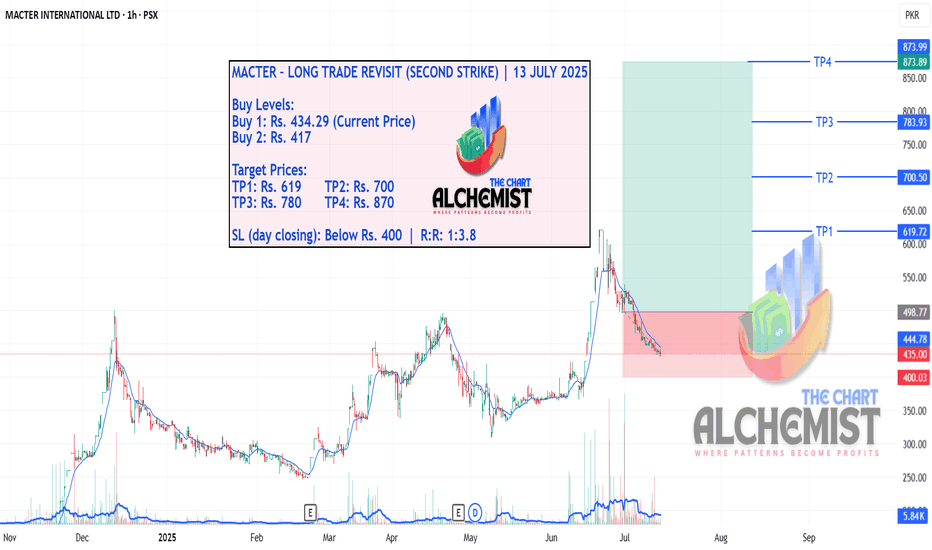

MACTER – LONG TRADE REVISIT (SECOND STRIKE) | 13 JULY 2025MACTER – LONG TRADE REVISIT (SECOND STRIKE) | 13 JULY 2025

After a successful first strike call that achieved all targets, MACTER experienced a deeper-than-expected pullback. With the stop loss now adjusted below Rs. 400, we are issuing a revisit entry as a Second Strike, based on renewed bullish potential.

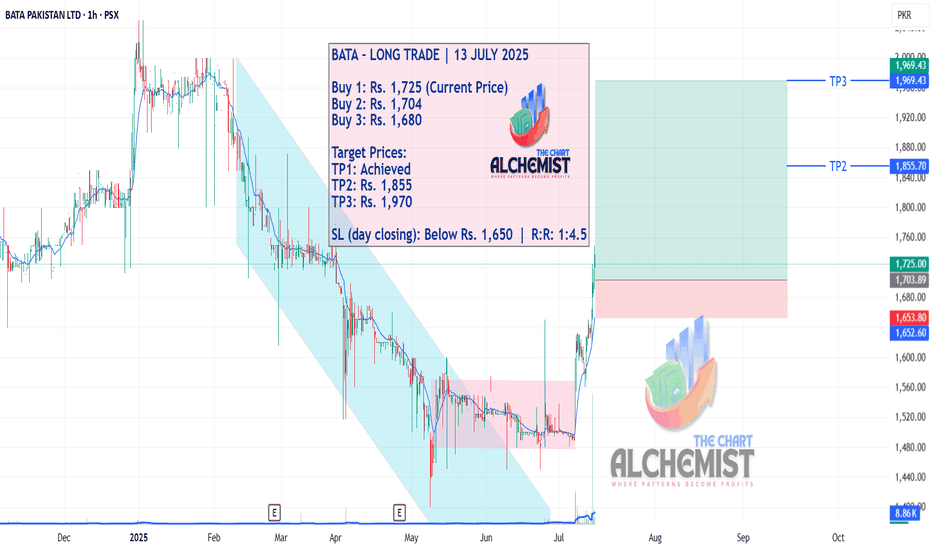

BATA – LONG TRADE (SECOND STRIKE) | 13 JULY 2025BATA – LONG TRADE (SECOND STRIKE) | 13 JULY 2025

The stock broke out of a consolidation phase (marked in light pink) after remaining in a downtrend (marked in blue channel). It achieved TP1 in our previous call and has now formed multiple bullish structures that are expected to act as major support for the next leg up.

