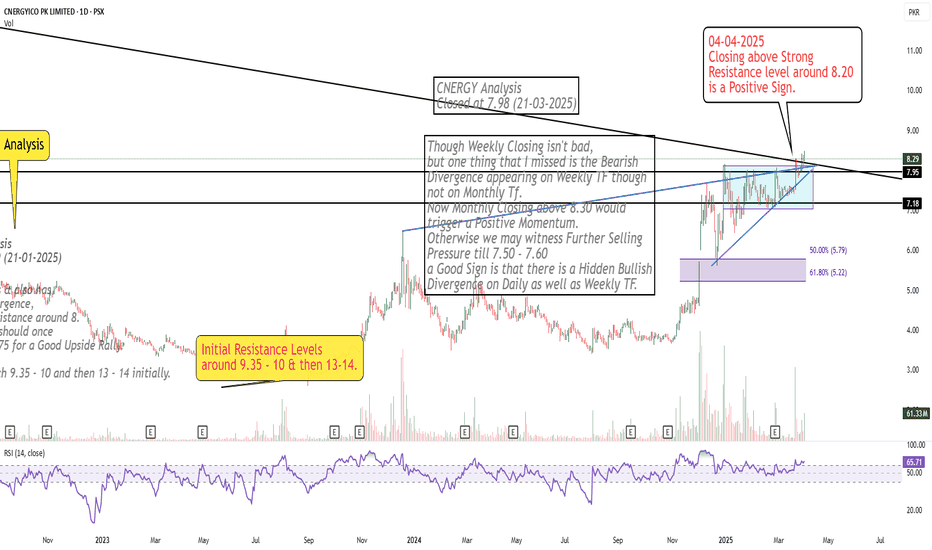

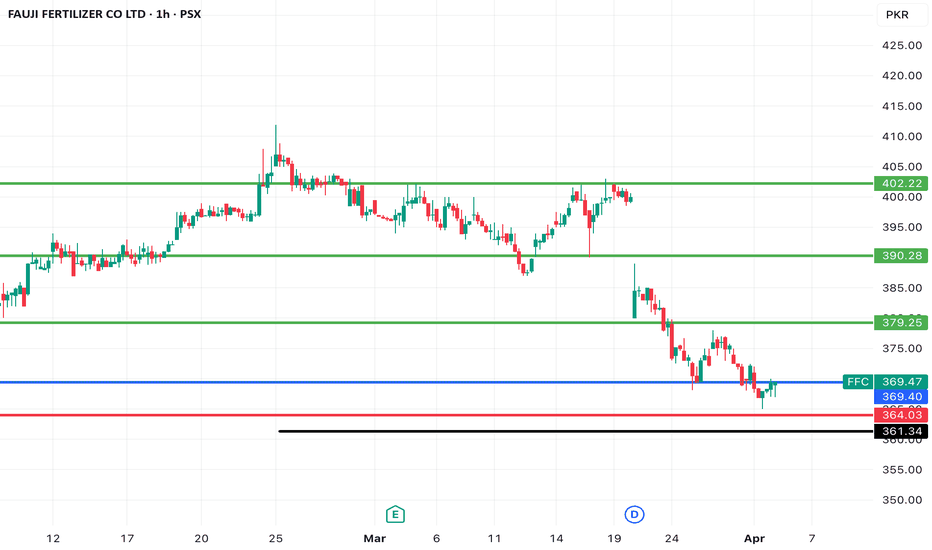

Bearish Divergence on Weekly TF but..Bearish Divergence on Weekly TF.

However, Breakout on Daily TF from 452 - 453.

Weekly Closing above this level would

be a positive sign.

Upside Targets can be around 495 - 500

& if this level is Sustained, with Good

Volumes , we may witness 540 - 550.

Should not break 400, otherwise, we may see

heavy Selling pressure.

