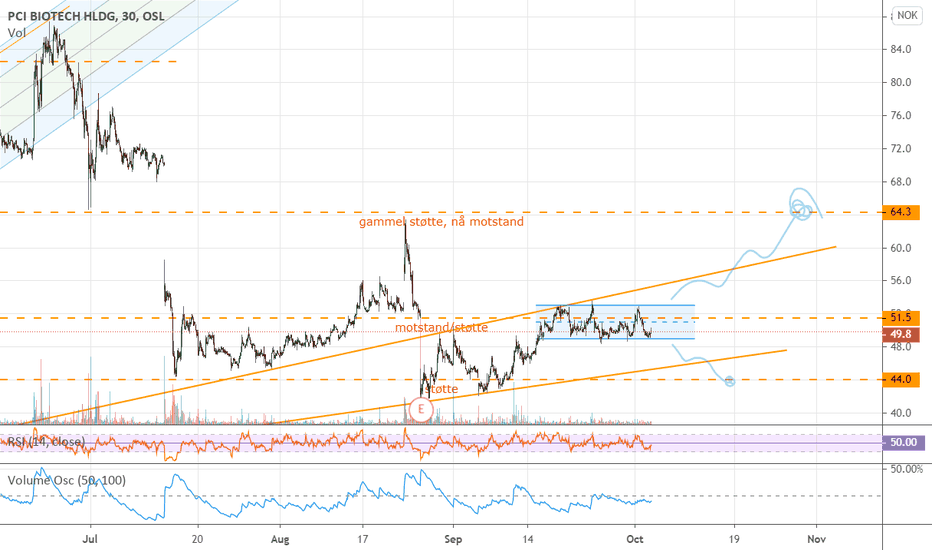

PCI Biotech $PCIB bullish breaching 100EMA coming into Q4* Norwegian Drug Delivery Platform Biotech operating within the Oslo Cancer Cluster

* Notoriously volatile norwegian small cap with large amount of stock held by enthusiastic retail investor crowd.

* Ongoing research collaboration with AstraZeneca recently concluded, longs betting on partnership deal incoming.

* Stock typically rallies ahead of quarterly reports and experiences sell the news events.

* Norwegian biotech flying at All Time High valuations after recent Vaccibody partnership with Genentech.

