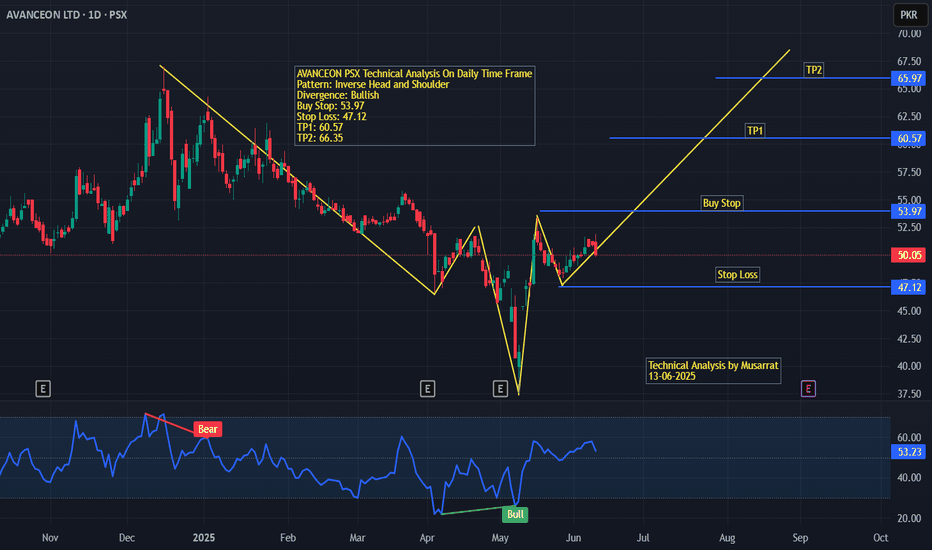

AVANCEON PSX (Daily Time Frame) Technical Analysis – AVANCEON LTD (PSX, Daily Chart)

Pattern: Inverse Head and Shoulders

Divergence: Bullish

Analyst: Musarrat Karamat | Date: 13-06-2025

AVANCEON Ltd (listed on PSX) is currently forming a classic Inverse Head and Shoulders pattern, which is a strong bullish reversal setup. The neckline breakout has been identified near the ₨53.97 level, which is the Buy Stop trigger for a long position.

Buy Stop: ₨53.97 – A breakout above this level would confirm the reversal and signal bullish entry.

Stop Loss: ₨47.12 – Placed below the right shoulder, providing a safe risk buffer in case of a failed breakout.

Target 1 (TP1): ₨60.57 – The first target is derived from the neckline-to-head distance projected upward.

Target 2 (TP2): ₨66.35 – A more optimistic target if bullish momentum continues post-breakout.

The RSI (Relative Strength Index) below the chart shows a bullish divergence, which further supports the reversal thesis. The RSI broke out of a downtrend with increasing momentum, hinting that institutional buying may be underway.

The price is currently trading around ₨50.05, indicating that the breakout hasn’t occurred yet. Traders should patiently wait for confirmation above the buy stop level before entering the trade.

Conclusion:

The setup reflects a textbook inverse head and shoulders with bullish divergence confirmation. If the neckline is broken decisively with strong volume, the stock may rally toward ₨60.57 and ₨66.35. However, prudent risk management is crucial, with a stop loss at ₨47.12 to limit downside exposure.

