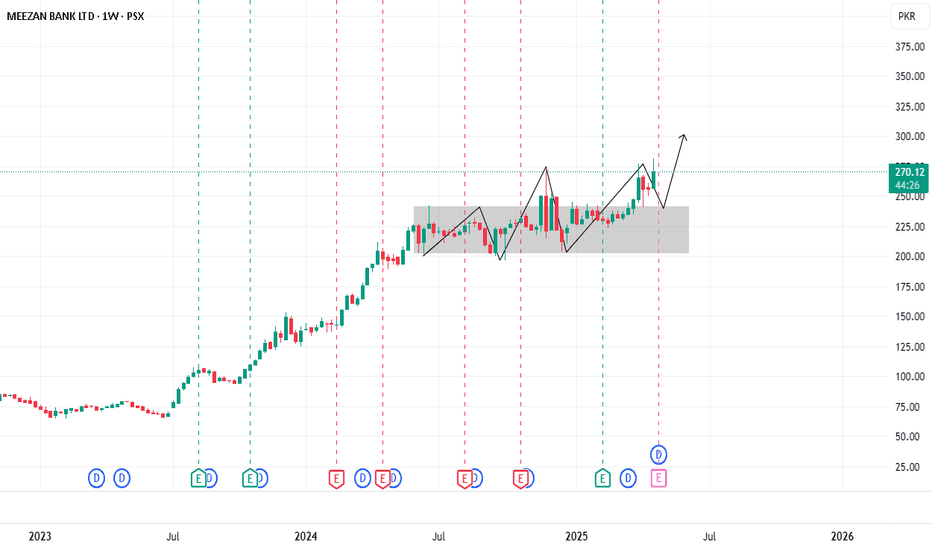

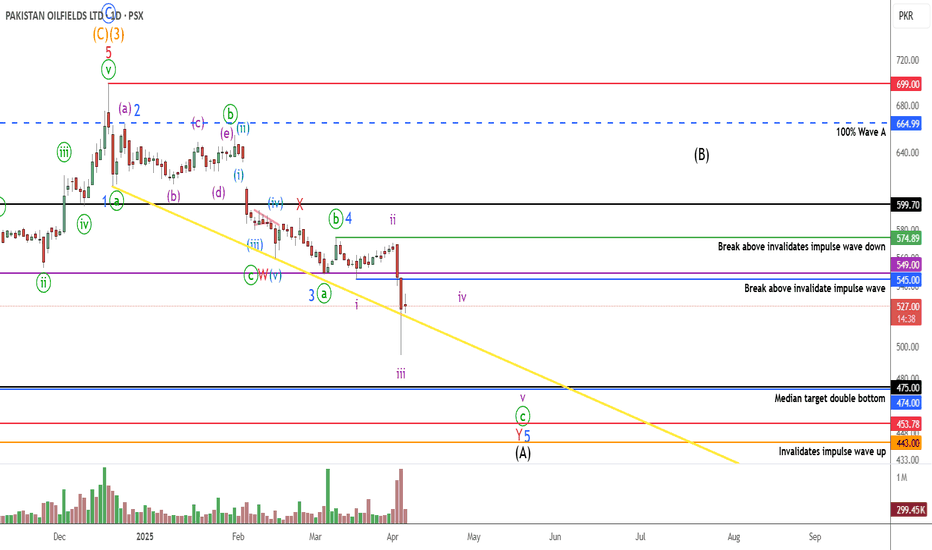

POL PROBABLY IN WAVE 'A' OR '1'This is an update on our POL wave count shared earlier, we have modified the wave count looking at the formations and excluded the possibility of the current wave being a wave C.

If the wave count is correct then we are in 5 or Y of wave 1 or A.

With reference to my last idea of POL in which we got greedy and took a loss on 50% of our positions and are still holding 50% of the long positions for long term. Since are preferred wave count is still showing some downside which can reach 500-475 range and even further, It is not wise to just let our investment sit there and wait for the upward movement which can take months from now. Therefore we have decided to hedge our current position with a small portion of short sell in POL futures.

