Where Is TRANSCORP on NGX Heading Next?TRANSCORP recently broke its previous all-time high (ATH) of ₦53.5, setting a new ATH at ₦54.5.

However, the bullish momentum did not sustain, and the price has retraced to the ₦50 zone, which is now acting as a key support level.

Currently, there are no strong fundamental drivers indicating the possibility of a new rally. This raises the question:

Could we see the price decline further to the ₦46 zone, a level that has served as strong support multiple times in the past?

The Nigerian Exchange (NGX) has been quite volatile recently, and TRANSCORP is no exception.

MRS Oil on NGX is dropping from ATHMRS Oil on NGX is dropping from ATH

This stock hit its ATH of N218 last month. Following this, the asset has started pulling back.

The question is: how far will it pull back?

Unilever Stock on NGX: Technical Analysis and ForecastUnilever stock on the NGX reached its all-time low of ₦10 around March 30, 2020, during the global market downturn. From March 2020 to November 4, 2024, it traded in a range between ₦10 and ₦20, consolidating within this zone.

On November 4, 2024, the stock broke out of the ₦10-₦20 range, signalling the start of a bullish rally that has since propelled the price upward.

Currently, the stock has completed a 50% retracement from its last highest point, a significant level often observed in technical analysis. Additionally, its present price is at the FIB 50 level, a key resistance zone that could determine the continuation or reversal of the upward trend.

Traders should closely monitor ₦40, as it represents a significant psychological and technical level to watch for further price action.

Forecast:

If the price breaks above FIB 50, it may continue its rally toward the ₦40 zone.

A rejection at FIB 50 could result in a pullback to test lower support levels.

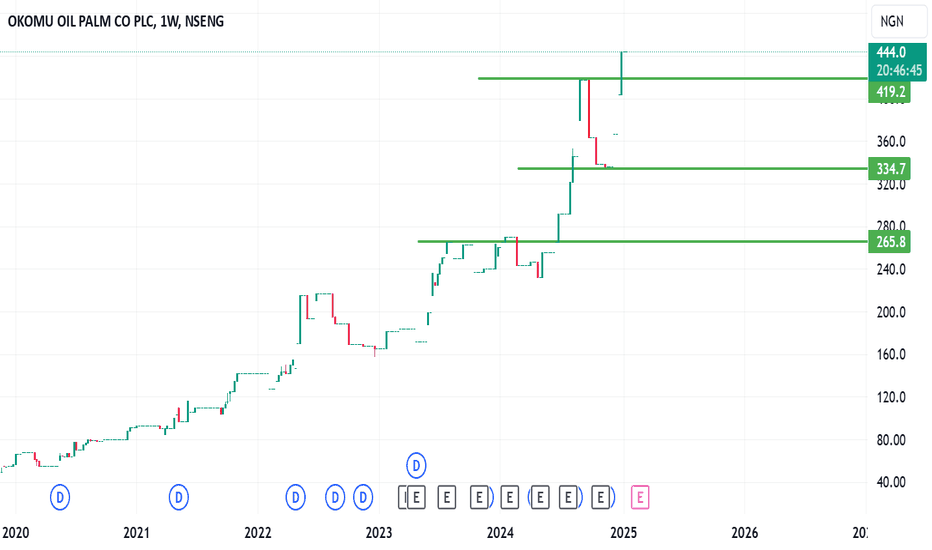

OKOMUOIL Hits a New All-Time High (ATH) on NGXOKOMUOIL Hits a New All-Time High (ATH) on NGX

OKOMUOIL on the Nigerian Exchange (NGX) has reached an impressive new All-Time High (ATH) of N440, breaking past its previous high set between August and September 2024.

A Quick Recap

After hitting its last ATH, OKOMUOIL retraced close to the Fibonacci 50% level, stabilizing around the N334 zone before regaining momentum.

This healthy pullback provided a solid foundation for the current bullish breakout.

The Key Question: What’s Fueling OKOMUOIL?

Several potential drivers could be behind this recent surge:

Strong Fundamentals: Increased earnings, strategic expansions, or operational efficiency improvements could have boosted investor confidence.

Market Sentiment: Positive sentiment around the agricultural or oil palm sector may be driving increased demand for OKOMUOIL shares.

Macroeconomic Factors: Government policies favoring local industries or rising commodity prices could be contributing to the upward momentum.

Technical Outlook

With the breakout above N440, the next step is to watch for potential consolidation or further rallying. Key areas to monitor include:

Support Levels: The N440 breakout level and the previous pullback zone at N334.

Fibonacci Extensions: These could help project potential future price targets.

Final Thoughts

OKOMUOIL’s price action reflects a strong bullish trend, but traders and investors should remain cautious. Understanding the fundamental catalysts and monitoring technical levels will be key to navigating the next move.

