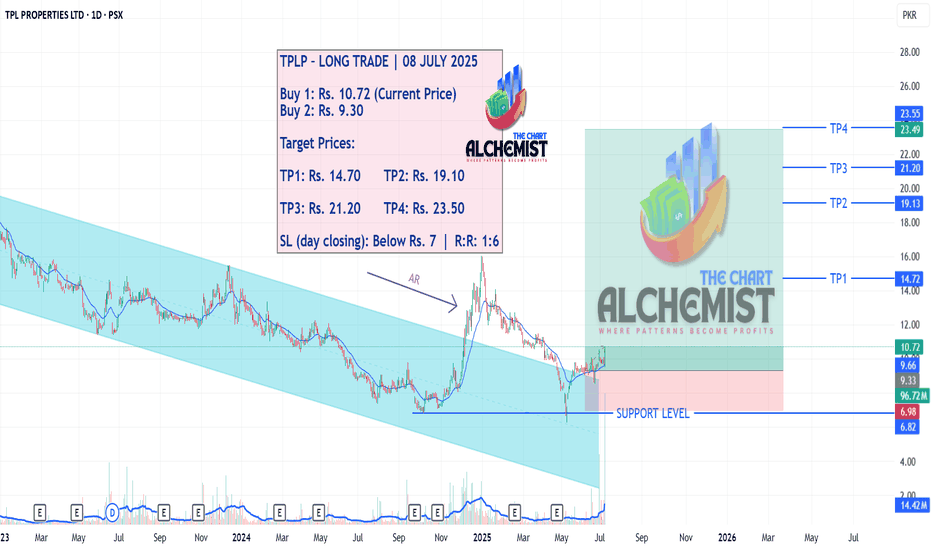

TPLP – LONG TRADE | 08 JULY 2025TPLP – LONG TRADE | 08 JULY 2025

TPLP broke out of a downward channel in December, followed by an automatic rally and a retest of the original support zone with a spring. Current structure indicates signs of a strong upward reversal, with multiple quantified targets likely to be achieved in the next leg of the trend.

📌 Execution Strategy:

Caution: Please buy in 3 parts within the buying range. Close at least 50% of your position at TP1 and trail the stop loss to protect profits in case of unforeseen market conditions.

📢 Disclaimer: Do not copy or redistribute signals without prior consent or proper credit to The Chart Alchemist (TCA).

✨ Kindly support our efforts by boosting and sharing this idea!

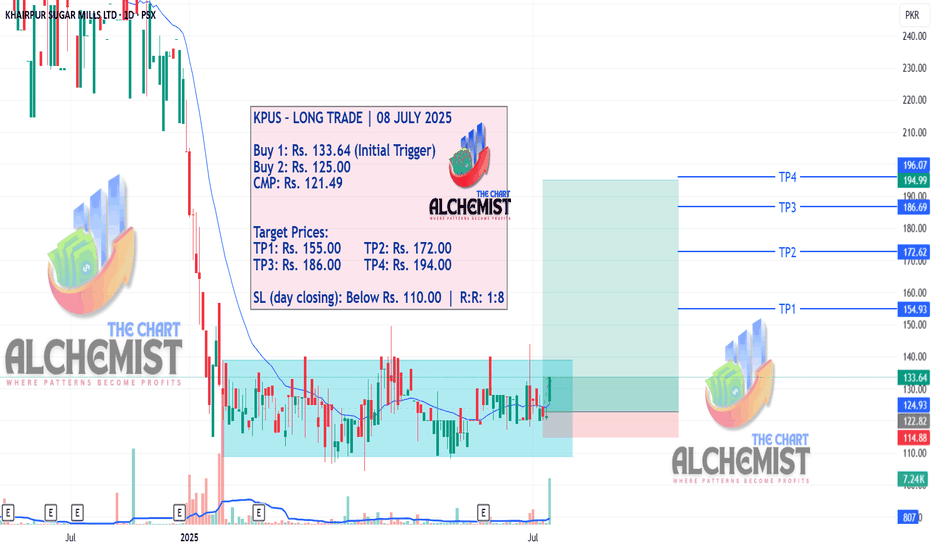

KPUS – LONG TRADE | 08 JULY 2025 KPUS – LONG TRADE | 08 JULY 2025

KPUS has been trading within a range since January 2025. The recent breakout move suggests the beginning of a new uptrend phase. Although the initial trigger was at Rs. 133.64, the stock has now pulled back and is trading at a more favorable level of Rs. 121.49, offering an excellent First Strike entry setup with significant upside potential and well-defined risk.