Will share the short sell trade setup tomorrow morning

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

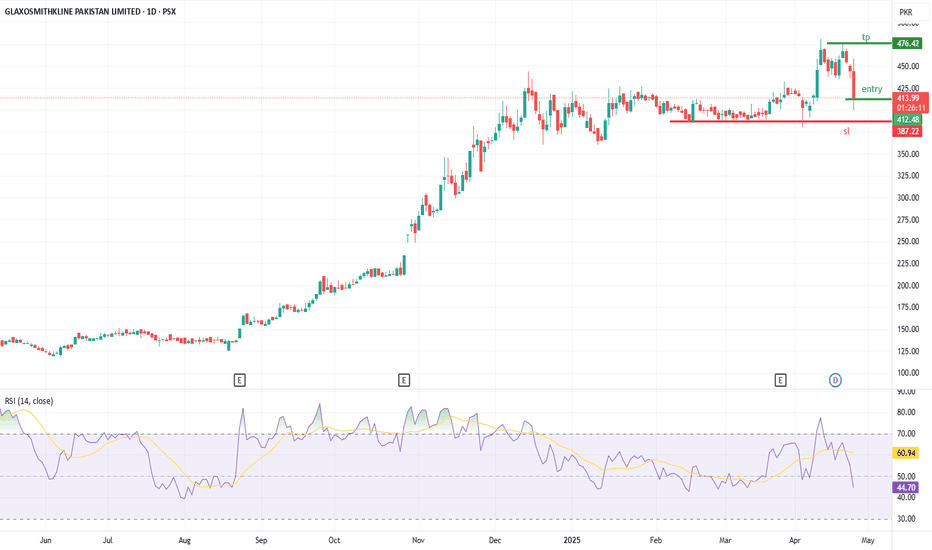

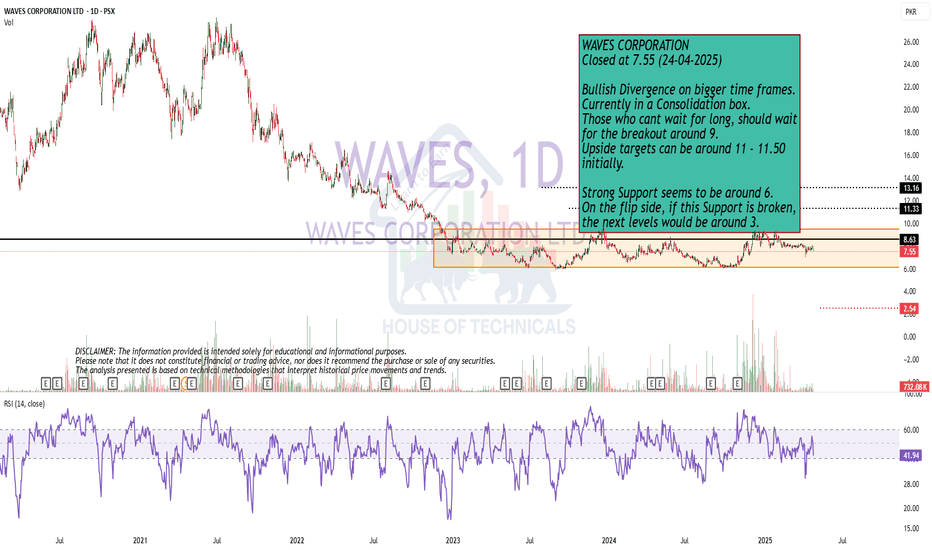

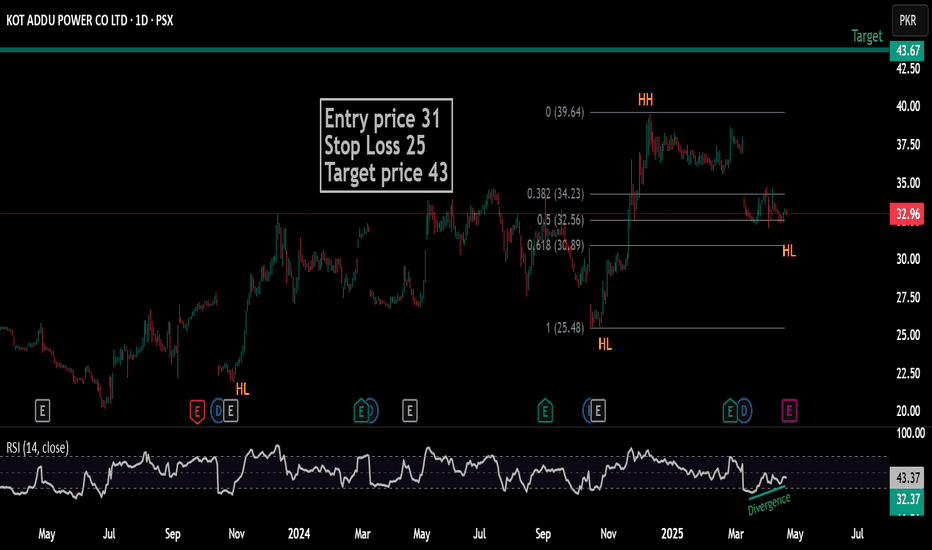

Bullish Divergence on bigger time frames.

Bullish Divergence on bigger time frames.

Currently in a Consolidation box.

Those who cant wait for long, should wait

for the breakout around 9.

Upside targets can be around 11 - 11.50

initially.

