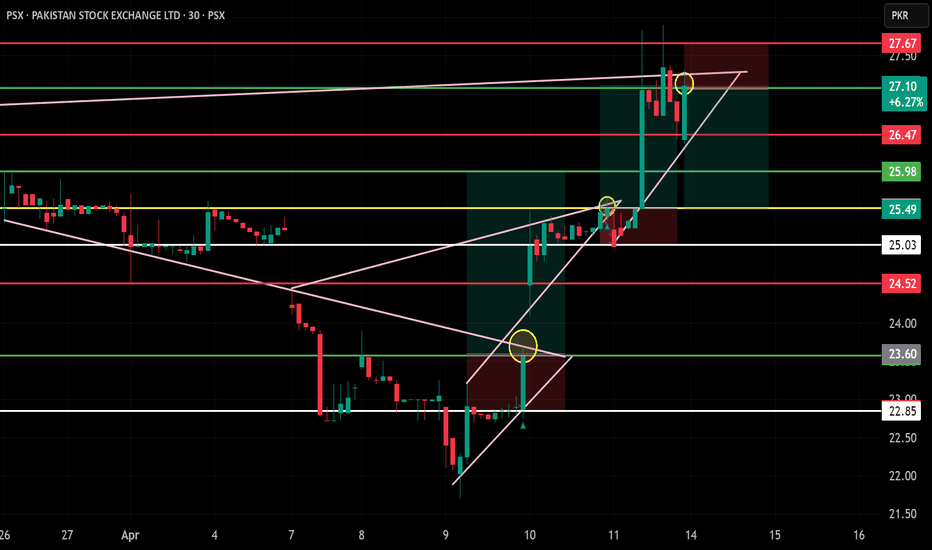

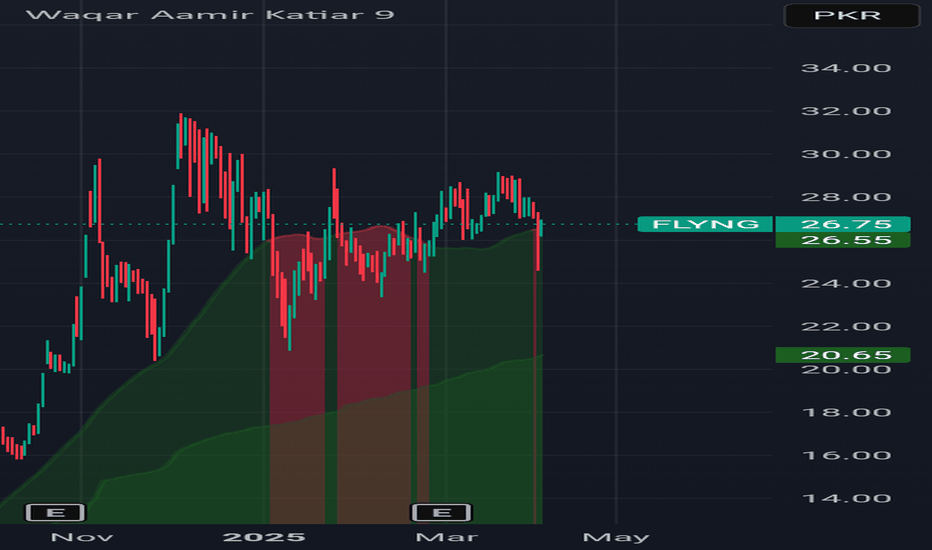

PSX – 30-Min Short Trade Setup!📉 🔻

🔹 Asset: Pakistan Stock Exchange Ltd. (PSX – PSX)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Double Top + Rising Wedge Breakdown

📊 Trade Plan – Short Position

✅ Entry Zone: ~27.00 (Rejection near resistance trendline)

✅ Stop-Loss (SL): 27.67 (Breakout high + wedge invalidation)

🎯 Take Profit Targets:

📌 TP1: 25.98 – Previous breakout level

📌 TP2: 25.03 – Horizontal support

📌 TP3: 23.60 – Trendline base

📐 Risk-Reward Calculation

🟥 Risk: ~0.67/share

🟩 Reward to TP3: ~3.40/share

📊 R/R Ratio: ~1 : 5+ – High-efficiency pullback play

🔍 Technical Highlights

📌 Double top rejection at supply zone ✔

📌 Rising wedge breakdown with selling pressure ✔

📌 Bearish engulfing near resistance ✔

📌 Volume spike confirms reversal intent

📉 Risk Management Strategy

🔁 Move SL to breakeven after TP1

💰 Lock profits at TP2

🚀 Let remainder trail to TP3

⚠️ Setup Invalidation If:

