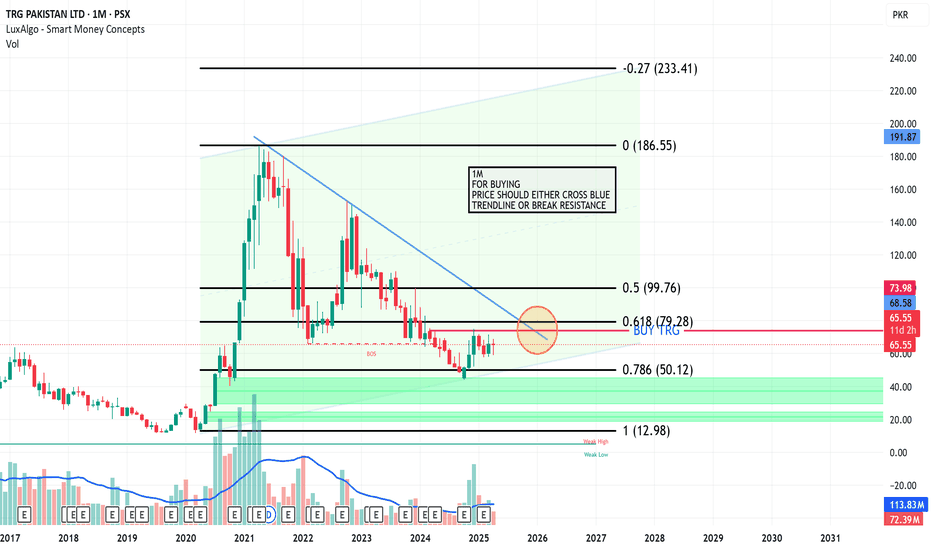

TRG LONGTERM ANALYSIS AND NEW ALL TIME HIGH COMINGTRG has been in Pullback since May 2021 when it posted its ATH of Rs 186.

It has reached 78% level of retracement and is rebounding from !M FVG(Fair Value Gap).

It is very much likely to start a long term bullish move after it crosses Rs74 level to make new high of Rs 230 In Sha Allah

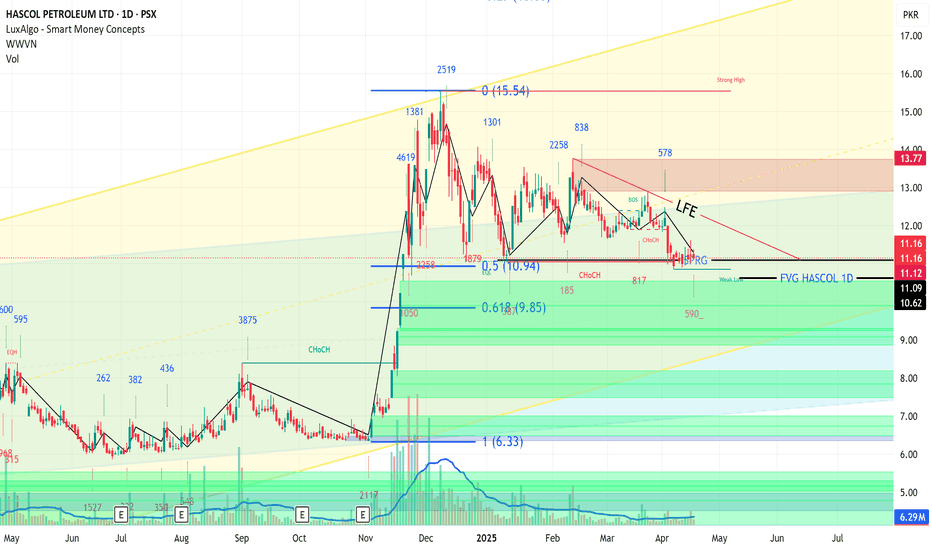

HASCOL LONG TRADEHASCOL has given breakout of previous channel ( blue ) and has now switched to new channel (yellow). It has completed 50% retracement of the breakout. I t is expected to rebound from current level or nearby FVG (Fair Value Gap) after going through spring/bear trap. It'll be a good buy only after some bullish confirmation. For now it is wait and watch strategy

