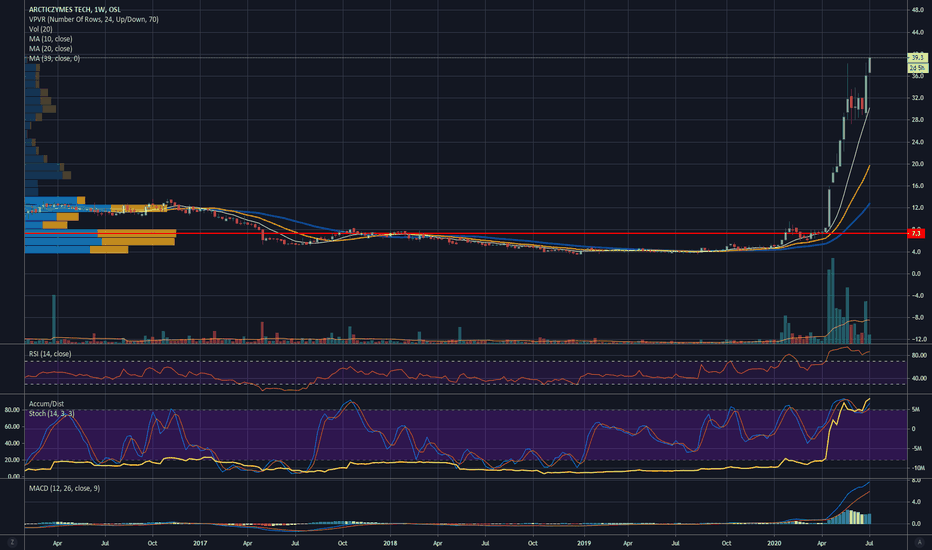

ArcticZymes is the Covid-19 stock that is valued at 197 mUSDArcticZymes has entered into an agreement with ReiThera to supply its SAN product for ReiThera’s COVID-19 vaccine candidate

Tromsø, 02 July, 2020: ArcticZymes AS (OSE:AZT), a subsidiary of ArcticZymes Technologies ASA, announces that it has entered into a supply agreement with vaccine specialist ReiThera Srl (Rome, Italy) for the supply of Salt Active Nuclease (SAN-HQ) to be used in the development and manufacturing of ReiThera’s novel vaccine candidate against COVID-19. The vaccine candidate, which is based on ReiThera’s viral vector technology, is scheduled to enter clinical trials soon.

SAN-HQ has established itself within the viral vector-based biopharmaceutical segment, where viruses are used to deliver genetic material into cells to treat or prevent disease. Due to safety concerns, regulators require manufacturers to minimize and control the amount of exogenous nucleic acids impurities (DNA or RNA not encapsulated by the vector) in the final dosage. Therefore, one or more nuclease treatments are often implemented in the downstream processing of the virus, in which the nuclease digests exogenous DNA. Exogenous DNA can also cause the viral particles to aggregate, which reduces both yield and potency of the vector. One of the key strategies to reduce aggregation involves keeping the virus at elevated salt concentrations. Unlike other commercially available nucleases, SAN-HQ digests nucleic acids with high efficiency at high salt concentrations. Furthermore SAN-HQ is utilized at much lower quantities which means less enzyme needs to be removed from the virus following its use which is another key advantage.

To put it into context, the manufacturing process of viral vaccines is a complicated and lengthy multi-stage process with many steps. SAN-HQ is utilised for one part of this process and does not end up as part of the final therapeutic vaccine. Hence, the supply deal relates to the provision of this essential component to streamline part of the process.

ReiThera, together with Leukocare AG (Germany) and Univercells S.A. (Belgium), has formed a pan-European consortium to fast-track the development of its vaccine against the novel coronavirus SARS-CoV-2, which causes COVID-19.

ArcticZymes AS, CEO, Jethro Holter said:

“We are delighted to expand our relationship in supporting ReiThera and its consortium partners with fast tracking its activities to develop a vaccine against the novel coronavirus SARS-CoV-2. ReiThera is a leading European company in genetic vaccine development focused on bringing innovative therapeutics to market via leveraging the best technologies such as ArcticZymes’ SAN-HQ. We look forward to supporting ReiThera in the development and future commercialisation of their vaccine.”

“This agreement seamlessly fits with our efforts to scale up SAN-HQ which is supported by the Innovation Norway funding recently granted to ArcticZymes in May 2020. The timely scaling of SAN-HQ production will satisfy future commercial demand from our partners such as ReiThera.”

ReiThera’s Project Manager, Marco Soriani, said:

“ReiThera’s effort to develop a vaccine against the coronavirus that causes COVID-19 relies on its solid partnerships with key pharmaceutical stakeholders, such as ArcticZymes, which provide crucial technologies to ensure a consistently high-quality product. We look forward to working with ArcticZymes on this important product development program, which aims to tackle the global COVID-19 pandemic.”

-ENDS-

About ReiThera Srl

ReiThera Srl is a biotech company dedicated to the technology development, GMP manufacturing and clinical translation of genetic vaccines and medicinal products for advanced therapies. The company’s management and scientific teams have developed a highly innovative technological platform based on simian adeno-vectored vaccines against several infectious diseases, such as RSV and Ebola. ReiThera is led by an experienced management team that has worked together for many years in previous successful enterprises, including Okairos (acquired by GSK), and has a long-standing expertise in scalable processes for viral vector manufacturing, supported by a cGMP facility inclusive of filling suite and quality control laboratories. ReiThera is also part of a pan-European consortium focused on the development and large-scale manufacture of an adeno-viral vector vaccine against COVID-19.