Strong Support seems to be around 6.

On the flip side, if this Support is broken,

the next levels would be around 3.

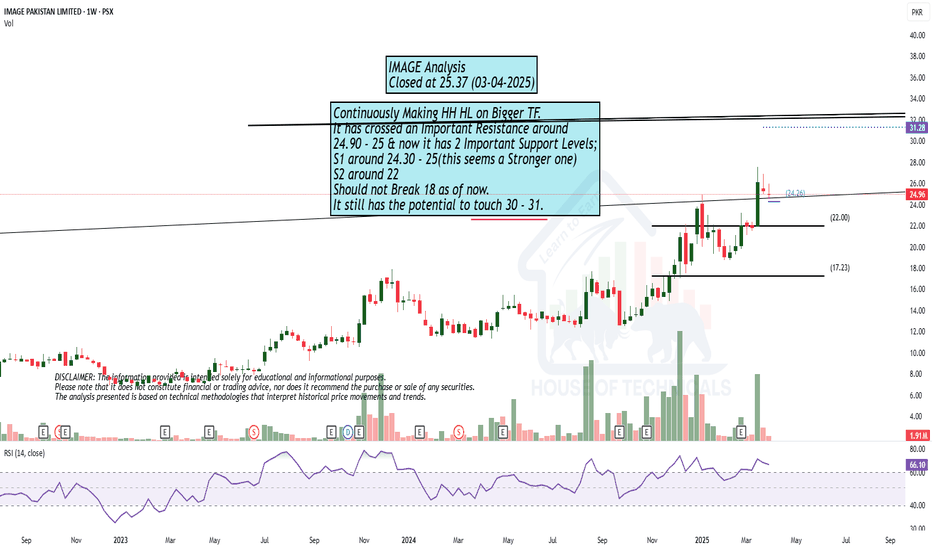

Continuously Making HH HL on Bigger TF.Continuously Making HH HL on Bigger TF.

It has crossed an Important Resistance around

24.90 - 25 & now it has 2 Important Support Levels;

S1 around 24.30 - 25(this seems a Stronger one)

S2 around 22

Should not Break 18 as of now.

It still has the potential to touch 30 - 31.