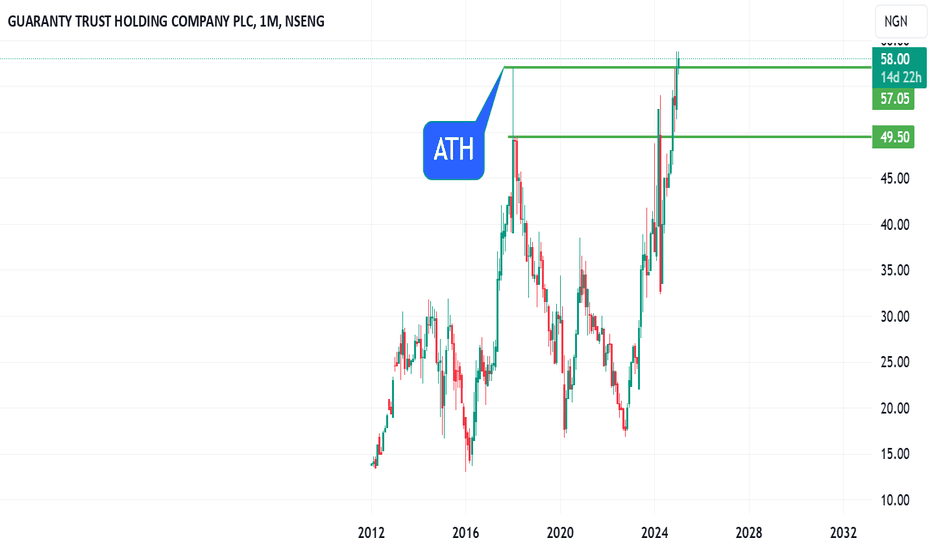

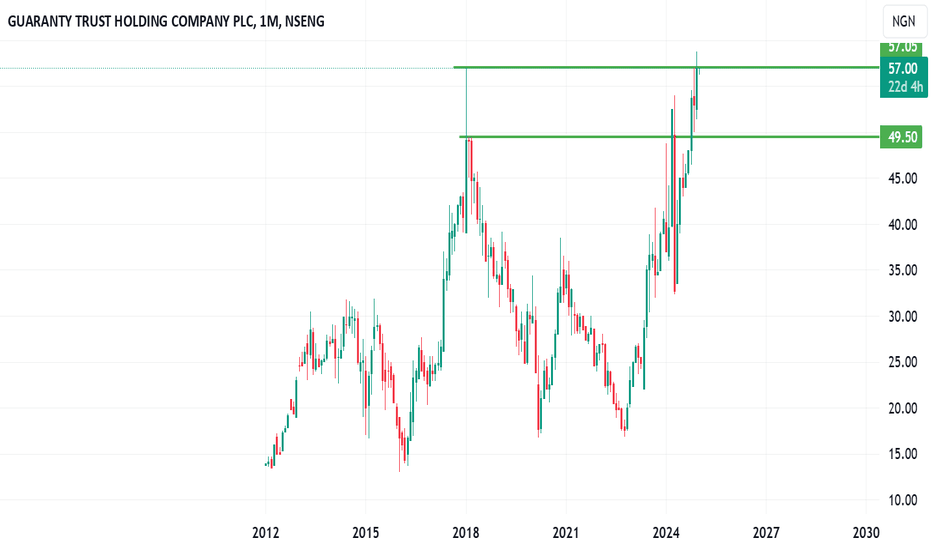

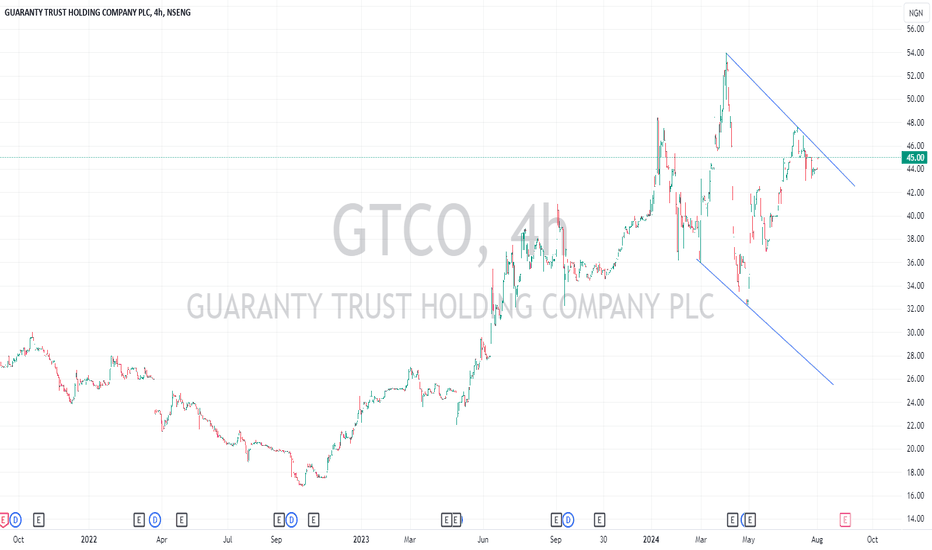

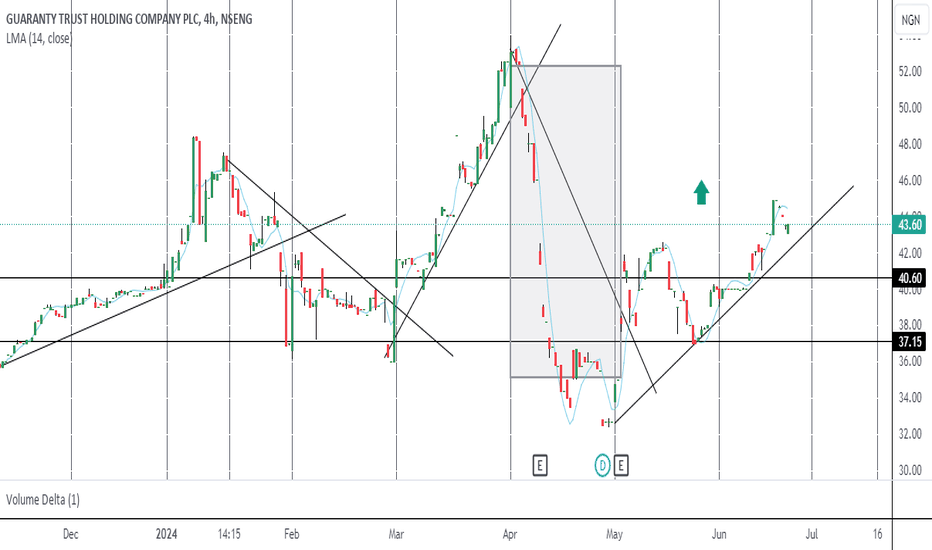

GTCO Faces Stiff Resistance at its 2018 All-Time HighGTCO Faces Stiff Resistance at its 2018 All-Time High.

Guaranty Trust Holding Company (GTCO) continues to grapple with breaking past its 2018 all-time high (ATH), a significant technical resistance level that has challenged the stock since November 2024. Despite showing moments of strength, the stock has been unable to sustain momentum above this critical level.

This persistent struggle suggests that investor sentiment may still be cautious, with the ATH acting as a psychological and technical barrier. For GTCO to convincingly surpass this level, it may require a strong catalyst—either in the form of robust financial performance, positive macroeconomic news, or heightened buying interest from institutional investors.

Traders and investors should closely monitor volume trends and price action around this resistance zone. A decisive breakout accompanied by increased trading volume could signal the start of a new bullish trend.

Conversely, repeated rejections could lead to a pullback, making the stock vulnerable to further corrections.

Hopefully, GTCO is going to be among the stocks on NGX breaking ATH this year.

Transcorp Stock Analysis and ForecastTranscorp Stock Analysis and Forecast

Transcorp's stock is currently testing its All-Time High (ATH) of approximately N53.5. This is a critical resistance level that could determine its next movement.

Bullish Scenario:

If buying momentum remains strong and the stock successfully breaks and sustains above the ATH, we could witness a significant upward trend as the stock moves into uncharted territory.

Bearish Scenario:

However, if the resistance at the ATH holds, a temporary pullback is likely. This retracement could offer an opportunity to enter the stock at a more favourable price point.

The overall market sentiment appears bullish with the current high demand for Transcorp shares on the Nigerian Exchange (NGX). As such, monitoring price action closely around the ATH is advisable to make informed entry or exit decisions.