❌ Price breaks and closes above 27.67

❌ Bullish consolidation instead of pullback

❌ Breakout volume resumes

🚨 Final Thoughts

✔ Bearish structure with strong reward potential

✔ Clean rejection at multi-day resistance

✔ Ideal short setup post breakout exhaustion

🔗 #PSX #ShortSetup #ProfittoPath #ChartAnalysis #BearishReversal #SwingTrade #TechnicalSetup #PriceAction #RiskReward #SmartMoneyMoves

Glaxco Stock Buying OpportunityGlaxco is in an uptrend. A buying opportunity arises if the stock weakens to 430-420, with:

Key Levels:

1. *Buy zone*: 430-420

2. *Stop loss*: 410

3. *Target 1*: 460

4. *Final target*: 485

Strategy:

1. *Buy on weakness*: Enter the trade if the stock price dips to 430-420.

2. *Risk management*: Set a stop loss at 410 to limit potential losses.

3. *Profit targets*: Aim for 460 and 485.

Considerations:

1. *Market conditions*: Monitor overall market trends and news.

Glaxco Stock Buying Opportunity:Glaxco is in an uptrend. A buying opportunity arises if the stock weakens to 430-420, with:

Key Levels:

1. *Buy zone*: 430-420

2. *Stop loss*: 410

3. *Target 1*: 460

4. *Final target*: 485

Strategy:

1. *Buy on weakness*: Enter the trade if the stock price dips to 430-420.

2. *Risk management*: Set a stop loss at 410 to limit potential losses.

3. *Profit targets*: Aim for 460 and 485.

Considerations:

1. *Market conditions*: Monitor overall market trends and news.

