Third Quarter 2025 Nigerian share picks Update..26Percentage Up!Third Quarter Price Movement Analysis Report - 1st September 2025

1. Overview

The analysis highlights percentage changes for individual stocks, the average change, and the overall portfolio change assuming equal investment across all 10.

2. Individual Stock Performance

| Stock | Previous (₦) | Current (₦) | % Change |

| -------------- | ------------ | ----------- | ----------- |

| **ARADEL** | 514.5 | 512.2 | **−0.45%** |

| **BUACEMENT** | 100.0 | 151.8 | **+51.80%** |

| **DANGSUGAR** | 48.4 | 58.0 | **+19.83%** |

| **DANGCEM** | 440.0 | 520.2 | **+18.23%** |

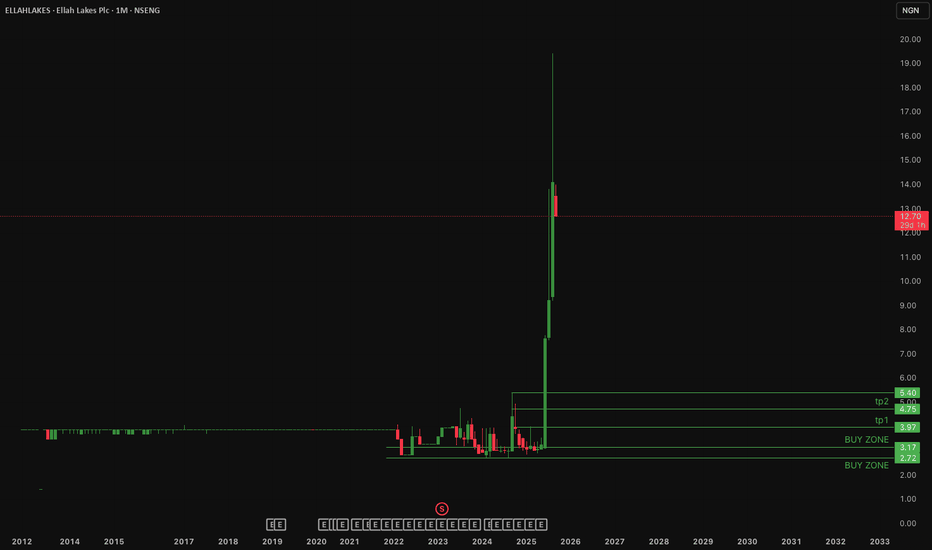

| **ELLAHLAKES** | 7.1 | 13.45 | **+89.44%** |

| **ETRANZACT** | 7.25 | 10.85 | **+49.66%** |

| **HMCALL** | 4.2 | 4.28 | **+1.90%** |

| **MULTIVERSE** | 8.75 | 10.90 | **+24.57%** |

| **NB** | 59.0 | 70.20 | **+19.00%** |

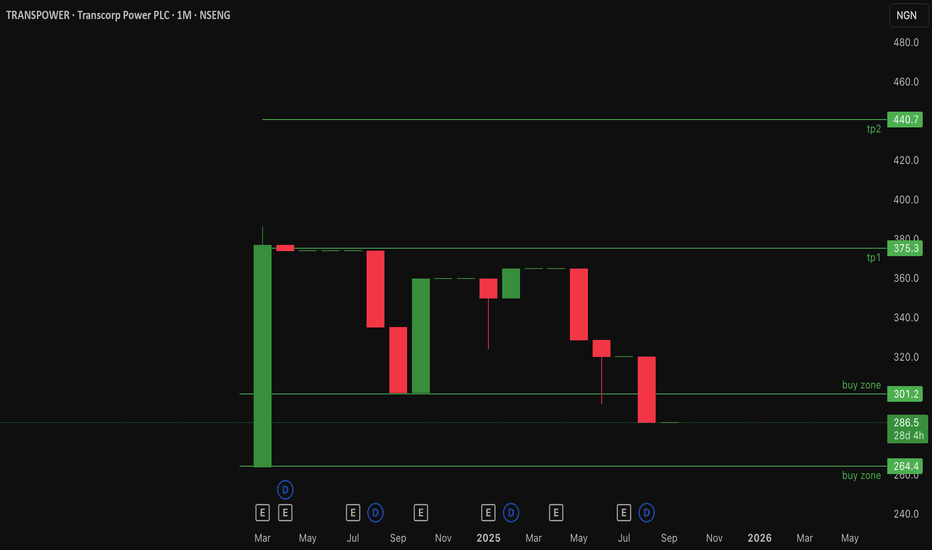

| **TRANSPOWER** | 320.0 | 286.5 | **−10.47%** |

3. Top Gainers and Losers

Top Gainers:

ELLAHLAKES** (+89.44%) — Small-cap rally, nearly doubled in price.

BUACEMENT** (+51.80%) — Strong institutional demand.

ETRANZACT** (+49.66%) — Fintech sector showing renewed momentum.

Moderate Gainers:

DANGSUGAR (+19.83%), NB (+19.00%), MULTIVERSE (+24.57%), DANGCEM (+18.23%).

Flat/Minor Move:

HMCALL (+1.90%), ARADEL (−0.45%).

Top Loser:

TRANSPOWER (−10.47%) — noticeable decline, likely on profit-taking.

4. Averages vs Portfolio Performance

Average of individual % changes:** **+26.35%**

→ Indicates the “average stock” in the basket rose strongly, pulled higher by extreme gainers like Ellah Lakes and BUA Cement.

5. Key Insights

1. **Small caps drive volatility:** Ellah Lakes’ +89% jump skews the average, but has limited effect on overall portfolio returns due to low nominal price.

2. **Cement stocks strong:** Both Dangote Cement (+18%) and BUA Cement (+52%) reflect strong sector sentiment.

3. **Fintech momentum:** ETranzact’s +49% surge suggests renewed investor confidence in payment platforms.

4. **Blue chips steady:** Nigerian Breweries and Dangote Sugar both posted \~+20% gains, showing defensive strength.

5. **Weakness in Power sector:** Transcorp Power fell −10%, the only significant drag in the basket.