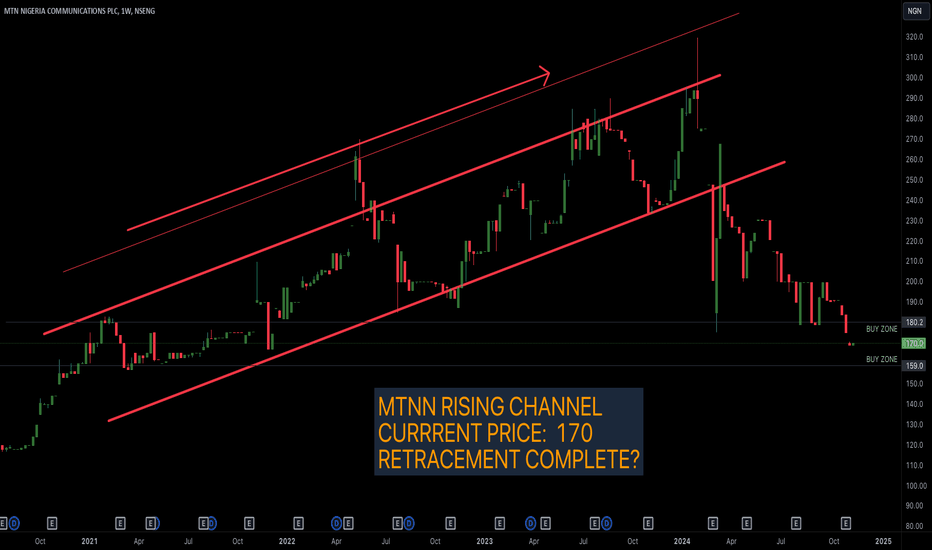

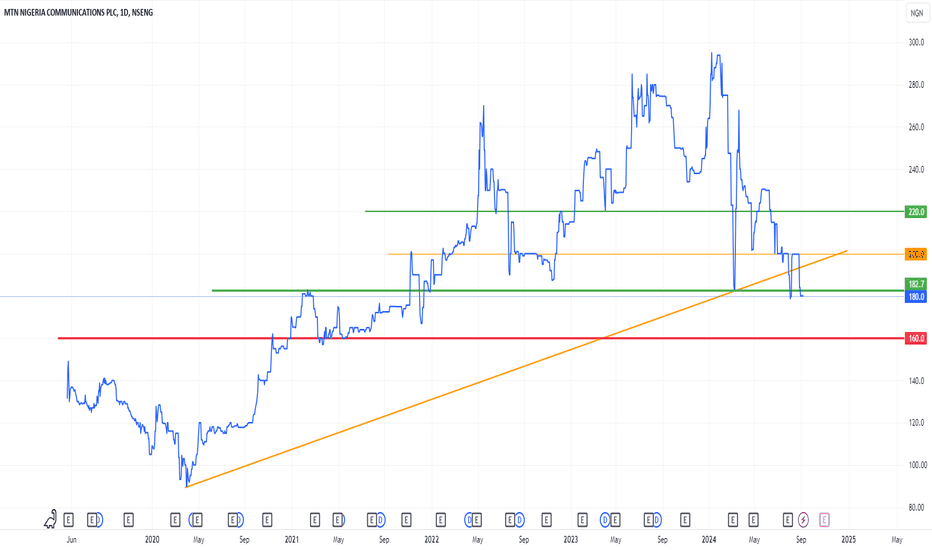

$MTNN MTN almost 50% retracement from all time high...NSENG:MTNN MTN Nigeria just had about a 50% retracement from an all time high of 319naira/share.

Current Price: 170

#MTN price action previously rose through it's rising channel from 159 to 319.

Currently, price action is at the bottom of this channel, making for a low risk buy zone (btw 159-180).

Time to buy MTN Nigeria shares?

My Nigerian Share Picks for the first quarter of 2025In this video, I analyzed my share picks from September - the last quarter of 2024 and found by analysis an over 50% increment in portfolio. If you want to have my share picks for first quarter of 2025. Please visit tally.so

Breakdown for the last quarter of 2024; Average % Change: About +54.53% across 19 shares

Largest Gain: SUNUASS with +597.67%.

Largest Decline: DAARCOM with –11.27%.

Stocks with Notable Increases

SUNUASS (+597.67%) is an extreme outlier, far exceeding other gains.

Several others also showed strong growth, notably:

#UBA (+48.29%)

#STERLING (+47.06%)

#NEM (+44.74%)

CSE:ETI (+33.97%)

NSENG:ROYALEX (+30.77%)

$FTNCOCO (+30.43%)

Stocks with Moderate Increases

VITAFOAM (+36.57%), WEMABA (+40.31%), JAIZBANK (+38.89%), ACCESSC (+26.91%), FBNH (+27.73%), and UPDC (+23.85%) also contributed significantly to the overall positive trend.

Stocks with Declines

Only three recorded losses:

DAARCOM (–11.27%)

CHAMS (–5.85%)

NASCON (–8.82%)

The declines were relatively small compared to the large gains seen elsewhere. Overall, this set of shares leans strongly positive, with a few exceptions.

