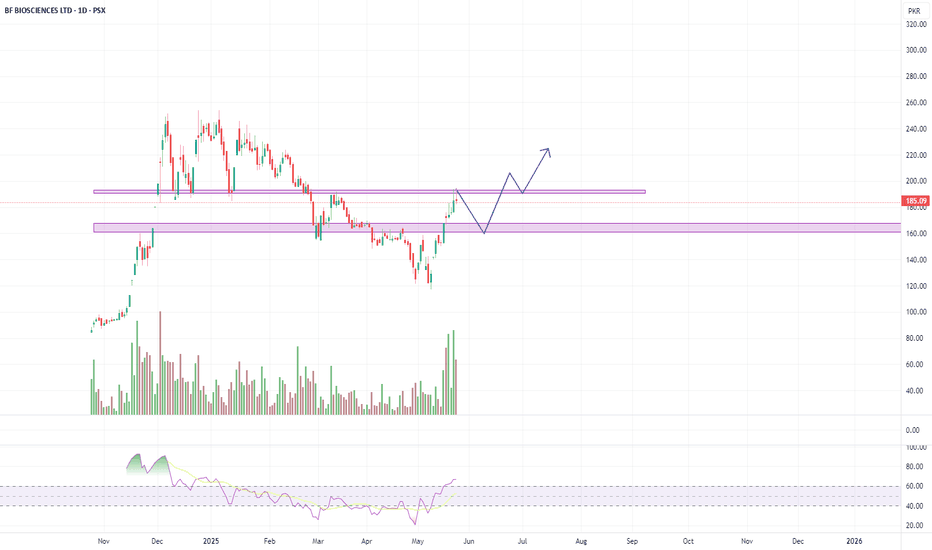

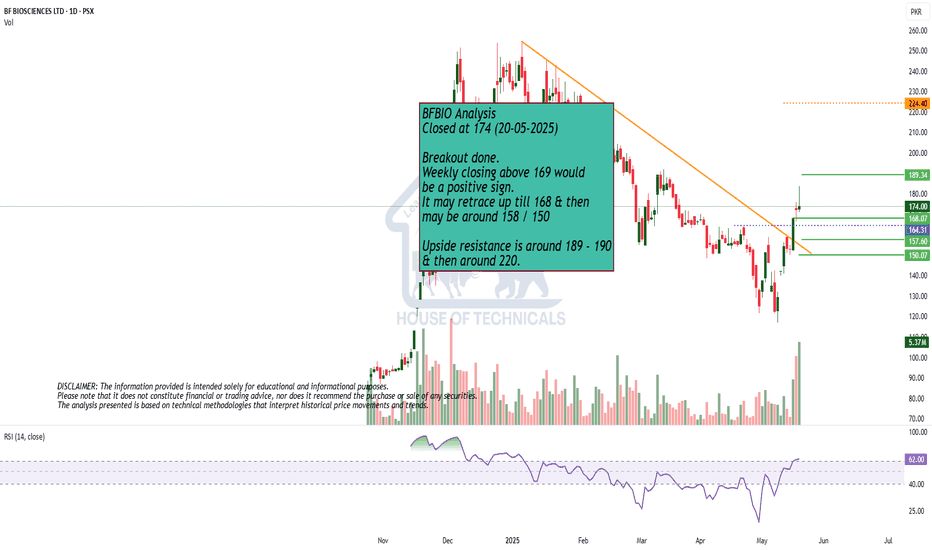

BFBIO Share Buying opportunity "BFBIO Share Buying Strategy:

- Current Price: Rs. 183

- Trend Line Breakout: Post-breakout, we expect a pullback to Rs. 166-160, which presents a buying opportunity.

- Buying Zone: Rs. 166-160

- Stop Loss: Rs. 150

- Targets:

- 1st Target: Rs. 192

- 2nd Target: Rs. 204

- Hold Target: Rs. 224

This strategy is based on technical analysis, and it's essential to monitor the stock's performance and adjust the strategy accordingly."

BFBIO LONG TRADEBFBIO has been in uptrend since its induction in PSX in Oct 2024.

It completed spike phase of its Uptrend in First week of Dec, then it started its Pullback in Bearish Channel (Remember Bear Channel is in fact a Bull Flag).