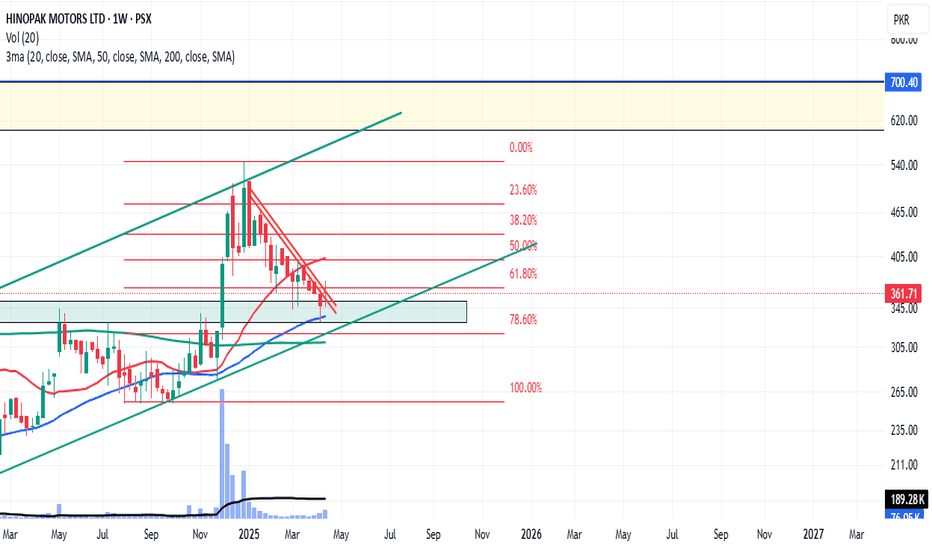

HINO--- A High Probability BUY SwingTradePrice is currently at a High Probability Buy Zone with Target at 544 & 600. Confluences include:

1. BB-50 (Base line Retest and Rejection) on weekly TF.

2. RBS Zone overlapping with 61.80% to 78.6% Fib. zone.

3.Strong MACD Signal.

4. Surge in Volume on Daily TF at a key support area.

5. SL below 322

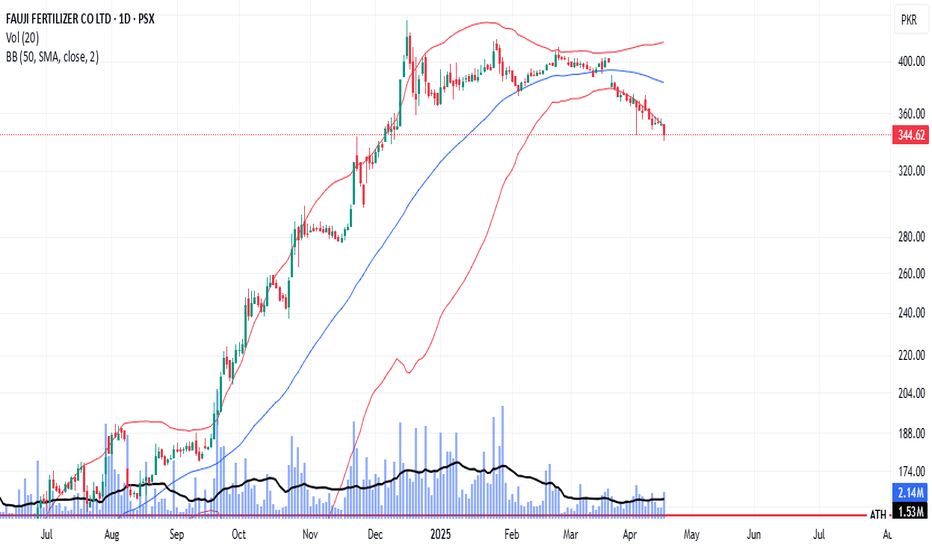

FFC- Deeper Retracement is Expected !Reasons for Deeper Retracements are :

1. 20, 50 & 200 SMAs are converging.

