$KLSE-INFOTEC FYE2023 Number of workforce (Employees)INDEX:KLSE -INFOTEC

Number of workforce (Employees):

26 permanent + 5 contract

= 31 employees in total

(dated LPD 23 May 2022, reported in IPO Prospectus dated 20 June 2022, page 132)

60 employees in total

(dated 31 May 2023, reported in NST News).

The number of employees have been doubled in a year, indicating rapid and aggressive APAC regional expansions have taken place.

Important point emphasized in the NST news: The team is still growing in line with its expansion drive.

That would translate into that more employees are expected onboard driven by continual business growth and in turn additional employees will push growth further on.

$KLSE-INFOTEC FYE 2023 Segments' GPM StudiesINDEX:KLSE -INFOTEC

FYE 2023 Segments' GPM Studies:

IT Infrastructure Solutions Segment GPM

= (19,142÷43,551)×(43,145÷43,551)

= 43.54%

Cybersecurity Solutions Segment GPM

= (990÷2,994)×(2,990÷2,994)

= 33.02%

Managed IT Services and Other IT

Services Segment GPM (Recurring)

= (16,686÷22,378)×(20,563÷22,378)

= 68.52%

Trading of Ancillary Hardware and Software Segment GPM

= (935÷5,374)×(5,231÷5,374)

= 16.94%

Pretty Impressive!

