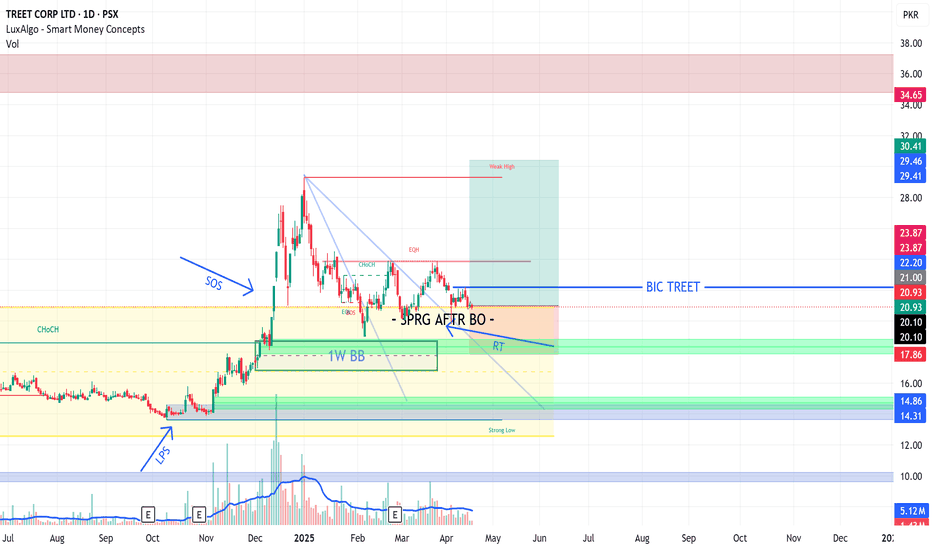

IF YOU MISSED BNL- DON'T SKIP TREET BREAKOUTTREET was in long-term downtrend till June 2021, it gave breakout in June and it's Pullback continued from July 21 to Dec 2022. I has been long term accumulation phases A,B,C & D of Wyckkoff Method from Dec 2022 to Dec 2024. It has given breakout from this consolidation and has given a beautiful Spring on Pullback of phase D. Huge up move after Breakout with above average volume and candle after Rs 22.2

