Play on Levels

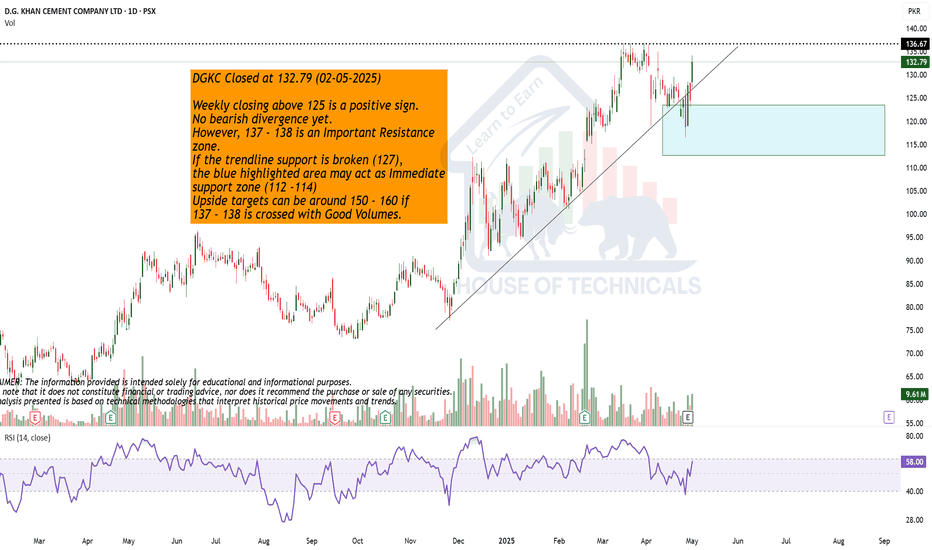

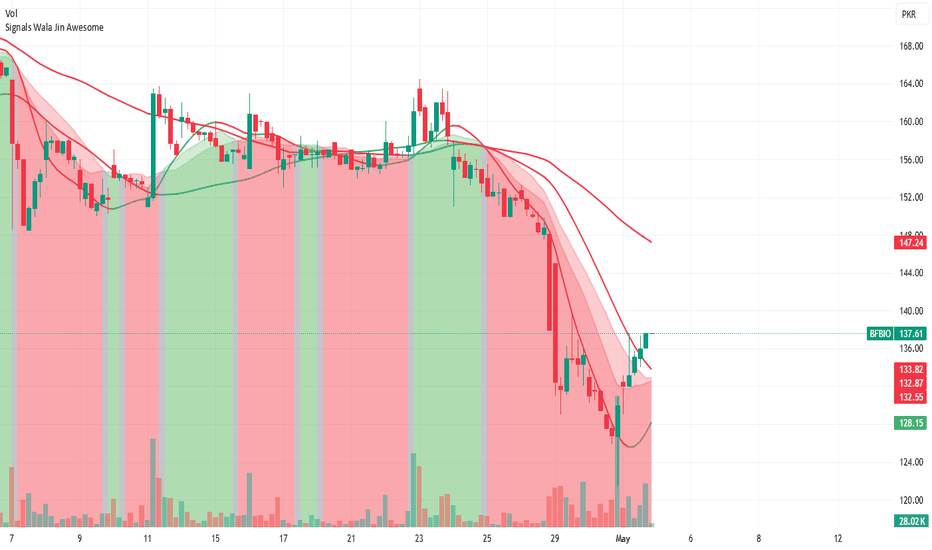

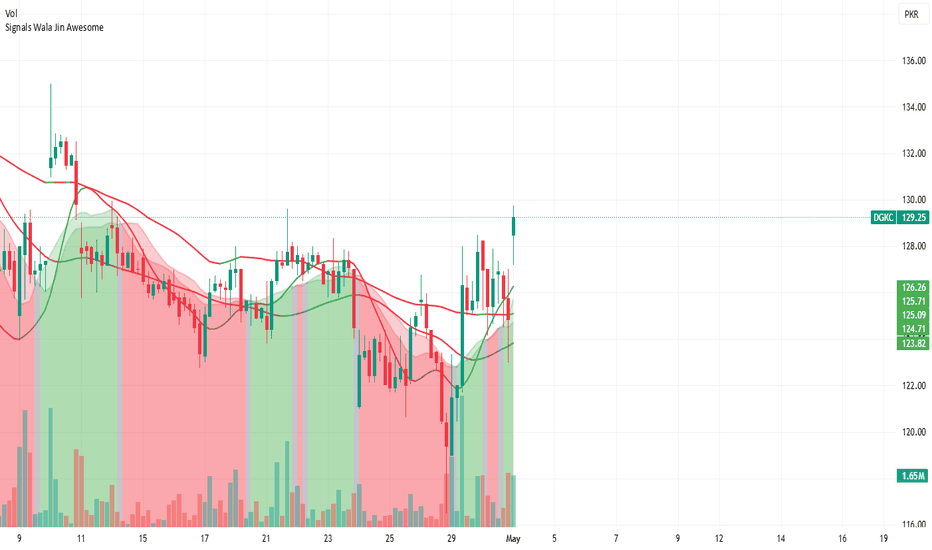

Weekly closing above 125 is a positive sign.

No bearish divergence yet.

However, 137 - 138 is an Important Resistance

zone.

If the trendline support is broken (127),

the blue highlighted area may act as Immediate

support zone (112 -114)

Upside targets can be around 150 - 160 if

137 - 138 is crossed with Good Volumes.

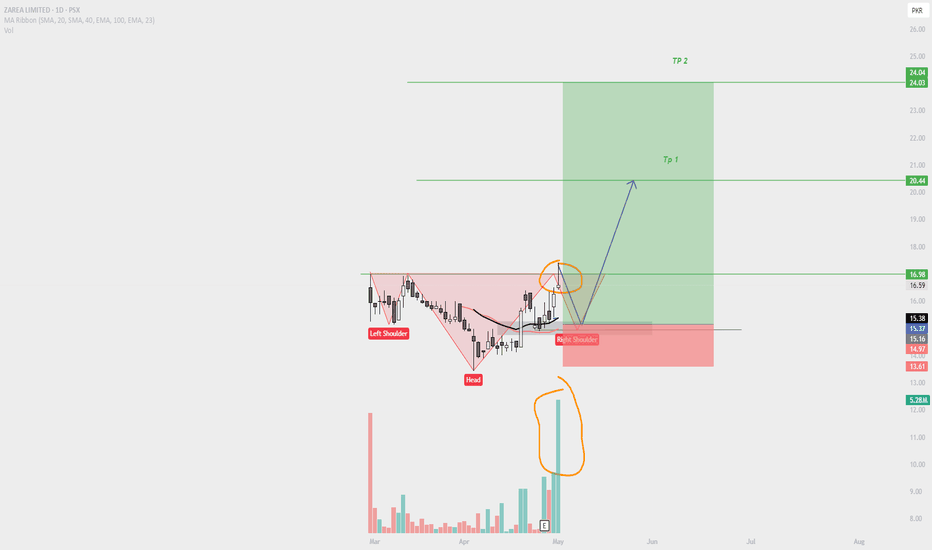

ZAL Trade Plan – Strong Fundamentals & High Growth PotentialCompany Overview:

ZAL is fundamentally one of the strongest companies in the market, showcasing impressive growth driven by increasing sales and expanding profit margins. The company is actively scaling its operations, which sets the stage for even greater future earnings. Given its solid financials and business expansion, ZAL holds significant potential for capital appreciation.

Growth Outlook:

With a strong earnings trajectory and business development initiatives, the stock price has the potential to generate gains of 40–70%, depending on the size of the upcoming rally.

✅ Trade Setup

Entry Options:

Breakout Entry: Buy on a confirmed breakout with closing above Rs. 17

Dip Entry: Buy between Rs. 15.20 – 14.50 (ideal accumulation zone) , CZ it will form the right Shoulder of Head and shoulder Pattern

Risk Management:

Stop-Loss: Rs. 13 (to manage downside risk)

Take-Profit Levels:

TP1: Rs. 16.50

TP2: Rs. 19.00

TP3: Rs. 22.00

TP4: Rs. 24.00

📌 Note: Follow proper risk management and position sizing based on your portfolio. Monitor price action and volume closely around the breakout level for confirmation.

