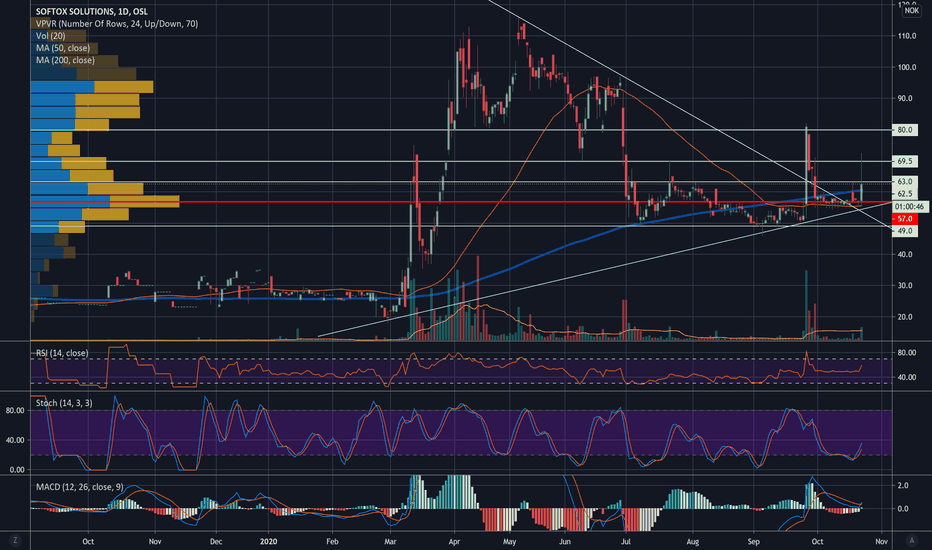

SoftOx Infection remover - US Department of Defense (DoD) grantSoftOx, today announced the US Department of Defense (DoD) awarded SoftOx $1.977 million (USD) for research and development of the SoftOx Infection remover (Biofilm Eradicator).

Oslo 03.11.2020

The project is a research and development collaboration between SoftOx Solutions AS and leading US and European wound care clinics, focusing on chronic wounds and biofilm infections. The project represents an innovative treatment principle in how to prevent and treat biofilm infections in wounds. The grant will contribute to perform clinical investigations to evaluate the SoftOx technology in humans with serious non-healing wounds.

The award was issued on behalf of the Naval Medical Research Center (NMRC) under Medical Technology Enterprise Consortium (MTEC) a biomedical technology consortium that collaborates under a transaction agreement (OTA) with the US Army Medical Research and Development Command (USAMRDC). The award issued is entitled “Clinical Development of a New Antimicrobial Agent to Treat and Prevent Biofilm Formation in Wounds”. SoftOx considers it a great honor that one of the world’s leading research organizations supports the development and the technology of SoftOx by issuing the award.

About SoftOx Solutions

SoftOx Solutions AS (SoftOx, listed at Oslo Stock Exchange Merkur Market) is a Norwegian MedTech company based in Oslo with the aim to contribute to fight major threats to human health, namely; the Emergence of Antimicrobial Resistance (AMR), Biofilm Infections in Chronic Wounds and Spread of viruses. For more information about SoftOx please visit www.soft-ox.com

About Medical Technology Enterprise Consortium

MTEC is a biomedical technology consortium collaborating with multiple government agencies under a 10-year renewable Other Transactional Agreement with the U.S. Army Medical Research and Development Command. To find out more about MTEC, visit www.mtec-sc.org.

