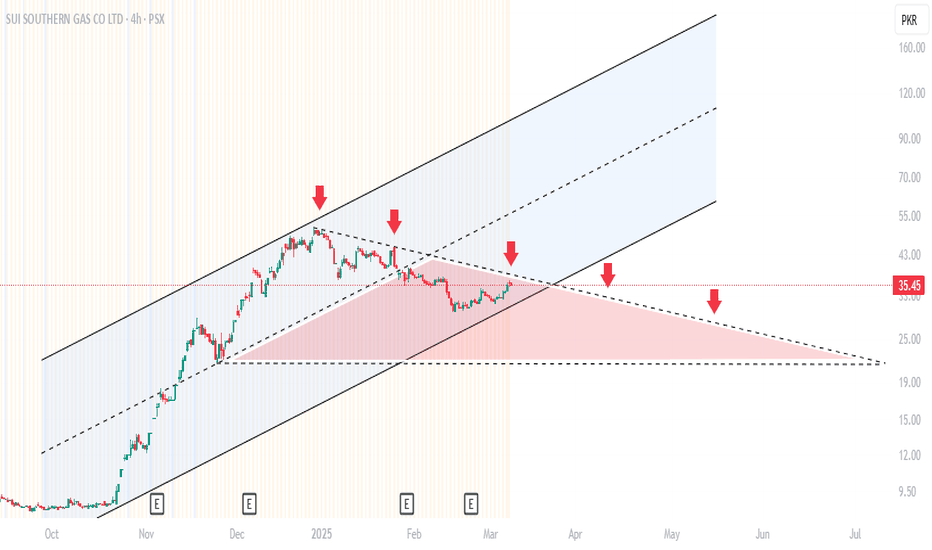

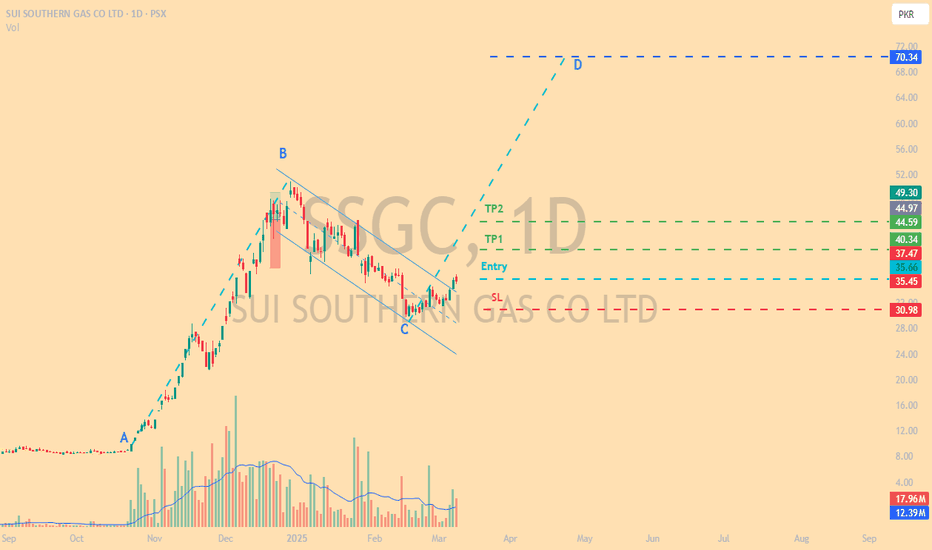

Understanding SSGC’s Upcoming Bullish Trend OR Sideways ?The stock was in a strong uptrend from October to January, staying within an ascending channel.The stock faced multiple rejections at the upper boundary of the channel.

Each time it approached resistance, it failed to sustain the momentum and pulled back.

Watchable zone

The lower trendline is acting as a support. If this support is broken, the price may drop towards PKR 25.00 - 22.00.

Sideways (Higher Probability)

A break below 32 PKR will confirm a sideway trend with range bound activity (24.00 - 28.00)

Bullish Case (less likely )

If the price breaks above 38 PKR,This would signal a bullish reversal, with potential upside targets at 46-48PKR.