ReiThera has its headquarters, R&D laboratories and GMP facilities in Rome, Italy.

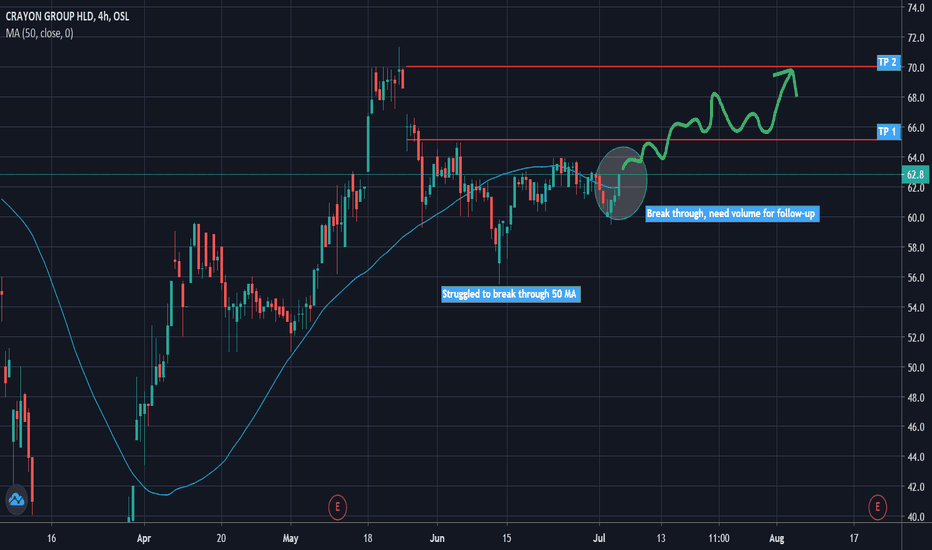

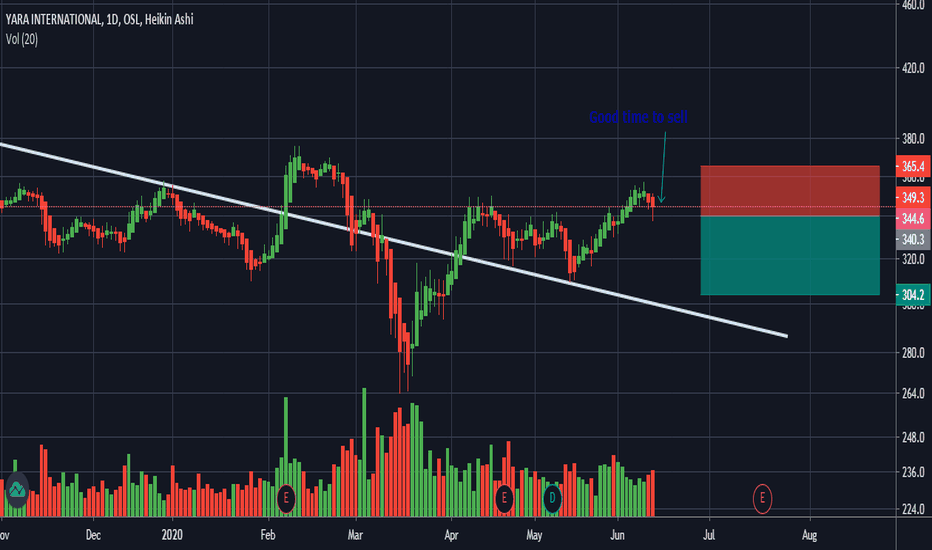

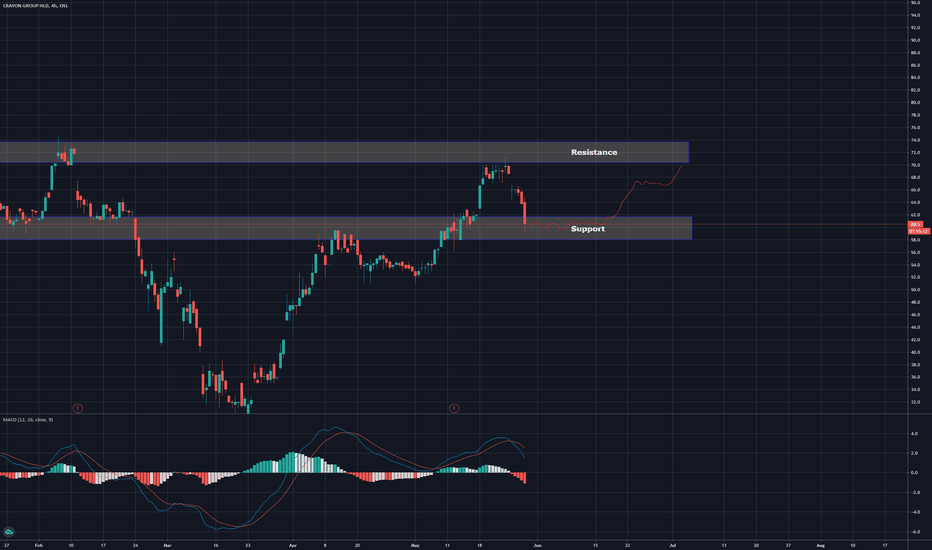

Finally time to re-test key resistance and ATH?Crayon is in general struggling with low-volume. However, end of day price action has been positive last weeks.