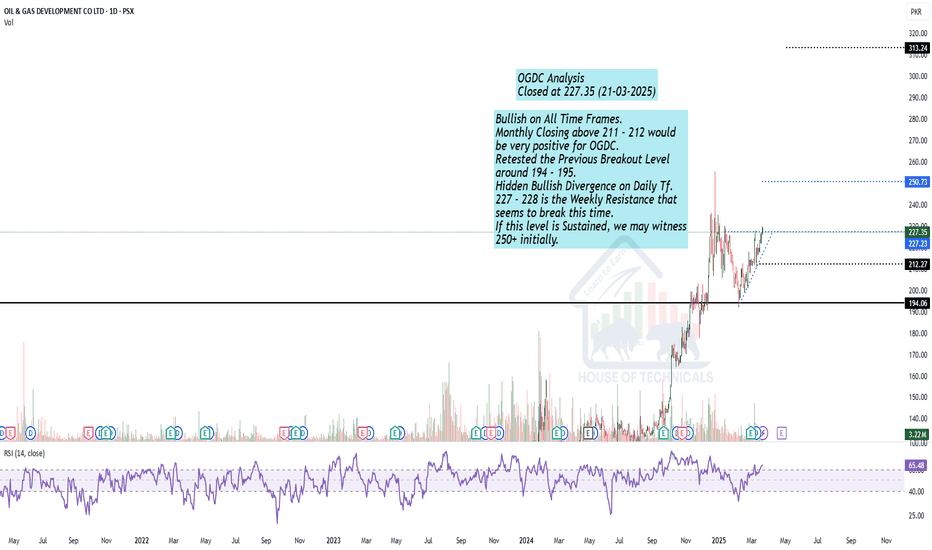

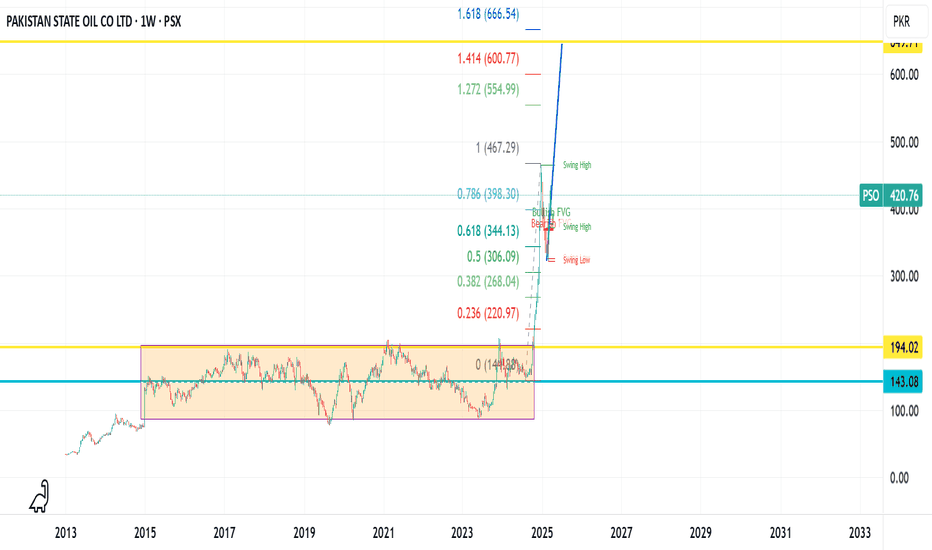

Bullish on All Time Frames.Bullish on All Time Frames.

Monthly Closing above 211 - 212 would

be very positive for OGDC.

Retested the Previous Breakout Level

around 194 - 195.

Hidden Bullish Divergence on Daily Tf.

227 - 228 is the Weekly Resistance that

seems to break this time.

If this level is Sustained, we may witness

250+ initially.

FCEPL*The price action is forming an ascending triangle, which is generally a bullish continuation pattern.

*The RSI at the bottom shows market momentum and potential overbought/oversold conditions.

*Bullish Strategy: Buy after a breakout above 93 , with targets at 111 and 117.

*Bearish Scenario: If the price fails to break out and falls below 75

it could invalidate the bullish pattern, leading to further downside.

MTL*Head & Shoulders Pattern: A potential head and shoulders pattern is visible, which is a bearish reversal structure

but still no any negative sign RSI moving in range between 30-70

*Safe Buying Zone: Marked around 615-620 , indicating a breakout level where price stability could confirm an upward move.

