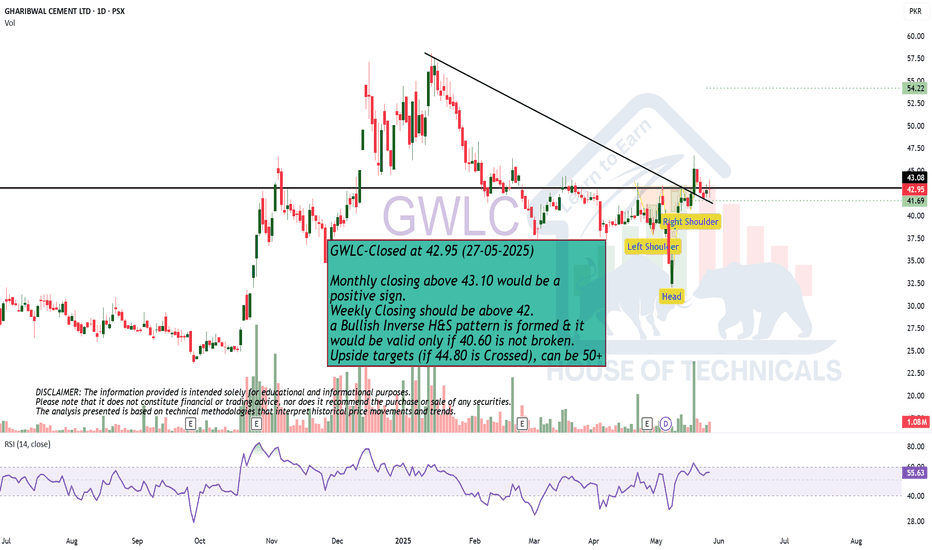

Monthly closing above 43.10 would be a positive sign. GWLC-Closed at 42.95 (27-05-2025)

Monthly closing above 43.10 would be a

positive sign.

Weekly Closing should be above 42.

a Bullish Inverse H&S pattern is formed & it

would be valid only if 40.60 is not broken.