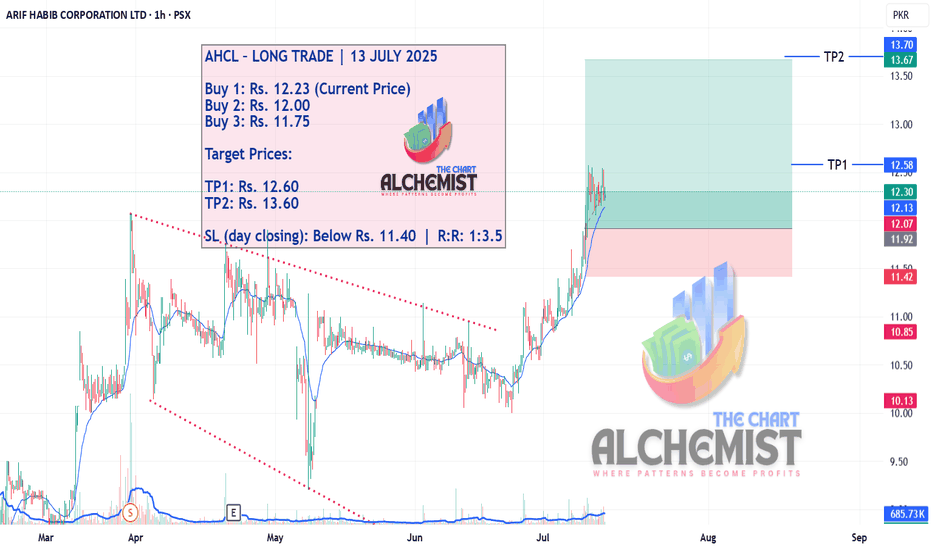

AHCL – LONG TRADE | 12 JULY 2025AHCL – LONG TRADE | 12 JULY 2025

The stock achieved a high of 12.07 PKR, then entered a complex correction forming a diverging channel. After breaking out of this channel, the stock has created bullish structures and currently lies at a newly formed support, making it a safe place for a long entry.

