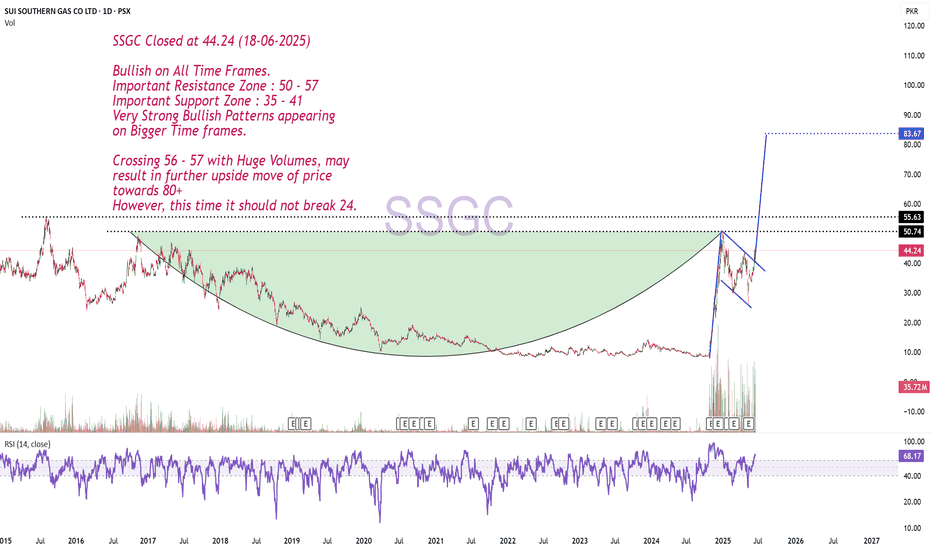

Bullish on All Time Frames.SSGC Closed at 44.24 (18-06-2025)

Bullish on All Time Frames.

Important Resistance Zone : 50 - 57

Important Support Zone : 35 - 41

Very Strong Bullish Patterns appearing

on Bigger Time frames.

Crossing 56 - 57 with Huge Volumes, may

result in further upside move of price

towards 80+

However, this time it should not break 24.

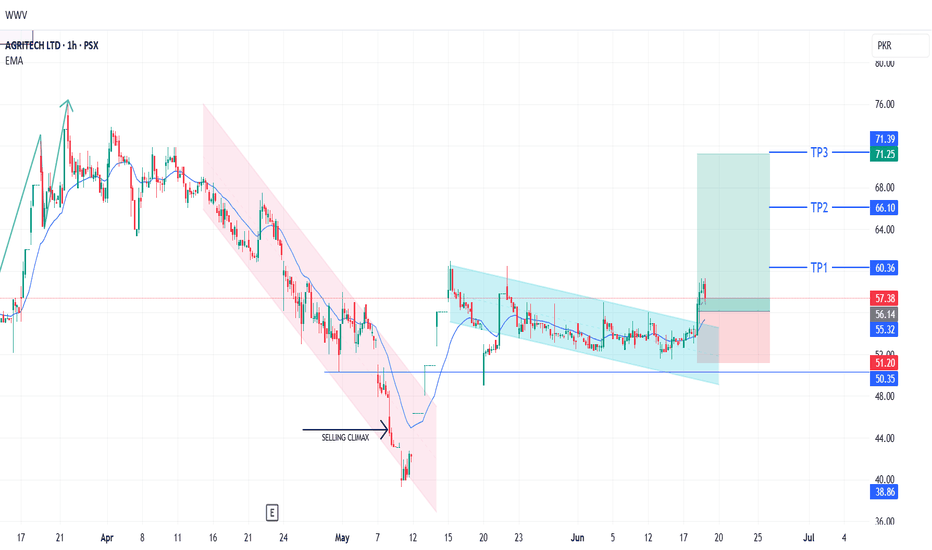

AGL LONG TRADE 18-06-2025 Second Strike"AGL Buy Call for Second Strike

AGL previously traded in a bearish channel (pink) and reached a low of 39.3, marking a selling climax. After reversing, the stock broke out of the channel and formed a bullish pipe pattern. A subsequent corrective bearish channel (blue) has given way to a bullish setup, with the recent formation of a bullish structure offering a safe entry point.

