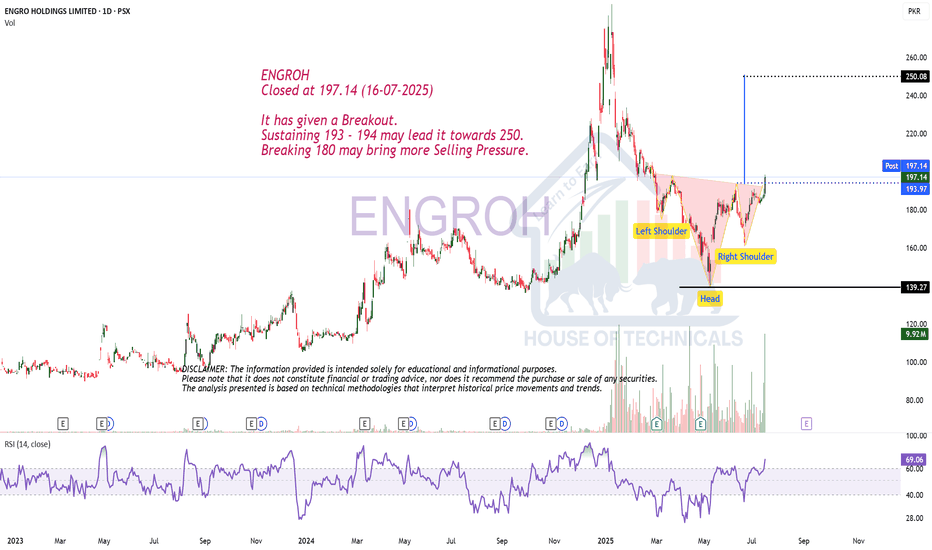

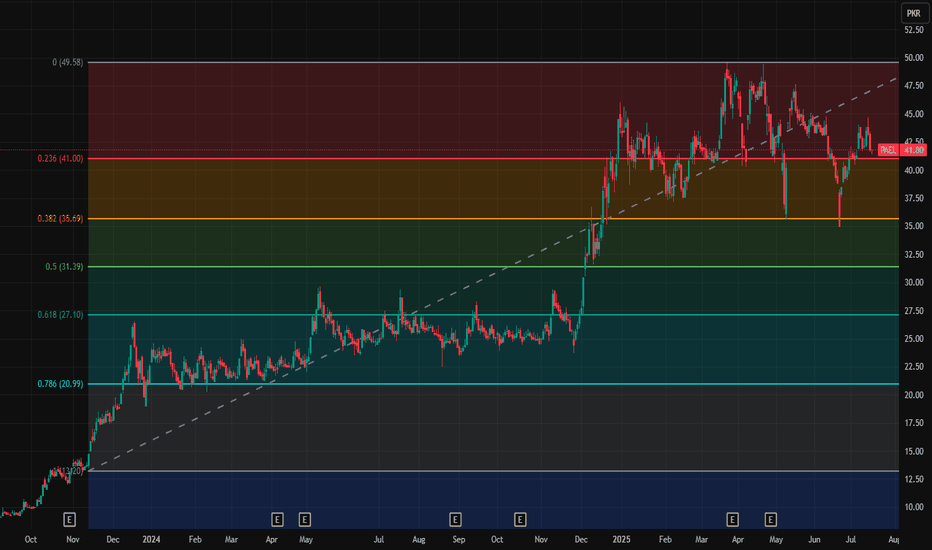

IML – LONG TRADE | 17 JULY 2025 IML – LONG TRADE | 17 JULY 2025

IML broke out of a bull flag formation (marked in light blue channel) following a correction, signaling renewed upward momentum. This breakout suggests the start of a fresh leg up, supported by structural strength and volume confirmation. The setup offers a solid entry with multiple upside targets.