Upside targets (if 44.80 is Crossed), can be 50+

Hidden Bullish Divergence on Bigger tf.IMAGE

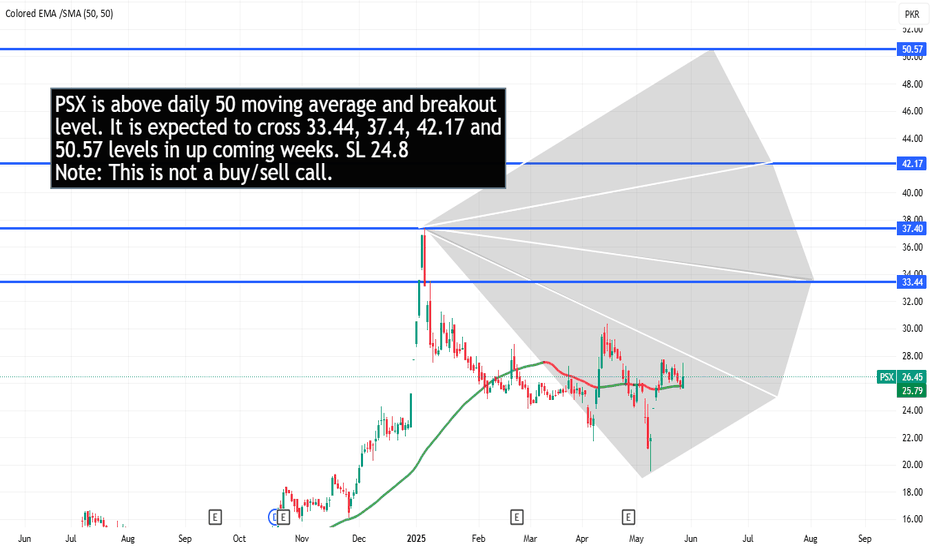

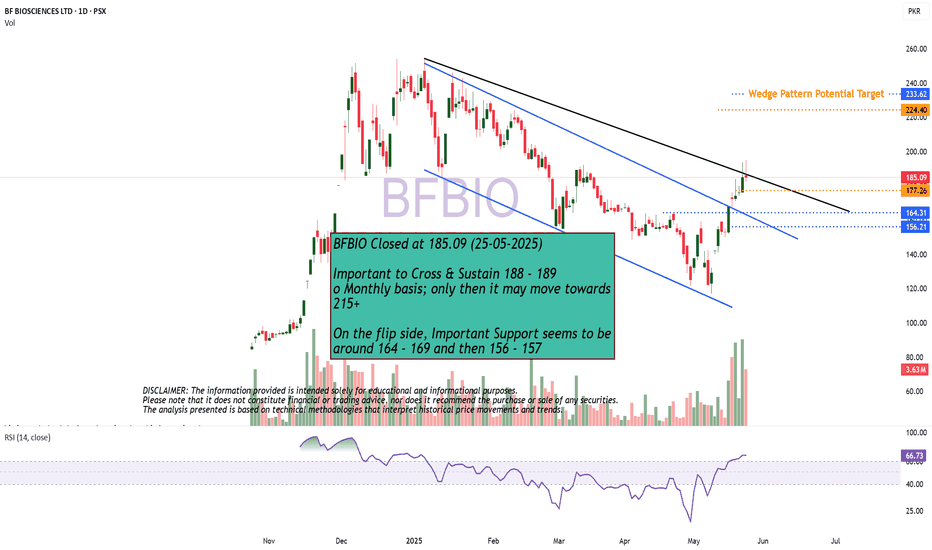

Closed at 21.94 (27-05-2025)

Hidden Bullish Divergence on Bigger tf.

Monthly Closing above 20.70 will be a

positive sign.

Upside Targets can be around 26 - 26.50

On the flip side, 20.50 - 20.68 is a Good

Support zone and then around 19.

Should not break 17.30, otherwise we may

witness nd Reversal.

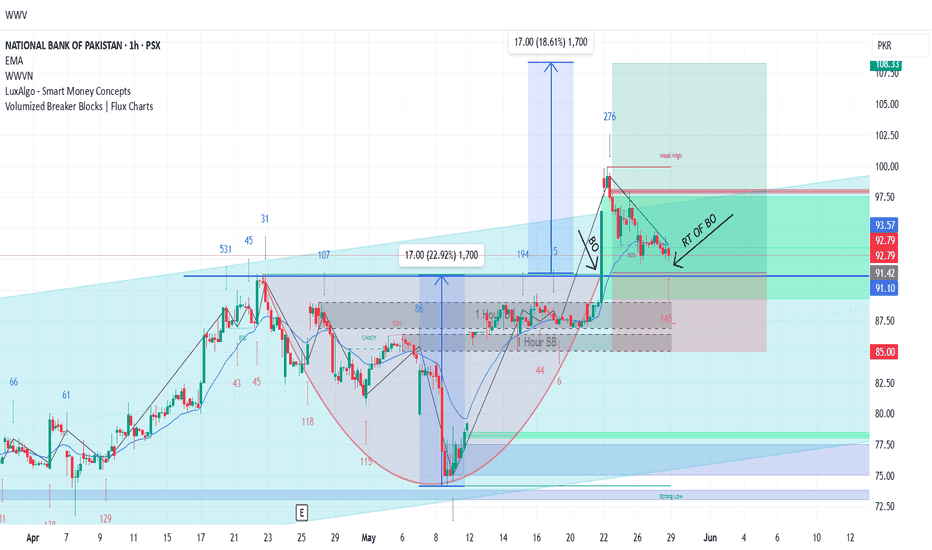

NBP LONG TRADENBP is in uptrend since long and trading in an upward channel. Recently it made a scallop and gave a massive breakout, making a high of 99.96. Currently, it is in process of retesting its breakout level to resume the uptrend.

TECHNICAL BUY CALL– NBP

BUY1 : Rs. 92.79

BUY2 : Rs. 91.11

BUY3 : Rs. 89

📈 TP1 : Rs. 99.9

📈 TP2 : Rs. 108

STOP LOSS: BELOW Rs. 85 (Daily Close)