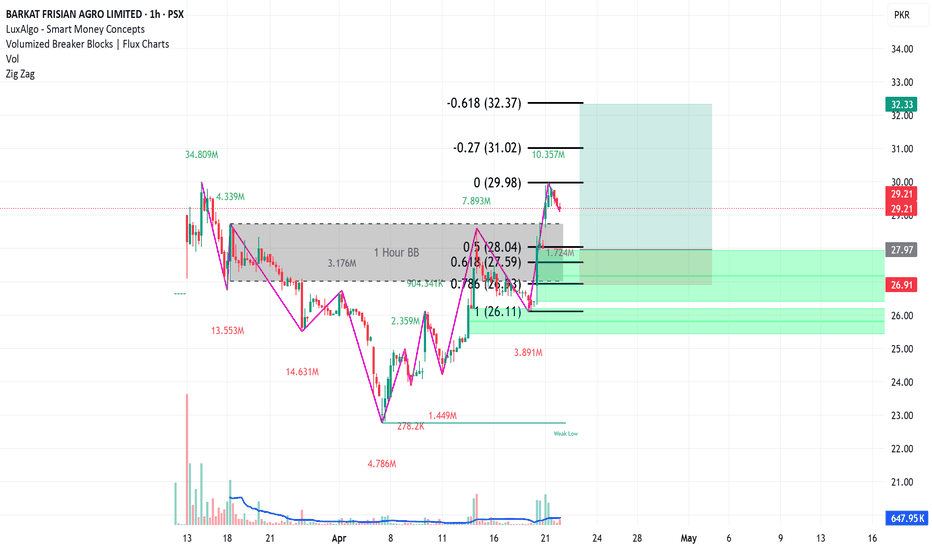

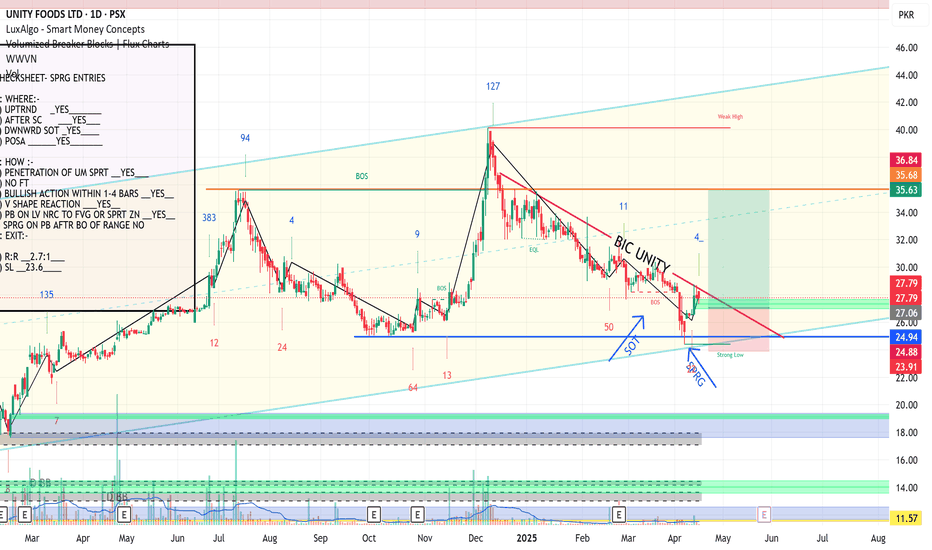

UNITY- INVESTMENT TRADEUNITY in trading in uptrend channel since May 23

It has reached bottom of this channel

It has successfully created a perfect spring/bear trap in Prominent OverSold Area (POSA)

It is low risk high probability investment trade set up with around 50% potential gain.

BUY1 @27.8

BUY2 @26.1

TP 35.8

SL 23.9

BF BIOSCIENCE BullishBUY SIGNAL...!!!!

Recent Price Movement: As of May 16, 2025, BFBIO's stock price closed at PKR 168.03, marking a 10% increase for the day. Over the past week, the stock has risen by 11.86%, although it has experienced a 3.45% decline over the past month.

TradingView

Technical Analysis: The stock is currently in a bullish zone, with analysts suggesting potential movement towards the PKR 200–250range in the near future. WT Cross indicators shows a great breakout from -55 zone which shows a strong trend reversal where as squeeze momentum breakout green histogram

Moving Averages: The 5-day and 50-day moving averages are at PKR 153.76 and PKR 143.35 respectively, both indicating a bullish trend.

Investing.com

Relative Strength Index (RSI): The 14-day RSI stands at 62.67, suggesting that the stock is approaching overbought territory, which often precedes continued upward momentum