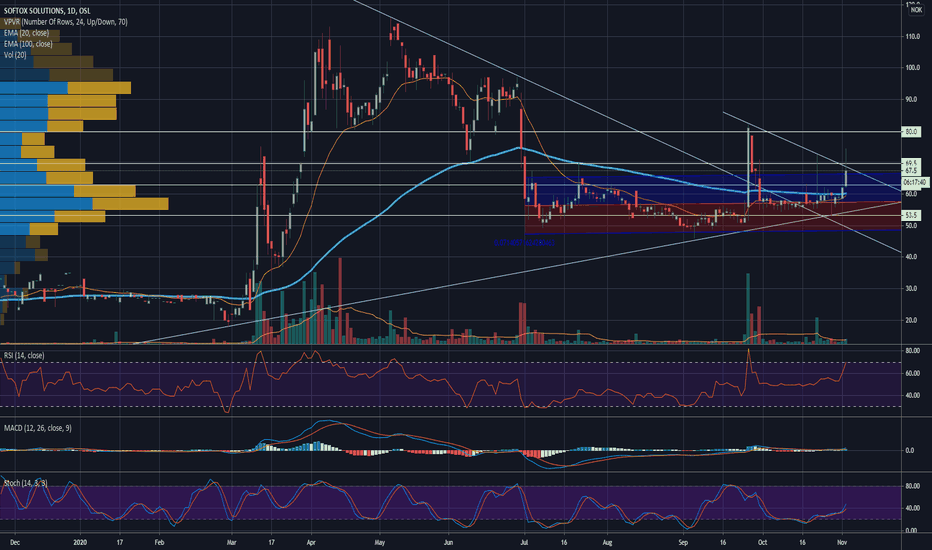

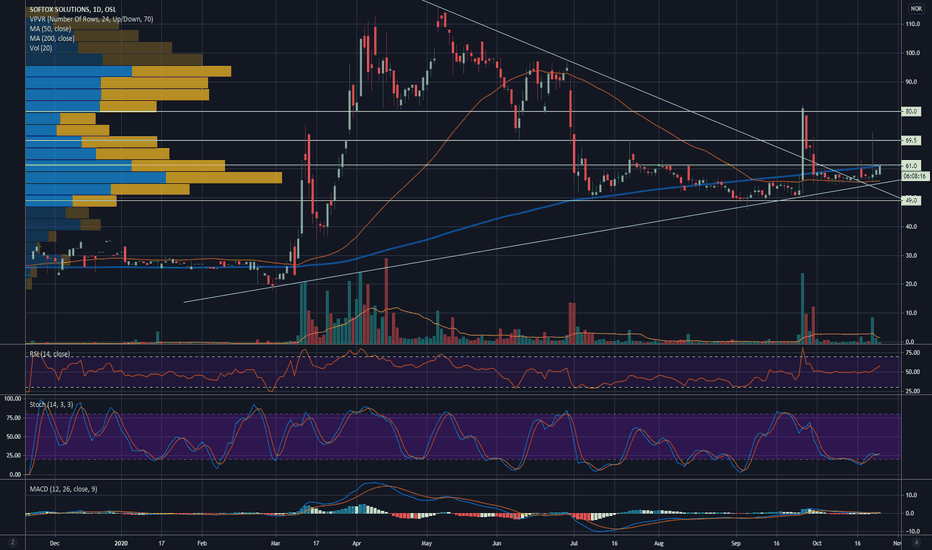

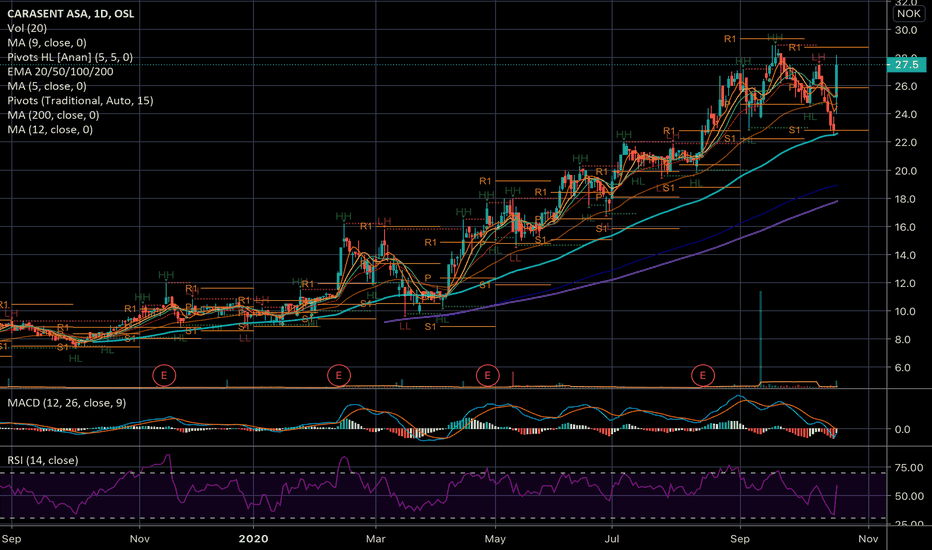

Possible break of trend line15 day EMA, indicates a test of a new high. Potentiel breakout from trendline, could cause new all time high

