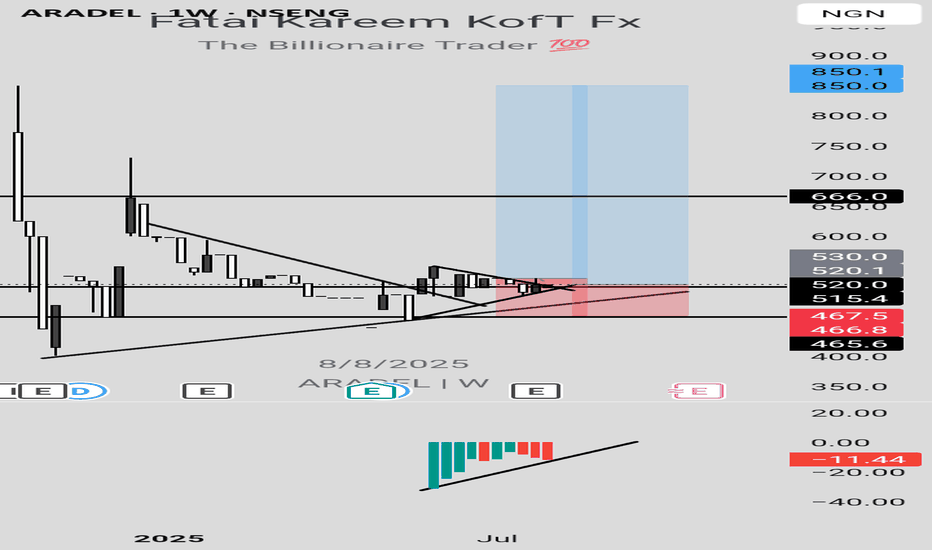

ARADEL LONG IDEAARADEL stock is giving a long signal by having bullish divergence on awesome oscillator using the weekly timeframe. Last week candle closed as a bullish candle after a bullish engulfing candlestick formed in the previous week. This happened at a support level which also has a trendline. In addition, there was a breakout of a down trendline. Confirming that buyers are ready to push the price higher.

To take advantage of this long signal, you can buy at the current market price. Stop can be at N467.5 (-10.11%) while the targets are N666 (27.92%) and 850 (63.43%).

Confluences for the long idea:

1. Awesome oscillator bullish divergence

2. Bullish engulfing candlestick confirmation

3. Support

4. Trendline breakout

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

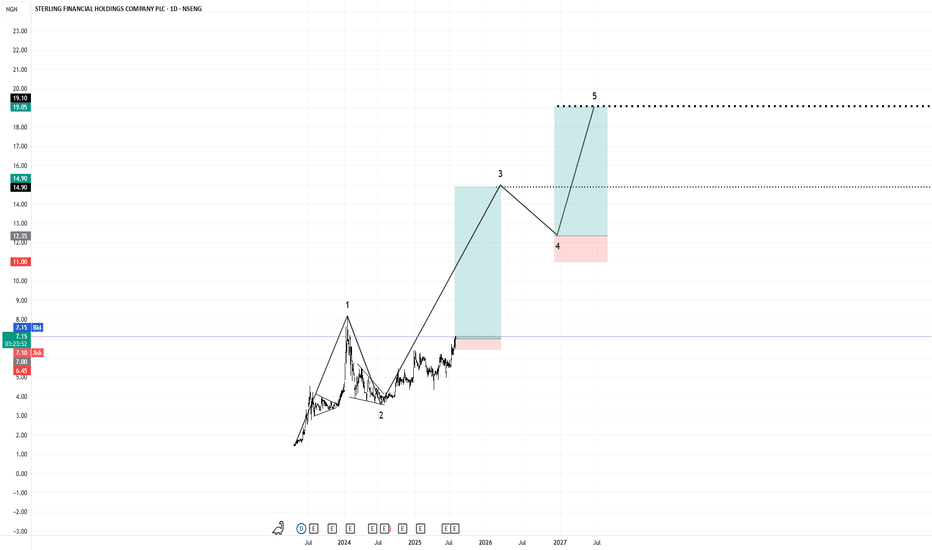

STERLING FINANCIAL HOLDINGS COMPANY BULLISHRiding off the back of improving finances every quarter, strong governance and leadership structure in the bank, impressive and competitive digital products, and a record number of onboarded new-to-bank customers between April and June 2025, the handwriting is on the wall; this long-standing gold mine in the Nigerian financial market is about to produce the goods.

At a very undervalued price, the market looks poised to reach its previous high and even surpass it.

Technically, the structure looks set in a 1,2,3,4,5 Elliott motive wave structure.

Wave 3 could be on its way now. Great time to buy.

$accesscorp Accesscorp Cup and handle pattern... bullish?This is the chart of NSENG:ACCESSCORP (Access Holdings PLC) on the weekly timeframe,

Current price: 28naira/share.

Price action is forming a cup-and-handle-like structure pattern.

* The recent move appears to be completing another **cup** formation, which is typically a bullish continuation pattern if confirmed with strong breakout volume.

* Price action is currently at neckline resistance roughly ₦28–₦29 (current level), meaning price is testing a critical breakout zone.

Key Levels to watch

Immediate Critical Resistance: ₦28 – ₦29.00 (current battle zone; a breakout here could open room for further upside).

First Target: ₦34.10 /share

Second Target: ₦40.25/share (potential measured move from fibbonacci).

Idea remains validated if this Support Zone remains respected ₦24.00 – ₦25.00 (mid-level pullback support).