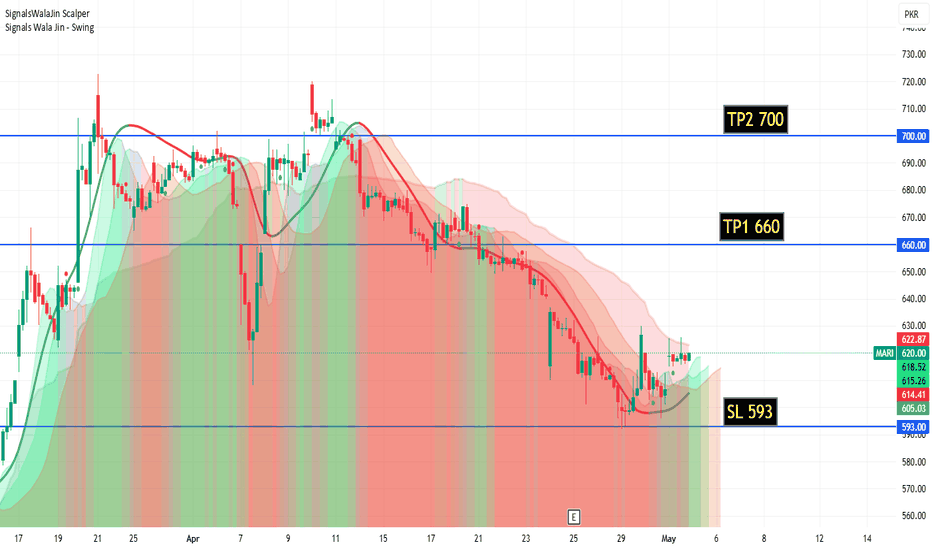

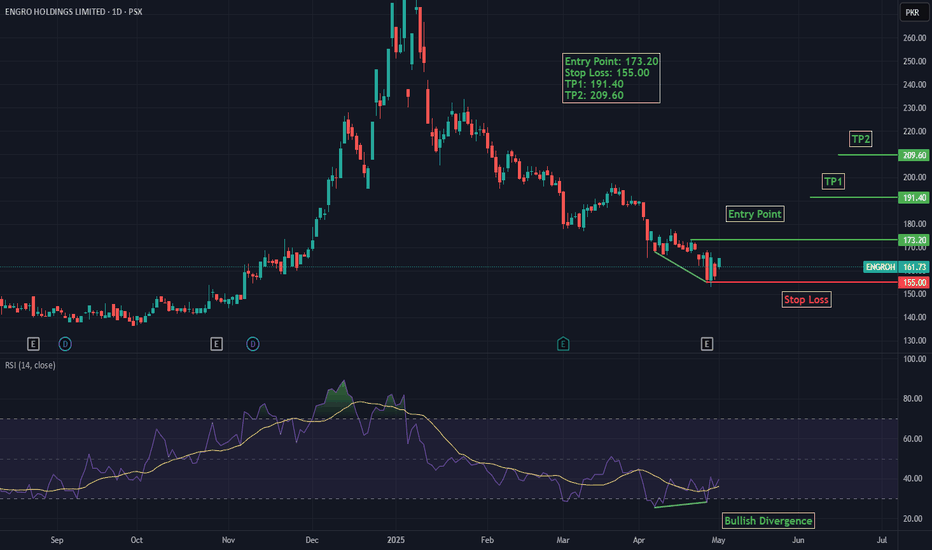

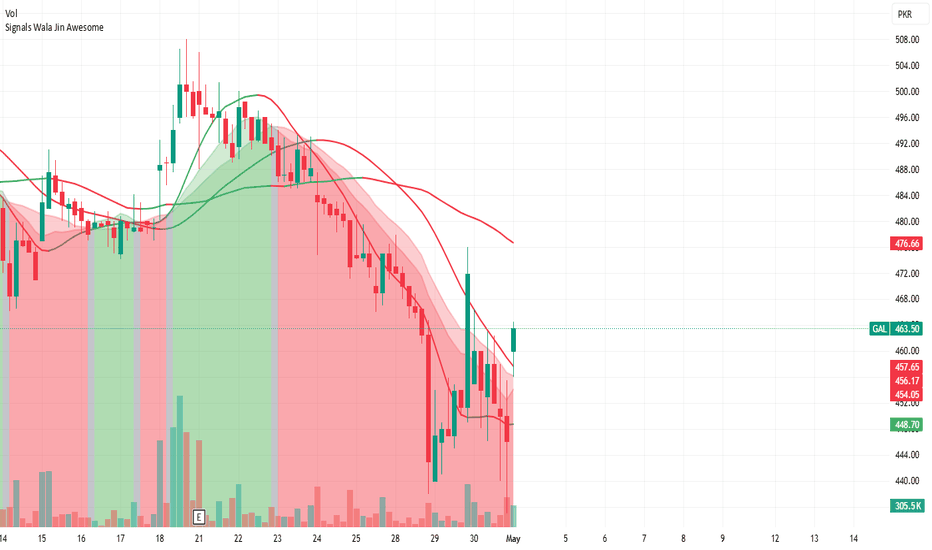

Bullish divergence in ENGROHBullish divergence is observed in the daily timeframe for ENGROH. The current downtrend is expected to reverse after the bullish divergence. The current downtrend is likely to reverse into an uptrend and reach levels indicated on the chart. When the trend starts to reverse and breaks the entry point level indicated on the chart, it will be considered a confirmation of the trend reverse and a good point to take a long position.

