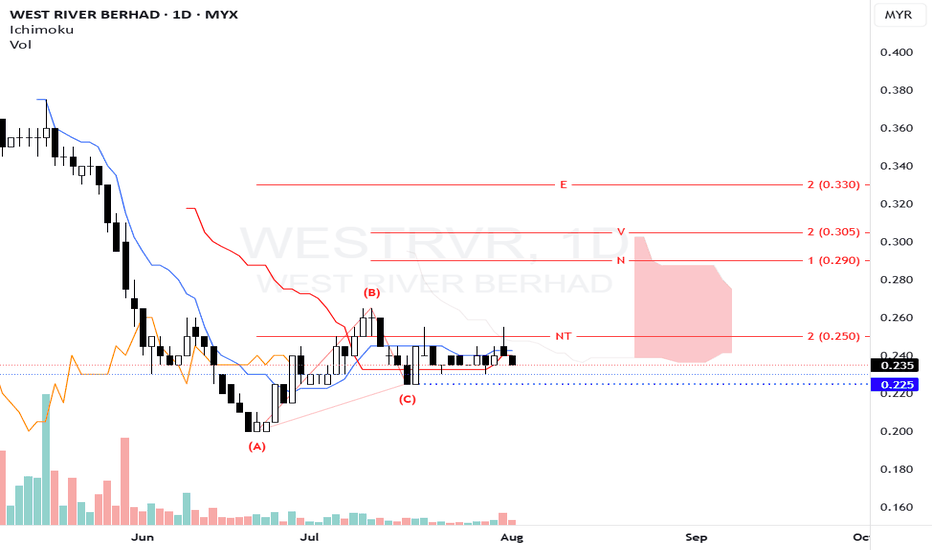

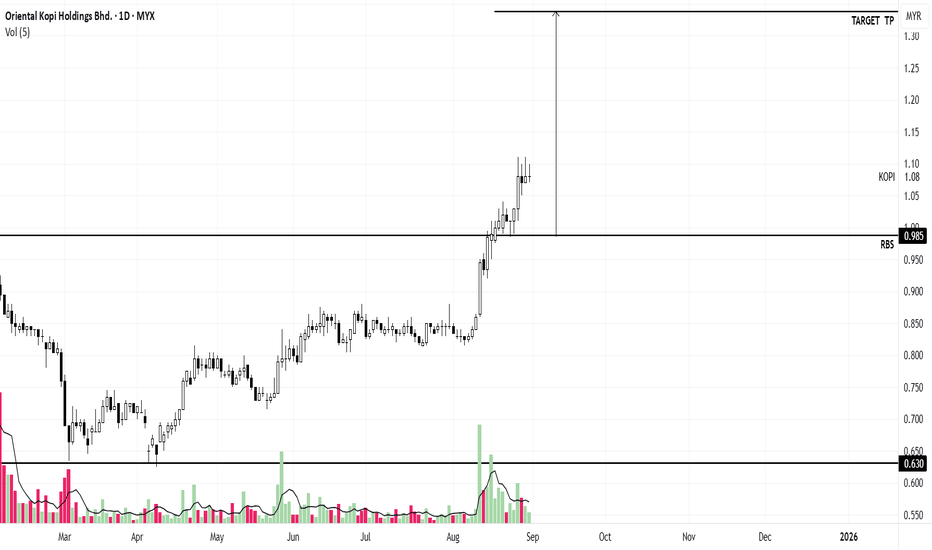

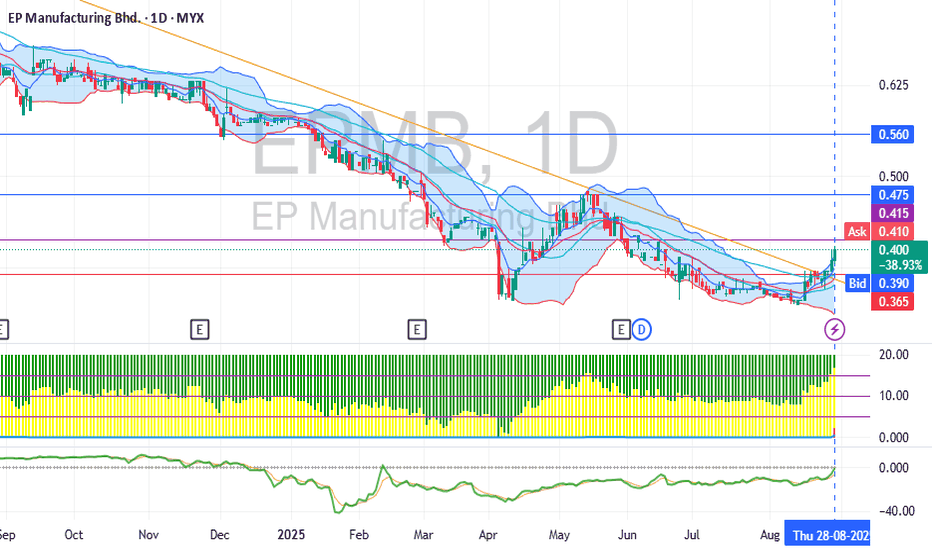

WESTRVR - Looking for potential bullish movementN wave with E, V, N & NT projection.

The wave pattern suggests an ongoing correction after a downtrend, with potential for upward movement toward the E and V projections if the breakout occurs.

The price has been consolidating around the NT level (0.250), and a breakout above this could signal a bullish move.

Resistance is near the 0.235-0.240 level; a confirmed break above this level would strengthen the bullish case.

Volume remains relatively stable, so confirmation of a breakout through volume would add validity.

The projections provide targets for potential upward movement:

Short-term target: ~0.250 (NT)

Medium-term target: ~0.290 (N)

