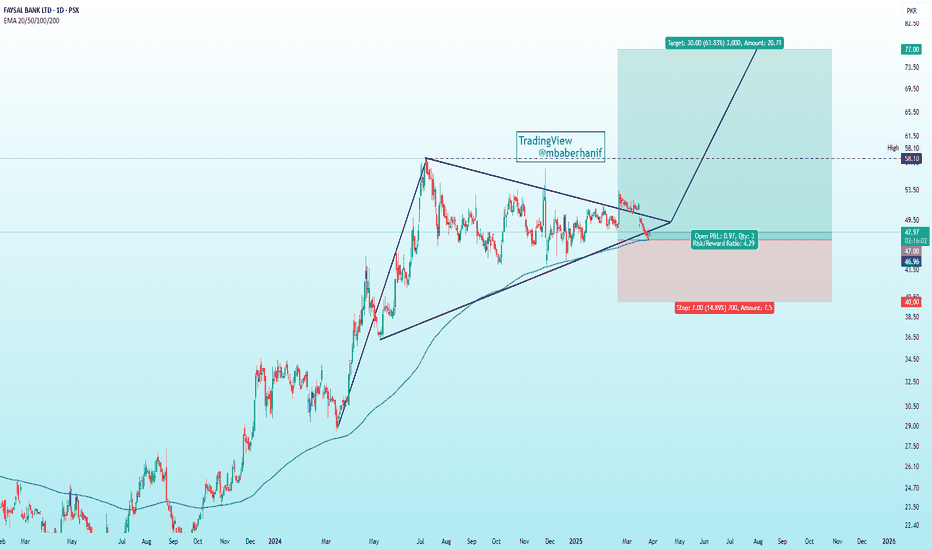

FABL | Bullish Pennant PatternAccording to its price action, FABL is currently testing 200-day EMA and forming bullish pennant pattern which need a break out. Offering a strategic entry opportunity for long positions. On the flip side, short term resistance levels are 50.97, 53.84 and 56.21 and pennant pattern projection lies around 77. Price reversal if it breaks moving average and stop loss level is 40.

Sazgar - Waiting for BudgetSazgar produced excillent performance in both 3rd quarter and 9MFY2025 with PAT of 104% and 186% YoY, respectively.

Technically its looks down at 1144 - 1150 support level.

Budget is the main obstacle.

The government is planning to increase the age limit for importing used vehicles from 3 years to 5 years. If implemented, this could negatively impact volumes of local automobile anufacturers.

The FBR has proposed an increase in withholding tax (WHT) on vehicles with engine capacities above 1,300cc. This would be negative for the local players.

Fundamentally, the light vehicles' manufacturers may face difficulties after budget, being the above, materalized.

Sazgar is excillent company but those external factors are not permitting the buy call.

I am still bullish and will buy more purely on technical basis to recover my losses.