🚨 TECHNICAL BUY CALL – AGL🚨

Buying Levels:

1. 57.38 (Current Price)

2. 55.1

3. 54

Targets:

TP1: 59.9

TP2: 66.1

TP3: 71.2

Stop Loss: Below 51 Day closing basis

Risk-Reward Ratio: 3

Caution: Please buy in 3 parts within the buying range. Close at least 50% of your position at TP1 and trail the stop loss to protect profits in case of unforeseen market conditions.

If you find this idea helpful, please boost and share it!

📢 Disclaimer: Do not copy or redistribute signals without prior consent or proper credit to The Chart Alchemist (TCA).

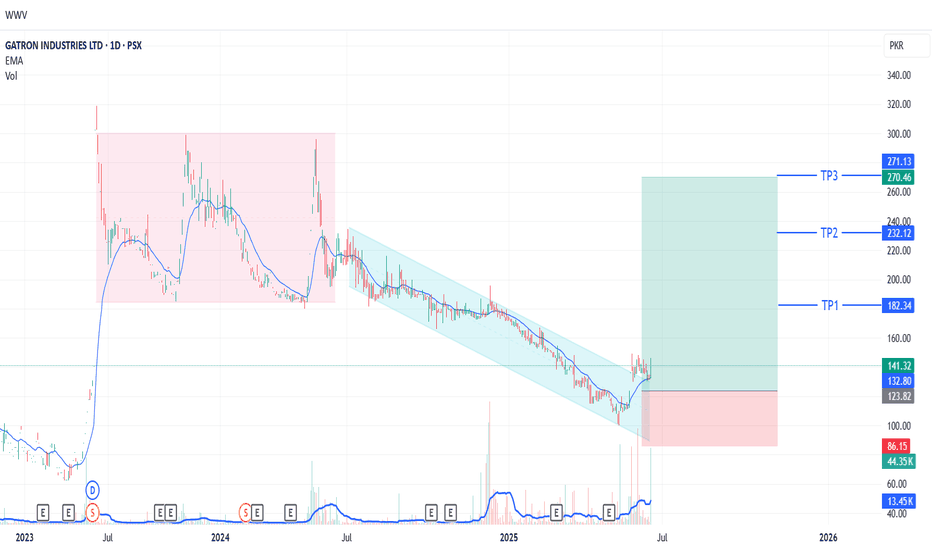

GATI LONG TRADE/INVESTMENT CALL 18-06-2025GATI Buy/Long Term Investment Call

Gati Limited (GATI) recently broke out from a bearish channel that touched a low of 100 rupees. The breakout is supported by 5x more volume than average, indicating potential for upward movement. The stock previously formed various bullish structures during its consolidation phase, which may prevent significant downfall.

🚨 TECHNICAL BUY CALL – GATI🚨

- *Buy 1: 141.32 (current price)