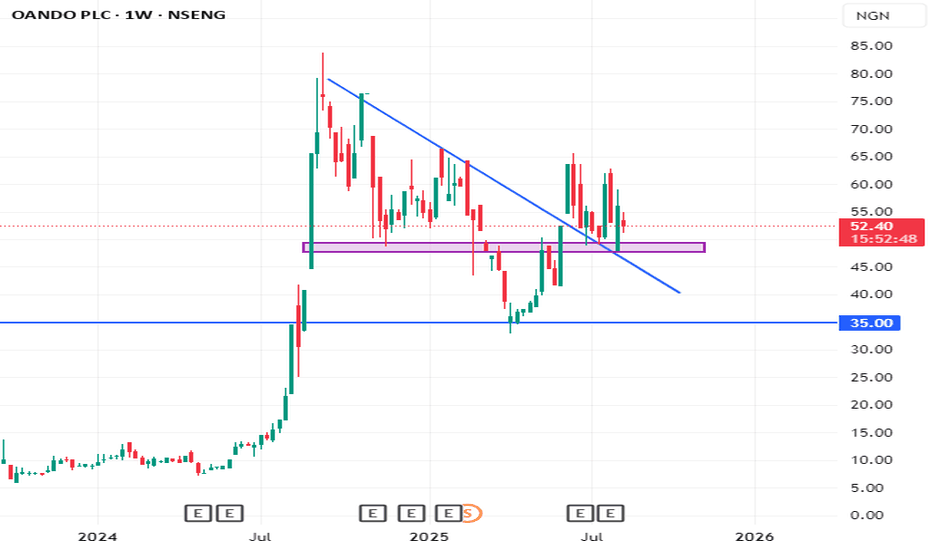

Is $TRANSPOWER Transpower devalued or of no value? 25% retraced.NSENG:TRANSPOWER Transcorp Power is a gas-fired thermal generation company operating in Nigeria and internationally. It's the owner/operator of the Ughelli Power Plant, with an installed capacity of approximately 972 MW, capable of generating around 2,500 GWh annually. Founded in 2012 (as Transcorp Ughelli Power Ltd), it became publicly listed in early 2024. It's a subsidiary of Transnational Corporation of Nigeria Plc.

The Stock is currently devalued by 25% (With an all time high of 386) and could be undervalued. Current price: ₦286.5.

The last few months are predominantly bearish), showing sustained weakness.

My buy zone for #transpower (₦264 – ₦301), suggesting potential accumulation interest around this region and could attract bargain hunters.

First Resistance / Take Profit (TP1): ₦375.3

→ A break above ₦301 with strong volume could see price retesting this level.

Major Resistance (TP2): ₦440.7

→ If bullish momentum continues, this is the next realistic upside target.

Invalidation for this NSENG:TRANSPOWER idea is under 260/per share

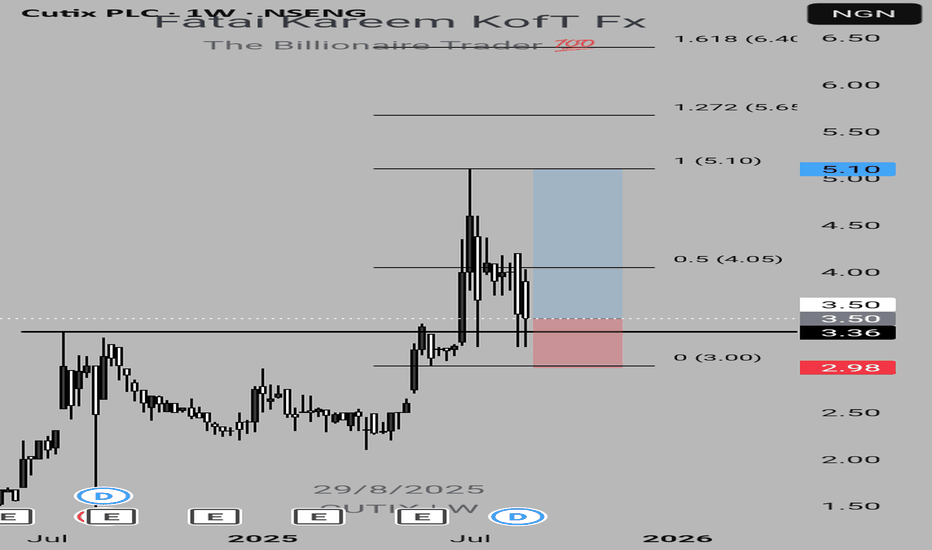

CUTIX LONG IDEA Cutix stock is currently within the discount level and price has been rejected from the support level showing that there's a higher probability of price being pushed higher by the buyers.

You can buy at the current market price. The targets are N4.19 (19.71%) and N5.10 (45.71%).

Confluences for the long idea:

1. The market structure is bullish.

2. Price is within the discount zone.

3. Being is being rejected from a support level.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you can't accept the risk.

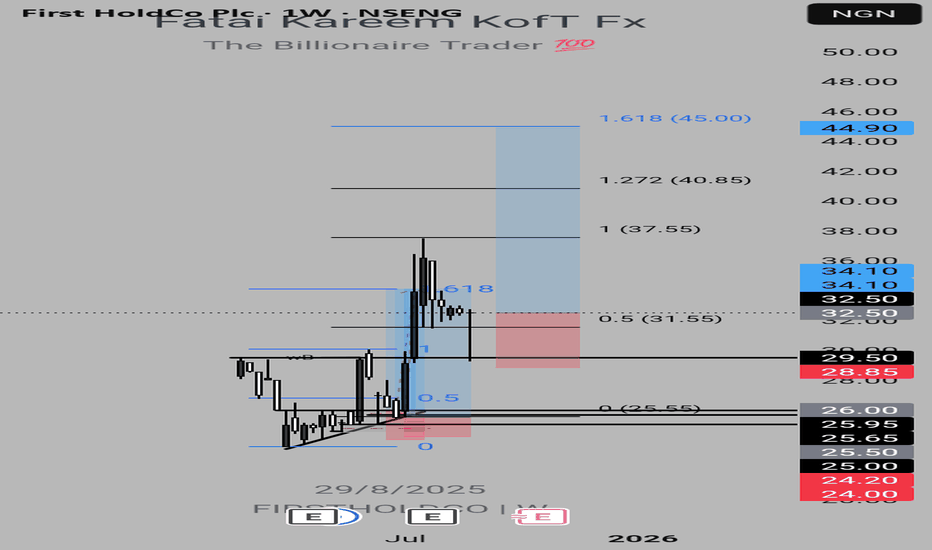

FIRSTHOLDCO LONG IDEA The price of FIRSTHOLDCO stock shows a strong rejection after getting to the discount level. This rejection shows a strong pressure from the buyers.

