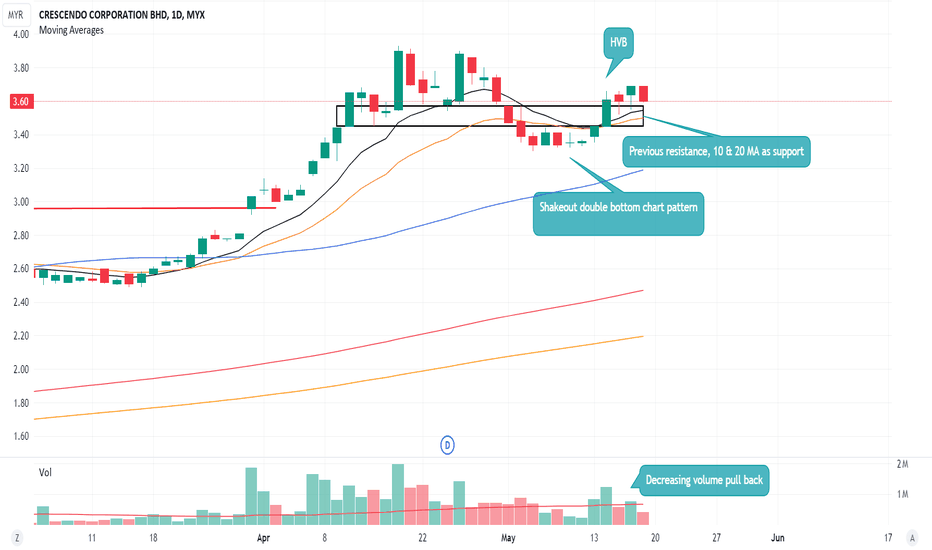

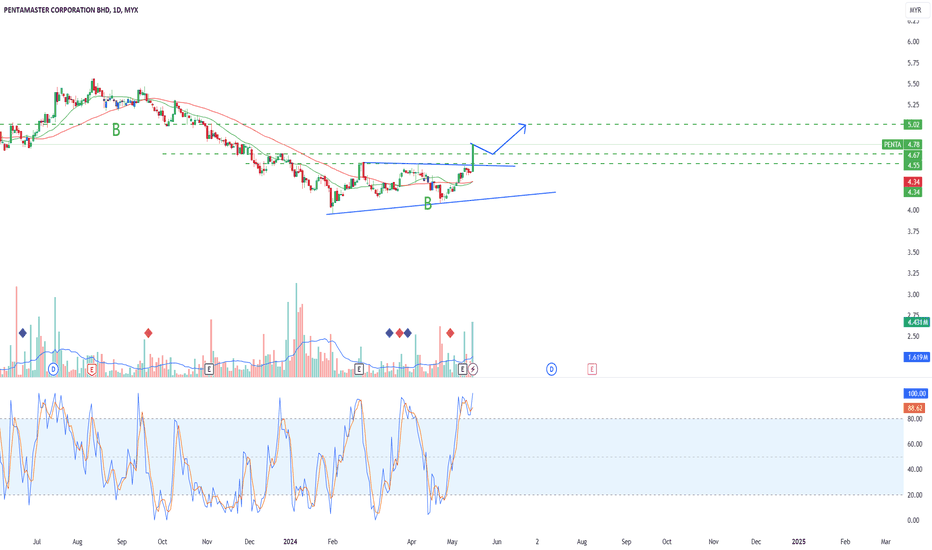

[MRCB]: Riding the construction wavePrice has tested resistance formed since September 2023 with some low volume selling on 9.1.2024.

Long & short term moving averages have aligned.

MACD shows bullish momentum.

Between Oct to Nov 2023, prices have tested support with low volume as well as two shakeouts.

Wyckoff accumulation pattern also appears to near its end with possible SOS.

If price manage to break the resistance again, this will go to a new 52 week high definitely and enter the mark up phase.

