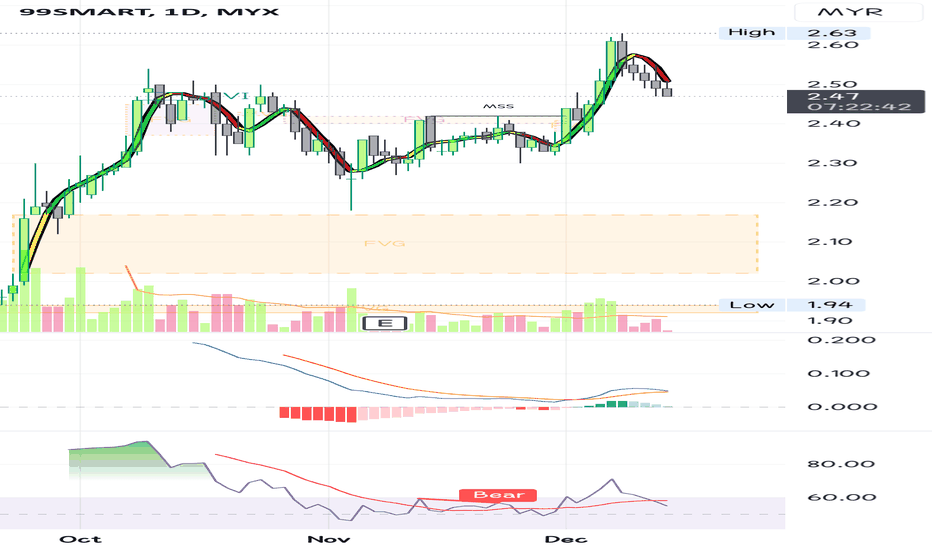

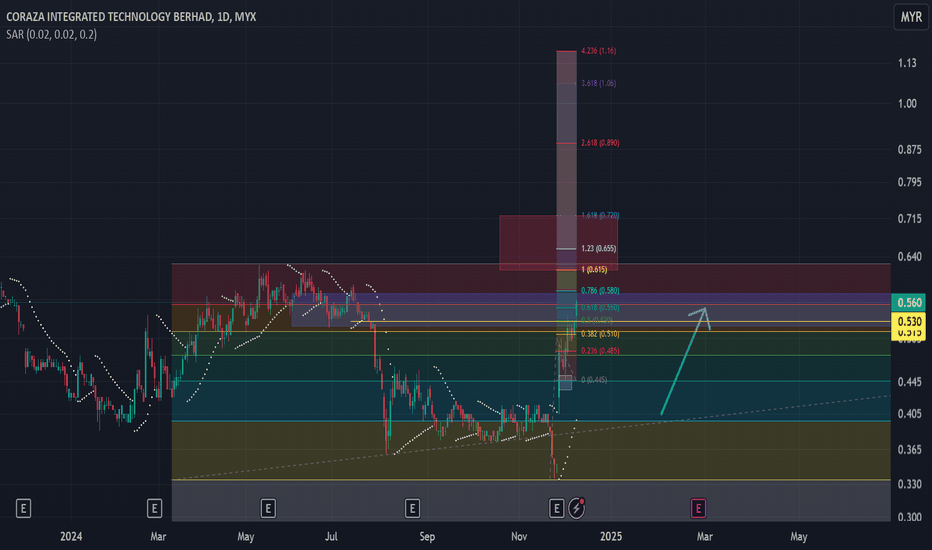

99SMART: A Potential Rebound Next Week?It experienced a significant decline of nearly 6% from its recent high of 2630.

If it further drops below the 2470 could dampen the stock's outlook.

For those who acquired the stock below the current price, there's still an opportunity for profit.

While uncertainty looms over the weekend, it's important to remember to enjoy the investment journey. By maintaining a positive outlook and making informed decisions, investors can navigate market fluctuations and maximize their returns.

We only profit when successfully sell. Otherwise it's merely a paper gain.

Disclaimer: Please be informed that all stock picks are solely for educational and discussion purposes; they are neither trading advice nor an invitation to trade. For trading advice, please consult your remisier or dealer representative.

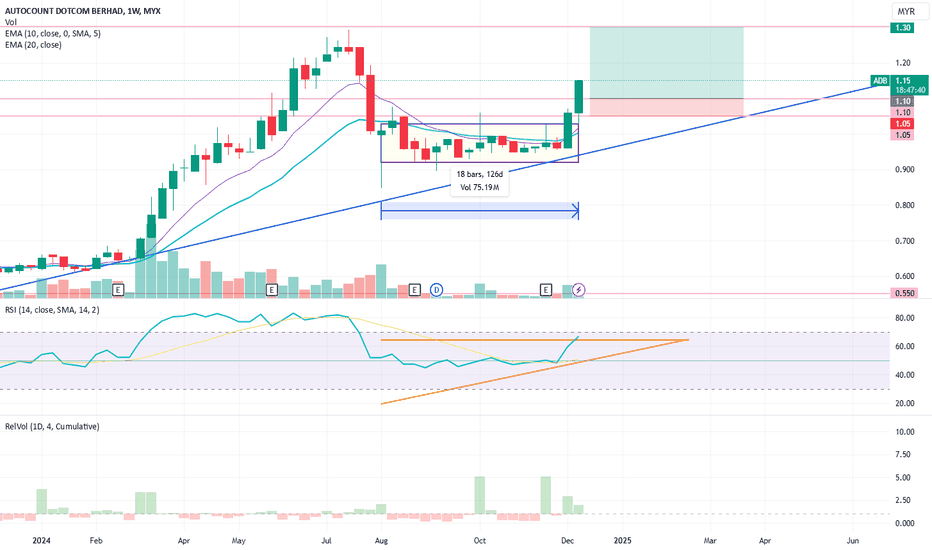

Simple13 Trading IdeaCurrent Price: RM 1.15

The stock successfully broke a 126-day consolidation and is now trading with strong upward momentum, pushing the RSI into the overbought range on the daily chart. Since the price is extended, waiting for a pullback could offer a better entry.