#accesscorp idea is invalidated under 24naira/share

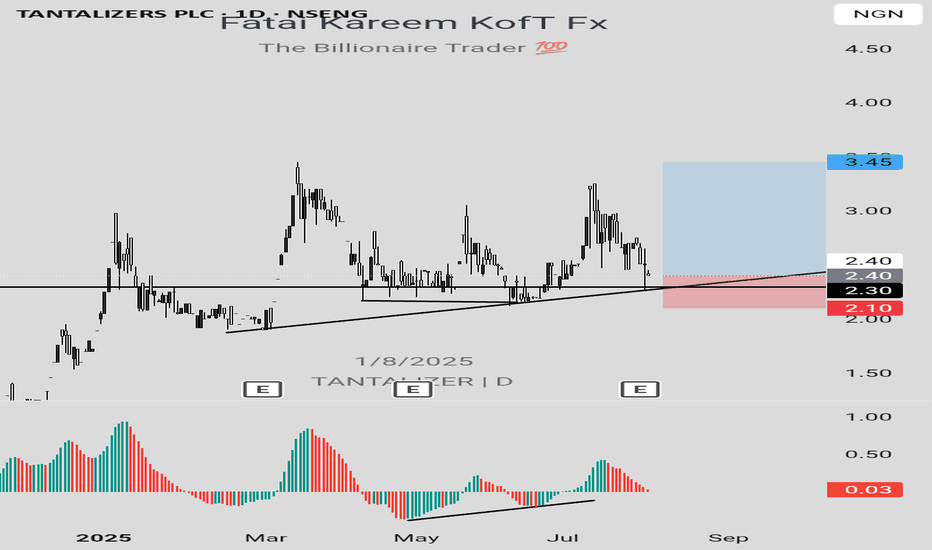

TANTALIZER LONG IDEATANTALIZER stock is looking promising. There was a bullish divergence on the awesome oscillator (daily timeframe), which was followed by a bullish change of character. This is a confirmation that the stock is ready to go higher. Price has recently dropped to the demand zone confluenced with trendline and support level, which is a good point to take a long position. After mitigating the demand zone, there was a rejection showing that buyers are willing to push price higher.

To take advantage of this long opportunity, one can buy at the current market price. The first target is N2.99 (24.58%) and the final target is N3.45 (43.75%). The stop can be at 2.10 (-12.50%).

Confluences for the long idea:

1. Bullish market structure

2. Trendline

3. Awesome oscillator divergence

4. Rejection candle

5. Support level

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

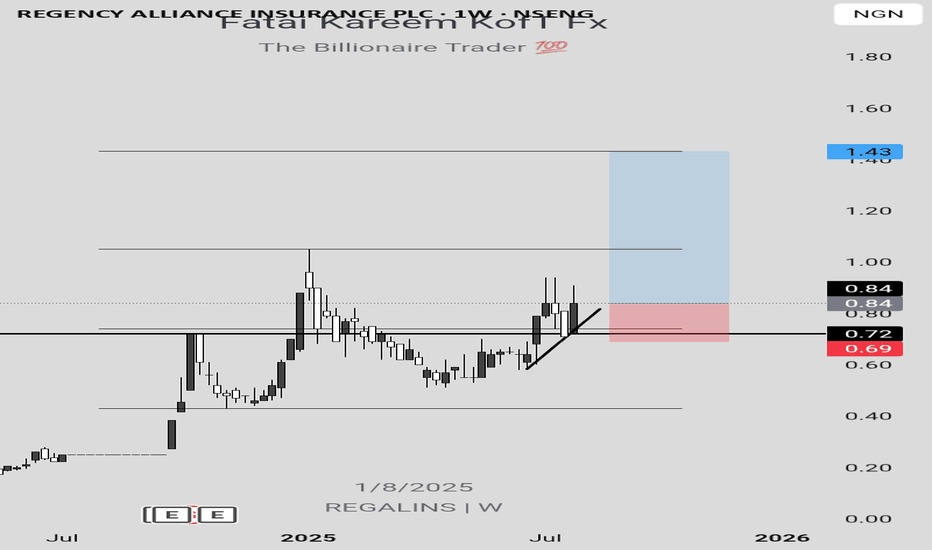

REGALINS LONG IDEA REGALINS stock is yet to take out the recent high which is the target for the current move. Hence, this serves as a long opportunity as confirmed by the bullish engulfing candlestick formation after testing resistance turned to support level. To take advantage of this long opportunity, one can buy at the current market price. The first target is N1.05 (25%) while the final target is N1.43 (70.24%). The stop can be at N0.69 (17.86%) below the support level.

Confluences for the long idea:

1. Bullish engulfing candlestick confirmation

2. Resistance turned to support level

3. Bullish market structure

4. Trendline

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

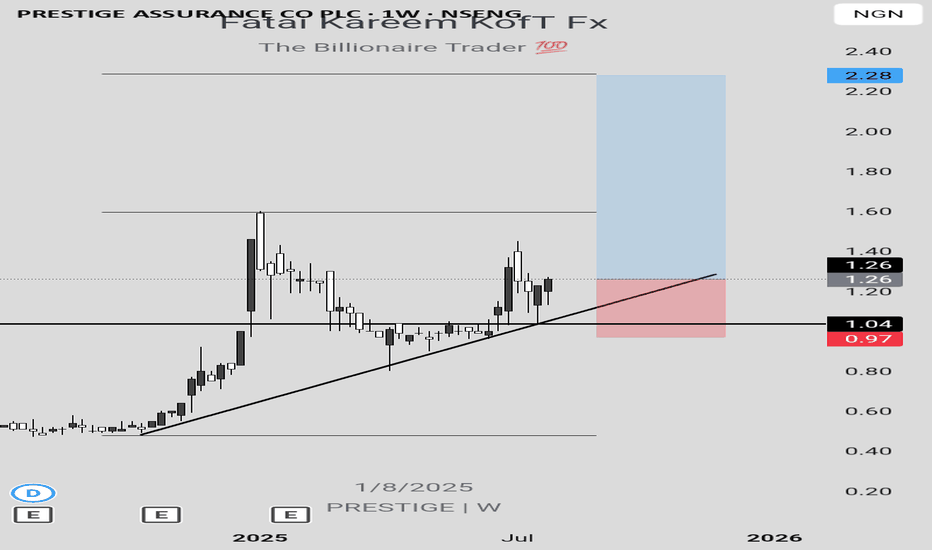

PRESTIGE LONG IDEA PRESTIGE stock has presented a long opportunity after coming from a support level and trendline. The 2 bullish weekly candles are strong indications that buyers are willing to push price higher. To take advantage of this long opportunity, one can buy at the current market price. The first target is N1.59 (26.19%) while the final target is N2.28 (80.95%) based on 1.618 Fibonacci level. The stop can be at N0.97 below the support level and trendline.