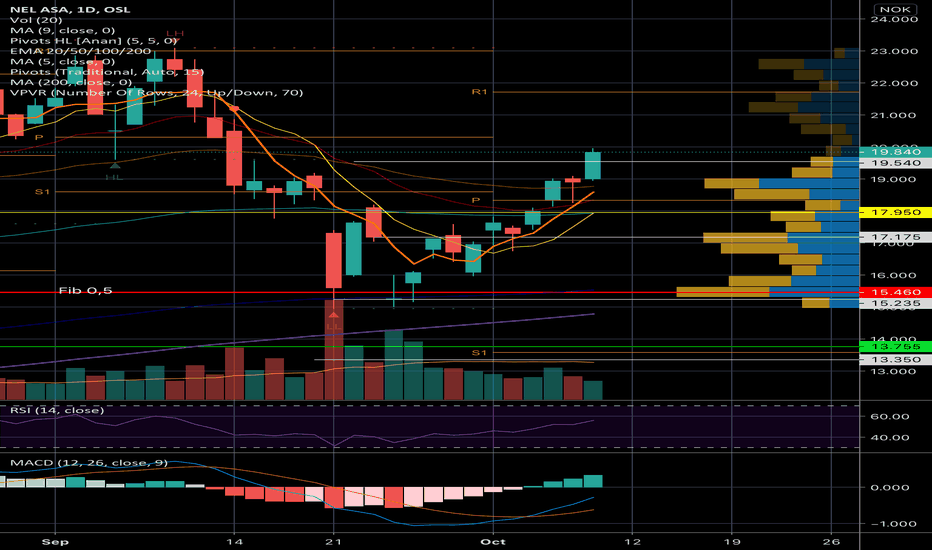

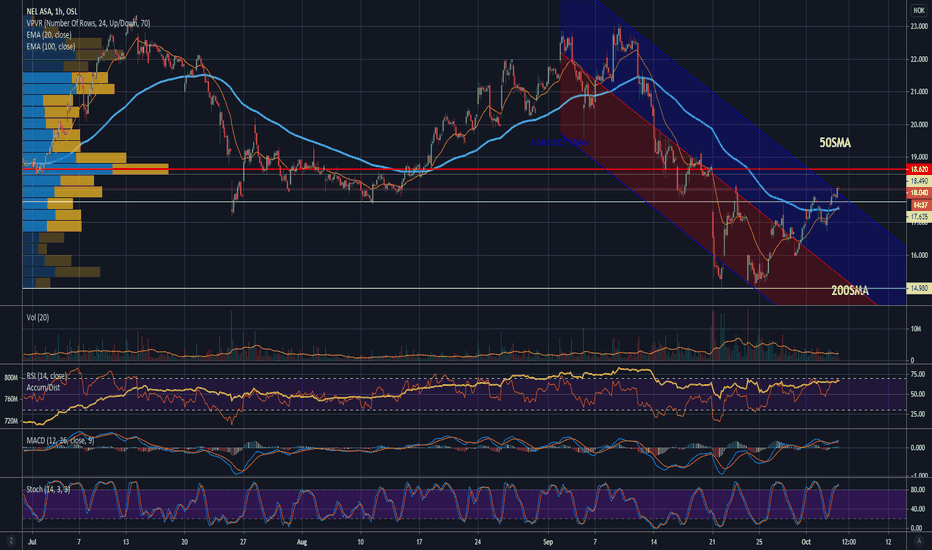

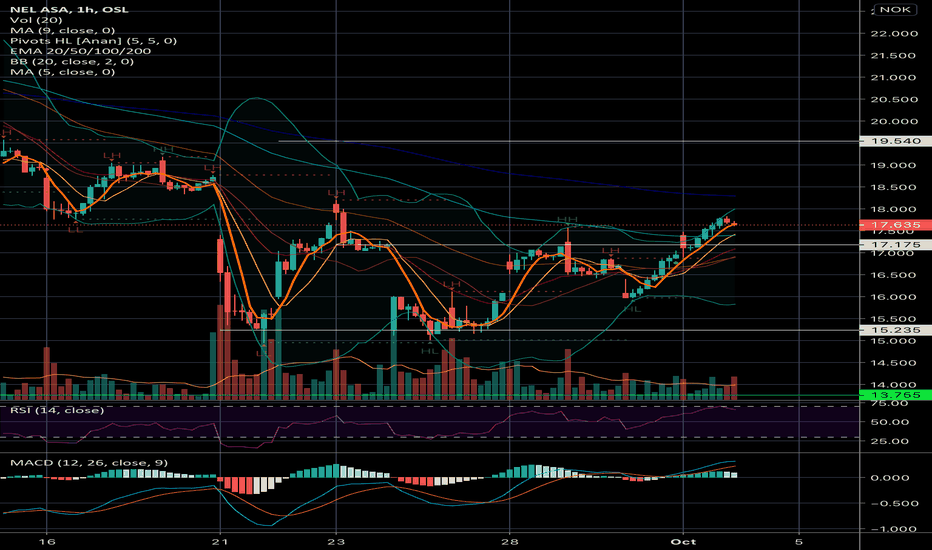

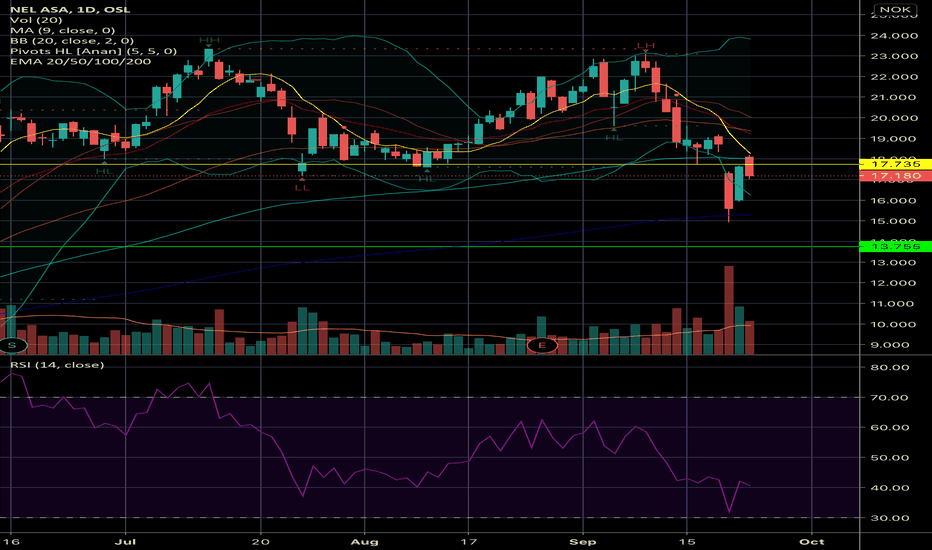

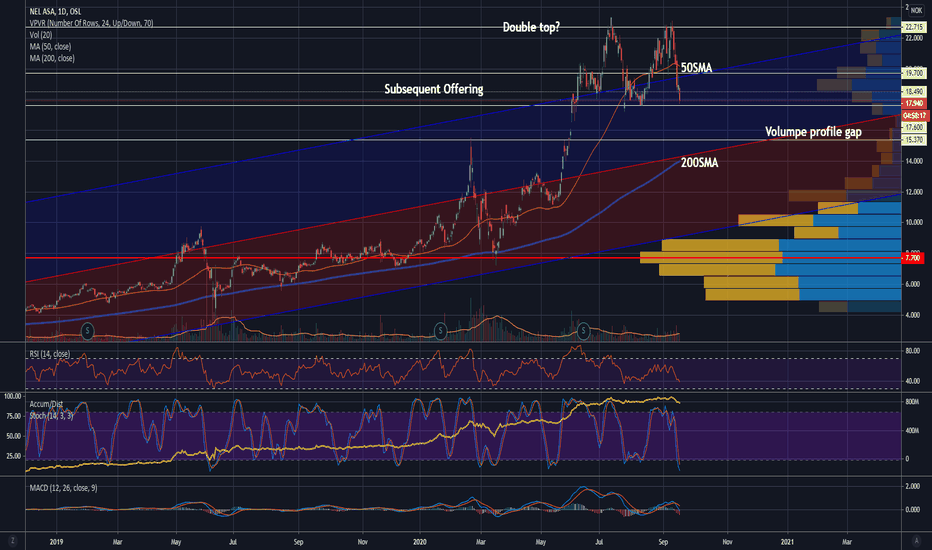

$NEL Hydrogen testing breakout from short term downtrendNEL has become a trader favourite with