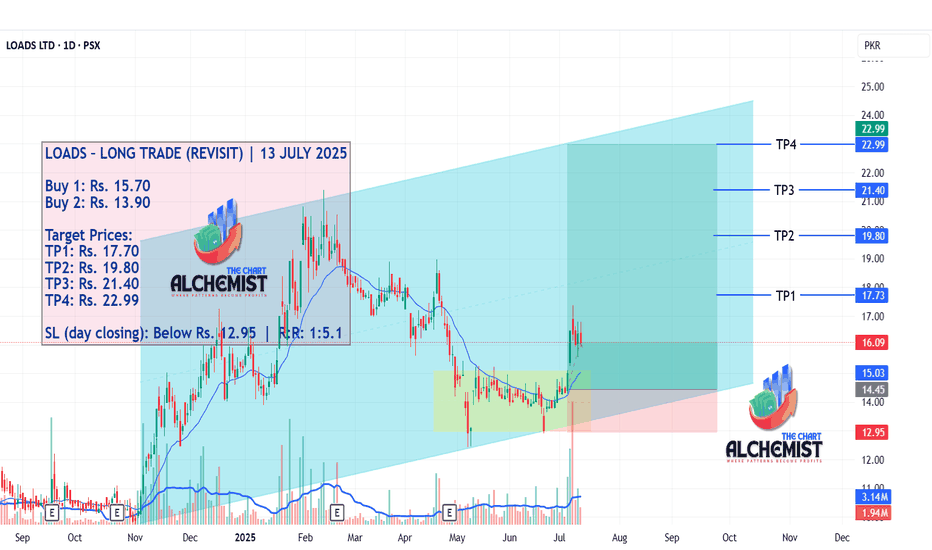

TREET – LONG TRADE (SECOND STRIKE) | 12 JULY 2025TREET – LONG TRADE (SECOND STRIKE) | 12 JULY 2025

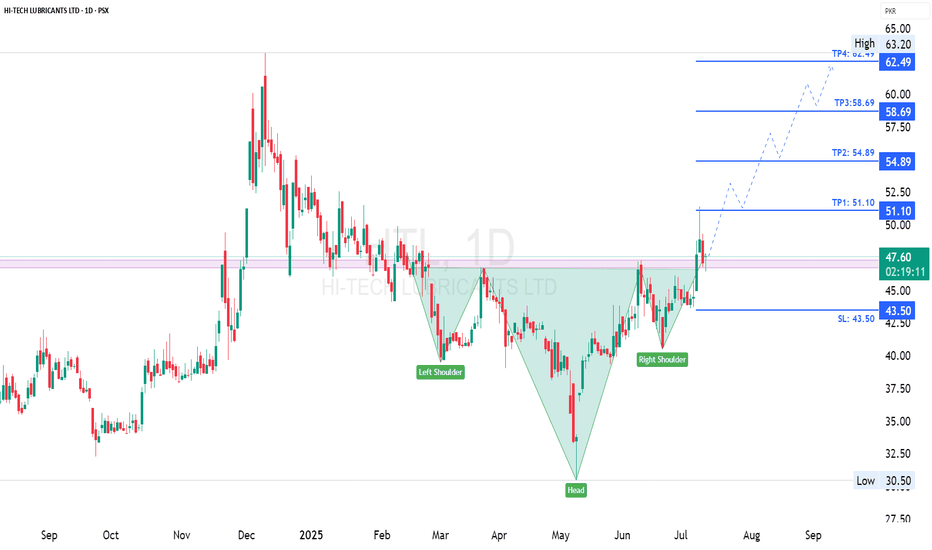

The stock previously trended downward in a blue channel but has reversed, forming an inverted head and shoulders pattern. With multiple bullish structures in place, the current level appears to be a profitable and safe entry point.

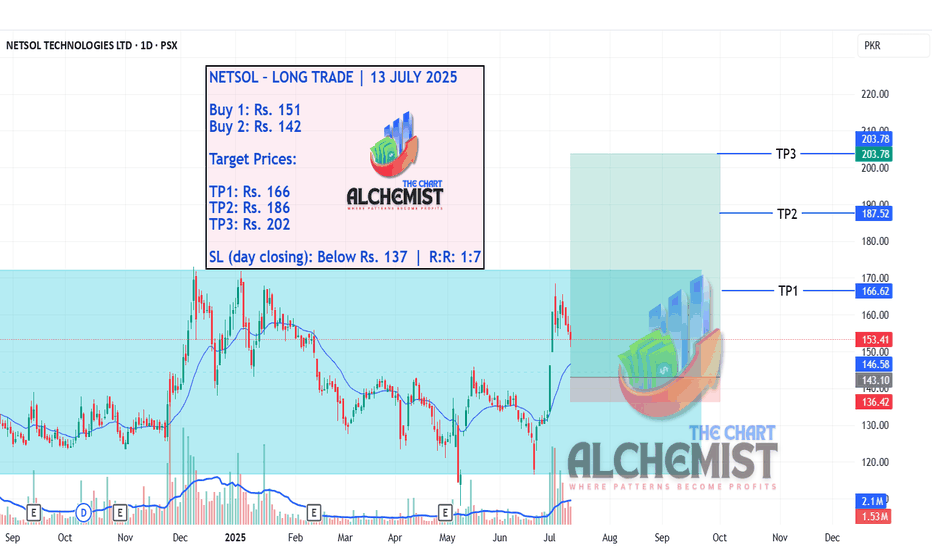

PIOC – LONG TRADE (REVISIT) | 12 JULY 2025PIOC – LONG TRADE (REVISIT) | 12 JULY 2025

The stock has been moving within a trading range, forming a DB Bull Flag, a powerful bullish pattern. Based on the current price position within the previous range (light blue channel), we identify a safe and profitable entry point for a long trade.