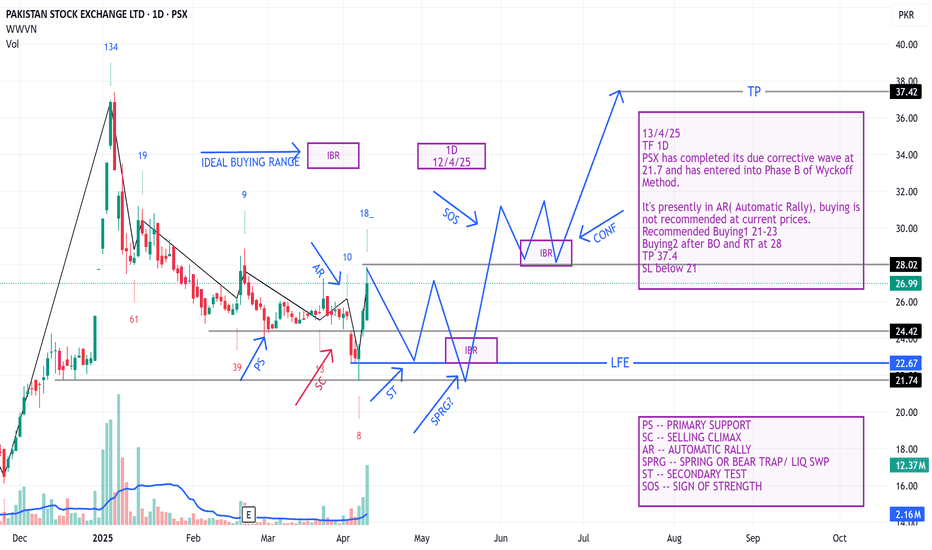

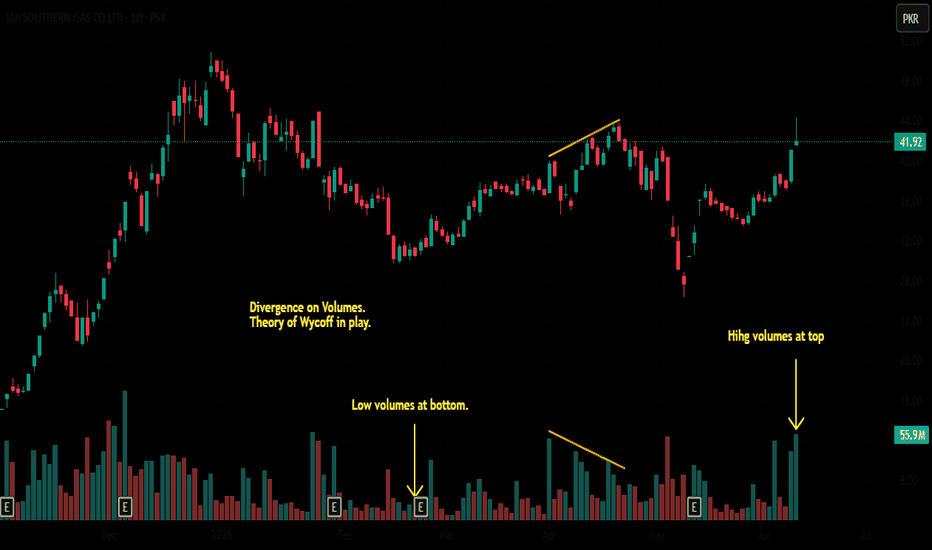

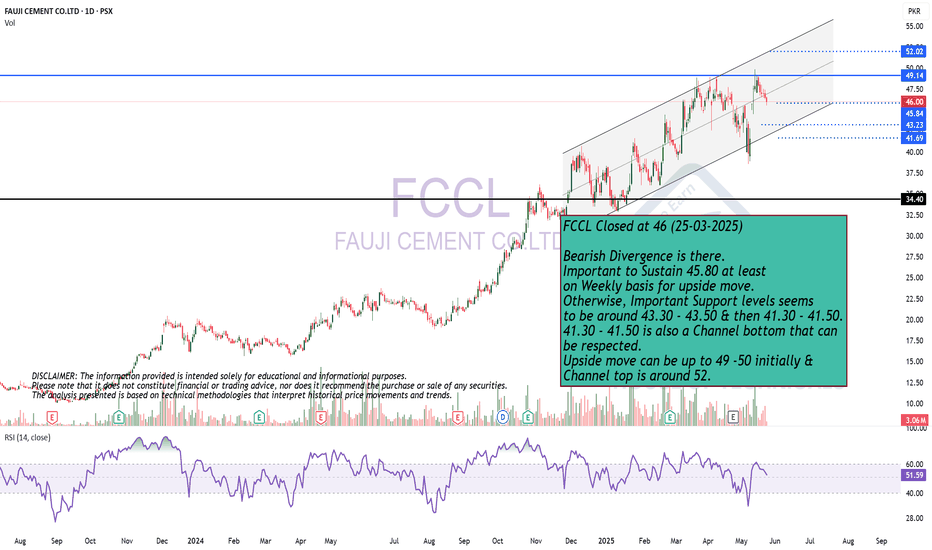

Make it Break it Situation!FCCL Closed at 46 (25-03-2025)

Bearish Divergence is there.