Confluences for the long idea:

1. Strongly buying momentum

2. Support level

3. Trendline

4. Bullish market structure

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

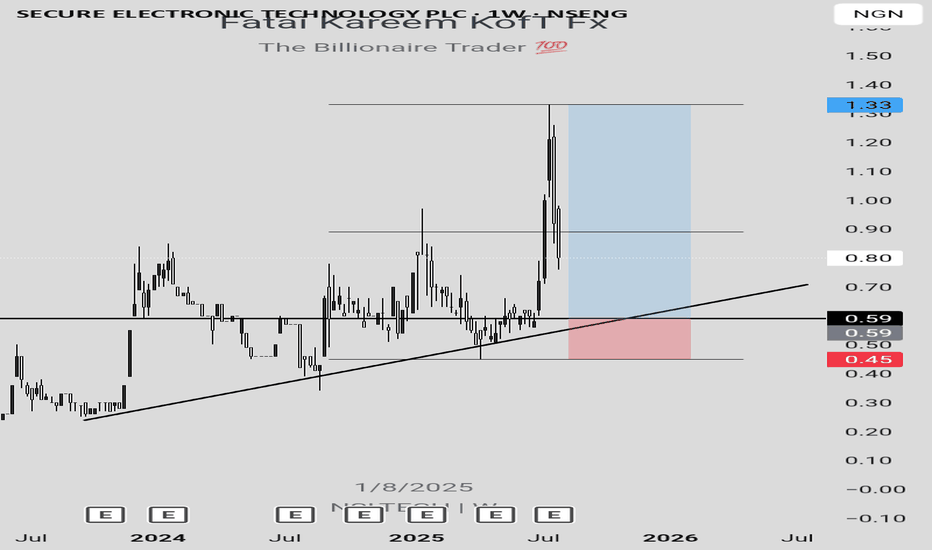

NSLTECH LONG IDEANSLTECH stock presents a long opportunity based on the market structure, support level and trendline. To take advantage of this long opportunity, there are different approaches. An aggressive approach is to buy at the current market price since price is in the discount level. Then, add more long positions when price gets to the support level around N0.60 and N0.57. While a conservative approach is to wait for price to get to the support level and give a candlestick confirmation before entering a long position. The stop can be at N0.45 (23.73%) while the final target is N1.33 (125.42%).

Confluences for the long idea:

1. Bullish market structure

2. Trendline

3. Support level

4. Discount level.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

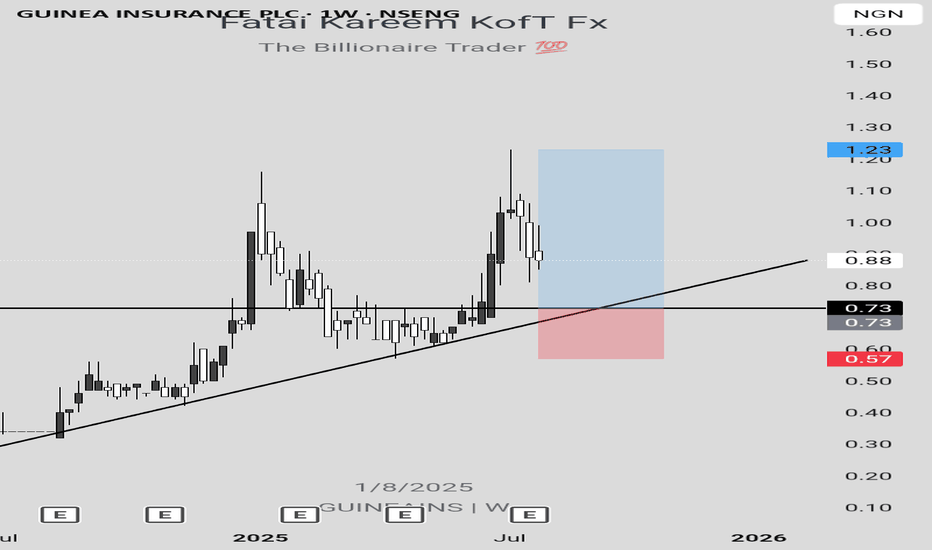

GUINEAINS LONG IDEA GUINEAINS stock presents a long opportunity based on trendline and support level. To take advantage of this opportunity, there's a need to wait for price to drop to the support level around N75 and N73. An aggressive approach is to enter a long position at that price while a conservative approach is to wait for a candlestick confirmation such as bullish engulfing or hammer. The last high around N1.23 (68.49%) can be the target while the stop can be around N0.57 (21.92%).

Confluences for the long idea:

1. Bullish trendline

2. Support level

3. Bullish market structure.

Disclaimer: this is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

Third Quarter 2025 Nigerian share picks Update....Percentage Up!Here's a summary and update on the third quarter 2025 Nigeria stock picks based on the price comparison between July and August - 1month:

Q3 2025 Trading View: Nigerian Stock Picks Update

Strong Performers with Significant Gains:

BUACEMENT: Up 48%, showing strong momentum as a cement sector leader.

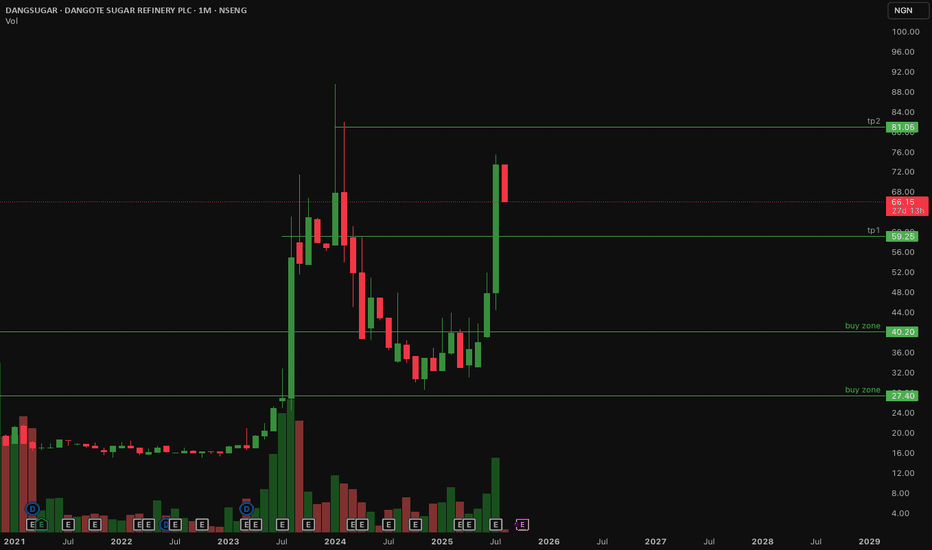

DANGSUGAR: Increased by nearly 37%, notable growth in the sugar sector.

