SSGC TRADE IDEA. RETEST + FVGSSGC is currently on a loosing streak after rallying up almost 80 percent after the breakout on daily chart at 28.75 The stock is now again coming back to retest the previous high at 28.75

There is a fair value gap also around 28.75. A large amount of liquidity is resting at 28.75 to 29.00. The stock will show a quick bounce from these levels.

But the stock will be very volatile near these level as mentioned above.

put limit orders also watch closely near 28.75 to 29.00

As the big players also might hunt for stop losses just below these levels so be careful and watch carefully but this is a big chance to buy as the stock will rally quickly around 10 to 15 percent after absorbing liquidity at these levels!

LETS SEE WHAT HAPPENS.

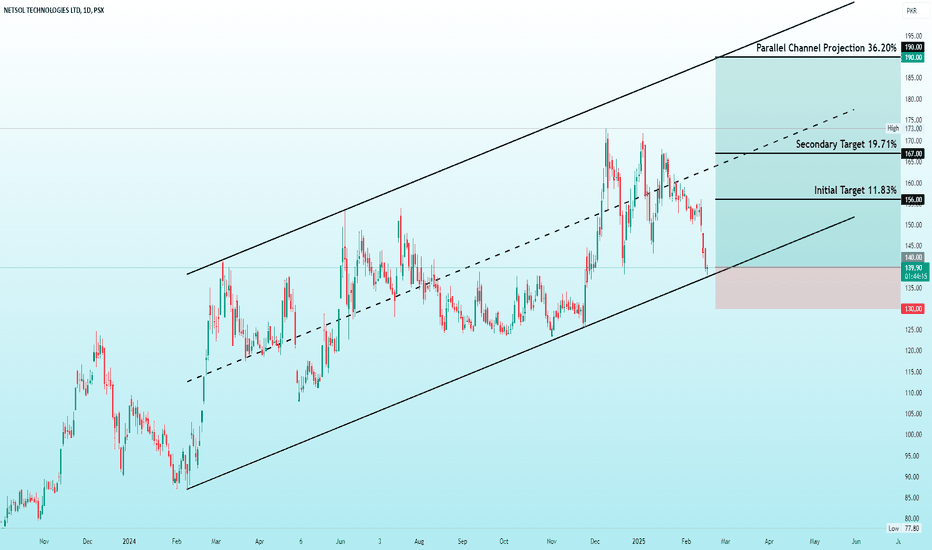

NETSOL |Ascending Parallel ChannelThis chart shows an ascending parallel channel formation for NETSOL, indicating a potential bullish reversal. The pattern suggests bullish momentum with key targets set at different levels: the initial target at 156 PKR, secondary target at 167 PKR, and a parallel channel projection target at 190 PKR. A stop loss is defined at 130 PKR, mitigating downside risk if it breaks the channel downward. This setup suggests traders are anticipating upward movement, with increasing potential as targets are met, though the stop loss limits potential losses in case of a downward move.

POWER CEMENT PERFECT SETUP FVG + HIGHER HIGH RETEST AND BREAKOUTPower cement fair value gap plus higher high retest at 9.75. also, there was an accumulation box on the higher time frame. the liquidity was resting in the higher high retest in the fair value gap. the stock absorbed all the liquidity at 9.75 and gave a breakout at 10.30, rallying quickly 8 percent in 2-3 hours. that’s how the smart money and the big institutes play!!