Potential Pullback Supports

Fibonacci Retracement Support (Daily Basis):

I adjust the Fibonacci retracement levels daily based on recent price action. Typically, I focus on the 50% retracement level, a key area where buyers might step in. This keeps the support level dynamic and in line with market movements.

20 EMA Support (Daily Chart):

The 20 EMA acts as a dynamic support level in a strong uptrend. If the stock retraces to this level, it could offer a buying opportunity, as prices often bounce off the 20 EMA in a sustained uptrend.

Trading Plan

Entry Area: RM 1.10 (near Fibonacci and 20 EMA support)

Target Price: RM 1.30 (based on projected resistance and price targets)

Cut Loss Level: RM 1.05 (if the stock closes below this level, indicating trend weakness)

Risk-to-Reward Ratio: 4:1

Summary

This setup aims to capitalize on the uptrend while managing risk with a clear entry, target, and stop-loss level. Adjusting the Fibonacci retracement and 20 EMA support on a daily basis will help refine entry timing.

Disclaimer: This is not financial advice. Conduct your own research before making investment decisions.

MYX:ADB

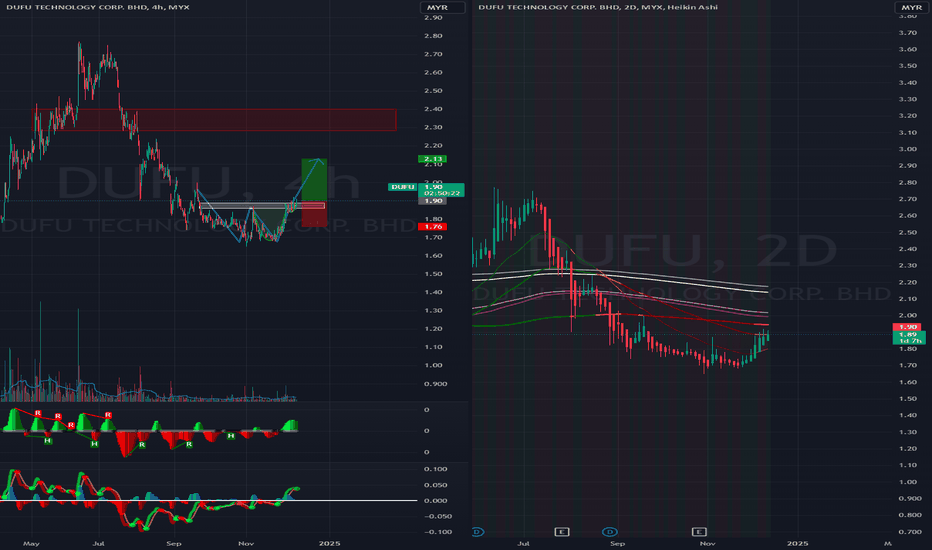

DUFU Double Bottom, BullishTime Frame: 4H

Sentiment: Overbought

Forecast: Bullish

We can see a strong support and buying momentum around 1.6-1.8, selling power is weak.

Bar price action and the volume, showing buyers' power increase.

Broke the resistant level 1.86.

Heading to 2.13 & the next resistant around 2.2 - 2.4.

Write your thought in the comment session :)

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like my works? Please hit the Like, Follow and Share or tip me a coin :)

Thanks!

Disclaimer

This information only serves as study references, does not constitute a buy or sell call.

IFCAMSC - Analysis for potential price movement N wave with E, V, N & NT projection.

The price is above the Kumo, indicating a bullish trend.

The Tenkan-sen is above the Kijun-sen, signaling bullish momentum.

Chikou Span is above the price candles and the Kumo, supporting the bullish bias.

The price has closed above a critical resistance zone (gap closure region), confirming bullish progress.

The price is at 0.685, moving into the gap closure area, which could serve as a magnet for price action.

Breakout above 0.720 (NT level) is critical for further bullish momentum.

Immediate resistance levels: 0.720 (NT), 0.745 (V), 0.775 (N), and 0.840 (E).

Immediate support levels: 0.660 (gap support) and 0.640 (upper Kumo edge).

Enter a long position if the price breaks above 0.720 (NT level) with strong volume.

Alternatively, wait for a pullback near 0.660–0.670 (gap support zone) for a better risk-reward setup.

Place a stop-loss below 0.640 (upper Kumo edge) to manage downside risk.

Volume Confirmation: Ensure the breakout above 0.720 (NT) is supported by significant volume.

Risk Management: Adjust position size according to the stop-loss distance and ensure the reward-to-risk ratio is favorable.

52-Week High: Monitor price action if it approaches the 52-week high, as this could act as psychological resistance.

Note:

1. Analysis for education purposes only.

2. Trade at your own risk.

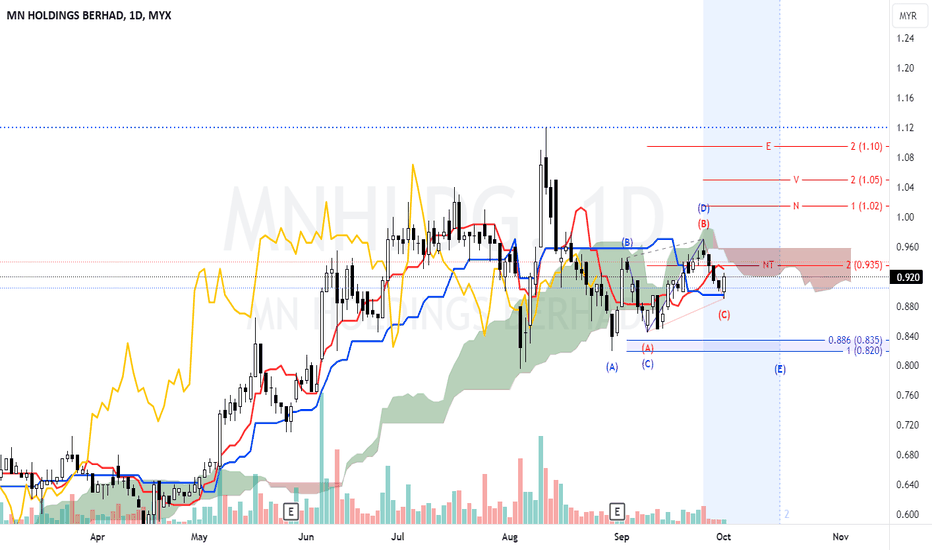

MNHLDG - Which sentiment is stronger, Bullish or Bearish?The chart presents two potential outcomes depending on the current market sentiment. The candle is below the Kumo, suggesting bearish momentum, but both bullish and bearish scenarios are possible:

N wave with E, V, N & NT projection.