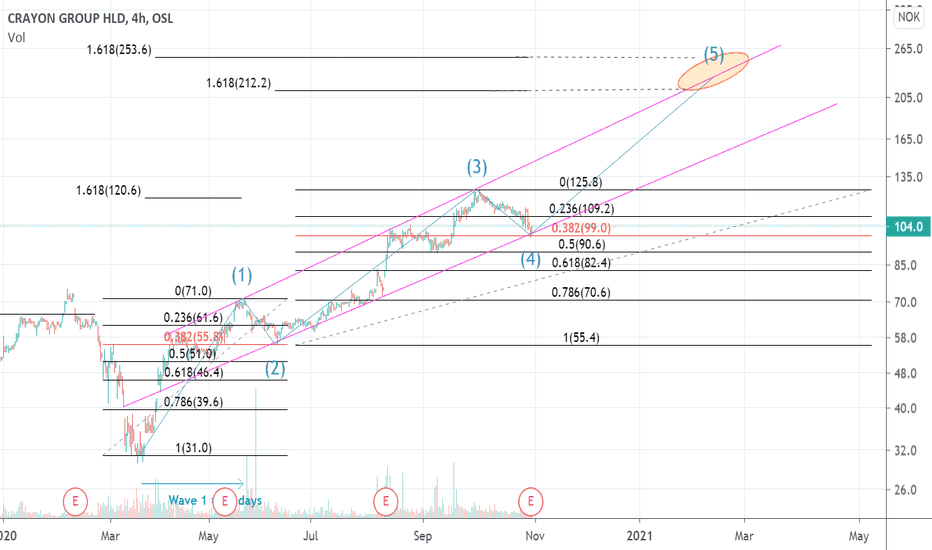

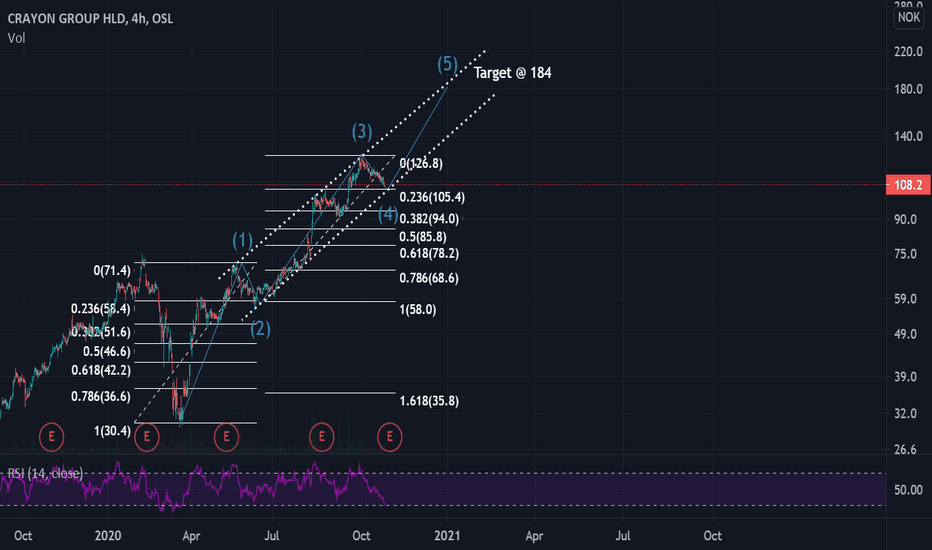

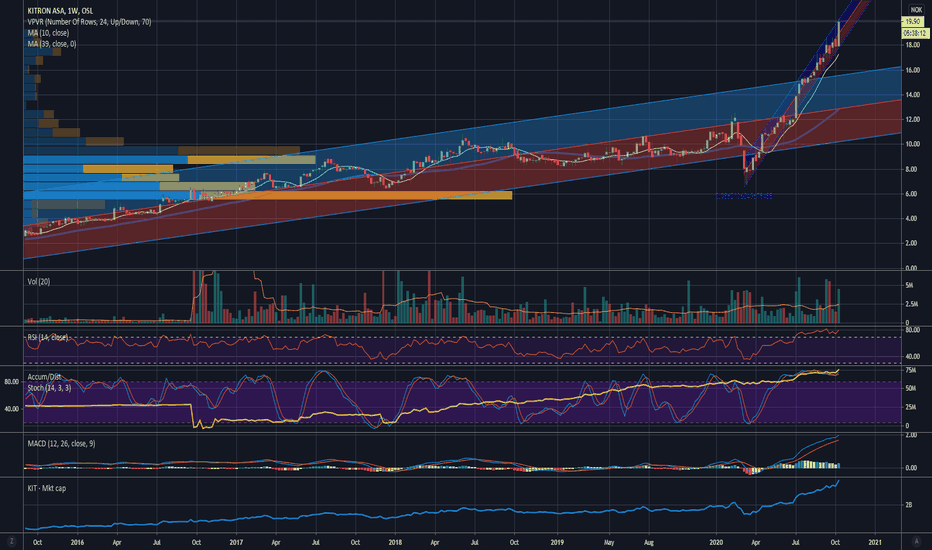

CrayonTwin 0.382 retracement coinciding with a channel support line.

Crayon has a habit of extending 1.618 of previous run before a correction (wave 3 = x1.618 wave 1), ranging back to 2018. If these extensions were applied to Wave 3 and to Wave 1→ peak Wave 3 and with a target being the channel resistance it would lead to a target somewhere within the red bubble in early 2021.

Wave 1 and Wave 3 have an almost identical % rise (128.2% and 126.9% respectively). If these % gains were applied to wave 5 at a place where it would coincide with the resistance line of the channel it would also lead to that target being met somewhere in early 2021 within the red bubble. However there is no guarantee there will be a third identical % rise and the prioritized target is the channel resistance line.