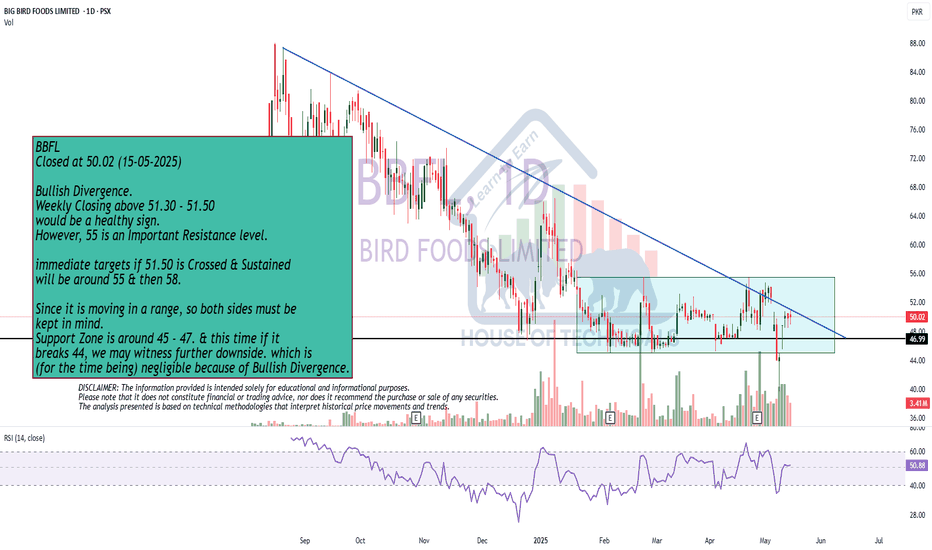

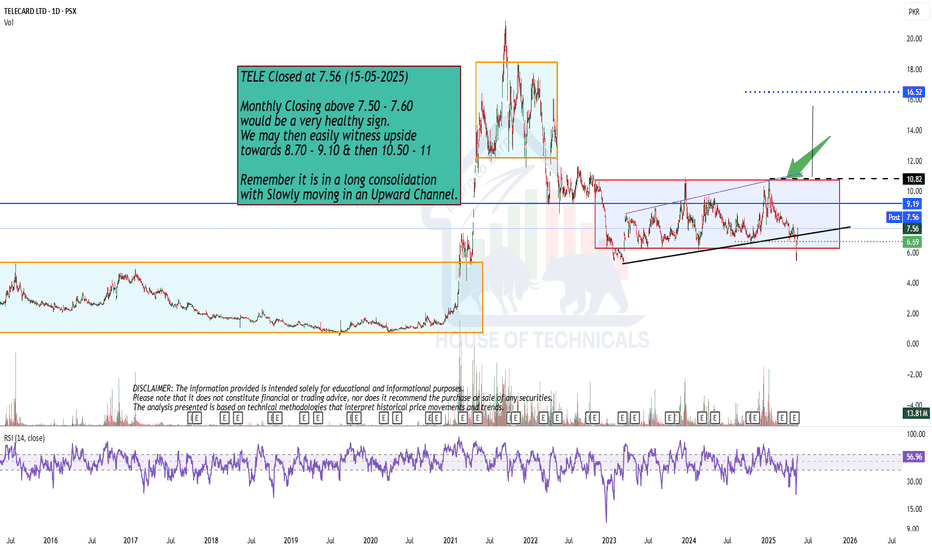

Bullish Divergence.

Bullish Divergence.