The price is below the Kumo, indicating a bearish trend. However, a break above the NT level and Kumo could trigger a bullish shift.

The Chikou-Span is below the price action, which confirms the bearish trend, but a breakout above the Kumo would reverse this sentiment.

A buy signal could be confirmed with a close above 0.935 (NT level) and ideally above the Kumo.

Watch for a Kumo breakout to validate this bullish outlook. Failing to break above NT could invalidate the bullish scenario.

Wait for a breakout above the Kumo and NT (0.935) to confirm a bullish move towards 1.02, 1.05, and 1.10.

Y wave, target (E) within stipulated range.

The corrective Y wave formation is seen with the potential to continue downwards if the price fails to break above the NT level and remains under the Kumo.

The price is below the Kumo, and the Chikou-Span is also confirming bearish sentiment. If the price stays below NT (0.935) and continues its downward path, the bearish outlook strengthens.

If the price rebounds at (E) in the bearish scenario (Y wave), it could signal the end of the corrective phase and the potential for a new bullish wave to begin. Here's how you can approach the situation:

E (0.820 - 0.835): This zone represents the final target of the bearish Y wave. If the price reaches this level and shows signs of support or bullish reversal patterns (e.g., bullish engulfing, hammer), it could signal the beginning of a bullish recovery.

Look for candlestick patterns like a bullish engulfing or a hammer around the E (0.820 - 0.835) level.

If the price moves above the Kumo after a rebound from E, it will further confirm the bullish reversal.

A cross of the Tenkan-Sen over the Kijun-Sen below the Kumo could signal early bullish momentum.

After the rebound, the price could start a new N wave pattern with an upward trend.

New projections for N, V, and E targets can be calculated based on the rebound.

If a strong rebound is confirmed near 0.820 to 0.835 with bullish price action and Ichimoku alignment, consider entering a long position.

Place a stop-loss slightly below the E level (0.820) to minimize downside risk.

First target: Near previous resistance levels, likely around 0.94 (NT level).

Subsequent targets: 1.02 (N), 1.05 (V), and 1.10 (E) from the potential new N wave.

This would offer a good risk-to-reward setup, assuming the price respects the E level and bullish momentum follows.

Note:

1. Analysis for education purposes only.

2. Trade at your own risk.

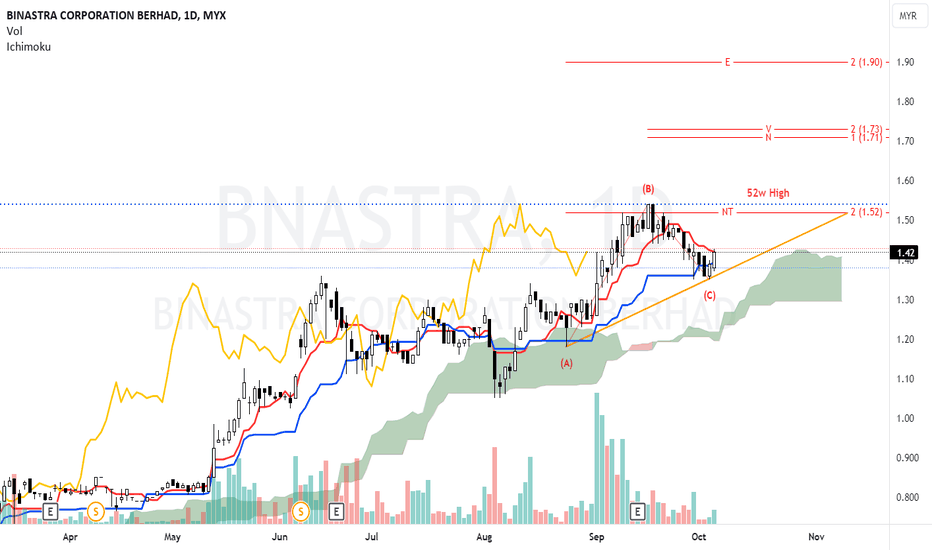

BNASTRA - Just a 2-cent ideaN wave with E, V, N & NT projection.

NT Projection (1.52): This level is the immediate resistance. The price recently tested this level but was unable to close above it, pulling back slightly to 1.42. If the price breaks and closes above this NT level, it could indicate a continuation of the bullish trend.

The price is above the Kumo, suggesting an overall bullish trend. The Chikou-Span remains above the price, supporting the current bullish outlook. However, the price is testing the lower boundary of the Kumo, so a breakout or rejection in the coming sessions will be important.

The stock recently tested its 52-week high around 1.52, coinciding with the NT level. A breakout above this high would be a strong bullish signal.

Recent price action has seen a slight increase in volume, indicating buyer interest, especially after the pullback to 1.37.

Entry: Enter above the NT level at 1.52 on a breakout confirmation.

Stop-Loss: Set the stop-loss around 1.38, below the recent low and Kumo support.

If the price fails to break above NT (1.52), it may lead to further consolidation or a re-test of lower support levels.

Ascending Triangle

The NT level at 1.52 acts as the horizontal resistance. The price has tested this level multiple times, forming the flat upper boundary of the triangle. This is also close to the stock's 52-week high, reinforcing the significance of this resistance.

The ascending trendline can be drawn from the recent lows at points A and C. This rising support line connects the higher lows, creating the lower boundary of the triangle.

The price is moving within the triangle, getting squeezed between the rising trendline and the horizontal resistance, indicating increasing pressure for a breakout.

An ascending triangle suggests a bullish breakout is likely if the price can close above the 1.52 resistance level with strong volume. The measured move (potential target after breakout) is typically calculated by taking the height of the triangle and projecting it upward from the breakout point.

Entry: Enter on a breakout above 1.52, with a strong daily close confirming the move.