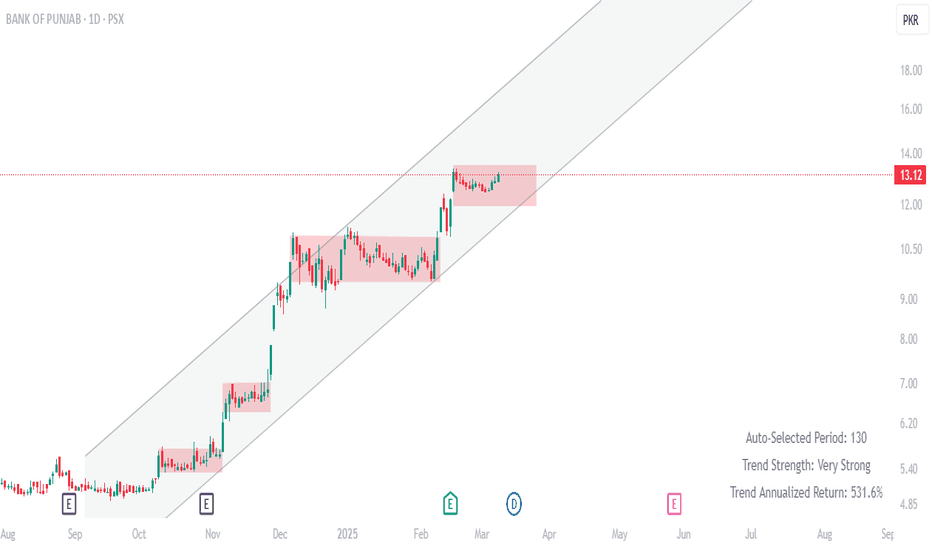

Understanding BOP’s Bullish Trendstock’s strong uptrend, trading within an ascending channel, and currently consolidating within a resistance zone.

The price is currently consolidating within a red resistance box, indicating that it is facing some selling pressure.A breakout above this zone could trigger another bullish rally

Immediate resistance: Around 12.20-13.50 PKR, where the stock is currently consolidating.

12.00-12.20 PKR, act as support for price retraces.

If the price successfully breaks out above 13.50 PKR, it may continue its uptrend toward the next resistance within the channel (15.75-16.25)

However, if it fails to break out, a short-term pullback to the lower trendline (around 12.00 PKR) could provide a better buying opportunity.

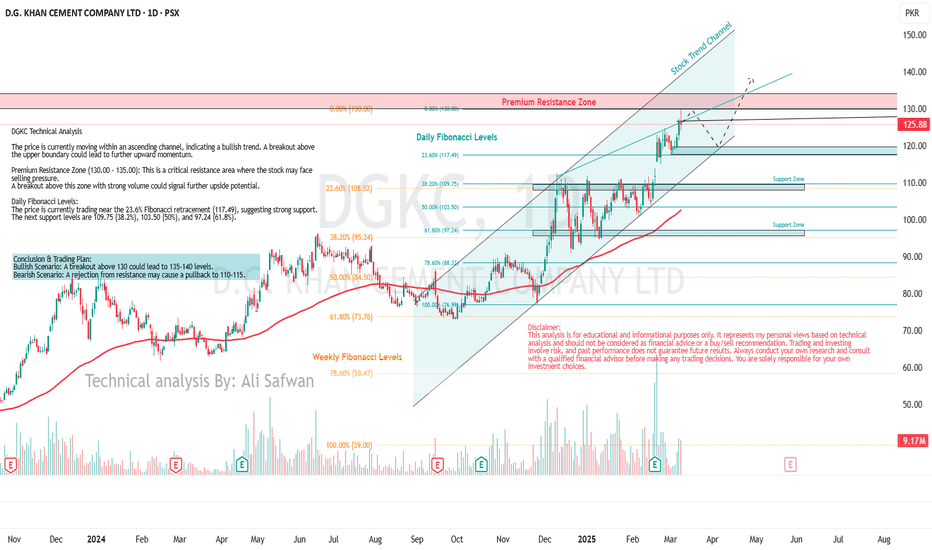

DGKC [ DG Khan Cement] Chart Technical Analysis, PSX DGKC Stock Analysis

CMP : 125.88 , 10-03-2025

The price is currently moving within an ascending channel, indicating a bullish trend.

A breakout above the upper boundary could lead to further upward momentum.

Premium Resistance Zone (130.00 - 135.00):

This is a critical resistance area where the stock may face selling pressure.

A breakout above this zone with strong volume could signal further upside potential.

Daily Fibonacci Levels:

The price is currently trading near the 23.6% Fibonacci retracement (117.49), suggesting strong support.

The next support levels are 109.75 (38.2%), 103.50 (50%), and 97.24 (61.8%).

Support Zones:

There are two key support levels around 110 and 100, which coincide with Fibonacci retracement zones.

If the price corrects, these areas could provide buying opportunities.

