#Softox $SOFTX nordic #biofilm medtech with US defence grantSoftOx Solutions AS is a Scandinavian medtech company, founded in 2012, listed at Euronext Growth with new ticker OSL:SOFTX . After years of research and product development with leading Nordic research institutions, SoftOx has developed a non-toxic and highly efficient antiseptic technology, which eradicates and prevents biofilm infections and is fully virucidal.

THESE PRODUCTS ARE CURRENTLY UNDER DEVELOPMENT

Human Wound & Infection Treatments

SoftOx is developing a range of products that can be classified as either medical devices or medicinal products (drugs) for human use. Collectively, the R&D efforts are focused on prevention and eradication of serious infections. Such infections are not limited to pathogenic bacteria, but may also include viral and fungal infections. The current product candidates are either in the clinical or late stage preclincal (animal testing) phase.

SoftOx Wound Irrigation Solutions (medical device) for acute and chronic wounds, to both prevent and treat infections (including biofilms).

SoftOx Anti-infectives are products aimed to actively treat and remove topical infections in wounded and mucosal tissues, such as those caused by biofilms, AMR microbes, viruses and fungi.

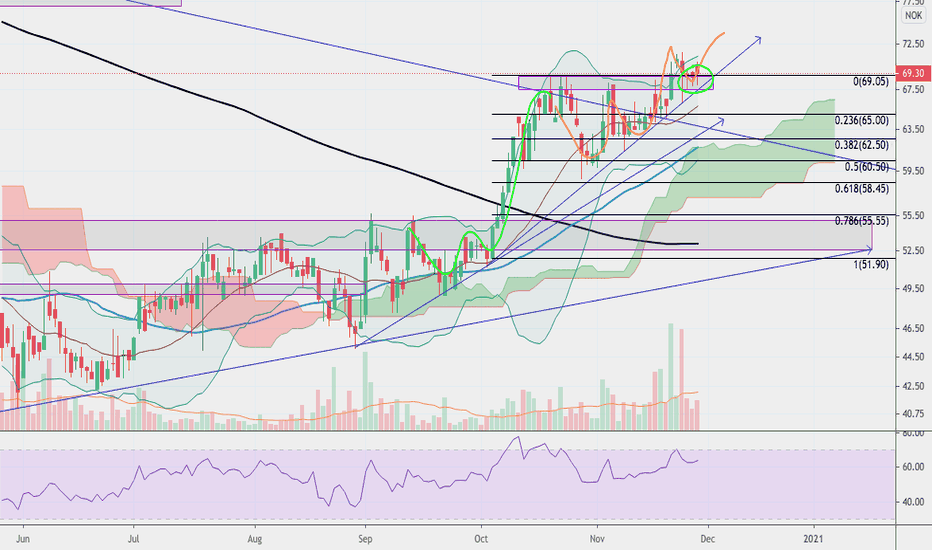

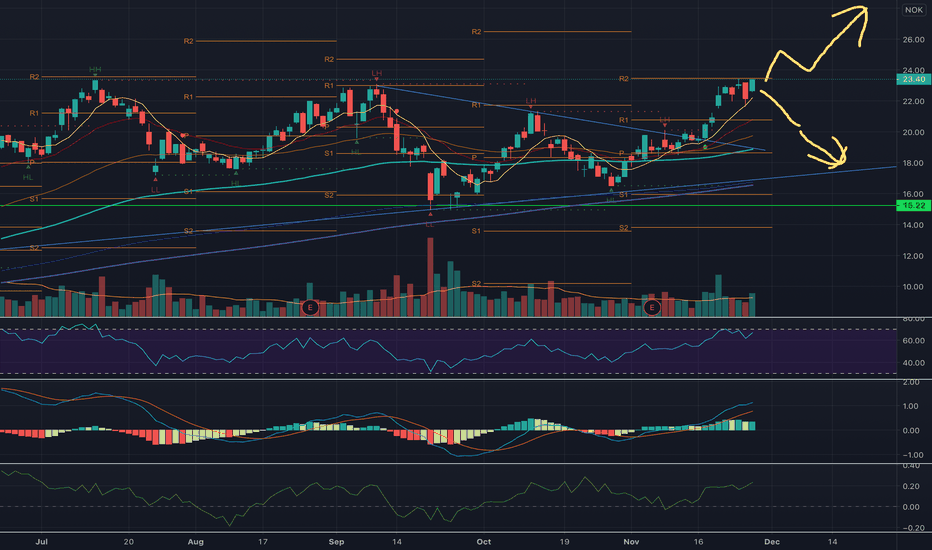

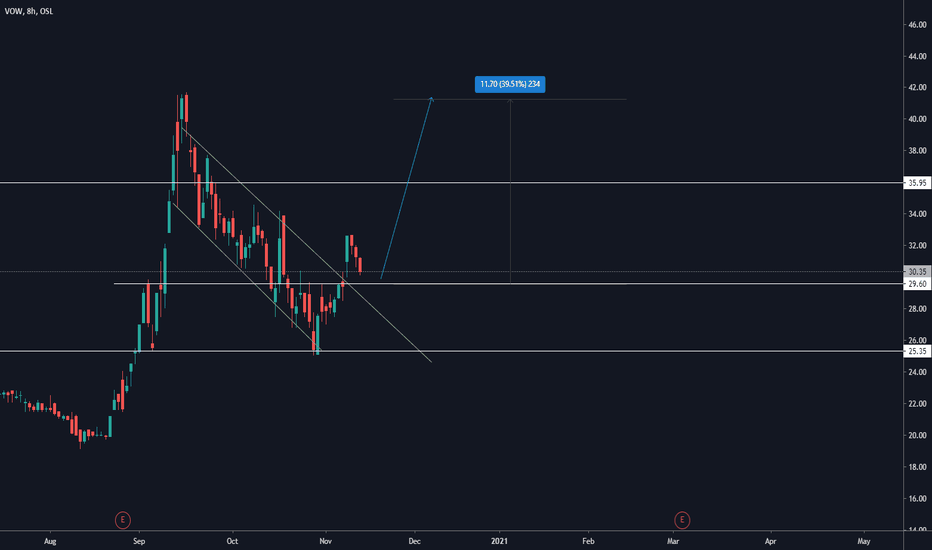

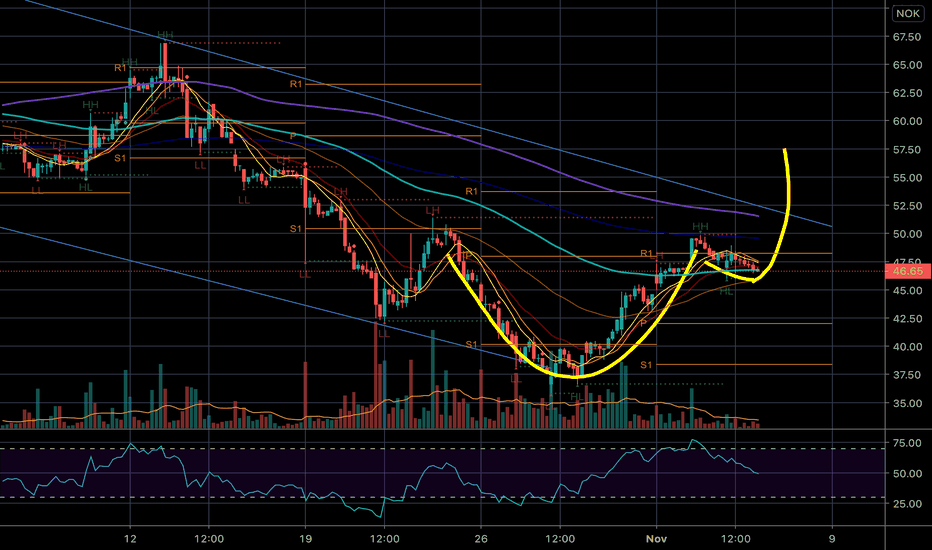

FLNG looks to set up for another leg up.So looking at FLNG's behaviour lately we see a W-formation was formed around the 52-55 area, before breaking through resistance from there (green line).

After this over extended W-formation a retrace was to be expected to at least the 0.318 fib, which is what happened.

Whilst testing the 0.318 fib/05 fib (60-62.50), another W-formation seems to have formed (see orange line).

Now FLNG has broken above horizontal resistance and a long term downward trendline and seems to be finding support on those previous resistances.

In short, everything seems like a perfect setup for another leg up.

My short term target is around NOK 77-80,- Which is the next resistance on the weekly chart and the top of the ichimoku cloud.