*Bullish Approach: Buy if price sustains above 615-620 with targets toward 640 and 680

*Bearish Approach: If the price breaks below 474.73 , it could confirm the head and shoulders breakdown, leading to a further drop.

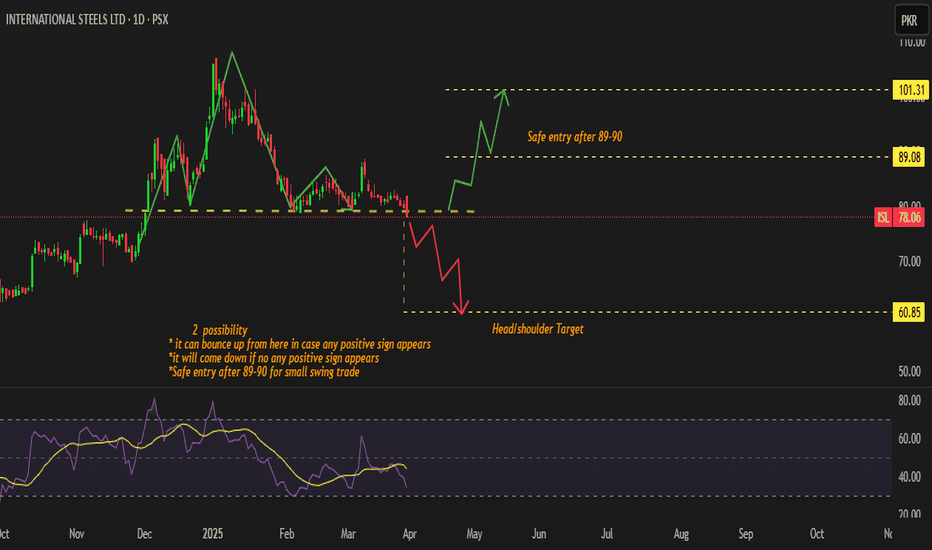

ISLCurrent Price: The stock is currently trading at 78.06

Safe Entry Point: A safe entry for a swing trade is suggested after 89-90

*Head and Shoulders Pattern:

If the price breaks below the current level and fails to show strength, it could drop further toward the Head & Shoulders target of 60.85

A downward movement (red arrow) represents this bearish scenario.

*Bullish Scenario:

If the stock shows positive signs (such as increased volume, breakout confirmation), it could bounce back up.

