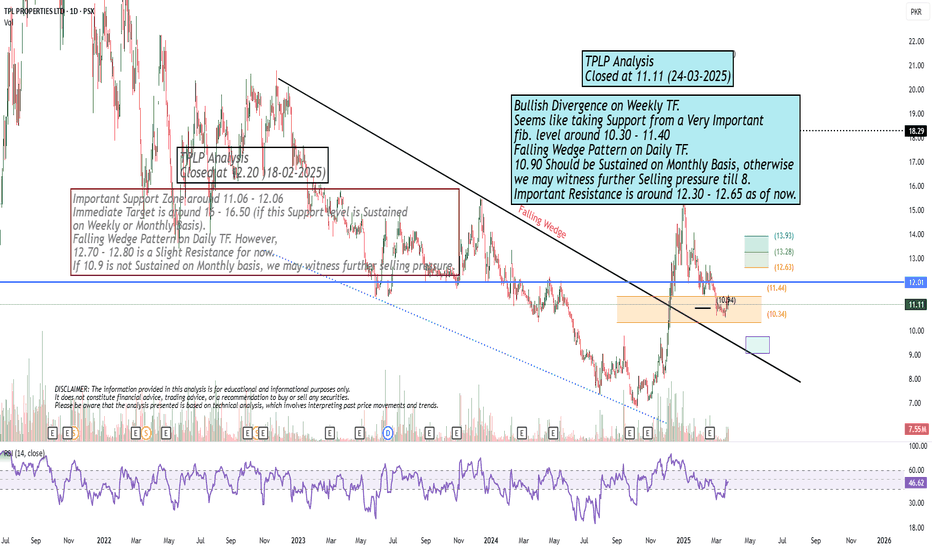

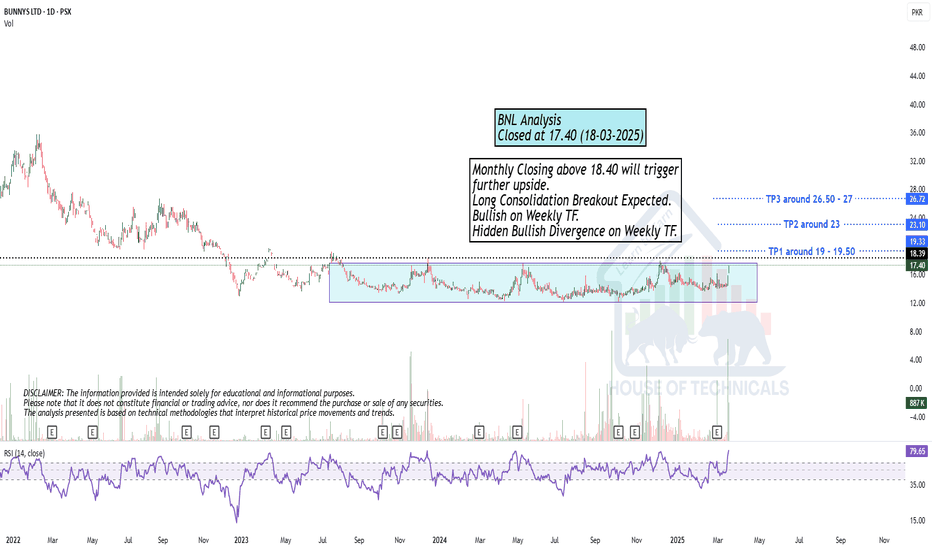

Bullish Divergence on Weekly TF.Bullish Divergence on Weekly TF.

Seems like taking Support from a Very Important

fib. level around 10.30 - 11.40

Falling Wedge Pattern on Daily TF.

10.90 Should be Sustained on Monthly Basis, otherwise

we may witness further Selling pressure till 8.

Important Resistance is around 12.30 - 12.65 as of now.