I gave Breakout from this Bull Flag with heavy volumes as shown by Weis Wave Volumes

Usually measured move out of channel correction goes to the start of the channel which is around 240

To have a better Risk to Reward Ratio buying is recommended in 3 parts

Trailing of SL after TP1 is also suggested

BUY1 170

BUY2 164

BUY3 158

TP1 190

TP2 240

SL BELOW 150

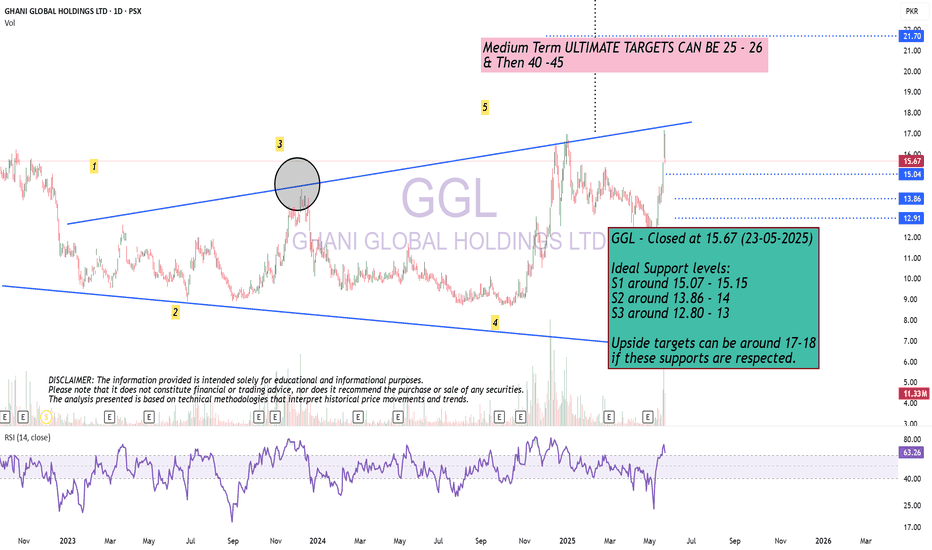

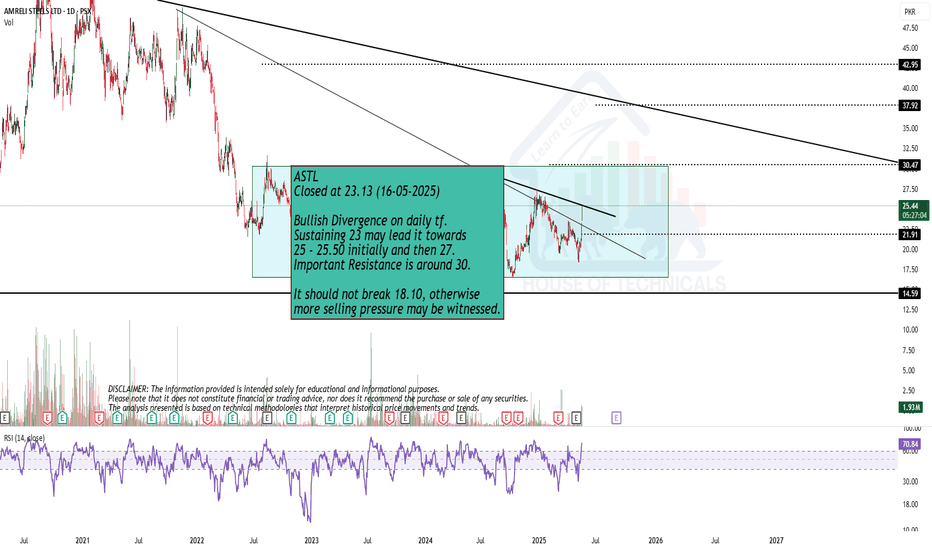

SLGL LONG TRADEUpon its inception in PSX, SLGL gave an astounding rally from Rs 8.0 to Rs 20.0 in just one month (Aug to Sep 2024).

Since then its has been correcting in a down sloping channel

It has recently Broken out of the Channel with Big Vol.

It has also given a Pullback on low volume.

All phases/events as per Wyckoff Methodology have been marked on the chart for easy comprehension.