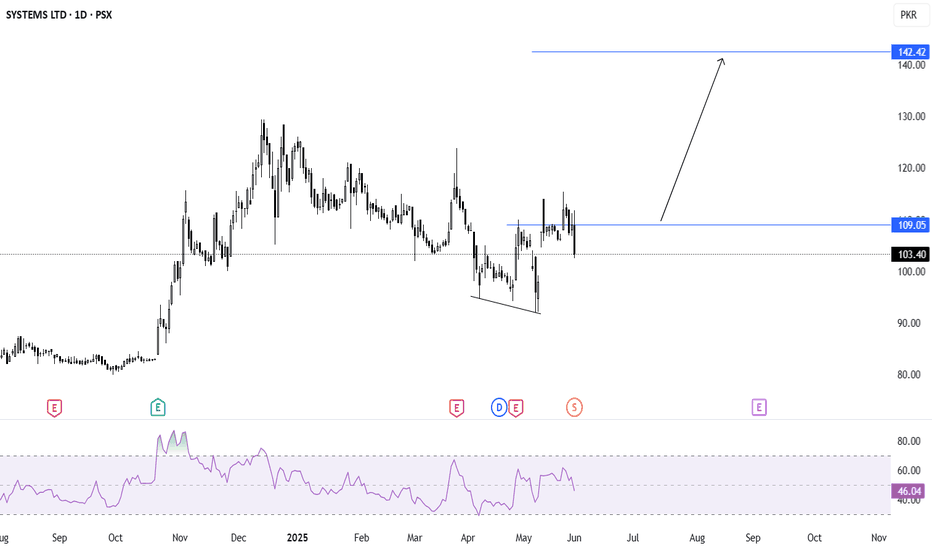

PSX LONG TRADE (SECOND STRIKE) on LTFPSX LONG TRADE (SECOND STRIKE) on LTF

PSX embarked uptrend bandwagon in Sep 2024. It made a high of 36 and went into pullback/correction.

PSX has reversed up in Spike & Gap Pattern – after completing all reversal events like AR, SC, ST, it has shown reversal supported by Volume Spread. It had a healthy pullback, during which we guided to Buy Low and Sell High. Now it is ready for a Swing Trade.

🚨 TECHNICAL BUY CALL – PSX🚨

BUY1: 26.66

BUY2: 26.00

BUY3: 25.67

📈 TP1 : Rs. 29.4

📈 TP2 : Rs. 32.8

📈 TP3 : Rs. 35.96

🛑 STOP LOSS: BELOW Rs. 23.5 (Daily Close)

📊 RISK-REWARD: 1:4.6

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

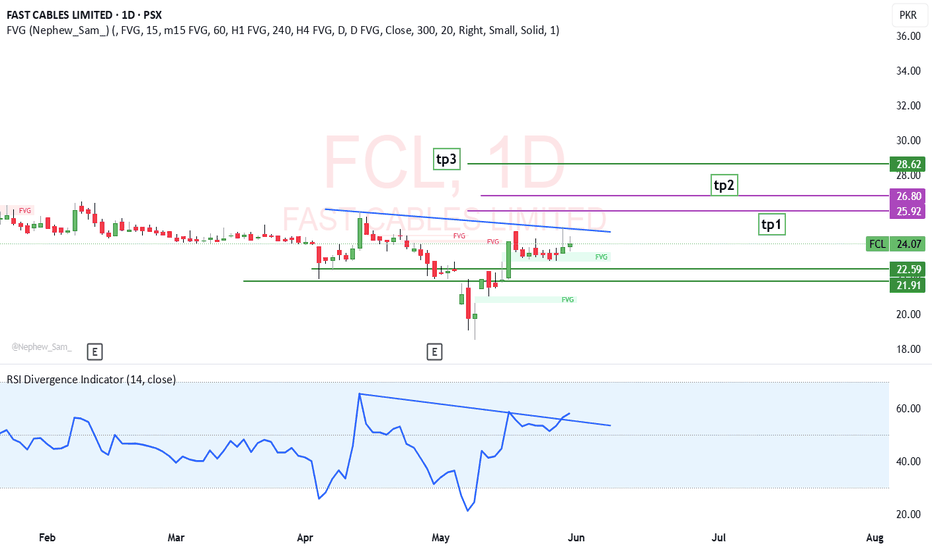

FCL LONGFCL faced a long consolidation almost 137 days, Now it seems it is making higher lows and chances it could hit new Tp1 in short term tp2 in medium term and tp3 in longer term (almost 4-5 months)

It good to accumulate in this zone once stoploss is clear just below 22.39 or 23

Hope to See good gains in this stocks.