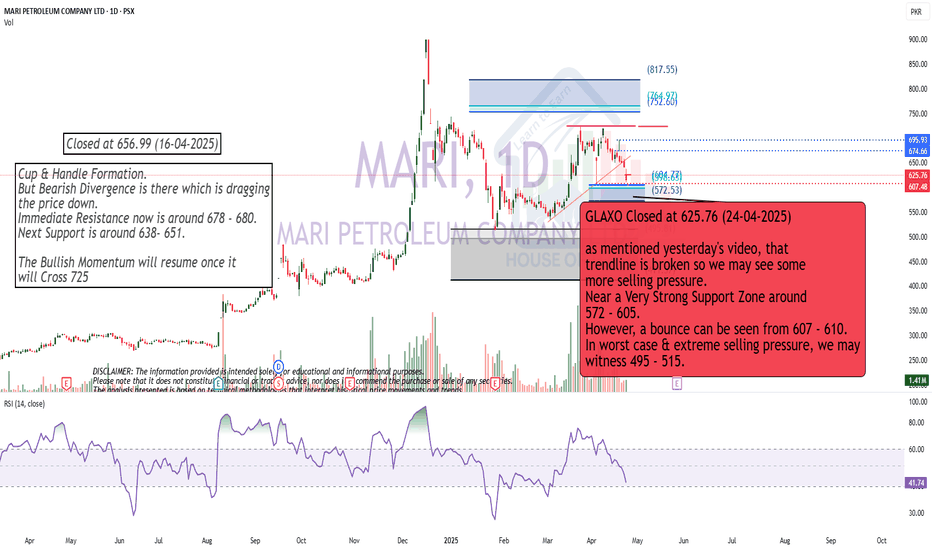

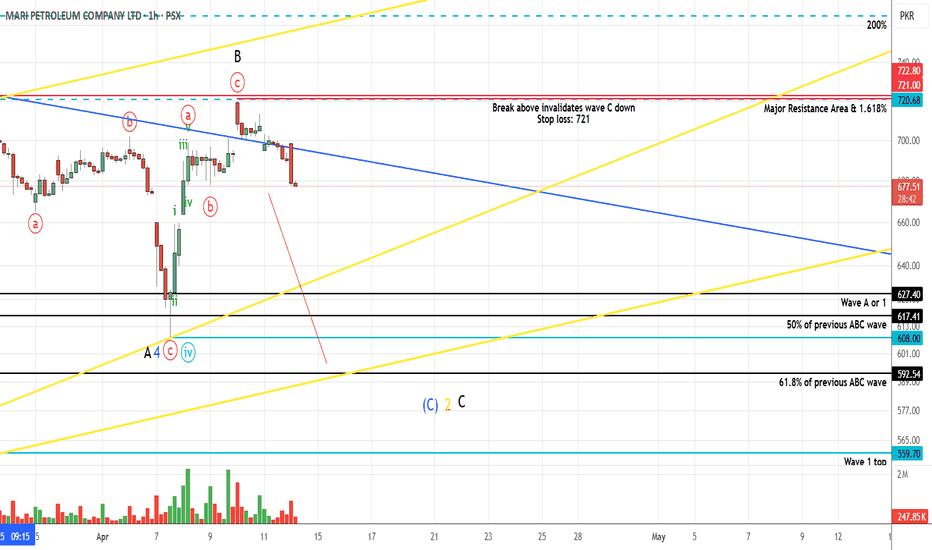

MARI PROBABLY IN WAVE '' C '' OF CORRECTION - SHORTThis is in continuation to our ongoing tracking of MARI.

Since prices moved down giving confidence to our bearish wave count, we are taking a small position by short selling. They are several possibilities at hand therefore we will trade this setup with cautious using trailing stop loss until we reach our target.

We only recommend small portions while short selling due to the fact that futures have less liquidity/volume.

If our wave count is correct then we can make around 10.85% or 13.04% on this trade.