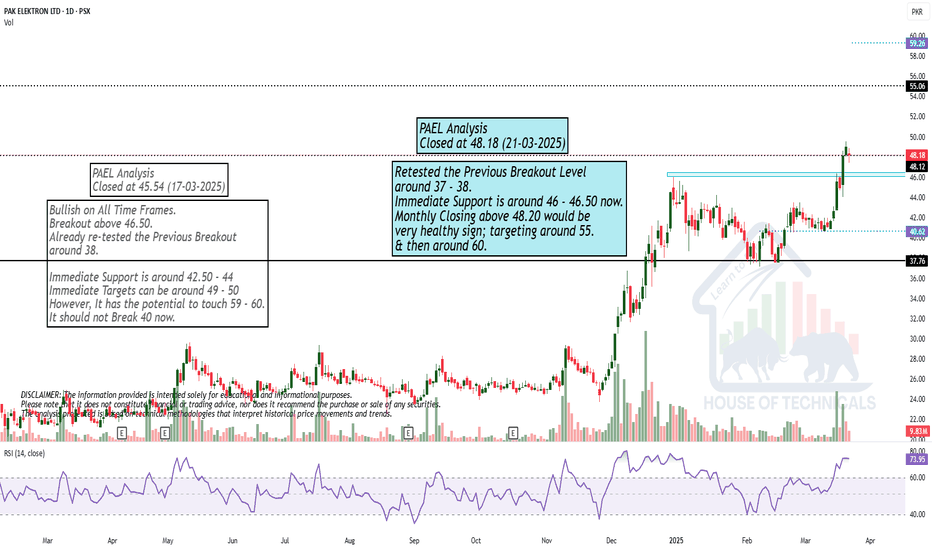

PAEL | Flag PatternThe stock displays a bullish flag pattern on strong volume, trading confidently above both the 20 and 200-day EMAs, suggesting robust upward momentum. Previous session shows a break out of the flag and price closed +3% above it. Initial resistance lies around 46 which is the formation of double top pattern from where short term rejection can be seen. However, a decisive break above the resistance level will confirm the continuation of the bullish trend and flag projection lies around 55.

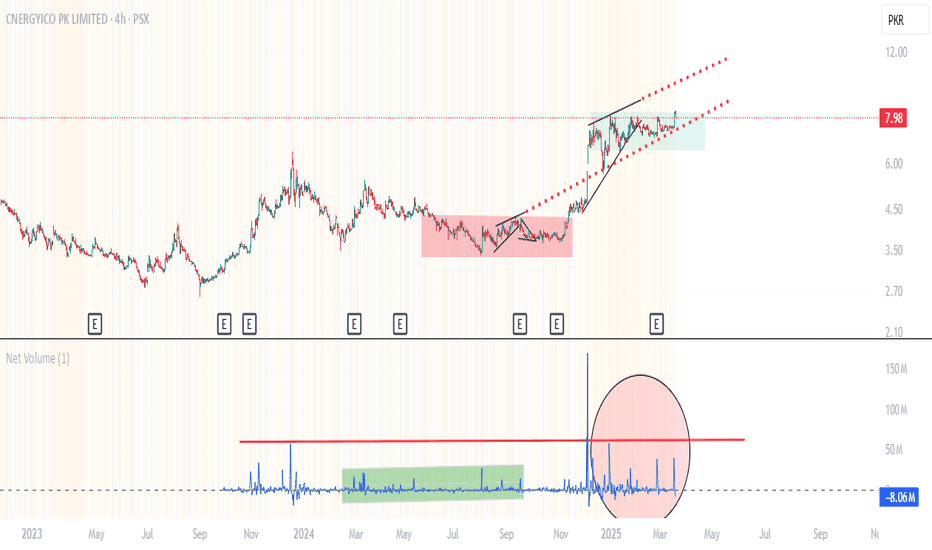

PSX- CNERGY : Breakout or Rejection? Trading Strategysignificant increase in volume is observed indicates accumulation by institutions or major market participants.

While Net volume remains negative (-8.06M), suggesting some selling pressure at higher levels.

Trading Strategy:

Short-Term Strategy

Buy on pullback when price retraces to 7.0 - 7.2 PKR, its a better risk-reward entry for Profit target: 8.7 - 9.0 PKR

Keeps Eyes on bearish divergence in volume —if price rises but volume declines, a correction may follow.