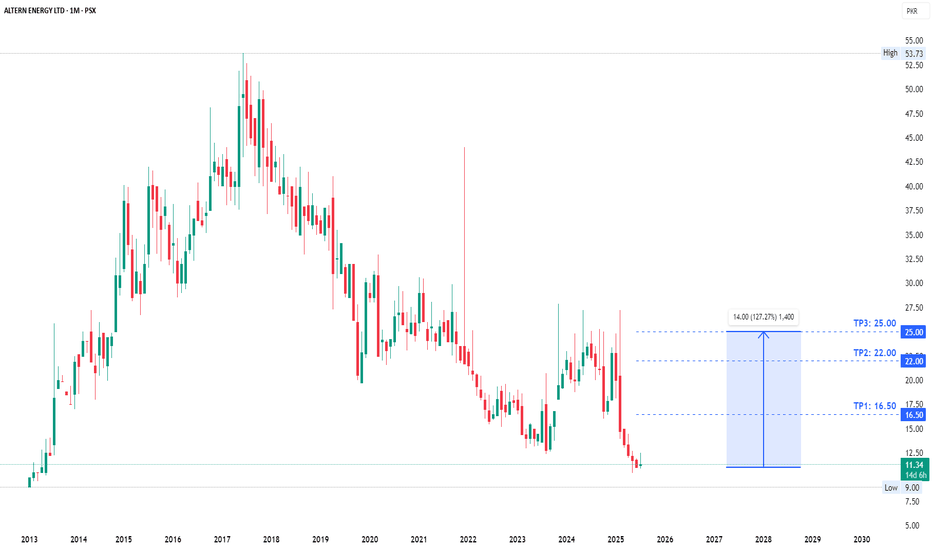

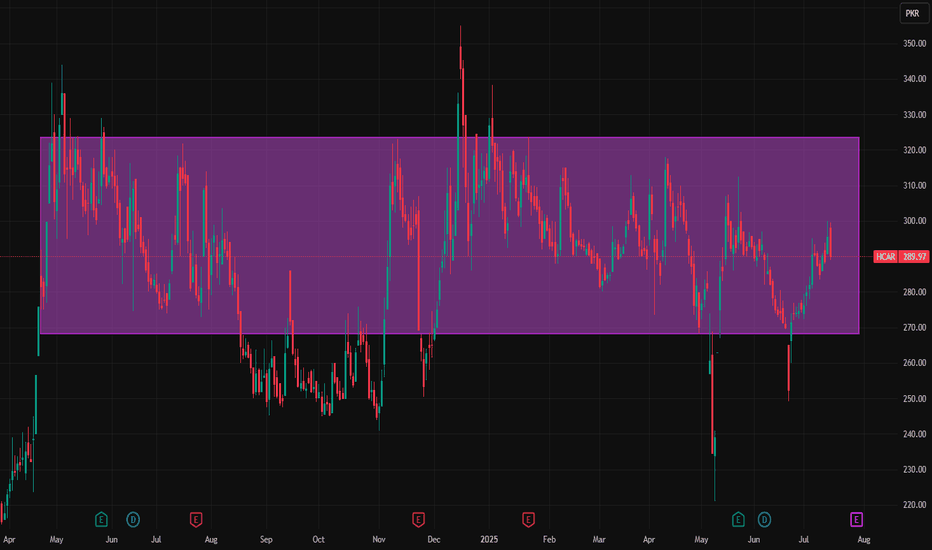

LUCK – LONG TRADE | 17 JULY 2025 – SECOND STRIKELUCK – LONG TRADE | 17 JULY 2025 – SECOND STRIKE

LUCK has been in a consolidation phase within a trading range (marked by a light blue channel) since April 2025. The latest price action suggests strength and positioning for a breakout, offering a favorable entry with promising upside potential.

