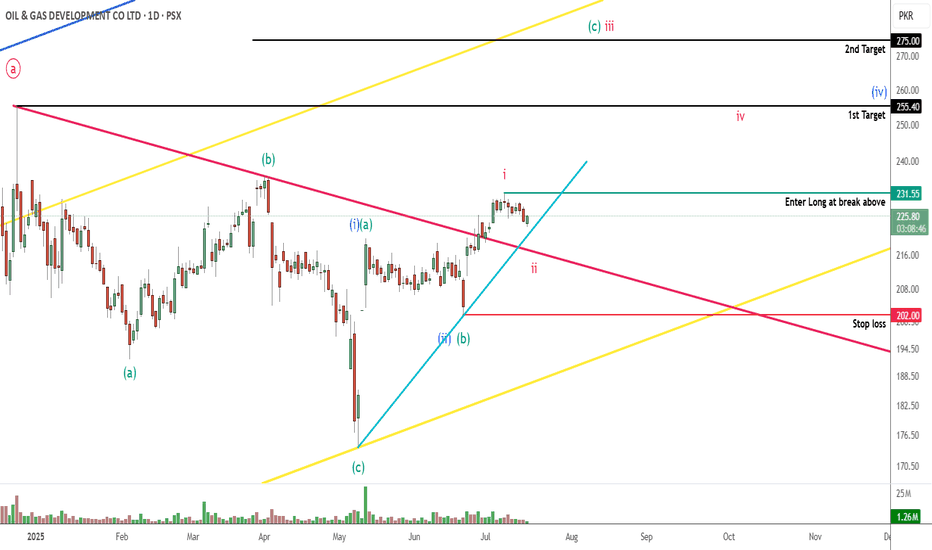

OGDC PROBABLY IN WAVE ' B ' OR ' C ' - LONGThis is in continuation to our ongoing tracking of OGDC wave structure.

If our wave count is correct then prices will take support from the 220-210 levels and will target the upside level of 255 and 275. Our wave count suggest that prices might even go above 300+ but that depends on how strong the bullish move is, if the move stays strong then price will target the upper yellow trendline.

Alternately, if price goes below the 202 level, it will take price well below 174.

We will buy 25% positions at 220-210 levels (ideally 218-216) and 75% at the break above 231.56

Trade Setup:

Entry level: 217 & 231.56

Stop loss: 202

Targets:

T1: 255

T2: 275

T3: Yellow trendline

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

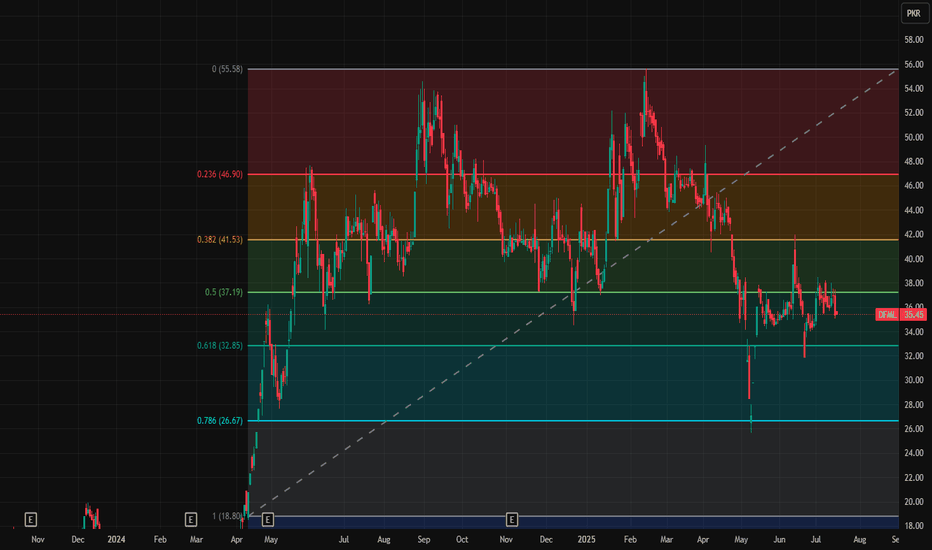

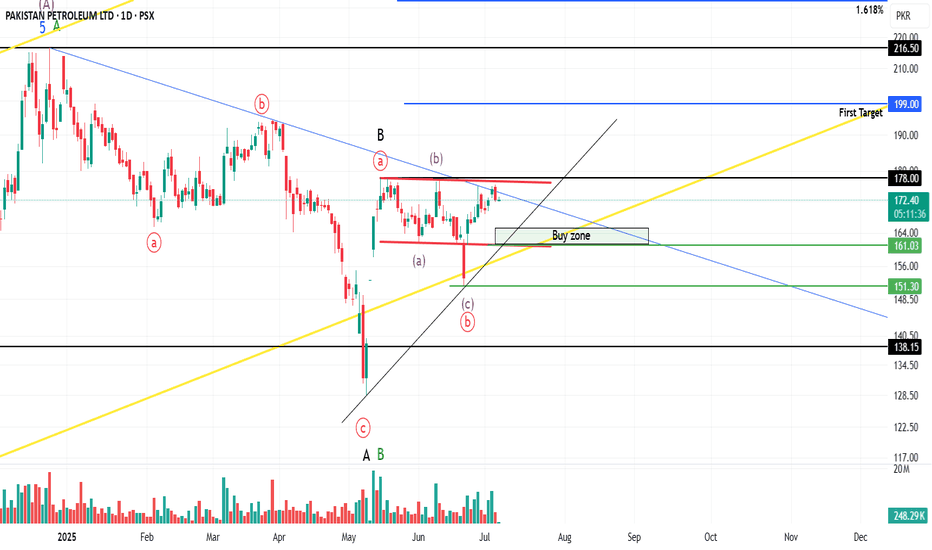

PPL PROBABLY IN WAVE '' C '' - LONGThis is in continuation to our ongoing tracking of PPL wave structure

PPL is most probably in wave C of a Y or B wave which will target areas of 200 and further up 230 - 250 level. Our ideal buy zone is at 165 - 160, however looking at the market momentum we might not get to our buy zone and prices will rise directly.

We will enter long positions once market breaks above 178 level (keep eye on the volume), although entering market at 178 will significantly effect our risk/reward ratio compared to entering at the buy zone of 165 - 160, either ways we will take long positions.

Alternately, if the prices decline below 151.30 then this trade setup will get void, 151.25 can be used as stop loss.

Trade setup:

Entry price: 165 - 160 (Ideal) or 178

Stop loss: We are bullish on PPL long term therefore we will hold these positions

Targets:

T1: 198 - 200

T2: 230 - 250

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

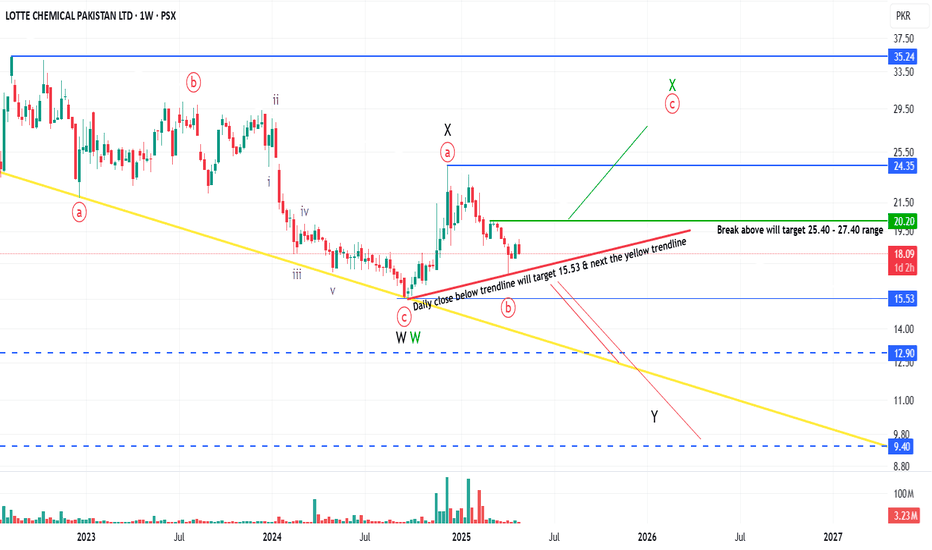

LOTCHEM PROBABLY IN WAVE ' X ' OR ' Y ' OF A CORRECTIONAs per our preferred wave count LOTCHEM is in wave Y which should take prices further down toward the 13 level and if bearish trend stays strong then even 9.50 is on the cards, however prices need to break below 15.53 level first.

Alternately prices can still be in X wave and will take prices further up towards 25.40 - 27.40 range and if the bullish trend stays strong 31 level is also at hand, however prices will have to break above 20.20 level first.

As the overall momentum of the PSX is bearish and our preferred wave count is bearish, We will activate short sell trade once price close below the red trendline on the daily chart.