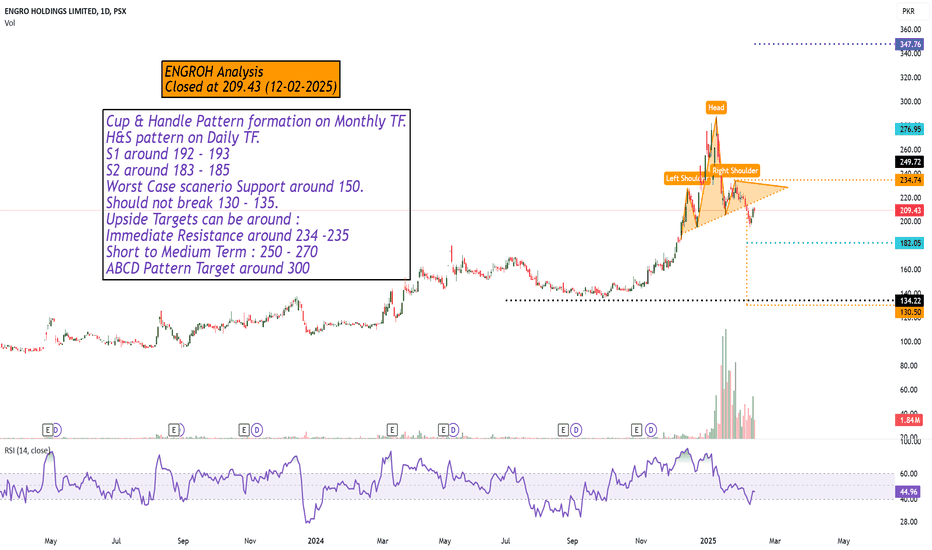

Different Patterns on Different Time FramesCup & Handle Pattern formation on Monthly TF.

H&S pattern on Daily TF.

S1 around 192 - 193

S2 around 183 - 185

Worst Case scanerio Support around 150.

Should not break 130 - 135.

Upside Targets can be around :

Immediate Resistance around 234 -235

Short to Medium Term : 250 - 270

ABCD Pattern Target around 300

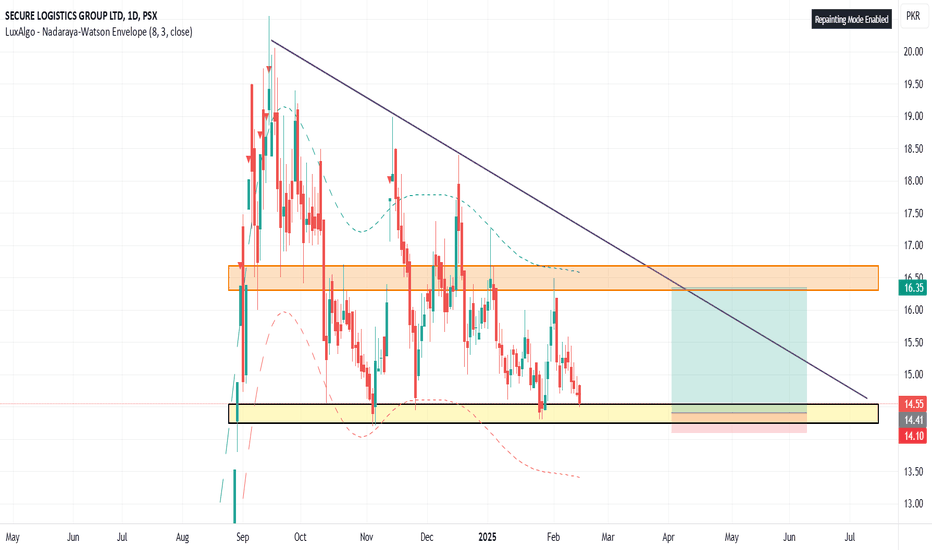

SLGL (Ammar)Buy and Sell Levels of SLGL, Pakistani Stock

Secure Logistics Group (Pvt) Ltd (SLG or the Group) has been rendering a broad array of solutions specializing in Logistics and Vehicle Fleet Management Services across the country. The Group has maintained a proven track record in achieving customer satisfaction across its businesses. Our key to success stems from quality human resources, judicious planning and meticulous execution while leveraging country-wide asset base and infrastructure.