CAUTION: Though measured move targets are big, readers are recommended to tighten the stop loss when the price crosses TP1 -18, because there is major Supply Zone right above this level

BUY SLGL 15-16

TP1 18

TP2 20.6

TP3 23.2

SL BELOW 14.2

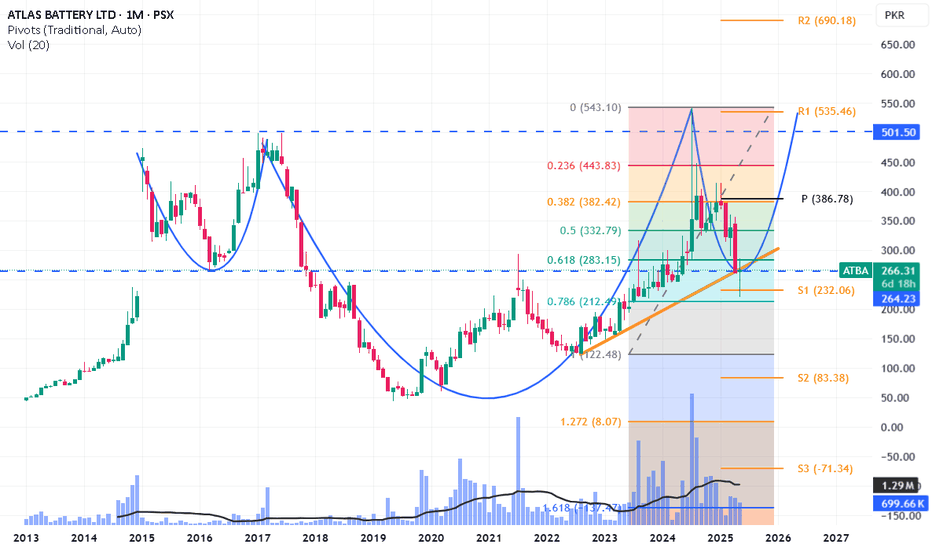

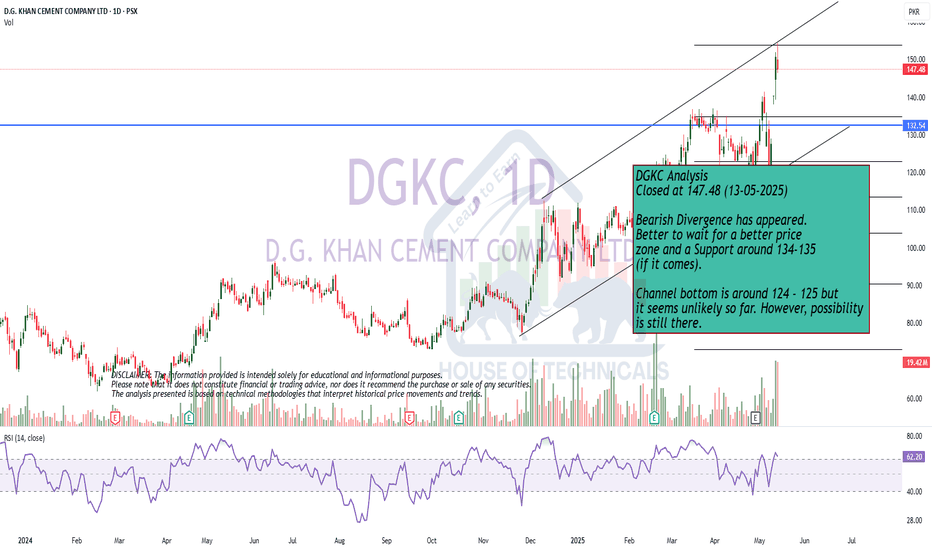

ATBA LongATBA is making inverse head and shoulders pattern.

After the war fiasco, it broke the orange trendline and is currently struggling to close above it on monthly chart. A monthly closing above 270 would be a very good sign.