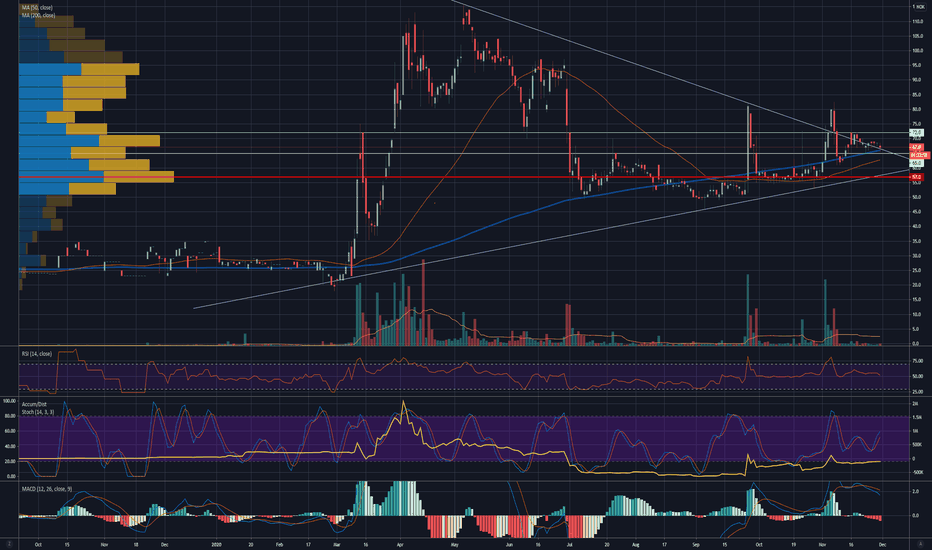

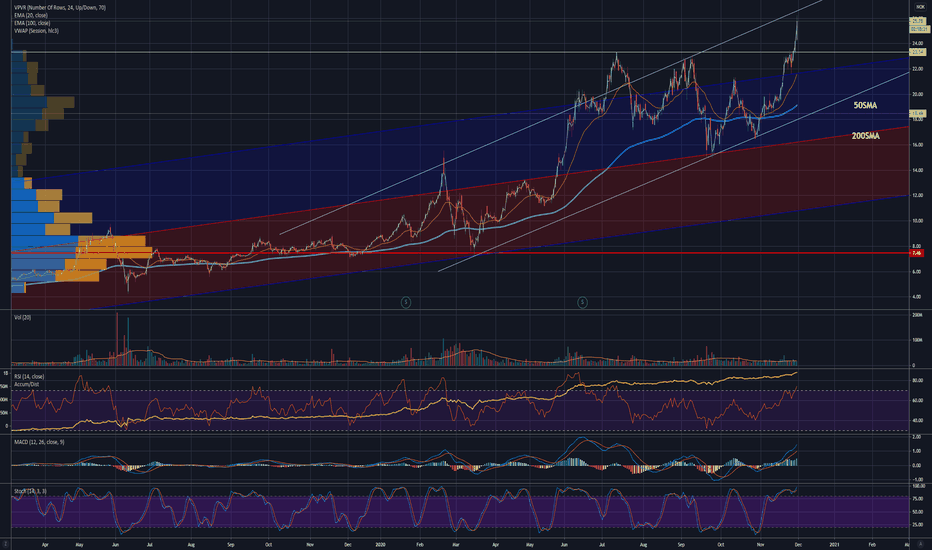

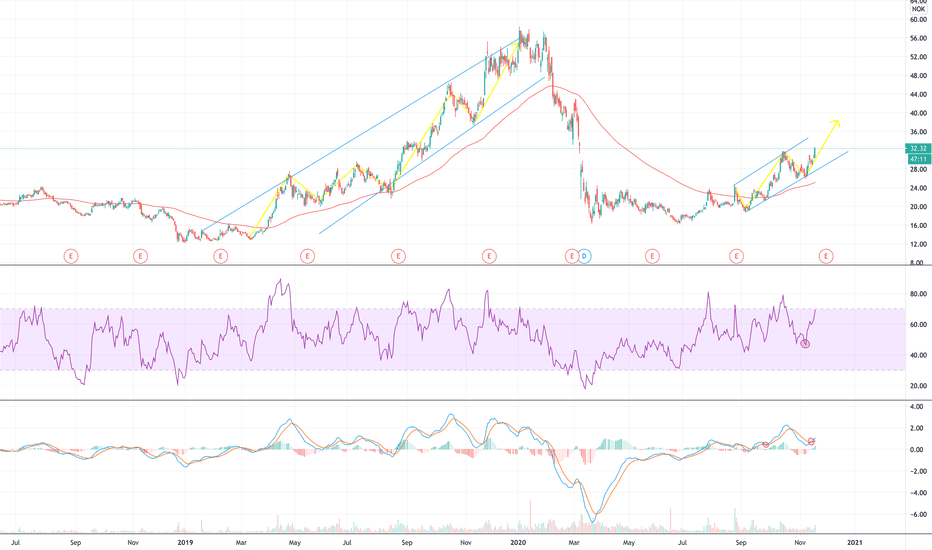

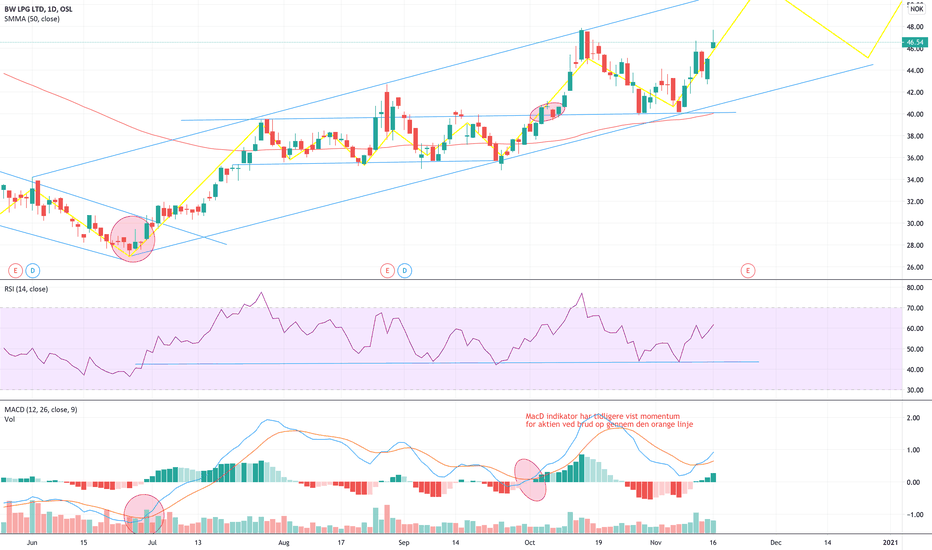

Avance BullishAs a result to the Covid-19 the LPG market fell way below their "fair-value", which is strongly indicated in the Price/ Earnings-value around 3.1-5.1.

The stock repeatedly shows a bullish RSI in the field between 50-75.

Besides the MacD indicator showing a strong momentum to proceed the trend

I personnel believe that the stock will try entering the same pattern as it did in the strong up-trend before the Covid-19 pandemic.

This would indicate a fair-value (relative to the value before the pandemic) around 70 NOK