Incase prices never close below the red trendline and starts rising, We will enter long position at 20.20 targeting 25.40 range. I will share stop loss for the trade setup once our trade gets actived

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

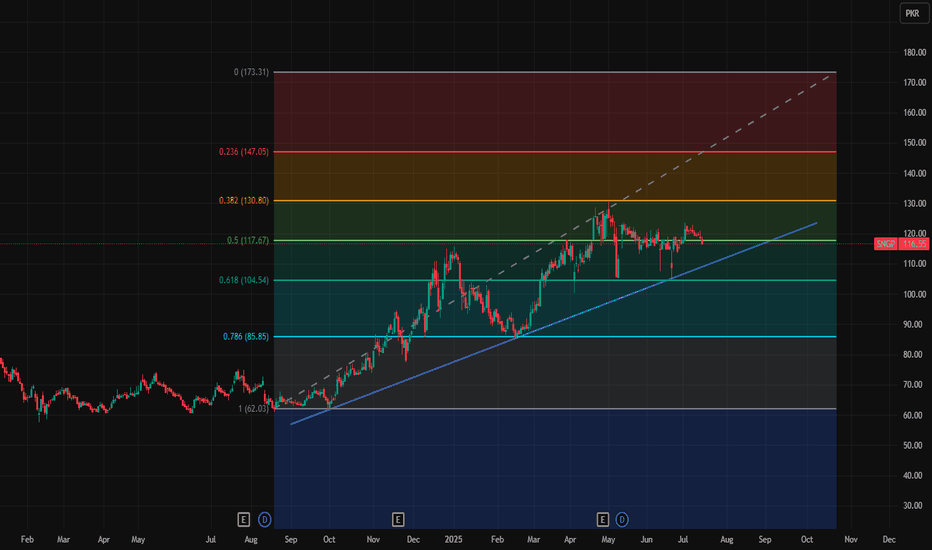

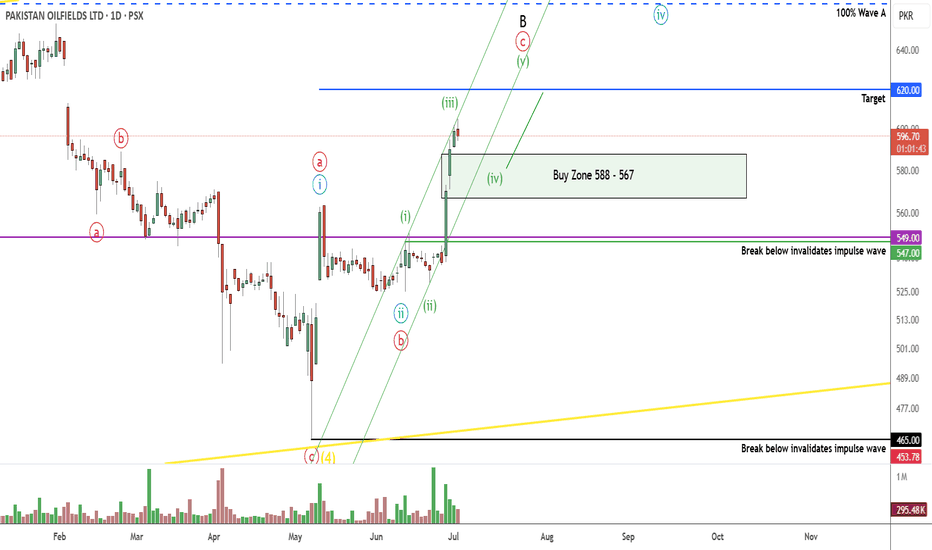

POL PROBABLY IN WAVE '' C '' OR " 3 " - LONGThis is in continuation of our ongoing tracking of POL wave structure.

POL is currently in C or 3 which will target the 620-623 or 680 level. Our preferred wave count is C and we will target the 620 level. If our wave count is correct then prices will decline to our buy zone of 588-567 range as wave 4.

Alternately prices will never go to our buy zone and will reach the 620 - 623 level directly making this trade setup as void.

We will buy in portions at 588 > 580 > 576 level

Trade setup:

Entry price: 588 - 567

Stop loss: 547

Targets: 620 - 623

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

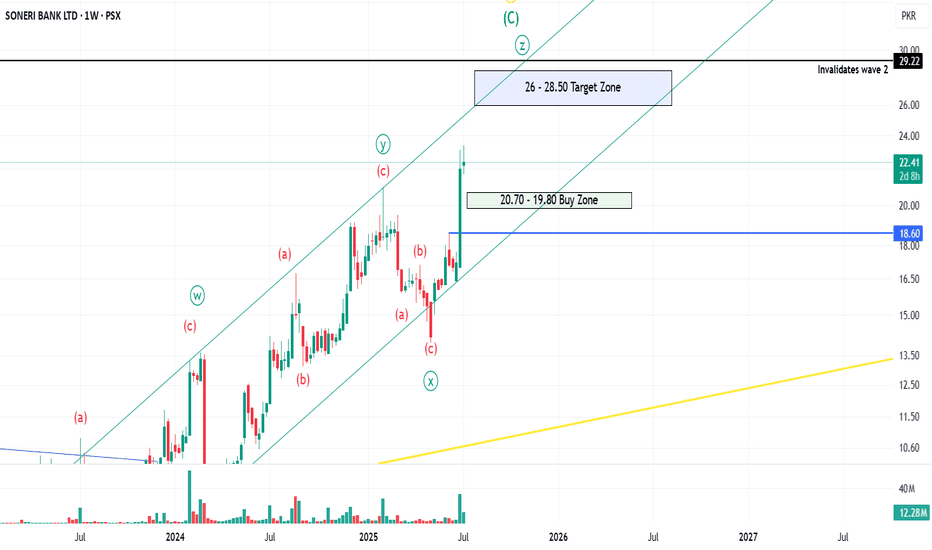

SNBL PROBABLY IN WAVE ' Z ' OF B or CThis is in continuation of our ongoing tracking of SNBL wave structure, prices have broken above the 22.50 level indicating one more leg upwards.

Currently the price is unfolding as wave Z which will target 26 - 28.50 zone, however the prices should decline towards the 20.70 - 19.80 level (buy zone) before rising again.

If the prices go below the 18.60 level, it will significantly weaken this wave count. we will only activate this trade if price reach our buy zone.

If the wave count is correct then this trade will provide us minimum 25.60% gross gain.

Trade Setup:

Entry level: 20.70 - 19.80

Stop loss: 18.59

Target: 26 - 28.50

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

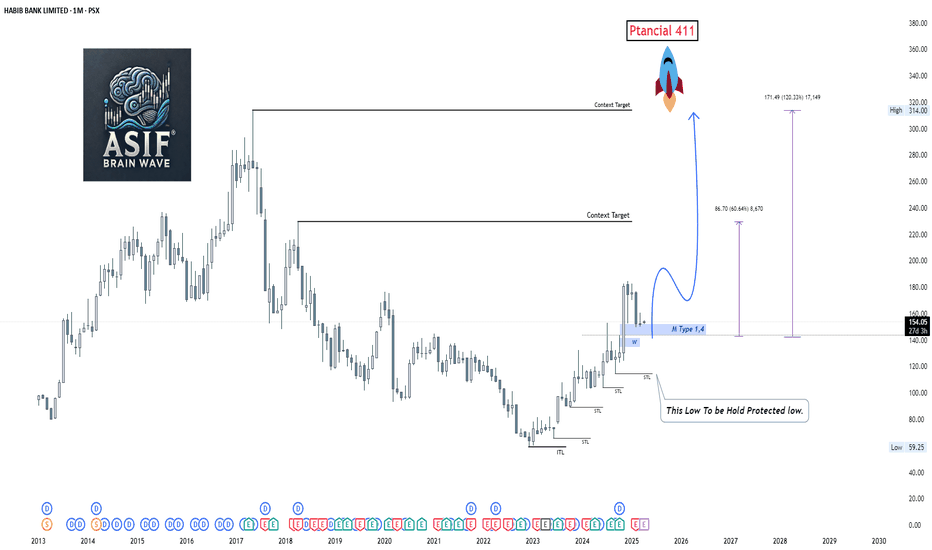

Buy Idea: Habib Bank Limited (HBL)📘 Buy Idea: Habib Bank Limited (HBL)

🔹 Timeframe: Monthly | Strategy: Structure + Type 1.4 + Context Targets

✅ Entry Zone:

Buy between 145 – 155 PKR (near the marked "M Type 1.4" level).

📉 Stop Loss (SL):

Below 92 PKR

("This low to be held as protected low" – the ITL zone).

🎯 Take-Profit Targets (TP):

Target Price (PKR) Gain % Description

TP1 240 ~60% First context target

TP2 314 ~120% Previous major high

TP3 411 ~165% Final potential rocket move 🚀

📌 Context & Narrative:

Price broke key structure levels and is forming a bullish base.

Multiple STL levels swept – shows smart money accumulation.

"M Type 1.4" indicates institutional interest.

Targets are based on historical price action and FVG-based projection.

💡 Position Strategy:

Buy 50% at current price (150–155)