📌 Execution Strategy: Please buy in 3 parts within the buying range. Close at least 50% of your position at TP1 and trail the stop loss to protect profits in case of unforeseen market conditions.

📢 Disclaimer: Do not copy or redistribute signals without prior consent or proper credit to The Chart Alchemist (TCA).

✨ Kindly support our efforts by boosting and sharing this idea!

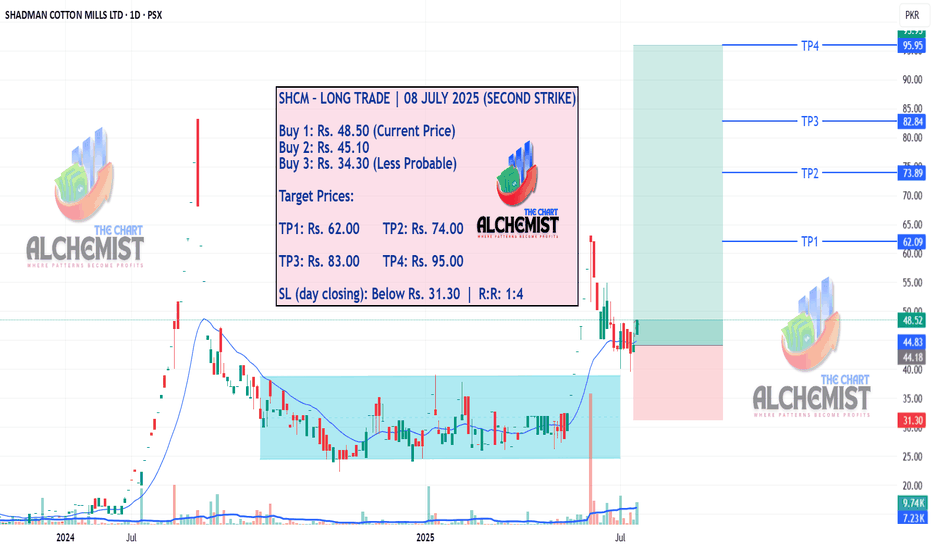

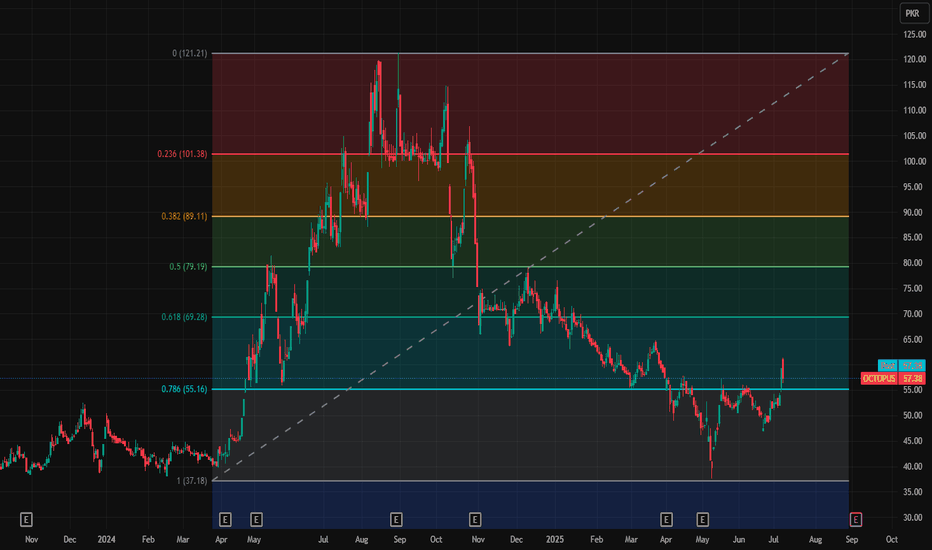

SHCM – LONG TRADE | 08 JULY 2025

SHCM – LONG TRADE | 08 JULY 2025 (SECOND STRIKE)

SHCM broke out from an accumulation zone in the second week of June with a massive upward spike, reaching Rs. 63.40. After completing its pullback, the stock now appears poised for the next leg of its uptrend. This structure marks a Second Strike opportunity with quantified targets ahead.

📌 Execution Strategy: Please buy in 3 parts within the buying range. Close at least 50% of your position at TP1 and trail the stop loss to protect profits in case of unforeseen market conditions.

📢 Disclaimer: Do not copy or redistribute signals without prior consent or proper credit to The Chart Alchemist (TCA).

✨ Kindly support our efforts by boosting and sharing this idea!

