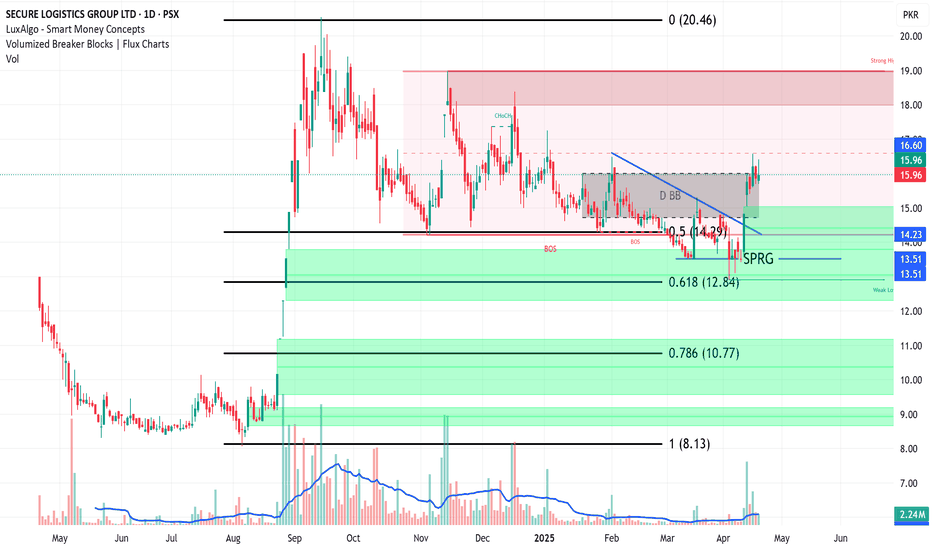

SYMMETRY GROUP LTD LONG IDEAGolden Cross Strategy (50, 200 MA)

Two moving averages are plotted: a 50-day (likely the green line) and a 200-day (likely the blue line).

The current price ₨14.19 is below the 50-day moving average (₨16.11) and the 200-day moving average (₨12.24). This suggests the stock is trading in a weak zone relative to its medium-term trend.

Support & Resistance

Price recently broke below a key upward trendline, shown as a blue diagonal line sloping upwards.

The stock seems to be testing this broken trendline as resistance.

Trade Markers

Several "Target" labels (green and red) appear on the chart, showing past trading signals.

Green icons indicate successful bullish targets; red icons indicate bearish signals or failure to sustain levels.

RSI (Relative Strength Index)

RSI is shown at 40.23, slightly below the neutral 50 level.

There’s also a yellow moving average line for RSI, currently at 36.19.

The RSI has been in a bearish phase since early 2025, with occasional “Bear” and “Bull” signals marked on the indicator. Recently, the RSI made a small uptick, but still stays below the 50 mark, which hints at weak buying strength.

⚡ Insights

Trend Weakness: The price has broken below a long-standing ascending trendline and is struggling to regain that line as support, which is a bearish technical signal.

Bearish Momentum: The RSI is under 50, showing weak bullish momentum and limited buying interest.

Resistance Overhead: The 50-day moving average around ₨16.11 and the downward-sloping trendline are likely to act as resistance in the near term.

Possible Bottom Formation: If the RSI holds above 36 and starts climbing, combined with price stabilizing around ₨14.19-₨12.50, a short-term reversal could happen — but confirmation is needed.

✅ Actionable Takeaways

For Traders: Avoid long positions until the stock breaks above ₨16.11 (50 MA) or shows a clear bullish RSI crossover.

For Investors: If you’re looking for value, watch for a base formation near the ₨12.24 (200 MA) region.

For Short Sellers: As long as the price remains below the 50-day MA and the RSI doesn't cross 50, bearish setups remain favorable.