Add 25% on a pullback to 140

Add 25% if price dips toward 130

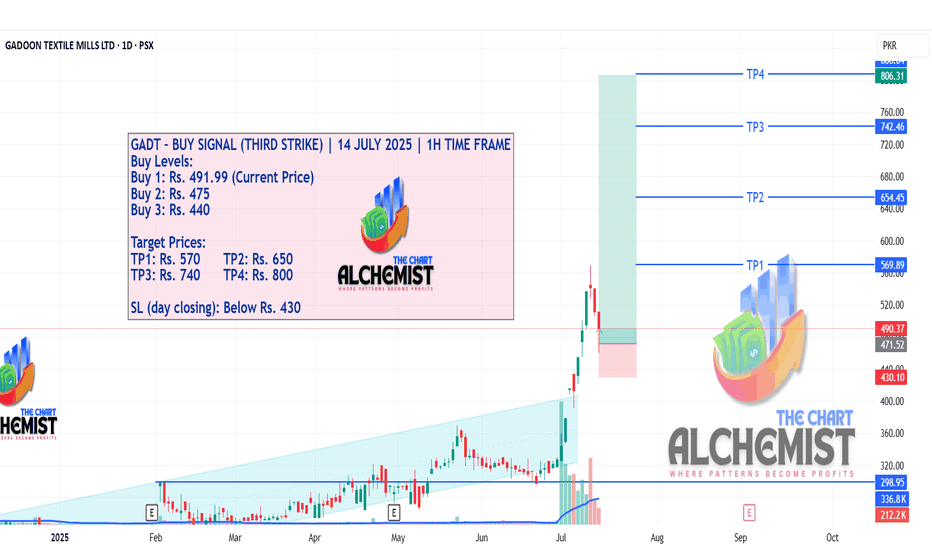

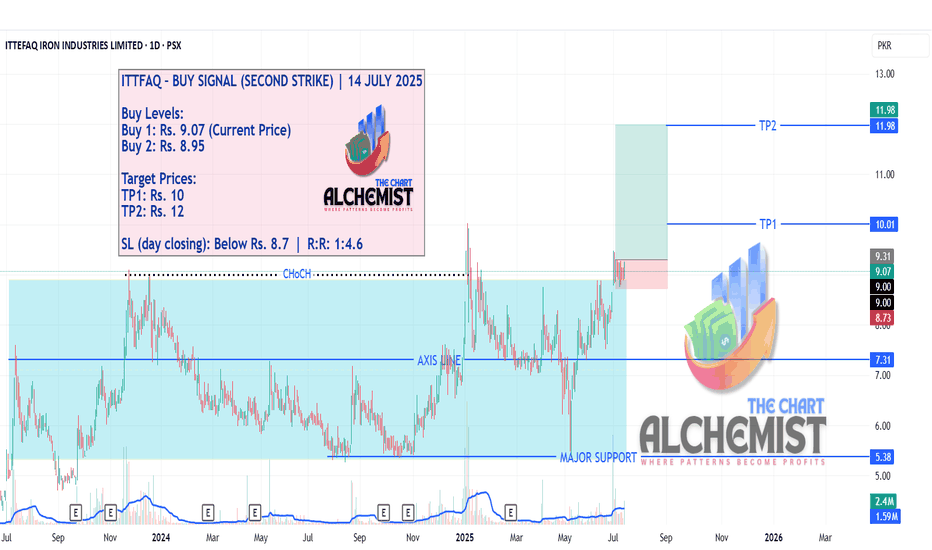

GADT – BUY SIGNAL (THIRD STRIKE) | 14 JULY 2025 | 1H TIME FRAMEGADT – BUY SIGNAL (THIRD STRIKE) | 14 JULY 2025 | 1H TIME FRAME

After breaking out of a slightly upsloping trading range (marked in light blue) and achieving a high of Rs. 570, GADT pulled back. With the pullback nearly complete, we expect a bounce and a run toward multiple quantified displacement targets.