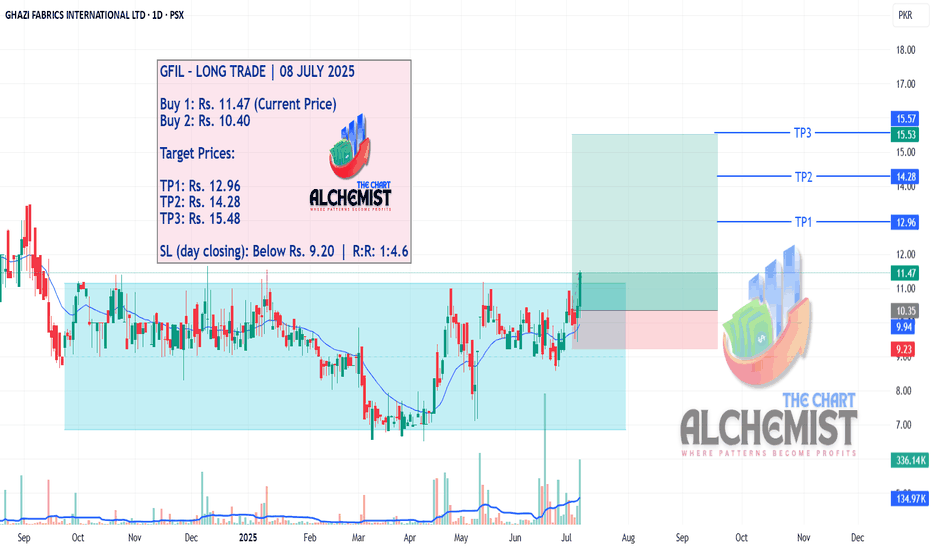

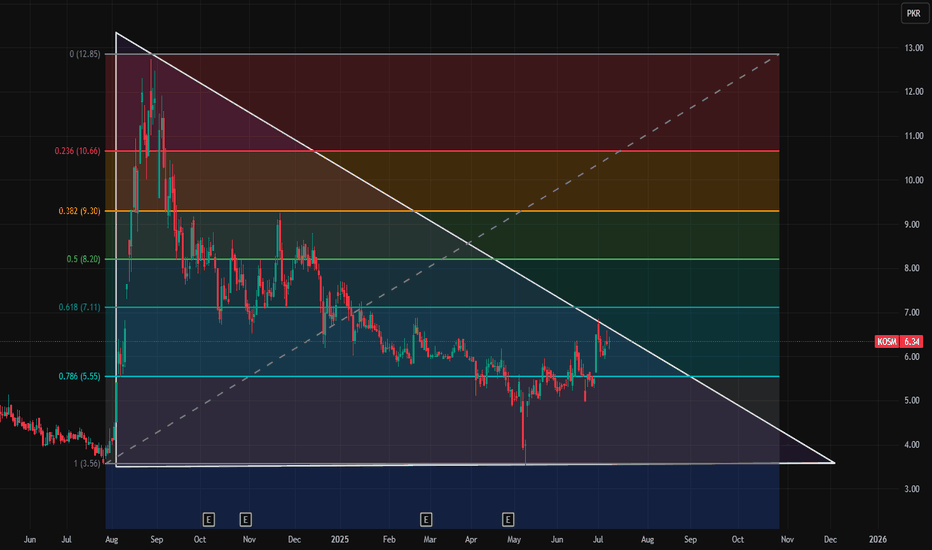

GFIL LONG TRADE 08/07/2025GFIL – LONG TRADE | 08 JULY 2025

GFIL has broken out of a reaccumulation range between Rs. 6.80 and Rs. 11.10. Recent price action confirms a strong breakout from this zone, indicating a shift in structure and positioning the stock for a potential upward leg toward multiple quantified targets.