You can buy at the current market price. The targets are N37.55 (15.54%), N40.85 (25.38%) and N45 (38.15%). This stock has a great potential. You can hold for a long term investment.

Confluences for the long idea:

1. The market structure is bullish.

2. Strong rejection candle.

3. The rejection happened after price got to the discount zone.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

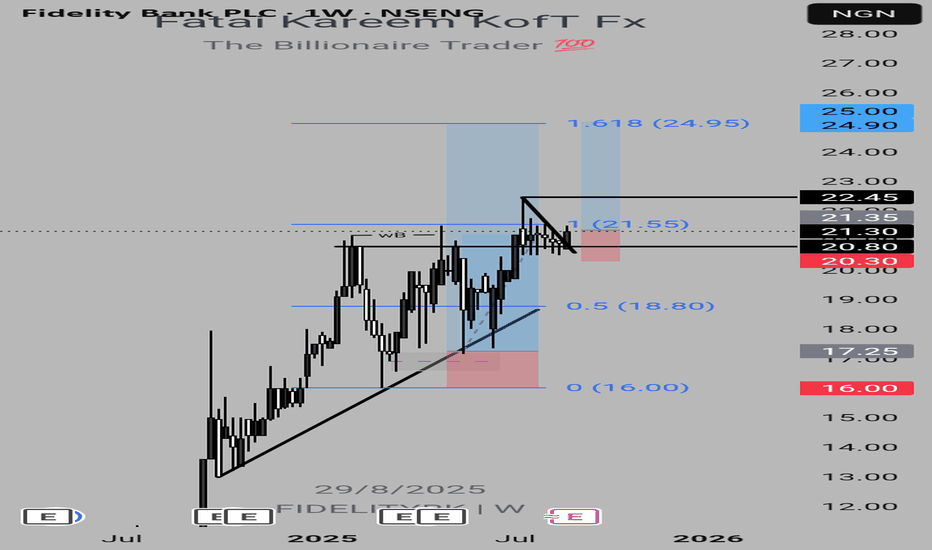

FIDELITYBK LONG IDEA Fidelitybk stock just broke out of a trendline with a strong candle closing above it. This happened at a support level with the formation of a bullish engulfing candlestick.

You can buy at the current market price. The targets are N22.45 (5.15%) and N24.95 (17.10%).

Confluences for the long idea:

1. The market structure is bullish.

2. Trendline breakout

3. Bullish engulfing candlestick confirmation at a support level.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

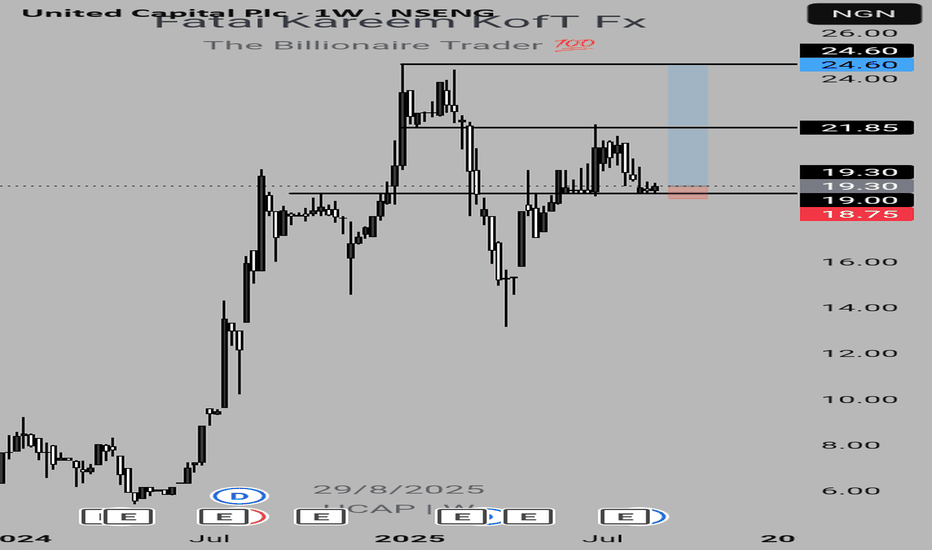

UCAP LONG IDEA UCAP stock is at currently at a support level. With the formation of a bullish engulfing at this key level, this is an indication that price is ready to go higher.

You can buy at the current market price. Targets are N21.85 (13.21%) and N24.60 (27.46%).

Confluences for the long idea:

1. The market structure is bullish.

2. Bullish engulfing candlestick confirmation at a support level.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

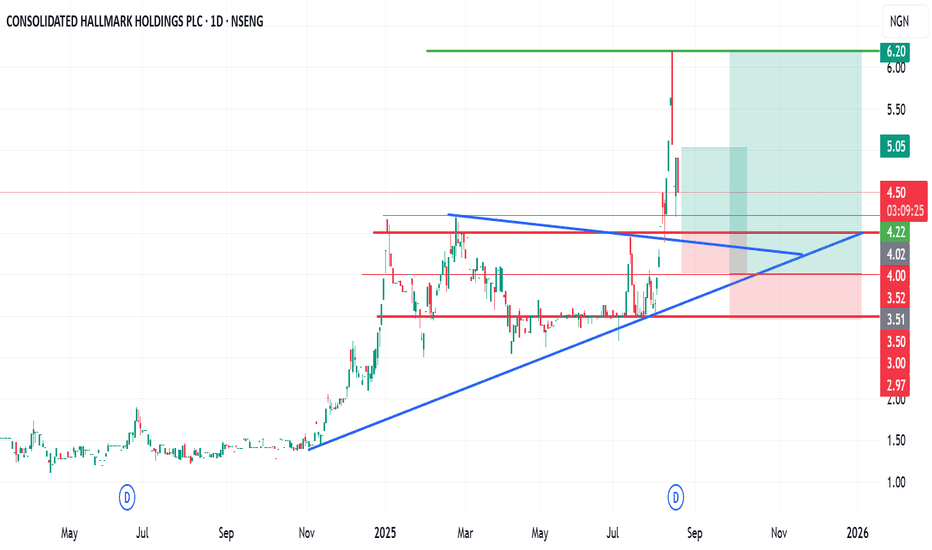

Consolidated Hallmark Holding (CONHALL) is downConsolidated Hallmark Holding (CONHALL) is down.