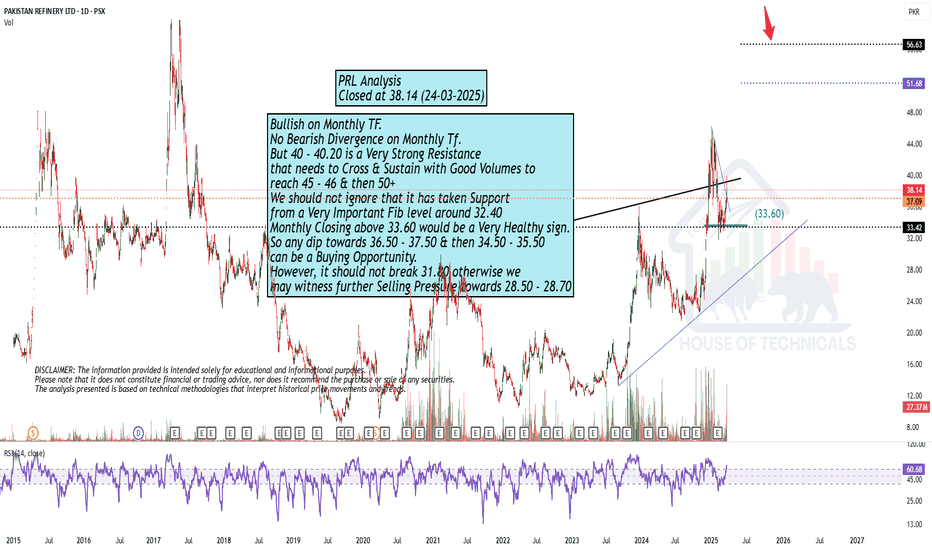

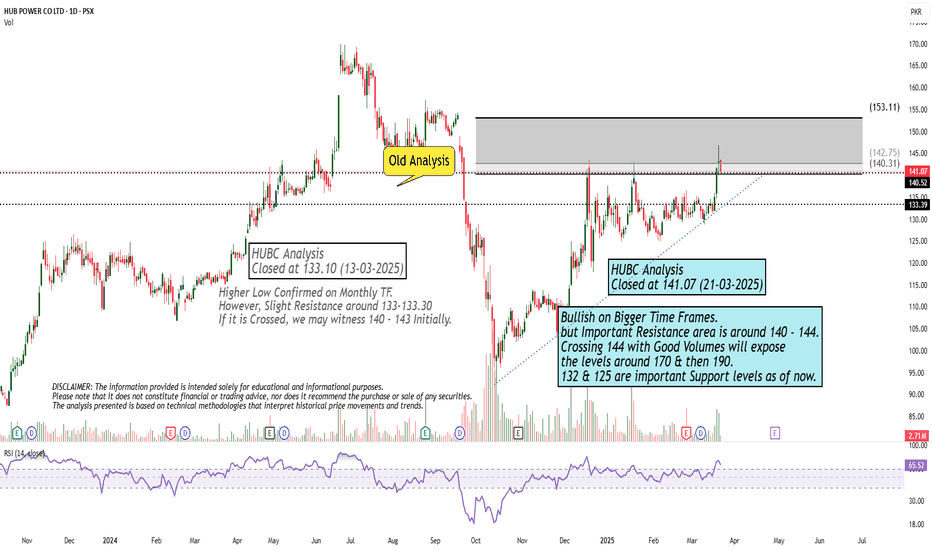

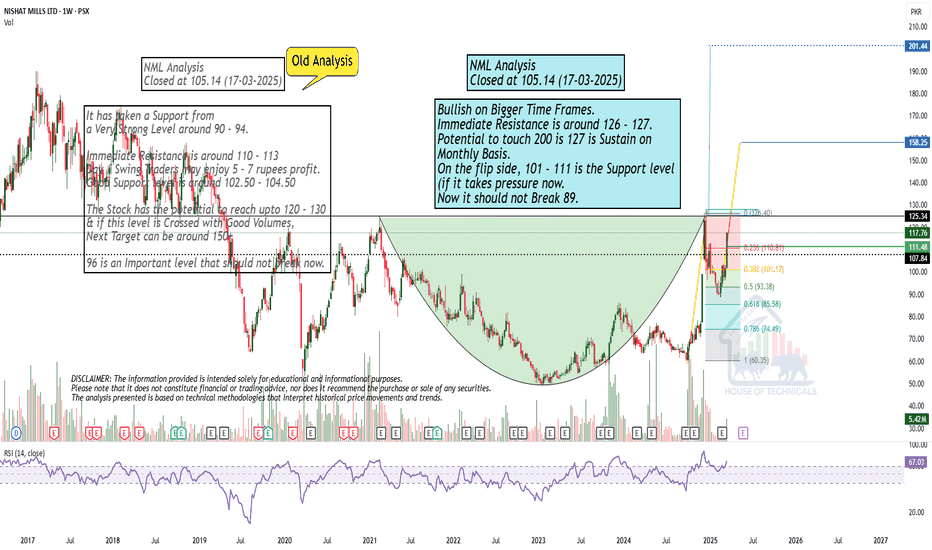

Bullish on Monthly TF but..Bullish on Monthly TF.

No Bearish Divergence on Monthly Tf.

But 40 - 40.20 is a Very Strong Resistance

that needs to Cross & Sustain with Good Volumes to

reach 45 - 46 & then 50+

We should not ignore that it has taken Support

from a Very Important Fib level around 32.40

Monthly Closing above 33.60 would be a Very Healthy sign.

So any dip towards 36.50 - 37.50 & then 34.50 - 35.50

can be a Buying Opportunity.