- *Buy 2: 136

- *Buy 3: 120

- *Buy 4: 108

- *TP1:* 182

- *TP2:* 232

- *TP3:* 270

*Stop Loss:* Below 85 - Day Closing Basis

*Risk-Reward Ratio:* 3.9

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

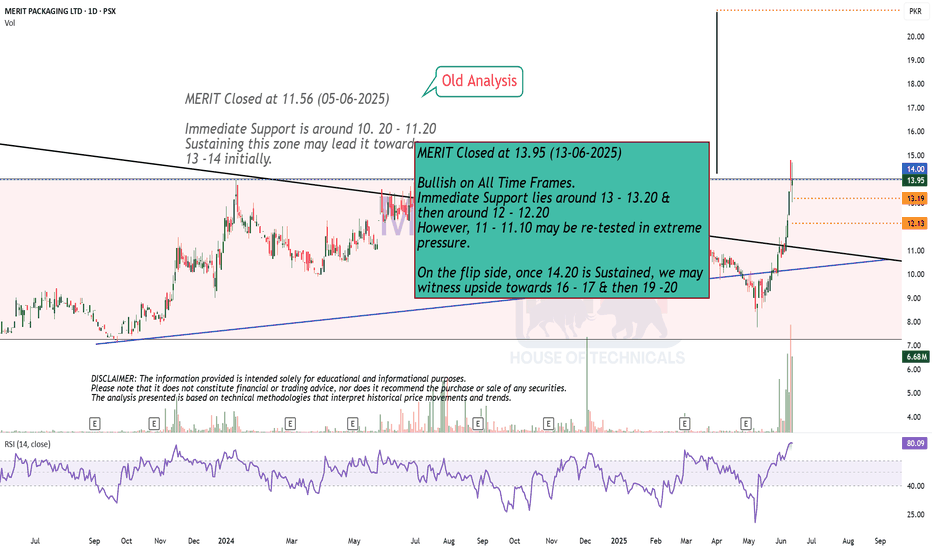

Bullish on All Time Frames.MERIT Closed at 13.95 (13-06-2025)

Bullish on All Time Frames.

Immediate Support lies around 13 - 13.20 &

then around 12 - 12.20

However, 11 - 11.10 may be re-tested in extreme

pressure.

On the flip side, once 14.20 is Sustained, we may

witness upside towards 16 - 17 & then 19 -20

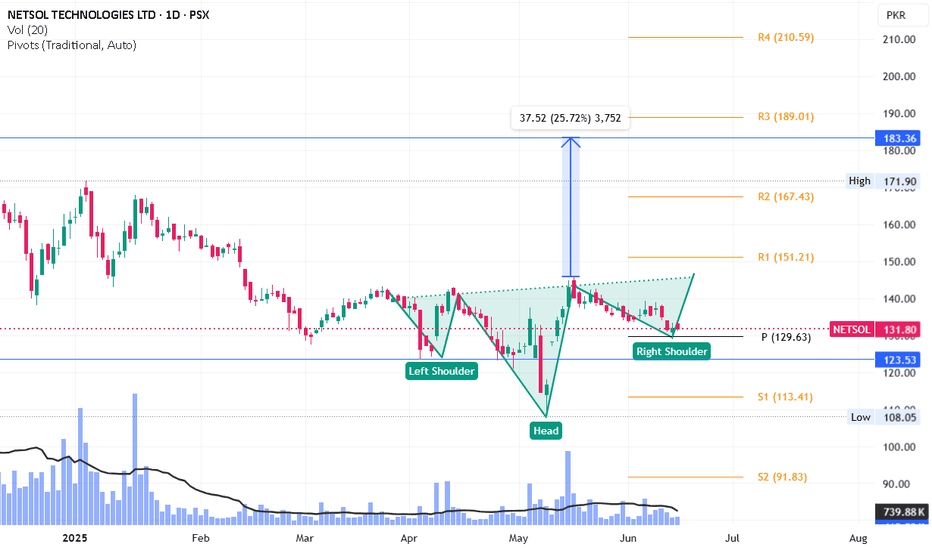

Netsol - Inverse H&S into playNetsol is in its buyback phase which is about to be over in June.

Inverse H&S is in play where it hit its daily pivot level. If it now makes a higher high and higher low, 2nd shoulder will be confirmed. Alternatively, it may hit 123 (bottom of its first shoulder) before going upward. Upside short term target will be 183.