Stop-Loss: Place the stop-loss below the rising trendline support, around 1.38 (or slightly below the recent lows).

Target: The expected move can be projected by measuring the height of the triangle, which is approximately 0.15 (1.52 - 1.37). This would give a target of around 1.67, which aligns with the N and V projections (1.73).

If the breakout is strong, the price may move towards the final E projection of 1.90 in the longer term.

Note:

1. Analysis for education purposes only.

2. Trade at your own risk.

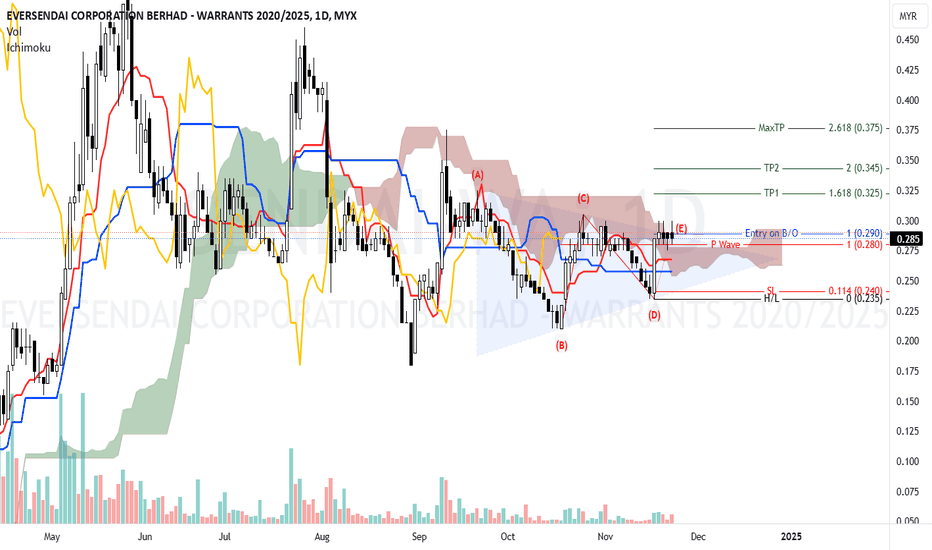

SENDAI-WA - P Wave breakout strategy setupThe price is currently situated near the Kumo. This hints at potential resistance above and support below.

Recent volume suggests increased interest, particularly around the P wave's resistance area, indicating possible upcoming volatility.

The P wave is visible in the price movements, defined by alternating highs and lows, indicating consolidation before a potential breakout.

Key price levels:

Support Zone (Lower end of P wave): around 0.240.

Resistance Zone: around 0.290 to confirm the breakout.

Monitor for a breakout above 0.290 with supportive volume to confirm your entry. Set your SL and TPs as outlined to maximize your trading strategy while managing risk appropriately. Use caution and stay updated on market conditions that may affect price movements.

Note:

1. Analysis for education purposes only.

2. Trade at your own risk.

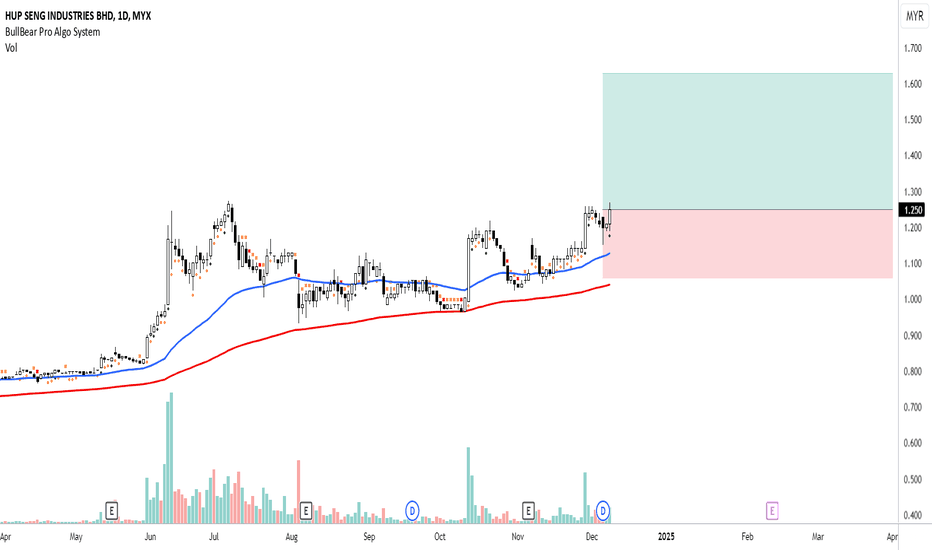

HUPSENGOur algorithm has identified potential upward signals in the current market. Increased trading volume and prices above the EMA20 and EMA50 suggest a possible upward trend.

💡Trading idea dan plan:

✅Entry: 1.25

🛑Stop Loss @SL: 1.05

🎯Target Price @TP1: 1.45

🎯Target Price @TP2: 1.60

🎉Target Price @TP3: 1.80

(This trading plan is for reference only and may vary based on your entry point and risk tolerance.)

Remember, trading strategies are just 10-20% of your overall success. The real key lies in effective risk management. Having a solid trading plan and proper position sizing are crucial for maintaining the right trading psychology. Master your risk management and stick to your plan.

Happy trading!