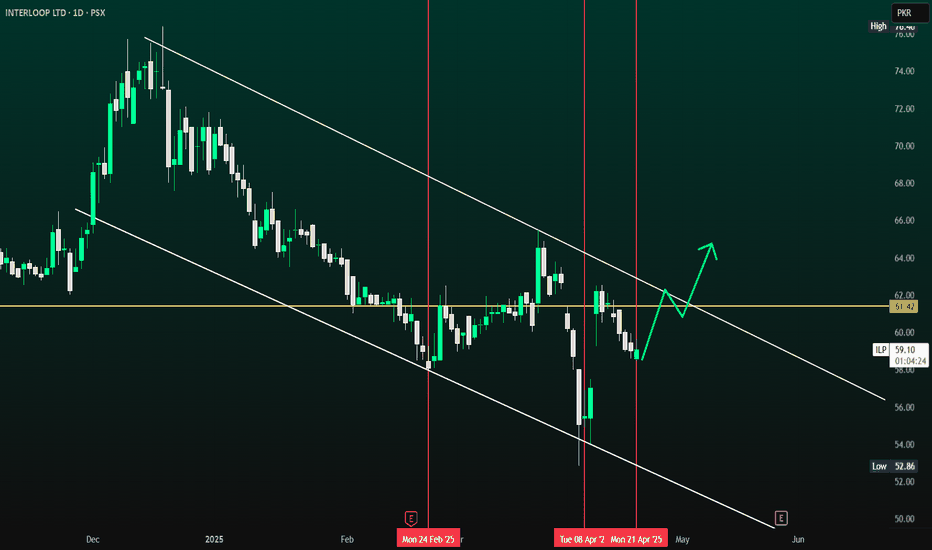

Interloop - ILP: Potential Bullish The chart for Interloop Limited (ILP) shows the stock currently trading within a downward-sloping channel, with clear support at 59.14 (marked by the yellow line) and resistance at 61.42. The price has been consistently testing the lower boundary of this channel, and the support level at 59.14 has held in the past, indicating it could offer a potential bounce. If the stock manages to hold above this support, it could initiate an upward move.

A breakout above 61.42 would be a strong bullish signal, suggesting the stock could continue to rise towards the next resistance levels around 64.00 or higher. However, if the price fails to maintain support at 59.14, it could slide further down to 52.86, marking the next significant support level.

Overall, the stock is in a downtrend, but the current setup provides an opportunity for a potential reversal if it successfully breaks the resistance and holds above support.