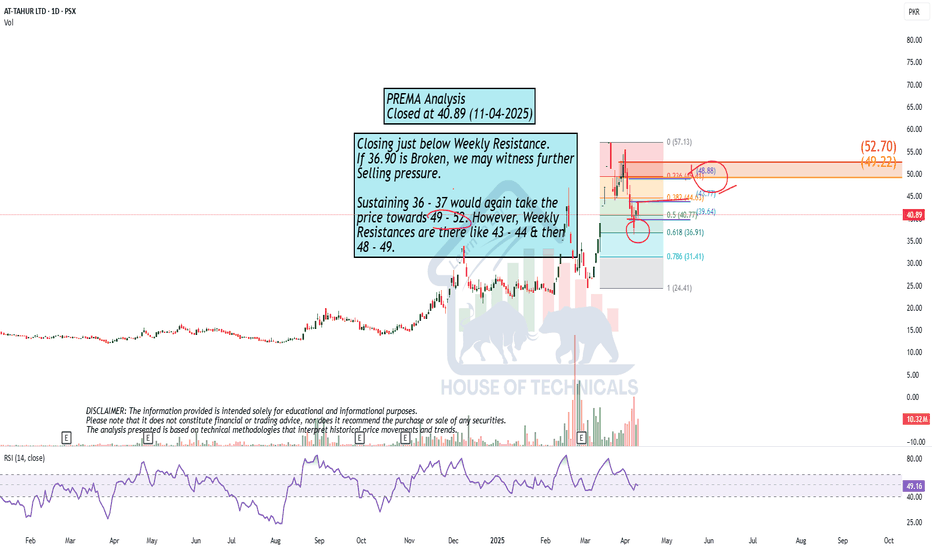

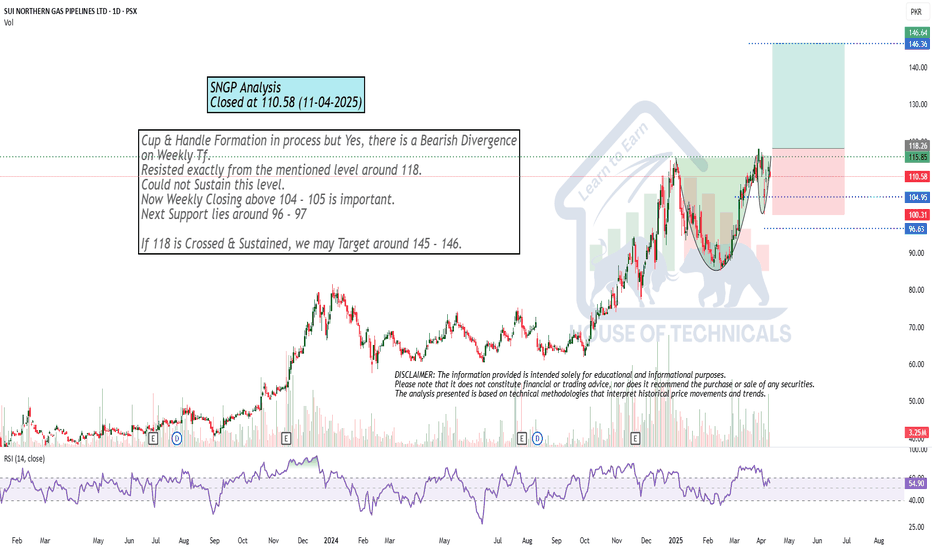

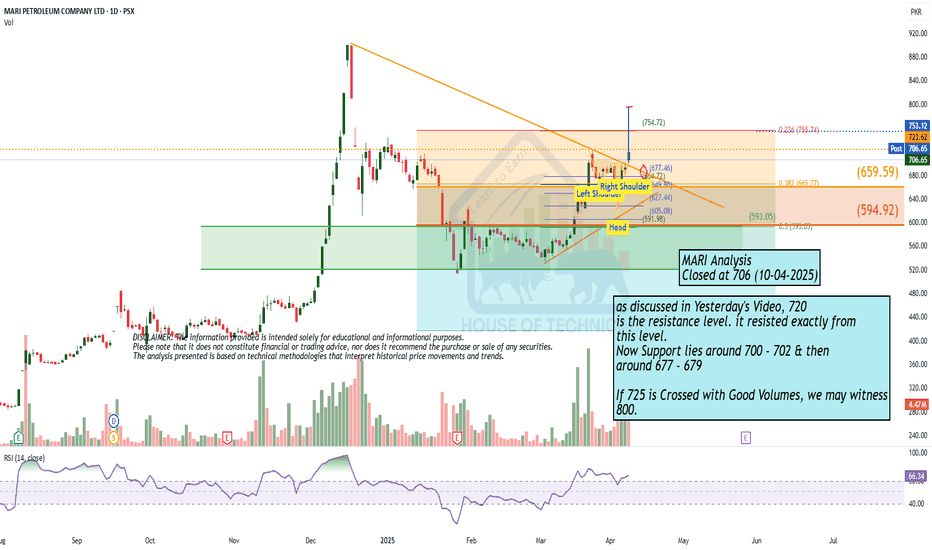

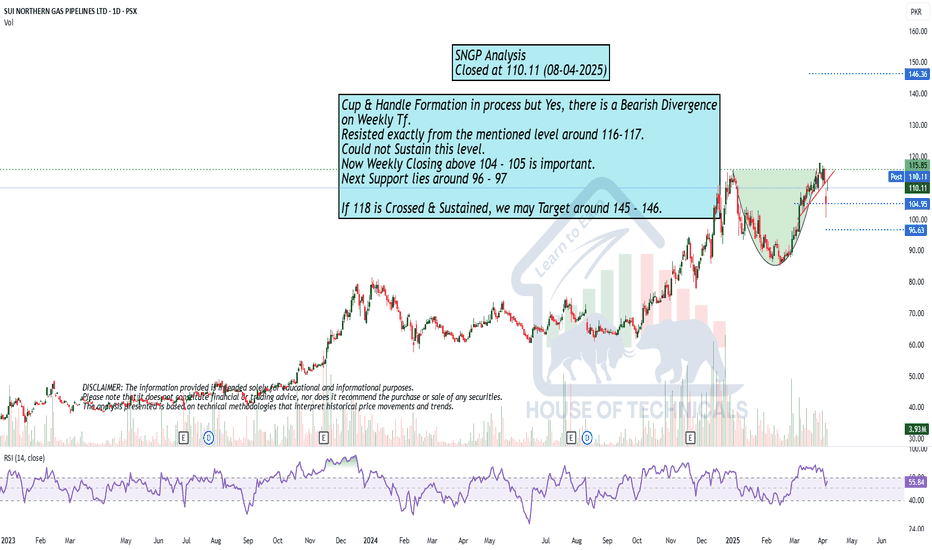

Cup & Handle Formation in process but Cup & Handle Formation in process but Yes, there is a Bearish Divergence

on Weekly Tf.

Resisted exactly from the mentioned level around 118.

Could not Sustain this level.

Now Weekly Closing above 104 - 105 is important.

Next Support lies around 96 - 97

If 118 is Crossed & Sustained, we may Target around 145 - 146.