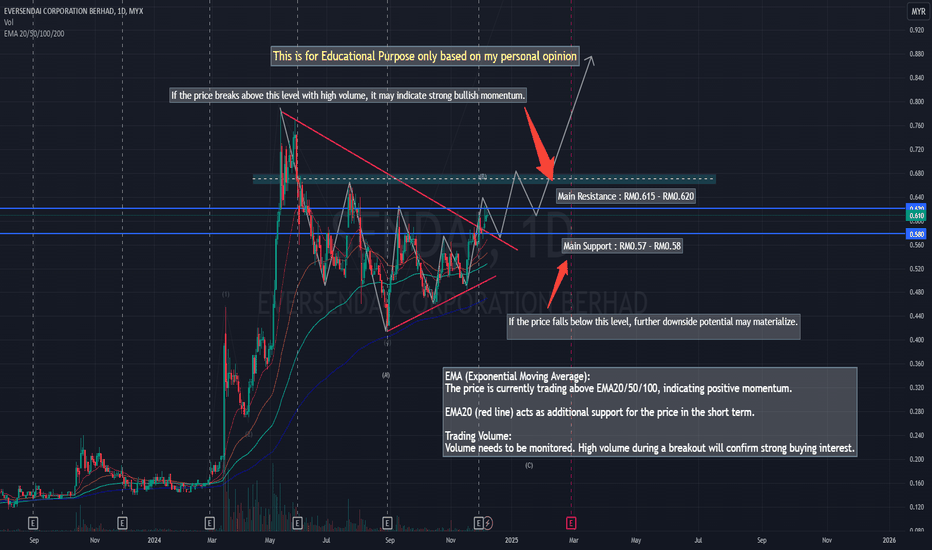

Case Study - EVERSENDAI CORPORATION BERHADCase Study - EVERSENDAI CORPORATION BERHAD

Eversendai Corporation Berhad (ECB), formerly Eversendai Corporation Sdn. Bhd is an investment holding company.

The Company's principal activity is the provision of management services. ECB's subsidiaries include EV Abu Dhabi, EV Dubai, EV India, EV Qatar, EVSC, EV Saudi, EV Sharjah, EV Singapore and SEVM. The Company owns 49% interest in EV Abu Dhabi, EV Dubai, EV Qatar and EVSC.

ECB provides some technical services, such as Structural design, Detailing works, Unfolding drawings and Value engineering services. It provides complete design services ranging from conceptual stage design to connection design for a range of structures using appropriate software.

ECB also provides structural detailing works services and services in unfolding drawings with 3-D curvatures for complex structures. The Company has completed over 100 projects, including projects in 10 countries, such as Malaysia, Thailand, Philippines, Indonesia, Hong Kong, Oman, Saudi Arabia, Bahrain, Qatar and UAE.

Analysis of Eversendai Corporation Berhad (SEND) Chart

1. General Trend Overview:

SENDAI 's stock price is showing a symmetric triangle pattern, which is a consolidation pattern.

A breakout above the resistance line may signal an upward movement, while a breakdown below the support line could lead to further price declines.

2. Key Support and Resistance Levels:

Main Resistance: The upper line around RM0.615-RM0.620.

If the price breaks above this level with high volume, it may indicate strong bullish momentum.

Support Level: The ascending lower trendline around RM0.57-RM0.58.

If the price falls below this level, further downside potential may materialize.

3. Technical Indicators:

EMA (Exponential Moving Average):

The price is currently trading above EMA20/50/100, indicating positive momentum.

EMA20 (red line) acts as additional support for the price in the short term.

Trading Volume:

Volume needs to be monitored. High volume during a breakout will confirm strong buying interest.

4. Stock Price Direction:

Positive Scenario:

If the price breaks above RM0.620 with high volume, the next target could be around RM0.65 or higher.

Negative Scenario:

If the price fails to hold above the support level of RM0.57, the stock may decline to lower levels, such as RM0.55 or below.

5. Recommendations:

Buy After Breakout:

Wait for the price to break above RM0.620 with significant volume before entering.

Monitor Support:

If the price drops below RM0.57, consider exiting to avoid further losses.

Set a Stop-Loss:

Place a stop-loss below the support level of RM0.57 to manage risk.

Conclusion: The SENDAI price is in a consolidation phase.

Wait for confirmation of a breakout above resistance or a breakdown below support before making a decision.

The short-term direction depends on how the price behaves around the RM0.620 resistance and RM0.57 support levels.

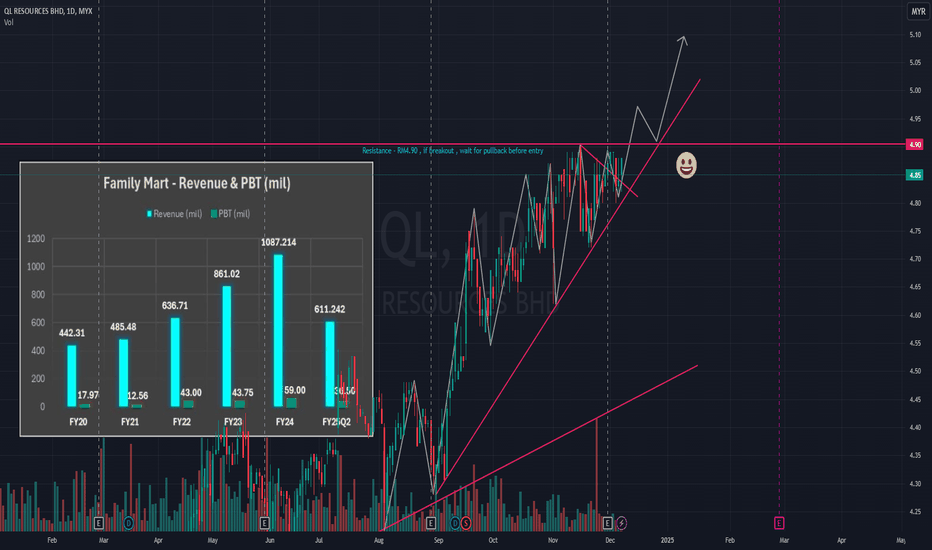

Case Study - Bursa - QL Resources BhdCase Study - Bursa - QL Resources Bhd

Fundamental and Historical Analysis:

Business Diversification:

Starting as an agribusiness and fisheries company, QL has expanded into the food, retail (FamilyMart), and green energy sectors.

The introduction of FamilyMart in 2016 was a pivotal move, strengthening QL’s presence in the retail and fast-food sectors, making it a key revenue source alongside agribusiness.

Green Energy:

The renewable energy initiative highlights QL’s commitment to sustainable development, making it appealing to ESG (Environment, Social, Governance) investors.

Stable Profitability:

Financial data indicates overall revenue growth, but profit margins (PBT) require attention, especially in FY24 and FY25 Q2.

Key Challenges:

Declining margins in FY25 Q2 and the need to compete in a highly competitive retail market may challenge future performance.