📊 RISK-REWARD: Medium Conviction | 1:2.63

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

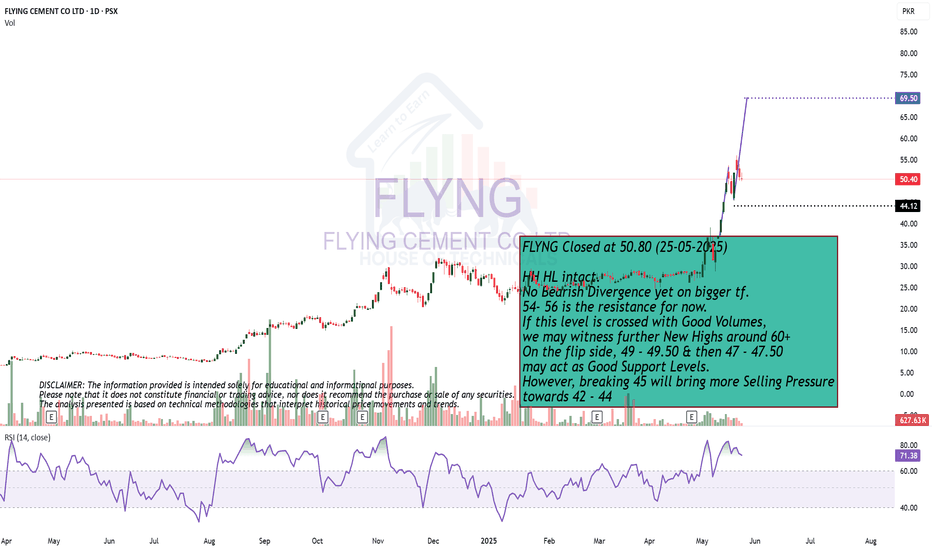

HH HL intact.FLYNG Closed at 50.80 (25-05-2025)

HH HL intact.

No Bearish Divergence yet on bigger tf.

54- 56 is the resistance for now.

If this level is crossed with Good Volumes,

we may witness further New Highs around 60+

On the flip side, 49 - 49.50 & then 47 - 47.50

may act as Good Support Levels.

However, breaking 45 will bring more Selling Pressure

towards 42 - 44

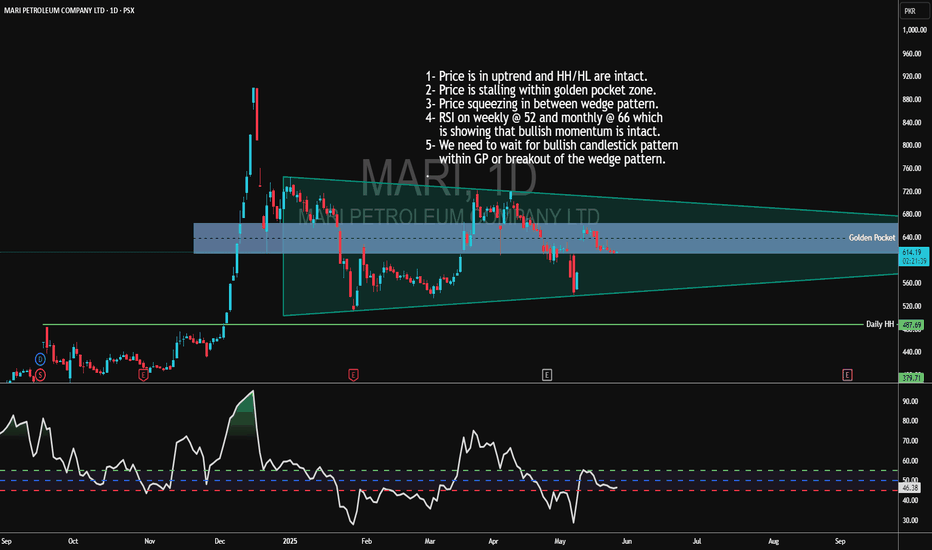

MARI Trade Idea1- Price is in uptrend and HH/HL are intact.

2- Price is stalling within golden pocket zone.

3- Price squeezing in between wedge pattern.

4- RSI on weekly @ 52 and monthly @ 66 which

is showing that bullish momentum is intact.

5- We need to wait for bullish candlestick pattern

within GP or breakout of the wedge pattern.

.

