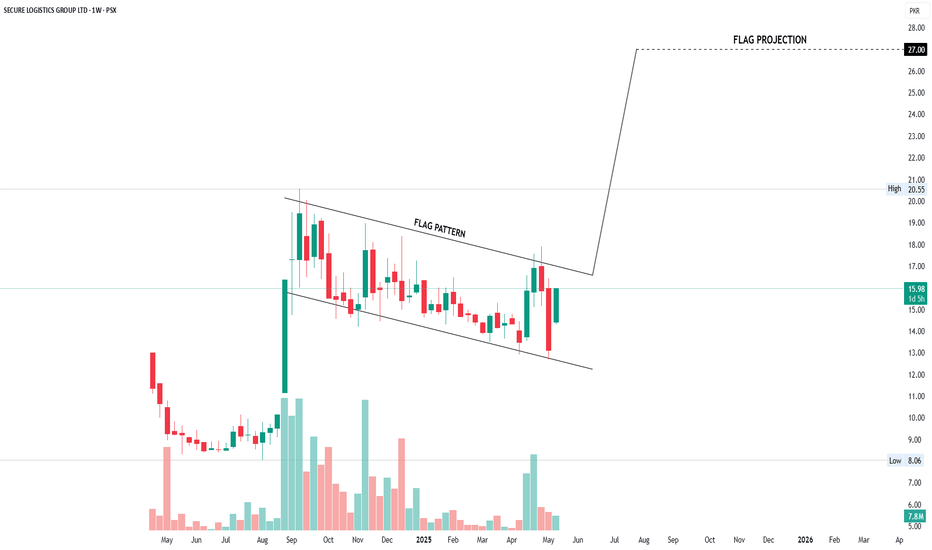

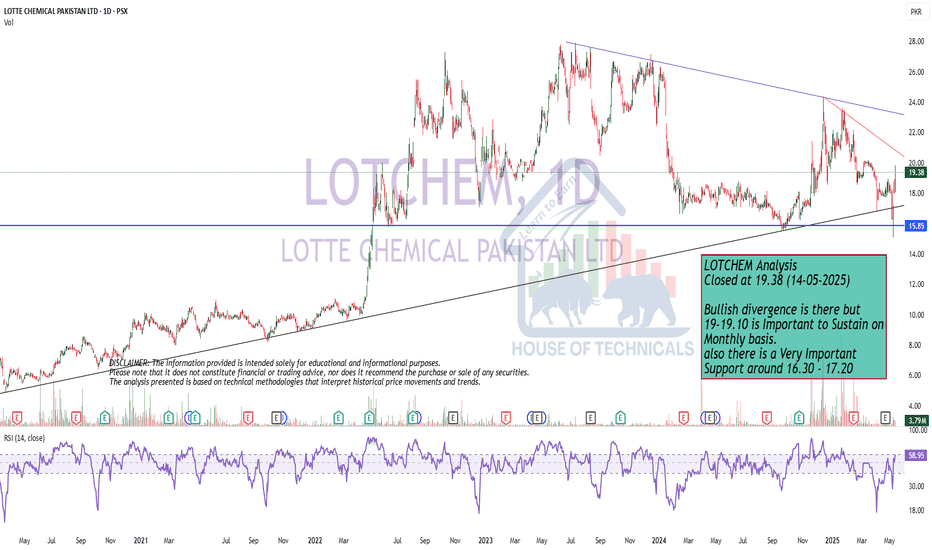

SLGL - Flag PatternSLGL is presently forming a flag pattern, which is expected to break out above the flag's resistance level of PKR 16.50-17. A successful breakout above this level could lead to a test of the previous top resistance at PKR 20-20.50.

If the stock breaks through this resistance with increased buying volume, the pattern's validity would be confirmed, with a potential target of PKR 27.

Disclaimer

This analysis is based on personal observation and should not be considered as investment advice. It is essential to evaluate the company's financial performance, monitor relevant news, and manage risk accordingly before making any investment decisions.