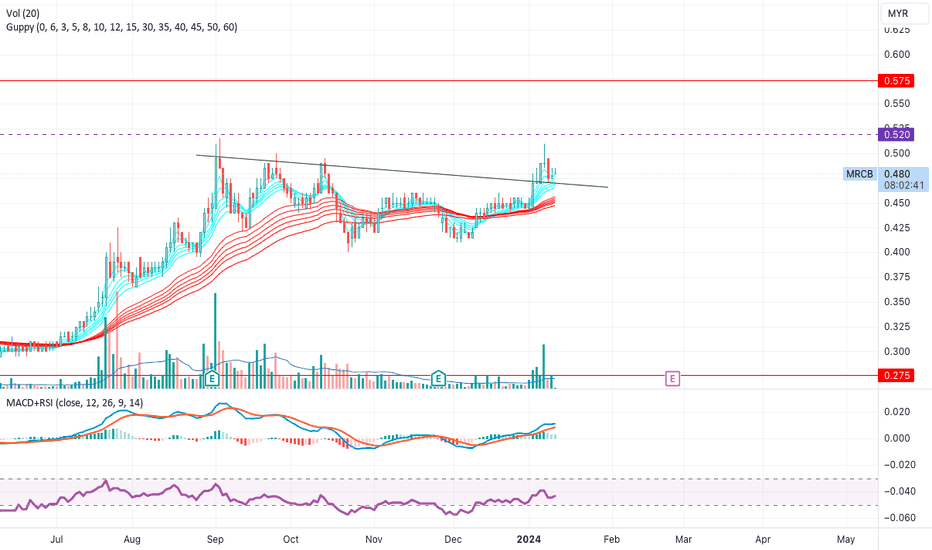

CORAZA, Capitalsahamplus Algo TradingSystem Remisier CheDinThe current point exhibits upward signals according to my algorithmic system, meeting various criteria. These include rising trading volume, an upward trend indicated by prices above EMA20 and EMA50, and the closing price surpassing VWAP. As a result, the present conditions suggest a potential upward trend.

