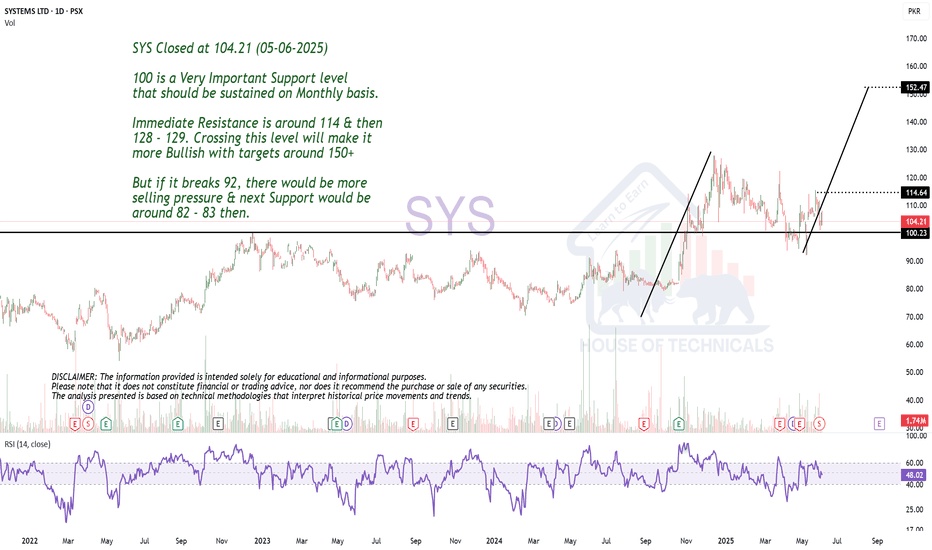

100 is a Very Important Support level.SYS Closed at 104.21 (05-06-2025)

100 is a Very Important Support level

that should be sustained on Monthly basis.

Immediate Resistance is around 114 & then

128 - 129. Crossing this level will make it

more Bullish with targets around 150+

But if it breaks 92, there would be more

selling pressure & next Support would be

around 82 - 83 then.