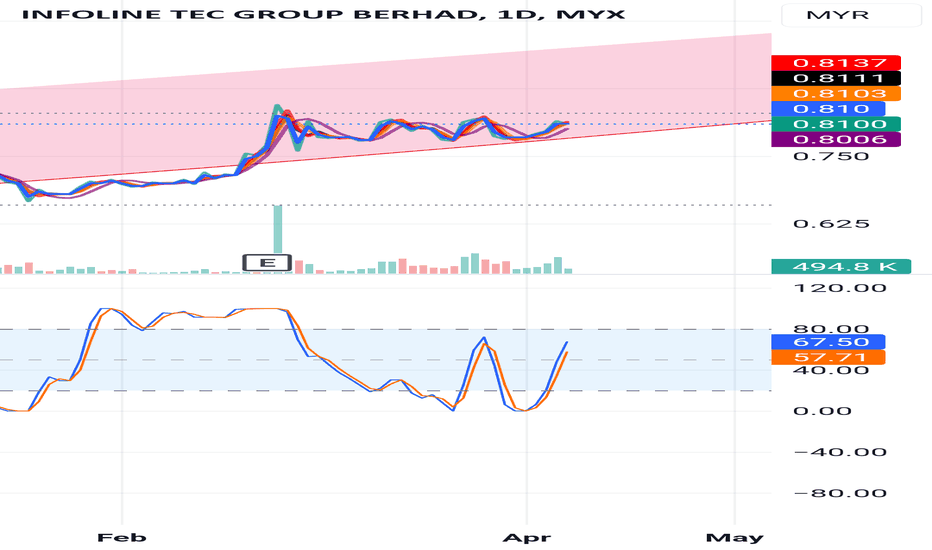

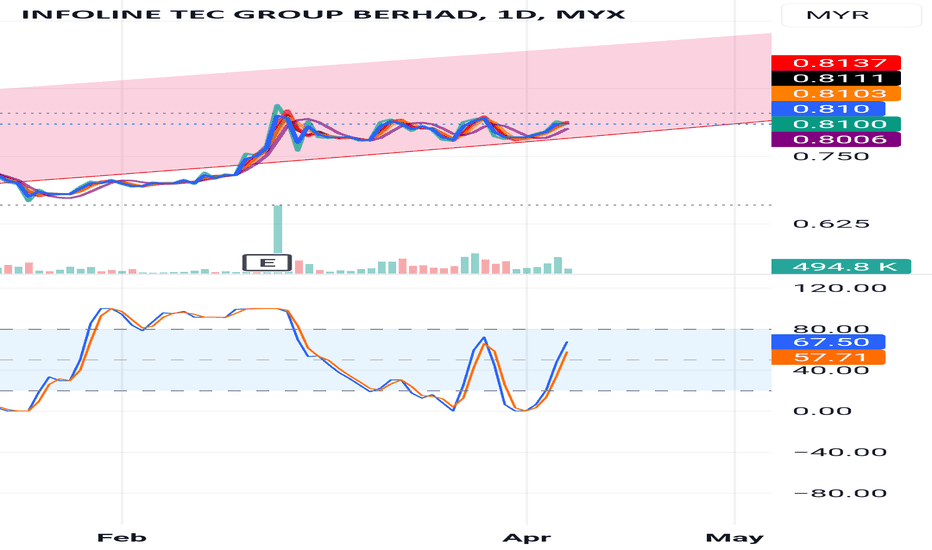

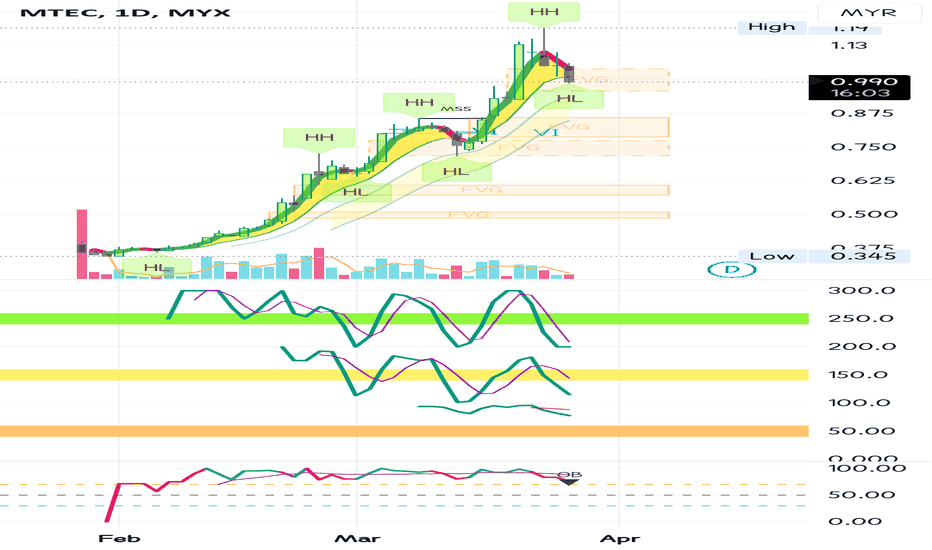

MTEC, possible rebound soon?>> Stochastic almost bottom.

>> RSI & MCDX still overbought too.

>> Awaiting it to give strong signal, perhaps soon?

Monitor for potential trade

I don't need to convince people to invest and win, it's a choice to let go if you don't believe the processes due to bad experiences you have encountered with others. But it's better you know a lot of people are still getting profitable outcome from this platform.

Disclaimer :

Please be informed that all stocks pick are solely for education and discussion purpose; it is neither a trading advice nor an invitation to trade. For trading advice, please speak to your remisier or dealer representative.