Technical Analysis Based on the Chart:

Main Trend:

The chart indicates a strong upward trend with consistent support lines, signaling investor confidence in QL shares.

Critical Levels:

Major Resistance: RM4.90 – this is a key level that needs to be breached to confirm upward momentum.

Major Support: Uptrend line – a breakdown below this trendline could indicate a reversal in momentum.

Zig-Zag Pattern:

The price correction in a zig-zag pattern is healthy and suggests consolidation before the next significant move.

Trading Strategy:

Wait for a breakout above RM4.90 with high volume as a sign of buyer strength.

Ensure a stop-loss plan below the support trendline to manage risk.

Insights and Recommendations:

Long-Term Growth Potential:

Diversification into green energy and FamilyMart's dominance in the local market provides positive growth prospects.

Risks:

Declining profit margins in future financial reports should be monitored.

If competition in the retail sector intensifies, QL will need to enhance operational efficiency to maintain profitability.

Smart Investment Steps:

Short-Term Investors: Focus on the RM4.90 level and use a "pullback entry" after a breakout.

Long-Term Investors: Focus on the company’s fundamentals, particularly developments in green energy and FamilyMart expansion.

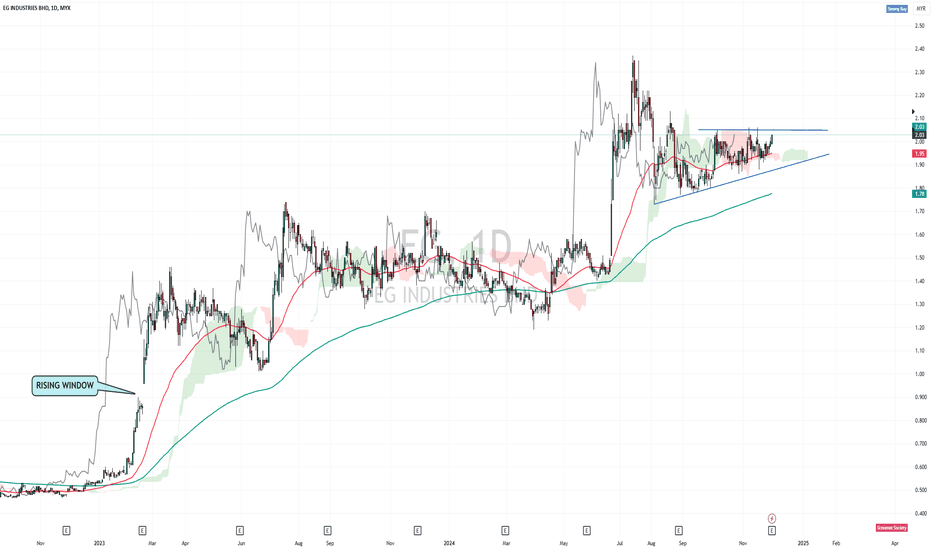

EG INDUSTRIES - POTENTIAL BULLISH CONTINUATION PATTERN ?EG INDUSTRIES - CURRENT PRICE : RM2.03

In long term the stock is UPTREND as the share price is above 200-day EMA. For short and medium term, the stock is trading in sideways. However, based on chart pattern analysis, the stock is potential of making BULLISH ASCENDING TRIANGLE - Bullish Continuation Pattern .

Based on ICHIMOKU CLOUD, the share price is trading above CLOUD indicates a little bit bullish scenario. CHIKOU SPAN is in CLOUD and pending to breakout above cloud. If CHIKOU SPAN manage to break above CLOUD, it will add more bullish outlook for the stock and technically it is a buy signal.

At current moment, if the stock made a high above RM2.05, then technically it is a buy signal for me based on CHART PATTERN (Completion of ASCENDING TRIANGLE) and ICHIMOKU CLOUD (CHIKOU SPAN breakout CLOUD).

ENTRY PRICE : RM2.06 - RM2.10

TARGET PRICE : RM2.22 and RM2.37

SUPPORT : 50-day EMA

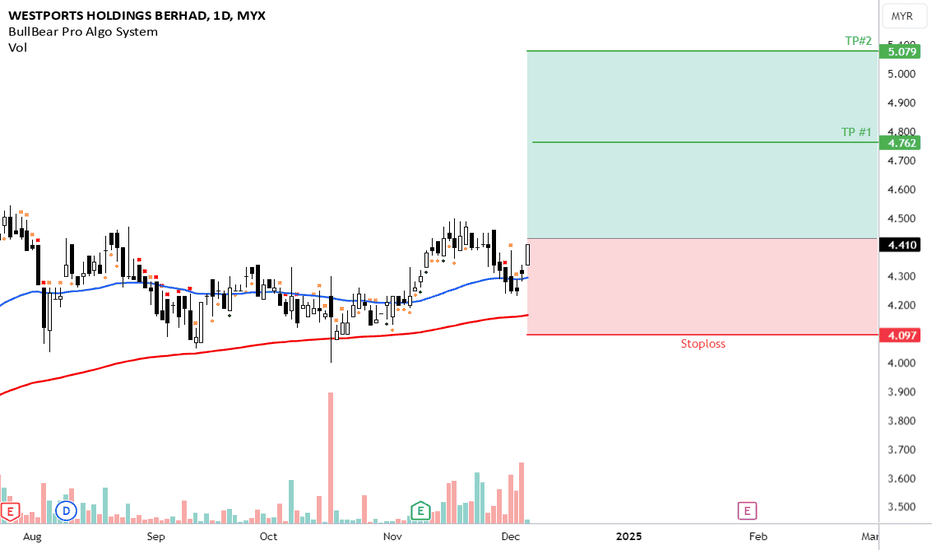

WPRTWPRTOur algorithm has identified potential upward signals in the current market. Increased trading volume and prices above the EMA20 and EMA50 suggest a possible upward trend.

💡Trading idea dan plan:

✅Entry: 4.43

🛑Stop Loss @SL: 4.10

🎯Target Price @TP1: 4.75

🎯Target Price @TP2: 5.08

🎉Target Price @TP3: 5.40

(This trading plan is for reference only and may vary based on your entry point and risk tolerance.)