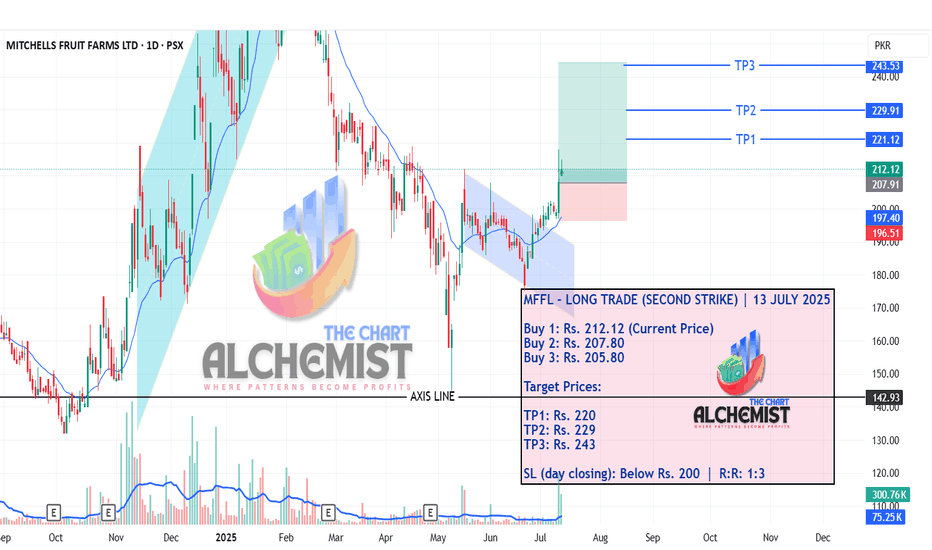

MFFL – LONG TRADE (SECOND STRIKE) | 12 JULY 2025MFFL – LONG TRADE (SECOND STRIKE) | 12 JULY 2025

After our previous buy call achieved its first target, the stock is currently positioned over a bullish structure, indicating potential for further upside. The present price position appears safe against downward action.

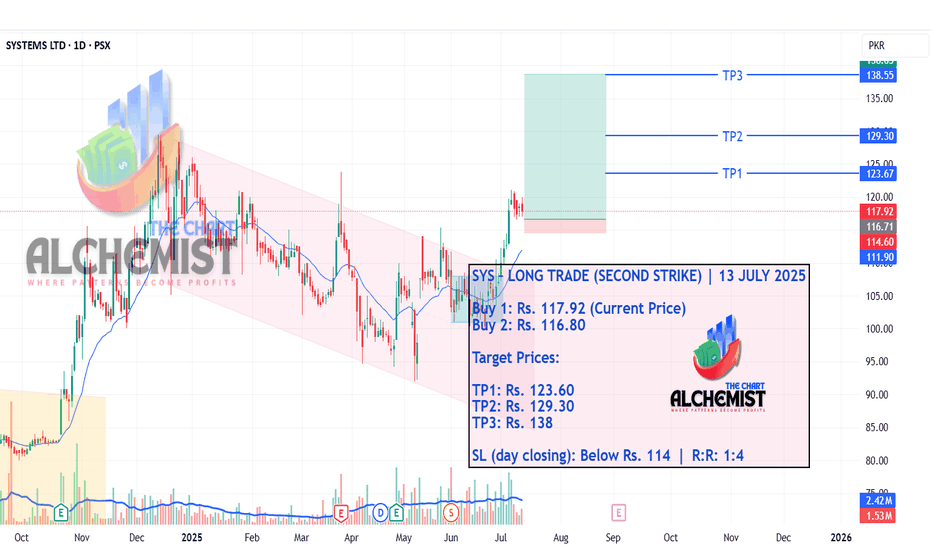

SYS – LONG TRADE (SECOND STRIKE) | 12 JULY 2025SYS – LONG TRADE (SECOND STRIKE) | 12JULY 2025

The stock previously trended downward in a pink channel but consolidated and formed a springboard (light blue channel). After achieving TP1 in our previous call, the stock has created a bullish structure, making this location a good spot for a second entry.