Convincing growth and strong market position leave no doubt that the fundamentals will deliver.

If able to keep above 50 MA with volume on Monday, should test TP1 and eventually TP2 during July.

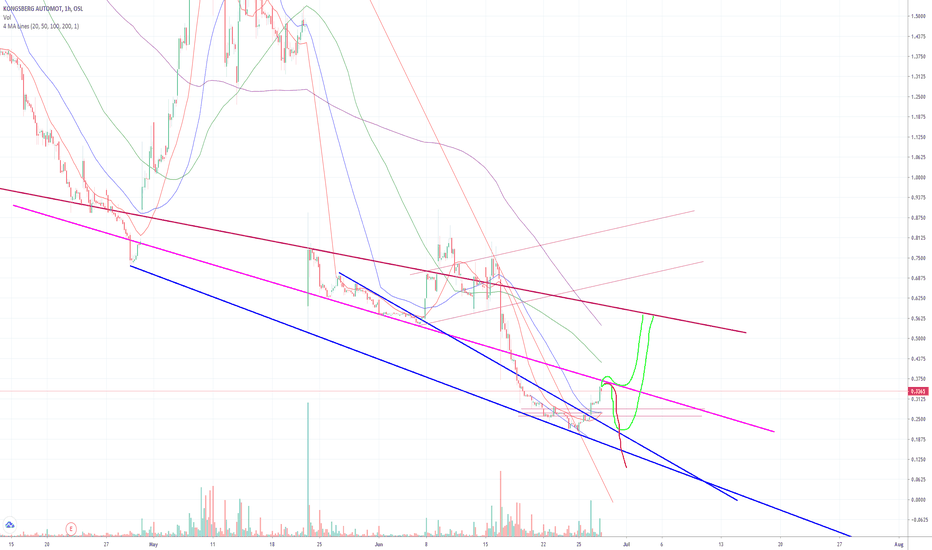

Risky buyLet's see if it can break the purple line and find support on it, 60% gains possible then (Fat red resistance line). If it breaks the fat red line, who knows how high we can go.

If it bounces of the purple and find support on the blue one's 160-280 % gains. Just see where it finds support before buying.

I bought already on 0.28 NOK (bullish rsi on daily chart) watched it go down but decided to keep it.

I wouldn't throw too much money at it, but i also don't think it will go bankrupt.