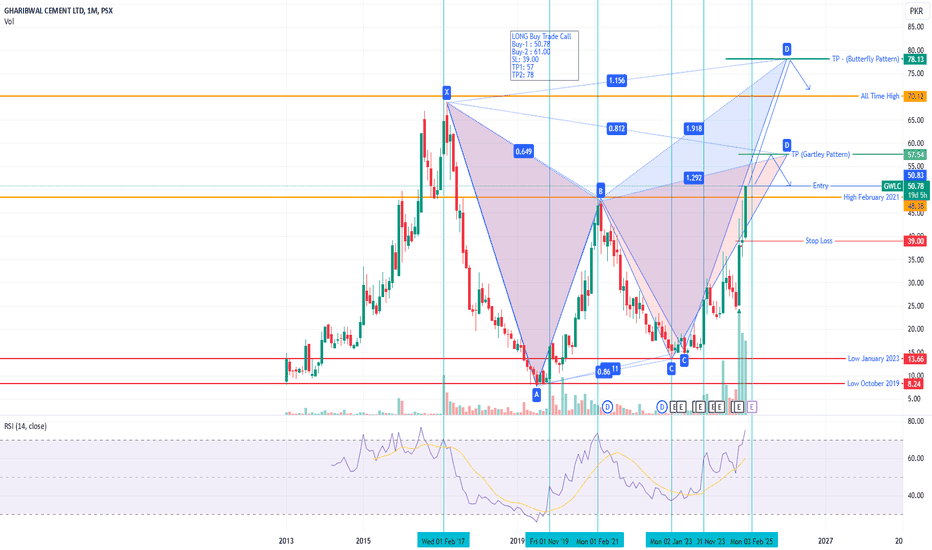

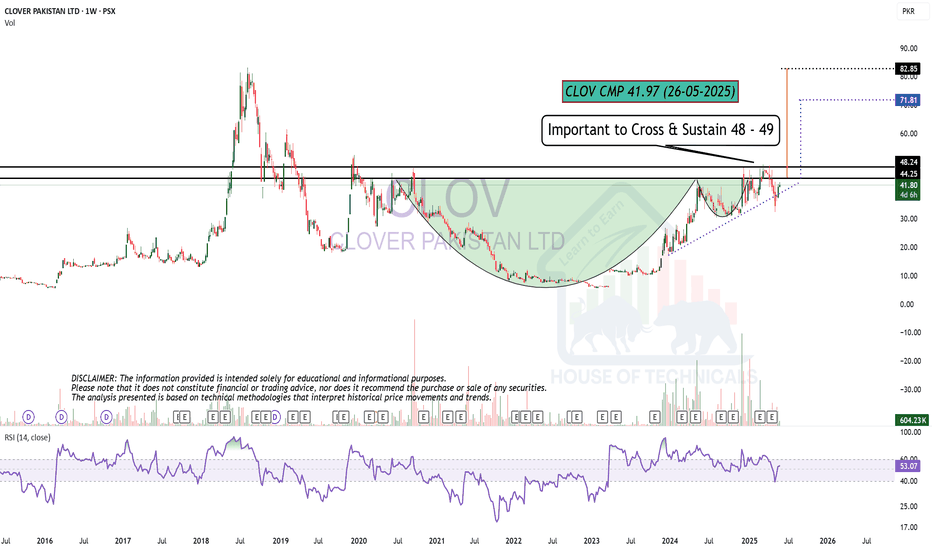

GWLC - PSX - SWING Trading Technical Analysis - Harmonic PatternOn Monthly TF, two harmonic patterns have been drawn. Gartley (94% complying) and Butterfly (88% complying).

In this bull run prices are moving way to fast. And due to market sentiments Bulls are in control. In normal bull run Gartley pattern will be complied before price drops but chances are that price will make new All Time High and follow Butterfly.

RSI is around 80 without any sign of reversal; however, minor retracements are normal but overall price will stay in up trend.

LONG Buy Trade Call

Buy-1 : 50.78

Buy-2 : 61.00

SL: 39.00

TP1: 57

TP2: 78

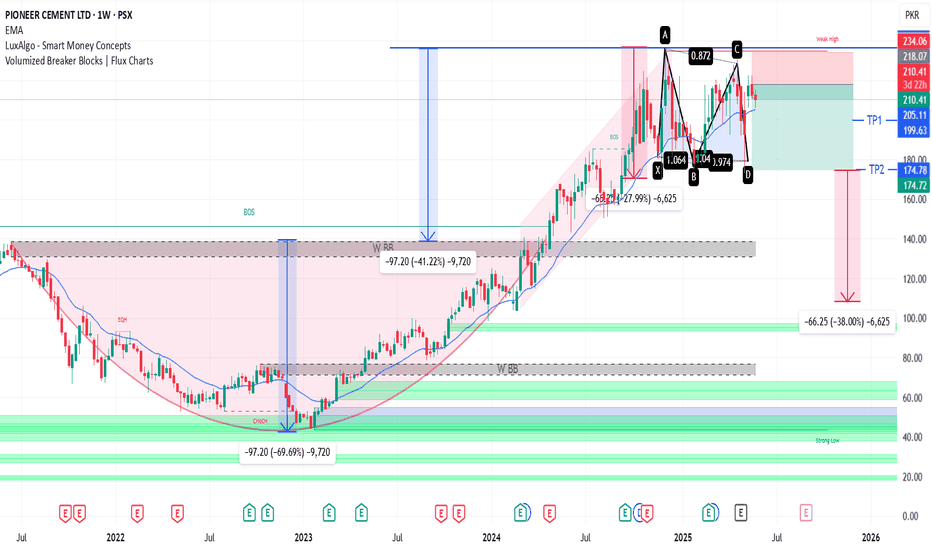

PIOC SHORT-SELL/EXIT CALLPIOC has been in an uptrend since Jan 2023. It made a Scallop formation and gave breakout from that formation in March 2024. It has exactly achieved the target price as projected by measured move. (TP 236), It has now formed a double top with right top lower than the left top. Though targets from the measured move projection of double top are much bigger, but those will be shared at later stage.