A breakout above 89-90 could push the price towards 101.21

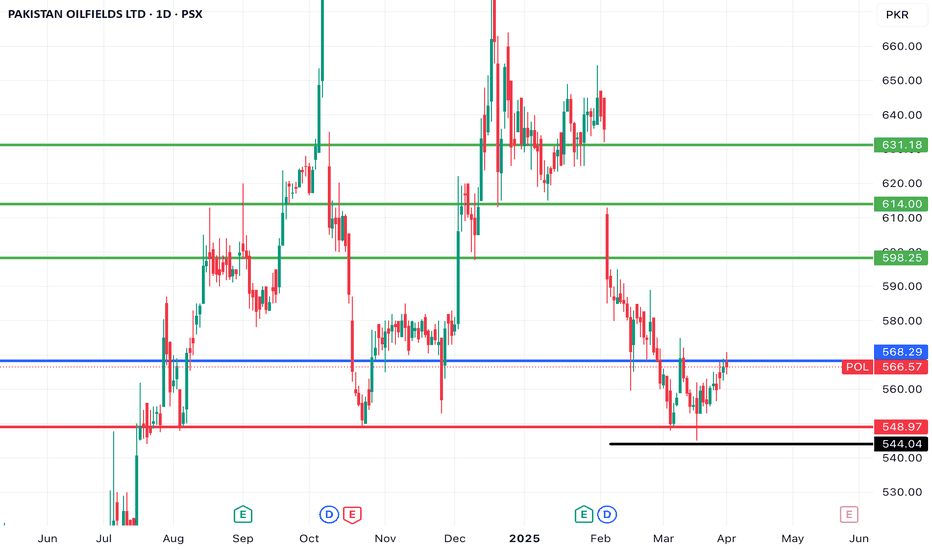

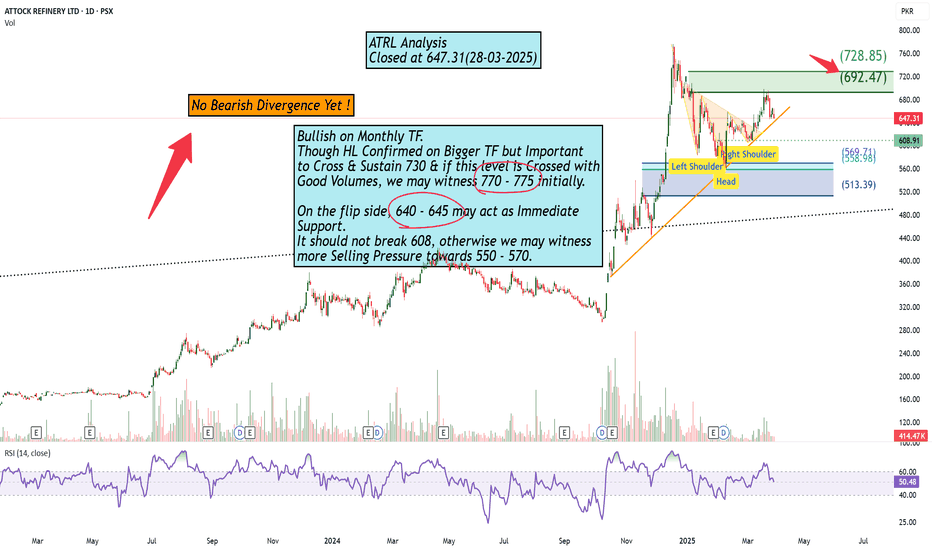

Bullish on Monthly TF.Bullish on Monthly TF.

Though HL Confirmed on Bigger TF but Important

to Cross & Sustain 730 & if this level is Crossed with

Good Volumes, we may witness 770 - 775 initially.

On the flip side, 640 - 645 may act as Immediate

Support.

It should not break 608, otherwise we may witness

more Selling Pressure towards 550 - 570.

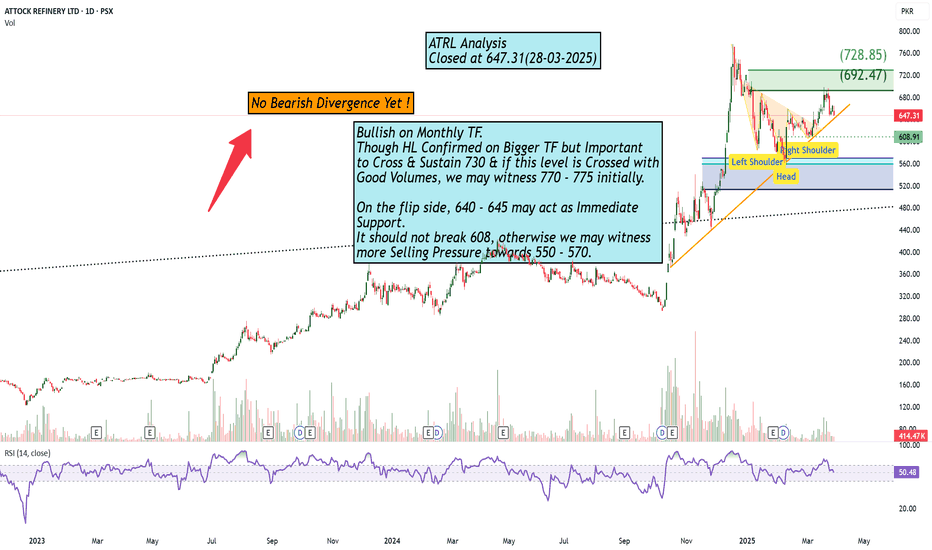

No Bearish Divergence Yet!Bullish on Monthly TF.

Though HL Confirmed on Bigger TF but Important

to Cross & Sustain 730 & if this level is Crossed with

Good Volumes, we may witness 770 - 775 initially.