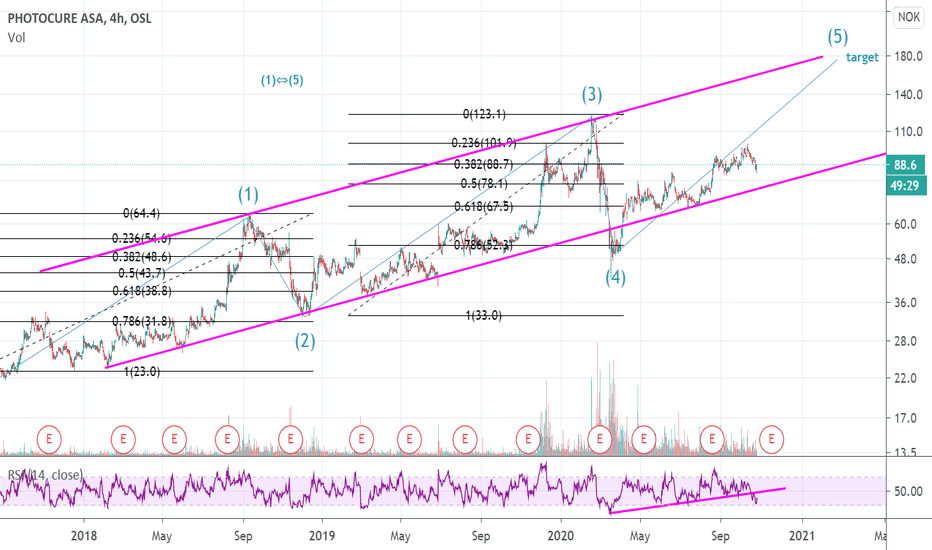

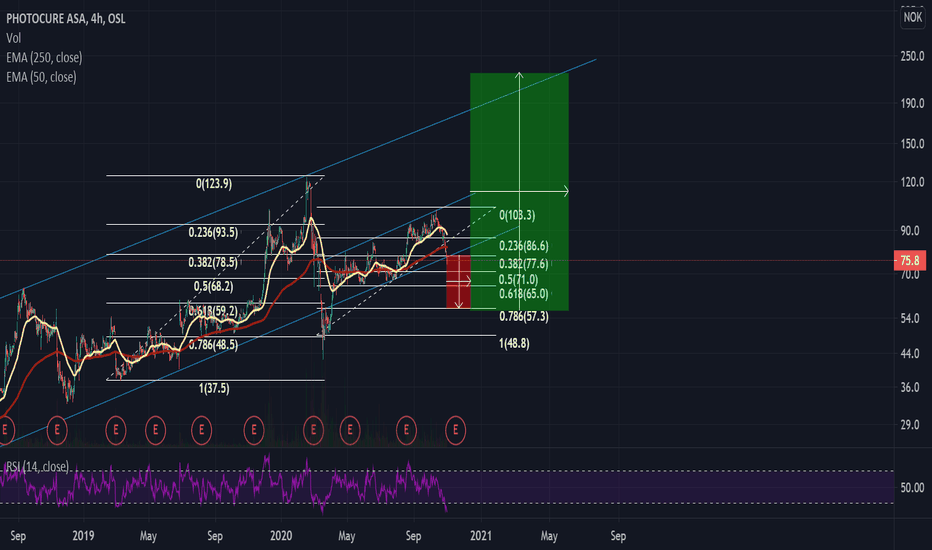

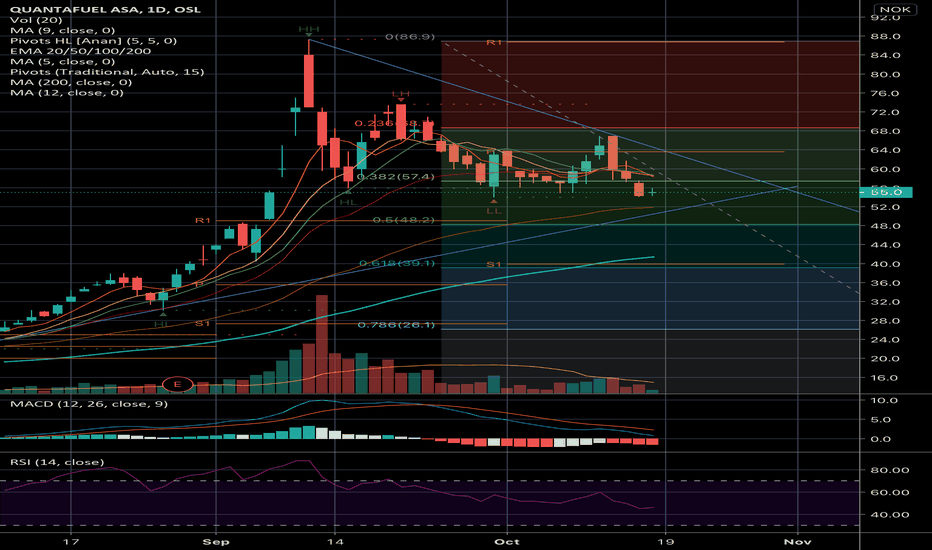

Photocure Long (retracement first)The whole stock market is experiencing the same type of "crack" as it did back in Feb/March, now being fueled by a Covid second wave and uncertainty around the US elections. Photocure's RSI is approaching its year low levels in March. The down period in March lasted for about 1 month. The length of this down period will be more uncertain depending on the outcome of the election. Regardless, I see Photocure retracing to between 71 and no more than 57NOK (which would equal a retracement of 0.786, same as in feb/march) before turning around and going to new heights. Currently the company's market valuation is around 2bn NOK. A price target of between 180-220 NOK in May 2021 would give it a market value of 5-6bn NOK which is not unlikely at all. 50 day MA will most likely cross down the 250 MA at first. When it crosses back up, we'll know this company will go to new heights.