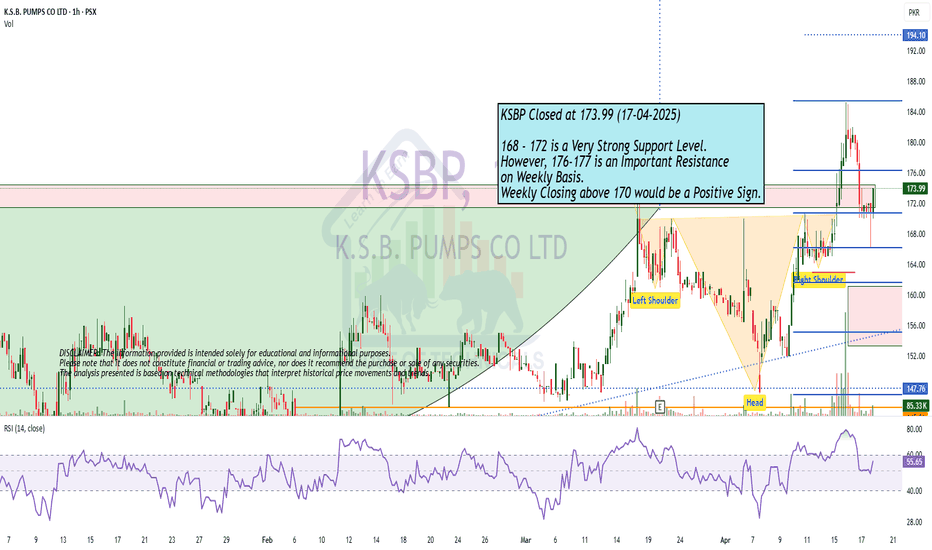

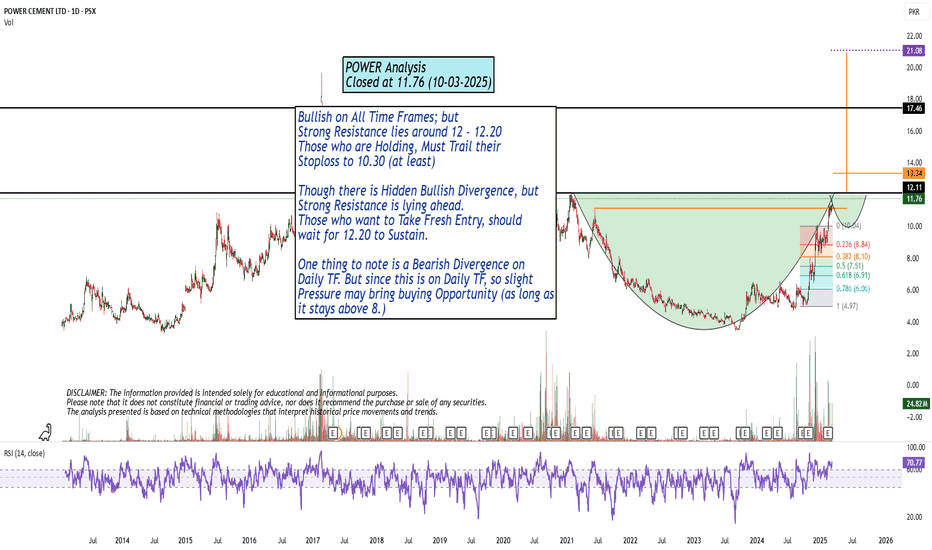

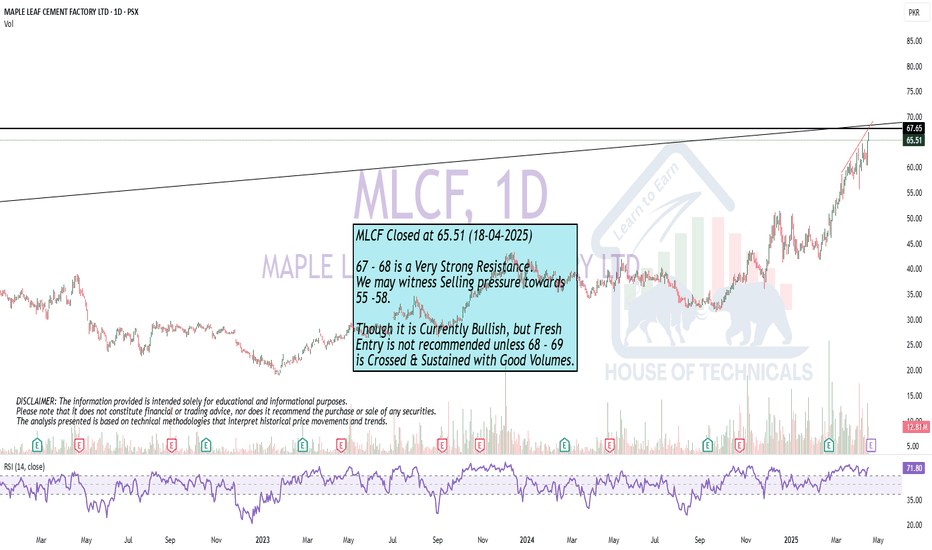

Bullish on All Time Frames; butBullish on All Time Frames; but

Strong Resistance lies around 12 - 12.20

Those who are Holding, Must Trail their

Stoploss to 10.30 (at least)

Though there is Hidden Bullish Divergence, but

Strong Resistance is lying ahead.

Those who want to Take Fresh Entry, should

wait for 12.20 to Sustain.