2. RSI on daily TF is below 30 which signifies Bearish Trend

3. Weaker Price Action at Recent Swing High is signalling Profit Taking activity is taking place.

Way Forward:

1. Observe Price Action once price tests 200 SMA and 78.6%% Fib. Level.

2.If a Bullish signal (Engulfing, Pin-Bar with surge in Volume) is observed, a good probability trade is on the cards.

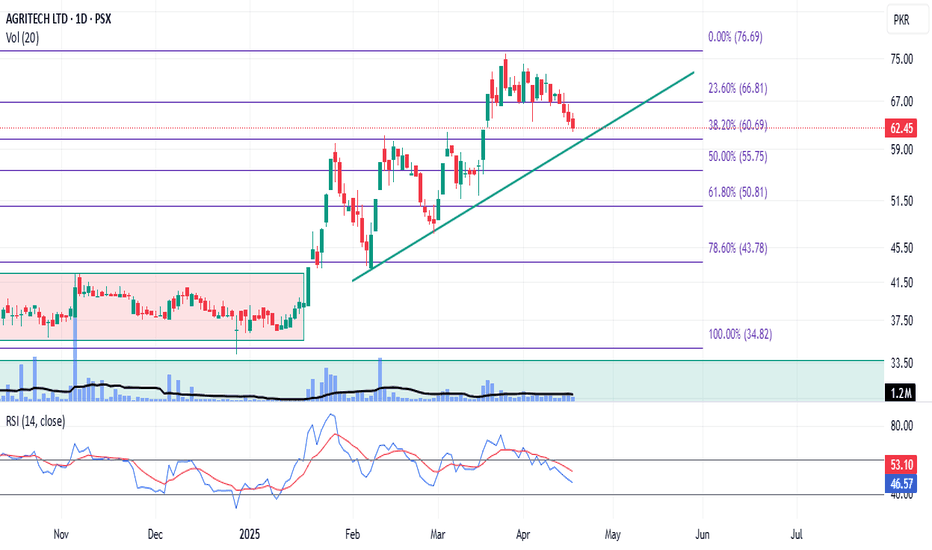

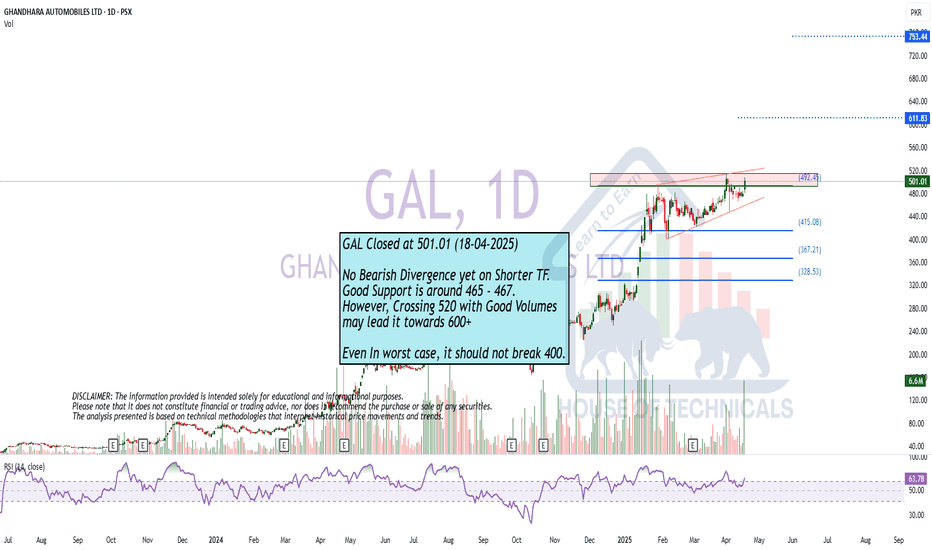