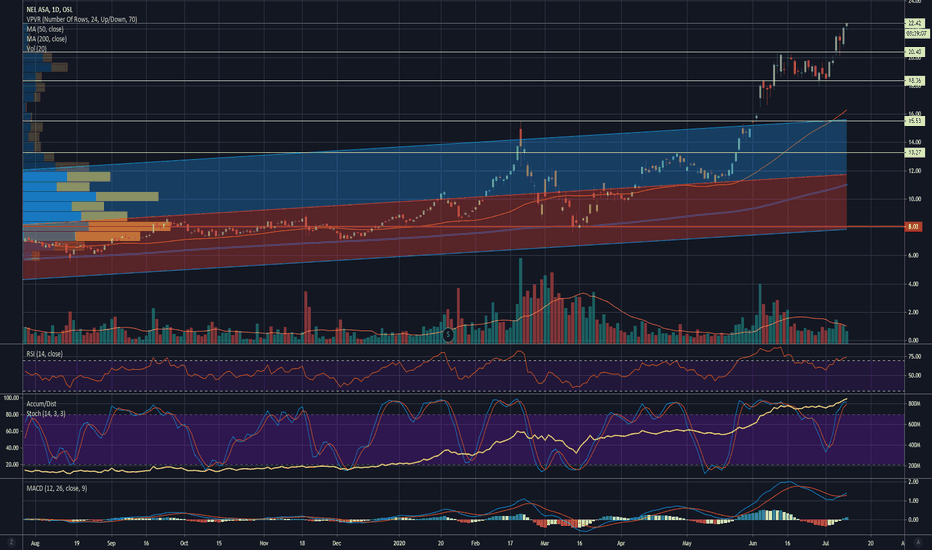

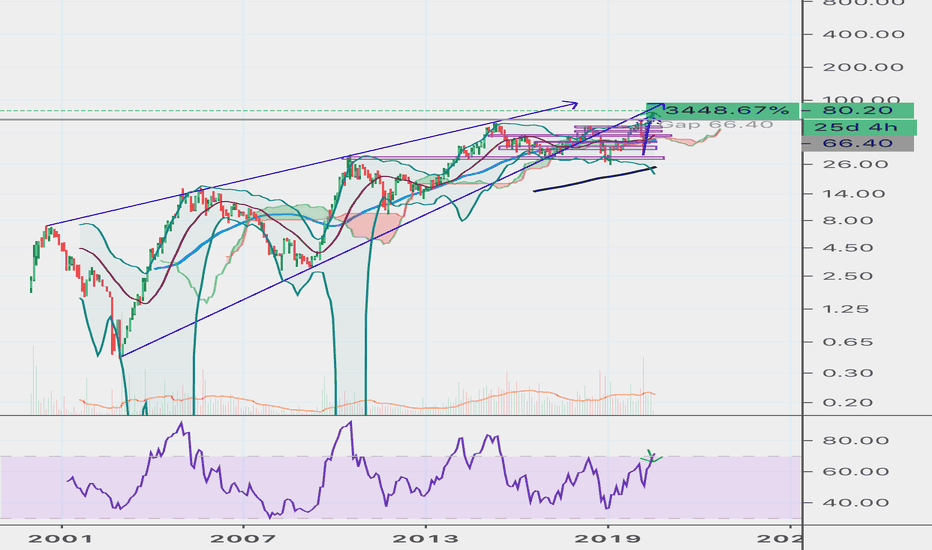

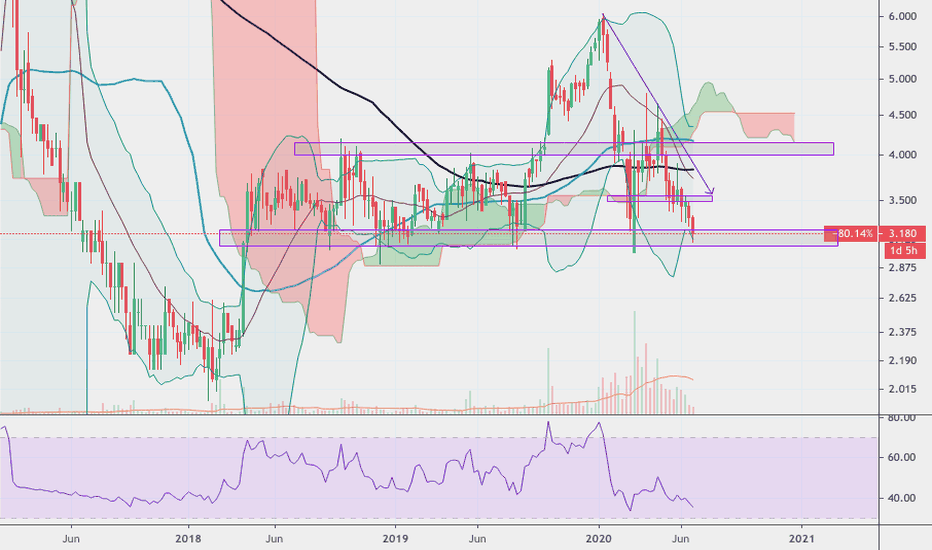

NOD bullish or not?So despite of any bullish signals NOD might give I’m very careful simply because of this picture on the monthly.

Bearish rising wedge broken and now an attempt to retest.

On the latest sprint up, some gaps are left behind as well.

For this to become invalid for me, we need to build a solid support first, then we can find our way up again.

Let’s see how it works out!

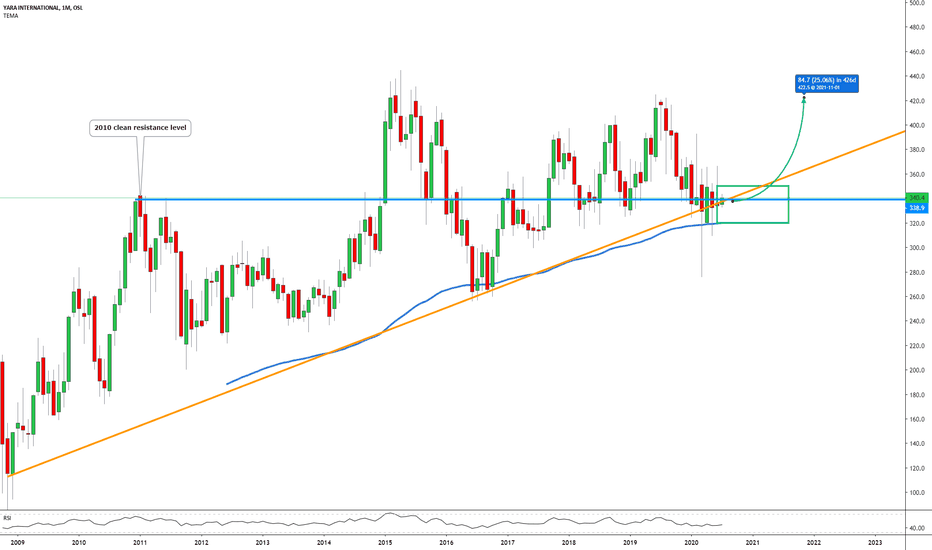

EQUINOR (EQNR)Hi,

Strong support around 115 - 130.

Technical criteria:

1) Historically the third strong rejection from the round number 100

2) Rejection from the Fibonacci retracement level 62%

3) Historically strong support area

4) 50% drop from the recent top acting as a support

5) The trendline

Regards,

Vaido

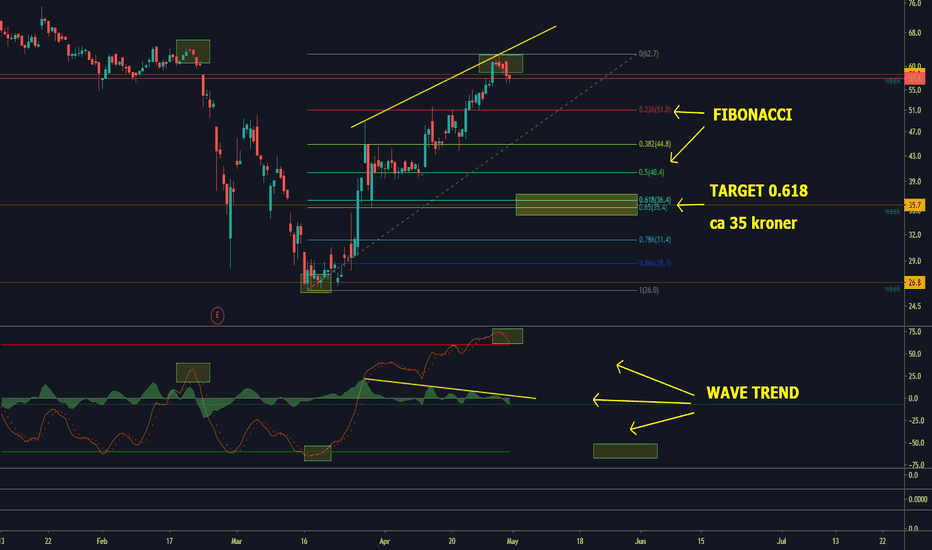

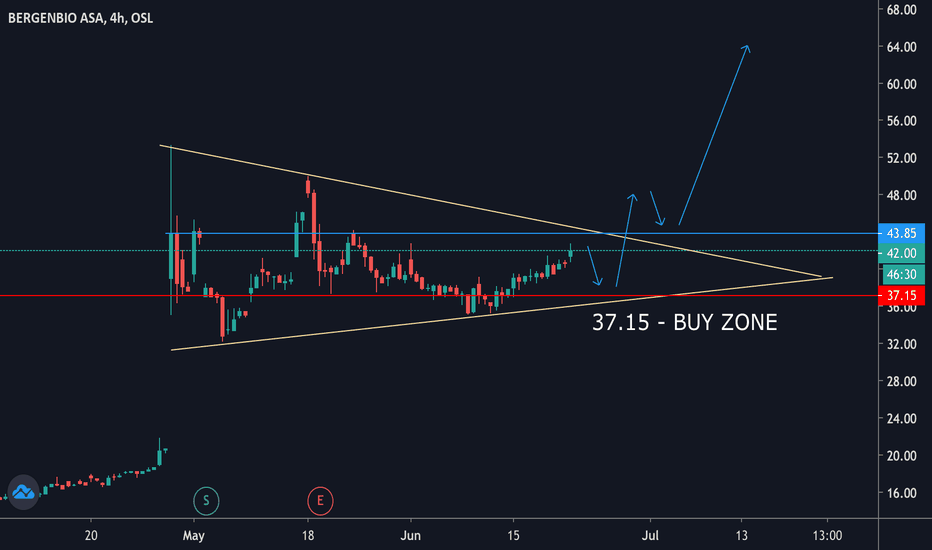

BerGenBio trading plan for the next few daysThis is a trading plan based on price action. Keep in mind that BerGenBio will present updates on their current cancer treatment 25th june. This could boost the price extremely, because of the high volatility.

37.15 will be the safest price to enter a possible trade. That's why I am waiting for a pullback before entering.