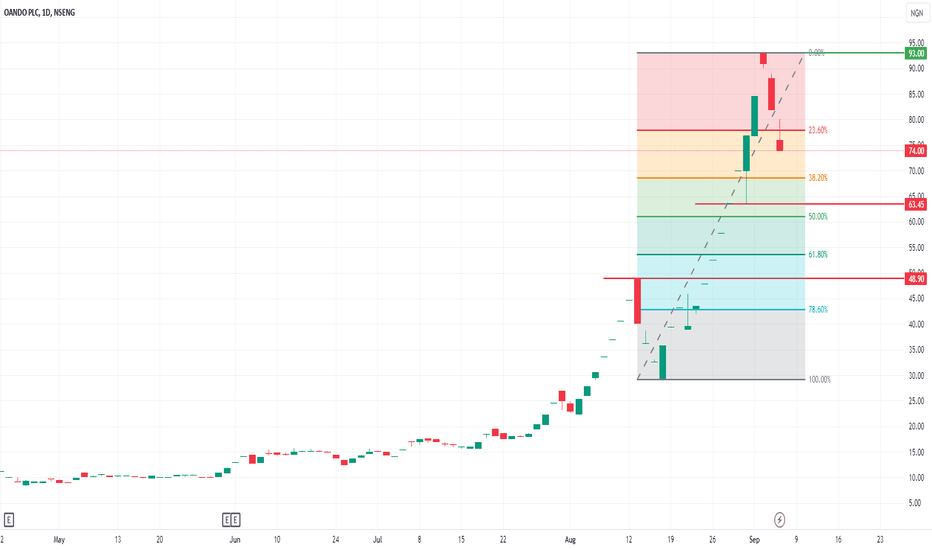

63 Naira Looks In Possible For Oando Stock63 Naira Looks In Possible For Oando Stock

This stock just joined the SWOOT (Stock Worth Over One Trillion naira) lately following its over 1,450% accelerated growth in a year.

It seem it is cooling off, and looking at Nigeria economic fundamentals, I think the run up may be over.

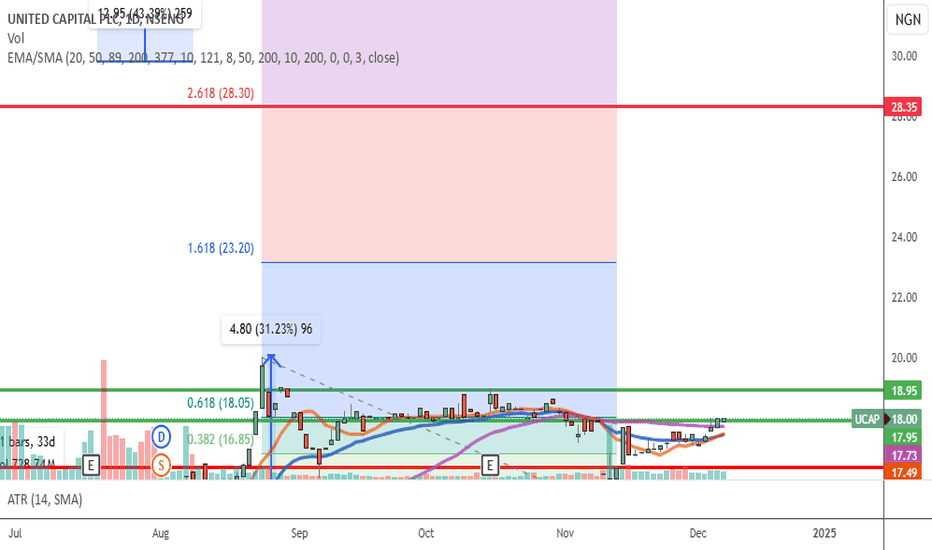

I STILL EXPECT GTCO TO MOVE SOUTH TO $40Well, I do not expect any serious ride-up from NG banking stocks anytime soon. The reason is that, they are still wooing investors to buy their stocks to raise the fund for CBN recapitalization.

Either you look for sell opportunities short term, or you buy to hold for the possible coming bull run in NG banking sector