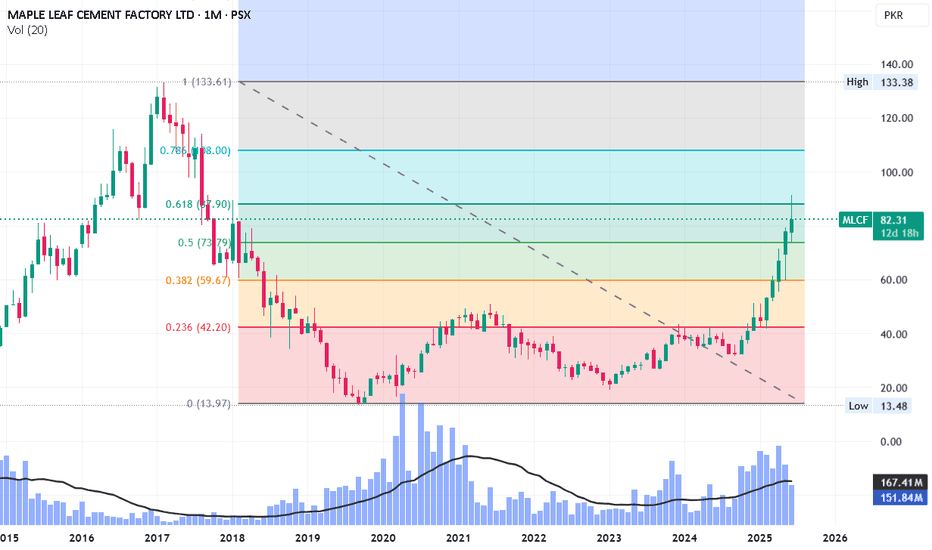

MLCF - Cooling down after a long rallyMaple Leaf is cooling down after a long rally and is preparing for touching its all time high.

It struck Fib 0.618 level and is now spending some time here as expected. It may retrace to its Fib 0.5 level (73 to 74) before again going up.

Once it crosses and gives monthly closing above 88, we can see it hitting 108 and then 133 in quick succession.

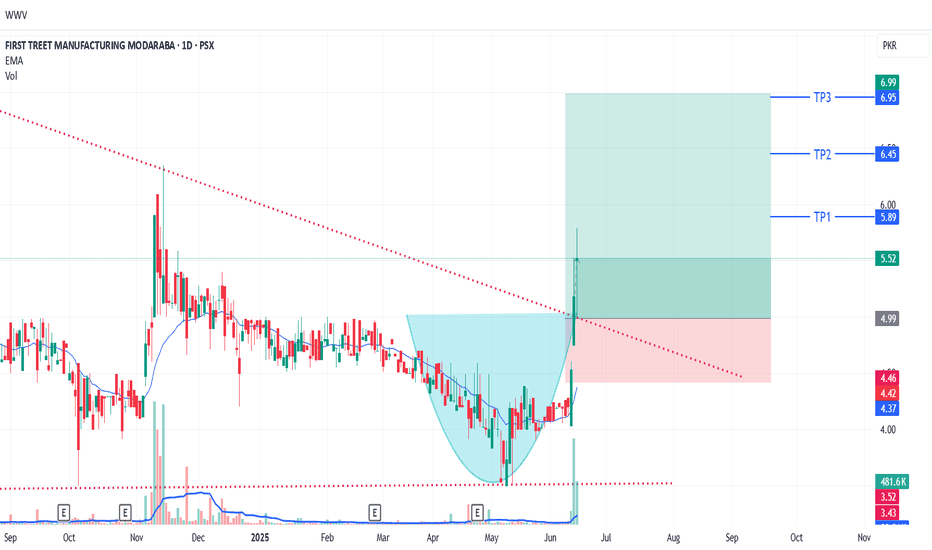

FTMM LONG TRADE 17-06-2025FTMM Technical Buy Call

Rationale - FTMM broke out of a prolonged range formation (since Nov 2023) at Rs. 5.02, forming a scale pattern beforehand. We expect the stock to reach minimum quantified displacement targets.