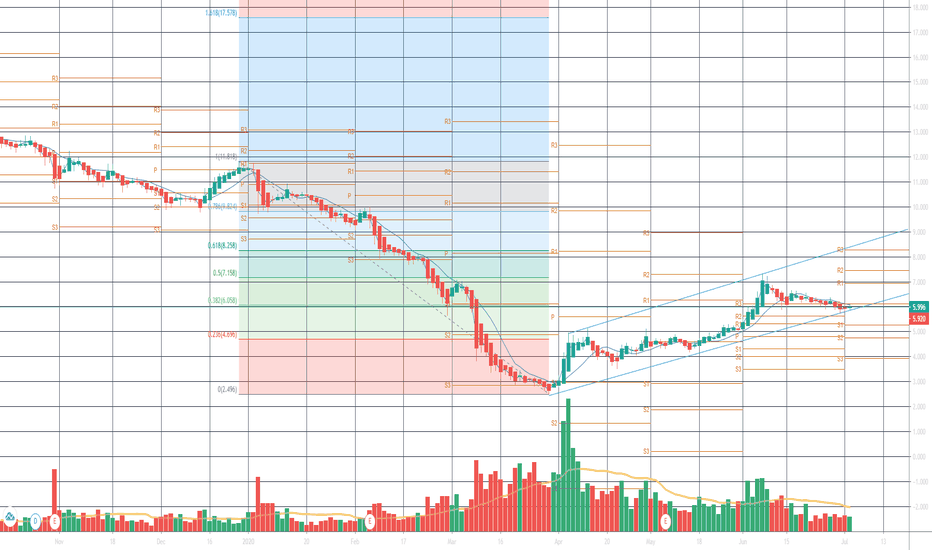

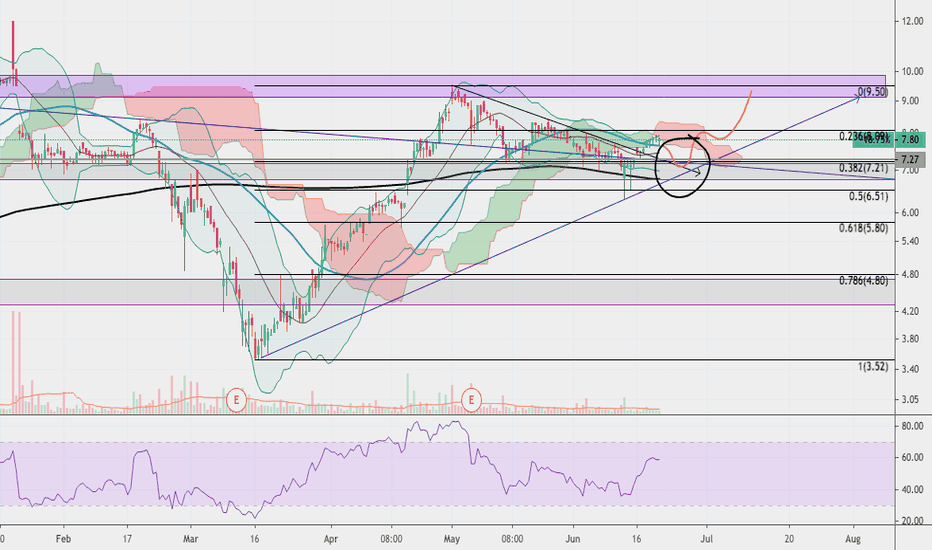

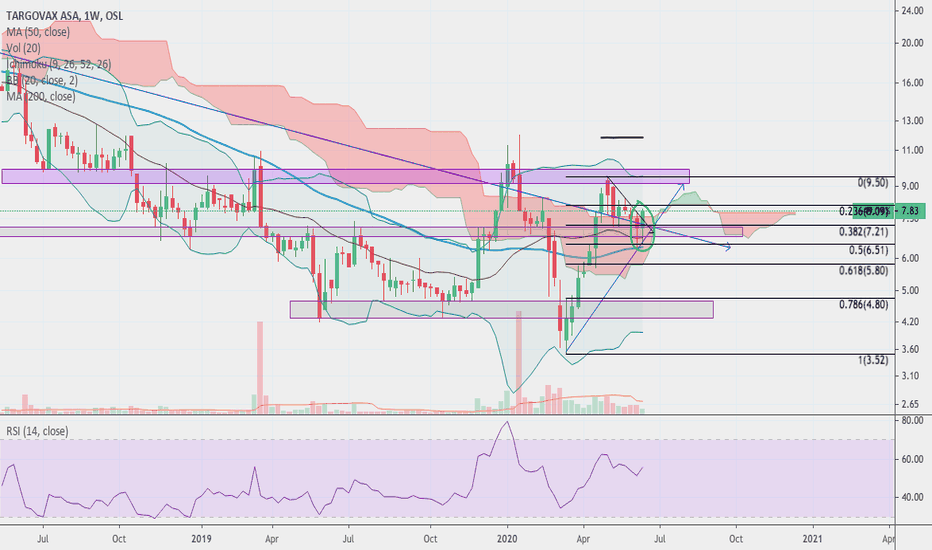

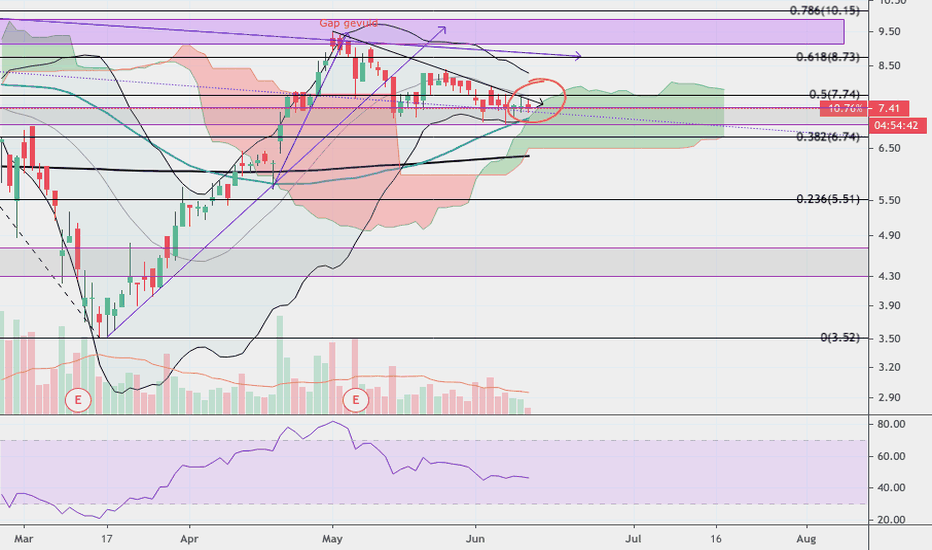

TRVX buy entryAs you know from my last analysis, TRVX gave a buy signal on the weekly chart last friday.

Now looking more closely for a good entry.

There is a smal gap down to 7.27, which I can easily see filled with a retest of the recently broken black trendline.

2 things will be providing support now, the horizontal support around NOK 6.75-7.20 and the blue upward trendline. I want to see the price hold and bounce from there and then it's a buy for me.

So to summarise:

- fill gap at 7.27

- finding support at the horizontal support area 6.75-7.20

- Not breaking the upward trendline.