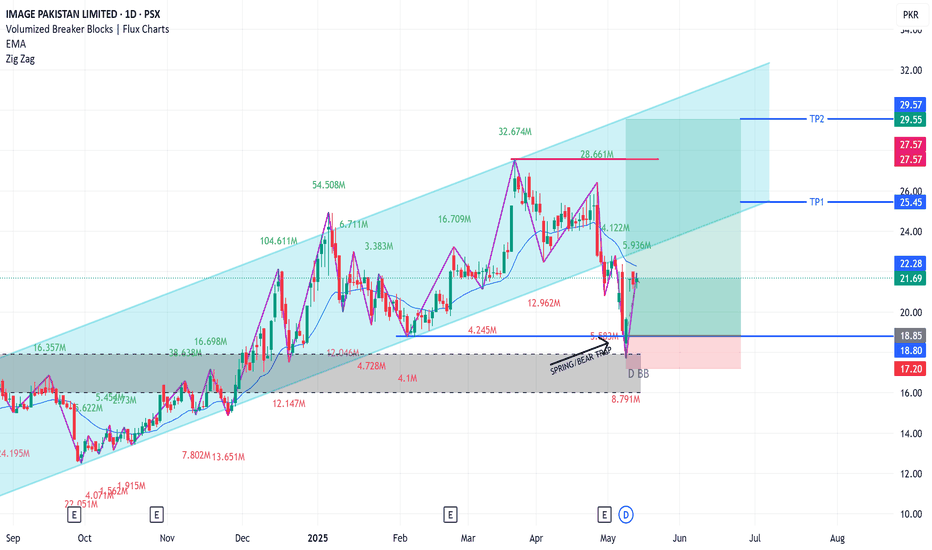

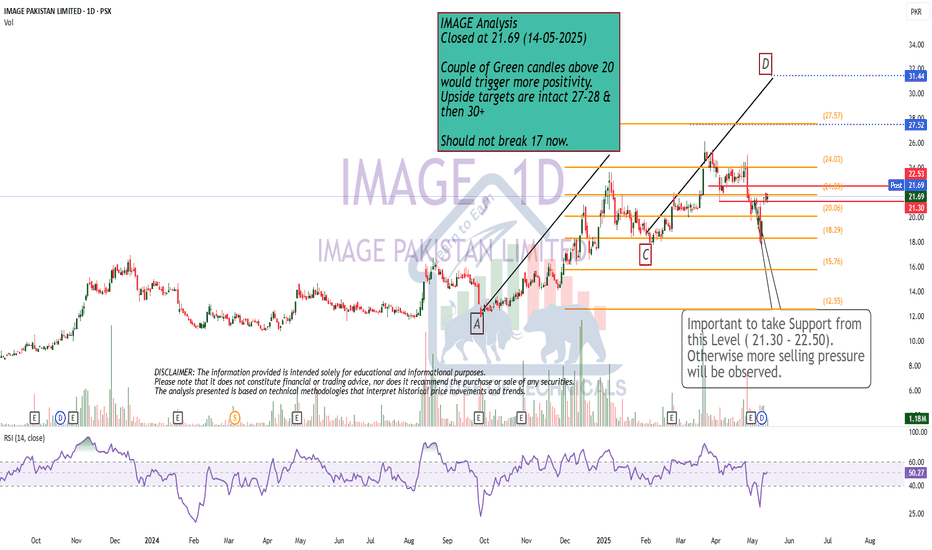

IMAGE LONG TRADEIMAGE has been trending in perfect uptrend channel.

Though it broke down from the channel but that behavior signifies impending bullish move for three reasons.