🚨 TECHNICAL BUY CALL – FTMM🚨

- Buy 1: Current level (Rs. 5.52)

- Buy 2: Rs. 5.02

- Buy 3: Rs. 4.82

- TP 1: Rs. 5.89

- TP 2: Rs. 6.45

- TP 3: Rs. 6.95

Stop Loss - Below Rs. 4.40

Risk-Reward Ratio - 3.5

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

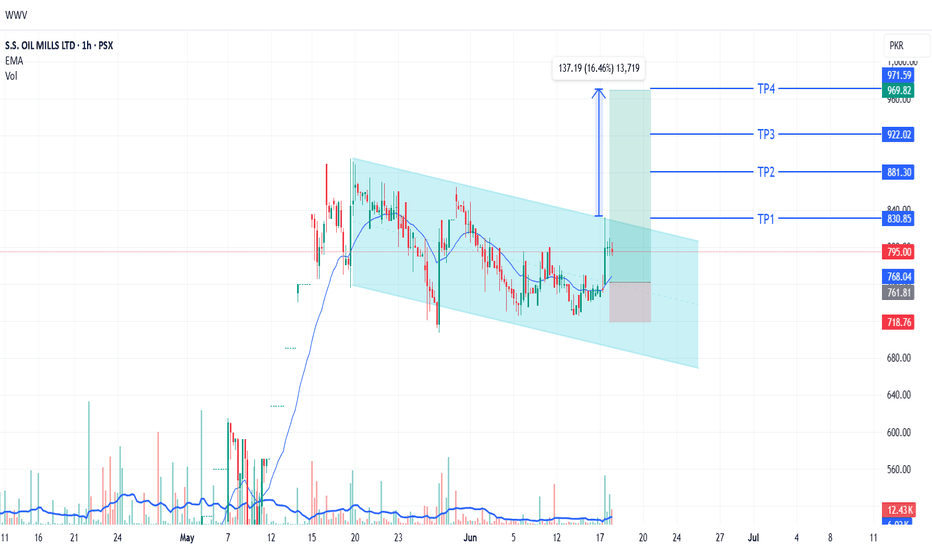

SSOM LONG TRADE 17-06-2025SSOM Long Trade

Rationale: SSOM previously surged from Rs. 87 to Rs. 900 (over 10x gain) from mid-March to mid-May. Despite recent correction/consolidation, price action suggests potential for further upside.

🚨 TECHNICAL BUY CALL – SSOM🚨

- Buy 1: Current level (Rs. 775)