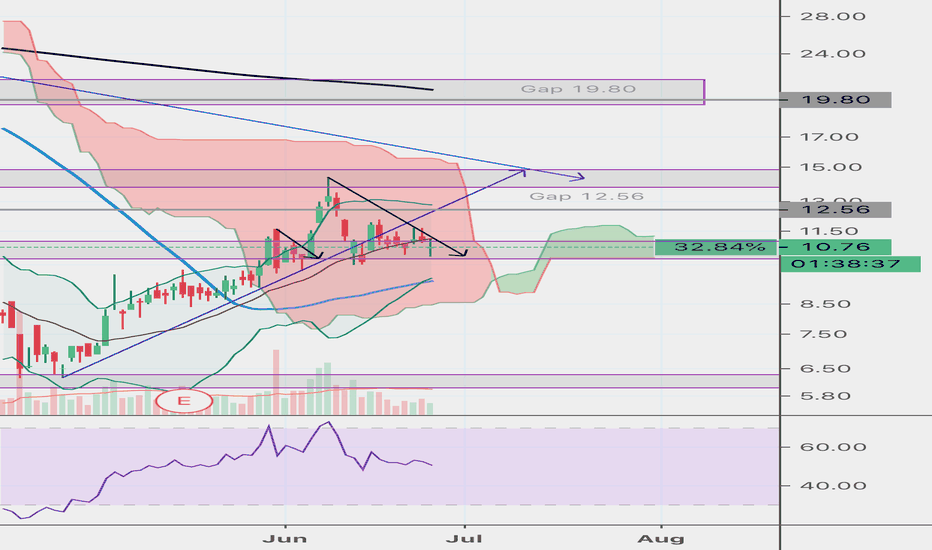

TRVX buy signal, target 19Fundamental analysts give Targovax a big BUY, with a target of around NOK 19,-.

I've been waiting for a clear signal of support lately and it has just been formed.

IF the weekly candle closes more or less the way it is now, several positive buy signals are there:

- Long term blue downward trendline got broken and retested. Clear support found on retest.

- Horizontal support area of 6.8-7.15 (purple/gray) held and got a good bounce.

- Weekly cloud got tested and provided clear support. price above the cloud once again.

- Taking the fibonacci retrace of the most recent low and high, the 0.5 fib retrace marked the reversal point, furthermore supporting the idea that this was simply a retrace in a continuing uptrend.

- Bullish engulfing candle pattern generated on the weekly chart(provided price stays more or less like this).

- Short term counter trendline (black) got broken after finding support.

The only 2 cautions I currently have are:

- The relative low volume.

- We are still inside the daily cloud (only just). We clear this cloud at 7.93 (current level).

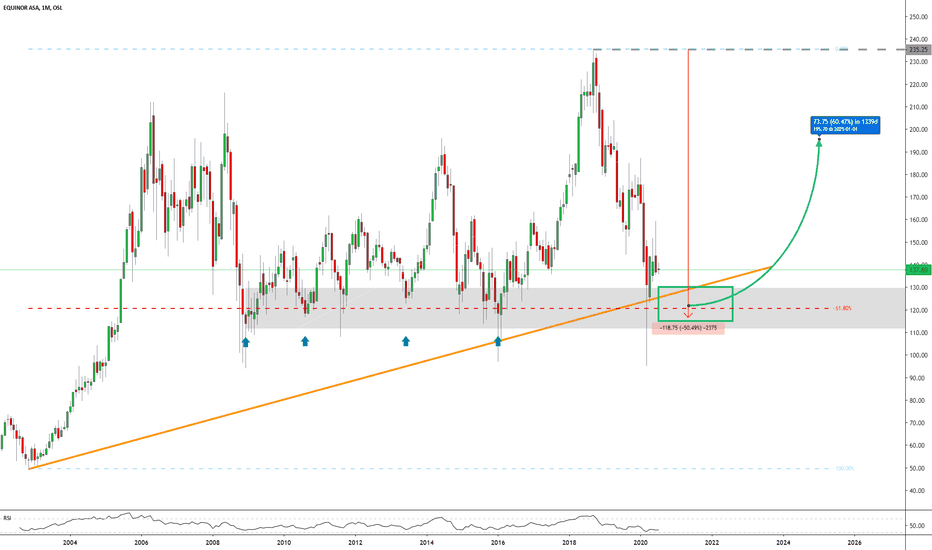

Consolidation before retest of resistanceCrayon is a cloud company with a significant position in the Nordic market and access to markets across the world.

There is substantial room for growth, both in their dominant Nordic area and other geographies.

They have just collected 30 MUSD targeted for M&A

I expect them to consolidate around the support zone for 7-14 days and start climbing towards a re-test of the resistance. Any news of completed and/or ongoing M&A is sure to boost the price significantly.

Medium term target 70

Long term target 85-90

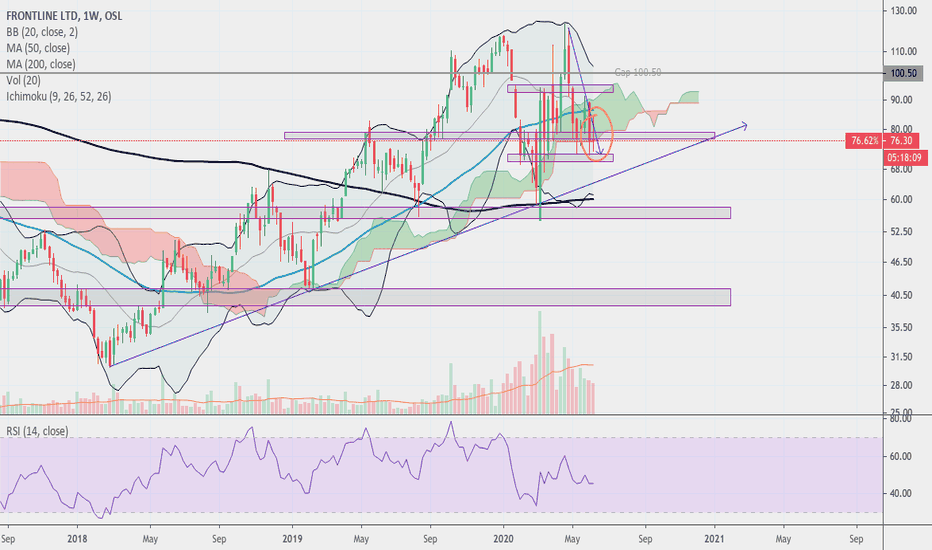

Frontline finding support? Potential target of 100.Another interesting one. Fundamental analyses puts the target for this stock at around 98. So plenty of potential!