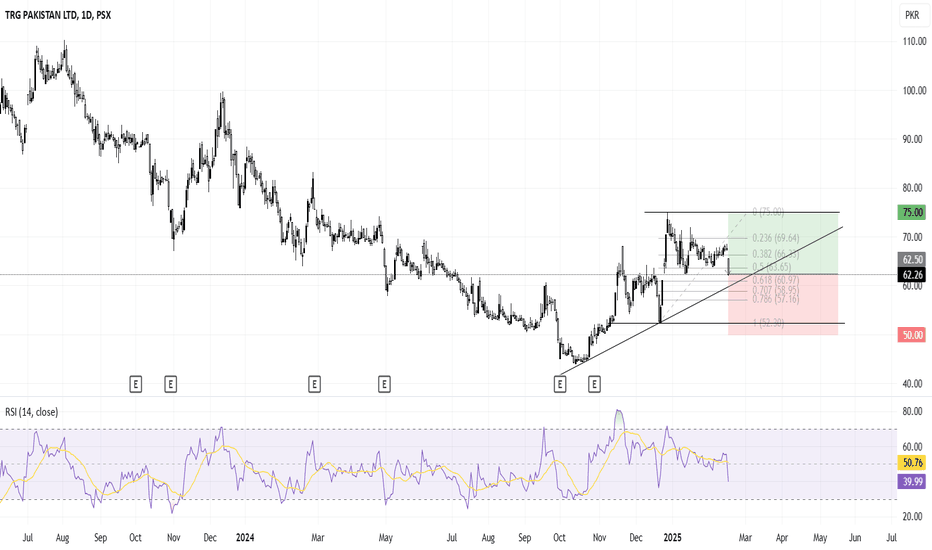

TRG Bullish Reversal: Buy at Golden PocketTRG is trending after a prolonged bearish phase, forming higher highs and higher lows. It is currently trading around the Fibonacci golden pocket. A buy entry at the current market price is suggested, with a stop loss below the last low and a target at the recent high.

Lucky Core Industries (LCI) - Long PositionLucky Core Industries is fundamentally one of the strongest company of PSX.

In 2024, they made the agreement with Pfizer for selling pharmaceutical raw materials. The revenue generated in 2024 from that agreement was Rs 3.2 billion. In 2025, the expected amount is roughly Rs 8-8.5 billion. You can compute the increase in overall earnings of this company in 2025.

My target is Rs 1700, and my second target is Rs 2000.

This is the company for those who are long-term investors and want to enjoy the fruit of such a wonderful company without any fear of losing money in long term