- Buy 2: Rs. 782

- Buy 3: Rs. 762

- TP 1: Rs. 830

- TP 2: Rs. 880

- TP 3: Rs. 922

- TP 4: Rs. 970

Stop Loss - Below Rs. 725

Risk-Reward Ratio - 1: 4.83

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

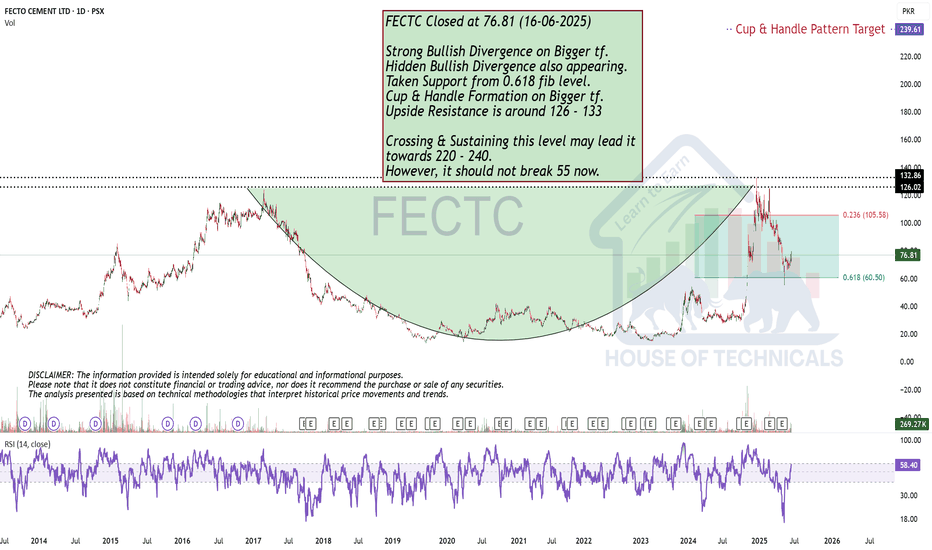

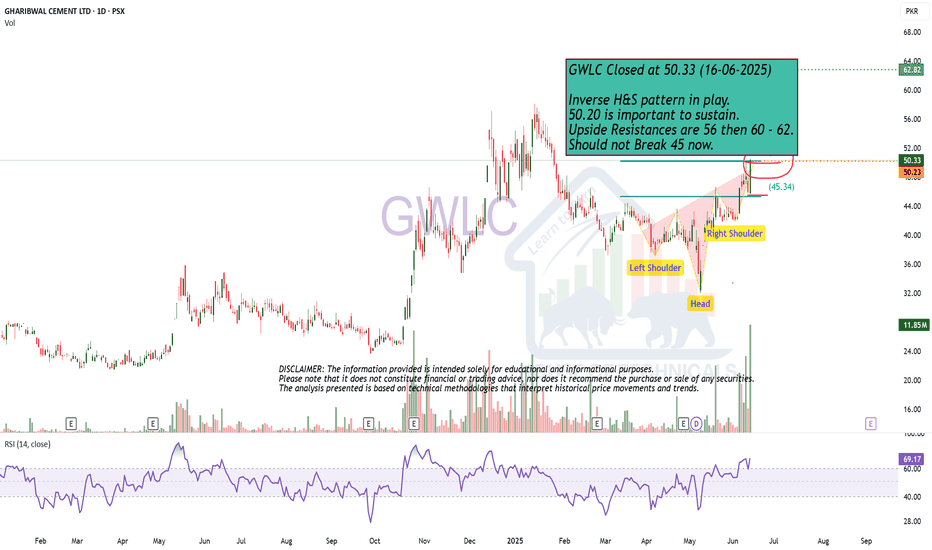

Strong Bullish Divergence on Bigger tf.FECTC Closed at 76.81 (16-06-2025)

Strong Bullish Divergence on Bigger tf.

Hidden Bullish Divergence also appearing.

Taken Support from 0.618 fib level.

Cup & Handle Formation on Bigger tf.

Upside Resistance is around 126 - 133

Crossing & Sustaining this level may lead it

towards 220 - 240.

However, it should not break 55 now.