ELLAHLAKES: Shares rose over 36%, a promising performer.

DANGCEM: Cement stock up about 20%, continuing solid growth.

ETRANZACT: Up 24%, showing steady improvement in the tech/payment sector.

MULTIVERSE: Grew by 24%, indicating healthy gains in diversified tech.

NB: +28.8%, good growth for the banking/finance sector.

Moderate or no Growth:

ARADEL: Small increase of about 1%, steady but minimal movement.

HMCALL: Stable with a minor 1.4% increase, remaining consistent.

TRANSPOWER: No price change, holding steady for now.

Overall Market Sentiment:

Average gain across all picks is approximately +22%, a strong positive trend overall.

Indicates a bullish sentiment on these carefully selected third-quarter stocks.

Opportunity exists to take advantage of higher momentum sectors like cement, sugar, and tech/payment companies.

Trading Takeaway:

The Q3 2025 picks demonstrate robust growth potential, especially in key sectors like construction materials and tech/payments. Conservative performers provide portfolio stability while high growth stocks offer upside. Continual monitoring for volume and market news is recommended to capitalize on gains and manage risks moving forward.

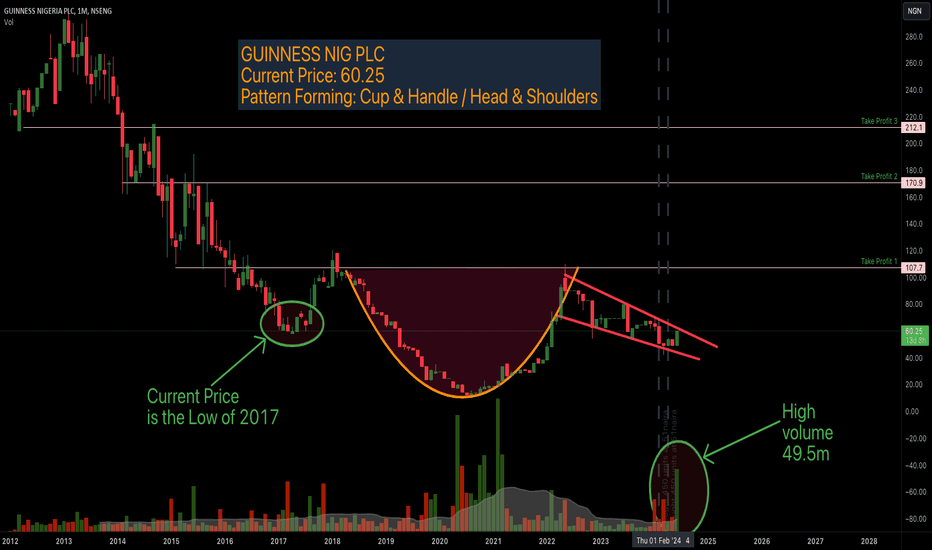

Guinness Nigeria PLC ... time to buy?So!

Guiness NIgeria PLC price action just formed a Cup and Handle pattern. The chart could also double for an inverse head and shoulder.

Current price: 60.25

Investment buy reasons:

1. Notably, a high volume buy of over 49.5m just entered into the market.

2. Current price is the low price of 2017 and hence Low Risk Buy

Profit taking areas if this analysis proves right: 107, 170, 212

Analysis invalidates below 49

One of the questions i get: "why you charting stocks?". Really? Isn't Price action involved in it's movements?

Dangote Group: The Most Undervalued Industrial Empire on EarthExecutive Thesis:

Dangote Group is the Apple + Exxon + Berkshire Hathaway of Africa — and the world hasn’t noticed.

It controls the infrastructure, energy, and food value chains of over a billion people — yet its valuation barely exceeds $6–8 billion.

This is not just a company. It's a sovereign-grade industrial force. And it may be the most underpriced macro asset class in global equity markets today.

1. 🏗️ Total Commodities Domination

While most companies specialize in one vertical, Dangote operates across core commodity supply chains — and dominates nearly every one:

Sector Subsidiary Market Control

Cement Dangote Cement (DANGCEM) >90% of Nigeria’s market, 10+ countries in Africa

Sugar Dangote Sugar Refinery ~95% of Nigerian sugar

Salt NASCON Allied Industries Market leader

Fertilizer Dangote Fertilizer (Lagos) Largest urea plant in Africa (3M tonnes)

Petrochem Dangote Oil Refinery 650,000 barrels/day — top 5 globally

Transport Dangote Transport Fleet of 10,000+ trucks

This vertical stack gives Dangote absolute pricing power, cost control, and policy influence no Western conglomerate can match.

2. 🌍 Strategic Scale — Africa’s Infrastructure Backbone

Africa is projected to grow to 2.5 billion people by 2050. Every new city, road, farm, or industrial zone depends on cement, fuel, fertilizer, and refined food — all controlled by Dangote.

Cement = Roads, bridges, housing

Fertilizer = Food security

Sugar/salt = Consumer staples

Refinery = Energy independence

Logistics = Nation-scale supply chains

Dangote doesn’t serve markets — it builds them.

3. 💸 Valuation Disconnect Is Historic

Metric Dangote Cement (DANGCEM) U.S./Global Peer

Market Cap ~$6–8B >$60B (e.g., Holcim)

ROE ~20%+ Comparable or higher

Revenue Growth Double-digit Slowing/stagnant

Market Position Near monopoly Fragmented

Global Awareness Very low Very high

In the U.S., a company with this margin, moat, and dominance would be valued at $100B+.