Trade setup:

Entry price: 682

Stop loss: 721

Targets:

T1: 608

T2: 593-578

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

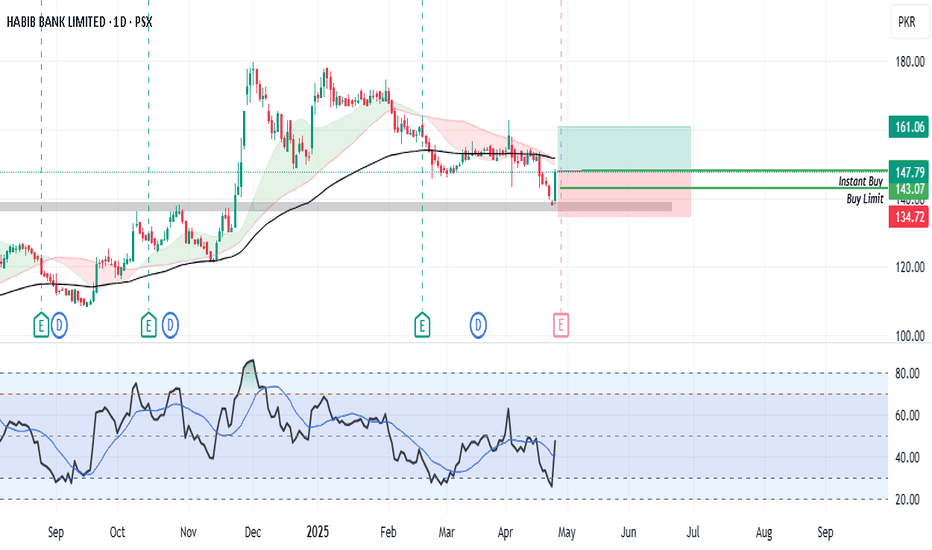

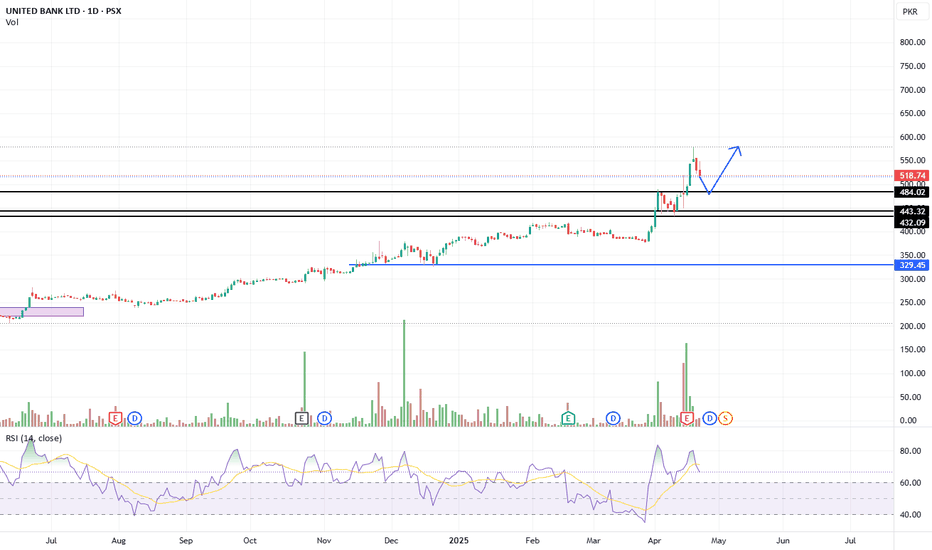

UBL Share StrategyUBL Buying Strategy:

To determine if the proposed buying strategy for United Bank Limited (UBL) shares is viable, let's break down the plan:

- Buy Price: PKR 500-480

- Stop Loss: PKR 470

- Target Price: PKR 580

Analysis:

1. Risk Management: The stop loss is set at PKR 470, which is PKR 10-30 below the buy price range. This seems like a reasonable risk management strategy.

2. Potential Return: The target price of PKR 580 offers a potential upside of PKR 80-100, which translates to approximately 16-20% return.

3. Market Conditions: It's essential to consider current market conditions, trends, and any potential catalysts that may impact UBL's stock performance.