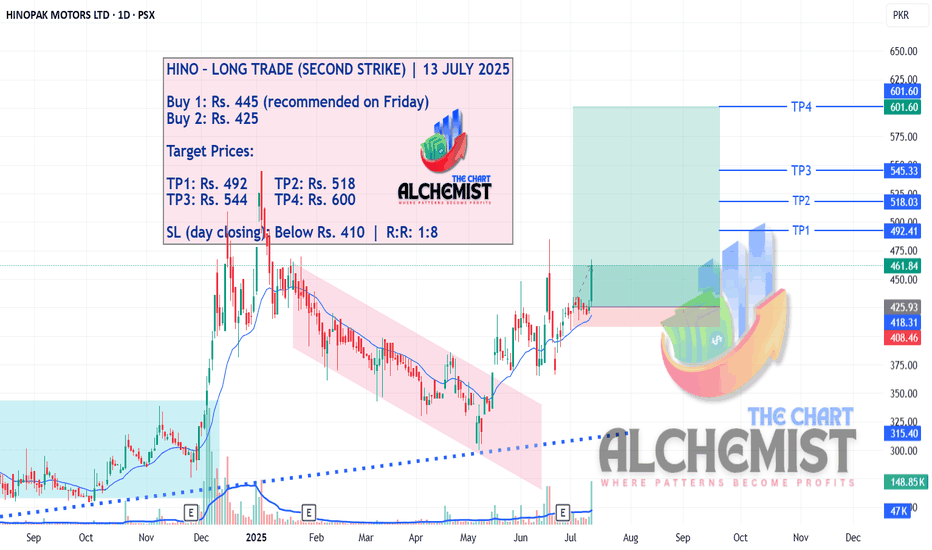

HINO – LONG TRADE (SECOND STRIKE) | 12 JULY 2025HINO – LONG TRADE (SECOND STRIKE) | 12 JULY 2025

The stock is in an uptrend supported by a trend line (dotted blue). After a corrective leg in a bearish channel (light pink), the stock showed signs of breakout and reversal. Our previous call achieved all targets, and after a minor correction, the stock appears primed for another uptrend leg.

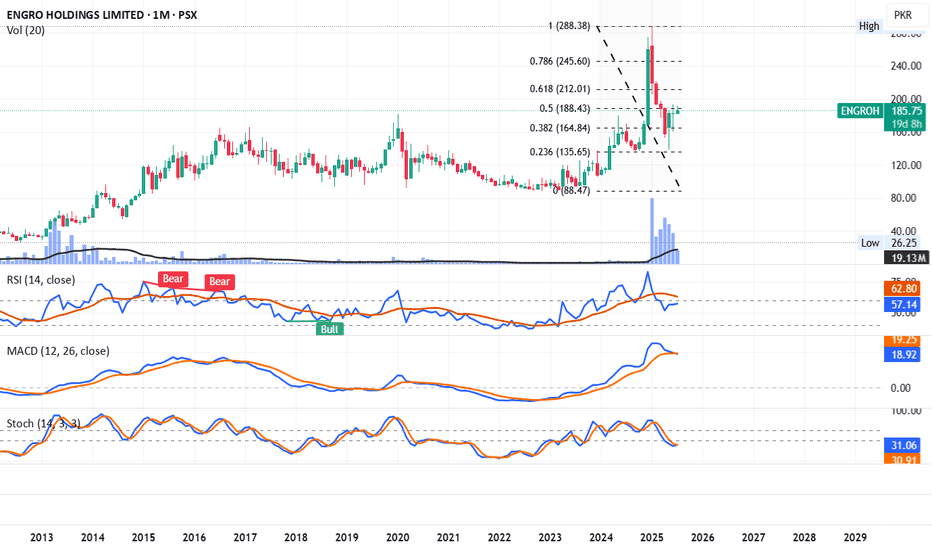

EngroH Bounce expectedEngroH is going to form an M pattern for which it has to take a bounce and then will fall back.

Bounce can be expected to Fib-0.618 (212) or Fib-0.786 level (245).

RSI and Stoch are in recovery phase. MACD still bearish.

Playing on levels should be prioritized with trailing stoploss once it reaches 212.

Exit should be planned near 245. Staying long can be fatal.

This is my personal opinion, not a buy / sell call.