Remember, trading strategies are just 10-20% of your overall success. The real key lies in effective risk management. Having a solid trading plan and proper position sizing are crucial for maintaining the right trading psychology. Master your risk management and stick to your plan.

Happy trading!

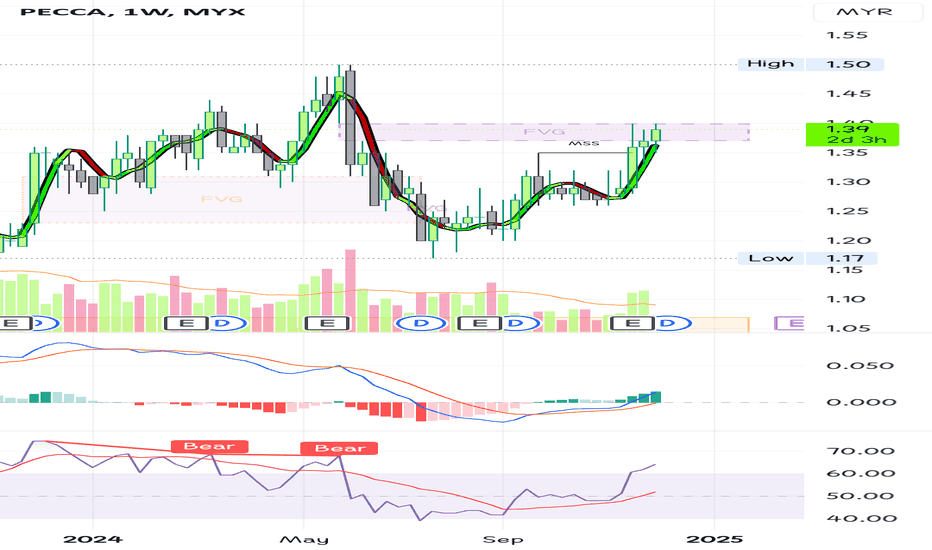

Pecca, able to breakout ?Is it possible for PECCA to make a healthy pullback and retest its resistance levels?

In the world of technical analysis, such a scenario often depends on market conditions and the stock's current momentum. A healthy pullback typically occurs when a stock temporarily retraces some of its gains after a strong upward movement, allowing it to consolidate and gather strength for another potential move higher.

If PECCA maintains its underlying bullish trend, a pullback to key support levels could provide a base for the stock to rebound and make another attempt at breaking or retesting resistance. Factors such as trading volume, overall market sentiment, and fundamental developments will also play a critical role in shaping this potential move.

Investors should closely monitor these levels and assess the broader market context to gauge the likelihood of a successful retest.

Disclaimer: Please be informed that all stock picks are solely for educational and discussion purposes; they are neither trading advice nor an invitation to trade. For trading advice, please consult your remisier or dealer representative.

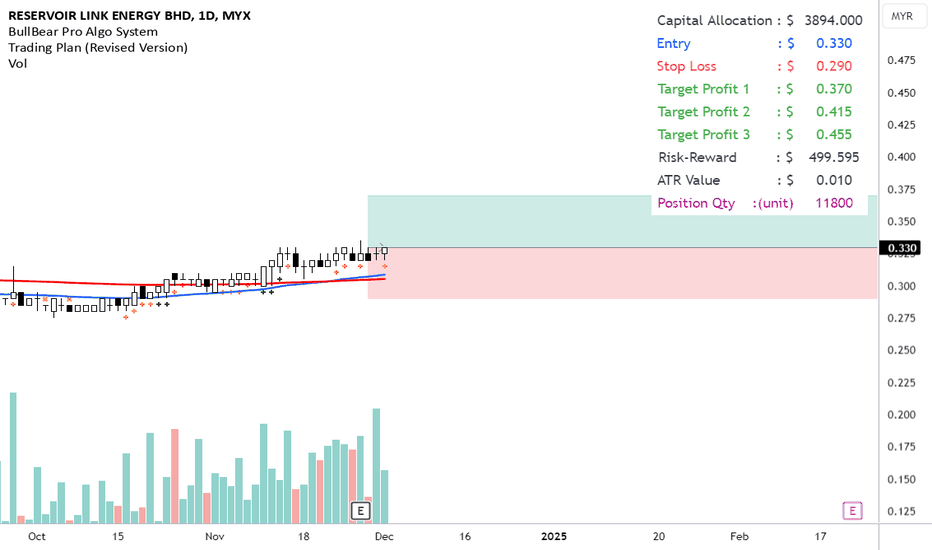

RLOur algorithm has identified potential upward signals in the current market. Increased trading volume and prices above the EMA20 and EMA50 suggest a possible upward trend.

💡Trading idea dan plan:

✅Entry: 0.33

🛑Stop Loss @SL: 0.29

🎯Target Price @TP1: 0.37

🎯Target Price @TP2: 0.415

🎉Target Price @TP3: 0.455

(This trading plan is for reference only and may vary based on your entry point and risk tolerance.)

Remember, trading strategies are just 10-20% of your overall success. The real key lies in effective risk management. Having a solid trading plan and proper position sizing are crucial for maintaining the right trading psychology. Master your risk management and stick to your plan.

Happy trading!

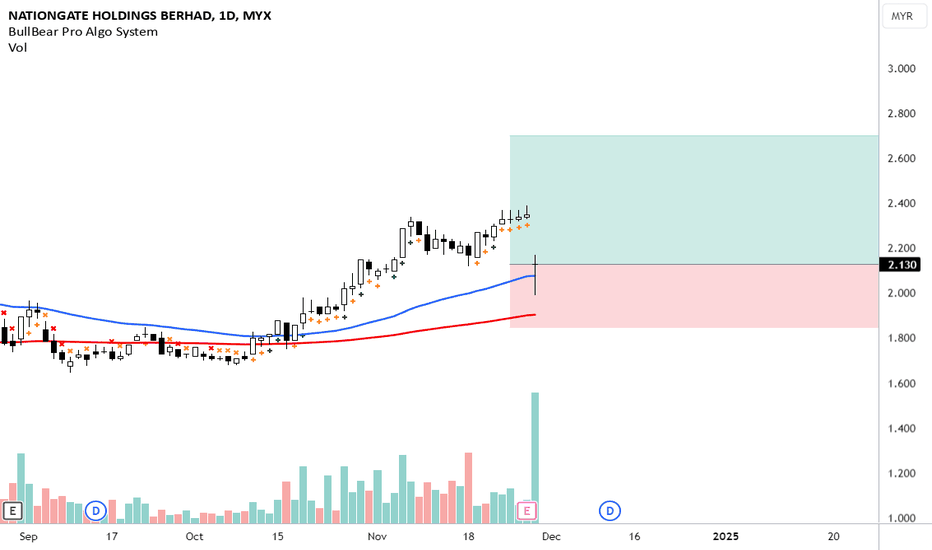

NATGATEOur algorithm has identified potential upward signals in the current market. Increased trading volume and prices above the EMA20 and EMA50 suggest a possible upward trend.