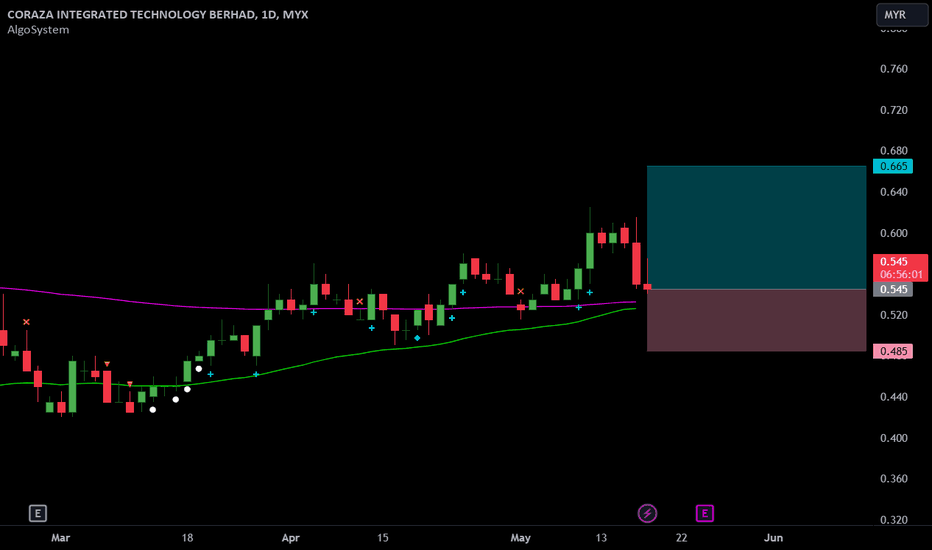

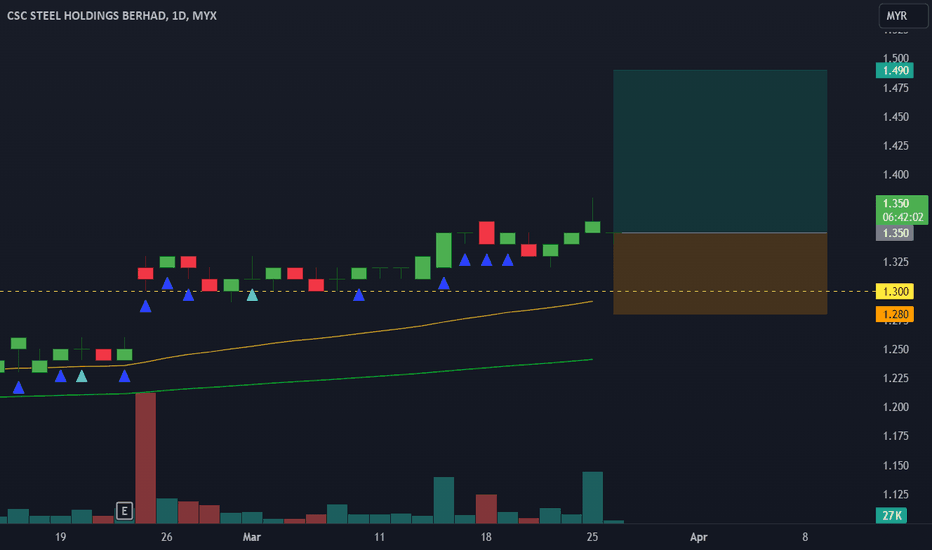

CSCSTEEL, Uptrend based on AlgoSignal StrategyThe current point exhibits promising upward signals according to my algorithmic system, meeting various criteria. These include rising trading volume, an upward trend indicated by prices above EMA20 and EMA50, and the closing price surpassing VWAP. As a result, the present conditions suggest a potential upward trend.

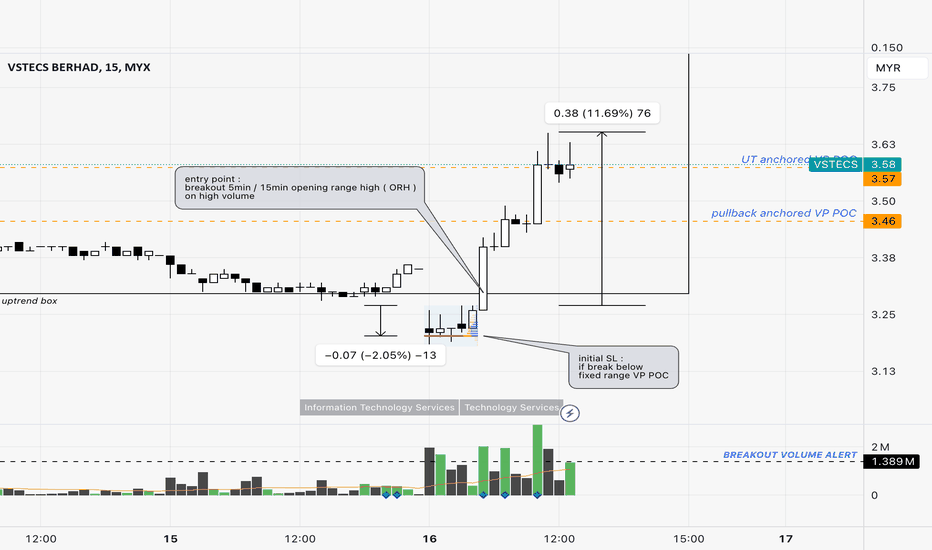

VSTECS : Breakout Opening Range High after down days streak

limit up 5 days ago.

subsequently , pullback with 4 days down streaks.

today on reversal day ( day 5 after the momentum limit up day ) :

- gap down during market opening

- mark the opening range high ( 5min )

entry :

- on breakout from 5min Opening Range High

- initial stop loss : below the opening range session VP POC ( using fixed range volume profile )

Hibiscs, Capitalsahamplus Algo TradingSystem Remisier CheDin The current point exhibits upward signals according to my algorithmic system, meeting various criteria. These include rising trading volume, an upward trend indicated by prices above EMA20 and EMA50, and the closing price surpassing VWAP. As a result, the present conditions suggest a potential upward trend.