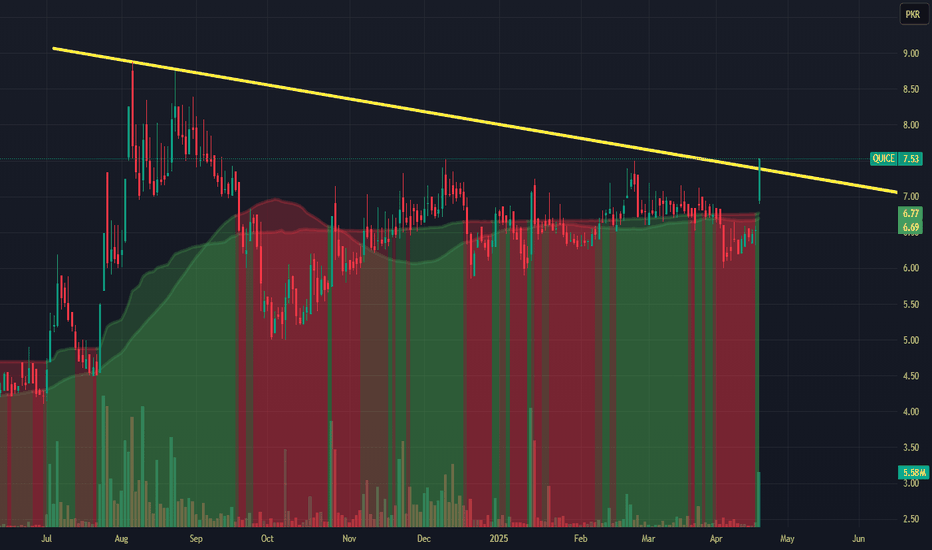

One thing to note is a Bearish Divergence on

Daily TF. But since this is on Daily TF, so slight

Pressure may bring buying Opportunity (as long as

it stays above 8.)

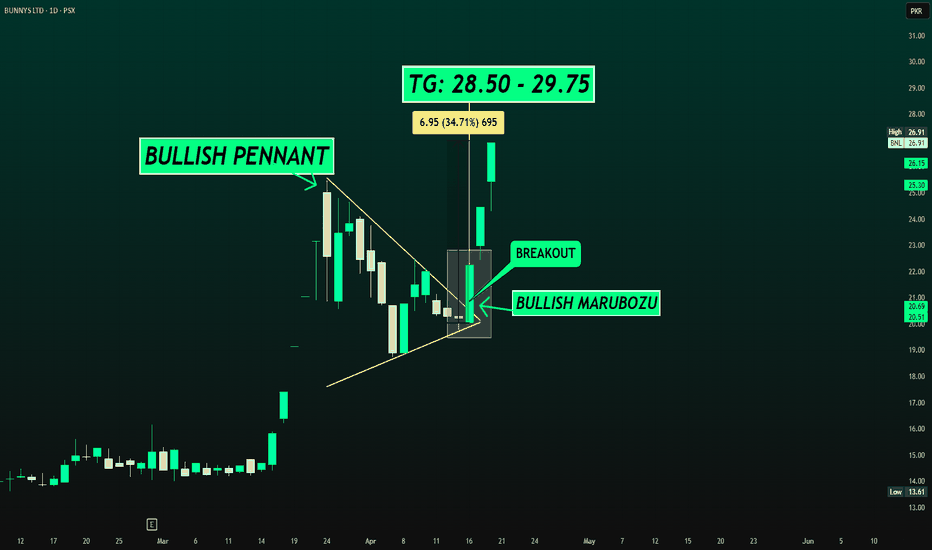

BNL - MULTIBAGGER ??

Current Price: 22.24

Chart Setup: Bullish Pennant and Breakout Pattern

BNL (Bunny's Ltd.) is currently showing a bullish pennant pattern, which is a continuation chart pattern that suggests a potential breakout to the upside. The price has been consolidating after a strong rally, forming a symmetrical triangle or pennant shape, with the upper boundary acting as resistance and the lower boundary as support. The breakout from this pattern is typically a sign of further upward momentum.

First Target (50% Extension): Once the breakout happens, the first target range for BNL could be around 25.48, followed by a potential move toward 28.50 in the medium term.

Extended Target: If the breakout holds and the bullish momentum continues, BNL could test higher resistance zones around 30.00–32.00 in the long term.