PSX – 30-Min Long Trade Setup !📈 🟢

🔹 Asset: Pakistan Stock Exchange Ltd. (PSX – PSX)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Inverse Head & Shoulders Breakout + Trendline Flip

📊 Trade Plan – Long Position

✅ Entry Zone: Around 25.50 (Breakout + Retest)

✅ Stop-Loss (SL): 23.60 (Below structure + trendline)

🎯 Take Profit Targets:

📌 TP1: 25.98 – Recent resistance

📌 TP2: 26.47 – Supply area

📌 TP3: 27.08 – Major resistance (swing extension)

📐 Risk-Reward Calculation

🟥 Risk: ~1.90/share

🟩 Reward to TP3: ~1.58/share

📊 R/R Ratio: ~1 : 2.8 – Solid high-conviction trade

🔍 Technical Highlights

📌 Breakout from inverted H&S pattern ✔

📌 Trendline breakout and retest confirmed ✔

📌 Bullish volume spike on breakout candle ✔

📌 Clear higher high and higher low structure 🔼

📉 Risk Management Strategy

🔁 SL to breakeven after TP1

💰 Secure 50% profits at TP2

🚀 Let the remaining portion run toward TP3

⚠️ Setup Invalidation If:

❌ Breakdown and close below 23.60

❌ Fails to hold the trendline breakout

❌ Sudden volume divergence + bearish reversal

🚨 Final Thoughts

✔ Pattern-backed breakout with momentum

✔ Tight SL + clean R/R = efficient swing setup

✔ Smart structure play with bullish follow-through

🔗 #PSX #PakistanStockExchange #BreakoutSetup #ProfittoPath #SwingTrade #TechnicalAnalysis #ChartSetup #RiskReward #VolumeSpike #PSXTradeIdeas

PSX – 30-Min Long Trade Setup !📈 🟢

🔹 Asset: Pakistan Stock Exchange Ltd. (PSX – PSX)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Trendline Breakout + Retest

📊 Trade Plan – Long Bias

✅ Entry Zone: Around 23.39 (post-breakout confirmation)

✅ Stop-Loss (SL): 22.85 (below recent structure low)

🎯 Take Profit Targets:

📌 TP1: 24.52 – Previous resistance

📌 TP2: 25.98 – Major supply / top of the range

📐 Risk-Reward Calculation

🟥 Risk: 23.39 - 22.85 = 0.54 PKR/share

🟩 Reward to TP2: 25.98 - 23.39 = 2.59 PKR/share

📊 R/R Ratio: ~1 : 4.79 – Excellent opportunity

🔍 Technical Highlights

📌 Falling trendline broken with bullish momentum ✔

📌 Support holding at 22.85 (white line) ✔

📌 Volume spike + bullish retest confirmation 🔥

📌 Yellow zone = structure resistance turned support

📉 Risk Management Strategy

🔁 SL to breakeven after TP1

💰 Book partial at TP1

🚀 Let the rest run to TP2

📏 Use structure – not emotion

⚠️ Setup Invalidation If:

❌ Breaks and closes below 22.85

❌ Fakeout candle with volume and rejection

❌ Loses trendline and support zone

🚨 Final Thoughts

✔ Trendline breakout confirmed with strong R/R

✔ Clean structure for intra or swing setups

✔ Great setup for PSX-focused traders

🔗 #PSX #PakistanStockExchange #TechnicalSetup #ProfittoPath #BreakoutTrade #RiskReward #StockTrading #SupportResistance #ChartAnalysis