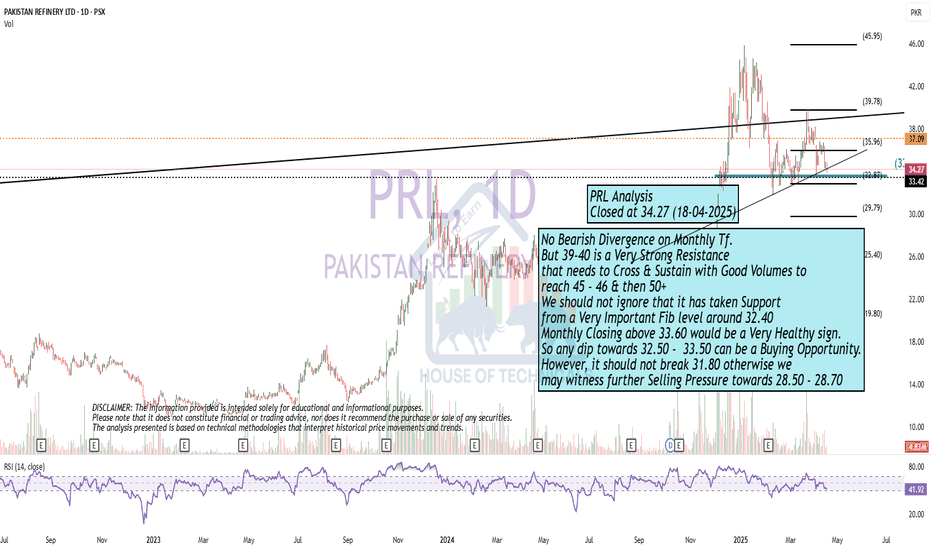

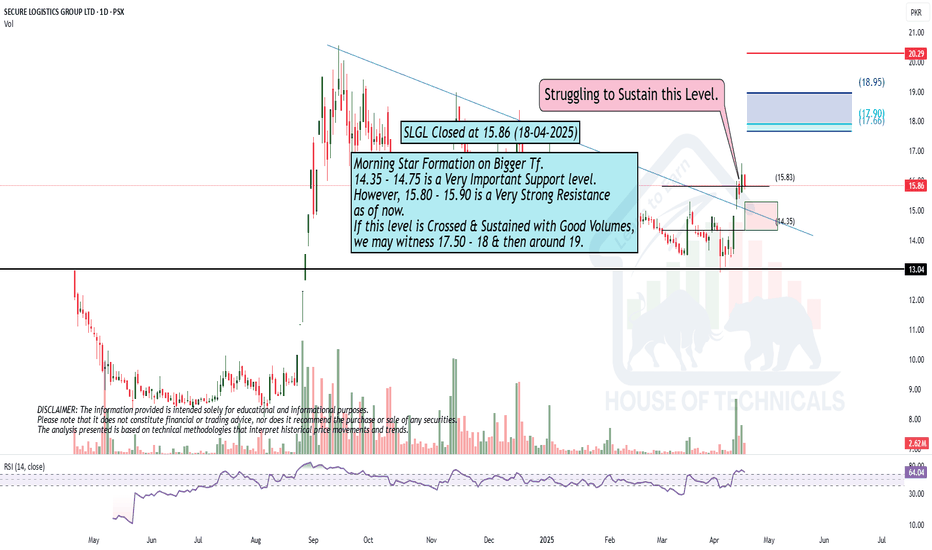

No Bearish Divergence on Monthly Tf.No Bearish Divergence on Monthly Tf.

But 39-40 is a Very Strong Resistance

that needs to Cross & Sustain with Good Volumes to

reach 45 - 46 & then 50+

We should not ignore that it has taken Support

from a Very Important Fib level around 32.40

Monthly Closing above 33.60 would be a Very Healthy sign.

So any dip towards 32.50 - 33.50 can be a Buying Opportunity.