🚨 TECHNICAL SHORT-SELL/EXIT CALL – PIOC 🚨

🎯 SHORT-SELL/EXIT ZONE: Rs. 210-220

📈 TP1 : Rs. 195

📈 TP2 : Rs. 175

🛑 STOP LOSS: ABOVE Rs. 234 (Daily Close)

NOTE – Prices are of ready market

📊 RISK-REWARD: Medium Conviction | 1:2.7

Caution: Please enter/exit in 3 parts in give range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

AVN SHORT-SELL/EXIT FOLLOW-UP TRADE (FRESH ENTRY)AVN is trending in a downward channel. After posting a healthy pull-back, AVN has been rejected from Breaker Block.

🚨 TECHNICAL SHORT SELL/EXIT CALL –AVN 🚨

🎯 SHORT-SELL/EXIT ZONE: Rs. 48.3-51

📈 TP1 : Rs. 45.1

📈 TP2 : Rs. 41.1

🛑 STOP LOSS: ABOVE Rs. 53.7(Daily Close)

NOTE – Prices are of ready market

📊 RISK-REWARD: Medium Conviction | 1:2.75

Caution: Please enter/exit in 3 parts in give range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

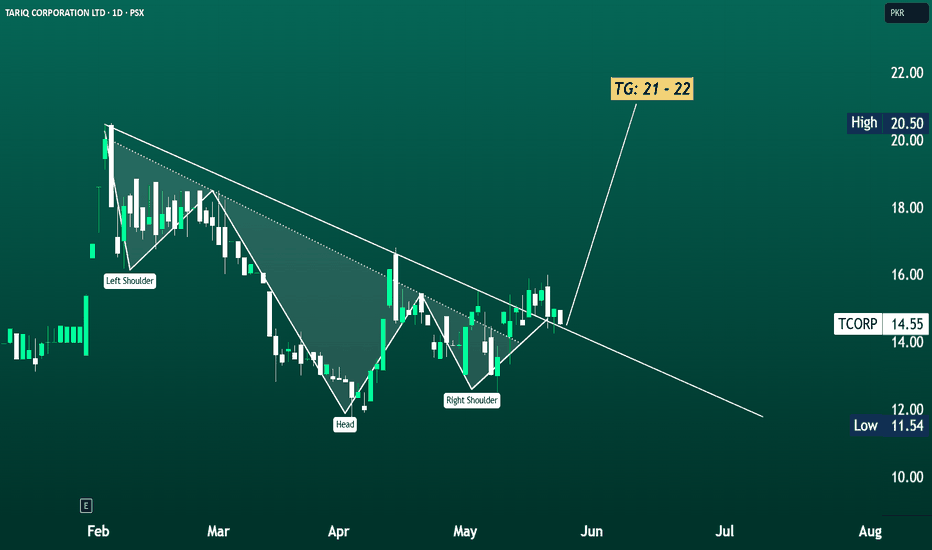

TCORP INVERSE H&S PATTERN; TG 20 -22📈 TCORP (Tariq Corporation Ltd – Hussein Sugar)

TCORP has triggered a classic bullish reversal pattern with a clear breakout from an Inverse Head & Shoulders formation on the daily chart. After forming a solid base with the Left Shoulder, Head, and Right Shoulder, the price has now convincingly broken above the neckline near PKR 14.80–15.00, confirming the pattern.

The current breakout candle, closing at PKR 15.30 with a gain of +5.15%, is backed by improving volume—adding strength to the bullish case. This pattern generally suggests a trend reversal from downtrend to uptrend, and based on the measured move from the head to the neckline, the projected target lies between 21–22, as indicated on the chart.

As long as the price sustains above the neckline zone (now turned support), this setup remains active and valid. A short-term retest of the breakout zone could offer a potential entry point for late movers, while momentum traders may look to ride the trend up to the target area.