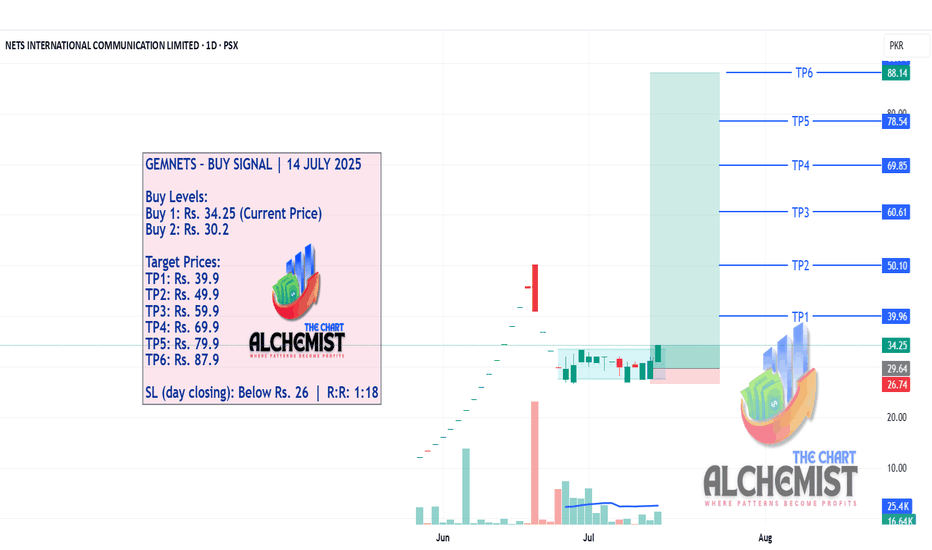

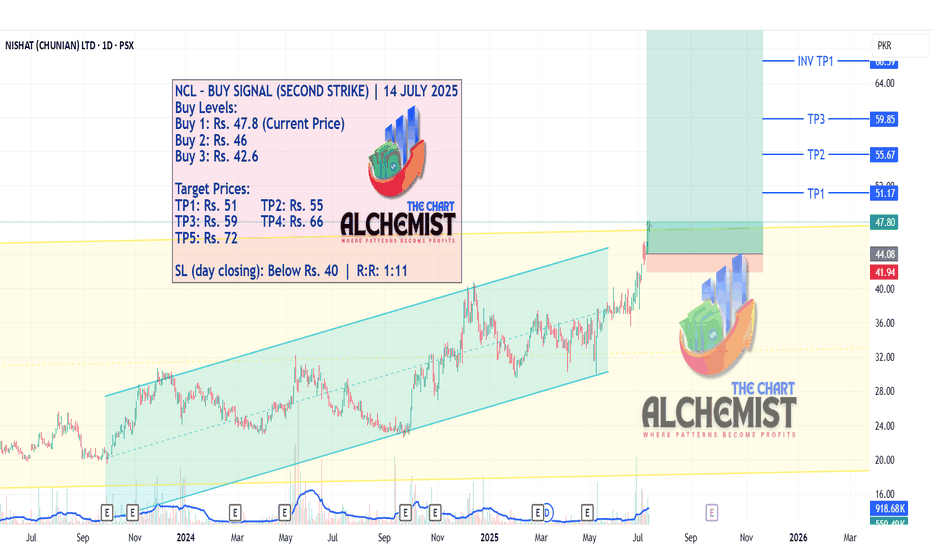

NCL – BUY SIGNAL (SECOND STRIKE) | 14 JULY 2025NCL – BUY SIGNAL (SECOND STRIKE) | 14 JULY 2025

After a successful first strike that achieved all targets, NCL has now broken out of consolidation zones on both higher (yellow) and shorter (light blue) time frames. This setup presents a strong second strike opportunity.

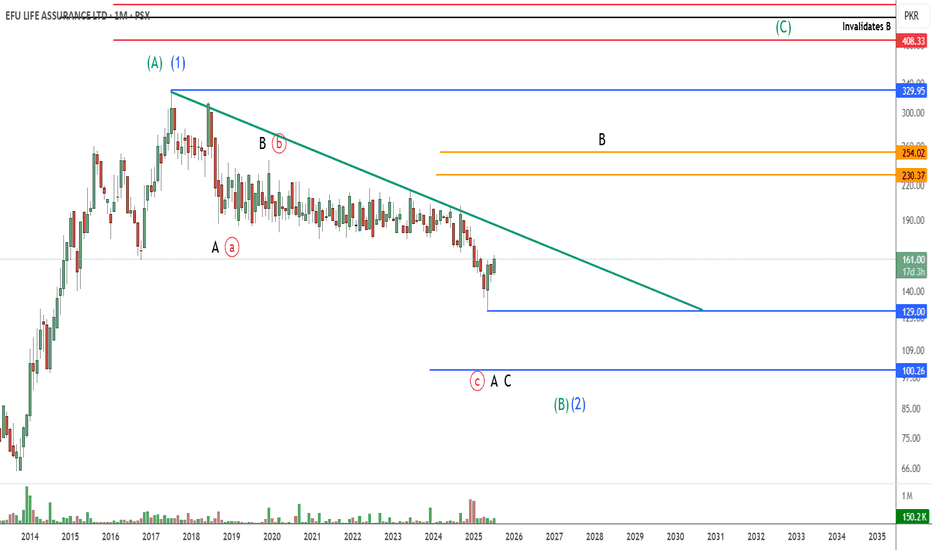

EFUL PROBABLY IN WAVE ' C ' OR ' 3 ' - LONGEFUL is most probably in wave C or 3

We are long term investor on this trade as the overall fundamentals are strong and the long term risk/reward ratio for this trade is very attractive.

Currently the price is in a lesser degree wave C which is almost finished or will finish soon starting an upside rally. If our wave count is correct then the lesser degree wave C is over and the bigger wave C or 3 has just started which will take prices toward 450 levels or even further up above 550 levels but this trade can take years to complete.

There's also a possibility that the lesser degree wave C is still in progress and will take prices further down towards 120 - 100 levels which will make this a more attractive buy trade.