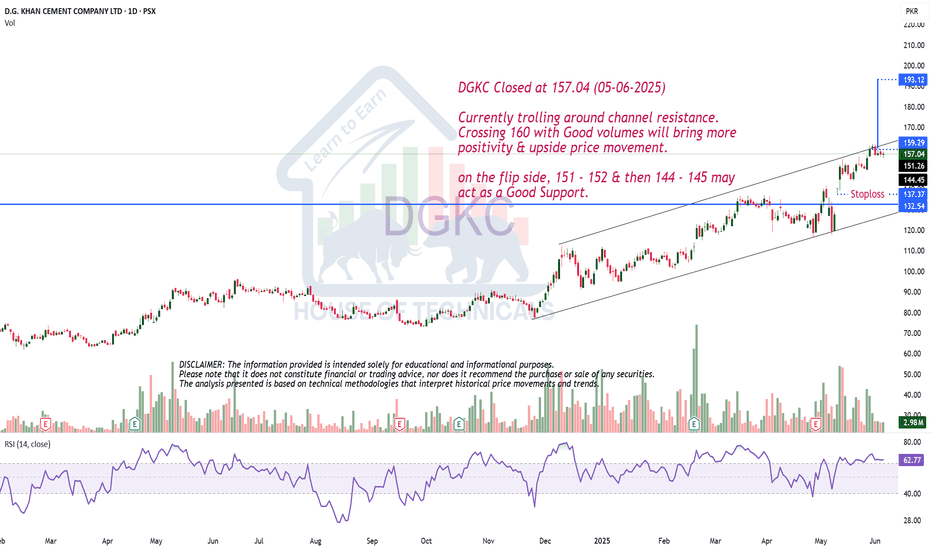

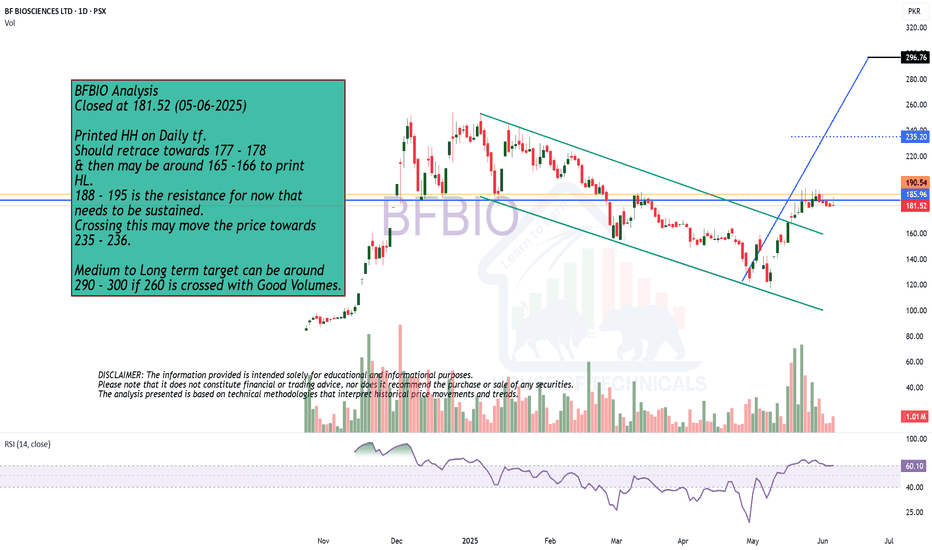

Good Stock for Medium to Long TermClosed at 181.52 (05-06-2025)

Printed HH on Daily tf.

Should retrace towards 177 - 178

& then may be around 165 -166 to print

HL.

188 - 195 is the resistance for now that

needs to be sustained.

Crossing this may move the price towards

235 - 236.

Medium to Long term target can be around

290 - 300 if 260 is crossed with Good Volumes.