On the flip side, 640 - 645 may act as Immediate

Support.

It should not break 608, otherwise we may witness

more Selling Pressure towards 550 - 570.

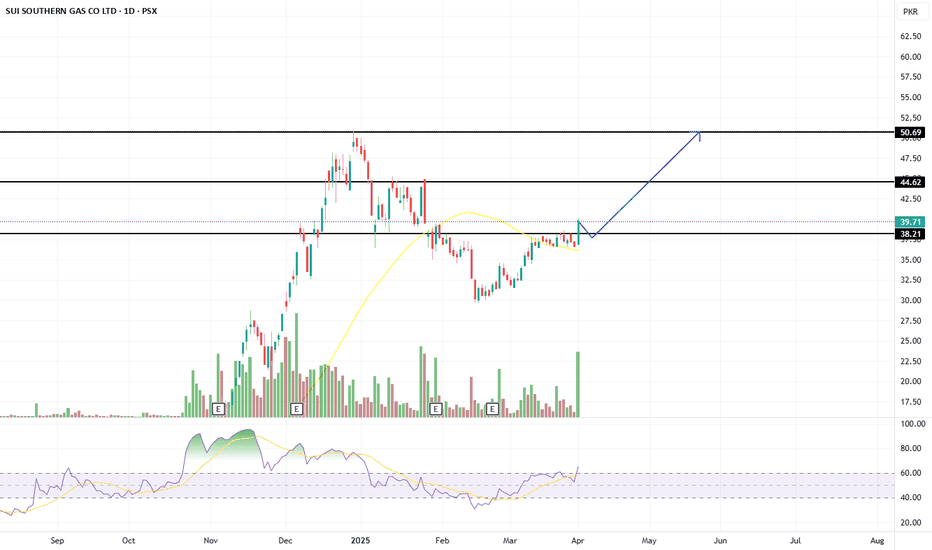

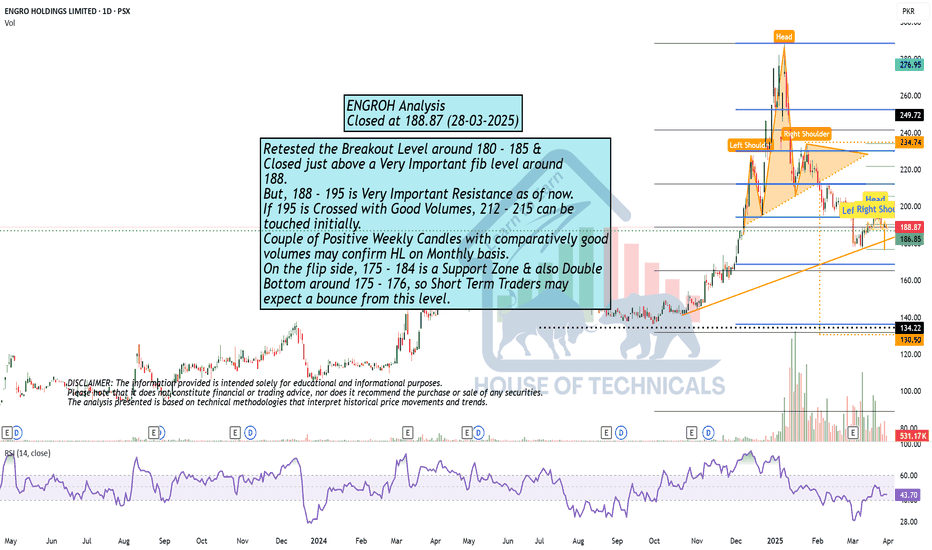

Play On LevelsRetested the Breakout Level around 180 - 185 &

Closed just above a Very Important fib level around

188.

But, 188 - 195 is Very Important Resistance as of now.

If 195 is Crossed with Good Volumes, 212 - 215 can be

touched initially.

Couple of Positive Weekly Candles with comparatively good

volumes may confirm HL on Monthly basis.

On the flip side, 175 - 184 is a Support Zone & also Double

Bottom around 175 - 176, so Short Term Traders may

expect a bounce from this level.