Longer target: ~0.305 (V)

Extended target: ~0.330 (E)

Entry: Consider entering a long position if the price decisively breaks above 0.250 with volume confirmation.

Stop Loss: Place SL below recent lows, around 0.220 to manage downside risk.

Note:

1. Analysis for education purpose only.

2. Trade at your own risk

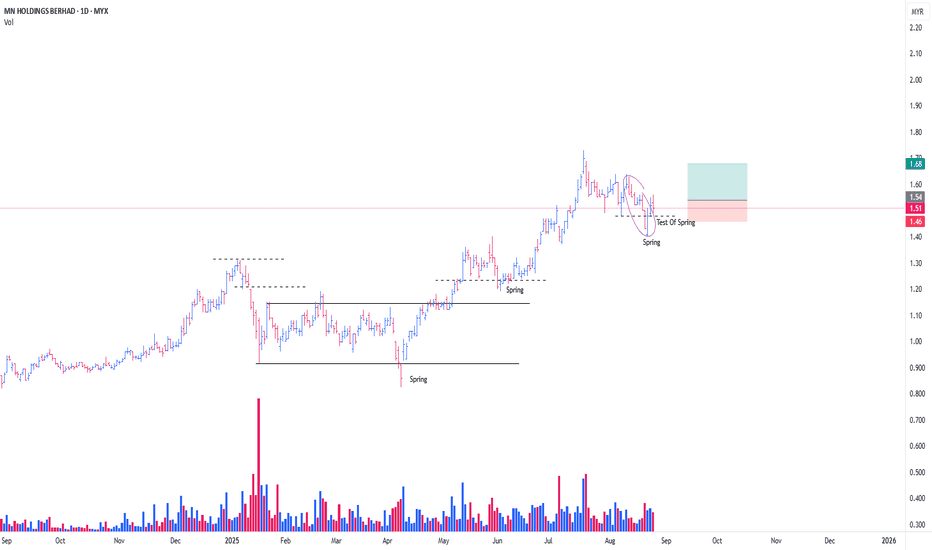

MNHLDG TO CONTINUE MARK UPMy previous, last entry for MNHLDG got knocked out

*pls refer to the link

This is my new position for MNHLDG

In view of Local Spring Formation, along with Schematic #2 of SpringBoard (purple colored circle)

- i initiated the 1st position @ 22/8/25 (RM 1.51)

I added another position @ 25/8/25 (RM 1.56) in view of, probable successful test of The Local Spring

Nothing difficult here, straight to the points . Obvious setup.