However, it should not break 31.80 otherwise we

may witness further Selling Pressure towards 28.50 - 28.70

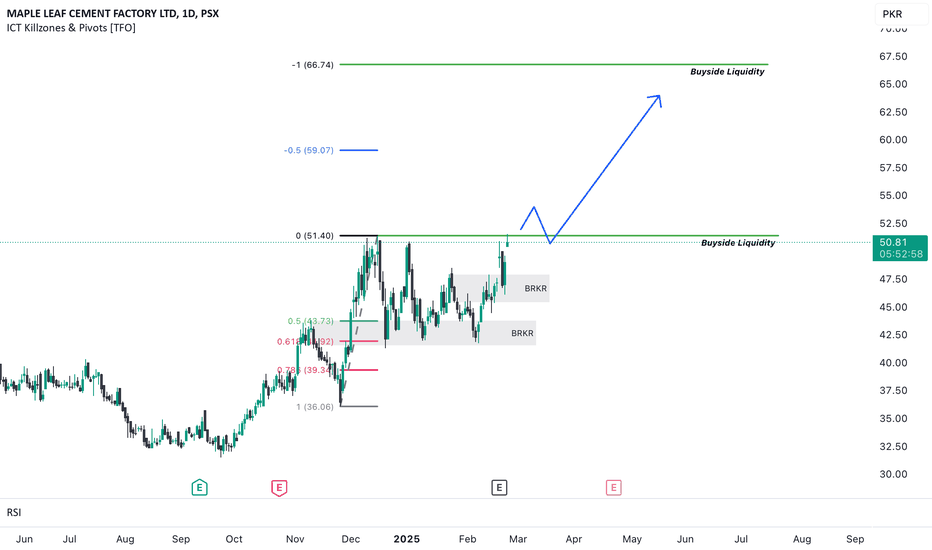

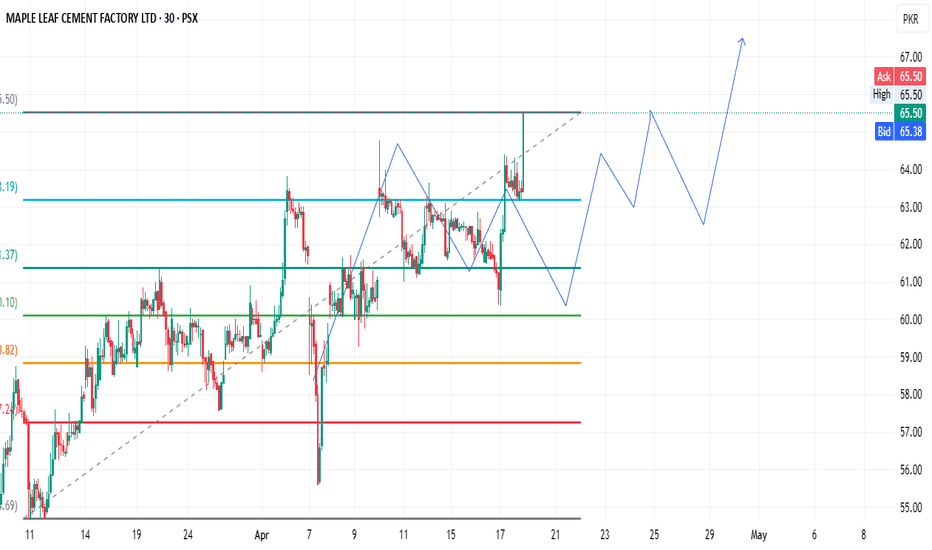

Trade Item MLCF 18/04/2025 Analysis Time 03:47 AM📈 MLCF (PSX) – Strong Buy Alert!

🗓️ 18/04/2025 | ⏱️ 30-Min Timeframe

MLCF is looking bullish with solid momentum on the 30-min chart. Great opportunity for short-term traders!

💸 Buy Range: 62.50

🎯 Target: 67.40

🛑 Stop Loss: No Stop Loss (High-risk, high-reward strategy)

Technical indicators are showing strength, and volume is backing the move. Watch closely for confirmation and breakout continuation.

🚀 Trade at your own risk. This is not financial advice.