1. Price has created Spring or Bear Trap through its recent support level of 18.80 and rebound

sharply upwards in a Liquidity Sweep manner to shake off weak hands

2. Price also took support from major Bullish Breaker Block at 18

3. Wave Volumes support the impending up move

BUY IMAGE 19-22

TP1 25.50

TP2 29.50

SL 17.20

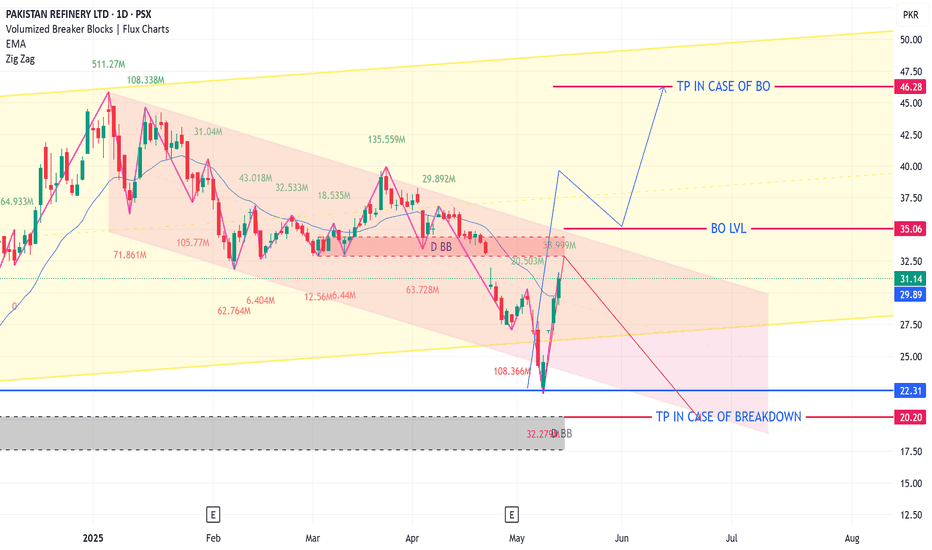

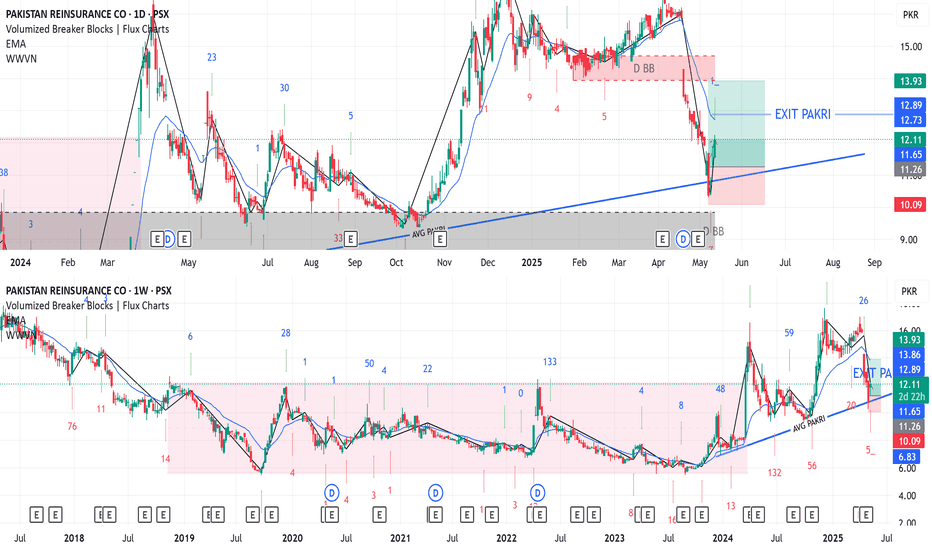

PRL ANALYSISThough PRL is trending in uptrend channel(yellow) in higher timeframe, presently it is in its down leg(pink channel), it has taken support from an important level of 22, it seems going towards higher end of Yellow channel or measured move after breakout from pink channel but there seem two main hurdles in this scenario, biggest is Bearish Breaker Block at 33 and others is still smaller volumes in its current rise from 22.

If PRL gets rejected from 33 then its downside target will be 20.

But on a brighter side if it manages to breakout from pink channel at 35 with heavy volumes only then can it go to target of measured move to 46 and yellow channel top 49

Conclusion: Don't buy at current levels before breakout at 35. In case of previous buying apply SL in case of rejection at 33