In summary, TCORP is showing strong technical momentum after confirming a textbook reversal pattern. With a well-defined structure and upside target in sight, the stock looks poised for a potential move toward 21–22 in the coming sessions.

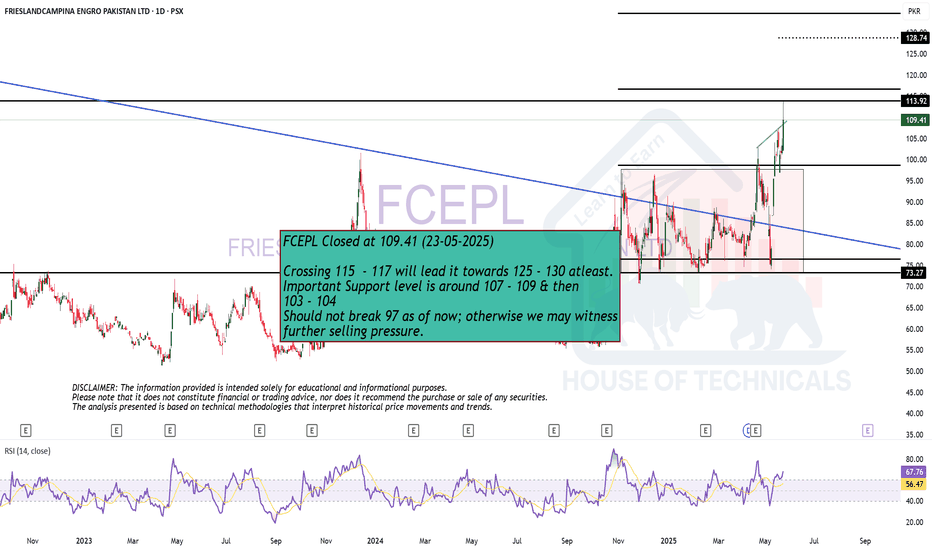

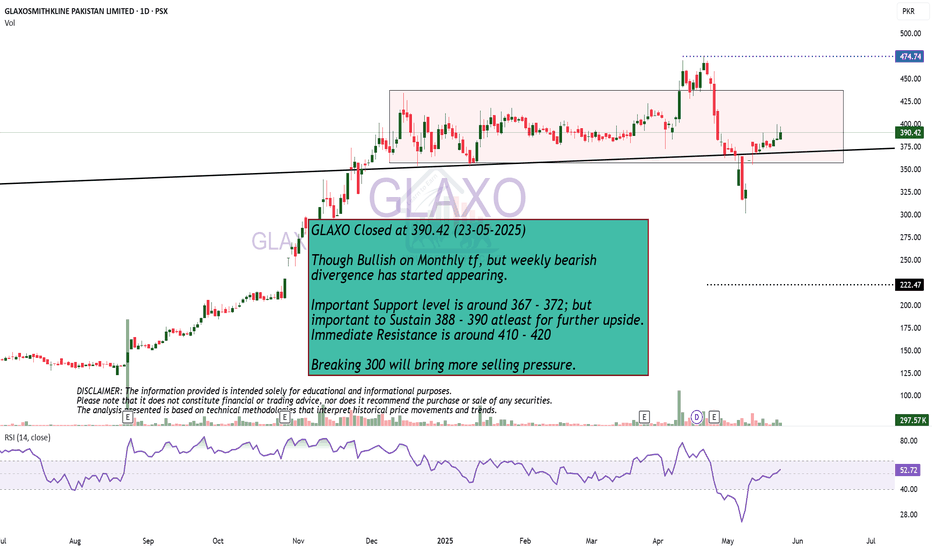

Though Bullish on Monthly tf, butGLAXO Closed at 390.42 (23-05-2025)

Though Bullish on Monthly tf, but weekly bearish

divergence has started appearing.

Important Support level is around 367 - 372; but

important to Sustain 388 - 390 atleast for further upside.

Immediate Resistance is around 410 - 420

Breaking 300 will bring more selling pressure.

NRL Share Buying Strategy"NRL Buying Strategy:

- Current Trend: NRL has performed well over the last two weeks.

- Buying Plan: We're waiting for the price to pull back to the optimal buying zone of Rs. 226-213.

- Buying Signal: We'll look for a buying signal within this zone before entering the trade.

- Trade Details:

- Buying Range: Rs. 226-213

- Stop Loss: Rs. 220

- Target: Rs. 290

This strategy is based on technical analysis, and we'll execute the trade when the conditions are met."