recent volatility after Nikola was hit by short seller report.

Hourly 20 EMA breaking above 100 EMA, often seen as a promising momentum shift indicator.

NEL needs to break above support/resistance at about 18 and consolidate to regain a bullish sentiment in the short term.

Todays top 20 list show that the Clearstream crowd are still buying NEL stock like hot cakes, reducing fear that main investors would be dissuaded by recent price movements

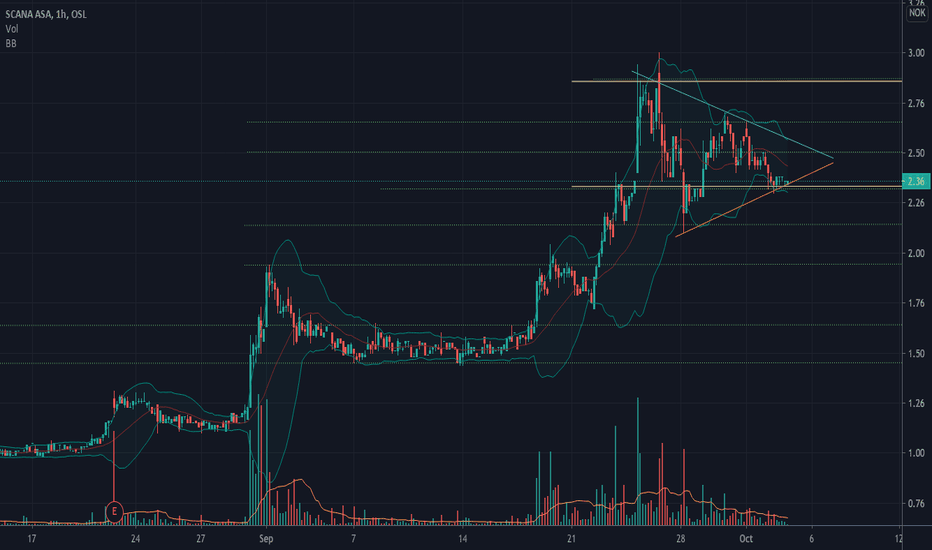

Scana, bullish triangleSCANA had been in a strong uptrend since it has restructured and gained new, valuable contracts.