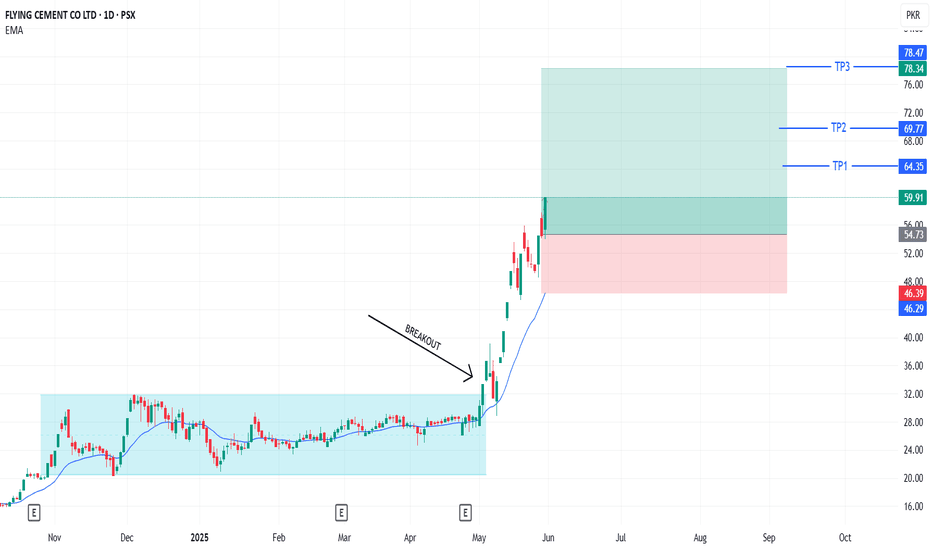

FLYING LONG TRADEFLYING LONG TRADE

FLYING completed its Wyckoff Events and gave a breakout and successfully retested breakout. Post that, entered first wave/ Spike Phase and plotted Historical Highs. Now it is expected to trend in a channel phase, with slower momentum than before (expected) but still in uptrend making HHs and HLs. Also, it has started its third and final up leg. Volume Gradient is encouraging towards FLYING CEMENT up-move journey.

🚨 TECHNICAL BUY CALL –FLYING 🚨

BUY1: 59.9

BUY2: 57.5

BUY3: 54.1

📈 TP1 : Rs. 64.2

📈 TP2 : Rs. 69.77

📈 TP2 : Rs. 78.33

🛑 STOP LOSS: BELOW Rs. 46 (Daily Close)

📊 RISK-REWARD: 1:2.85

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

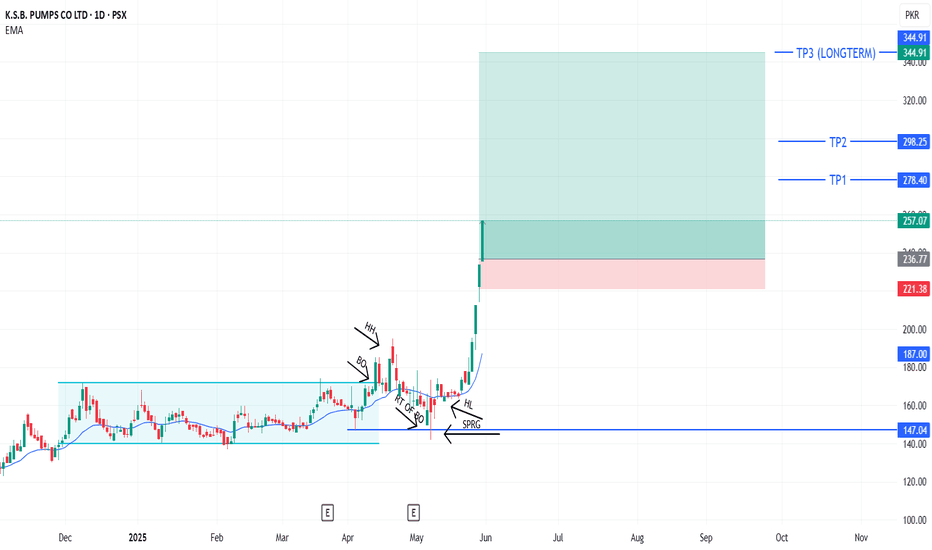

KSBP LONG TRADE (SECOND STRIKE)KSBP LONG TRADE (SECOND STRIKE)

Those who missed, KSBP is offering another ride. It has potential to attain targets beyond current price.

It is in Spike Phase and it created several Inefficiency Zones and Defensive POI. Not to forget the Marubozu candles in the past week demonstrating strength of the uptrend.