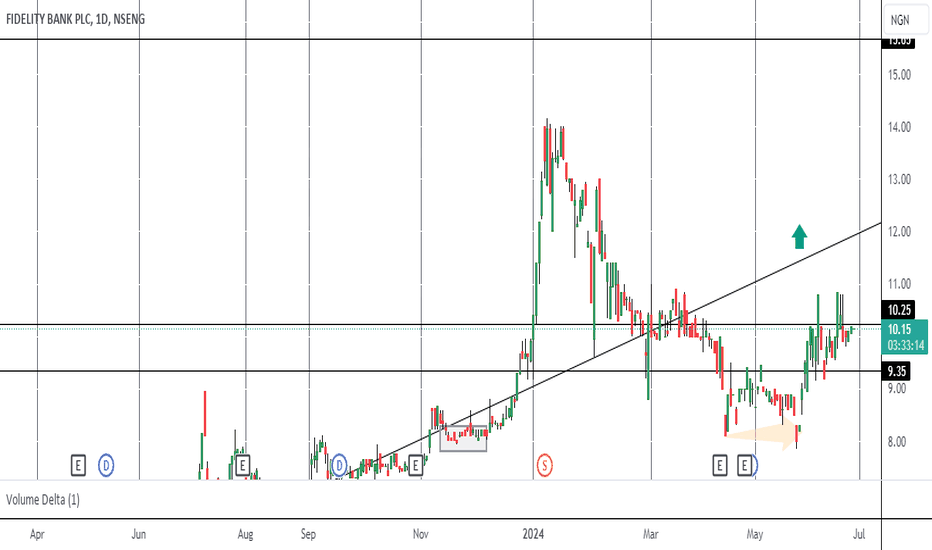

FIDELITY: A CLEAR PATH FOR THIS CRUDE ECONOMYNigeria's economy has shown remarkable resilience in the second quarter of the year, defying expectations and paving the way for a promising outlook. Despite global challenges, the West African nation has made significant strides in key sectors, setting the stage for a robust performance in the remaining half of the year.

Under the leadership of Governor Cardoso, the CBN has implemented policies aimed at diversifying the economy, improving the business environment, and boosting investor confidence. These efforts have started to bear fruit, with notable gains in:

- Agriculture: Increased investment in the sector has led to enhanced productivity and exports.

- Infrastructure: Ongoing projects in transportation, energy, and telecommunications are expected to drive growth.

- Manufacturing: Improved policies have attracted foreign investment, boosting production and job creation.

With these positive developments, expectations are high that Cardoso's mandate will:

- Foster sustained economic growth

- Enhance Nigeria's global competitiveness

- Create jobs and improve living standards

As the economy continues to gain momentum, Nigeria is poised for a remarkable turnaround.

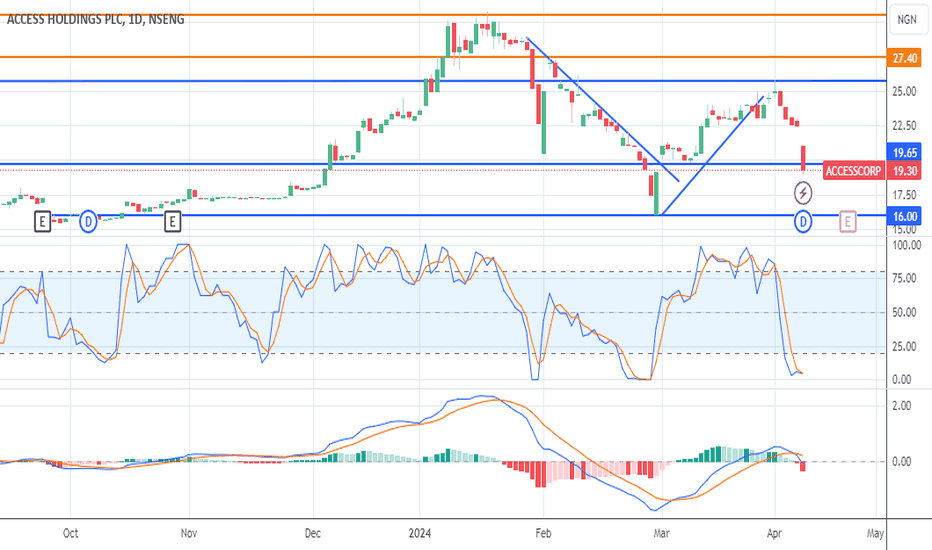

Nigerian Stock Market Analysis: Access Bank Technical Analysis Introduction

Nigerian Stock Market Analysis of Access Bank Technical Share Review. Access Bank stands as a beacon of opportunity, but how should investors interpret the current technical indicators? Let’s dive into the data and uncover the insights that could guide your next investment move.

Technical Indicators Overview

The technical indicators present a mixed picture, with oscillators signaling neutrality, moving averages suggesting a sell sentiment, and pivot points indicating potential support and resistance levels.

Moving Averages Analysis

Moving averages reflect a bearish sentiment, with both exponential and simple moving averages signaling a sell. This trend persists across various timeframes, from short-term to long-term, highlighting a consistent downward pressure on the stock price.

Pivot Points Analysis

Pivot points reveal critical price levels, with the classic, Fibonacci, Camarilla, Woodie, and DeMark pivot points indicating potential support and resistance zones for Access Bank shares. Understanding these levels can assist traders in setting entry and exit points. Overall, pivot point analysis aligns with the strong sell sentiment observed in other technical indicators.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that helps traders identify potential changes in the direction of a stock’s price movement. The blue line crosses below the orange line above the histogram, which signifies selling potential. The histogram also shows mild selling strength. This signal is oversold; traders should watch for potential trend reversals or buying opportunities. This is based on Nigerian Stock Market Analysis.