Important to Sustain 45.80 at least

on Weekly basis for upside move.

Otherwise, Important Support levels seems

to be around 43.30 - 43.50 & then 41.30 - 41.50.

41.30 - 41.50 is also a Channel bottom that can

be respected.

Upside move can be up to 49 -50 initially &

Channel top is around 52.

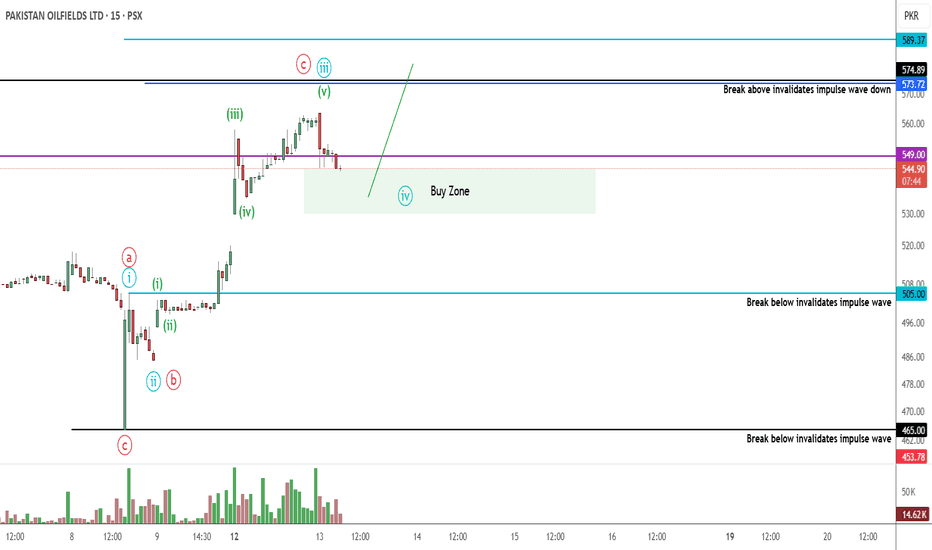

POL PROBABLY IN WAVE '' A '' OR " B " - LONGThis is in continuation of our ongoing tracking of POL wave structure.

Prices went below our buying zone of 475 touching 465, taking a cautious approach as the overall market was down, we did not buy at 475-465 area and waited for a bounce up for confirmation. Now the bounce has been significant and if our wave count is correct then we are most probably in wave 4 of an impulse wave of A or B.

This trade setup remains valid until 505 is taken out.

Trade setup:

Entry price: 545 - 530

Stop loss: 504

Targets: 575 - 590

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

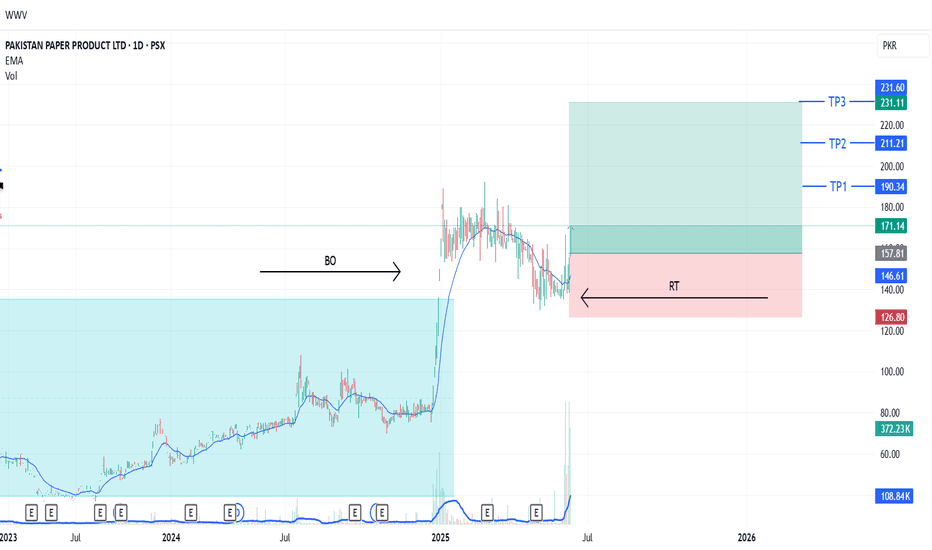

PPP LONG TRADE 11-06-2025PPP LONG TRADE

- *Historical Performance:* PPP started a gradual uptrend in 2013, followed by a spike-like upturn in April 2017, reaching 135. The stock then traded in a range between 35 and 137 until the start of this year.

- *Breakout and Pullback:* PPP broke out of this long-term trading range with strong volume distribution. After the breakout, the stock experienced a slow pullback, touching the breakout level and the major gap created by the breakout spike. Recently, it has shown reversal signs upwards.

- *Current Setup:* The stock is primed for an up move.

🚨 TECHNICAL BUY CALL – PPP🚨

- Buy levels:

- Current level: 170

- 162

- 155

- Targets:

- TP1: 190

- TP2: 210

- TP3: 231

- Stop Loss: Below 125

- Risk Reward Ratio: 2.4

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

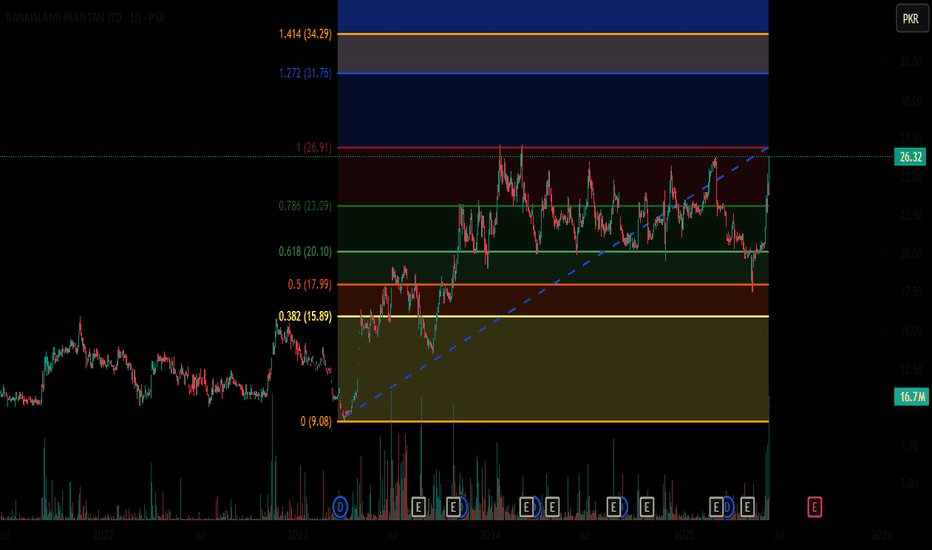

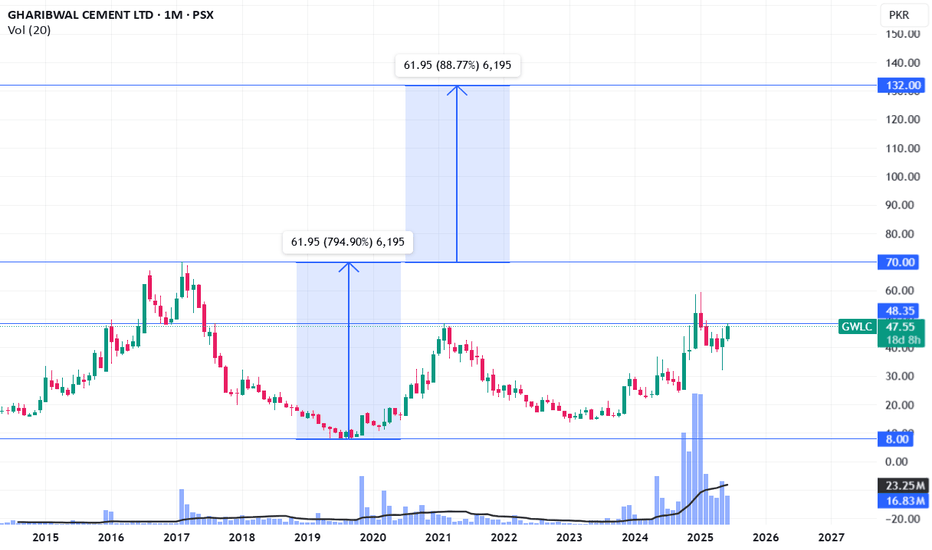

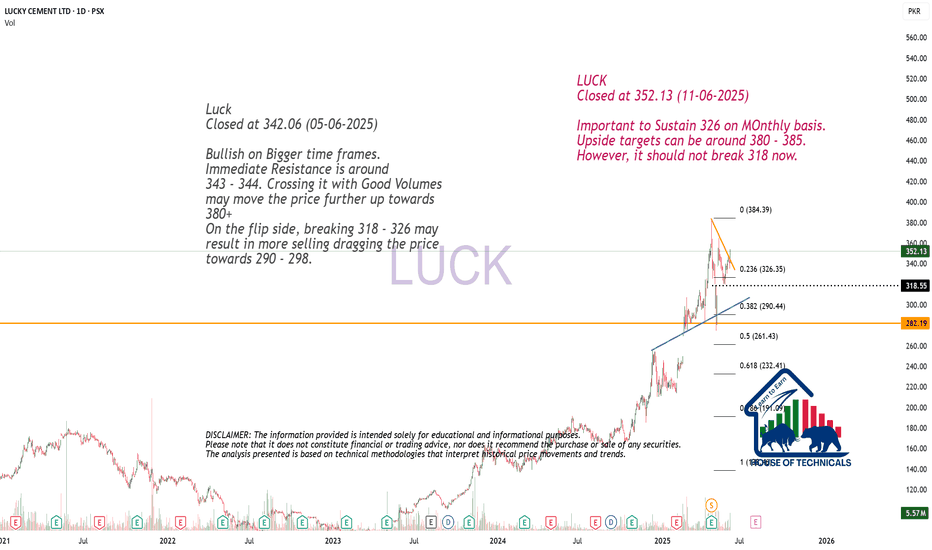

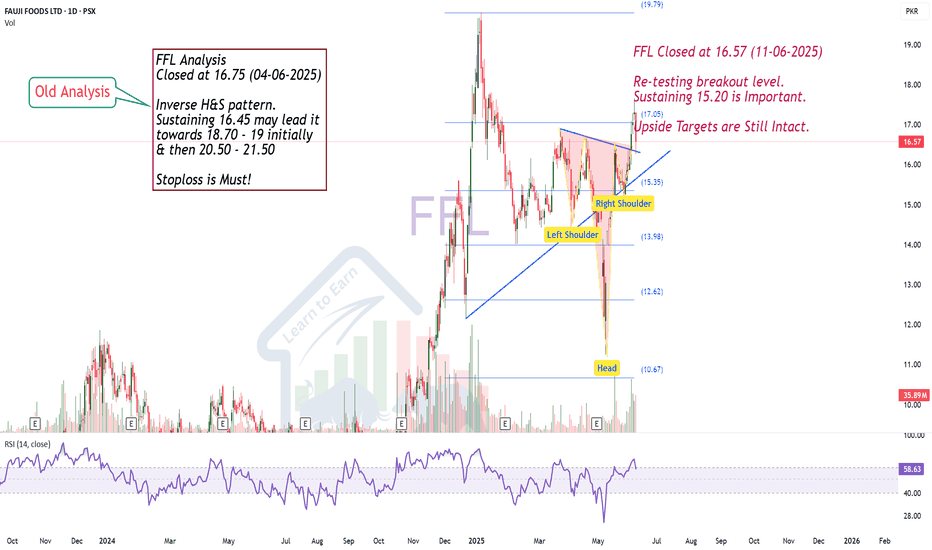

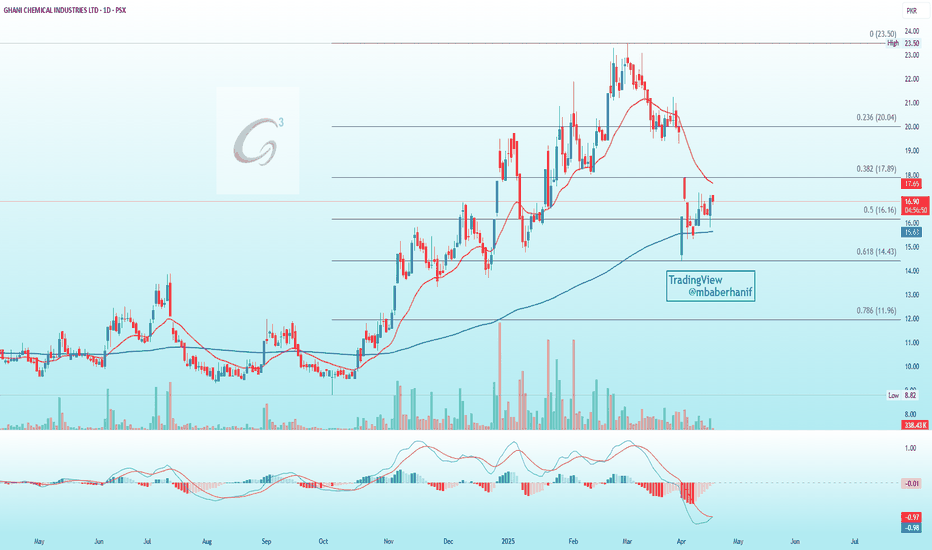

GCIL | Swing Trade Setup!!!GCIL's current price action indicates a favorable technical setup.

Key observations include:

Uptrend indication: The stock price is trading above the 200-day EMA, suggesting an overall uptrend.

Fibonacci retracement: A fake breakout was observed on April 3rd, which coincided with a 61.8% retracement level from the low of 8.82 (October 4th, 2024) to the high of 23.50 (March 3rd, 2025). The stock has since appreciated by 9.10%.

MACD crossover: The MACD indicator is exhibiting a bullish crossover from its bottom, signaling a potential reversal and strengthening of the uptrend.

Trading Strategy

Based on the technical analysis, a long position can be considered at the support level of 16.16. To manage risk, a strict stop-loss is recommended at 14.40. Potential targets for the trade are:

Target 1: 17.89, representing a 10.71% upside

Target 2: 20, representing a 23.76% upside

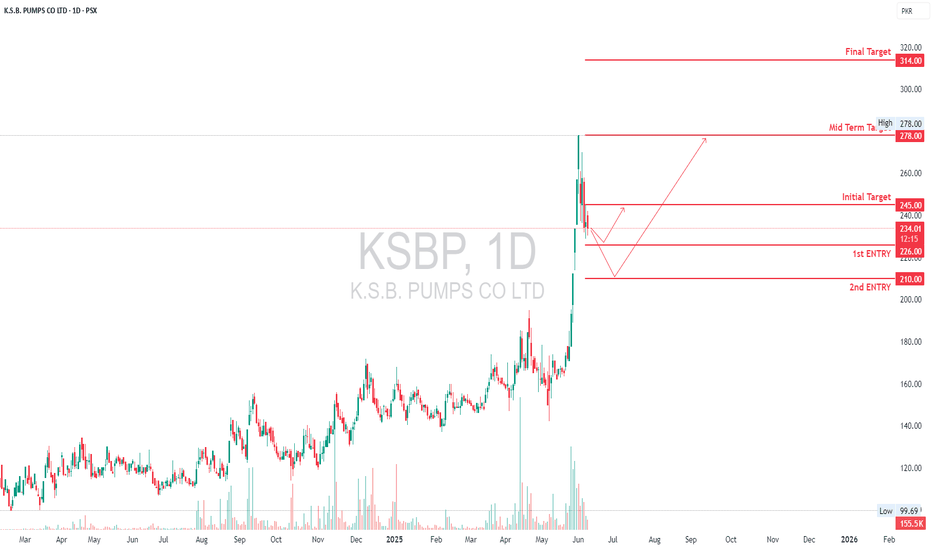

Trade Setup with Multi-Stage Target LevelsThe stock experienced a sharp upward movement, breaking out from a long consolidation phase and reaching a high near PKR 278. Currently, it has pulled back to PKR 235. The chart outlines a trading plan with multiple levels: the first entry point around PKR 226, and a second entry around PKR 210, indicating potential accumulation zones for traders. The initial target is set at PKR 245, the mid-term target at PKR 278, and the final target at PKR 314. The projected paths suggest two scenarios: either a bounce from current levels or a deeper pullback before resuming the uptrend. Volume spikes during the breakout phase suggest strong buying interest. Overall, the chart indicates a bullish outlook with clear risk management levels for potential entries and profit-taking.

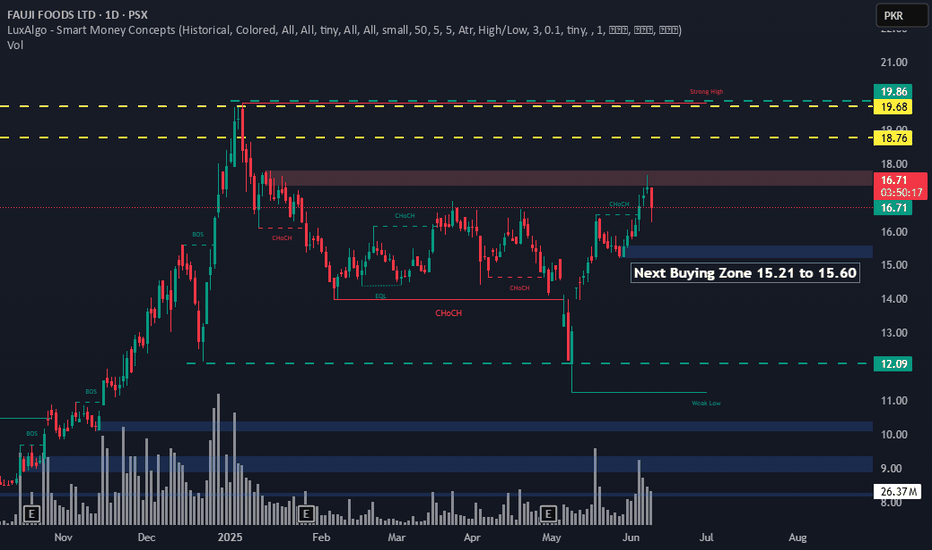

BFBIO Analysis1- Price has been struggling to breakout previous HL since 22nd May

but went vain to date. Which show lack of interest from buyers.

2- Candles with upper wicks and RSI is taking resistance from 60

level on hourly is evident that price will retrace further.

3- Bearish divergence on daily confirming is also confirming the

retracement will proceed. The price may retrace in between

152~192 to form a right shoulder before and impulsive move or

else price need to break and retest the previous LH area to

confirm an impulsive move to start.

4- Keep monitoring for both above mentioned scenarios.