Once it closes above it, next resistances will be 283, 333 and 383 before eventually moving towards its all time high (500-530)

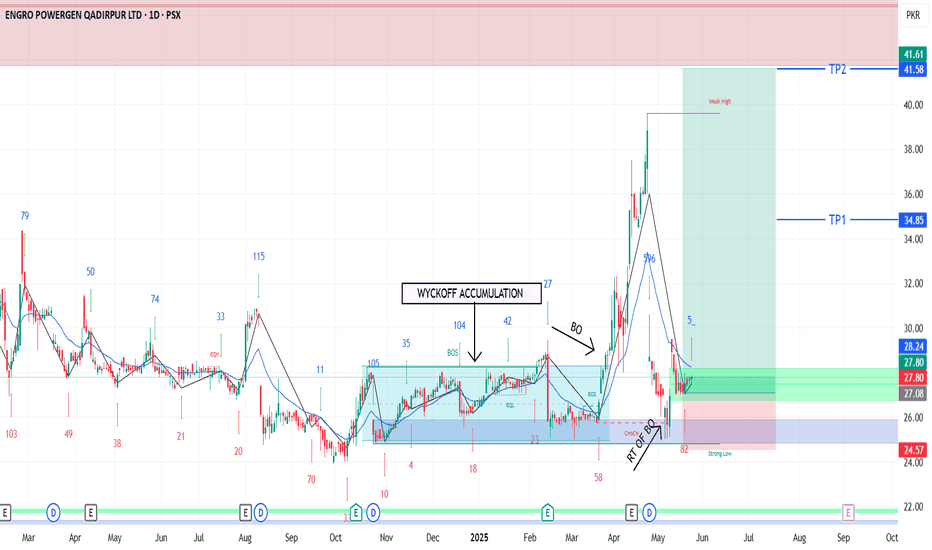

EPQL LONG TRADEEPQL was previously in downtrend, then it switched to WYCKOFF Accumulation Phase from Oct 2024 to March 2025. Then it broke out of this accumulation phase with supportive volume distribution. Recently, it has retraced back to the Demand Zone which caused the breakout. It is ready to resume its ascend.

🚨 TECHNICAL BUY CALL – EPQL🚨

🎯 BUY ZONE: Rs. 26-28

📈 TP1 : Rs. 34.8

📈 TP2 : Rs. 41.6

🛑 STOP LOSS: BELOW Rs. 24.5 (Daily Close)

📊 RISK-REWARD: High Conviction | 1:5.8

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST THE IDEA IF YOU FIND IT HELPFUL.