Potential Price Movement (Dashed Projection):

The dotted lines suggest a possible retest of the resistance zone (130-135) before a correction or continuation.

If rejected from resistance, the stock may pull back to the lower trendline before resuming its uptrend.

200-Day Moving Average:

The red line (200-day MA) is trending upwards, indicating long-term bullish sentiment.

Conclusion & Trading Plan:

Bullish Scenario: A breakout above 130 could lead to 135-140 levels.

Bearish Scenario: A rejection from resistance may cause a pullback to 110-115.

Support Levels to Watch: 110, 100

Resistance Levels to Watch: 130, 135

Disclaimer:

This analysis is for educational and informational purposes only. It represents my personal views based on technical analysis and should not be considered as financial advice or a buy/sell recommendation. Trading and investing involve risk, and past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making any trading decisions. You are solely responsible for your own investment choices.

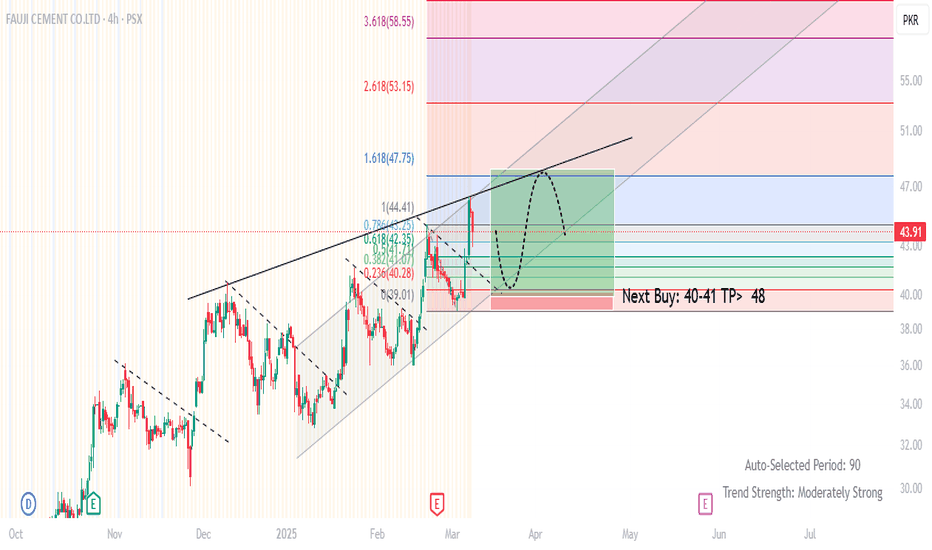

FCCL : Will It Retrace Before the Next Rally?On previous Call 4th mar 2025 , Stock met his target . Now next Short-term traders may wait for a retracement to 40-41 PKR before entering long positions.

The stock is moving within an ascending channel, with price action respecting both the support and resistance trendlines.

The price is currently near the upper resistance of this channel,Around 45-PKR, where price is struggling to break higher. suggesting a potential correction before another move higher.