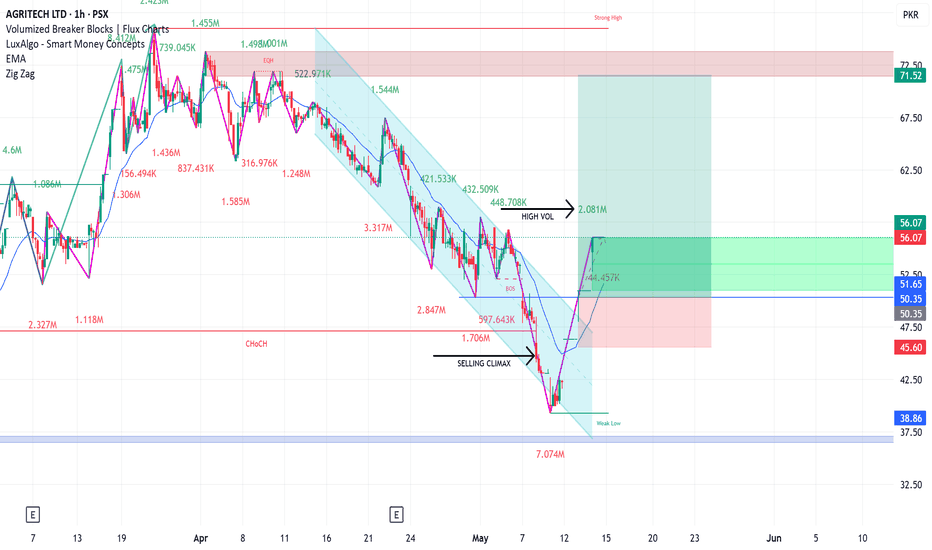

AGL LONG TRADEAGL was in downtrend since start of April.

It has completed three downward pushes which ended with Selling Climax

Selling Climax ensure transfer of possession from Weak Hands to Strong hands which results in rise of price or uptrend

AGL has also broken out of Bearish channel and 20 EMA with heavy volumes.

It can be bought at current price and also after pullback to Breakout.