Bullish Divergence

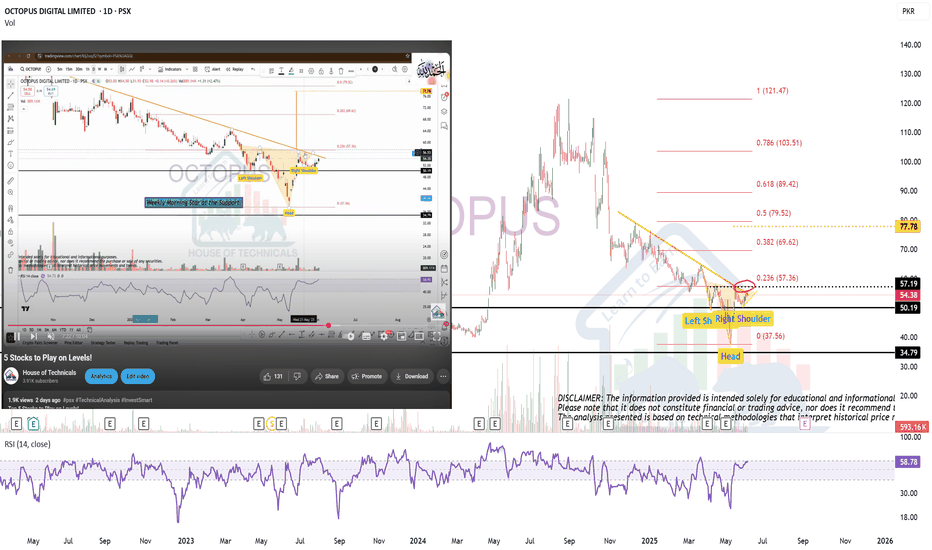

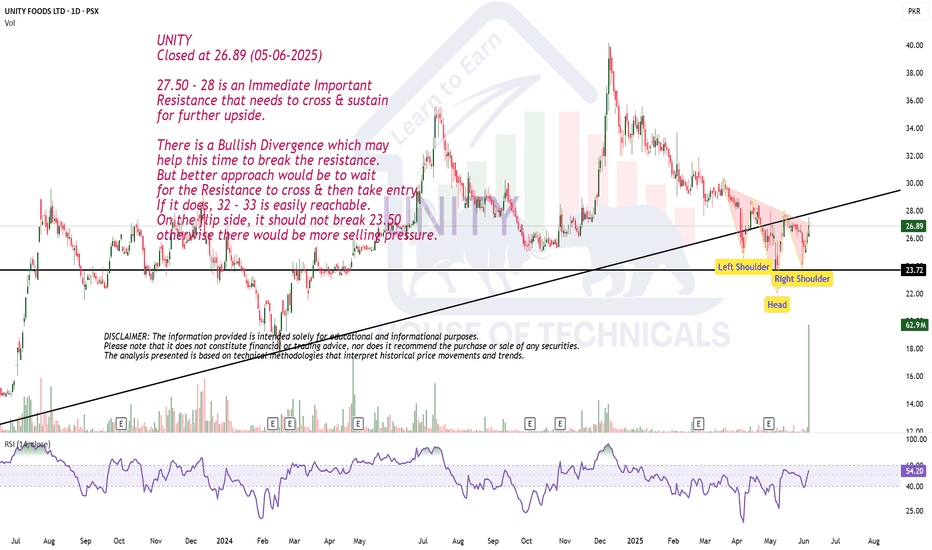

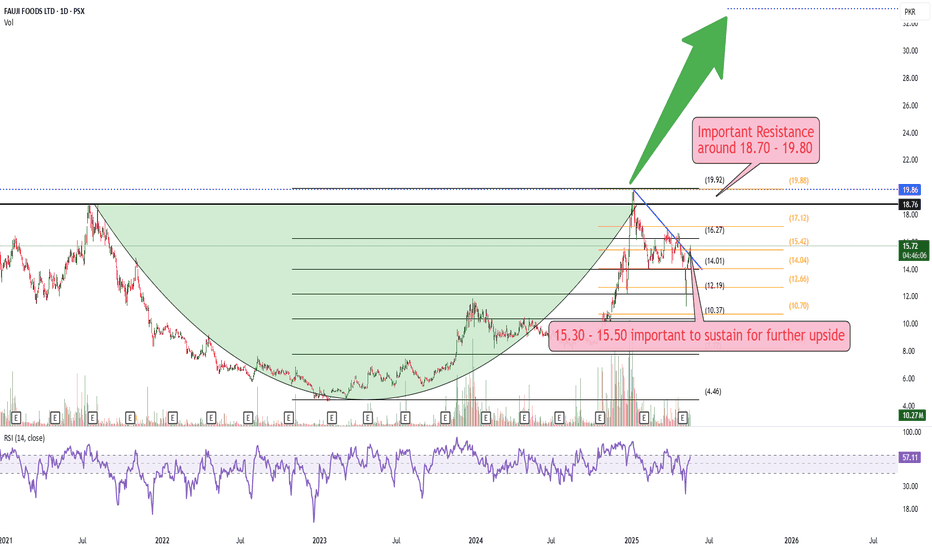

Closed at 26.89 (05-06-2025)

27.50 - 28 is an Immediate Important

Resistance that needs to cross & sustain

for further upside.

There is a Bullish Divergence which may

help this time to break the resistance.

But better approach would be to wait

for the Resistance to cross & then take entry.

If it does, 32 - 33 is easily reachable.

On the flip side, it should not break 23.50

otherwise there would be more selling pressure.