It’s now the third week since this asset began cooling off after rallying to the ₦6.20 zone.

From a technical perspective, and observing the ascending trendline that began on November 1st, 2024, I am monitoring potential entry levels around ₦4.22 and ₦4.00. These entries will be executed using a Dollar-Cost Averaging (DCA) strategy.

Please note the key trendlines highlighted on my chart for context.

I’d be glad to connect and hear your perspectives.

Kindly share your thoughts in the comments, and don’t forget to like and share.

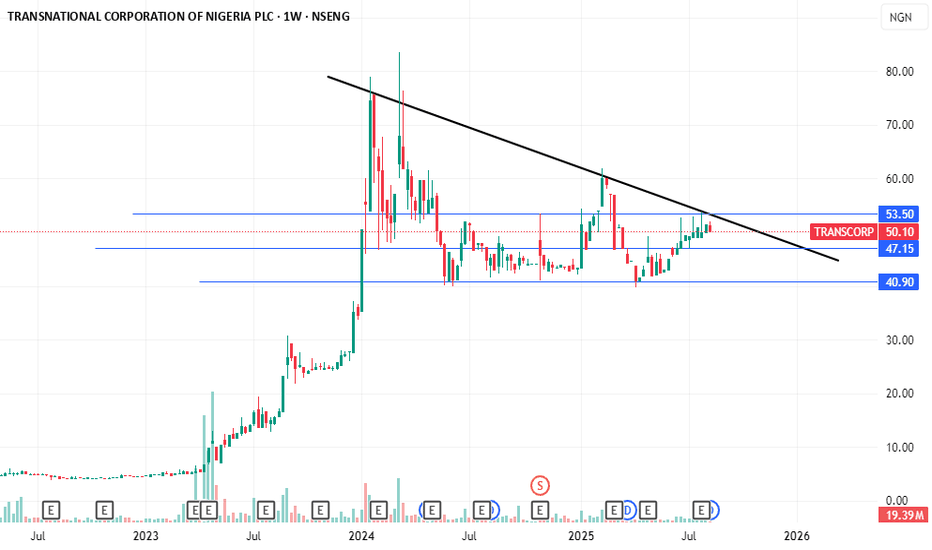

TRANSCORP ON A TIGHT WATCHTranscorp is bouncing off from a resistance trendline ,looks quit scary for short time frame but optimistic on a longer time frame tho because of the bullish triangle formed,wont be suprise to see price at 40-41 major support zone if NGX closes on another week on red ,BUT OVERALL LONG TIME IS BULLISH AND PROMISING FOR A LONG TIME INVESTMENT

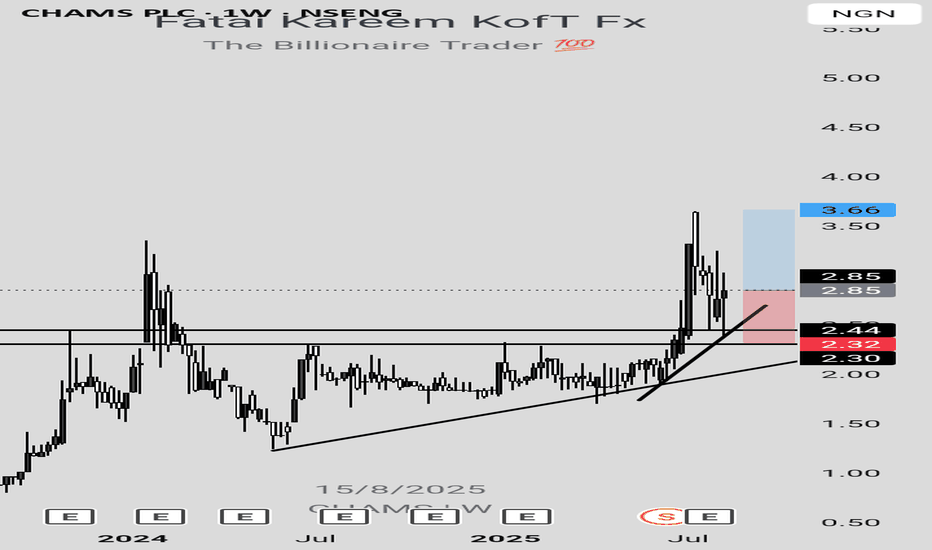

CHAMS LONG IDEA After a strong pullback by sellers pushing the price down which led to the formation of a pin bar, last week witnessed a strong push to the upside with a strong rejection from a support level in confluence with a trendline. This is an indication that buyers are ready to push price higher.

You can buy at the current market price. The stop can be at N2.32 (-18.60%) below the support level. The target is N3.66 (28.42%).