🚨 TECHNICAL BUY CALL – KSBP🚨

BUY1: 257

BUY2: 247

BUY3: 237

📈 TP : Rs. 278

📈 TP : Rs. 298

📈 TP : Rs. 344 (LONG TERM)

🛑 STOP LOSS: BELOW Rs. 220 (Daily Close)

📊 RISK-REWARD: 1:7

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

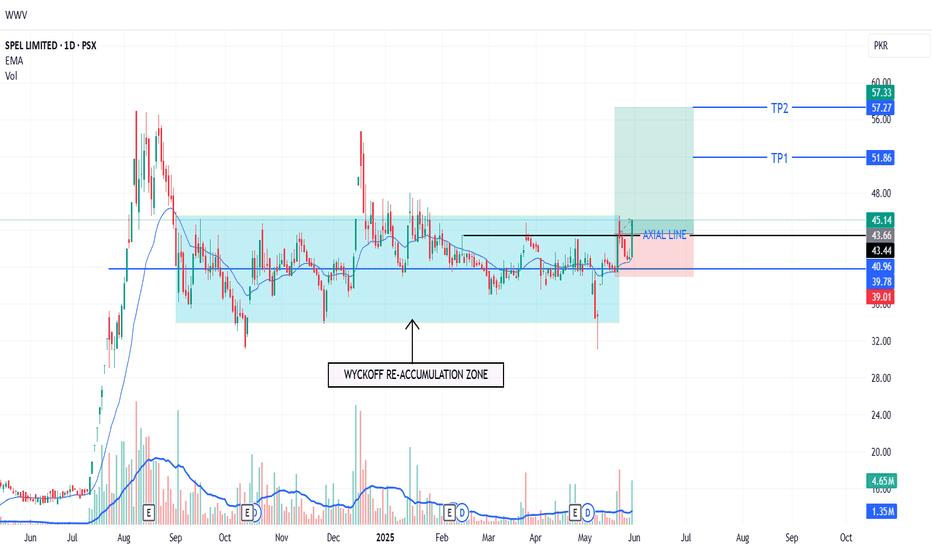

SPEL LONG TRADE (SECOND STRIKE)SPEL LONG TRADE (SECOND STRIKE)

SPEL went into uptrend with a Spike in July 2024. Making a high of 56, it pulled back in Wyckoff Re-Accumulation for months. Now it is in upward reversal as indicated by Volume Distribution. Price is trading above EMA-20. It showed a healthy pull back and now resuming its uptrend journey. During this progression, it has made an Axial Line on Day TF, which is a low-risk spot to enter the trade.

🚨 TECHNICAL BUY CALL – SPEL🚨

BUY1: 45.14

BUY2: 43.5

BUY3: 42.6

📈 TP : Rs. 51.86

📈 TP : Rs. 57.27

🛑 STOP LOSS: BELOW Rs. 39 (Daily Close)

📊 RISK-REWARD: 1:2.9

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

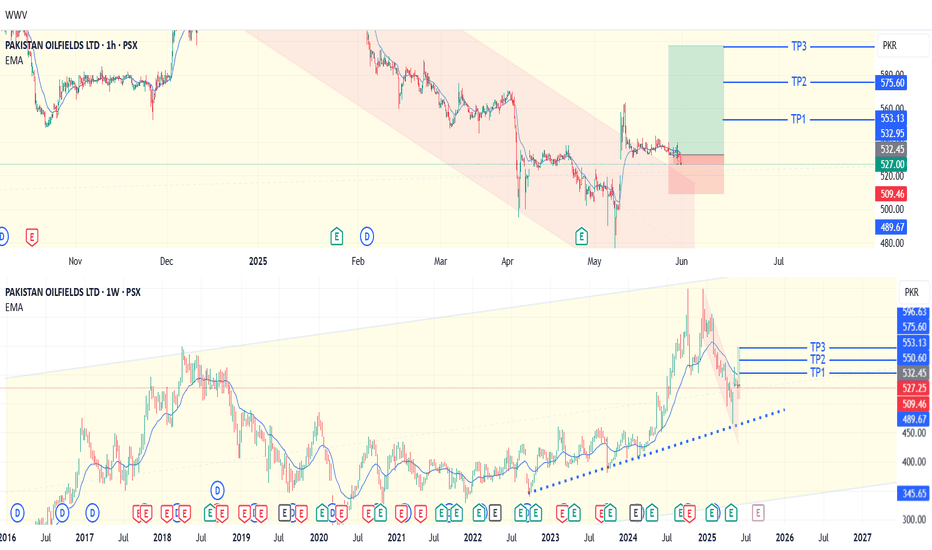

POL LONG TRADEPOL LONG TRADE

POL is in uptrend on 1W chart (yellow channel) since end of 2015. Within this channel, it is now following an upward trend line (blue dotted line) since Oct 2022.