Alternate wave count suggest of a wave B which will also take prices upward, however the target levels will change significantly i.e. 230 - 250 levels

We are already active in this trade and will accumulate more positions in EFUL if prices go below toward 120-100 levels

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

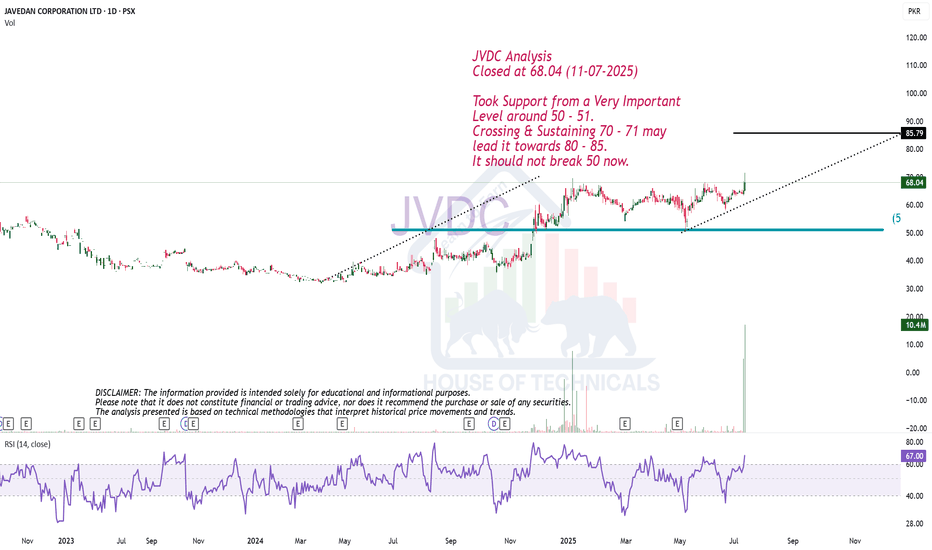

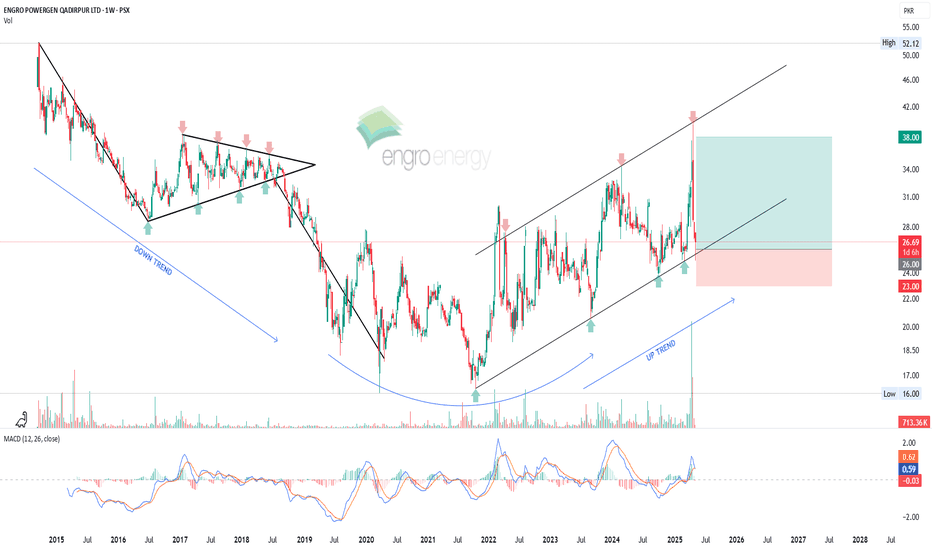

EPQL - Swing Trade SetupThe current price action is testing the support of an ascending parallel channel. A potential pullback from the 26 level, which aligns with the channel's support, is anticipated. If the price rebounds from this level, a swing trade setup could be confirmed, with a possible target of 38.

However, the MACD indicator has recently crossed over to the downside on weekly time frame, with red histograms forming. To confirm a more reliable entry point, we will await a reversal signal from the MACD indicator.