4. ⚙️ Self-Sufficient and Geopolitically Backed

Builds its own roads, ports, terminals, and energy

Enjoys full support from Nigerian government

Protected by tariff structures, policy controls, and export incentives

Free Zone development in Lekki has full sovereign backing

This is what a “National Champion” looks like.

The West has Boeing. Russia has Gazprom. Africa has Dangote.

5. 📉 Why It’s So Undervalued

Listed only on NGX — no dual listing in NYSE or LSE

Priced in Nigerian Naira (NGN), which depreciates regularly

Global funds avoid Africa due to FX + liquidity risks

Most of the world simply doesn’t know it exists

🔮 Macro Outlook

As Africa industrializes, Dangote is positioned to grow 5x–10x over the next 10–15 years, purely on population and urbanization tailwinds.

If it ever:

Lists its refinery division

Secures dollar-based revenue streams

Or enters international ETFs...

…it would be one of the top performing industrial investments globally.

✅ Bottom Line:

Dangote is not just undervalued — it is misclassified.

It is not an “emerging markets stock.”

It is a continental-scale industrial monopoly operating at frontier prices.

🚀 Investment Conclusion

If you're looking for the next Berkshire, Aramco, or Tesla, start where no one else is looking:

Nigeria. Dangote. The engine of Africa.

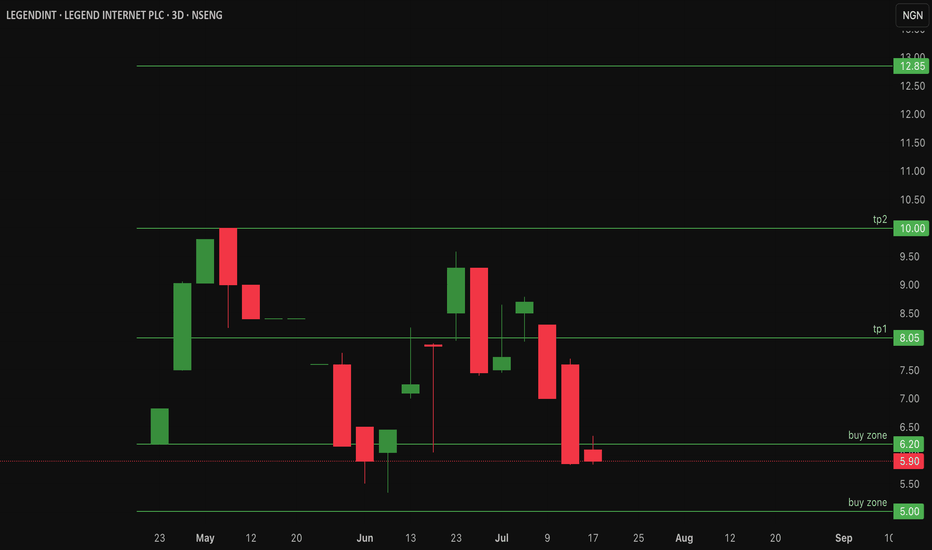

$legendint Could LegendInt be undervalued? - 40% RetracementLegend Internet Plc on the Nigerian Stock Exchange (NGX) was listed on April 24, 2025, under ticker LEGENDINT. The company offers fiber-to-the-home (FTTH) services in Abuja and digital products like LegendMail and MailPay.

IPO price: ₦5.64 per share, closed first trading day at ₦6.20. Previously NSENG:LEGENDINT has reached an all time high of 10naira/share and has currently retraced over 40%

Current price: 5.90

As a newly listed small-cap, it faces low visibility and high volatility, contributing to weak investor demand and price devaluation. It would be interesting to see what the future holds for #legendint.

Upside resistance at 8naira and 10naira per share

Buy zone range is between 5 -6.2naira/share

Price action looks like an inverse cup and handle pattern - Not a bullish pattern!

Invalidation for this Legend Idea is under 5naira per share!

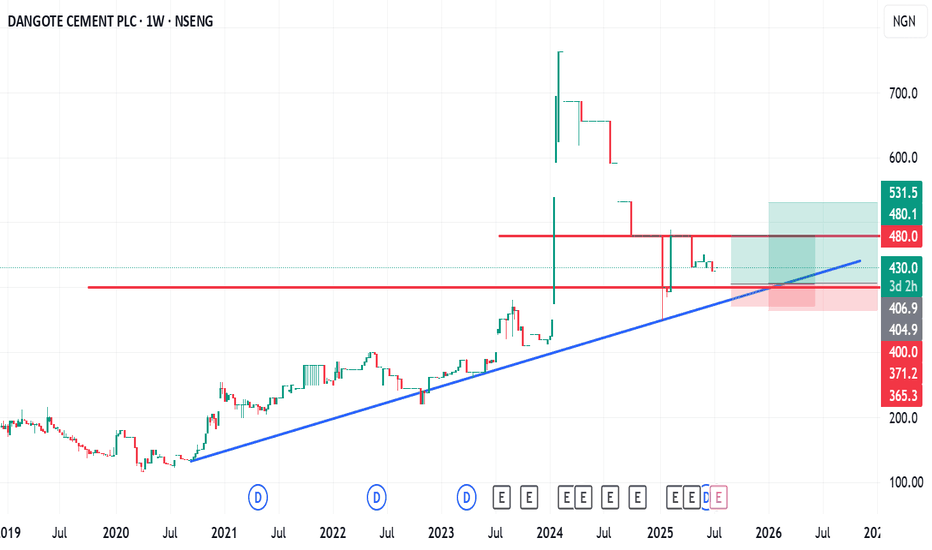

How I view Dangote CementHow I view Dangote Cement.

Technically:

N480 & N400 have been a strong psychological resistance zone for some time now.

Fundamentally:

The news that Dangote is planning to build a deep-sea port is a positive catalyst if it comes to fruition.

My entry:

I am looking at a buy entry from N400 using DCA.

I will continue to add if it falls below my N400 entry.