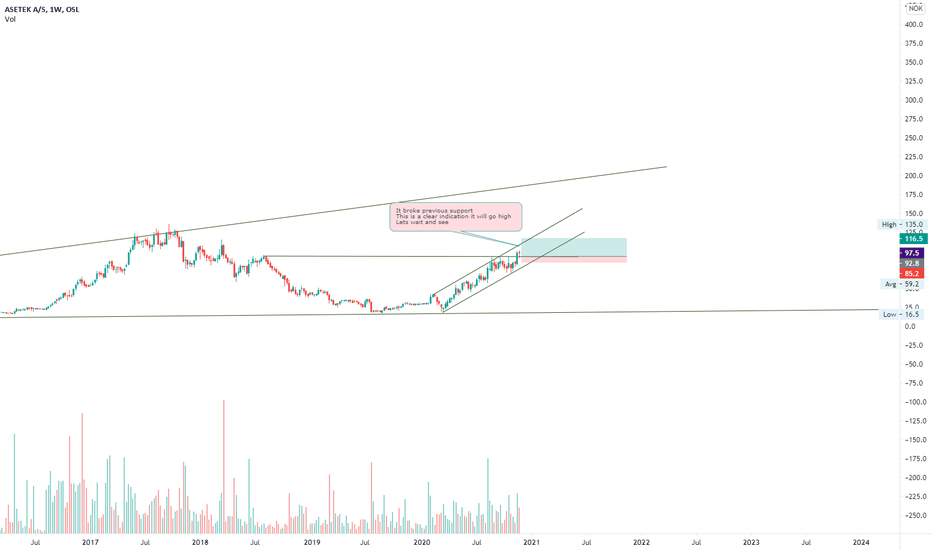

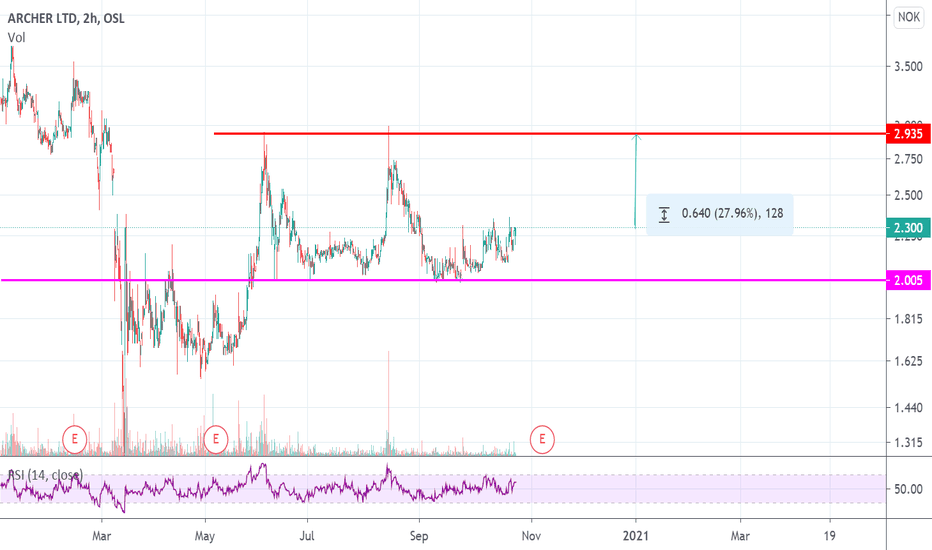

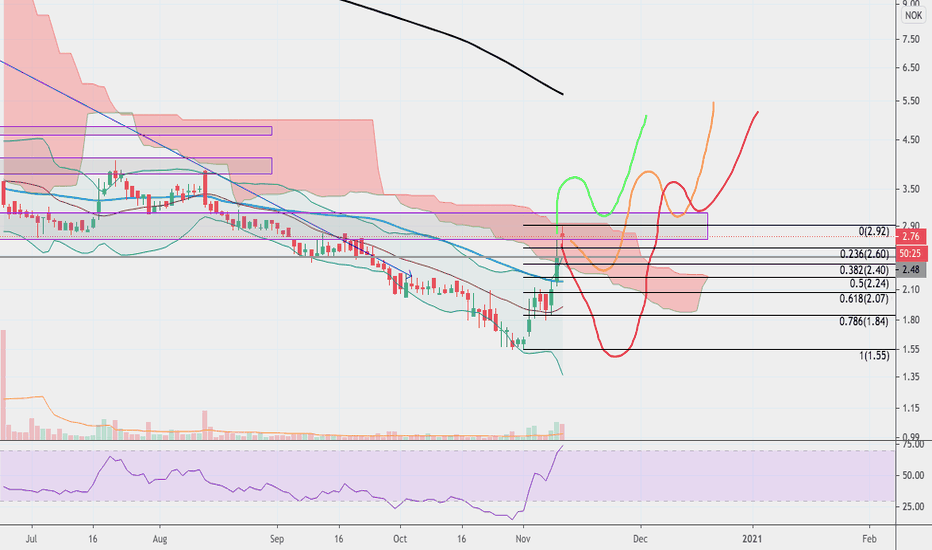

SHLF looking bullish, looking for entrySo very brief analysis of SHLF, as it is definitively giving signs of life.

We have just arrived at major resistance that previously acted as support for a long time. So expecting a retrace from here, before even looking for a buying opportunity.

Furthermore a gap was left behind at 2.48 yesterday that will likely get filled. And we are inside the daily cloud --> consolidation.

I see 3 possible scenarios:

GREEN, Very bullish:

We break resistance and out of the cloud, we retest and continue up. Buy on the retest.

ORANGE, "normal":

We fill the gap, retest the bottom of the D cloud and find support in the cloud and on the 0.5 or 0.618 fib.

RED, "bottom formation":

We go back down looking for a bottom, possibly forming a double bottom or another bottom formation.

In conclusion; wait to see where SHLF starts to find support, or if it breaks up, look for the retest and buy.