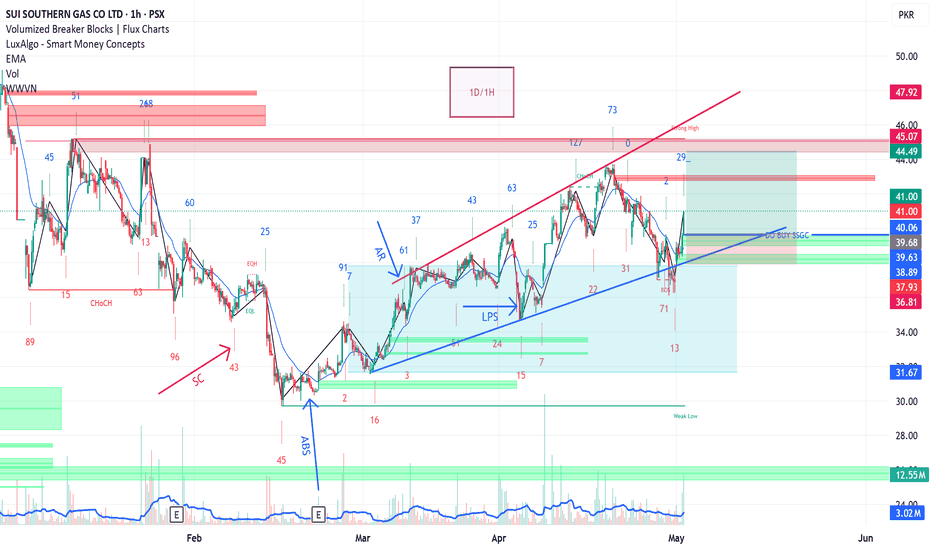

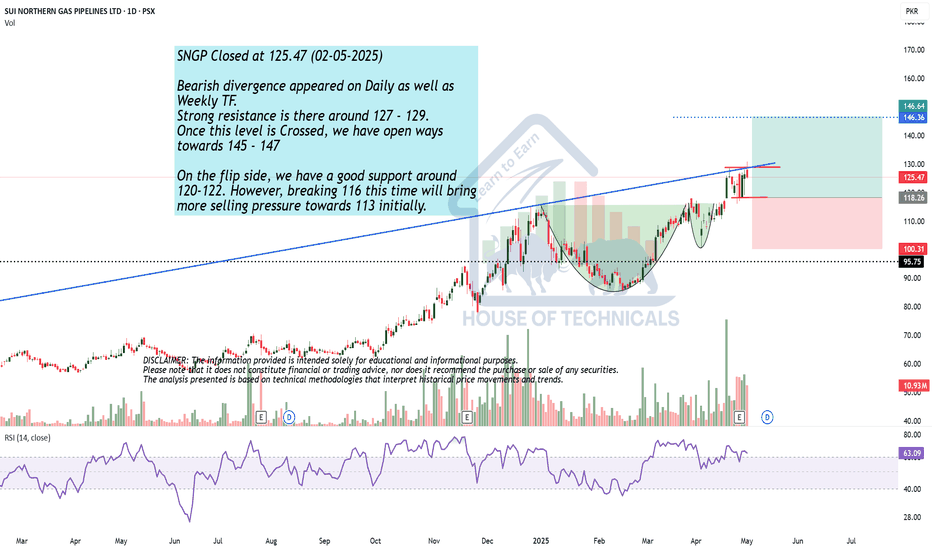

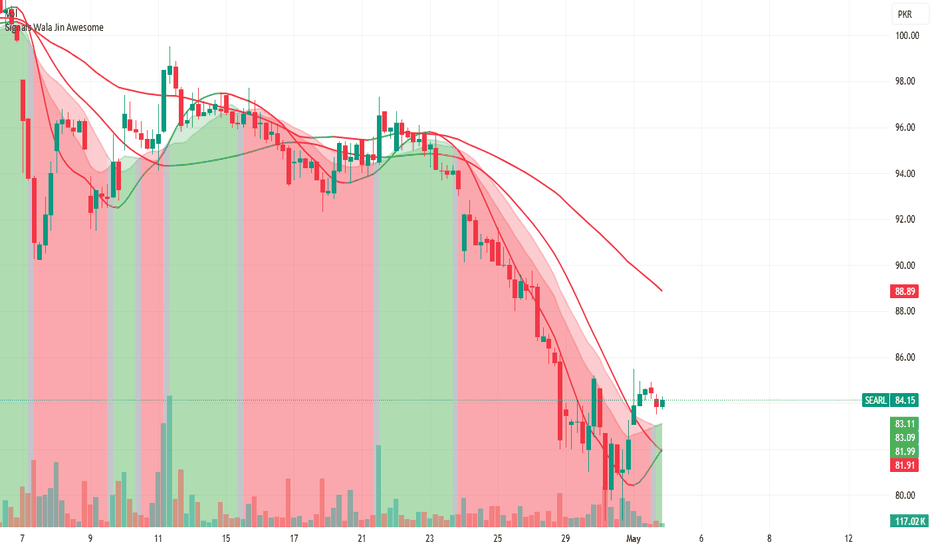

Bearish Divergence appeared.Bearish divergence appeared on Daily as well as

Weekly TF.

Strong resistance is there around 127 - 129.

Once this level is Crossed, we have open ways

towards 145 - 147

On the flip side, we have a good support around

120-122. However, breaking 116 this time will bring

more selling pressure towards 113 initially.