It touched the top of the 1W channel in Dec 2024 and started its Downward leg (pink channel).

If we zoom into lower TF (1H - upper window), POL has broken out of this downward channel in a Spike & Gap Fashion with sufficient Volume Gradient creating a Bullish Breaker Block and FVG.

Trade is considered low risk at this Juncture.

🚨 TECHNICAL BUY CALL – POL 🚨

BUY1: 527

BUY2: 524

BUY3: 521

📈 TP1 : Rs. 552

📈 TP2 : Rs. 574

📈 TP3 : Rs. 596

🛑 STOP LOSS: BELOW Rs. 510 (Daily Close)

📊 RISK-REWARD: | 1:3

Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

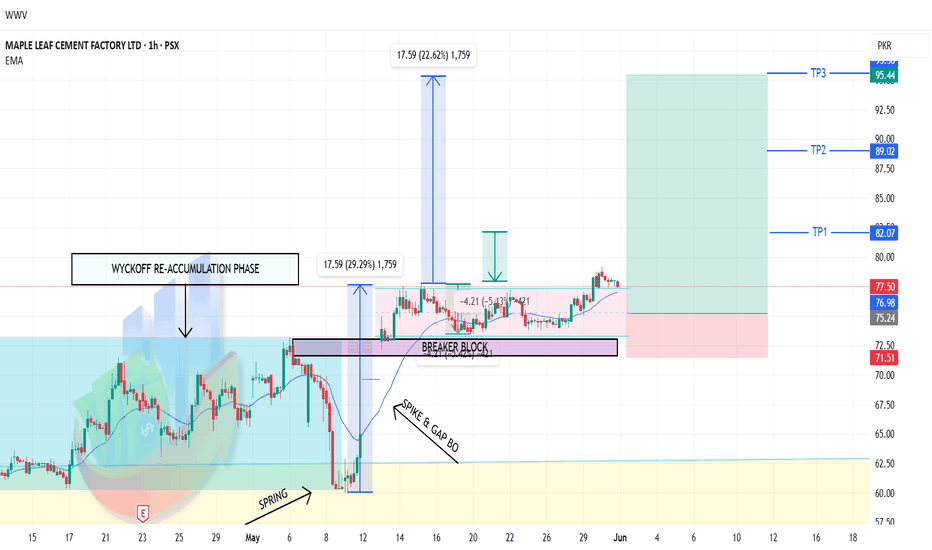

MLCF LONG TRADE (1H TF)MLCF LONG TRADE - on 1H TF

MLCF has been in uptrend since Nov 2024, with a high of 79 on charts.

On LTF/1H, it has recently completed its Wyckoff Re-Accumulation Phase (blue channel) and Broke out of it in shape of Spike and Gap. It continued to consolidate in a Double Bottom Pattern.

This Spike and Double Bottom jointly formed Double Bottom Bull Flag (pink channel). Along with these events, Volume gradient also supports an impending up-move. Importantly, it created a Bullish Breaker block on 1H when it Broke out of the DB Bull Flag, which is a low-risk spot to enter the long trade. The price is also above EMA-20.

Targets have been calculated from different Measured Moves as marked.