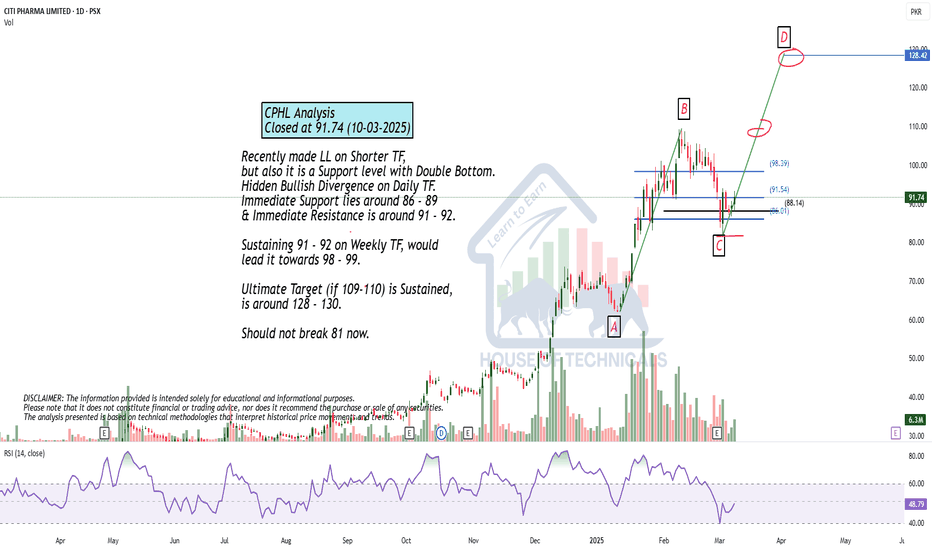

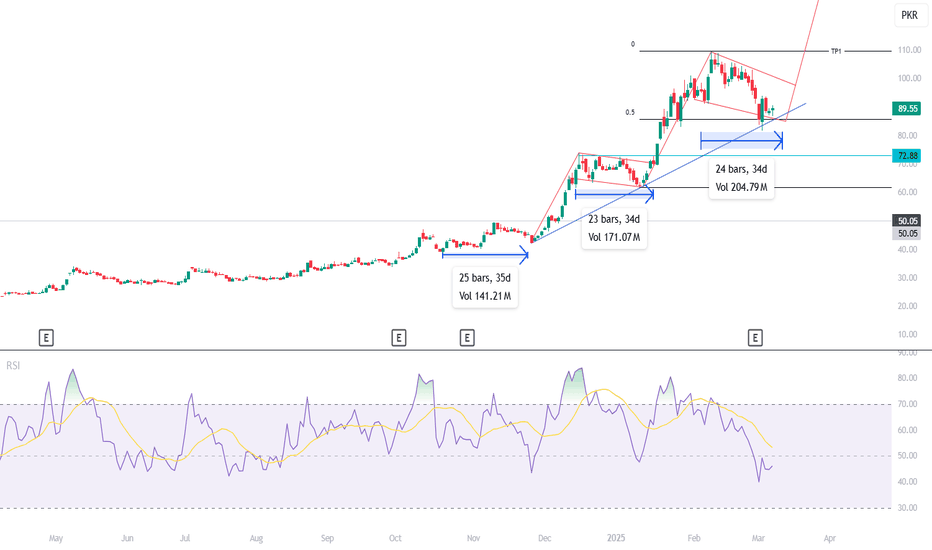

Recently made LL on Shorter TF, but..Recently made LL on Shorter TF,

but also it is a Support level with Double Bottom.

Hidden Bullish Divergence on Daily TF.

Immediate Support lies around 86 - 89

& Immediate Resistance is around 91 - 92.

Sustaining 91 - 92 on Weekly TF, would

lead it towards 98 - 99.

Ultimate Target (if 109-110) is Sustained,

is around 128 - 130.

Should not break 81 now.

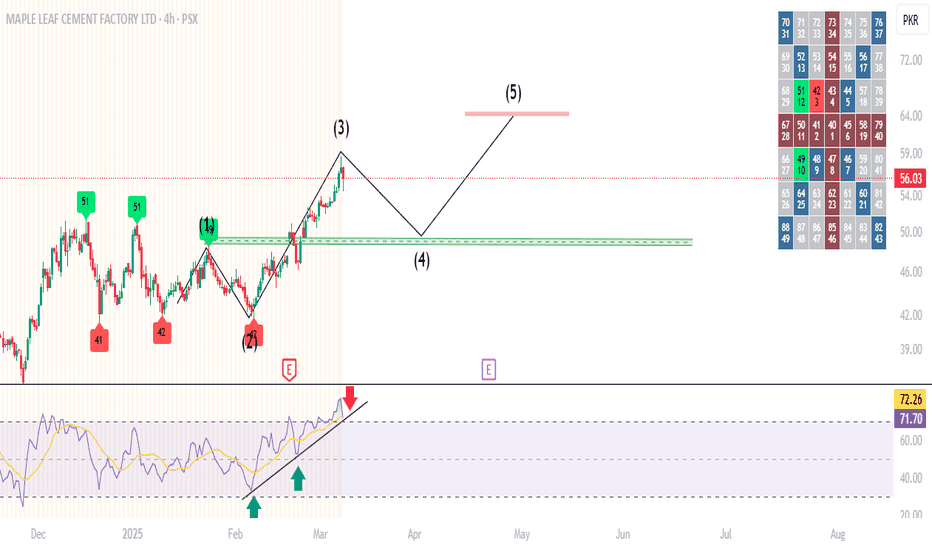

MLCF : Uptrend but short-term pullbackKey Observations:

Elliott Wave Count:

Currently, the stock is at the peak of wave (3), indicating that a short-term correction (wave 4) might be expected before the price resumes its uptrend toward wave (5).

48-50 PKR is a strong demand area for a potential bounce,If its Hold an upward move toward 62-65 PKR is expected in wave 5.

RSI It recently touched an upward trendline, indicating a potential overbought condition, possibly leading to a short-term correction.