However, it should not break 31.80 otherwise we

may witness further Selling Pressure towards 28.50 - 28.70

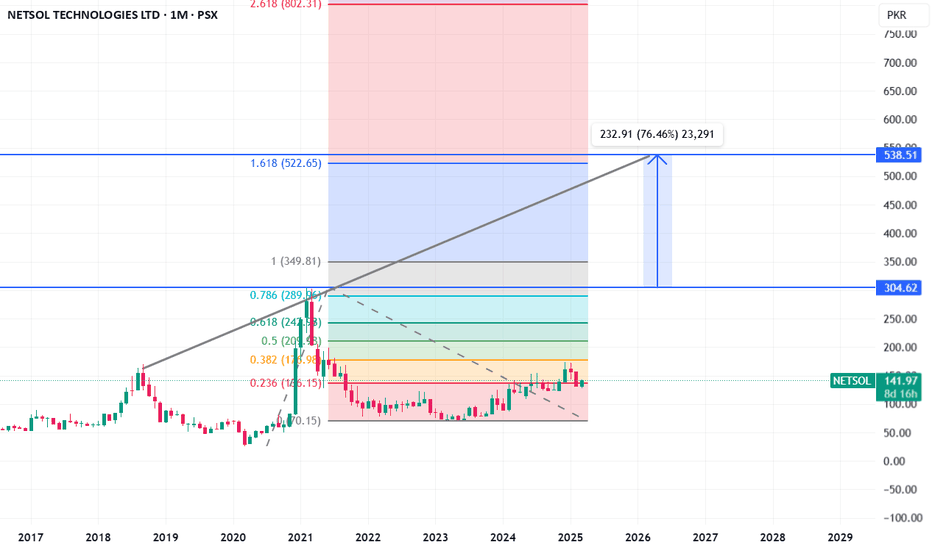

NETSOL LongIt is totally my assumption and can be wrong as well. This is not a buy / sell call.

Netsol is in accumulation phase and may touch the high and touch the trendline shown by Feb-Mar 2026.

The high it may touch will be its Fib level 1.618 i.e. 522 or best assumption can be 538 (difference of its previous high and recent low). Buyback by company is another strong indication of "Something's Cooking".

Have a blessed Ramazan and great trading experience.