EFORCE. AlgoSignal reveals potential uptrendSeveral indicators within my algorithmic system are signaling a potential uptrend. These include:

- Increased volume: Activity is picking up, suggesting growing interest and potential momentum.

- Mid- to long-term uptrend: Both the 50-day and 150-day exponential moving averages are pointing upward, indicating a sustained positive trajectory.

These factors collectively point towards the possibility of an upward movement in the near future.

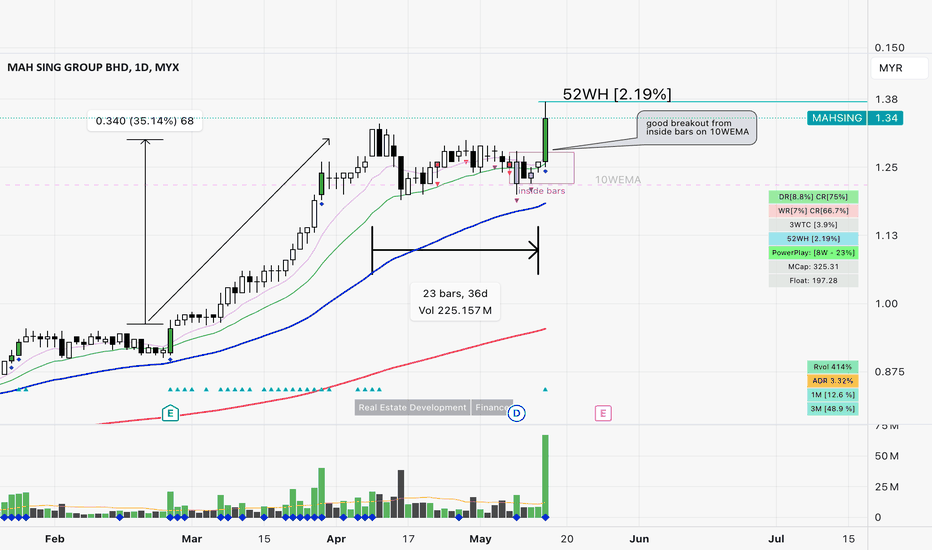

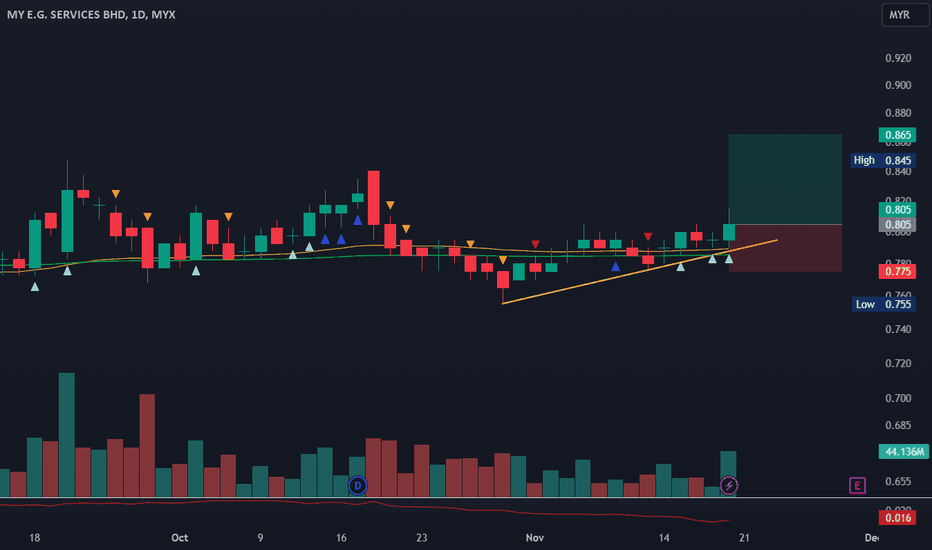

MYEG, Potential Buy based on AlgoSignal StrategyThe current price exhibits promising upward signals according to my algorithmic system, meeting various criteria. These include rising trading volume, an upward trend indicated by prices above EMA20 and EMA50, and the closing price surpassing VWAP. As a result, the present conditions suggest a potential upward trend.