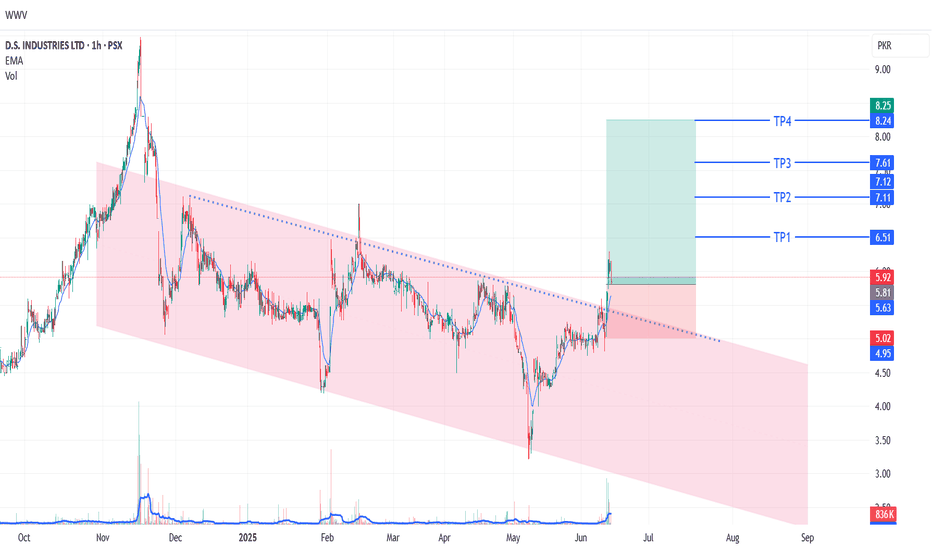

DSIL LONG TRADE 16-06-2025DSIL Long Trade

Rationale: DSIL broke out of a bearish channel (potentially reversing trend) and seems ready to resume its uptrend. Targets are deduced from price action and quantified displacement method.

🚨 TECHNICAL BUY CALL – DSIL🚨

- Buy 1: Current level (Rs. 5.9)