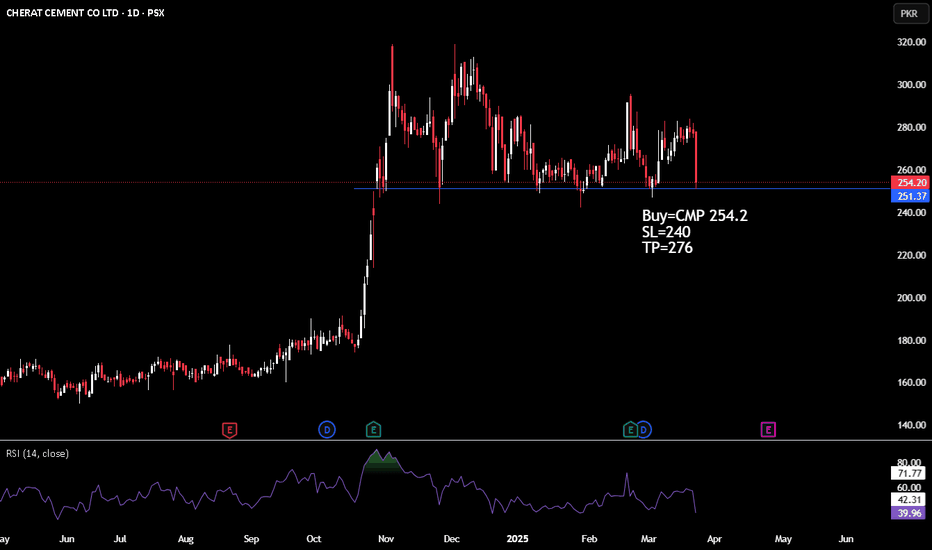

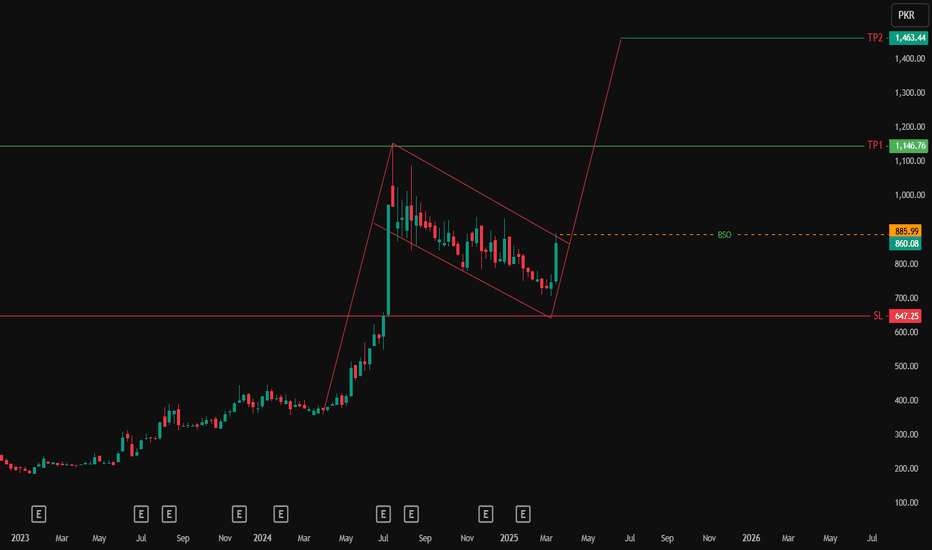

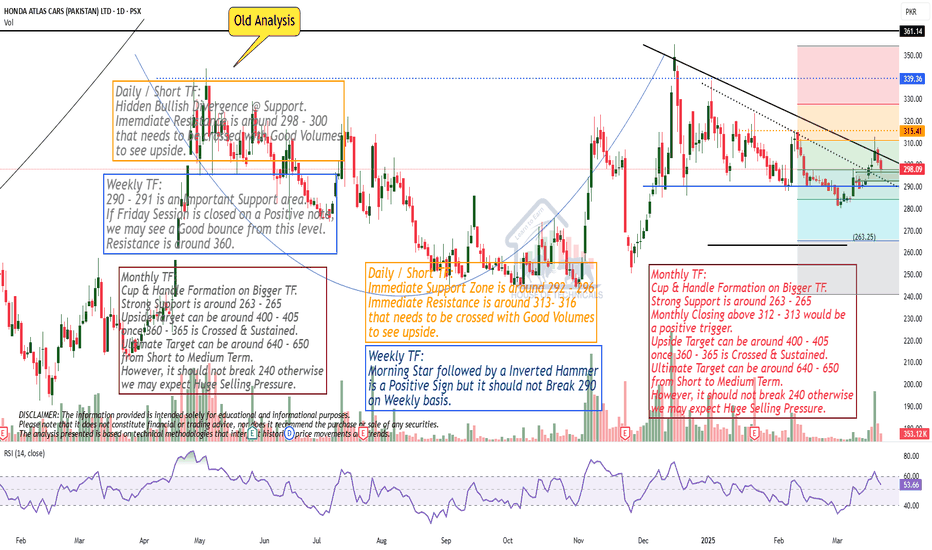

Monthly TF:

Cup & Handle Formation on Bigger TF.

Strong Support is around 263 - 265

Monthly Closing above 312 - 313 would be

a positive trigger.

Upside Target can be around 400 - 405

once 360 - 365 is Crossed & Sustained.

Ultimate Target can be around 640 - 650

from Short to Medium Term.

However, it should not break 240 otherwise

we may expect Huge Selling Pressure.