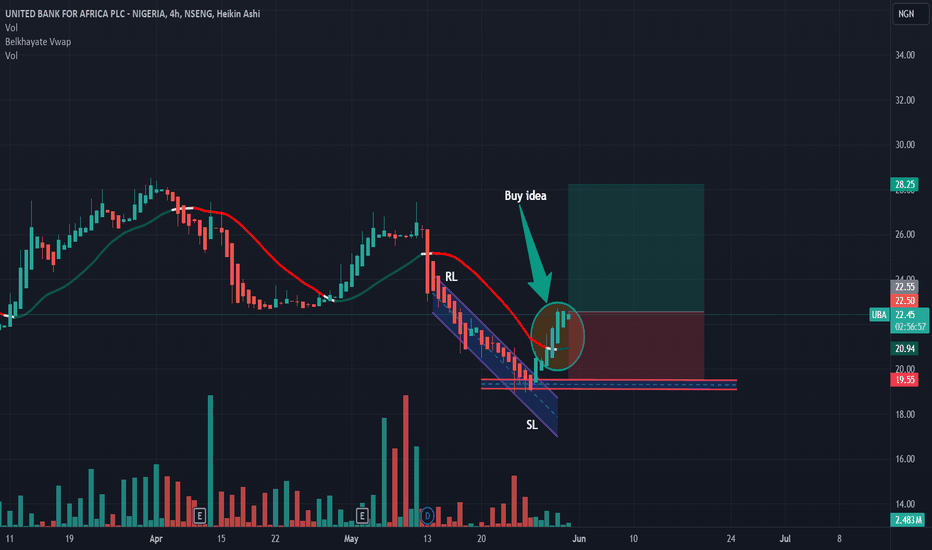

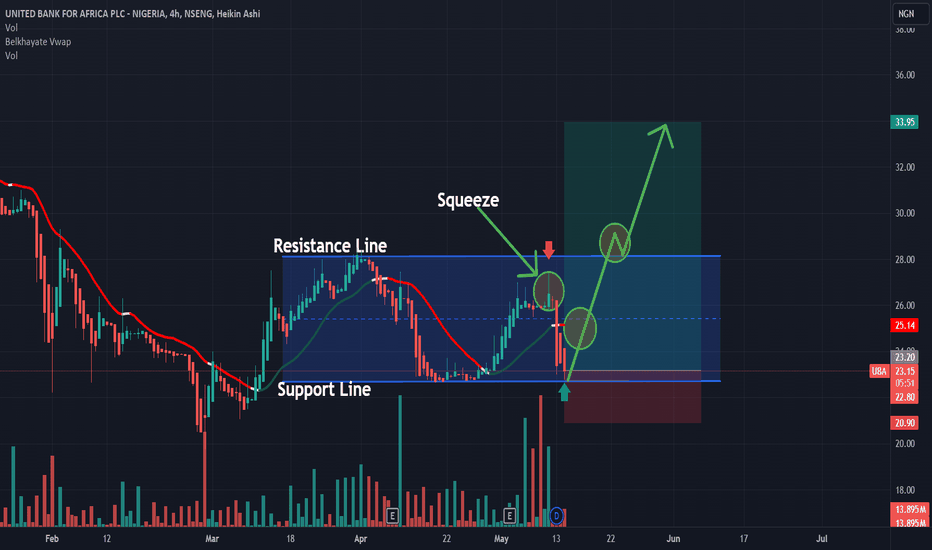

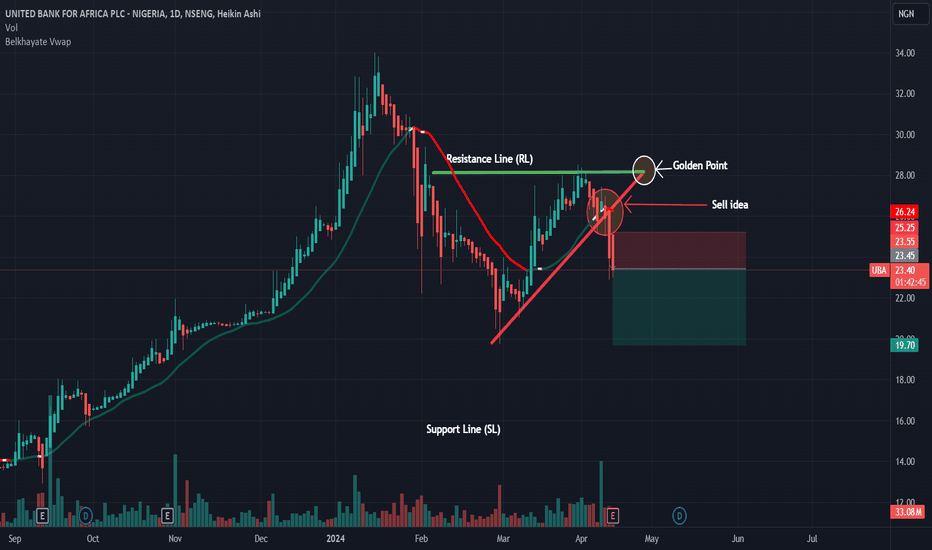

Support and Resistance Line

Support and resistance levels are areas on a stock chart where the price tends to find barriers to moving further in a particular direction. We have resistance at 25.80, 27.40 and 30.50, while support lines exist at 16.00 and 19.65. The price is about to break from 19.65 support back to 16.00.

Stochastic Oscillator

Traders use the stochastic oscillator to identify overbought and oversold conditions in the market. Access bank Shares are oversold (20%) on the daily chart for short-term to medium-term investors and heading toward oversold (20%) on the weekly chart for long-term investors or traders.

Recommendation Based on Market Oversold Signals

Despite the bearish technical indicators, it’s crucial to consider the broader market sentiment. The market appears oversold based on daily chart indicators, suggesting a potential reversal in the near future. Therefore, investors may view this as an opportunity to accumulate shares at a discounted price. Short-term and medium term investors can buy now at N19.30 or N16.00, take a profit at N25.80, and look further to take another profit at N30.00 based on market sentiment.

Conclusion

While technical analysis provides valuable insights, it’s essential to complement it with fundamental analysis and market sentiment. Access Bank’s stock presents an intriguing opportunity amidst the current market conditions. However, investors should exercise caution and conduct thorough research before making any investment decisions.

Remember, this analysis serves as a guide, not as financial advice. Always conduct your due diligence and consult with a financial advisor before executing any trades.

By offering a comprehensive analysis of Access Bank’s technical indicators and market conditions, this article aims to empower investors with the knowledge needed to navigate the Nigerian Stock Market effectively.

Access Bank Technical Analysis: On Nigerian Stock MarketIntroduction

Welcome to our in-depth technical analysis of Access Bank shares on the Nigerian Stock Market. In this analysis, we will examine various technical indicators, including RSI, MACD, moving averages, pivot points, and more, to provide valuable insights into Access Bank’s current market sentiment and potential investment opportunities.

Technical Indicators Overview: Access Bank’s technical indicators suggest a strong buy sentiment. The RSI (Relative Strength Index) stands at 60.413, indicating a buy signal, while the MACD (Moving Average Convergence Divergence) and CCI (Commodity Channel Index) also signal buy opportunities. However, the STOCH (Stochastic Oscillator) suggests a sell neutral, highlighting some conflicting signals in the short term.