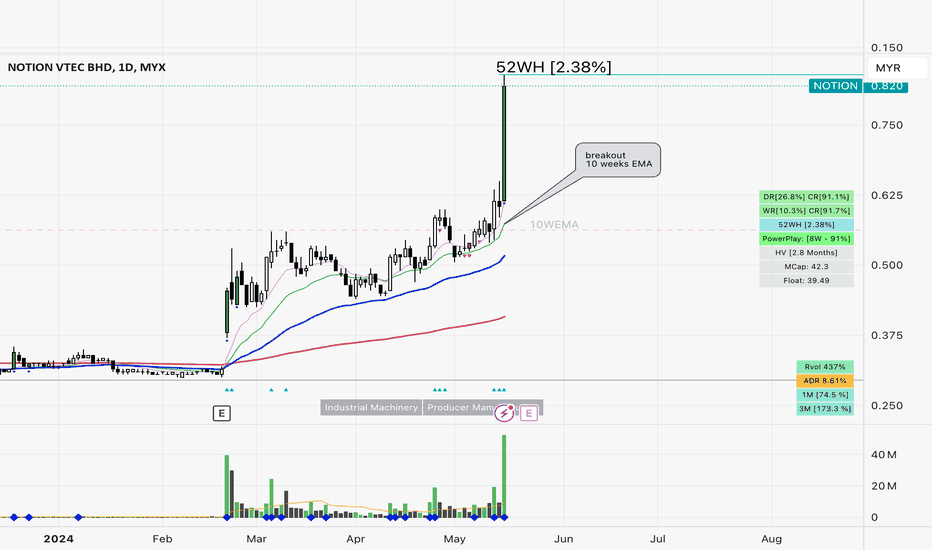

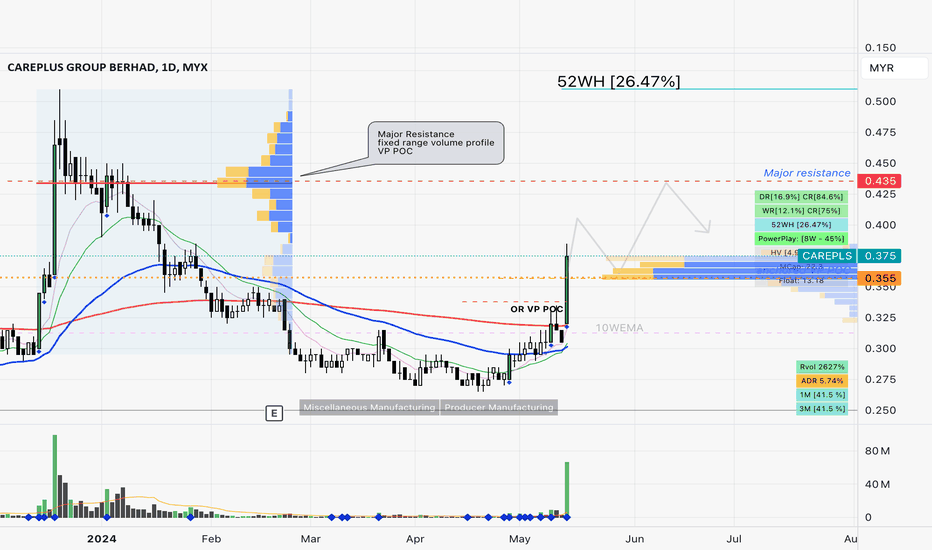

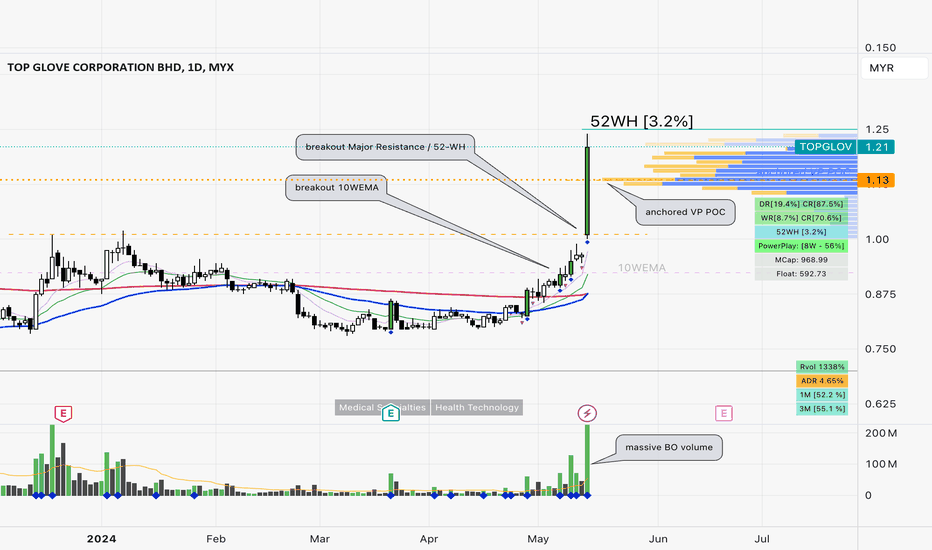

US-China Tariff : TOPGLOV Breakout

president Joe Biden raises the tariffs on Chinese rubber medical and surgical gloves from 7.5% to 25% in 2026, among others.

With the tariff hike, Chinese gloves will be more expensive in about two years compared to now.

--------------

breakout 52-WH

breakout 1 year overehad resistance

breakout 10 Weeks EMA

massive breakout volume

------------

price needs to sustain on/above today's VP POC. cut loss / take profit if break below VP POC