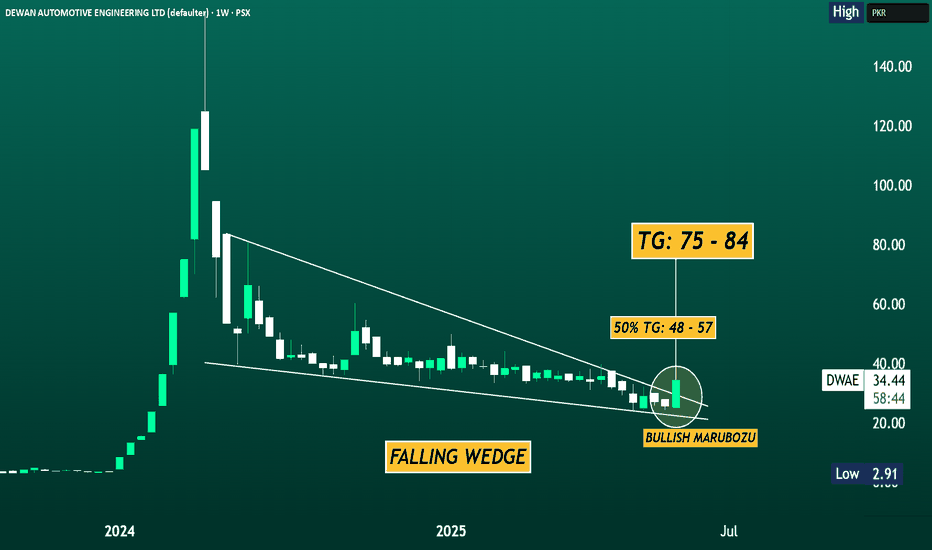

DWAE BULLISH MARUBOZU WITH STRONG BREAKOUT TG: 48 -57, 75 - 84📈 DWAE (Dewan Automotive Engineering Ltd) - TECHNICAL VIEW

Dewan Automotive Engineering Ltd (PSX: DWAE) has delivered a decisive breakout from a long-standing falling wedge pattern, accompanied by a powerful bullish marubozu candle on the weekly chart. The stock surged by +34.01%, closing at PKR 34.44, signaling the potential start of a new uptrend after an extended consolidation phase.

The falling wedge, a classic bullish reversal formation, had been compressing price action for several months. The current breakout, confirmed by increased volume and a strong weekly close above the wedge resistance, marks a shift in momentum from distribution to accumulation.

From a technical standpoint, the immediate initial target lies in the PKR 48–57 range—roughly the 50% retracement zone of the previous decline. A sustained move above this range would open the door toward the broader breakout objective of PKR 75–84, offering significant upside potential.

To maintain this bullish outlook, DWAE must hold above the breakout zone near PKR 28–30, which now acts as strong structural support. Any consolidation above this level would be viewed as a healthy retest and continuation setup.

In summary, DWAE has initiated a high-probability breakout from a classic wedge pattern, supported by a bullish candlestick structure and rising volume. As long as it holds above key support, the stock is well-positioned to advance toward PKR 48–57, with an extended target of PKR 75–84 in the coming weeks.