Crayon Long - Fibonacci x Elliot WaveCrayon looks to have entered a bullish pattern closely resembling the elliot wave theory. Support and resistance levels fit well with what is expected to see in a fibonacci and elliot wave combination. RSI shows the stock has not been this underbought since March. Support at 105 and price target is set to about 184 in January. If Crayon falls through the 105 support line, next support is expected to appear at 94 NOK.

#SoftOx closer to a possible breakthrough against #covid19The Danish Medicines Agency has given its recommendation for further development of the SoftOx inhalation solution for the treatment of respiratory infections, including COVID-19.

The SoftOx Inhalation Project aims to develop an inhalation solution for the treatment of respiratory infections. This has the potential to be a breakthrough in the treatment of respiratory infections including Covid-19 infections. Following a scientific advisory meeting with the Danish Medicines Agency, a favorable development path has been suggested to be able to start testing in humans as soon as possible.

- It is now expected that the first studies in humans can start as early as the second quarter of 2021. SoftOx will therefore immediately start preparations to provide the necessary documentation that involves further safety studies in animal models, says Geir Almås, CEO of SoftOx Solutions.

- The need for new solutions treating respiratory tract infections is significant, this is a market which with conservative estimates for the EU and the US is approximately 12 billion USD. The number can probably be doubled looking in a global perspective, continue Almås.

This technology is unique, it is simple, exceptionally effective and does not trigger resistance. The effect is also independent of possible new mutated variants, as recently reported for the Corona virus.

- My team and I believe that we are facing a breakthrough in the treatment of difficult infections, both viral and bacterial. We have tested SoftOx solutions in the respiratory tract and we see that this can be an important treatment principle that can help fight the ongoing pandemic and future epidemics and pandemics ", says Professor of Microbiology and trial leader Thomas Bjarnsholt at the University of Copenhagen.

For more information contact:

Professor Thomas Bjarnsholt; tbjarnsholt@sund.ku.dk +45 206 59 888

CEO Geir Almås; geir.almaas@soft-ox.com +47 977 59 071

Professor Thomas Bjarnsholt is a member of the company's Scientific Advisory Board and has 20.000 stock options in SoftOx Solutions.

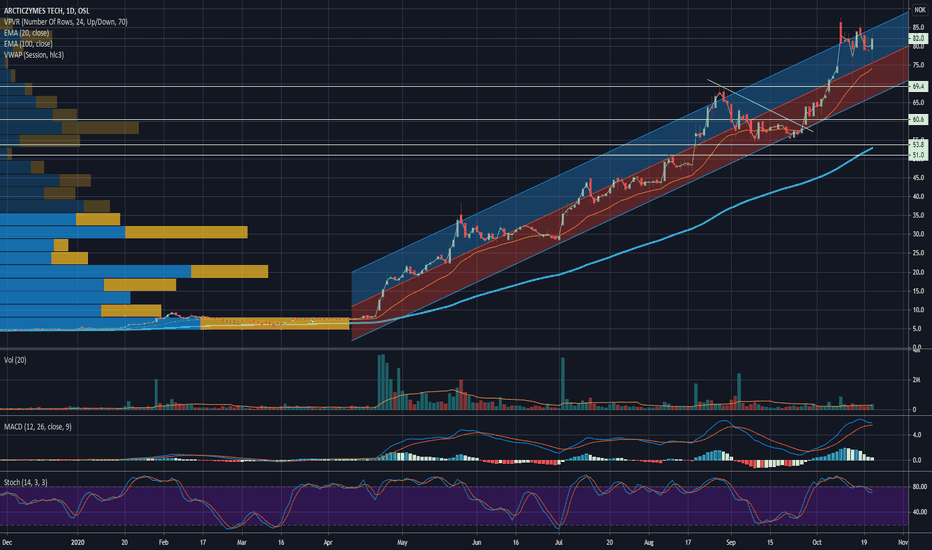

ArcticZymes $AZT Q3 2020 reportHighlights for Q3 2020

• Annual group sales exceed 100 MNOK for the first time

• Gross profit for the Group improved 65% to NOK 26.0 million (Q3 2019: NOK 15.7 million)

• ArcticZymes had Q3 sales of NOK 19.5 million growing by 63% (Q3 2019: NOK 12.0 million)

• Biotec BetaGlucans had Q3 sales of NOK 11.2 million growing by 7% (Q3 2019: NOK 10.5 million)

• Upsides relating to COVID-19 pandemic is estimated at NOK 4 million for ArcticZymes and NOK 1.25 million for consumer health

• The Group delivered positive EBITDA with NOK 10.1 million (Q3 2019: NOK 0.8 million)