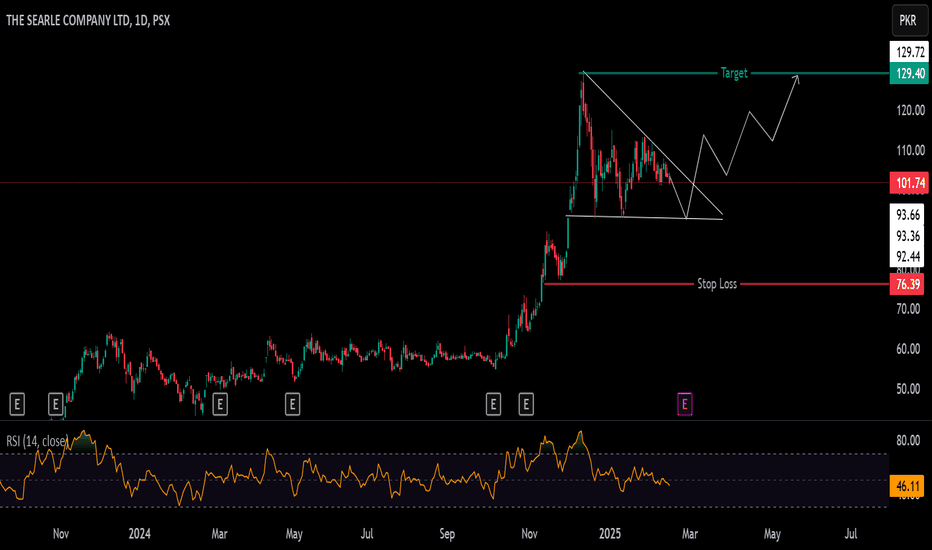

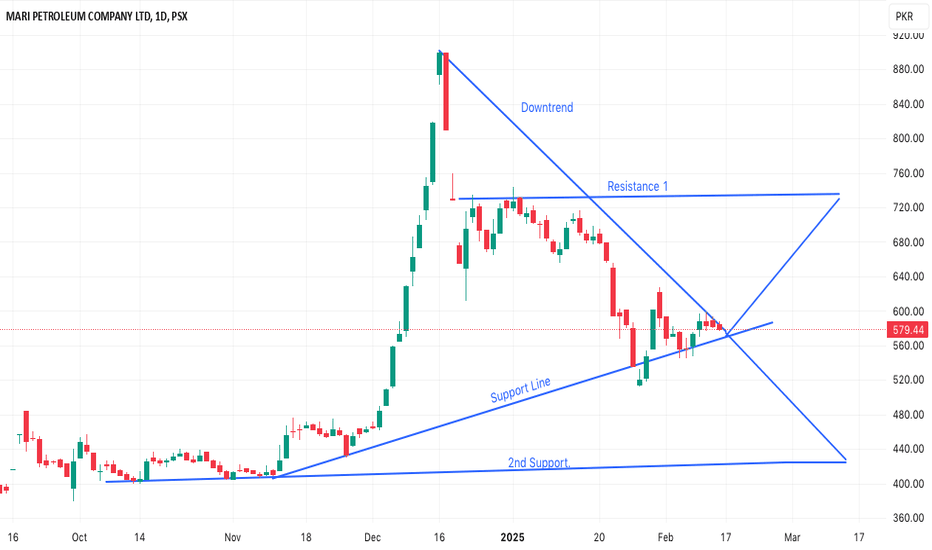

Technical analysis of MARI petroleumIt is in downtrend on daily chart and honouring the first support level.In case the index performs and it generates reasonable volumes then it'll go through Rs.618 easily and move towards its second resistance level of Rs.720.On the other hand in case it breaks its first resistance then it'll be clear to forsecond support level at Rs.425.So far it is showing signs to bounce back from current stage.

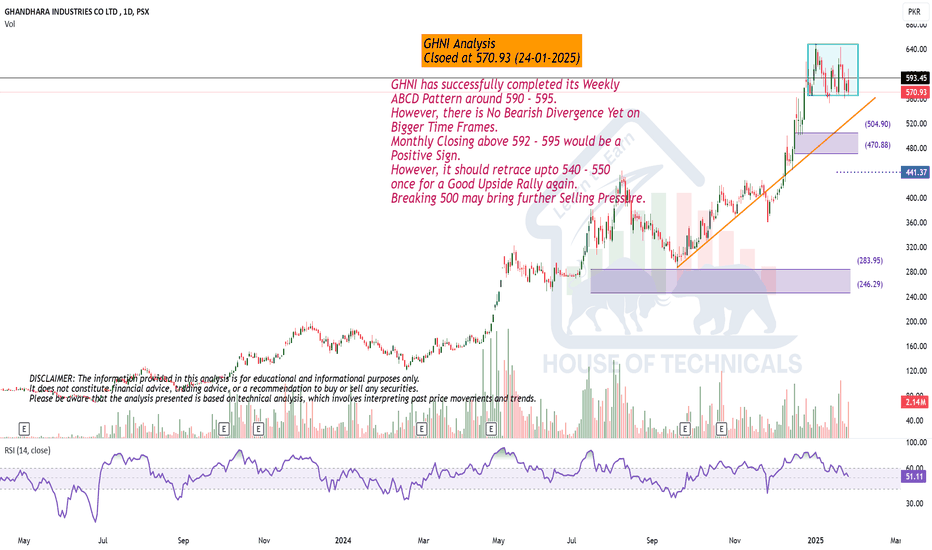

Monthly Closing is ImportantGHNI has successfully completed its Weekly

ABCD Pattern around 590 - 595.

However, there is No Bearish Divergence Yet on

Bigger Time Frames.

Monthly Closing above 592 - 595 would be a

Positive Sign.

However, it should retrace upto 540 - 550

once for a Good Upside Rally again.

Breaking 500 may bring further Selling Pressure.