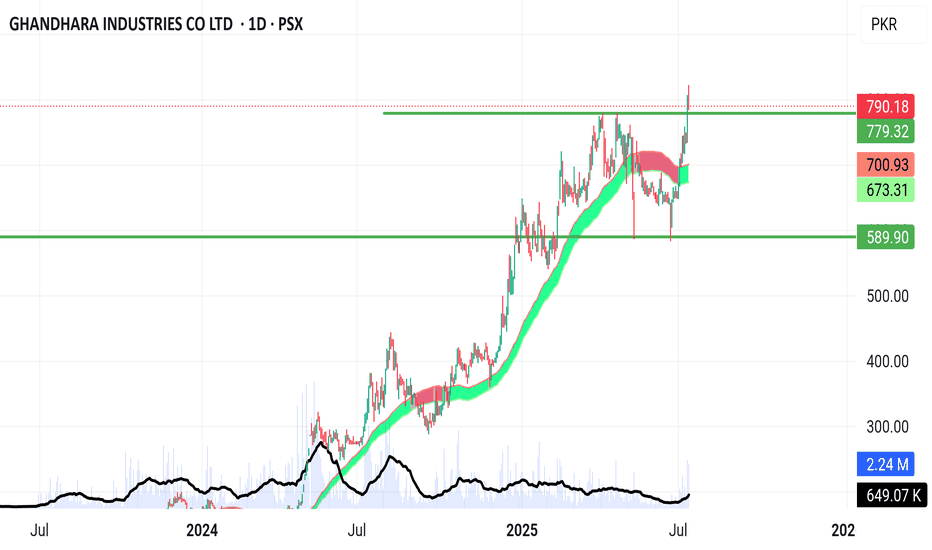

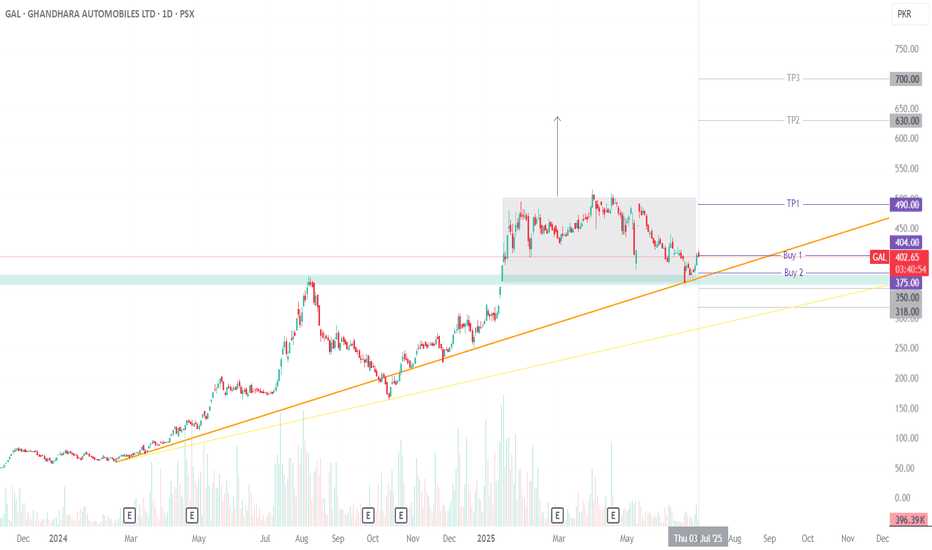

GAL Technical Analysis: Bullish OpportunityGAL (Ghandhara Automobiles Ltd.) is showing a strong bullish setup. Price is holding above its trendline after bouncing off solid horizontal and rectangle support zones. On top of that, GAL has a history of performing well in July, which adds a seasonal boost to the setup.

Fresh entries can be considered at the CMP, while for averaging or pullbacks, 375 and even 350 could offer attractive buy zones if the price dips.

For risk management, there are two stop-loss options: a conservative one below 318 to guard against broader breakdowns or gap fills, or a more aggressive one on a closing basis under 350, just beneath key structure.

Take Profit 1 at 490 lines up with rectangle resistance. A strong close above this opens the door to the next projection around 630. If price manages a firm close above 630, momentum could drive it further, with the AB=CD pattern pointing toward a stretch target near 700.

Trading Recommendations:

Buy 1 (CMP): 404

Buy 2: 375

Stop-Loss (Aggressive): Closing below 350

Stop-Loss (Conservative): Closing below 318

Take Profit 1: 490

Take Profit 2: 630

Take Profit 3: 700

Happy trading!