• Cash-flow for Q3 was positive NOK 13.6 million (Q3 2019: NOK 0.7 million) giving a cash balance of NOK 69.7 million (Q3 2019: NOK 22.1 million)

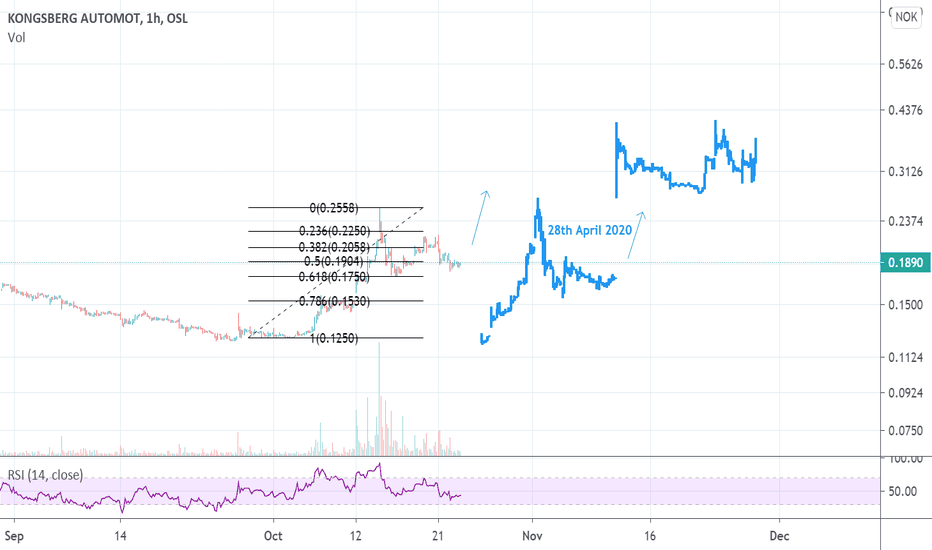

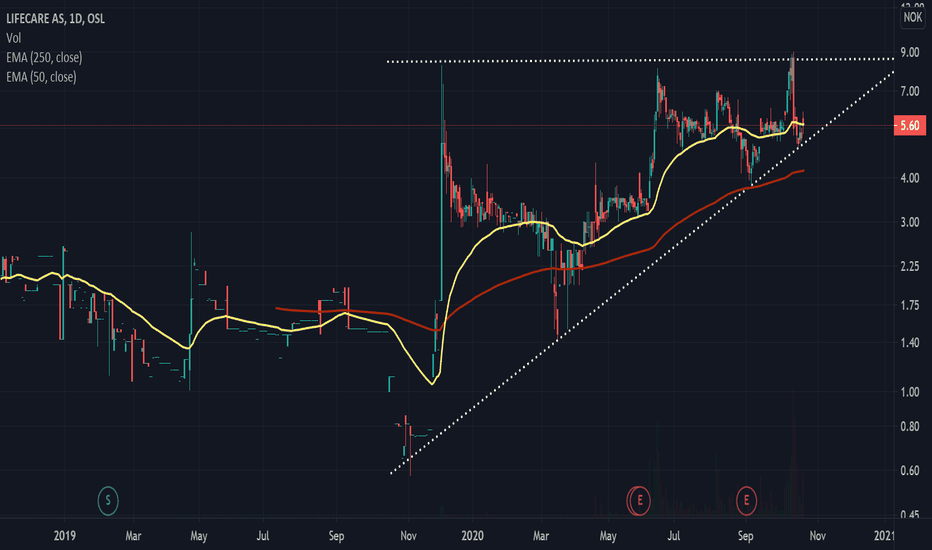

Lifecare Long (daughter company worth 4x as much)This analysis isn't as based on techincal indicators as it is on market insight. As far as the technical signs go, RSI and stochastic RSI show that it is significantly underbought. The appearance of an ascending triangle formation is also noticable, with high potential gains if it breaks up. The most interesting find is that Lifecare has ownership in Digital Diagnostics (a company which has come far within Covid-19 testing) worth over 4x as much as the Lifecare valuation itself. This coupled with the fact that Lifecare has conducted successful sensor technology testing for Diabetes, and it being the only commercial actor in this consortium, could potentially take this company to new heights.