So FRO seems to have found support, for now.

Confluence of a horizontal longer term support and the bottom of the weekly cloud (@75.99 currently).

When does FRO become a buy for me?

- Has to break the blue trendline.

- Not break down out of the weekly cloud, so stay above 75.99.

Now looking at the target.

- The highest point of the weekly cloud is 96.50.

- The FA target is 98.

- There is a gap at 100.50.

So somewhere between 96.50 and 100.50 I would say.

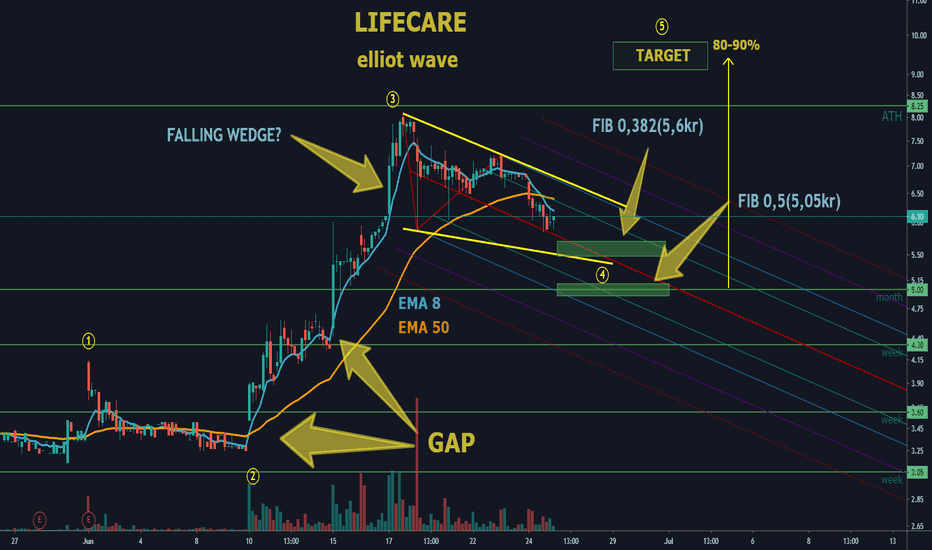

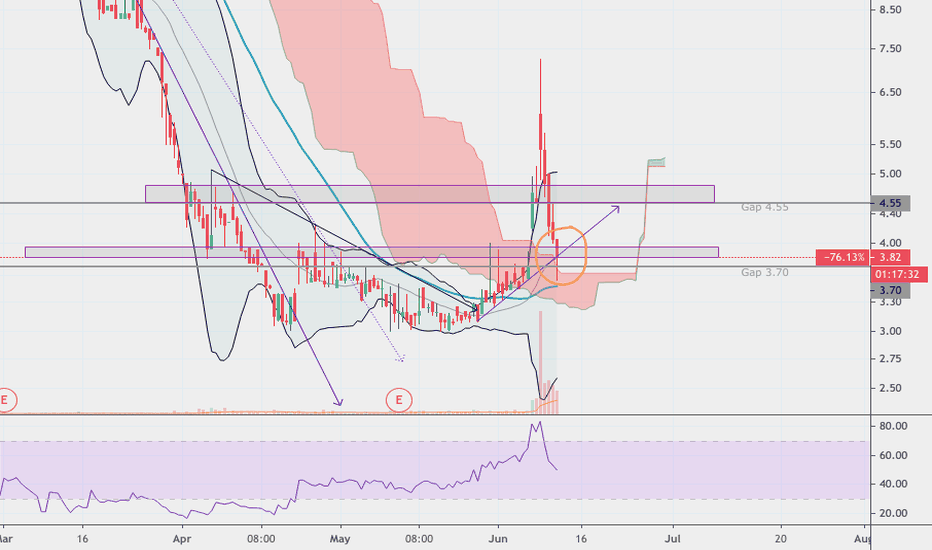

SHLF reached my potential buying target, now what?SHLF made a huge plummet down after an equally impressive rise just before that.

Now, the gap at 3.70 has been filled and for now the trendline (blue) is holding. But it's not a buy signal yet. We need at least a confirmation in the candles and with the support structure before it becomes a buy.

- First start is there, the big wick on the current/last candle.

Now I want to see 2 things (maybe 3);

- Blue trendline holding

- getting above the support area (3.95)

(- retesting the support area (holding the trendline)

That's it!

TRVX buying opportunity, waiting for breakoutAnalysts, from a fundamental point of view, are giving TRVX huge potential with a target of around 19. Reason enough to look at the chart.

So TRVX still seems to find support around 7.00-7.40.

I'm looking for a reaction upwards at the top of the daily cloud and thus breaking out of the descending triangle that has been forming. This can happen any time now!

If this happens then it's a buy for me.