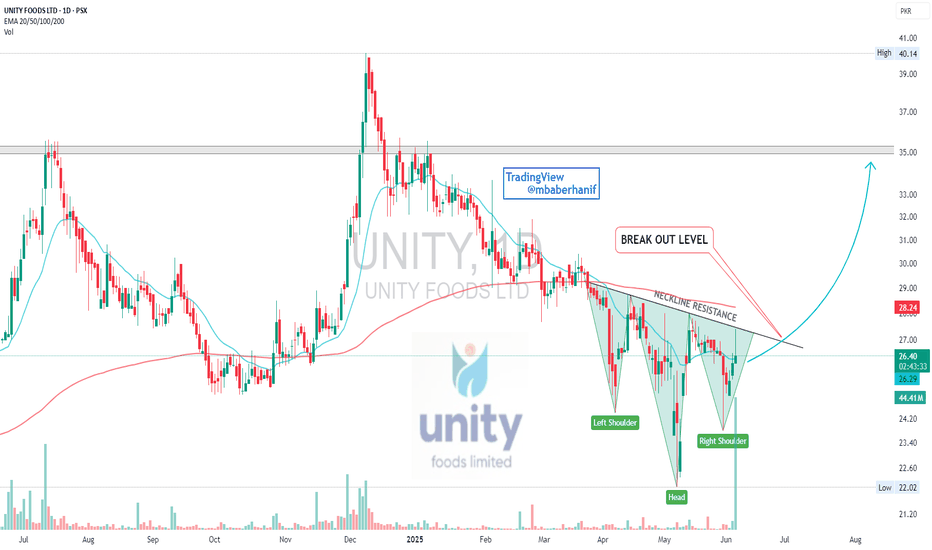

Inverse Head & Shoulders Forming – Watch for Breakout Above 28UNITY indicates the formation of an inverse head and shoulders pattern, a bullish reversal setup. The neckline resistance is drawn around the PKR 27.5–28 level, which also aligns closely with the 200-day EMA at PKR 28.23, adding to its significance. Volume has notably increased during the formation of the right shoulder, suggesting growing bullish interest. A long position should only be considered after a decisive breakout above the neckline resistance , ideally on strong volume, confirming the pattern. If the breakout occurs, the projected upside target could extend toward the PKR 34–35 range, which is a previous major resistance zone. Until then, the setup remains neutral and unconfirmed.

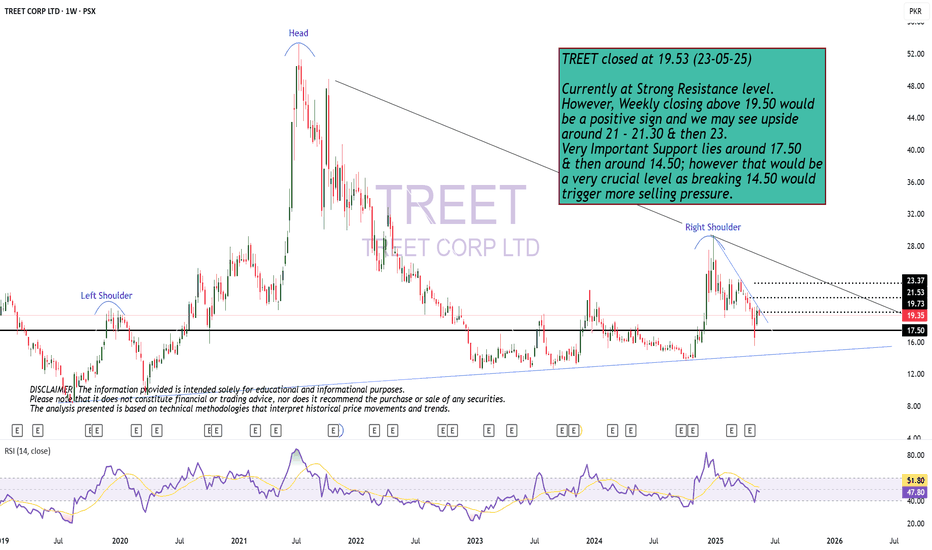

Currently at Strong Resistance level.TREET closed at 19.53 (23-05-25)

Currently at Strong Resistance level.

However, Weekly closing above 19.50 would

be a positive sign and we may see upside

around 21 - 21.30 & then 23.

Very Important Support lies around 17.50

& then around 14.50; however that would be

a very crucial level as breaking 14.50 would

trigger more selling pressure.

Making HH HL.

Closed at 40.45 (04-06-2025)

Making HH HL.

Bearish Divergence played well &

dragged the price from 44 - 45 to around 33.

Printed HL & started moving upside.

If 45 is Crossed & Sustained, we may witness

new Highs around 55 - 57.

However this time, Stoploss should be 33.50

on Closing basis.