The stock is now in consolidation. The bullish triangle formation and bullish candlesticks indicate a new uptrend ahead. Low RSI level at about 38 with hidden divergence and bottoming on Bollinger bands as well.

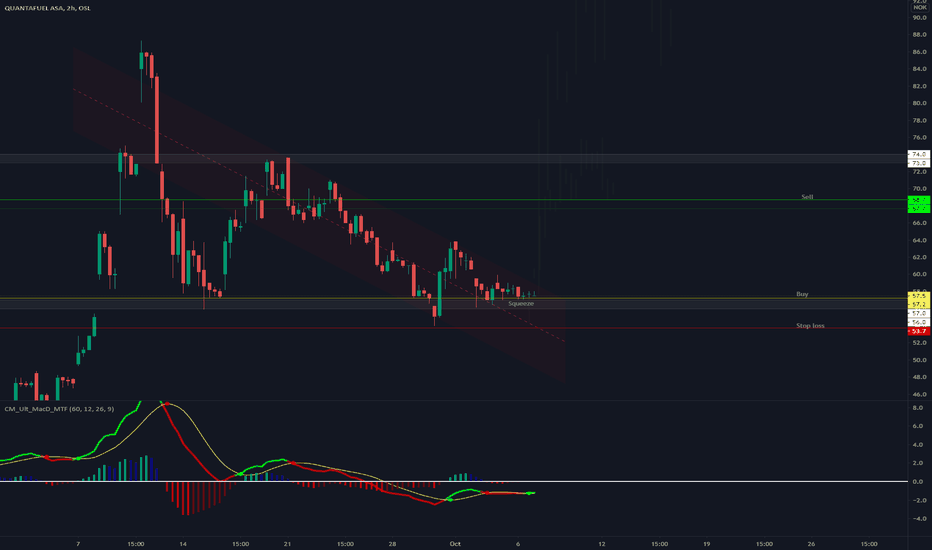

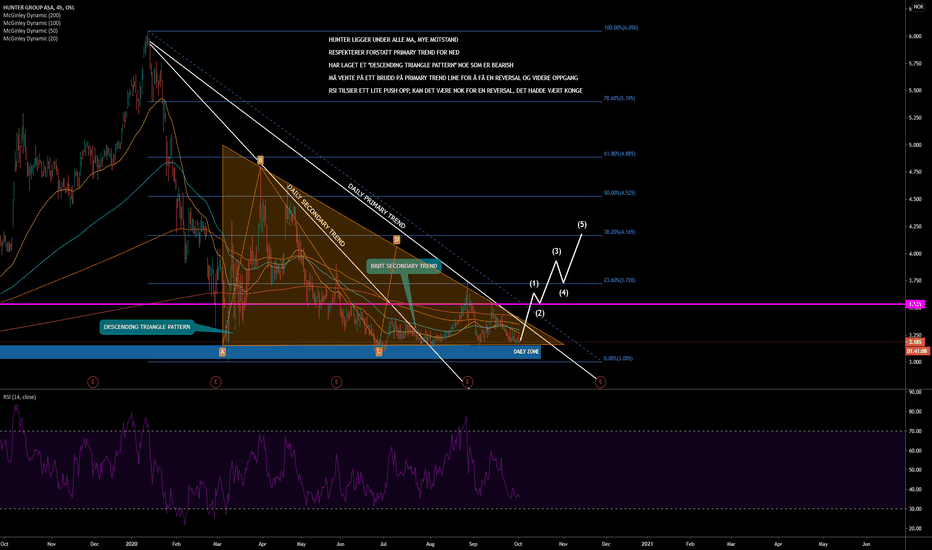

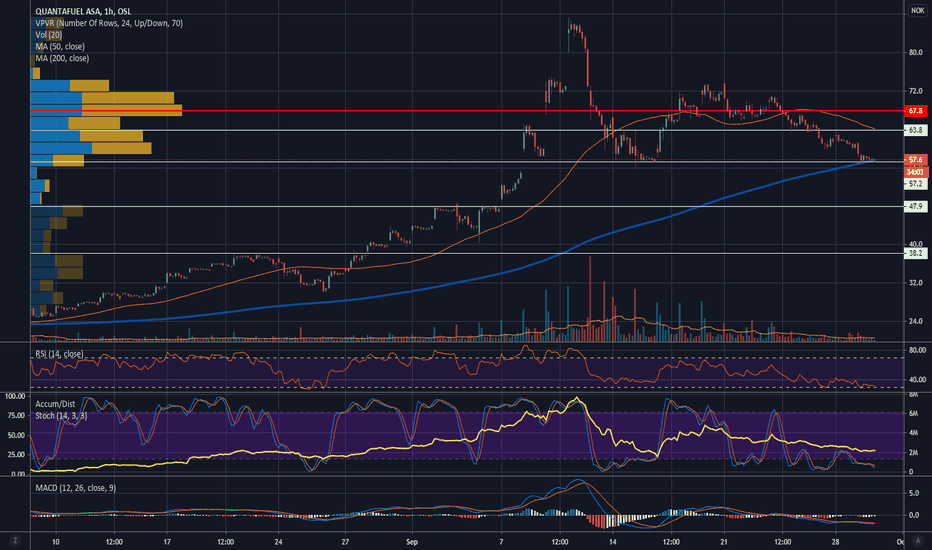

QuantaFuel trading at last relevant support – mind the gapQuantafuel executed an extremely successfull round of financing after strong newsflow, but is currently trading at last relevant level of support.

Note the volume profile in the chart.

Investors could try a new long position at this price level, but should have a keen eye on risk management. Or do the safe choice, and wait to see if the stock bounces.