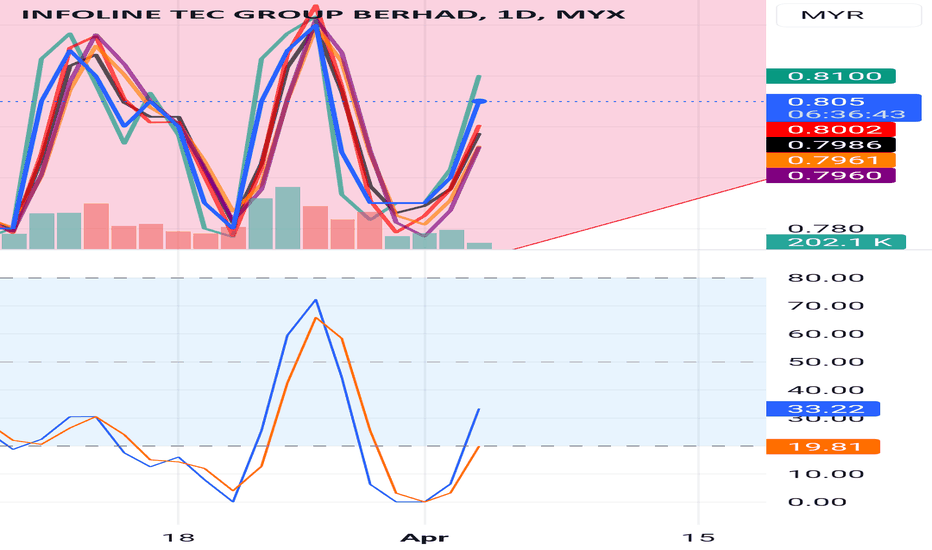

Infoline Tec Group @KLSE: Revenue FYE 2024Forecast by APEX SECINFOTEC@KLSE

Apex Securities

academy.apexetrade.com/filestore/research-pdf/20240226_Infotec_4QFY23_Results.pdf

Revenue FYE 2024Forecast by Apex Securities

= 120.5M

Assuming the Net Profit Margin remains at 26.8%:

Net Profit FYE 2024 Forecast

= 120.5×0.268

= 32.294M

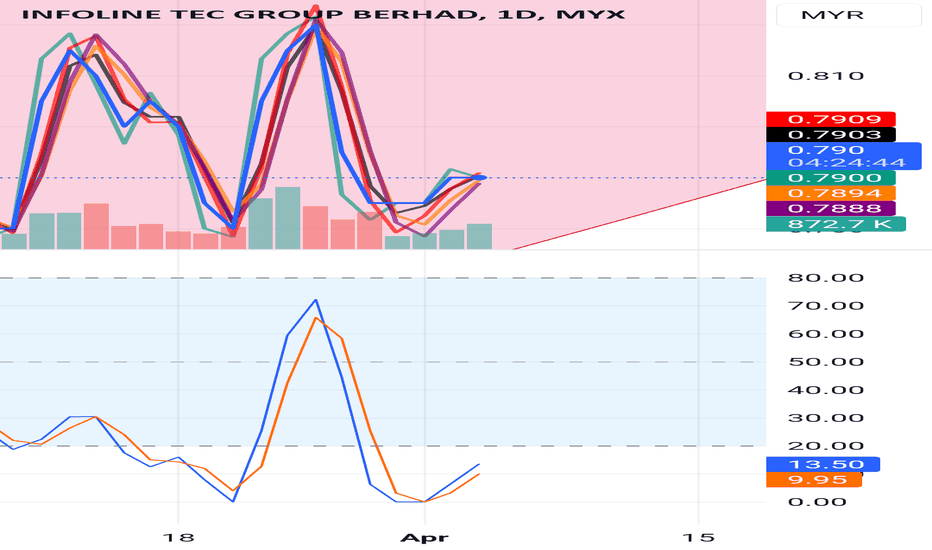

$KLSE-INFOTEC: EV/EBIT ÷ EBIT Growth MultipleINDEX:KLSE -INFOTEC

EV/EBIT ÷ EBIT Growth Multiple

EV@RM0.805

= 0.805×363,229+389+119+407+107-10,780-8,445

= 274,196.345

EBIT

= 25,792+38

= 25,830

EV/EBIT

= 274,196.345÷25,830

= 10.6154217964

EBIT Growth

= 100×(25,830÷16,683-1)