Confluences for the long idea:

1. Hammer candlestick

2. Rejection from a support level in confluence with a trendline

3. Bullish market structure

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

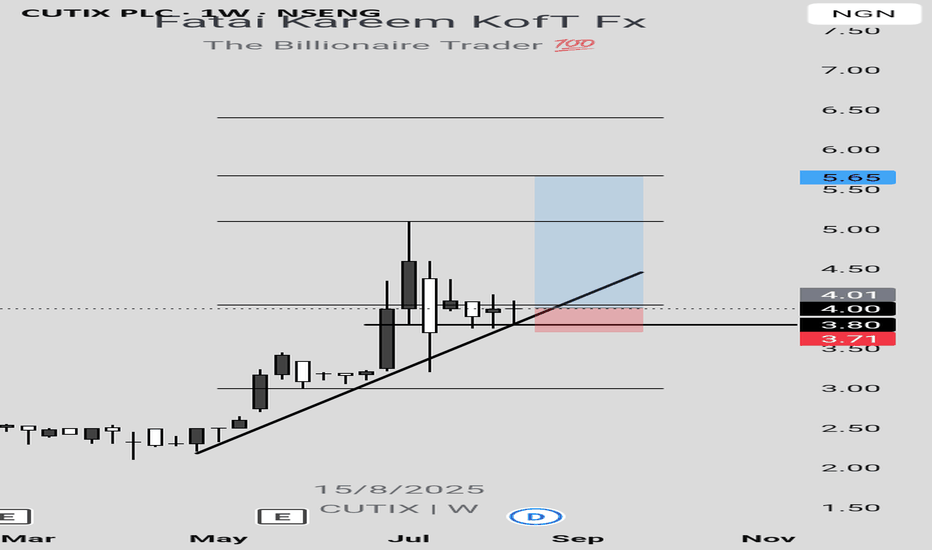

CUTIX LONG IDEAPrice is respecting the trendline and it's currently at a point where support level and trendline are in confluence. With the formation of a dragonfly doji and series of rejection at the zone, this is an indication that buyers are ready to push price higher.

Buy at the current market price. The stop can be at N3.71 (-7.48%) below the support level. The targets are N4.50 (12.22%), N5.10 (27.18%) and N5.65 (41.40%).

Confluences for the long idea:

1. Confluence of trendline and support level

2. Dragonfly doji

3. Rejections at the key level

4. Bullish market structure

5. Price is in discount region

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

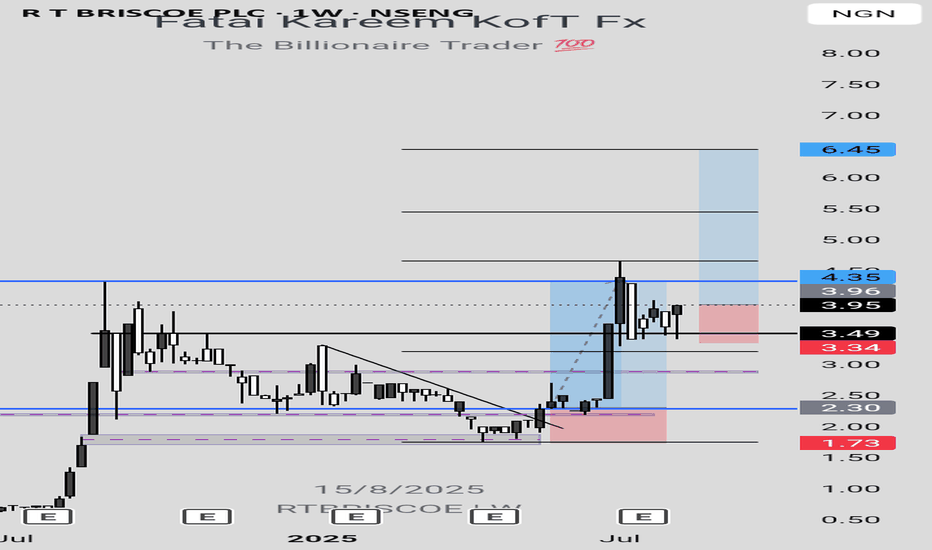

RTBRISCOE LONG IDEA At a resistance turned into a support level, the stock formed a bullish engulfing candlestick. This is an indication that buyers are ready to push the price higher.

You can buy at the current market price. The stop can be at N3.34 (-15.66%) below the support level. The targets are N4.65 (17.42%), N5.45 (37.37%) and N6.45 (62.88%)

N4.65 is the actual target based on the external liquidity expected be taken out as buyers are more likely to aim for a new higher price. Other targets are based on Fibonacci levels, which may or may not to be met anytime soon.

Confluences for the long idea:

1. Bullish market structure

2. Resistance turned into support level

3. Bullish engulfing candlestick confirmation

4. Rejections at the key level.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

AIICO, this is the pullback I have been waiting forThe strong breakout rewarded investors with over 120% ROI from the 4th of August 2025 before this massive -26% pullback

While I am bullish on the Nigerian insurance sector because of the new insurance reform, I am patiently waiting for some of this stock to retrace for my entry for a ride into 2026

I would love to start buying AIICO from N5 to N2.3 using the Dollar Cost Averaging (DCA) strategy

The yellow zone is my entry zone

I would love to hear from you.