Trade with care

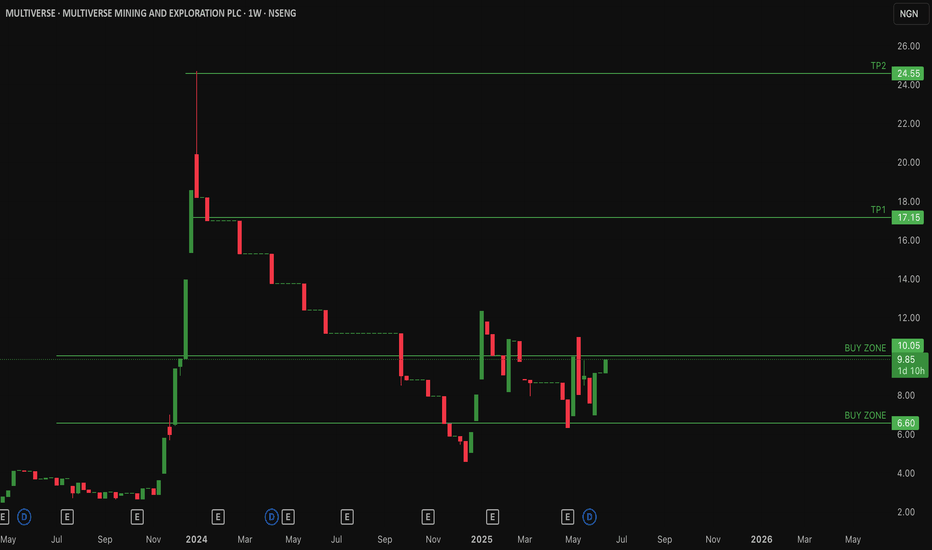

$MULTIVERSE Multiverse over 60% retracement from All time HighNSENG:MULTIVERSE Multiverse Mining & Exploration Plc focuses on quarrying solid minerals (granite, zinc, tin, tantalite, barite, columbite, gold, etc.) in Nigeria, with operations in Ogun and Nasarawa State.

Currently NSENG:MULTIVERSE has lost over 60% of its value from an all time high of 24.50/share and is in consolidation.

Current price: 9.85naira/share

Low risk Buy zone levels is between 6.8naira - 10naira/share

Expecting #Multiverse to retest previous resistances at 17naira/share and 24naira/share if price attempts a recovery.

📈 Key Levels

Breakout above ₦10.20 Breakout zone – key resistance turning into support if broken

₦17.1 TP1 – next major resistance (target)

₦24.5 TP2 – higher resistance / bull target

Invalidation of this idea is a weekly close under 6.8naira/share

FTN Cocoa has more than doubled price in 3 weeksFTN Cocoa has more than doubled its price in 3 weeks.

The questions are

1. Is this sustainable

2. What is the catalyst for this accelerated rise

However, my thought is clear on the chart. A fall below those levels may push it lower. But if the momentum continues, we may see a continuous positive run.

Tradew ith care

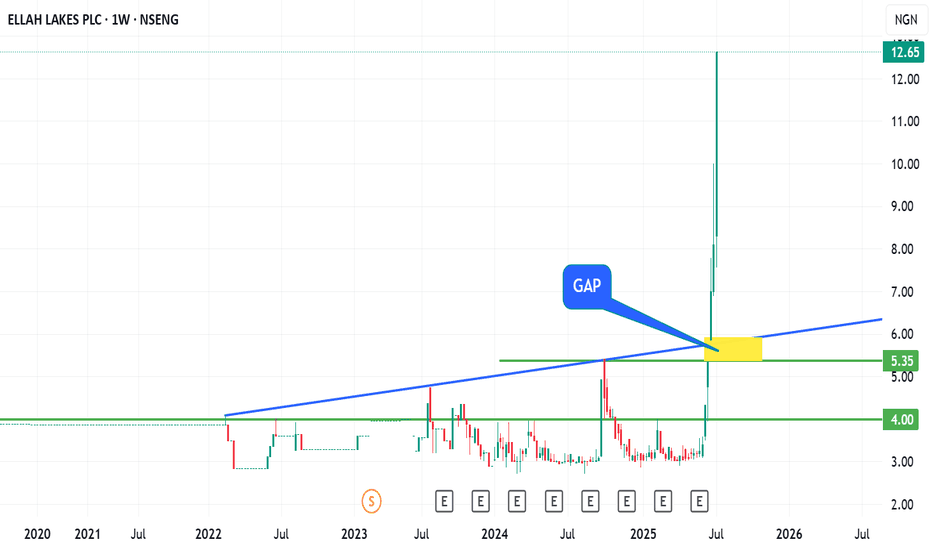

From Fish Farming to Agribusiness Giant: Ellah Lakes’ 304% Rise Ellah Lakes Plc is a Nigeria‑based agribusiness firm, once focused on fish farming but now primarily engaged in oil palm, cassava, maize, soya, and rice production and processing, operating plantations across Edo, Ondo, Enugu, Ekiti (Nigeria) and Ghana.

This asset has made roughly 304% gain since 2nd of June of this year.

The questions are:

1. Is this vertical growth sustainable?

2. Will price action be respected technically as shown on the chart?

3. Will Ellah Lake drop back to close the yellow gap? (N5.3 - N6 zone)

My final view:

After a 304% gain since June, I am now questioning the sustainability of this vertical move, key technical zones, and whether a price correction to the ₦5.3–₦6 gap is on the horizon

Trade with care

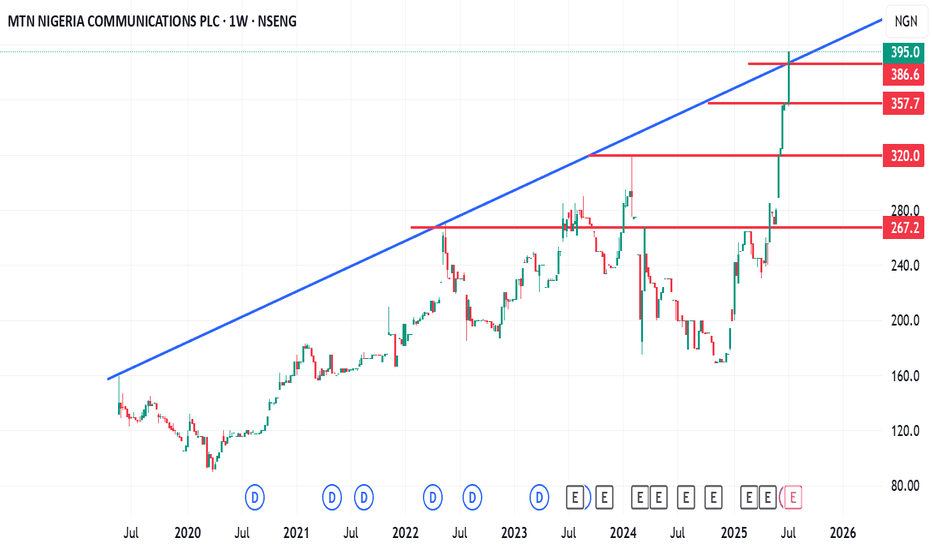

MTN Nigeria Stock: A Strong Rally smashing the roofMTN Nigeria Stock: A Strong Rally smashing the roof

MTN Nigeria stock has demonstrated remarkable growth since trading around the 170 naira zone in December 2024.