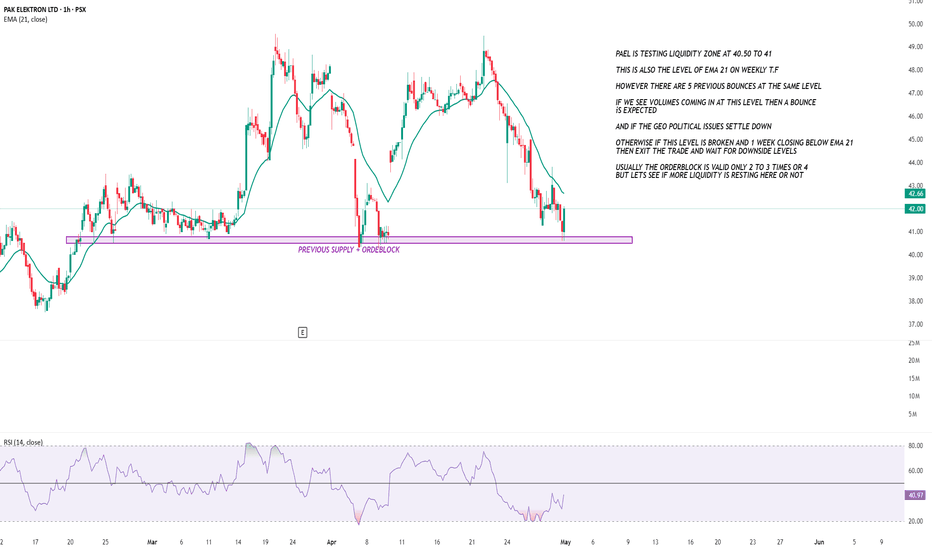

PAEL SETUP ONCE AGAINPAEL is currently at its orderblock zone where the liquidity is resting if volumes come in at this level then we can expect a bounce again if the orderblock fails and there is no liquidity in OB then wait for downside levels and if the weekly ema 21 is broken then i see 30 level coming but still we will look into some more levels for now just focus on this orderblock