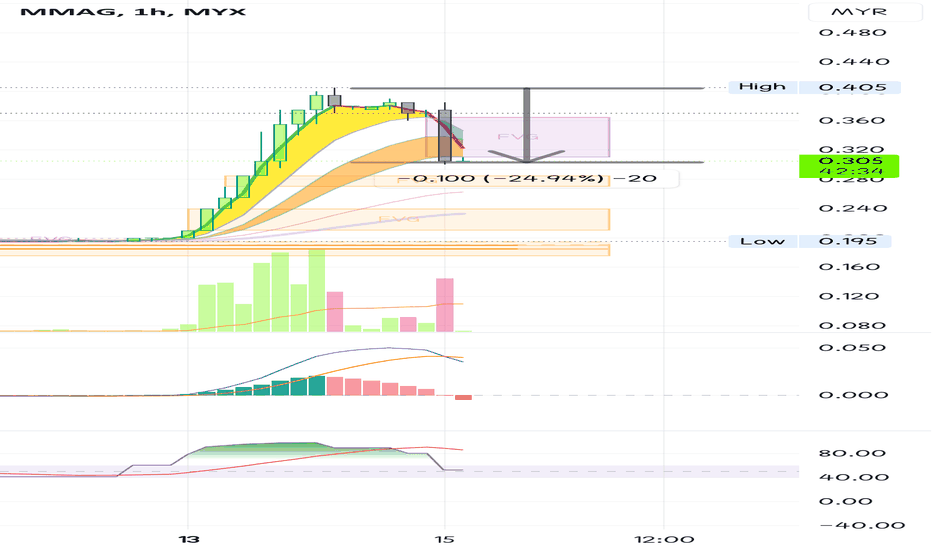

MMAG, whatever up will downMayday for MMAG?

Can short at Bursa? If not, better don't catch the falling knife.

The stock market is a highly dangerous place.

Get in, take your profit and get out quick!

If no profit, protect downside and run!!!

Disclaimer: Mentioned stocks are solely based on own opinions for education and/or discussion purpose only. There's no buy and/or sell recommendation. Trading involve financial risk on your own. The author shall not be responsible for any losses or lost profits resulting from investment decisions based on the use of the information contained herein.