Moving Averages Analysis: Access Bank’s moving averages analysis further supports a strong buy sentiment. The simple and exponential moving averages (MA) across different periods (5, 10, 20, 50, 100, and 200) all indicate buy signals. This suggests a positive trend in Access Bank’s stock price movement across various time frames.

Pivot Points Analysis: Pivot points analysis provides additional insights into potential support and resistance levels for Access Bank shares. The pivot points, including classic, Fibonacci, Camarilla, Woodie’s, and DeMark’s, suggest key price levels that traders and investors can use to make informed decisions. Overall, pivot points analysis aligns with the strong buy sentiment observed in other technical indicators.

MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that helps traders identify potential changes in the direction of a stock’s price movement. The blue line crosses above the orange line below the histogram, which signifies buying potential. The histogram also shows good buying strength.

Support and Resistance Lines: Support and resistance levels are areas on a stock chart where the price tends to find barriers to moving further in a particular direction. We have resistance at 27.40 and 30.50, while support lines exist at 16.00 and 19.65

Stochastic Oscillator: Traders use the stochastic oscillator to identify overbought and oversold conditions in the market. Access bank Shares are overbought on the daily chart for short-term to medium-term investors.

Recommendation:

Based on the technical analysis conducted, Access Bank shares demonstrate a favorable outlook, with most indicators signaling a strong buy sentiment. Investors looking to capitalize on potential upward price movements may consider buying Access Bank shares. However, it’s essential to conduct thorough research and consider other factors, such as market trends and risk tolerance, before making investment decisions. Short-term and medium term investors can buy now and take a profit at N27.40 and look further to take another profit at N30.00 based on market sentiment.

Conclusion: In conclusion, Access Bank’s technical analysis reveals a positive market sentiment, with various indicators suggesting a strong buy recommendation. By leveraging technical insights such as RSI, MACD, moving averages, and pivot points, investors can make informed decisions and navigate the Nigerian stock market effectively. Please contact your broker for a final investment decision.