the previous supply is completed here

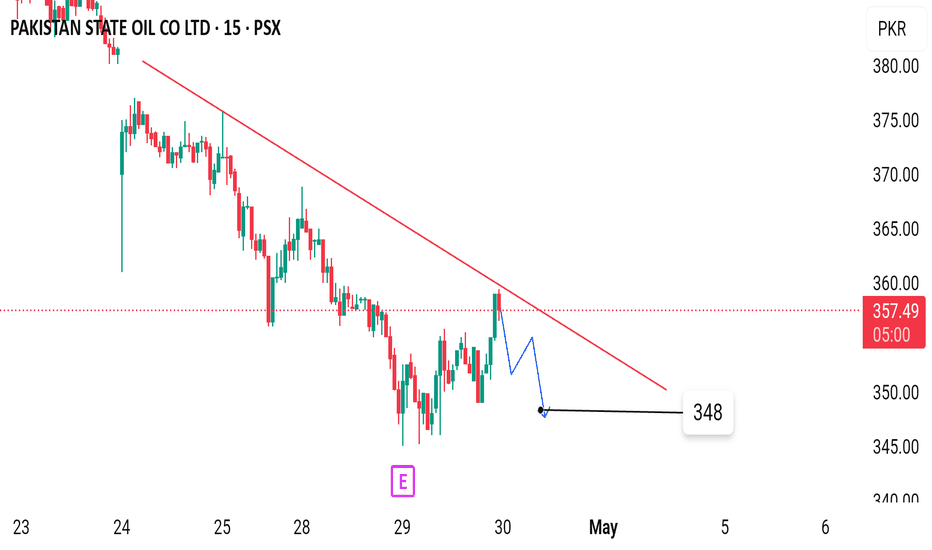

PSO Facing Trendline Resistance – Possible Retracement AheadMollyRonaldFx Report

The PSO 15-minute chart shows a strong bounce from recent lows, with price currently testing a well-defined descending trendline. Although today’s movement reflects bullish momentum (+2.22%), the resistance at this trendline may trigger a pullback. The projected short-term scenario indicates a potential dip towards the 348 support zone. A failure to break and hold above the trendline could confirm this bearish move. Watch price action closely near the resistance area for confirmation.

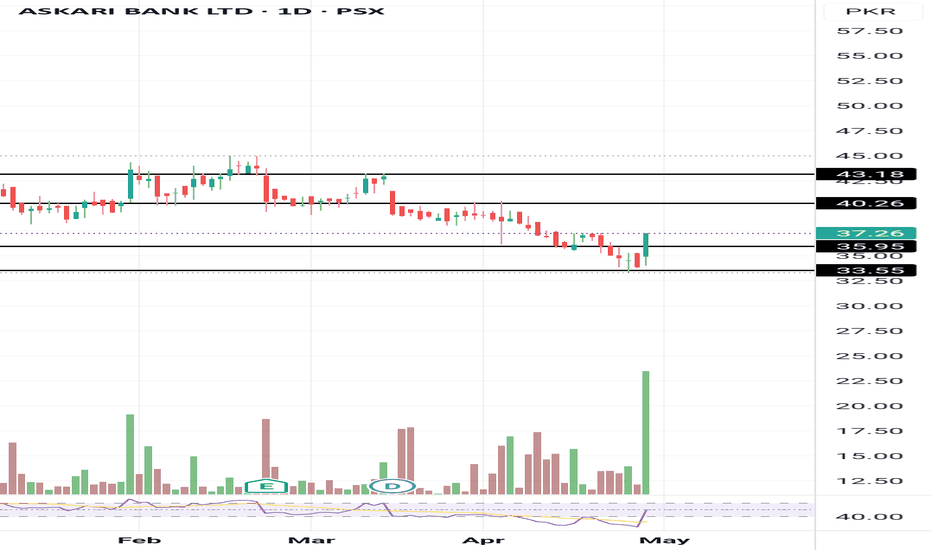

AKBL buying opertunity AKBL Buying Opportunity:

Analysis:

1. *Support Level*: AKBL shows strength on support, indicating potential buying interest.

2. *Buying Range*: PKR 37-34 seems like a reasonable entry point.

3. *Stop Loss*: PKR 32 provides a buffer against potential losses.

4. *Target Prices*: PKR 40-42 and PKR 45 offer potential

Next Steps:

1. *Monitor AKBL's Performance*: Keep an eye on AKBL's stock price and adjust strategy as needed.

2. *Stay Informed*: Stay up-to-date with market news and analysis.