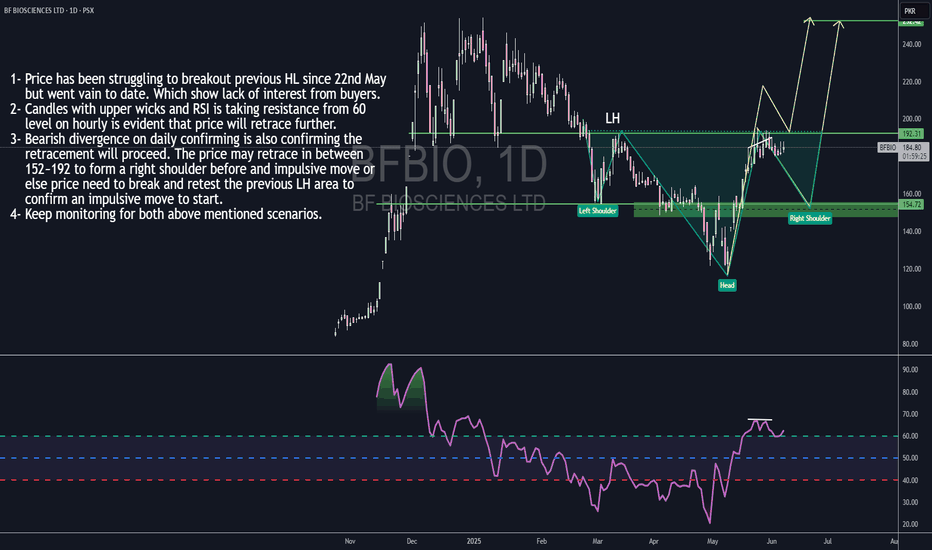

AGSML - BREAKOUT TARGETING 8.50 -11.00, FOLLOWED BY 13.50 - 16.5📈 AGSML (Abdullah Shah Ghazi Sugar Mills Ltd) – Technical Analysis

AGSML has confirmed a breakout from its long-term downtrend line after a prolonged accumulation phase around the PKR 4.5–6.5 range. The stock closed at PKR 7.00, gaining +18.64%, and is now positioned above key Fibonacci retracement levels — signaling a potential trend reversal.

With this breakout, immediate upside targets lie at PKR 8.49, followed by PKR 9.40–10.95 in the short to medium term. A strong move beyond these zones could extend the rally toward PKR 13.50–16.50, based on historical Fibonacci projections.

As long as the price holds above the 6.50–6.90 breakout zone, AGSML appears technically poised for a sustained upward move.

📌 Disclaimer:

This is a technical analysis-based trade idea for educational and informational purposes only. It does not constitute financial advice. Please do your own research (DYOR) and consult your financial advisor before making any investment decisions. Trading involves risk, and past performance is not indicative of future results.

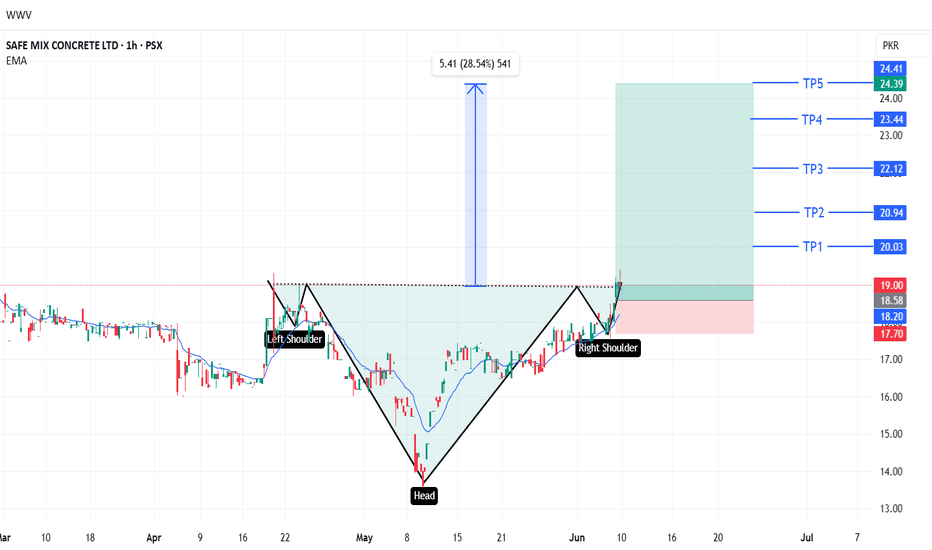

SMCPL LONG TRADE 09-06-2025 (1H TF)SMCPL LONG TRADE

After a recent downtrend, SMCPL is showing signs of upper reversal in the form of an inverted head and shoulders pattern. This reversal is accompanied by increased volumes, adding credibility to the potential upside movement. The stock has created a flipped institutional demand zone and a gap, making this a safe long trade opportunity.

🚨 TECHNICAL BUY CALL – SMCPL🚨

- Buy 1: PKR 19 (current level)

- Buy 2: PKR 18.6

- Buy 3: PKR 18.1

- TP1: PKR 20

- TP2: PKR 20.94

- TP3: PKR 22.12

- TP4: PKR 23.40

- TP5: PKR 24.40

*Stop Loss:* Below PKR 17.7 Daily Close

*Risk-Reward Ratio:* 1:6.6

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.