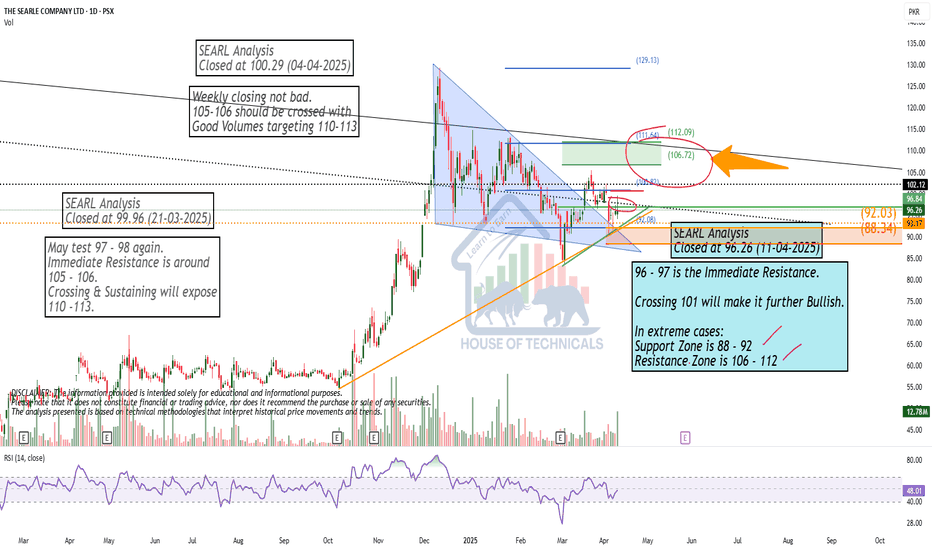

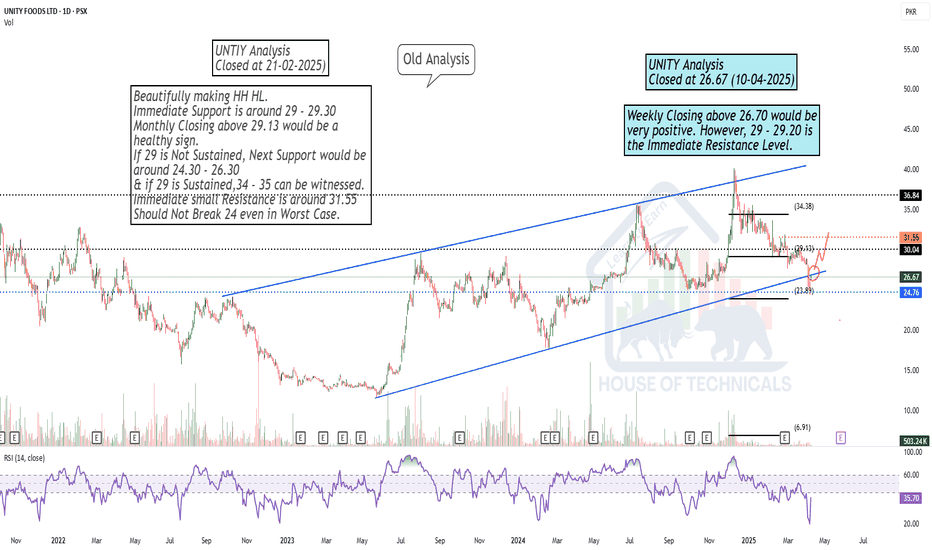

Cup & Handle Formation in process but..Cup & Handle Formation in process but Yes, there is a Bearish Divergence

on Weekly Tf.

Resisted exactly from the mentioned level around 116-117.

Could not Sustain this level.

Now Weekly Closing above 104 - 105 is important.

Next Support lies around 96 - 97

If 118 is Crossed & Sustained, we may Target around 145 - 146.

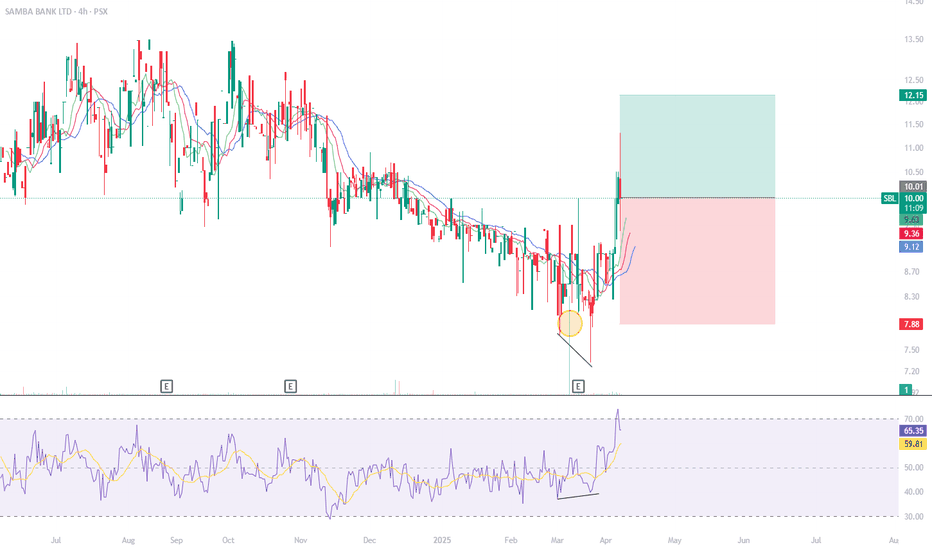

DGKC Trading Analysis:DGKC broke down after consolidating between 32-36 and is now trading at 124. The strategy is to exit if the price shows weakness when it revisits the 30-level mark.

Downside Targets:

1. *First target*: 110

2. *Second target*: 102

This analysis suggests a cautious approach, with a focus on managing risk and potential downside targets.