BUY AGL 50-56

TP 72

SL 44

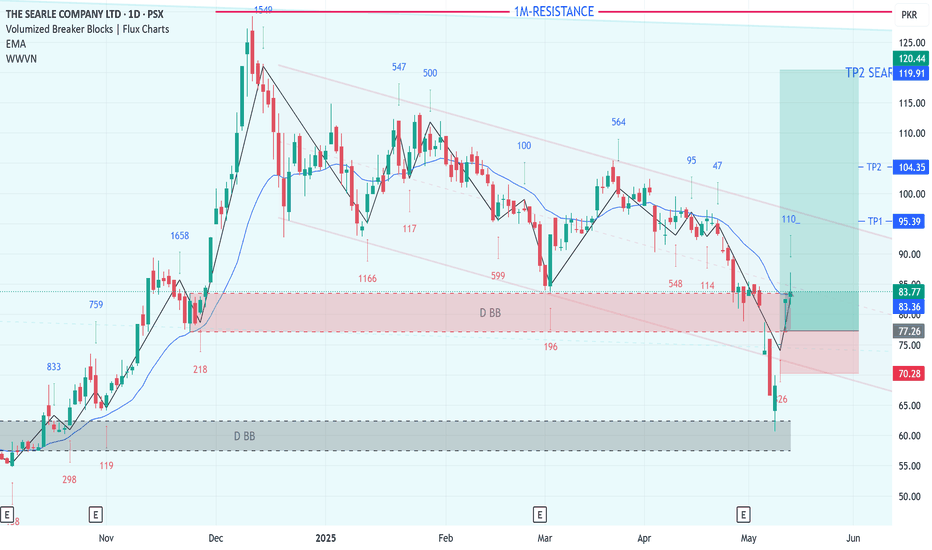

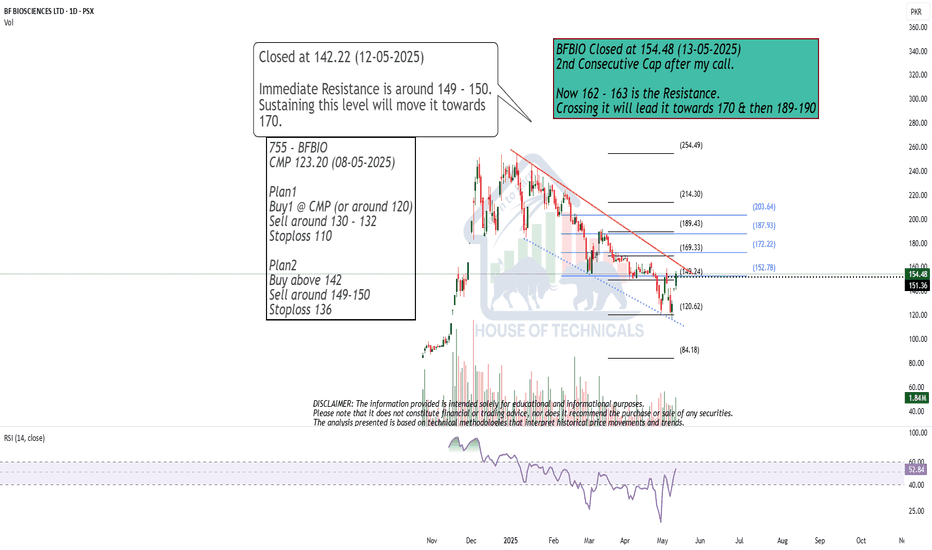

SEARLE LONG TRADESEARLE has been in downtrend since Dec 25, it has recently take support from a strong Breaker Block and also crossed over a bearish Breaker Block which is a sign of strength.

The downward Bear Channel is actually a Bull Flag as per Price Action Principles of Al Brooks the Father of Price Action.

Price went below this channel in shape of Selling Climax to dry out all Supply at those lower levels, this process has shifted the possession of Searle from Weak Hands to Strong Hands (Big Institutions). thus creating a Supply Vacuum.

Price has only logical direction to go and that's upwards.

BUY SEARLE 78-84

TP1 95

TP2 105

TP3 120

SL 70

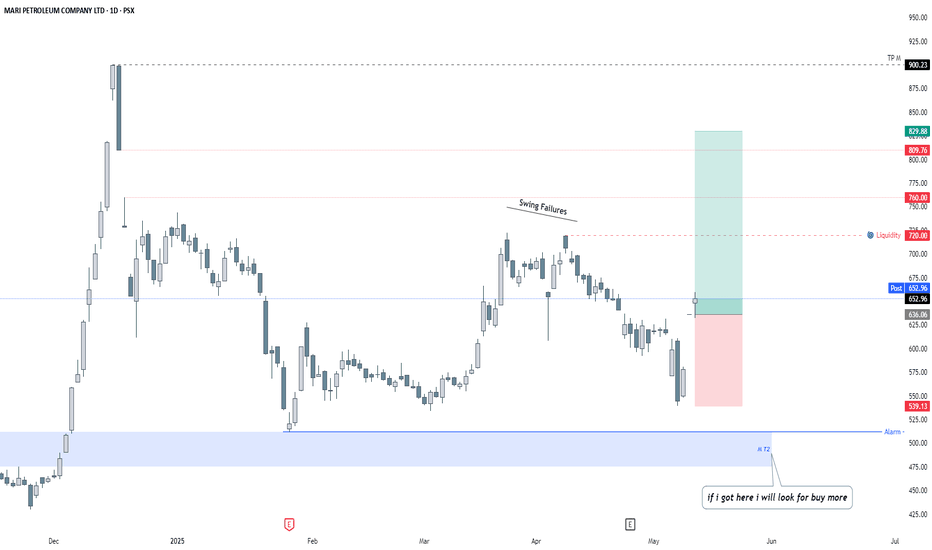

MARI Petroleum Company Ltd (PSX) Buy Idea✅ Buy Idea Summary

Symbol: MARI

Timeframe: Daily

Current Price: 652.96

📊 Analysis & Plan

Context:

Price has bounced from a higher-timeframe demand zone (highlighted in blue) and is currently forming a bullish structure.

Key Observations:

Swing Failure Pattern near top (distribution clue).

Liquidity Pool marked at 720 — likely target for short-term buy-side liquidity.

Strong bullish reaction after price tapped near the low of the previous range.

🛒 Entry:

At/around: 652.96 (Post price).

🎯 Target Levels:

TP1 (Partial/Intraday): 720 (Liquidity Zone)

TP2 (Major Target): 829.88

TP Final: 900.23

🛑 Stop Loss:

Below 539.13 (last swing low and structural invalidation)

📥 Reinforcement Buy Zone:

Blue Demand Area (around 460–500):

“If I got here, I will look to buy more.”

→ A key reaccumulation area if price revisits.