BNL OUR FIRST CALL INITIATED @ 14 LEVELS IN MARCH

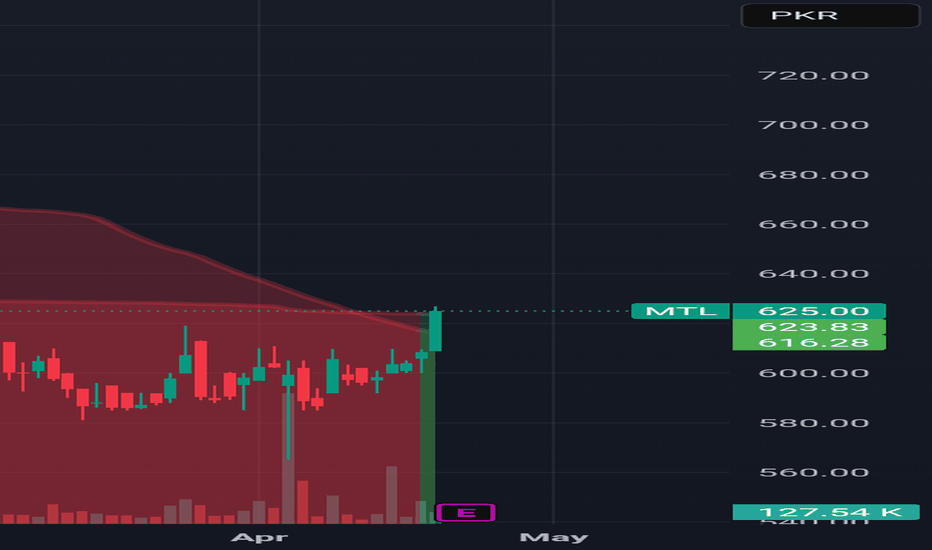

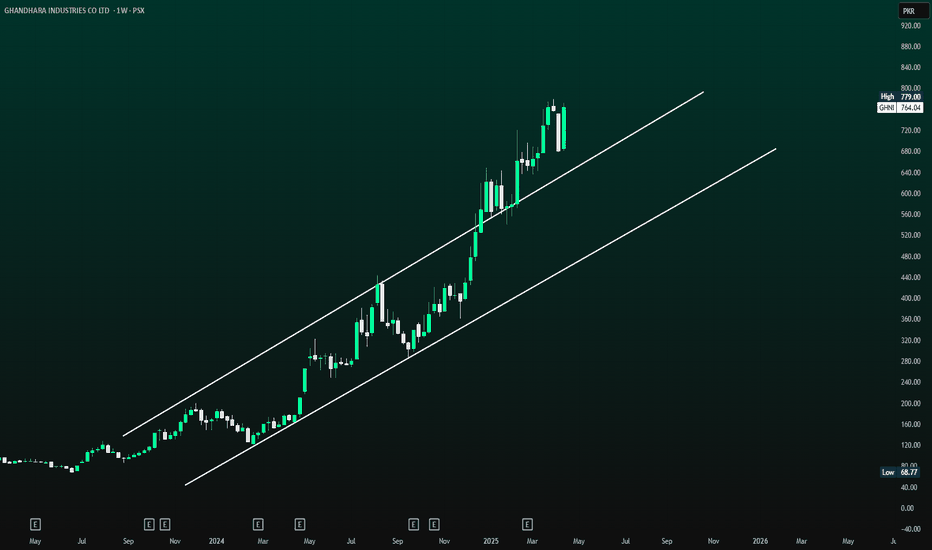

GHNI - CONTINUES TO B UPWARD, IS IT HEADING FOR 1000+ ???

Current Price: 764.04

Chart Setup: Uptrend within an Ascending Channel

Ghandhara Industries Ltd. (GHNI) has been experiencing a strong bullish trend, moving within an ascending channel over the past year. The stock has shown significant upward momentum, consistently bouncing between the support and resistance levels of the channel. Currently, it is nearing the upper resistance line, suggesting that further upside could be expected if the trend continues.