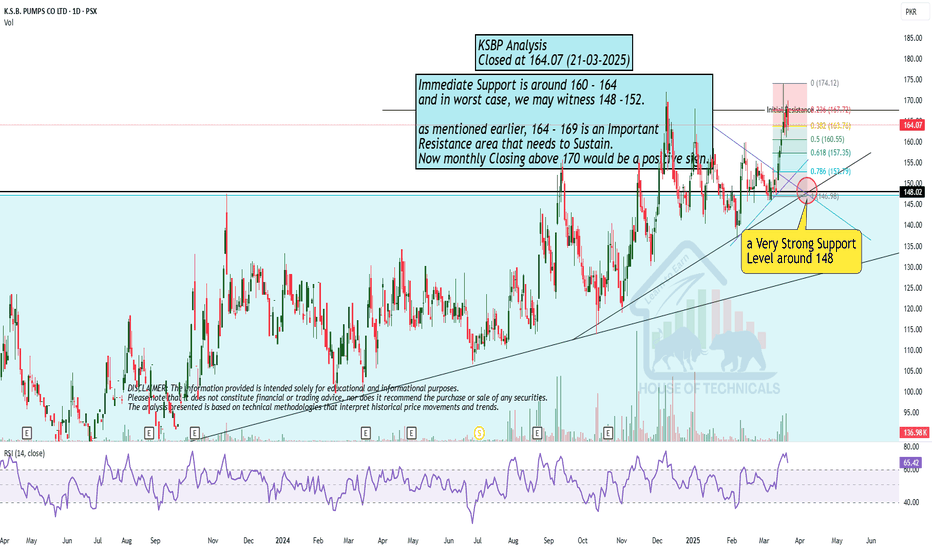

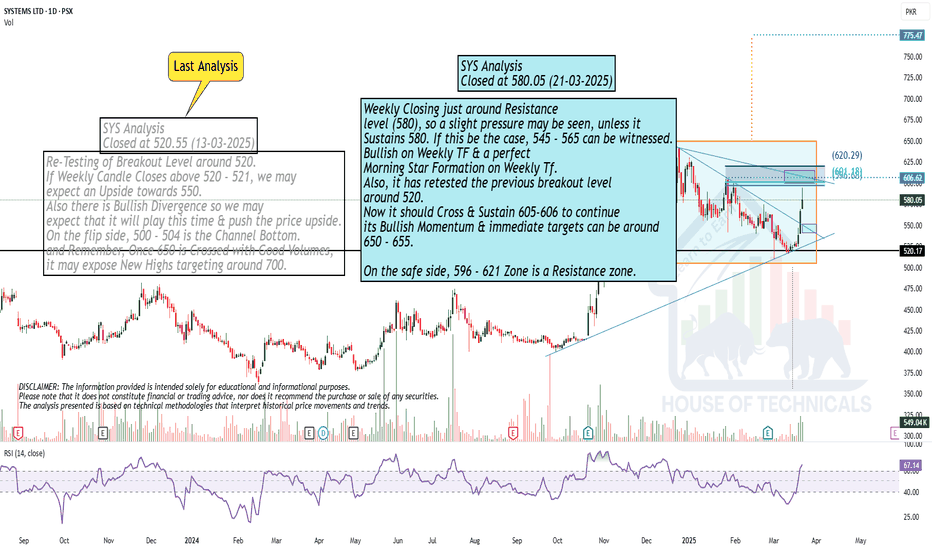

Weekly Closing just at Resistance!Weekly Closing just around Resistance

level (580), so a slight pressure may be seen, unless it

Sustains 580. If this be the case, 545 - 565 can be witnessed.

Bullish on Weekly TF & a perfect

Morning Star Formation on Weekly Tf.

Also, it has retested the previous breakout level

around 520.

Now it should Cross & Sustain 605-606 to continue

its Bullish Momentum & immediate targets can be around

650 - 655.

On the safe side, 596 - 621 Zone is a Resistance zone.