- Buy 2: Rs. 5.7

- Buy 3: Rs. 5.3

- TP 1: Rs. 6.51

- TP 2: Rs. 7.10

- TP 3: Rs. 7.60

- TP 4: Rs. 8.20

Stop Loss - Below Rs. 5 closing basis

Risk-Reward Ratio - 1:3

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

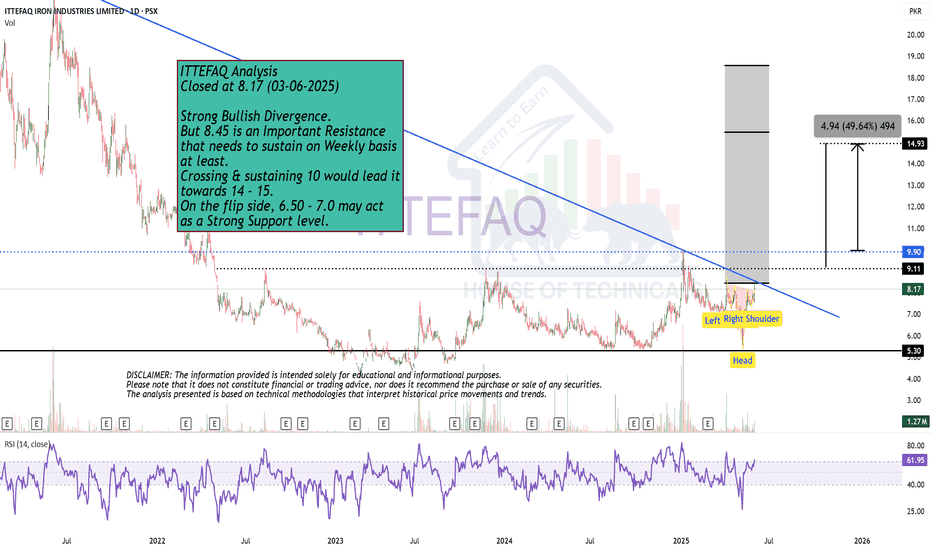

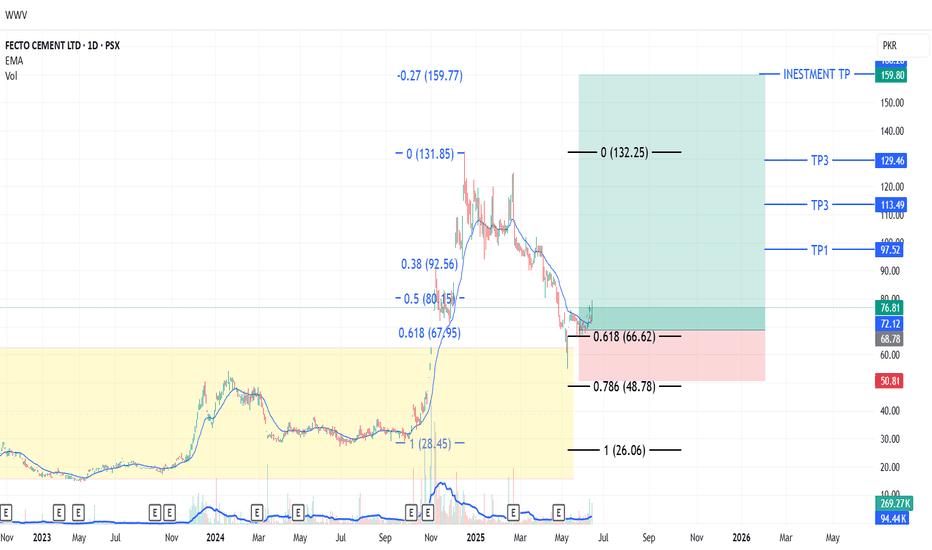

FECTC LONG TRADE/INVESTMENT 16-06-2025FECTC Technical Long & Investment Buy Call

Rationale: FECTC broke out of a range in Oct 2024, achieved a target of 132, and then corrected in an ABC pattern. After pulling back to the breakout level, the stock shows good price action with volumes, suggesting a resumption of the uptrend.

🚨 TECHNICAL BUY CALL – FECTEC🚨

- Buy 1: Current level (Rs. 77-76.8)

- Buy 2: Rs. 69.6

- Buy 3: Rs. 62.4

- TP 1: Rs. 97.52

- TP 2: Rs. 113.5

- TP 3: Rs. 129.5

- Long-term Investment TP: Rs. 159.8

Stop Loss- Below Rs. 50.8

Risk-Reward Ratio- 1:5

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

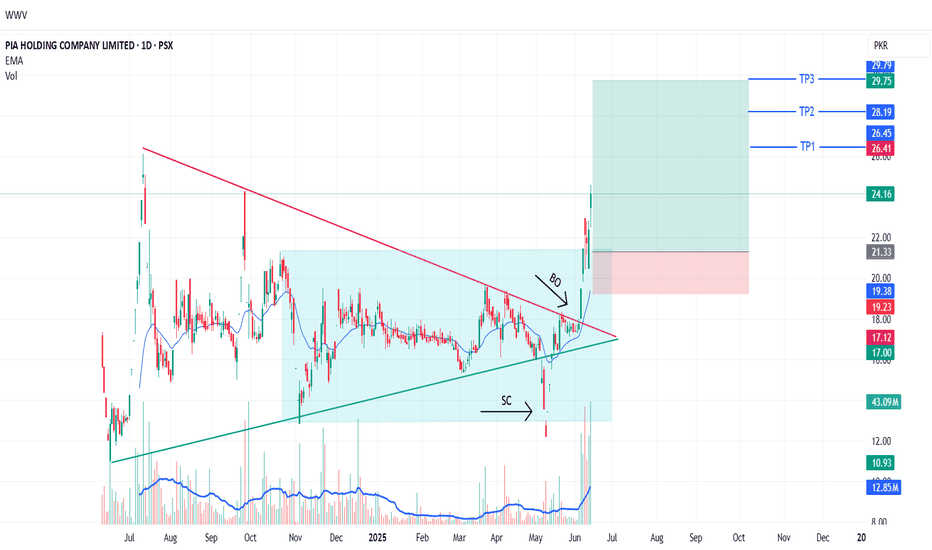

PIAHCLA LONG TRADE (SECOND STRIKE) 16-06-2025PIAHCLA Buy Call - Second Strike

Previous Performance : We recently gave a buy call for PIAHCLA, which achieved all its given targets.

Rationale: PIAHCLA broke out of a range (Rs. 12.9 - Rs. 21.2) and assumed a new uptrend. We expect the stock to achieve targets based on quantified displacements and overlying supply zones.

🚨 TECHNICAL BUY CALL – PIAHCLA🚨

- Buy 1: Current price (Rs. 26.1)

- Buy 2: Rs. 22.4

- Buy 3: Rs. 20.5

- TP 1: Rs. 26.4

- TP 2: Rs. 28.2

- TP 3: Rs. 29.8

Stop Loss - Below Rs. 19.5 closing basis

Risk-Reward Ratio - 1:4

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.