Please like, comment, follow me and share

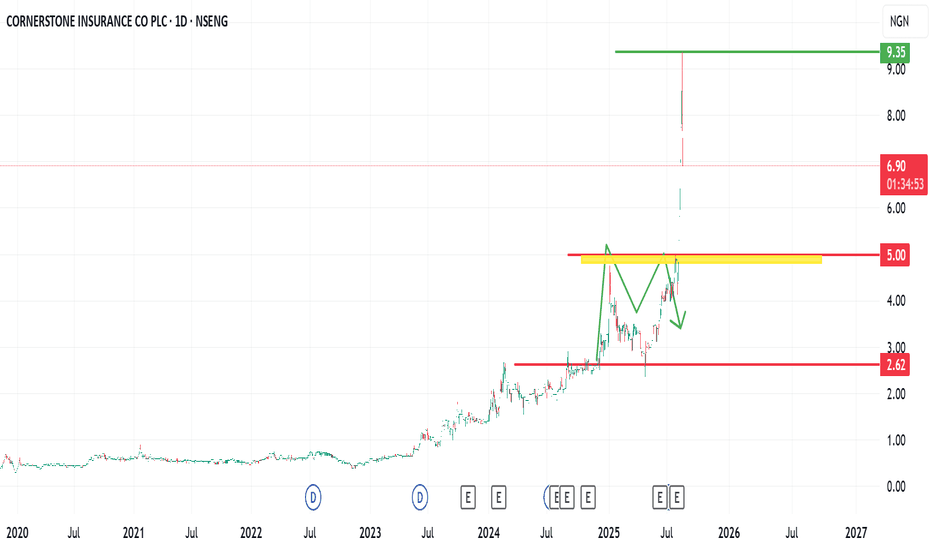

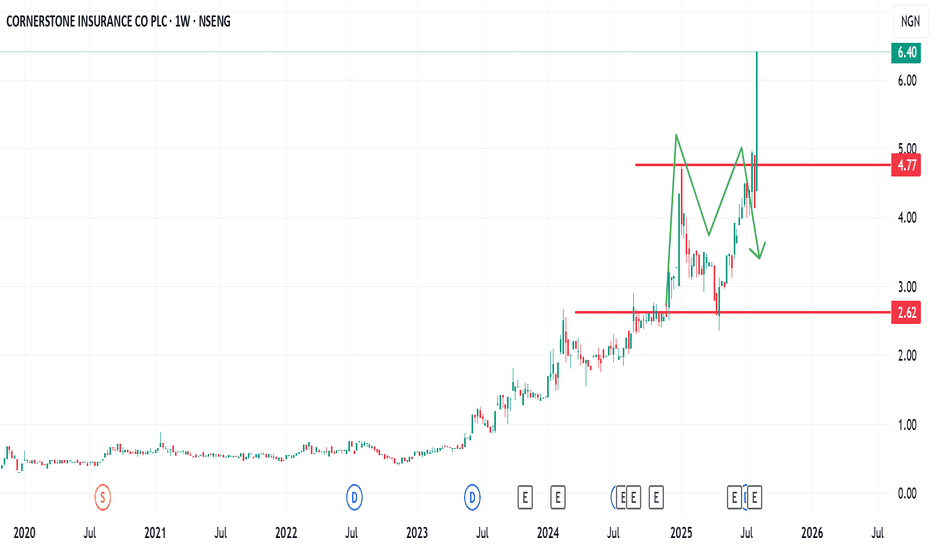

Here is the pullback for Cornerstone Here is the pullback for Cornerstone

The Nigerian insurance sector is seriously under a positive catalyst that is pushing insurance stocks

I am patiently waiting for a strong pullback for my long-term entries for a ride into 2026. This is because the breakout from the N5 zone was too vertical, and there was a need for a retest, technically speaking

Contrary to my previous buy entry of N3.5, I am ready to start buying at N5 per stock.

I hope to connect with you.

Please like, follow me, share and comment.

CORNERSTONE insurance with strong break outCORNERSTONE insurance with a strong breakout

The Nigerian insurance sector is seriously under a positive catalyst that is pushing insurance stocks

I am patiently waiting for a strong pullback for my long-term entries for a ride into 2026, likely

I hope to start buying from N3.5 up

AIICO Insurance aggressive channel breakoutAIICO Insurance's aggressive channel breakout.

The strong breakout rewarded investors with over 61% ROI last week alone.

While I am bullish on the Nigerian insurance sector because of the new insurance reform, I am patiently waiting for some of this stock to retrace for my entry for a ride into 2026

I would love to start buying AIICO from N2.3 using Dollar Cost Averaging strategy

I would love to hear from you.

Please like, comment, follow me and share

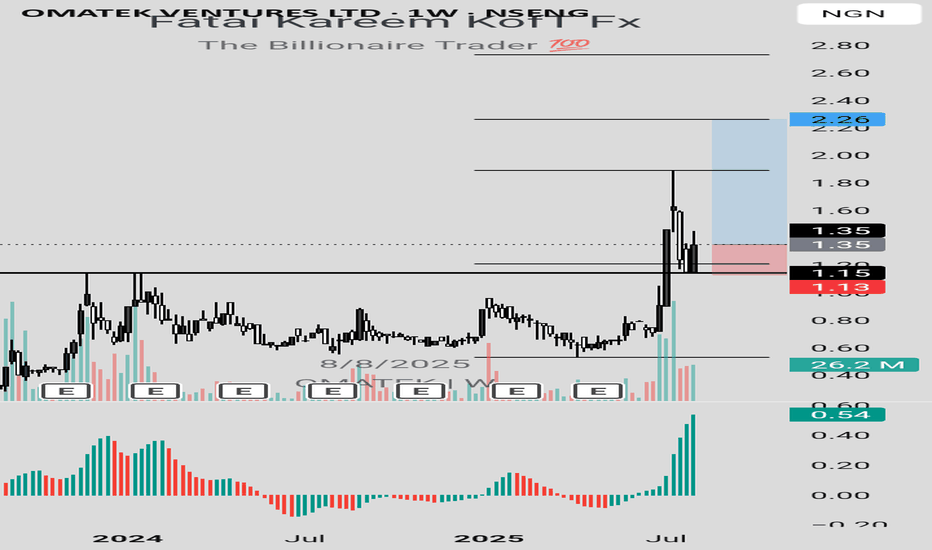

OMATEK LONG IDEAAfter getting to a resistance turned support within the discount level, bullish engulfing candlestick was formed on OMATEK stock. This is a signal that price is ready to go higher.

To take advantage of the long opportunity, you can buy at the current market price. The stop can be at N1.13 (-16.30%) while the targets are N1.89 (40%) and N2.26 (67.41%).

Confluences for the long idea:

1. Key level (resistance turned support)

2. Bullish engulfing candlestick

3. Uptrend

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

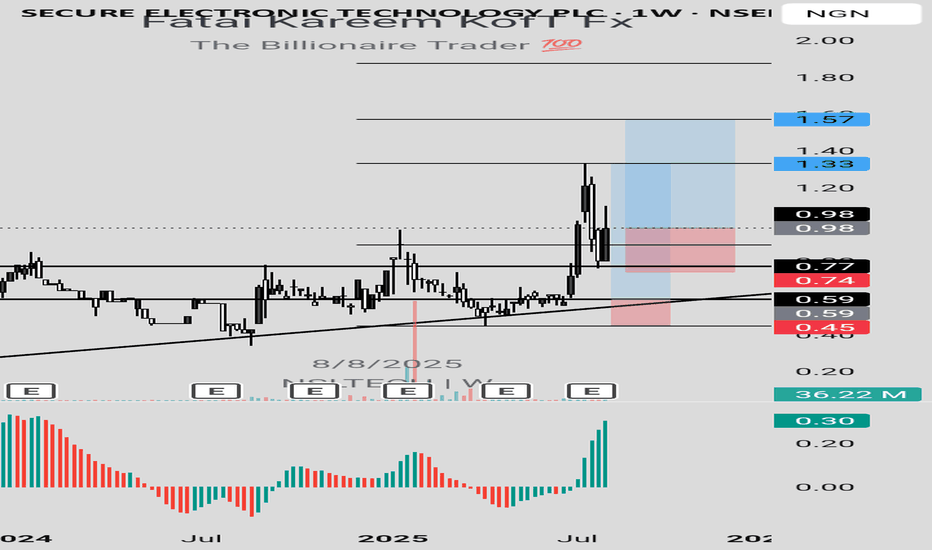

NSLTECH LONG IDEALast week, I gave a buy signal on NSLTECH stock, but price didn't get to the area where I expected the buy. However, a bullish engulfing candlestick was formed, showing that price is ready to buy at the current market price. You can buy at the current market price. The stop can be at N0.74 (-24.49%) while the targets are N1.33 (35.71%) and N1.51 (60.20%).

Confluences for the long idea:

1. Key level (Resistance turned Support level)

2. Fibonacci level (0.5)

3. Bullish engulfing candlestick

4. Uptrend

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

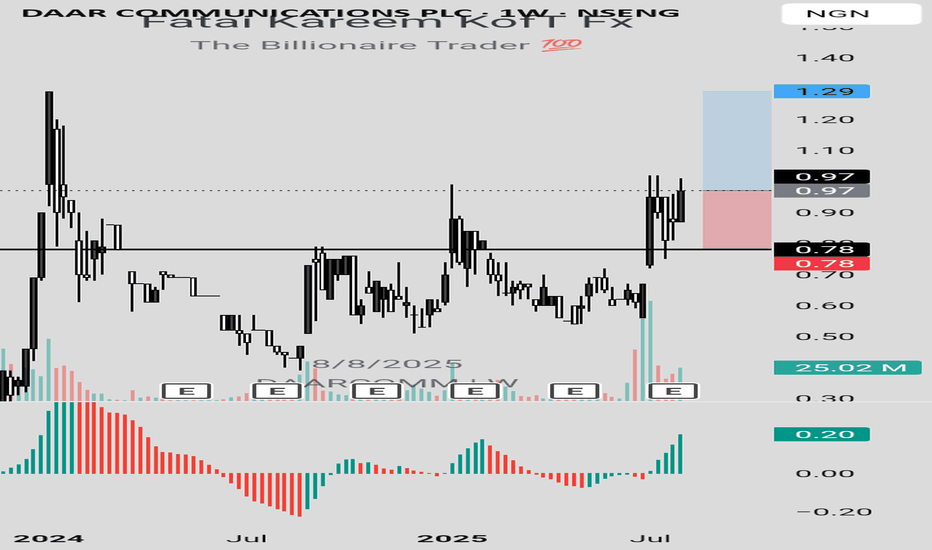

DAARCOMM LONG IDEA DAARCOMM stock, after breaking out of a trendline and retesting a support level, a bullish engulfing candlestick was formed. This is an indication that price is ready to go higher.

To take advantage of this long opportunity, you can buy at the current market price. The stop can be at N0.78 (-19.59%) while the target can be at N1.29 (32.99%).

Confluences for the long idea:

1. Trendline breakout

2. Support level

3. Bullish engulfing candlestick

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

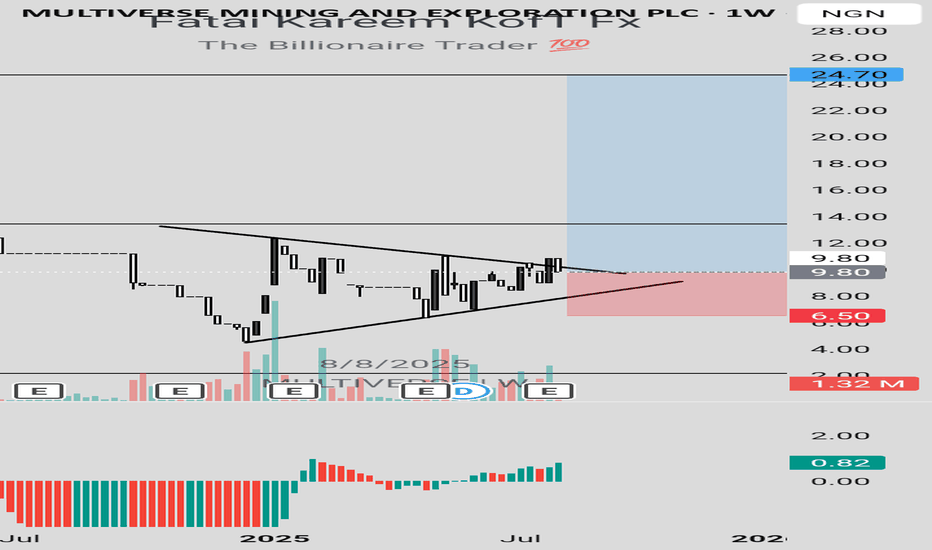

MULTIVERSE LONG IDEAMULTIVERSE just broke out of a trendline with a bullish engulfing candlestick. This happened within the discount level. Hence, this is an indication that price is ready to rally up targeting the high.

To take advantage of this long opportunity, you can buy at the current market price. The stop can be at N6.50 (-33.67%) while the targets are N12.30 (25.51%) and N24.70 (152.04%).