💡Trading idea dan plan:

✅Entry: 2.14

🛑Stop Loss @SL: 1.85

🎯Target Price @TP1: 2.40

🎯Target Price @TP2: 2.70

🎉Target Price @TP3: 3.00

(This trading plan is for reference only and may vary based on your entry point and risk tolerance.)

Remember, trading strategies are just 10-20% of your overall success. The real key lies in effective risk management. Having a solid trading plan and proper position sizing are crucial for maintaining the right trading psychology. Master your risk management and stick to your plan.

Happy trading!

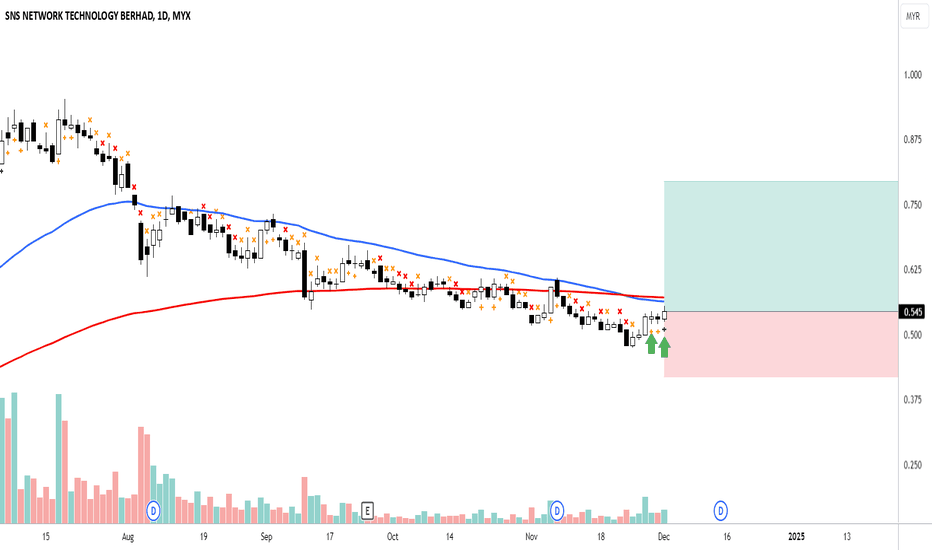

SNSOur algorithm has identified potential upward signals in the current market. Increased trading volume and prices above the EMA20 and EMA50 suggest a possible upward trend.

💡Trading idea dan plan:

✅Entry: 0.545

🛑Stop Loss @SL: 0.445

🎯Target Price @TP1: 0.675

🎯Target Price @TP2: 0.775

🎉Target Price @TP3: 0.875

(This trading plan is for reference only and may vary based on your entry point and risk tolerance.)

Remember, trading strategies are just 10-20% of your overall success. The real key lies in effective risk management. Having a solid trading plan and proper position sizing are crucial for maintaining the right trading psychology. Master your risk management and stick to your plan.

Happy trading!

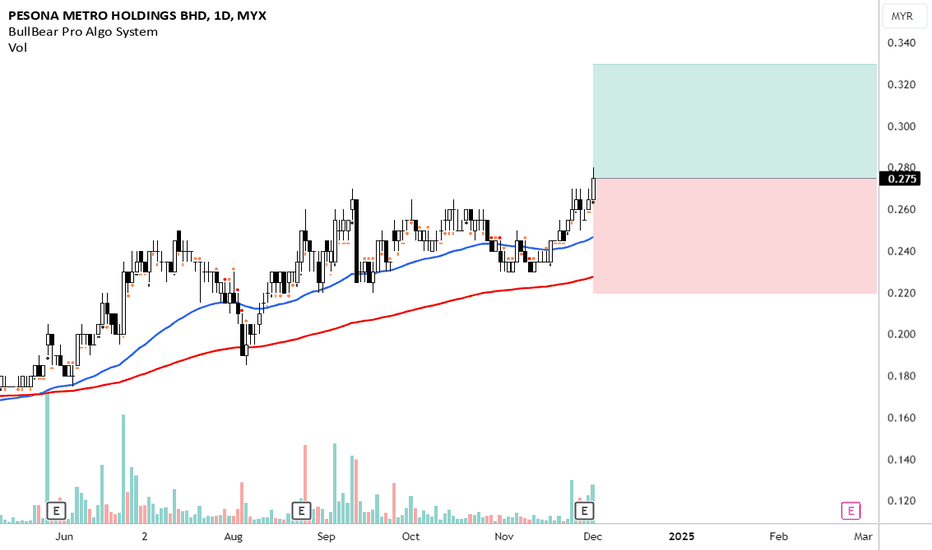

PESONAOur algorithm has identified potential upward signals in the current market. Increased trading volume and prices above the EMA20 and EMA50 suggest a possible upward trend.

💡Trading idea dan plan:

✅Entry: 0.275

🛑Stop Loss @SL: 0.22

🎯Target Price @TP1: 0.33

🎯Target Price @TP2: 0.385

🎉Target Price @TP3: 0.44

(This trading plan is for reference only and may vary based on your entry point and risk tolerance.)

Remember, trading strategies are just 10-20% of your overall success. The real key lies in effective risk management. Having a solid trading plan and proper position sizing are crucial for maintaining the right trading psychology. Master your risk management and stick to your plan.

Happy trading!