= 54.8282682971%

EV/EBIT ÷ EBIT Growth Multiple

= 10.6154217964÷54.8282682971

= 0.1936122027 Extremely Low, Extremely Undervalued

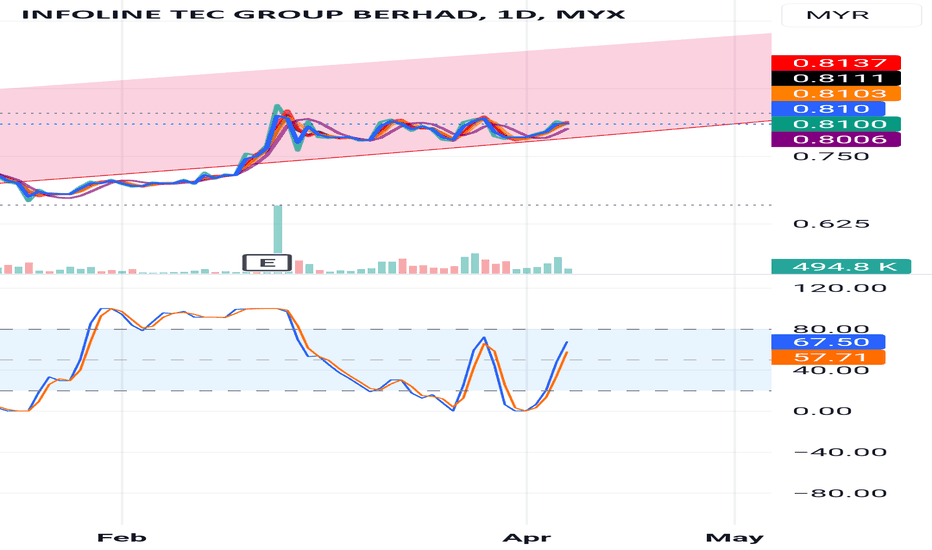

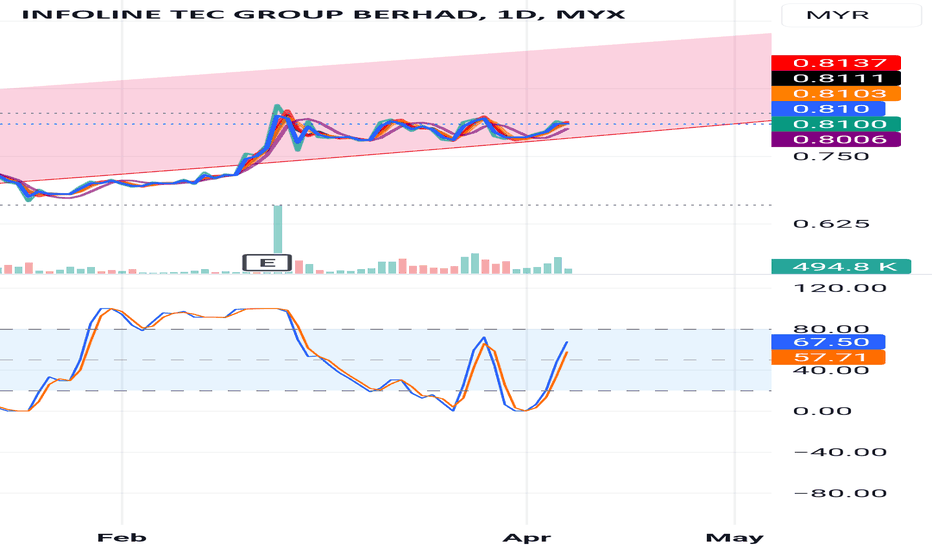

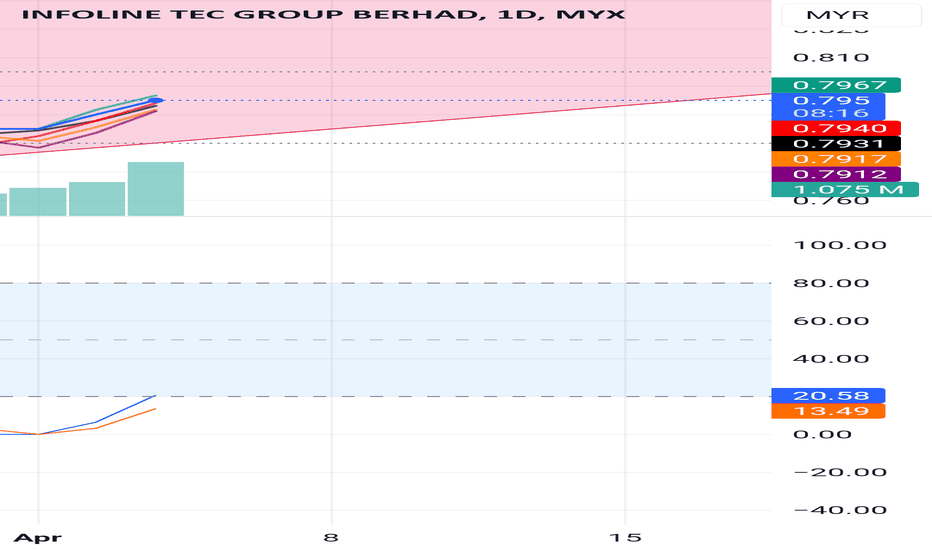

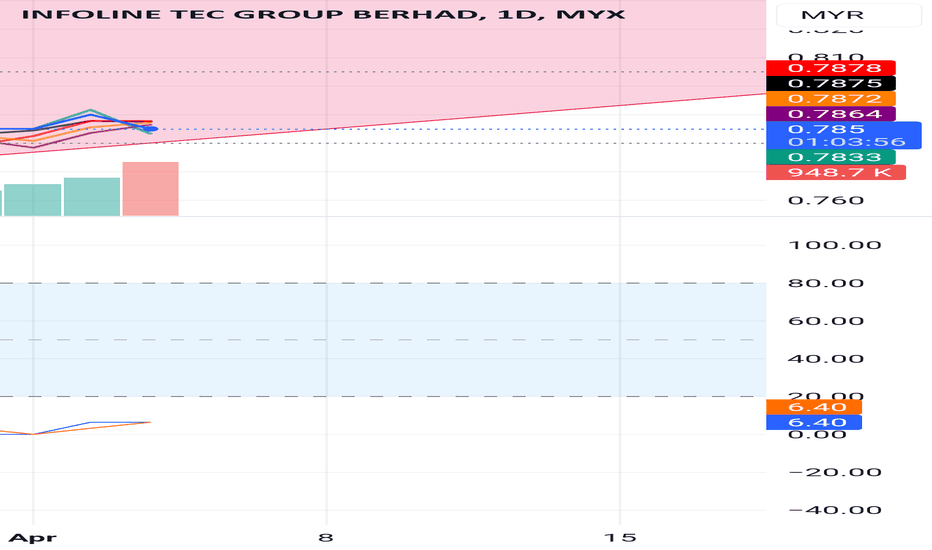

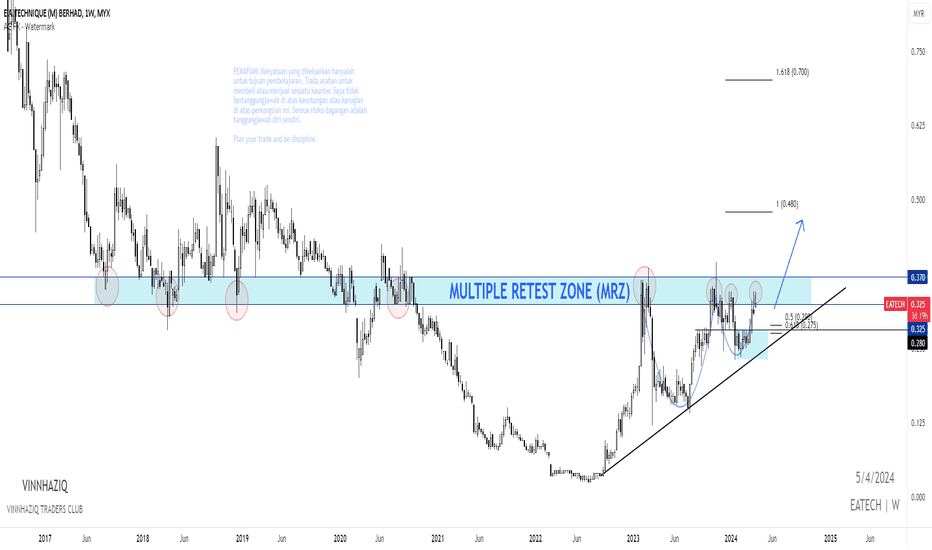

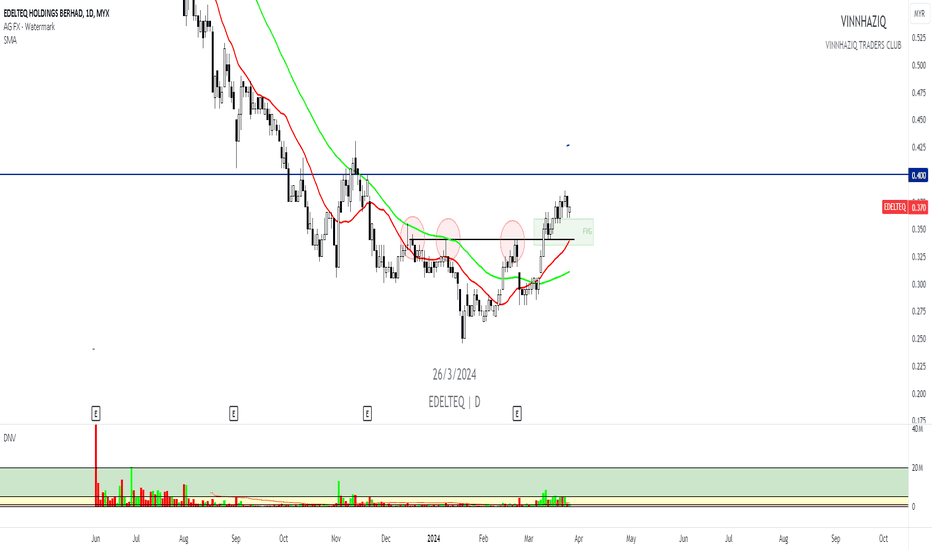

MULTIPLE RETEST ZONE / CUP AND HANDLE PATTERNFrom my analysis, it appears to be forming a Cup and Handle Pattern. Or I can call it Multiple Retest Zone at the moment.