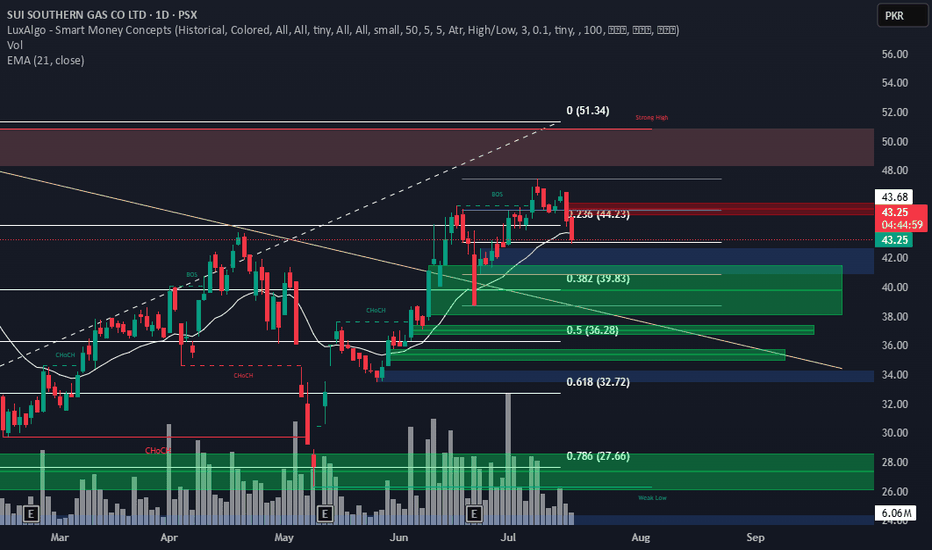

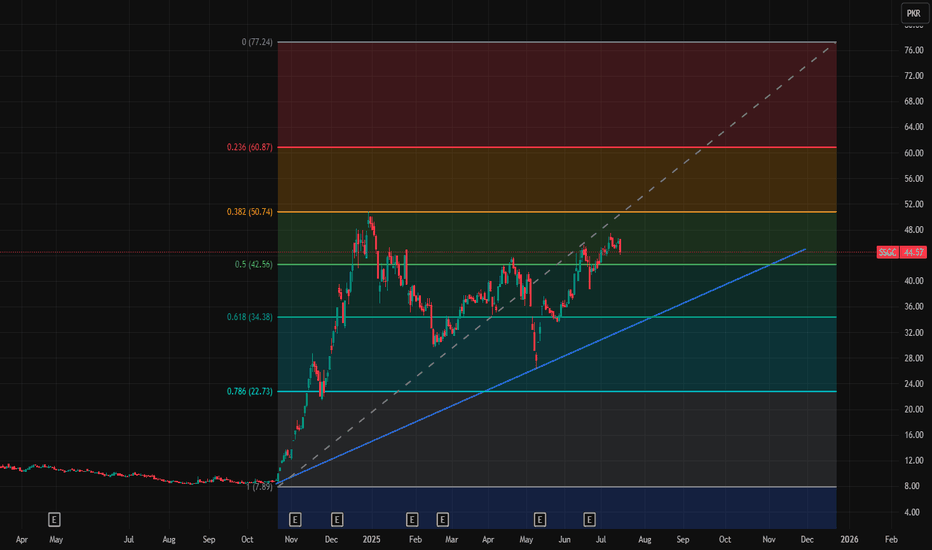

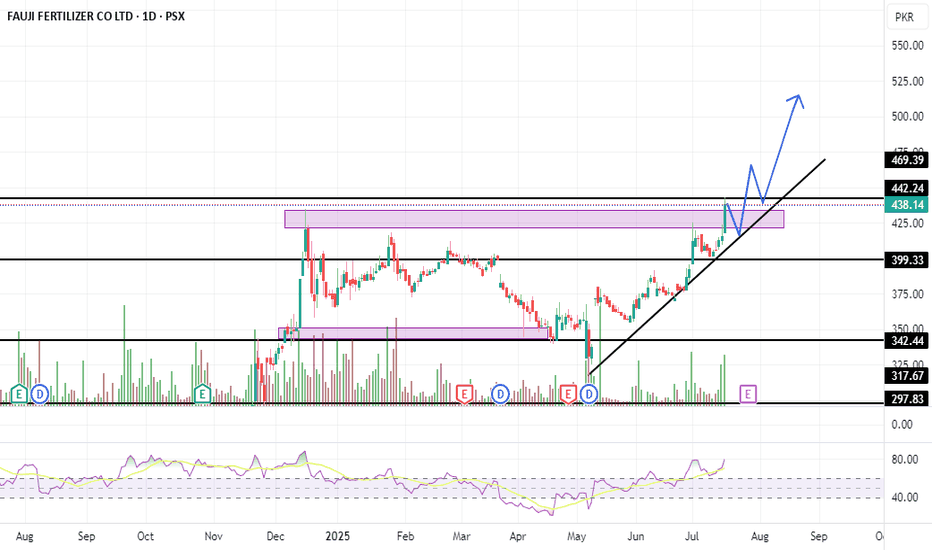

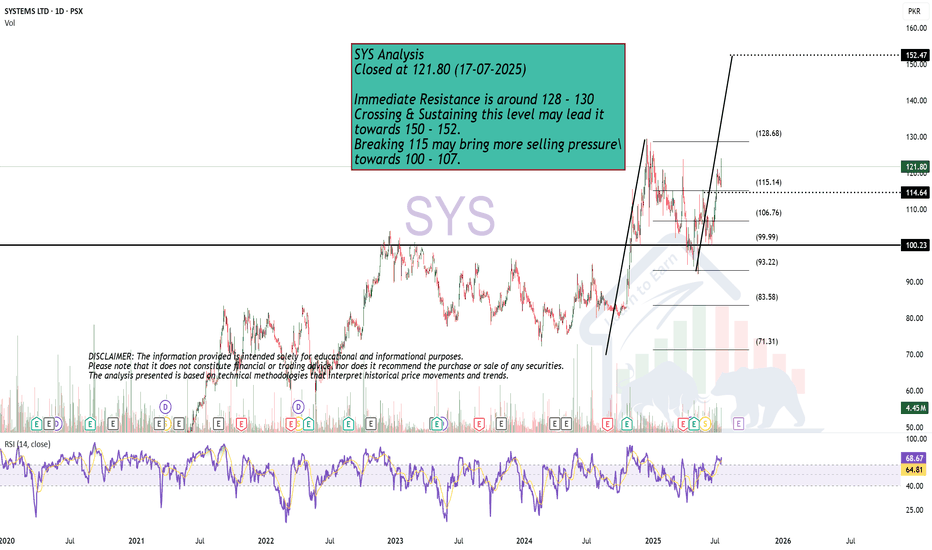

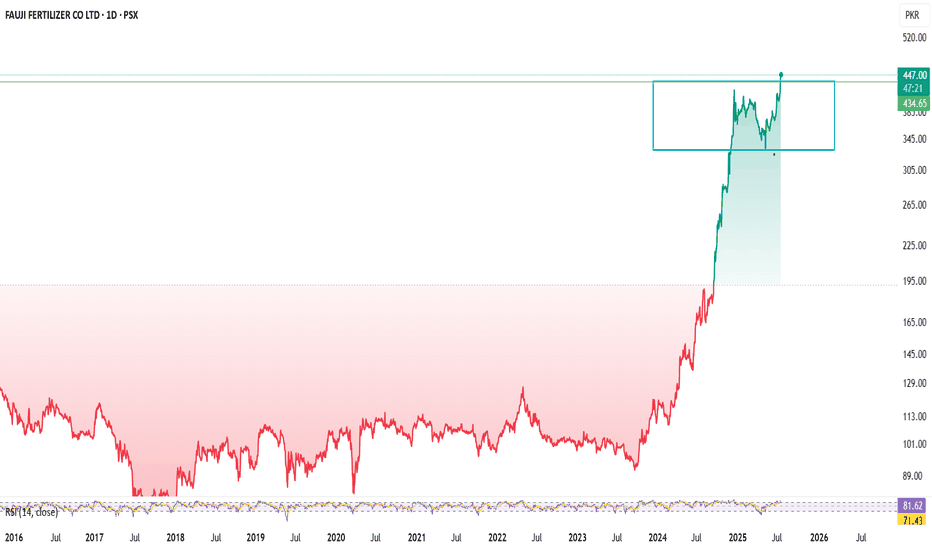

FFC Share Buying StrategyFFC Share Buying Strategy

Key Buying Zone:

📍 Buy between PKR 438 – 416

Note: if tomorrow open above 442 then buy don't wait for dip

Stop Loss:

🚫 Place stop loss at PKR 399

Targets:

🎯 Target 1: PKR 464

🎯 Target 2: PKR 500

Extended Strategy:

🔒 If price sustains above PKR 500, hold the position and apply a trailing stop loss to protect profits.