Bullish

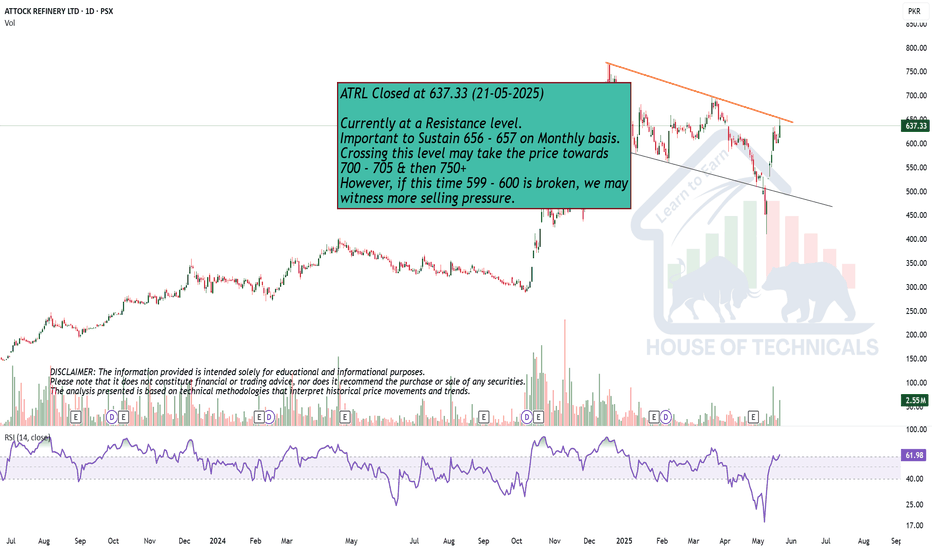

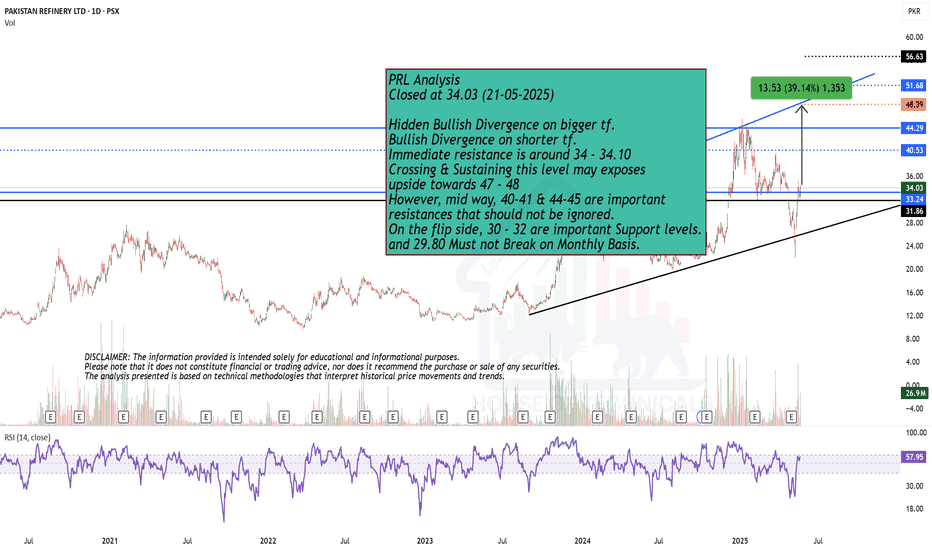

Closed at 34.03 (21-05-2025)

Hidden Bullish Divergence on bigger tf.

Bullish Divergence on shorter tf.

Immediate resistance is around 34 - 34.10

Crossing & Sustaining this level may exposes

upside towards 47 - 48

However, mid way, 40-41 & 44-45 are important

resistances that should not be ignored.

On the flip side, 30 - 32 are important Support levels.

and 29.80 Must not Break on Monthly Basis.

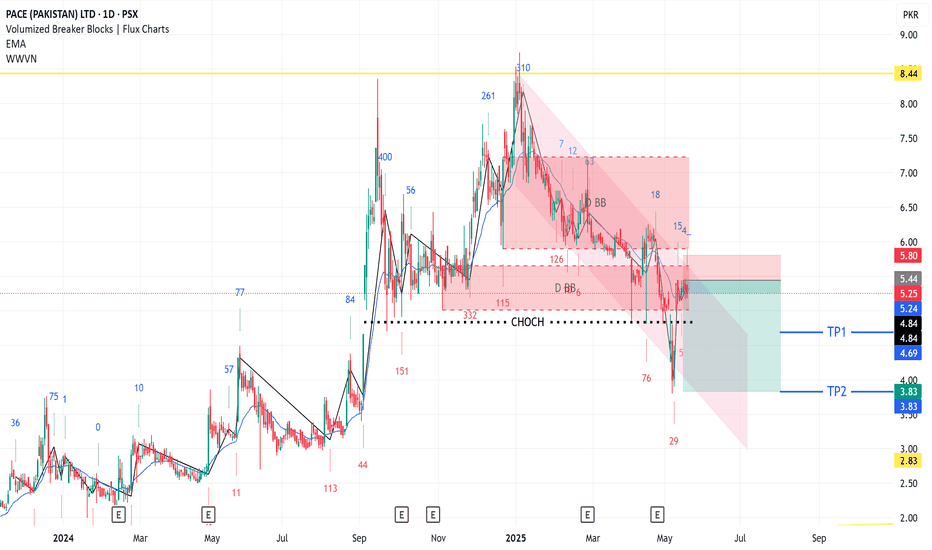

PACE SHORTSELL TRADEPACE been in DOWNTREND since JAN 2025.

Recent up leg has been mostly due to across the board Bullish Sentiments because of improvement in Geo Political Environment.

Current Up Move is also just a healthy Pullback in overall Downtrend.

There's strong Bearish Breaker Block overhead current levels which will obstruct any upward movement.

🚨 TECHNICAL SHORT SELL CALL –PACE 🚨

🎯 SHORTSELL ZONE : 5.2-5.6

📈 TP1 : Rs. 4.7

📈 TP2 : Rs. 3.9

🛑 STOP LOSS: Above Rs. 6 (Daily Close)

📊 RISK-REWARD: High Conviction | 1:4.5

Caution:

Please close at least 50% position size at TP1 and then follow strict trailing SL to avoid losing incurred profits in case of unforeseen market conditions

PLEASE BOOST THE IDEA IF YOU FIND IT HELPFUL.