As of December 9th, the stock was priced at 170 naira but has steadily rallied over the months to surpass several resistance levels (N320, N357 & N386).

Based on this momentum, the nearest most significant support zone is N386. This is a zone with confluence between an ascending resistance trendline and a support level.

The question is.

1. Can the buy continue with this vertical push-up up

2. Will the N386 confluence zone continue to hold this stock from falling?

Trade with care.

Please like, follow, and share your thoughts.

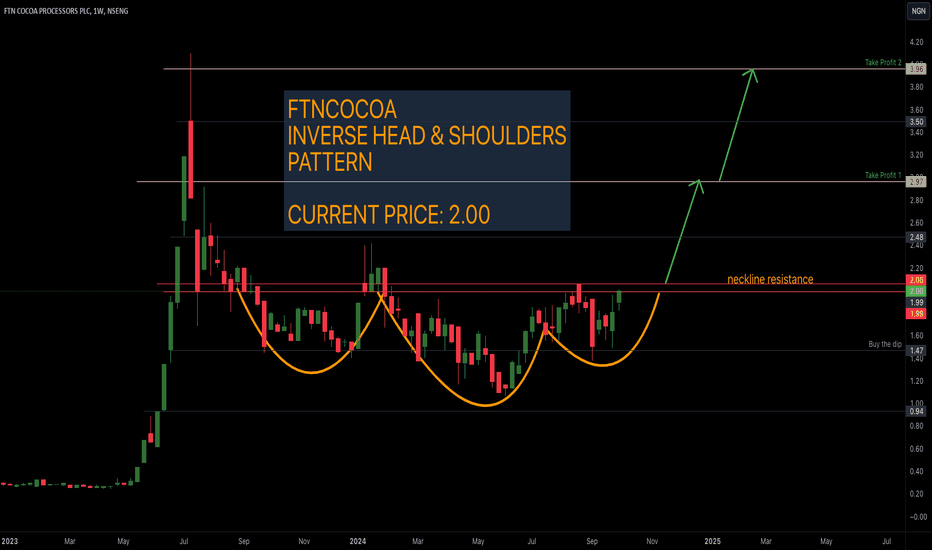

FTNCOCOA FTN Cocoa Processors PlcFTN Cocoa Processors Plc price action just formed an inverse head and shoulders pattern.

Current price: 2.00 (at Neckline Resistance)

Investment buy reasons:

1. Notable higher highs created from 0.94 to 1.47

2. Current price is a low risk buy, as price action has retraced over 50% from all time high of 4.1

Profit taking areas if price action breaks neckline resistance: 2.97, 3.96

Note: This Analysis invalidates below. 1.47

Disclaimer:

This is for educational purposes only and does not constitute financial or investment advice. Always do your own research and consult with a professional before making any investment decisions.