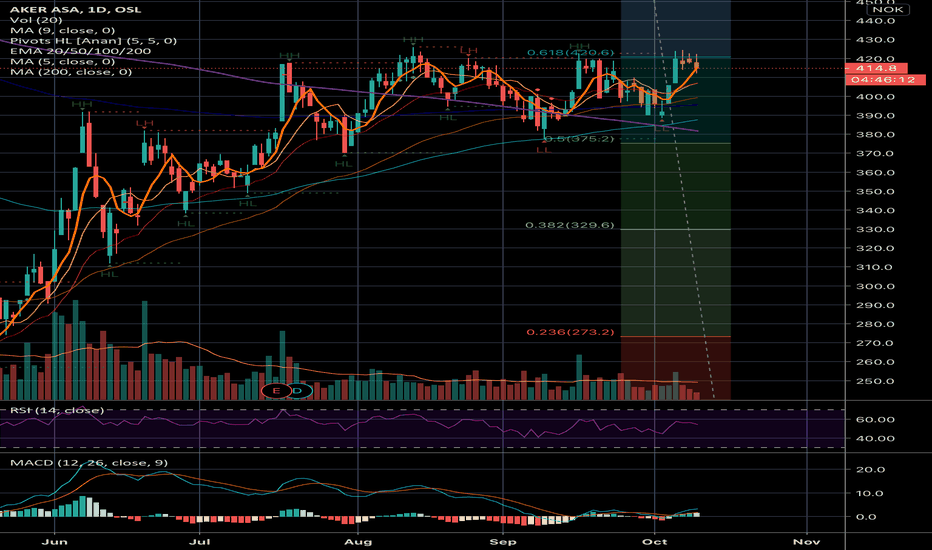

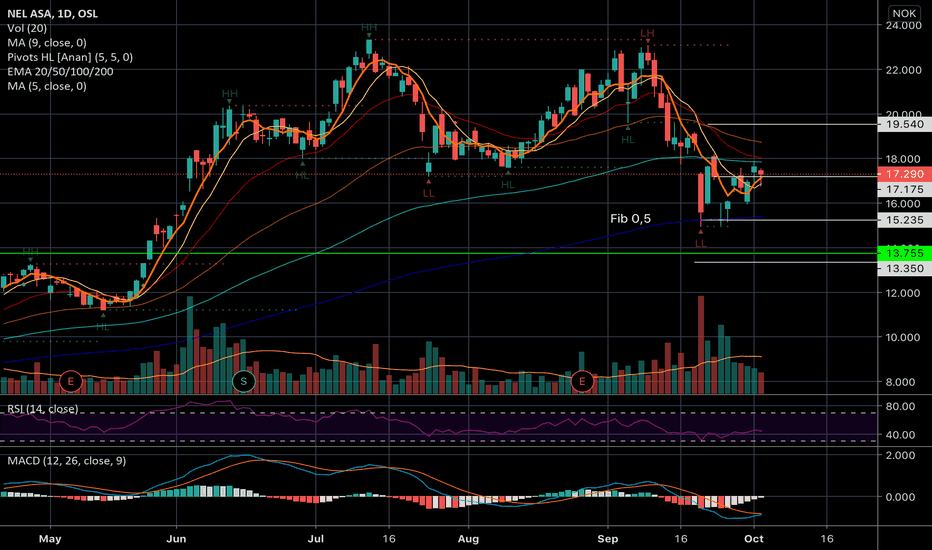

NEL stock pulling back sharply after Nikola crash - but no panicAs expected in previous trading idea, NEL falling under important support confirmed the double top sell signal.

But NEL is a stock that has experience several huge volatility events in the past, with earlier drops from top to bottom as large as 53 and 58 %.

Compared to those the recent drop of 36% seem to not cause any sense of panic among the shareholders at all, especially considering that Nikola short report hit at the exact same time as the large US tech selloff.

Investors should consider the volume profile and be a bit patient to see if the stock consolidates already, or that some more time is needed for the market do do its price discovery.

Significant insider by reported this week:

(Oslo, 25 September 2020) Bjørn Simonsen, VP Investor Relations & Corporate

Communication of Nel ASA ("Nel") has today through Simonsen Invest AS, a company

100% owned by Bjørn Simonsen, purchased 100,000 shares in Nel at a price of NOK

15.39 per share. After the transaction Bjørn Simonsen holds 1,616,138 shares and

616,000 options in Nel.

Cloudberry to the clouds?Ride the green wave they say, this green gem cloud_me currently trading on m-market might just be a ticket for the ones who got on the green train too late. A pattern and a pathway is soon establishing. By the looks of it, a bullish pennant or bull flag, maybe a bit too early to see. Read a little here about it www.cloudberry.no make up your own mind but clean wind and clean water energy is thumbs up at the moment. Also, with electricity currently at rock bottom price this looks juicy!