Tight SL

PureWcykoff

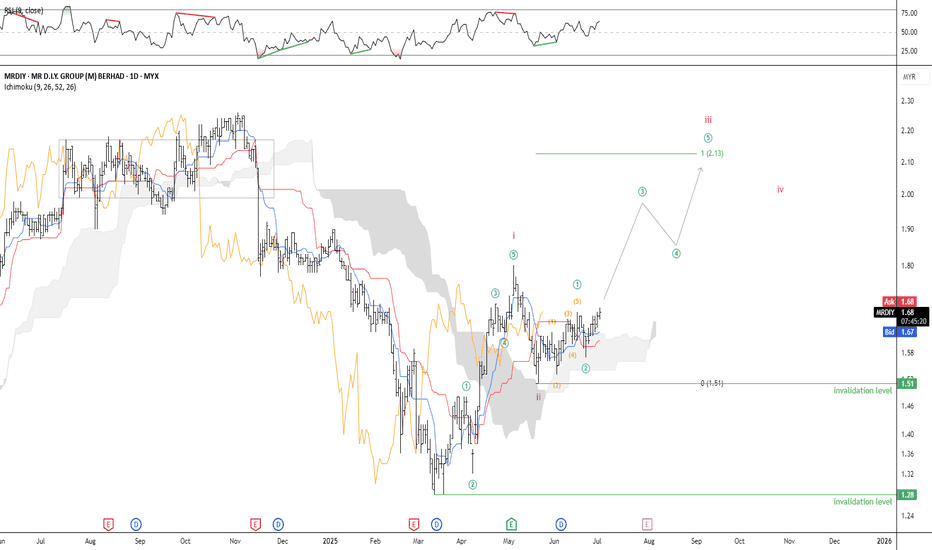

MR.DIY Chart Check: Bullish Wave Structure with Cloud SupportMR.DIY is riding a bullish wave, supported by both Elliott Wave structure and Ichimoku signals. Price action suggests a developing Wave iii, with strong momentum above the cloud—confirming trend strength. The Tenkan-sen and Kijun-sen crossover adds bullish conviction, while the Chikou Span remains above price, reinforcing upward bias. As long as price holds above the cloud base, the bullish count remains valid. Invalidation sits below MYR 1.51. Eyes on a potential breakout if Wave iii extends.