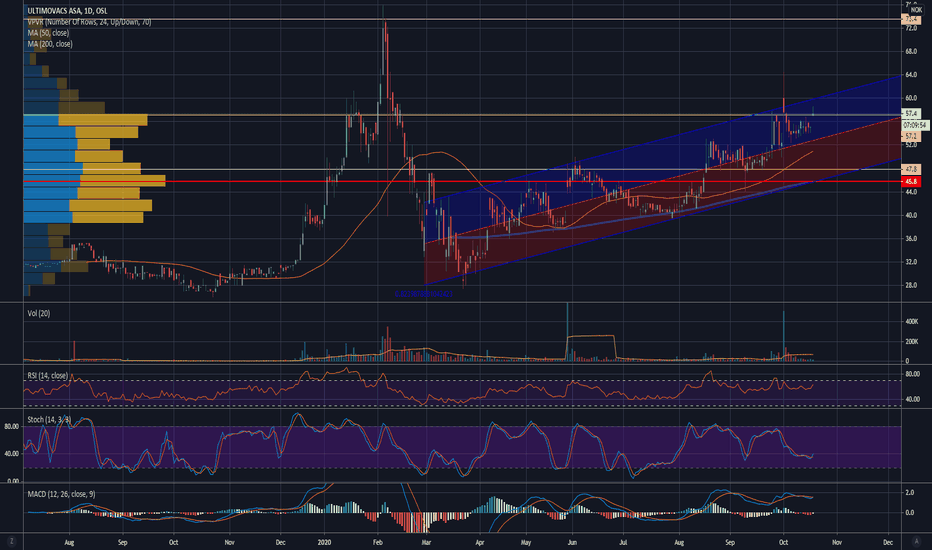

Ultimovacs Announces Updated Positive Results from Phase I TrialOslo, 19 October 2020: Ultimovacs ASA ("Ultimovacs", ticker ULTIMO), today

announced five-year overall survival data from the Phase I trial evaluating UV1

as maintenance therapy in patients with non-small cell lung cancer. The results

confirm achievement of the primary endpoints of safety and tolerability and

indicate encouraging initial signals of long-term survival benefit.

"Ultimovacs has established a growing body of clinical data demonstrating a

strong safety and tolerability profile for UV1 and a range of preliminary

efficacy signals in several cancer indications, all of which supports the

further development of our proprietary cancer vaccine candidate," stated Carlos

de Sousa, Chief Executive Officer at Ultimovacs. "The long-term follow-up

results announced today demonstrate that treatment with UV1 is safe both at the

time of administration and throughout the follow-up period of at least 5 years.

Non-small cell lung cancer highly expresses telomerase and remains an indication

in great need of new treatment options for patients."

In the study, a total of 18 non-small cell lung cancer patients whose disease

had not progressed after receiving at least 2nd line treatment with chemotherapy

were enrolled to receive UV1 monotherapy as maintenance treatment. Outcomes of

the study included the safety and tolerability of UV1 as well as initial signs

of clinical response. As per the cut-off date of June 2020, every patient in the

trial reached at least 60-months of follow-up post treatment with UV1. At the

five-years landmark, the Overall Survival (OS) rate was 33% and median

Progression Free Survival (mPFS) was 10.7 months. Throughout the follow-up

period, none of the patients experienced unexpected safety issues related to

UV1. Further, none of the patients alive after 5 years have received other

immunotherapy after the vaccination with UV1.

"At the time of the study initiation, there were no checkpoint inhibitors

available for treatment of this patient population. For patients that received a

second-line of chemotherapy the expected 5-year survival rate was less than 5

percent," stated Jens Bjørheim, Chief Medical Officer at Ultimovacs. "While our

Phase I study is non-randomized and conducted in a small population, it is

promising to see that UV1 was safe and well-tolerated and that using UV1 as a

maintenance therapy could potentially provide benefit to patients in need of

novel approaches."

Ultimovacs presented 48-months of follow-up data at the Society for

Immunotherapy of Cancer's (SITC) 34th Annual Meeting in November of last year.

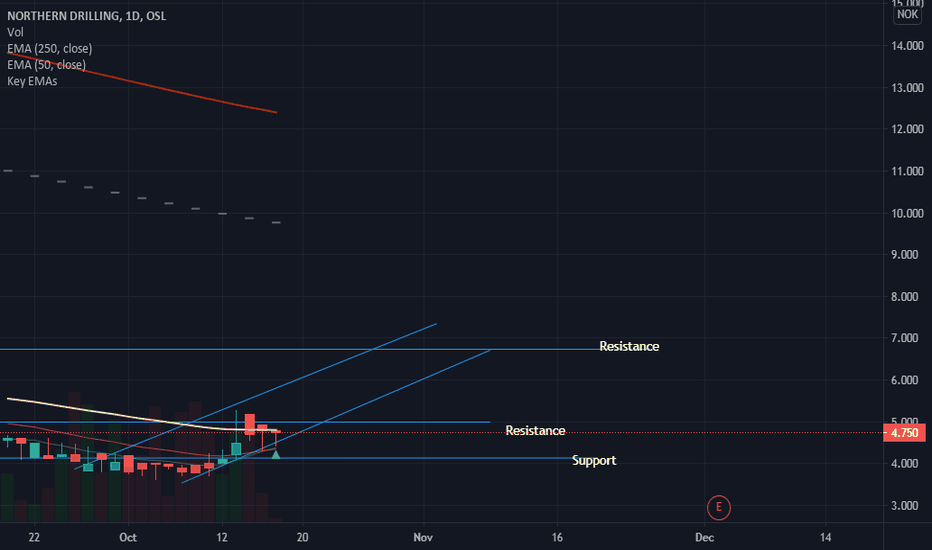

NODL long, short-term MAs moving up. Northern drilling seems to have bottomed out after an extended devaluation period. The stock has oscillated between 3 and 6 NOK for the past months and looks to have entered a bullish channel. Technical signals include a recent 10 and 20 MA crossing up in the 4 hour and 1 day intervals. The stock's potential ability to break out over its resistance levels at 5 and 6.7 NOK could indicate a longer bullish trend. Stochastic RSI and RSI indicate that the instrument is close to or overbought as of now. Operating revenue first six months of 2020 increased from last six months of 2019, however second quarter results decreased YoY compared to second quarter of 2019.