Additionally, when applying the BBMA Technique and observing the Weekly Timeframe, there's a notable "Arah Kukuh Candle," indicating a bullish signal. However, it's possible that there may still be room for retracement.

MULTIPLE RETEST ZONE / CUP AND HANDLE PATTERNFrom my analysis, it appears to be forming a Cup and Handle Pattern. Or I can call it Multiple Retest Zone at the moment.

Additionally, when applying the BBMA Technique and observing the Weekly Timeframe, there's a notable "Arah Kukuh Candle," indicating a bullish signal. However, it's possible that there may still be room for retracement.

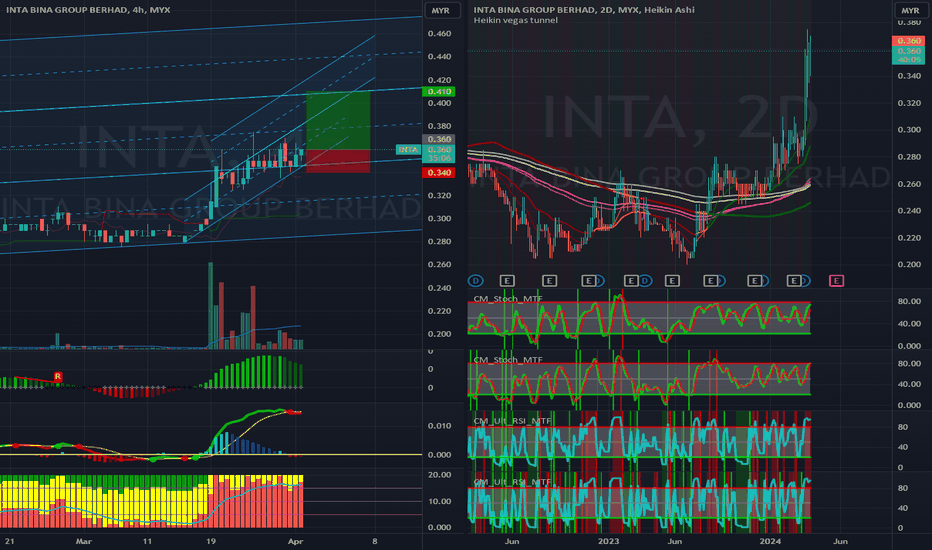

INTA LONG TP 0.41Time Frame: 4H

Sentiment: Overbought

Forecast: Bullish

We can see a strong support and buying momentum around 0.34-0.36, selling power is weak.

Bar price action and the volume, showing buyers' power increase.

expecting it can break the resistant level 0.375 and hit 0.41+

Write your thought in the comment session :)

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like my works? Please hit the Like, Follow and Share or tip me a coin :)

Thanks!

Disclaimer

This information only serves as study references, does not constitute a buy or sell call.