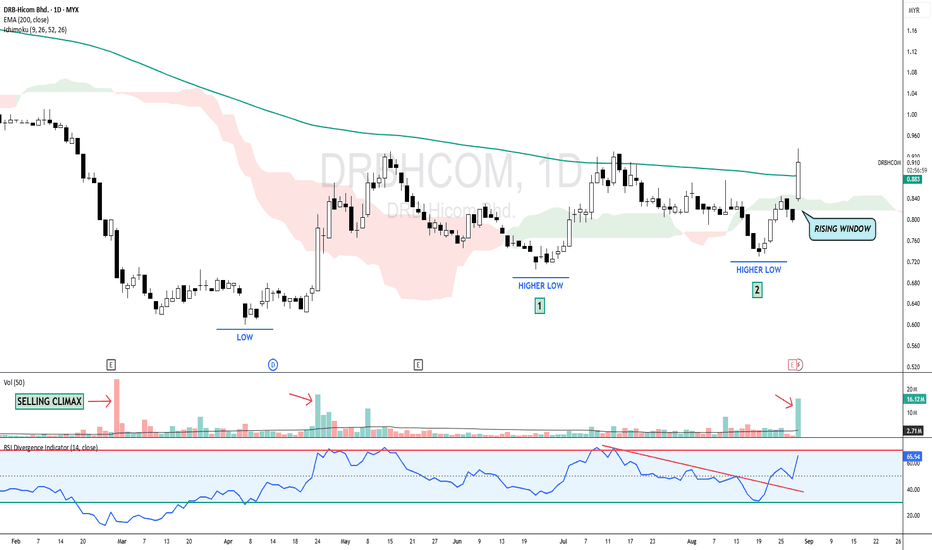

DRBHCOM - BREAKOUT EMA 200 with VOLUME !DRBHCOM - CURRENT PRICE : RM0.910

DRBHCOM broke out EMA 200 with high trading volume. At the same time, the stock is also above ICHIMOKU CLOUD. Take note that the lows in price are getting higher - indicating demand is increasing. This bullish scenario is also supported by recent breakout down trendline in RSI oscillator. RSI is rising and currently at 65.54.

Take note also that there is a double bottom chart pattern with the second low is slightly higher than previous low.

There is possibility that the price may trend higher in near term. Rising window low RM0.820 may acts as strong support.

ENTRY PRICE : RM0.900 - RM0.910

TARGET : RM0.980 and RM1.09

SUPPORT : RM0.820

Notes : The company just announced its QUARTER REPORT. For more details, please visit their website. Previously I had wrote technical report for the company (already hit my both targets). I share the link below here.

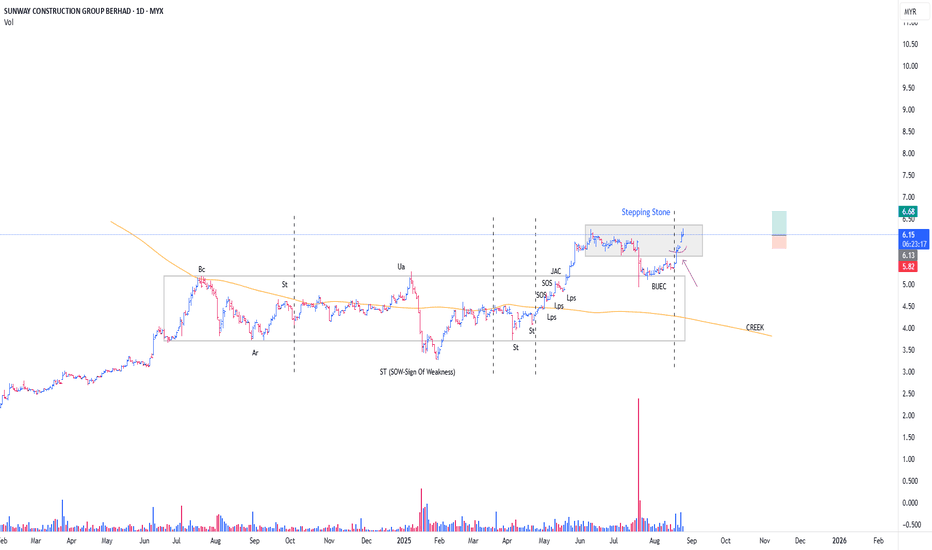

SUNCON MARKING UPThis is a Schematic #2 Re-Accmulation

The point of focus would be over the Stepping Stone area

*(Black Color, Shaded Area)

*SS (Stepping S)

-SS, bascially a temporary 'place' / 'phase' where, the price would be lingering around before continuing the markup.

The purple color arc **Purple Arrow, is a A type of Contraction.

-A Contraction, indicating that the market participant has been reducing.

-to be more specific, this is #1 schematic of SpringBoard

I initiated my position from the Trigger Bar @ 22/8/25 (RM 6.07)

Added another position today (RM 6.21)