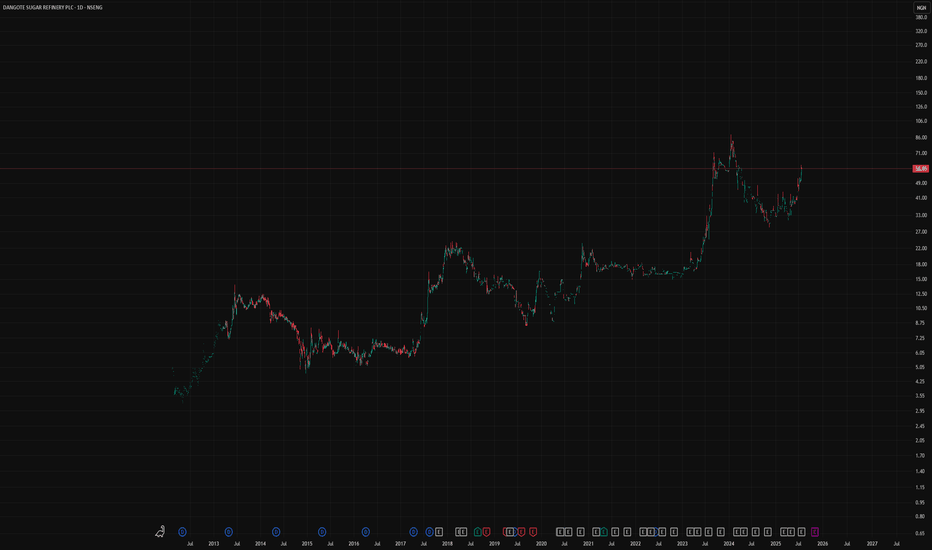

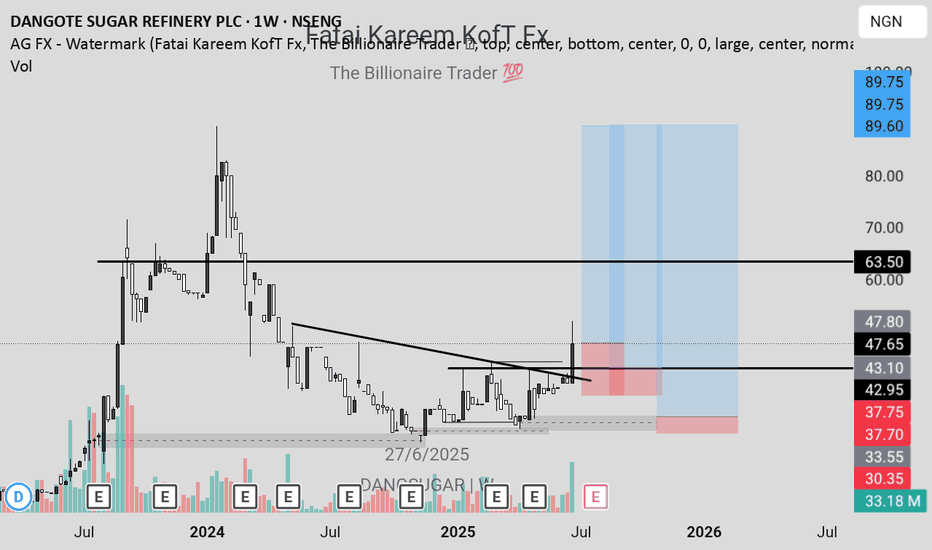

DANGSUGAR LONG IDEARecently, the price of DANGSUGAR stock has broken out of a bearish trendline with a strong bullish weekly candle. This shows a strong intention to continue the buying momentum. To take advantage of the long opportunity, you can buy at the current market price while you can also wait for price to drop to N42.95. The stop can be at N37.70 while the target are N47.85 and N63.50 (final target). If this zone should fail, then the next long opportunity will be at N33.50 with a stop at N30.35 based on market structure.

Confluences for the long idea:

1. Trendline and resistance breakout with a strong bullish weekly candle.

2. Strong volume momentum on the volume indicator.

3. Market structure is bullish.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

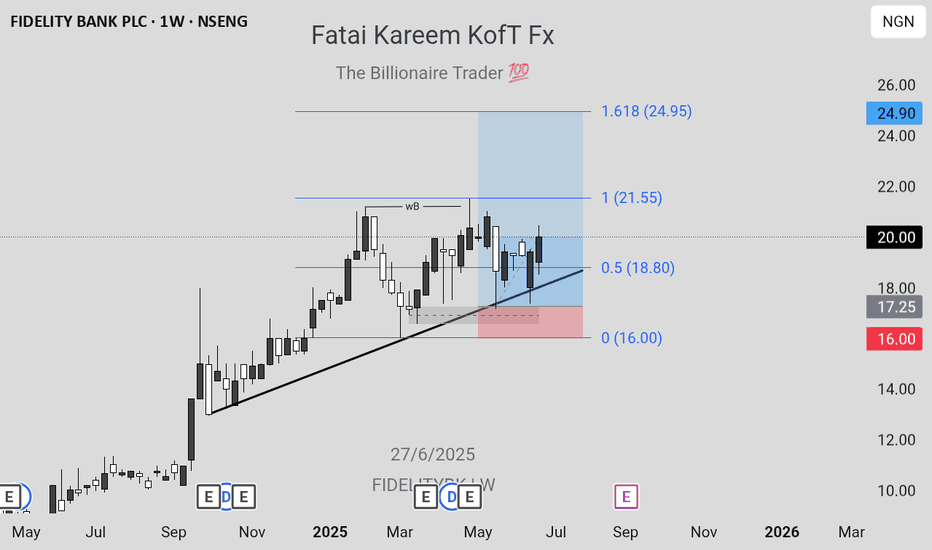

FIDELITYBK: HOLD OR SELL?FIDELITYBK is running up towards its target after mitigating a valid demand zone within the discount level at a price of N17.25. If you have this stock in your portfolio, it's a good idea to hold the stock as it has a potential to go as high as N24.95. Although, the weekly swing high is the actual target, which is at a price of N21.55. Afterwhich, a drop in price is anticipated in order to create another long opportunity. Nevertheless, with the market structure being bullish, it's a good idea to ride on the higher prices that can be created in a bullish market.

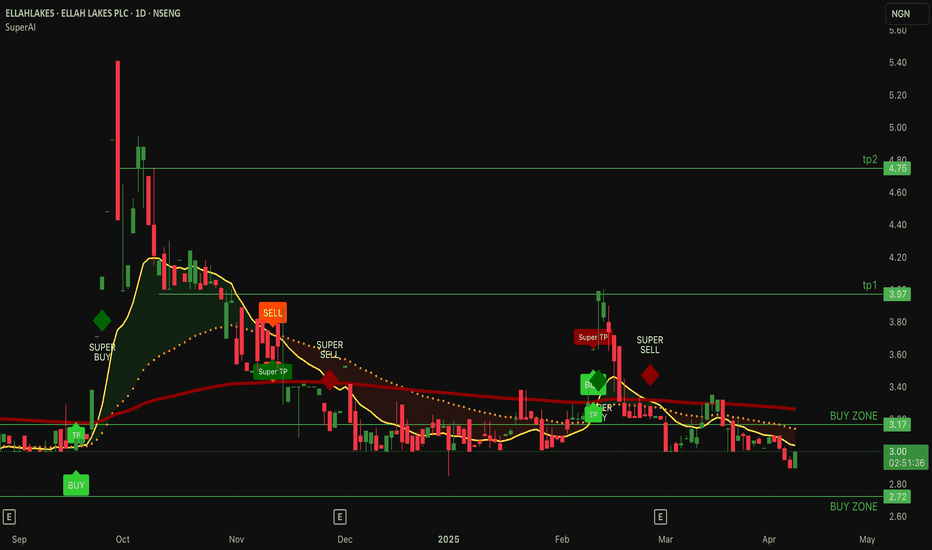

$ellahlakes Ellahlakes over 45% Retracement from 5.4naira/shareEllah Lakes Plc, established in 1980 and headquartered in Benin City, Nigeria, is an agribusiness company engaged in cultivating oil palm, cassava, soybean, maize, and rice. The company manages plantations across Edo, Ondo, and Enugu States.

NSENG:ELLAHLAKES all time high is 5.4naira/share in September 2024

Current price: 2.99naira/Share

#Ellahlakes is currently a low risk investment with possible heights of 3.9 and 4.7 per share.

Preferred buy zone is between: 2.7-3.1

Please Note: Idea Invalidation is Under 2.7

Indicator in use is the SuperAI: Check my Profile for more Information.