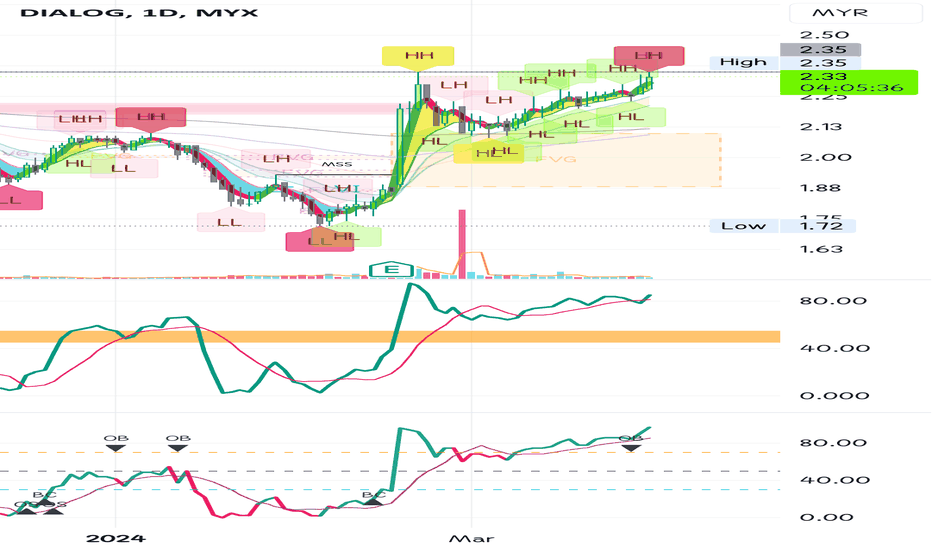

Dialog, be careful of triple top?>> 2.35 as resistance

>> RSI and MCDX at overbought level. Might pullback, worst go for correction.

>> If already entry, protect profit / capital.

We cannot control how much we win. But we can control how much we lose. Focus on what you can control!

Disclaimer :

Please be informed that all stocks pick are solely for education and discussion purpose; it is neither a trading advice nor an invitation to trade. For trading advice, please speak to your remisier or dealer representative.

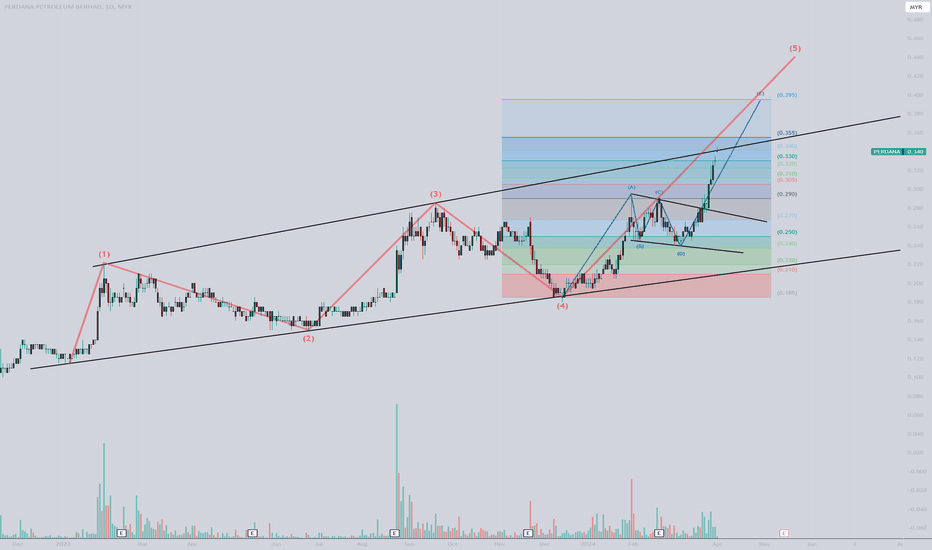

HIGHER HIGH PATTERN RECOGNIZEDRegarding Edelteq, it appears that the stock is predominantly moving in an Uptrend Bias.

On the weekly timeframe, there seems to be a formation of a Fair Value Gap.

Additionally, it's worth noting that the volume during the breakout is increasing, which provides a promising indication of bullish potential.