🚨 TECHNICAL BUY CALL – MLCF 🚨

BUY1: 77

BUY2: 75

BUY3: 73

📈 TP1 : Rs. 82

📈 TP2 : Rs. 89

📈 TP3 : Rs. 95.25

🛑 STOP LOSS: BELOW Rs. 71 (Daily Close)

📊 RISK-REWARD: High Conviction | 1:5.4

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

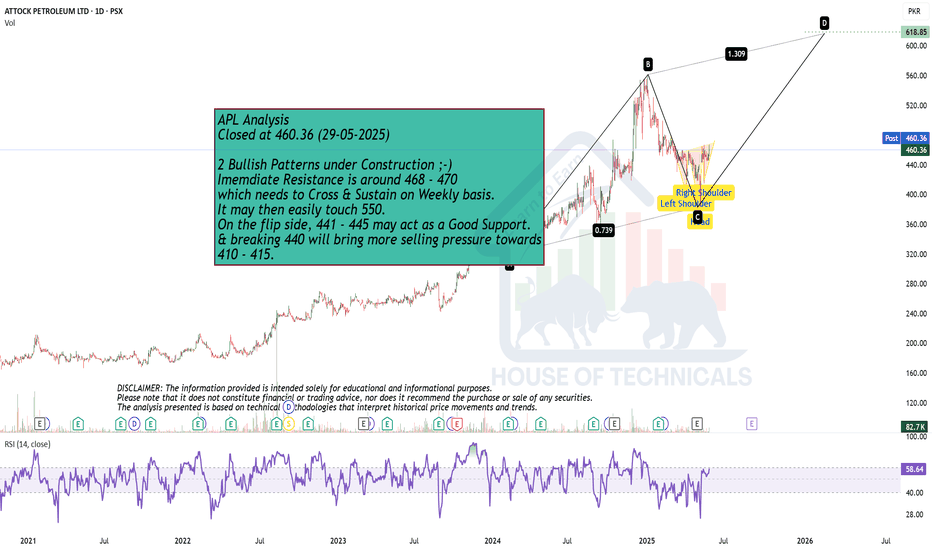

2 Bullish Patterns under Construction ;-)APL Analysis

Closed at 460.36 (29-05-2025)

2 Bullish Patterns under Construction ;-)

Imemdiate Resistance is around 468 - 470

which needs to Cross & Sustain on Weekly basis.

It may then easily touch 550.

On the flip side, 441 - 445 may act as a Good Support.

& breaking 440 will bring more selling pressure towards

410 - 415.

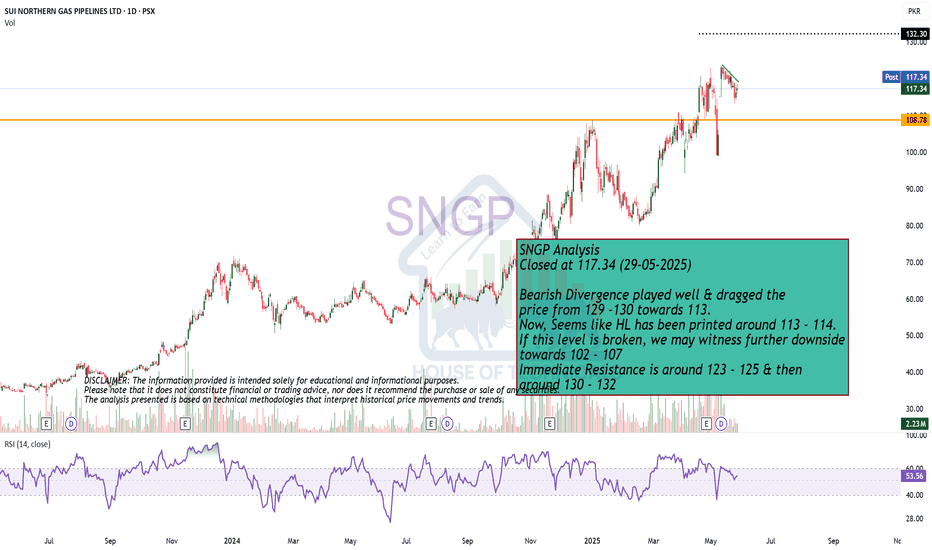

Bearish Divergence played wellSNGP Analysis

Closed at 117.34 (29-05-2025)

Bearish Divergence played well & dragged the

price from 129 -130 towards 113.

Now, Seems like HL has been printed around 113 - 114.

If this level is broken, we may witness further downside

towards 102 - 107

Immediate Resistance is around 123 - 125 & then

around 130 - 132