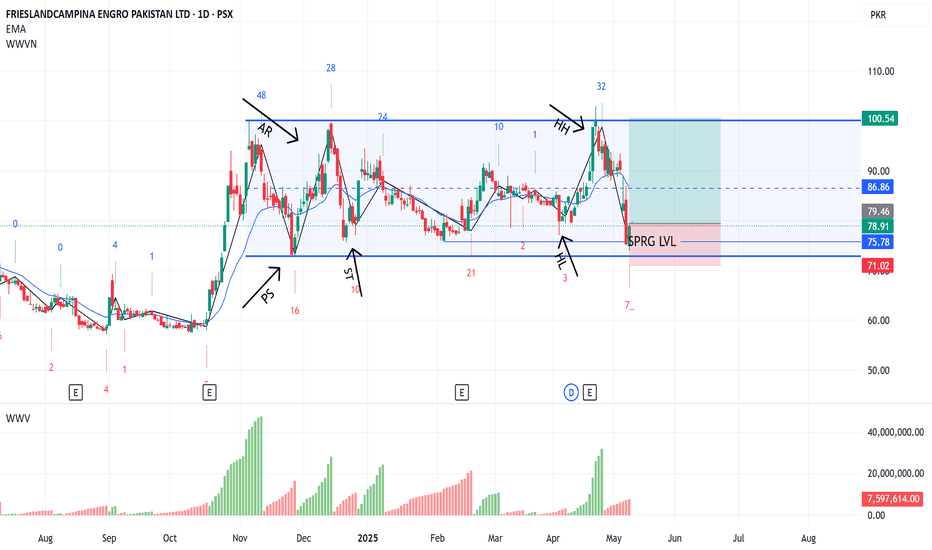

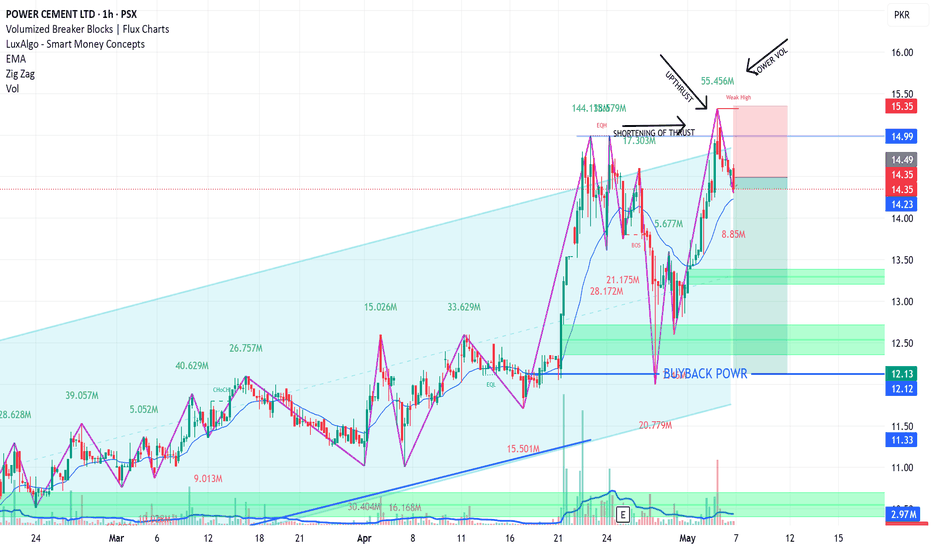

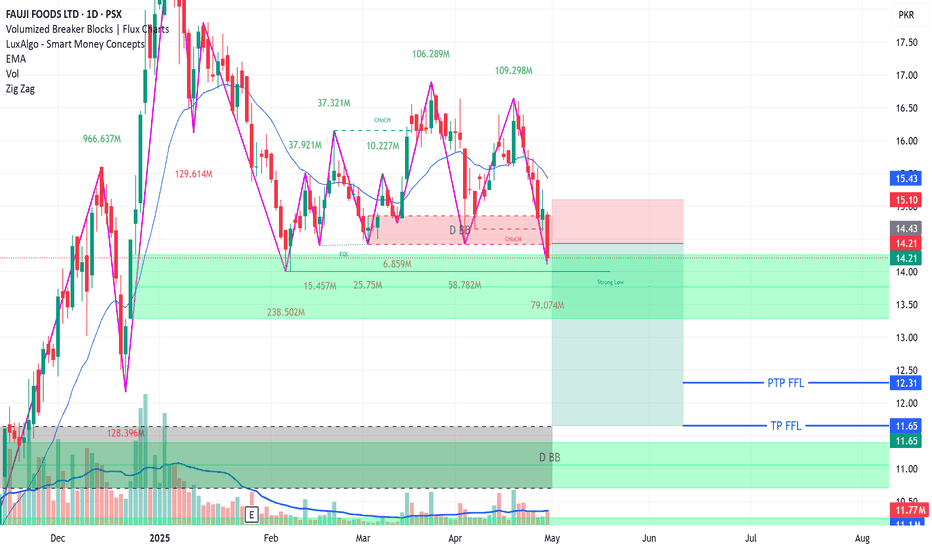

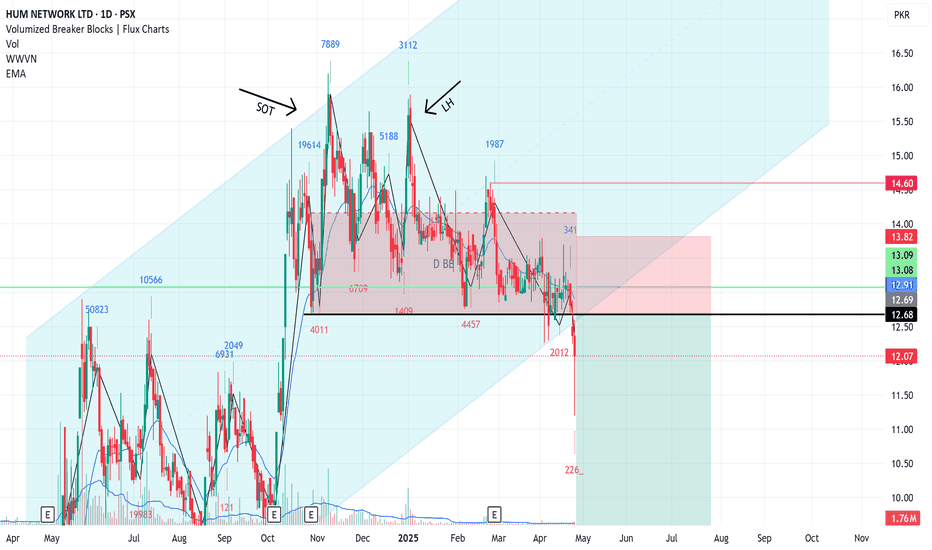

POWER SHORT TRADEPOWER went through Buying Climax on previous Up Leg with 144M, latest Up Leg has drastically lower volumes 55M , conversely volumes on Down Leg have increased. Power has gone through Shortening of Thrust and also Up thrust or Bull Trap as per Wyckoff Methodology, it is expected to embark on major downtrend with immediate target 12.10

SHORT POWER 14.3 - 14.6

TP 12.1

SL 15.35