Confluences for the long idea:

1. Trendline breakout

2. Discount level

3. Uptrend

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

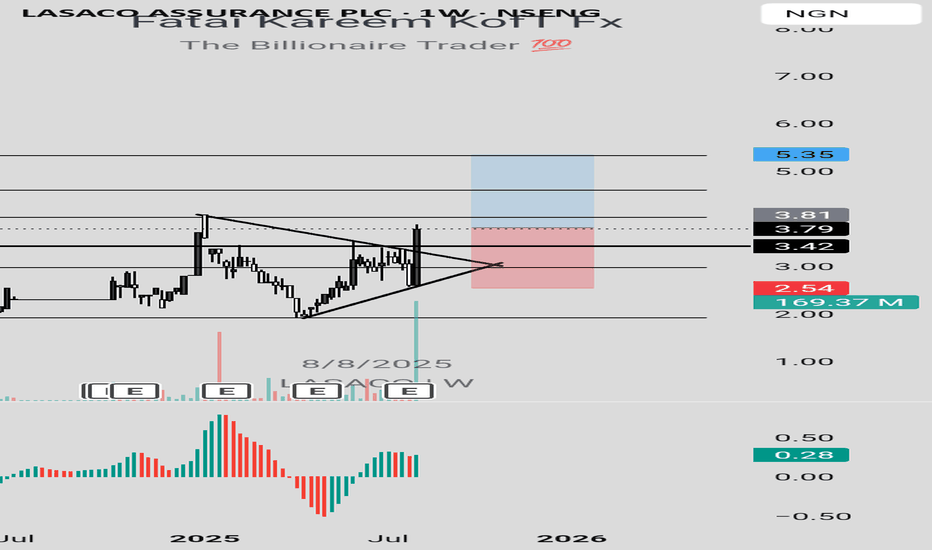

LASACO LONG IDEALASACO stock just broke out of a trendline with a strong bullish engulfing candlestick. In addition to the trendline breakout, the candle also broke a resistance level, respecting the uptrend.

To take advantage of this long opportunity, you can buy at the current market price or wait for price to drop to the resistance turned support level at N3.42. the stop can be at N2.54 (-33.33%) while the target can be at N5.35 (40.16%).

Confluences for the long idea:

1. Trendline breakout

2. Bullish engulfing candlestick

3. Strong volume momentum

4. Uptrend

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

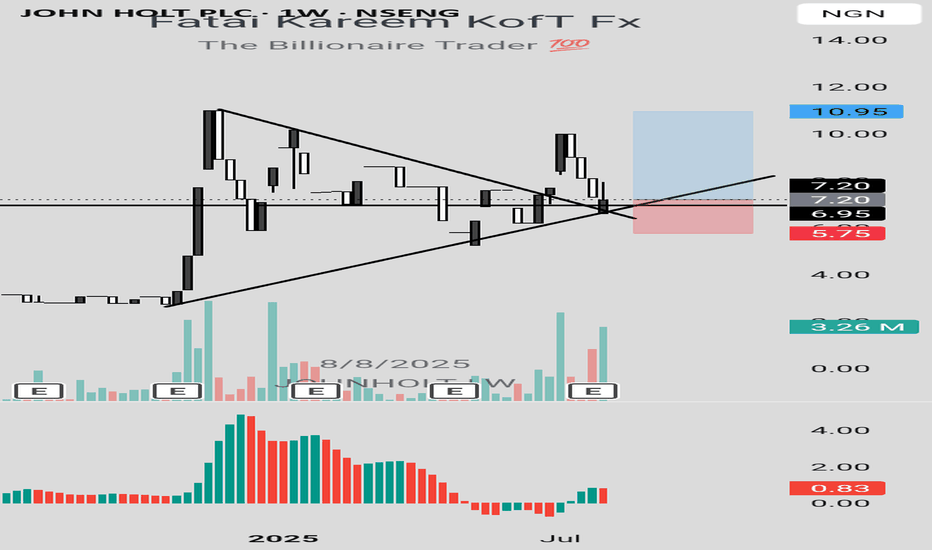

JOHN HOLT LONG IDEAJOHN HOLT stock retested a support level and trendline last week and closed above these key levels, showing the readiness of buyers to push price higher. This was confirmed with a strong volume momentum.

To take advantage of this long signal, you can buy at the current market price. The stop can be at N5.75 (-20.14%) while the targets are N10 (38.89%) and N10.95 (52.08%).

Confluences for the long idea:

1. Breakout and retest of a trendline

2. Uptrend

3. Strong volume momentum

4. Support level

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

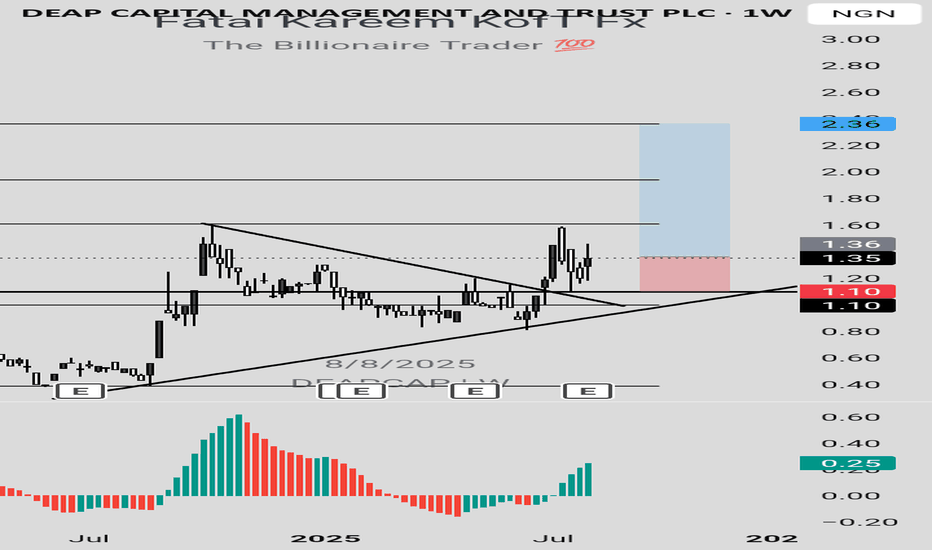

DEAPCAP LONG IDEADEAPCAP stock, after breaking out of a trendline and retesting the trendline and support level, it formed a bullish engulfing candlestick, confirming that it's ready to continue the rally.

To advantage of this long signal, you can buy at the current market price. The stop can be at N1.10 (-19.12%) while the targets are N1.60 (17.65%), N1.94 (42.65%) and 2.36 (73.53%).

Confluences for the long idea:

1. Breakout and retest of a trendline

2. Bullish engulfing candlestick confirmation

3. Support level

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.