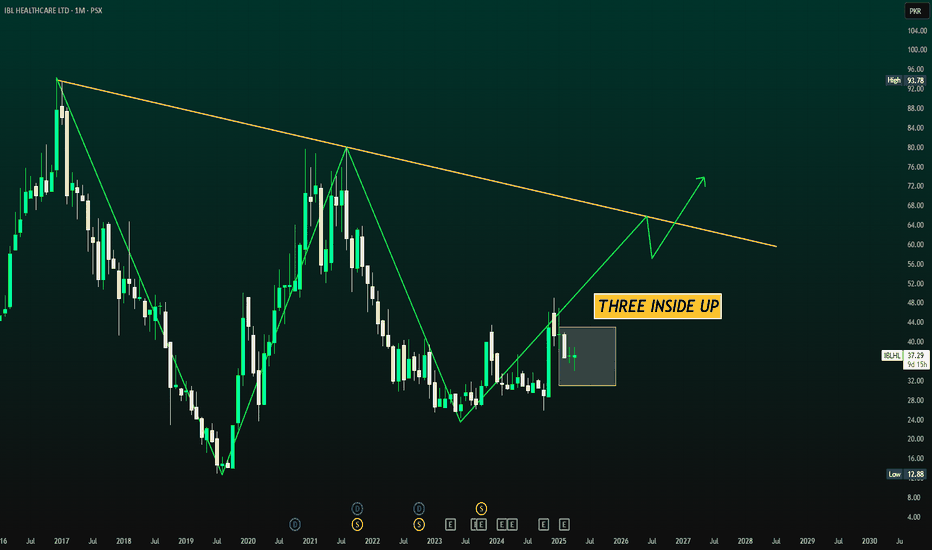

IBLHL (MONTHLY) - THREE INSIDE UP IBL Healthcare Ltd. (IBLHL) is showing significant bullish potential after a long downtrend, with a "Three Inside Up" candlestick pattern forming at the bottom of the trend. This pattern suggests a potential reversal to the upside after a prolonged period of decline, and it signals strength as the buyers are beginning to take control.

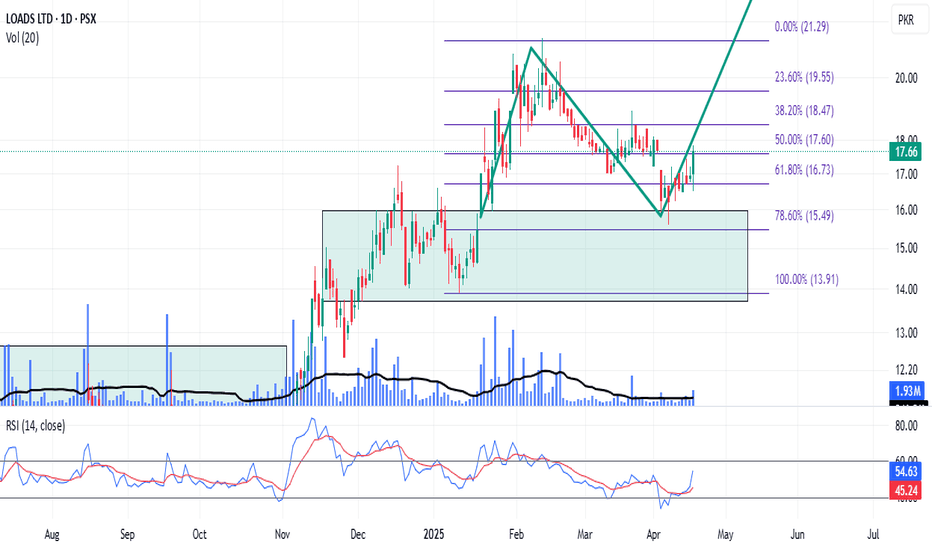

LOADS--- a Short Term Yet Powerful Trade Loads is offering a powerful Buy Set-up with following confluences:

1. Pirce has broken out range and re-tested it.

2. Re-test of Breakout range with healthy price action (Pin-Bar)

3. Surge in Volume after a bounce-off price from breakout zone.

4. MACD & RSI have generated a Buy Signal.

5. Rejection of Price at lower boundary of BB.

Target Prices are 19, 21 & 25.