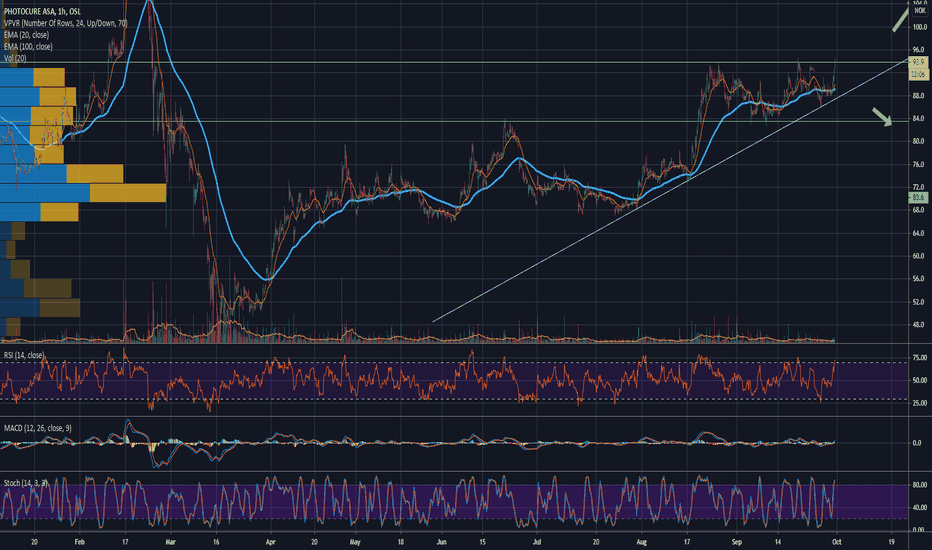

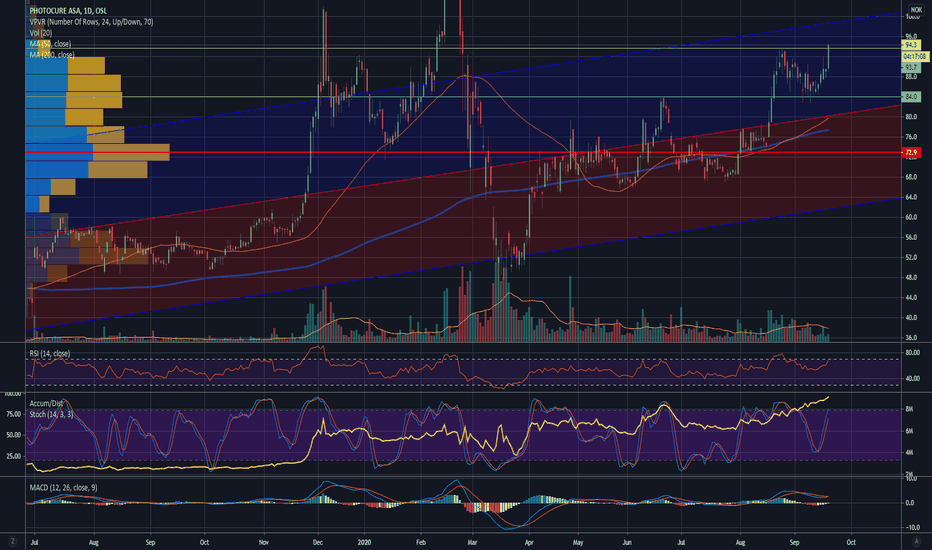

Photocure $PHO trading above previous top as shorts reduce posThe Photocure share price has been increasing steadily even in the face of short sellers thas has been adding to their positions in Photocure stock for three weeks straight.

With the stock now trading above the last top, longs will be hoping to see a short squeeze effect in the the price development.

Recent 50SMA / 200SMA golden cross.

Top 20 ownership increasing steadily.