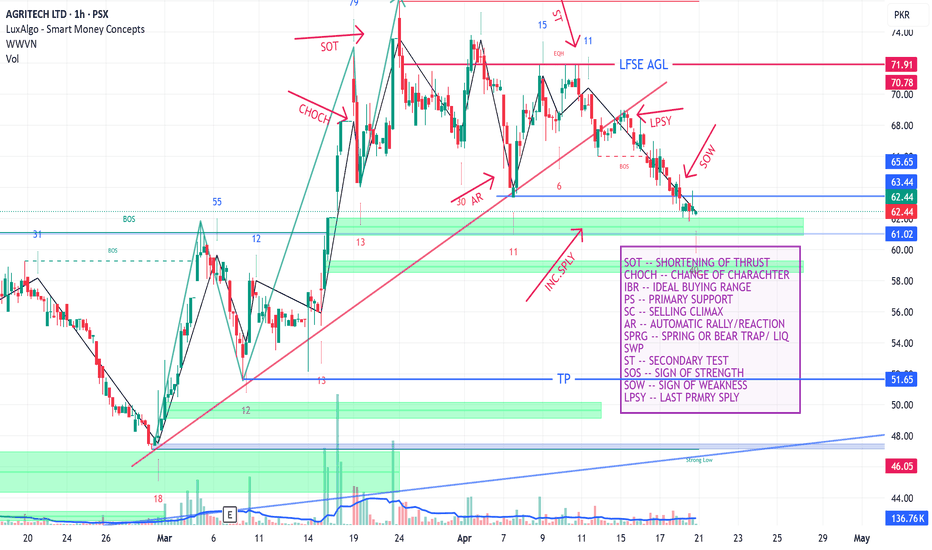

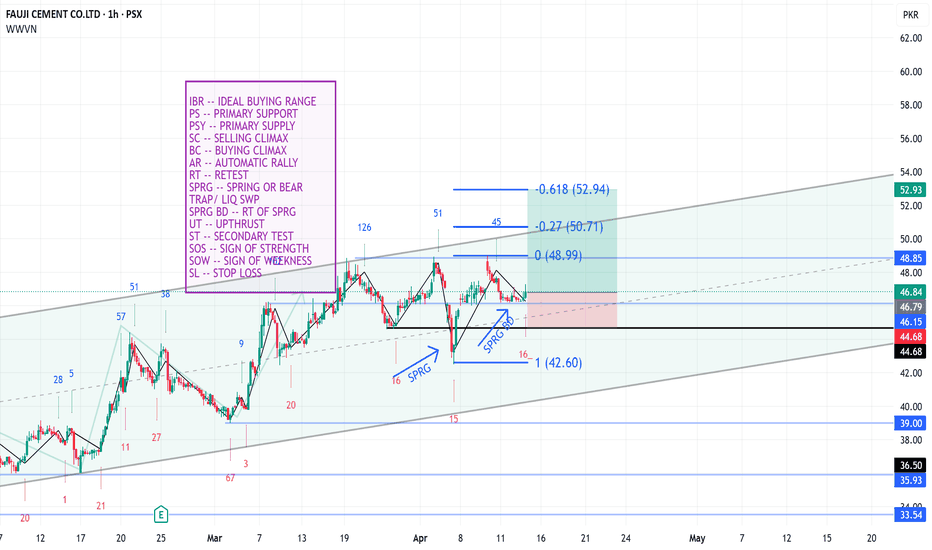

Weekly Closing above 51.30 - 51.50

would be a healthy sign.

However, 55 is an Important Resistance level.

immediate targets if 51.50 is Crossed & Sustained

will be around 55 & then 58.

Since it is moving in a range, so both sides must be

kept in mind.

Support Zone is around 45 - 47. & this time if it

breaks 44, we may witness further downside. which is

(for the time being) negligible because of Bullish Divergence.

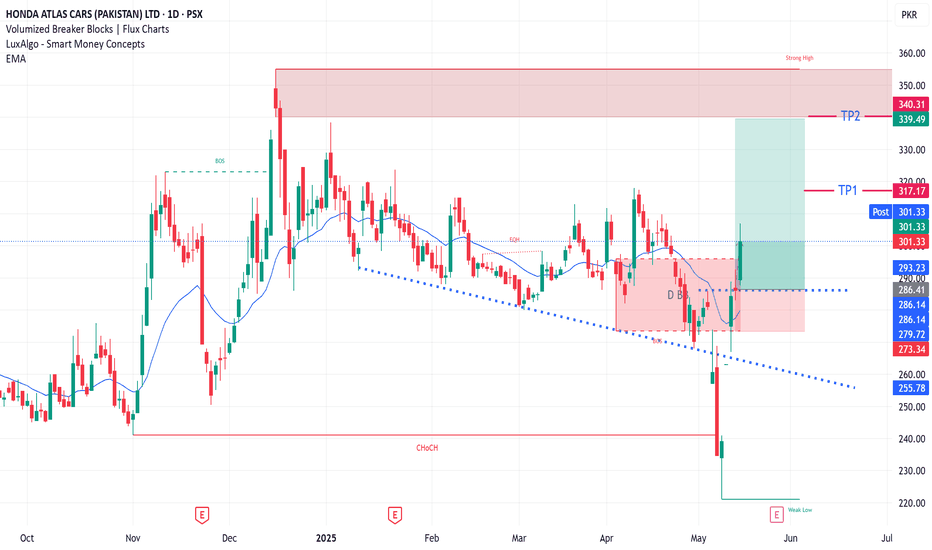

HCAR LONG TRADEHCAR has been in Bearish Channel which actually acts as Bull Flag.

It went below the channel in false breakdown to facilitate Selling Climax which is transfer of possession from Weak Hands ( Individuals ) to Strong Hands ( Institutions ).

This process and its components are actually a fuel for future uptrend.

Low Wave volume during Selling Climax/ Bear Trap are signs of Fake Breakdown to influence weak hands to sell their shares so that institutions have ownership during uptrend

BUY HCAR 290-300

TP1 320

TP2 340

SL BELOW 280