GAL LONG TRADEGAL is in a Consolidation since past 5 months- the simple Rule of Trading Ranges is "BUY LOW AND SELL HIGH". GAL has been trading towards channel bottom and now has shown a significant reversal confirmed by HL, VG and price crossing over EMA-20 on 1H TF.

🚨 TECHNICAL BUY CALL –GAL🚨

🎯 BUY ZONE: Rs. 425-430

📈 TP 1: Rs. 445

📈 TP 2: Rs. 468

📈 TP 3: Rs. 490

🛑 STOP LOSS: Below Rs. 413 (Daily Close)

📊 RISK-REWARD: High Conviction | 1:5

Caution:

Buy in 3 parts within given range - Please close at least 50% position size at TP1 and then follow strict trailing SL to avoid losing incurred profits in case of unforeseen market conditions.

SHARE AND BOOST IF YOU FIND THIS HELPFUL

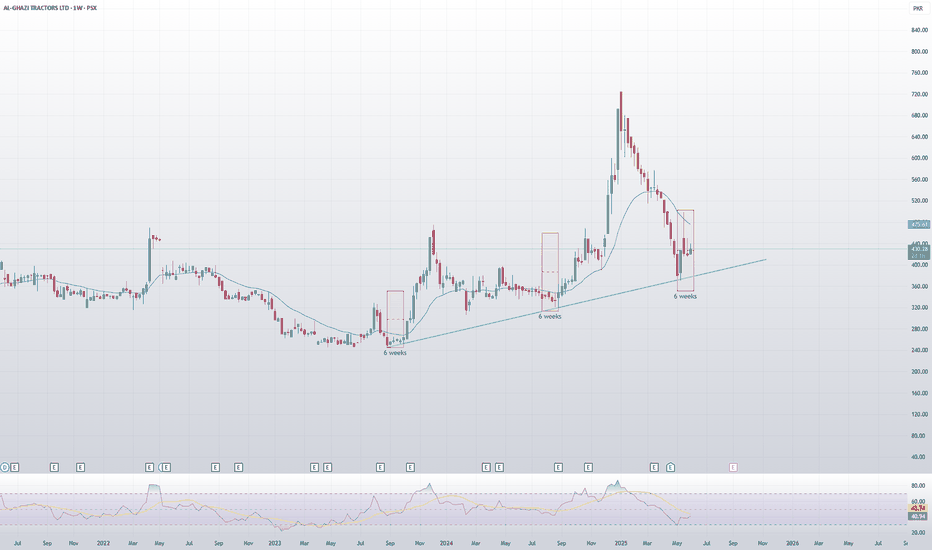

AGTL Weekly Chart Analysis (PSX: AGTL)🟢 Consistent Bullish Reaction from Trendline Support

Trendline Support: Price is respecting a strong ascending trendline that has been tested multiple times since 2023.

Key Observation:

Each time price touches the trendline, it consolidates for exactly 6 weeks.

After this 6-week consolidation, AGTL typically enters a strong bullish rally.

🔁 Repeating 6-Week Pattern

First Zone: October 2023 — 6-week base → breakout rally.

Second Zone: July 2024 — again 6-week accumulation → bullish trend resumes.

Current Zone: May 2025 — AGTL touched the trendline again and has completed another 6-week base.

This is the third time this exact behavior is repeating, indicating a strong fractal pattern and high probability of a new uptrend starting soon.

🔮 Bullish Outlook

If history repeats, AGTL is likely to start rallying soon, potentially leading to a new swing high over the coming weeks/months.

The 6-week cycle provides a time-based edge to anticipate movement rather than reacting late.

📌 Possible Price Projections for Bullish Trend

These are historically grounded targets based on actual previous price movements following similar trendline+consolidation patterns.

If AGTL follows the same 6-week base → rally pattern again:

Short-term target: ~670 PKR (87%)

Extended bull case: ~1030 PKR (188%)

📈 Conclusion

AGTL is showing strong technical consistency:

Each touch of the trendline has led to a 6-week accumulation followed by a bullish breakout.