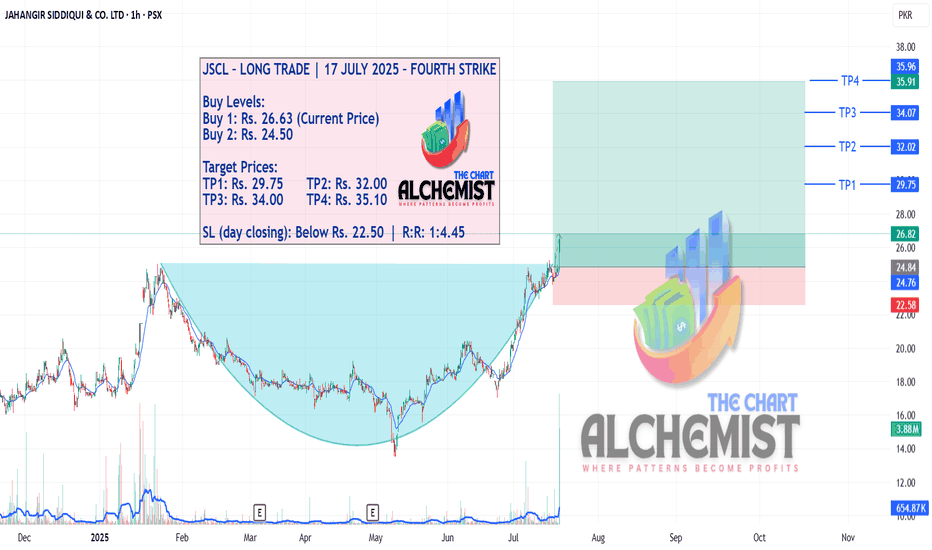

JSCL – LONG TRADE | 17 JULY 2025 – FOURTH STRIKEJSCL – LONG TRADE | 17 JULY 2025 – FOURTH STRIKE

After three successful previous buy calls, JSCL is offering another opportunity. The stock has broken out of a SLOP formation, indicating potential continuation of the bullish trend with strong upside targets.

FFCFFC PSX STOCKs breakout Day Level Buy Call

Fundamental Strengths

Robust earnings growth:

FY 2024 net profit ~PKR 64.7 B vs ~PKR 29.7 B (2023) – EPS nearly doubled to PKR 45.49

Pakistan Stock Exchange

+15

StockAnalysis

+15

.

Q1 2025 EPS ~PKR 9.33 (Sep‑Nov on TTM ~PKR 66.6)

Pakistan Stock Exchange

.

Attractive valuation:

TTM P/E ~9.6× (TradingView shows ~6.6×—likely consolidated vs standalone) .

High dividend yield:

~8.7–9.9% yield in 2024, with a ~60% payout ratio

TradingView

.

Diversified portfolio:

Operations across fertiliser, power, food, banking (via Askari Bank), wind generation, phosphate JV – mitigating sector risk

TradingView

+1

+1

Strong ownership:

Backed by Fauji Foundation (~43% owner) – adds stability and governance credibility

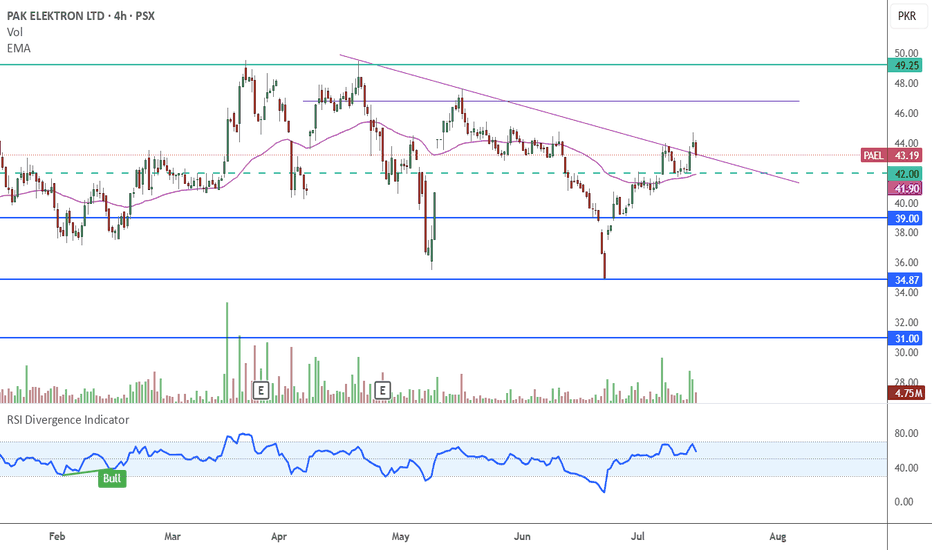

PIBTL Share Buying StrategyPIBTL Share Buying Strategy

🔑 Key Buying Zone:

Buy between PKR 9.69 – 9.34

🛑 Stop Loss:

Set at PKR 8.70

🎯 Targets:

Target 1: PKR 10.08

Target 2: PKR 11.10

📈 Extended Plan:

If price sustains above PKR 11.10, consider holding with a trailing stop loss to capture further upside.