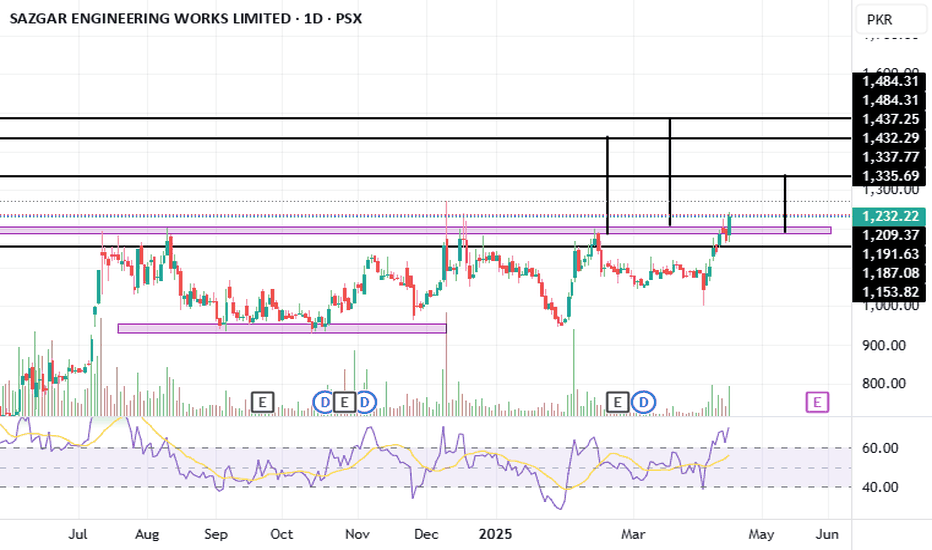

SAZEW Share StrategySazew Buying Strategy:

Key Levels:

1. Breakout level: 1232

2. Stop loss: 1150

3. Targets:

1. 1335

2. 1430

3. 1485

Strategy:

1. Buy after breakout: Enter the trade after Sazew closes above 1232.

2. Risk management: Set a stop loss at 1150.

3. Profit targets: Aim for 1335, 1430, and 1485.

Considerations:

1. Trailing stop loss: Consider using a trailing stop loss to lock in profits.

2. Sustaining above targets: If the price sustains above the final target, consider holding for further gains.

This strategy is based on the provided information. Always conduct your own research and consider consulting a financial advisor before making investment decisions.

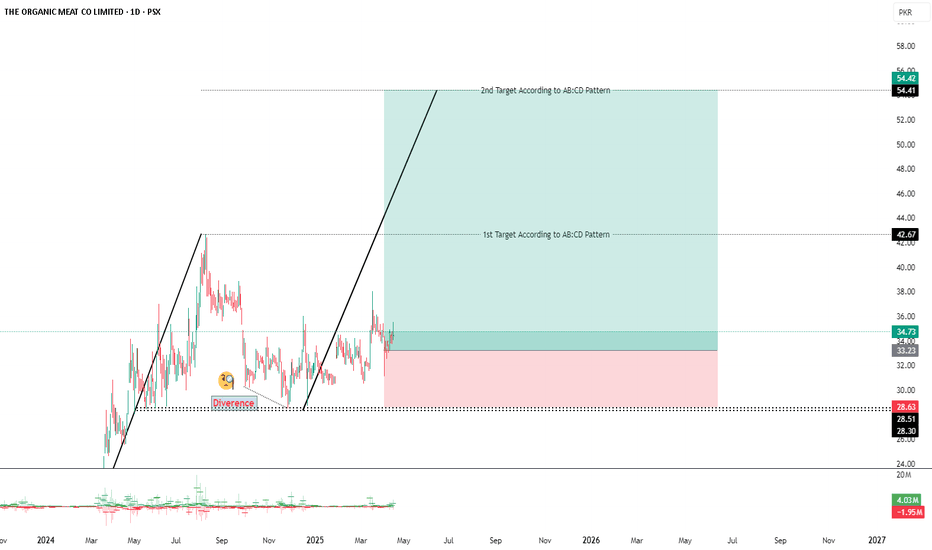

The ORGANIC MEAT CO LIMITED

1) TOMCL bounce back from gold number of fab retracement currently following AB:CD pattern on daily, weekly, & monthly time frame.

2) Showing uptrend from gold numbers of fib, we can expect uptrend continue and achieve its future targets.

3) Created divergence on daily time frame, from that divergence on daily time frame share price showing uptrend.

4) Trend line define uptrend on daily, weekly, & monthly time frame.

5) This share in past increased too much in days of Bakra Eid, so currently we expect good move in recent future.

6) Super trend also confirmed uptrend and it look will continue.

7) According Elliot wave theory, it is creating 3rd wave that means uptrend continue further

Need a patience for achieving targets and behave like a professional trader.

Target 01 (42.64) Target02 (54.41)

Stop loss (28.63)