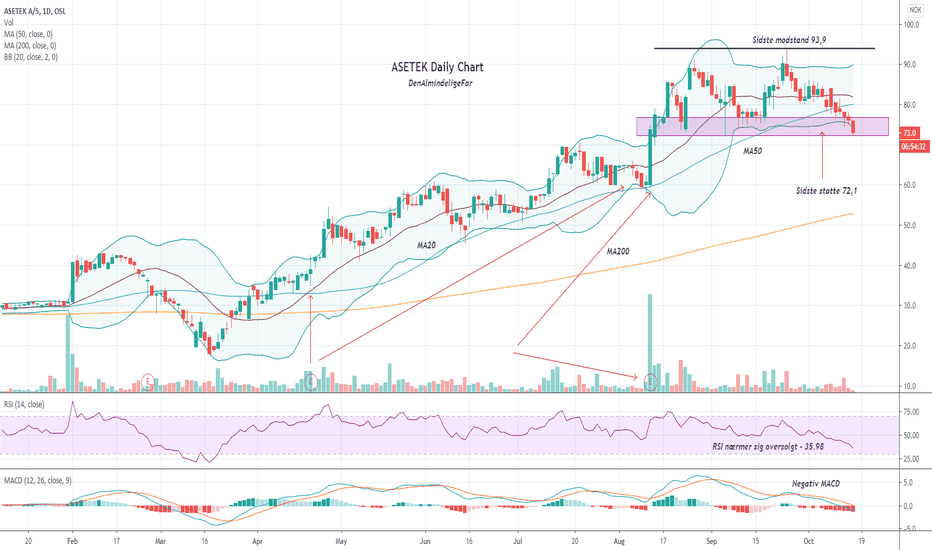

Asetek balancing on last supportRSI moving towards oversold

MACD bearish

Still long term uptrend

Upcoming Earnings.

Love to supply near 72.

Reversal might show next week.

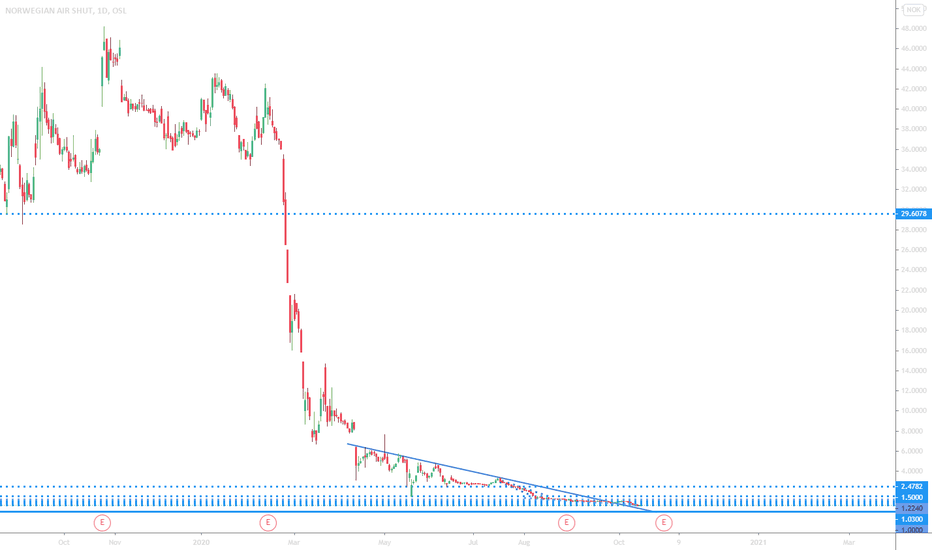

Norwegian Air shuttle's potential - stock price down 99.72%Hello you all

As you know Norwegian Air Shuttle is a company which is heavely affected by the actual pandemic.

So why could the stock have a huge potential in the near/medium term future?

- Chinese government invested via BOC Aviation into Norwegian

- cash burn reduced to <300 million NOK per month

- current stock price 99.72% under all time high

Norwegian announced at the beginning of the pandemic, that there will be a liquidity risk from Q4 2020/Q1 2021. Norwegian is currently talking with the Norwegian government for another bailout. If that will be accepted, it could give the company money for another six month's or so, which means, that a bankruptcy is unlikely during that period of time. Chances of a higher stock price stands pretty good.

In my opinion it makes totally sence that the stock price went down heavely during this time. But 99.72% of all time highs?

Nevertheless, be careful, the company has a possibility to go bankrupt. Could go to zero.