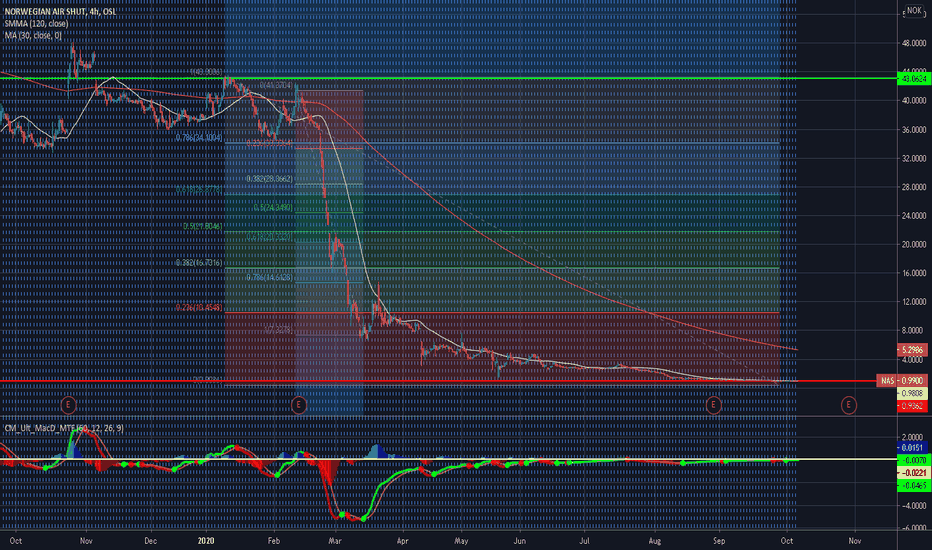

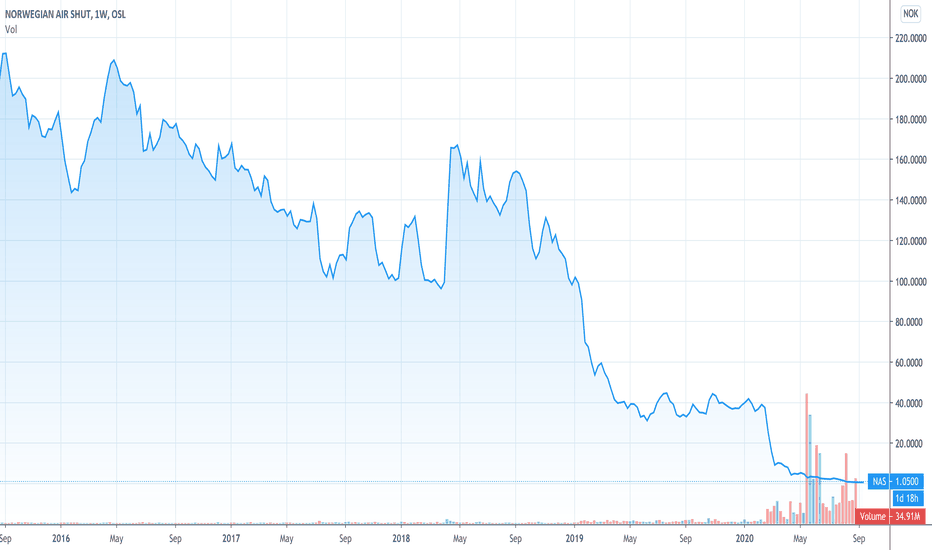

SHORT: Headed for bankruptcy....Norwegian Air senior execs are now desperately pleading for additional funding to make it through the winter. Its not looking good. Sounds very much like the last gasps for air before bankruptcy proceedings start.

Competitor SAS has been bailed out by Denmark and Sweden, but Norwegian Air has already burned through its bailout from Norway.

All the healthier airline stocks have been going up lately: Delta, EasyJet..... but NAS is still headed down and will have to be diluted further in the unlikely event it racks up even more debt.

I have sold off all my holdings to save what's left before the stock plummets to zero end of this year or early 2021.

MarketScreener has this stock a buy at 0.6, down another 40%......

Sad to see Norwegian Air head into bankruptcy yet again......I have enjoyed their quality budget flights.

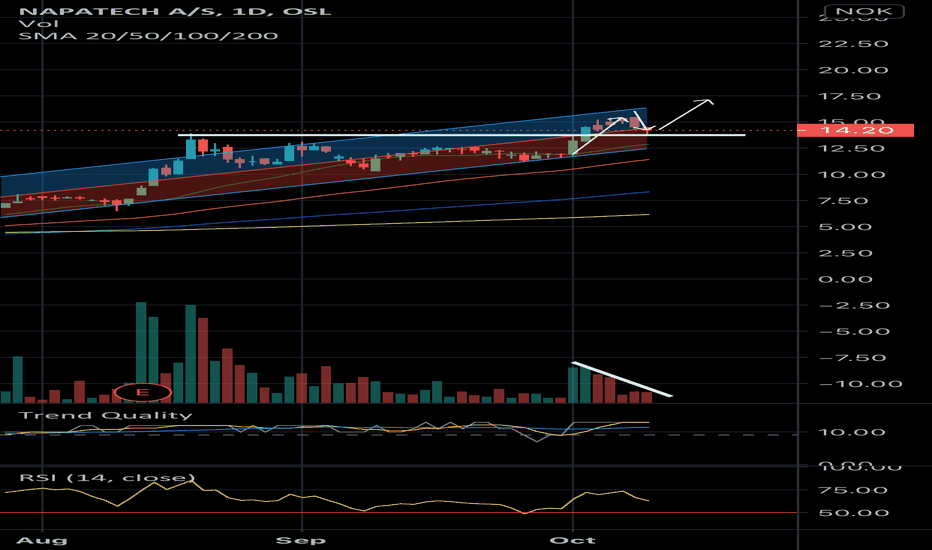

NEL hit by Nikola Short hit piece - mind the gapWith the Hindenburg short accusation report against Nikola, the price of the NEL stock has come under pressure, indicating a possible double top pattern and putting the subsidiary offering in doubt.

The stock need to protect the last major support level at around 17.5, or the clearly visible gap in the volume profile will come into play as large amount of recent positions come deeply underwater.

With new strong disruptions to major markets, a major crash in the share price to more solid support levels in the 12-14 range can not be seen as impossible

However, any strong comeback from Nikola could cause a strong reaction to the upside.

Attractive play to consider a trade with tight stop loss. :)