Recommendations:

1. Monitor Market Trends: Keep a close eye on market trends and adjust the strategy accordingly.

2. Set Realistic Targets: Ensure the target price is realistic based on UBL's financial performance and market outlook.

3. Diversification: Consider diversifying your portfolio to minimize risk.

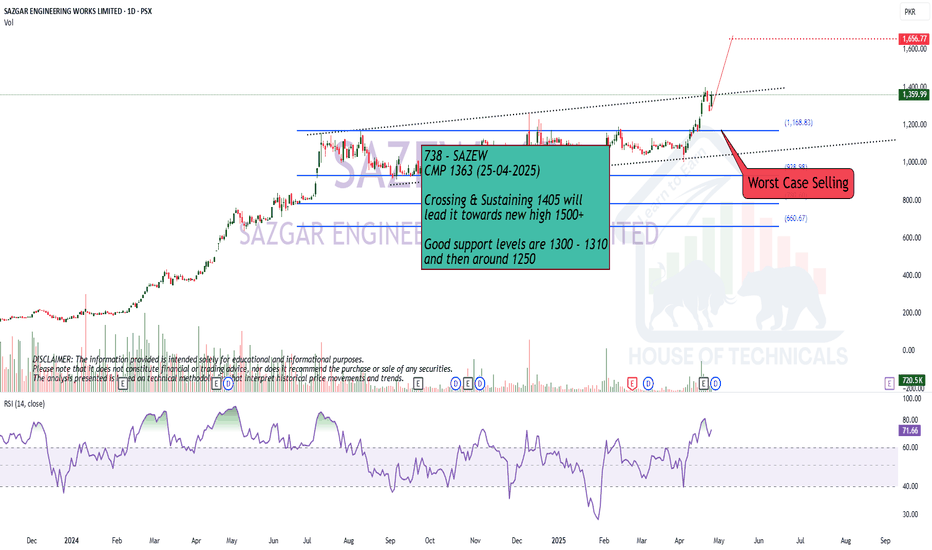

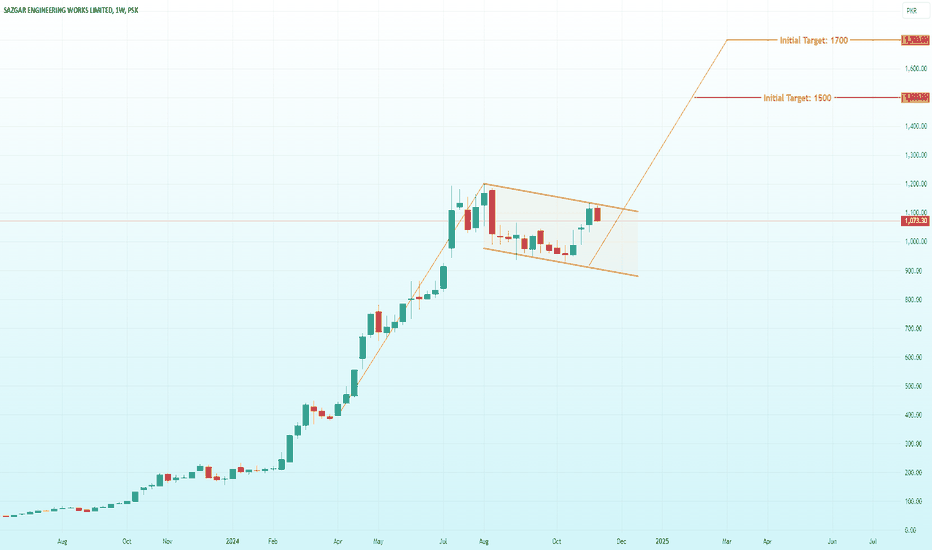

SAZEW | Bullish Flag PatternBack with SAZEW trading idea once again!!!

SAZEW printed a bullish flag pattern with no sign of divergence. A bullish trend continuation is expected, entry is suggested at 1,070 with the stop loss below previous lower high level at 780. Previous top of 1,202 considered as TP1 and after the break out it can leads towards the completion of the pattern, the price can projected towards 1,500 and then 1,700.