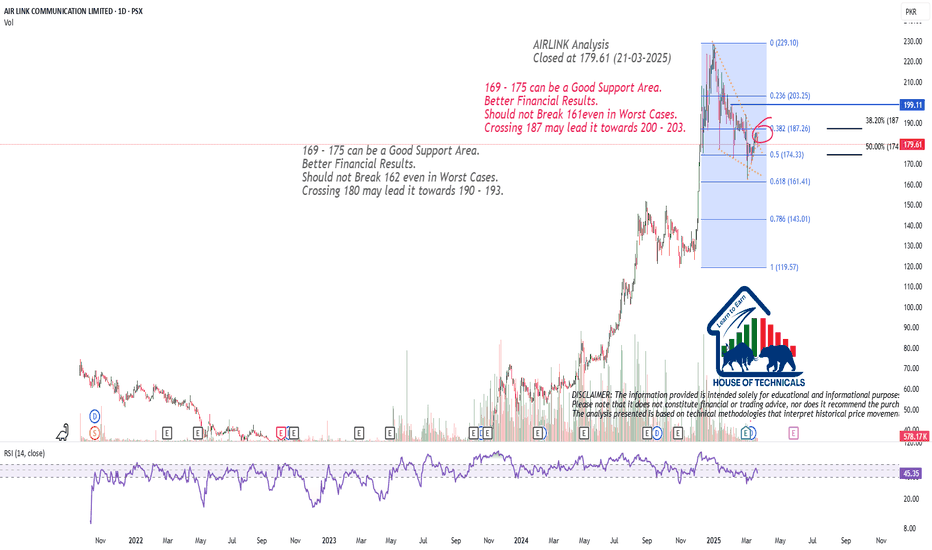

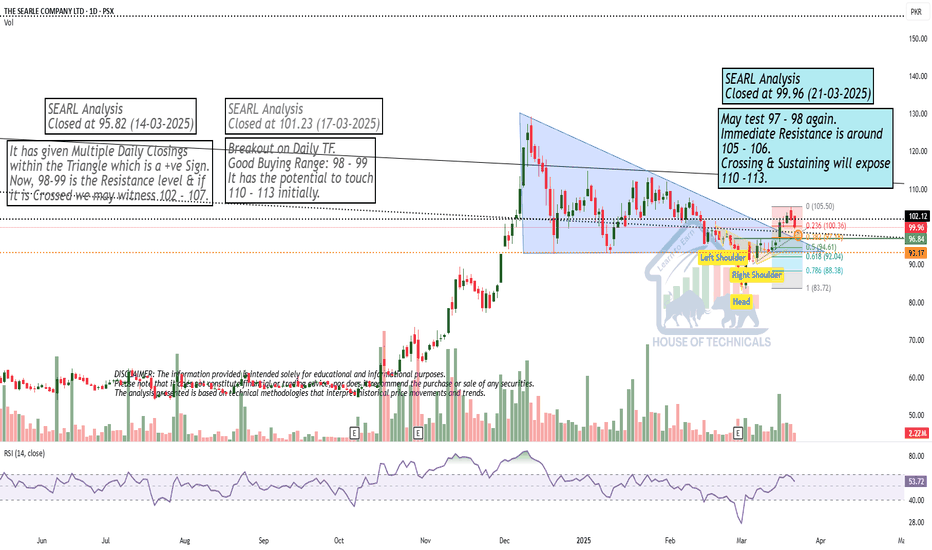

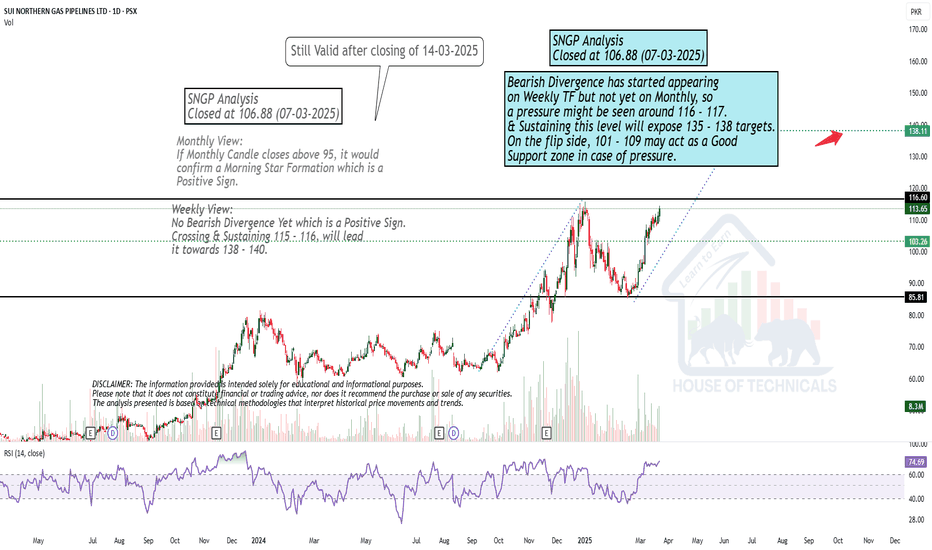

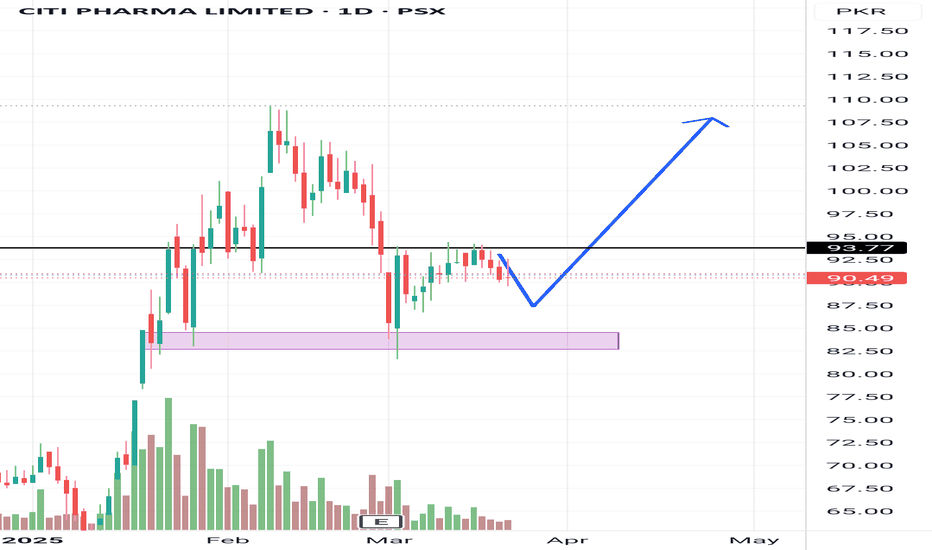

Bearish Divergence has started appearing but...Bearish Divergence has started appearing

on Weekly TF but not yet on Monthly, so

a pressure might be seen around 116 - 117.

& Sustaining this level will expose 135 - 138 targets.

On the flip side, 101 - 109 may act as a Good

Support zone in case of pressure.