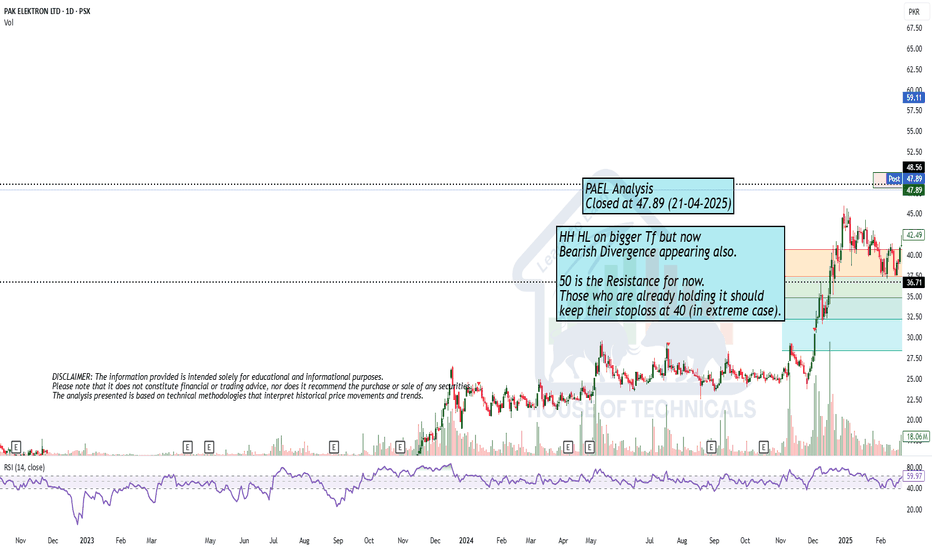

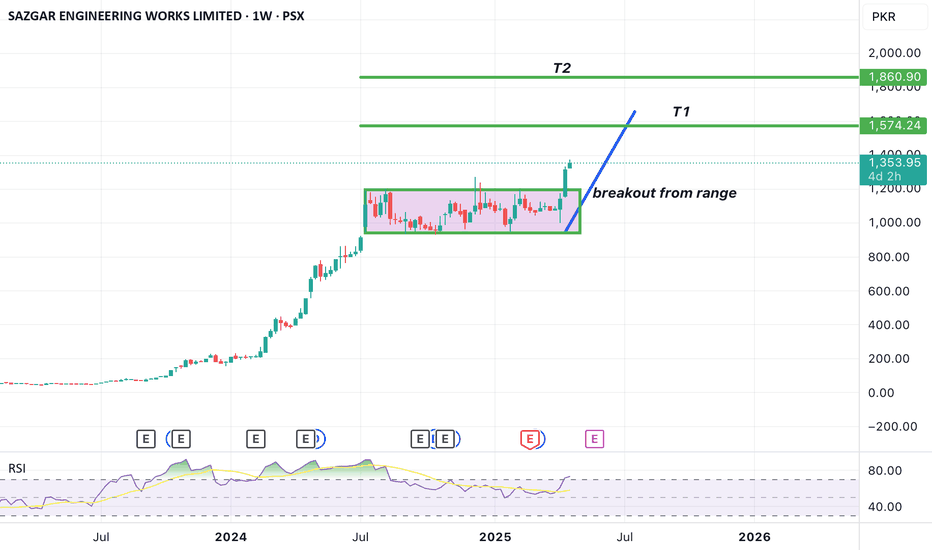

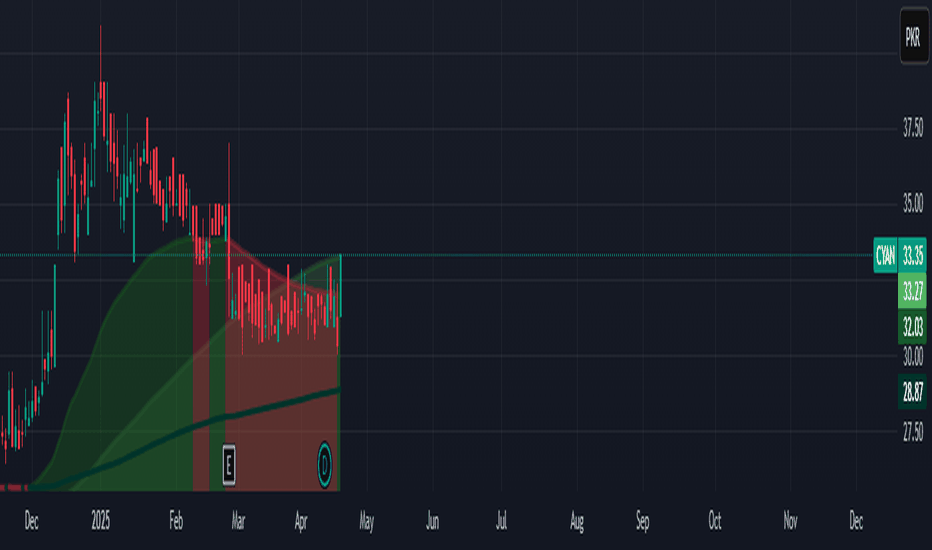

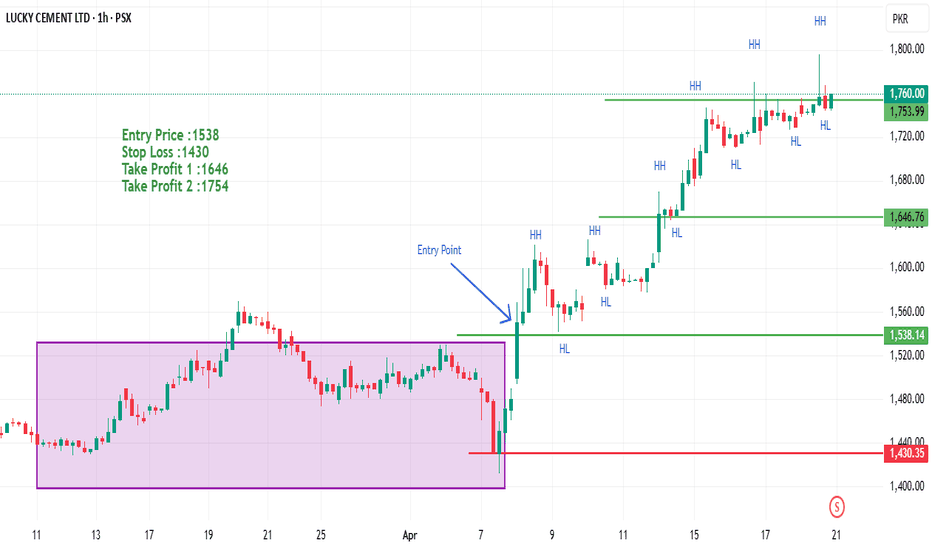

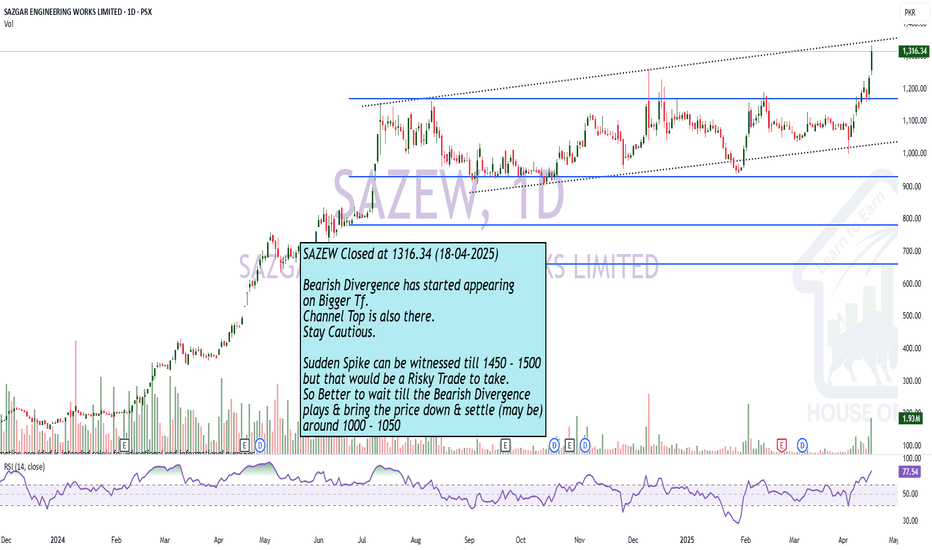

Bearish Divergence has started appearing

Bearish Divergence has started appearing

on Bigger Tf.

Channel Top is also there.

Stay Cautious.

Sudden Spike can be witnessed till 1450 - 1500

but that would be a Risky Trade to take.

So Better to wait till the Bearish Divergence

plays & bring the price down & settle (may be)

around 1000 - 1050