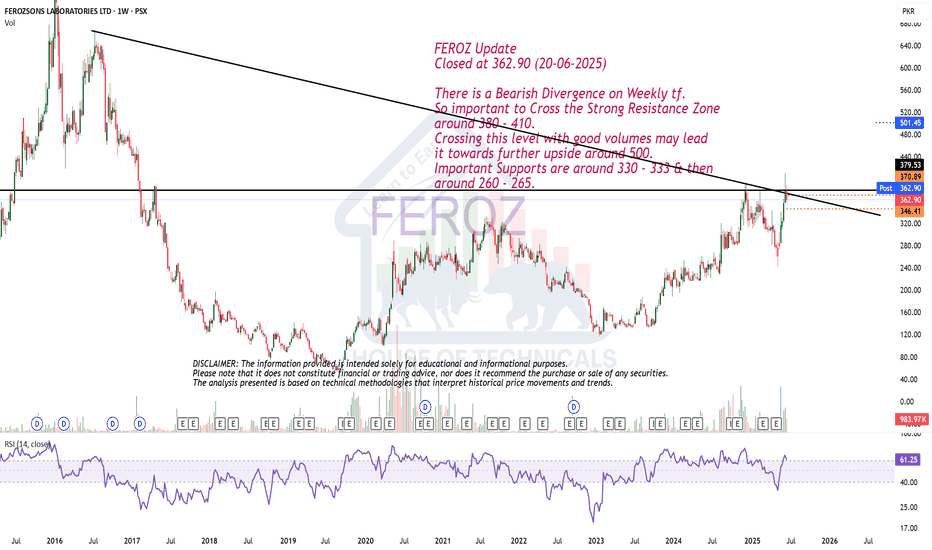

Bearish Divergence on Weekly tf.FEROZ Update

Closed at 362.90 (20-06-2025)

There is a Bearish Divergence on Weekly tf.

So important to Cross the Strong Resistance Zone

around 380 - 410.

Crossing this level with good volumes may lead

it towards further upside around 500.

Important Supports are around 330 - 333 & then

around 260 - 265.

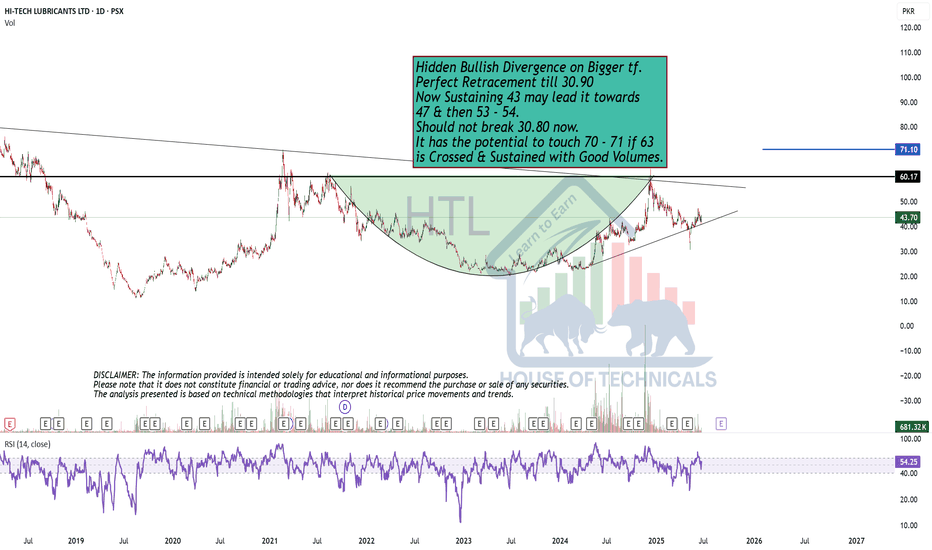

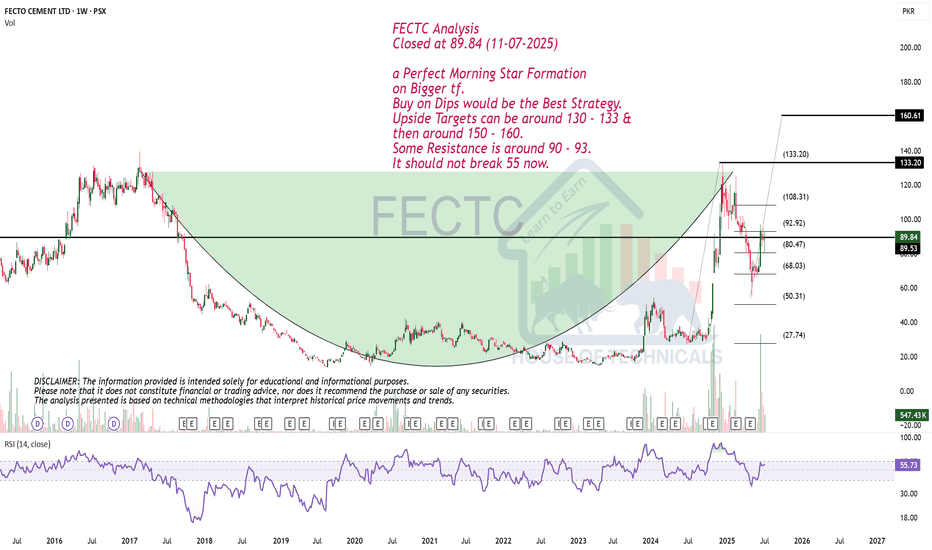

a Perfect Morning Star Formation on Bigger tf.FECTC Analysis

Closed at 89.84 (11-07-2025)

a Perfect Morning Star Formation

on Bigger tf.

Buy on Dips would be the Best Strategy.

Upside Targets can be around 130 - 133 &

then around 150 - 160.

Some Resistance is around 90 - 93.

It should not break 55 now.