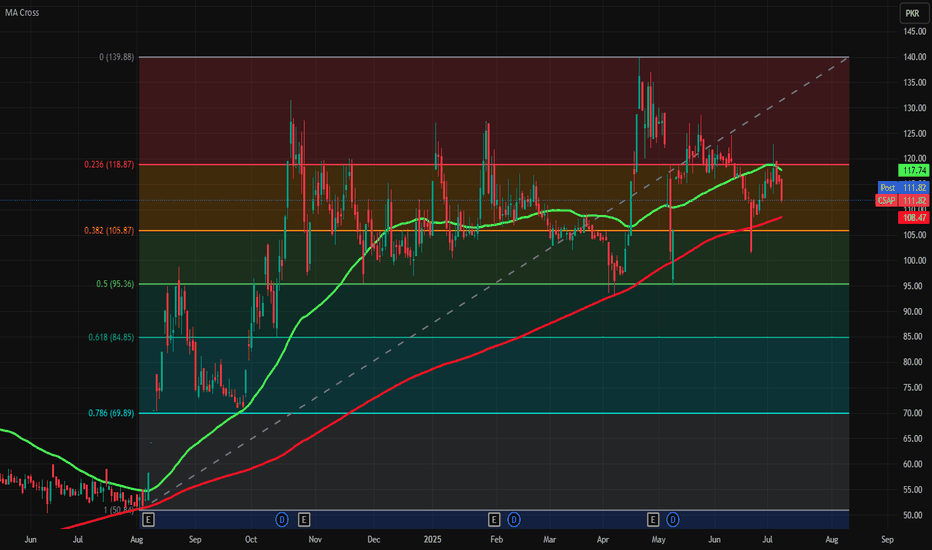

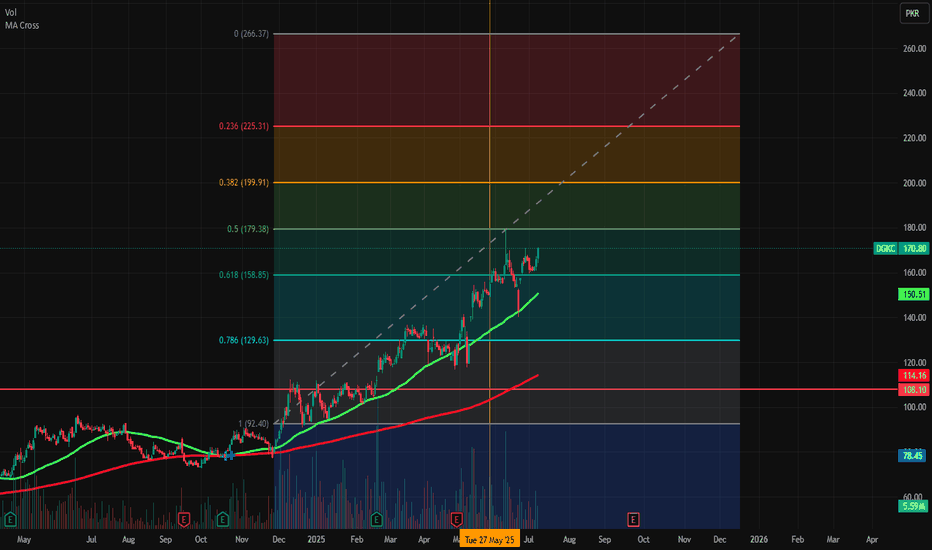

Fresh entry for CSAPAs you can watch it is now below 50 days moving average (green line) and it is also near to 200 days moving average (red line).

Buying conditions:

1) if it cross above green line (117.74)

2) If it fall below from red line (108.47) and cross above it

3) If it fall more red line then wait for its strong support of 105.87 and if it fall below it then wait for cross over above 105.87 level to take fresh entry.

SL is 84.8 and TPS are 118.87 and 139.88

Note: This is not a buy/sell trade call.

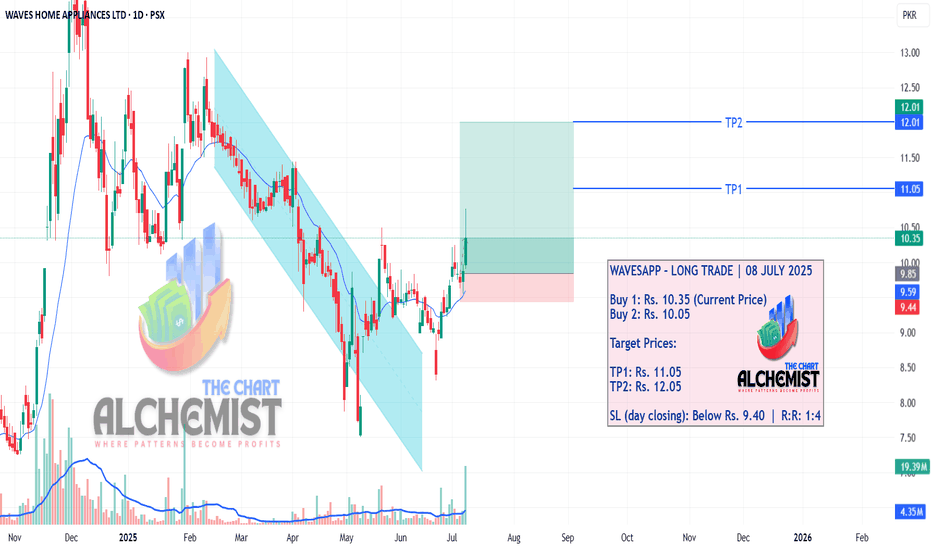

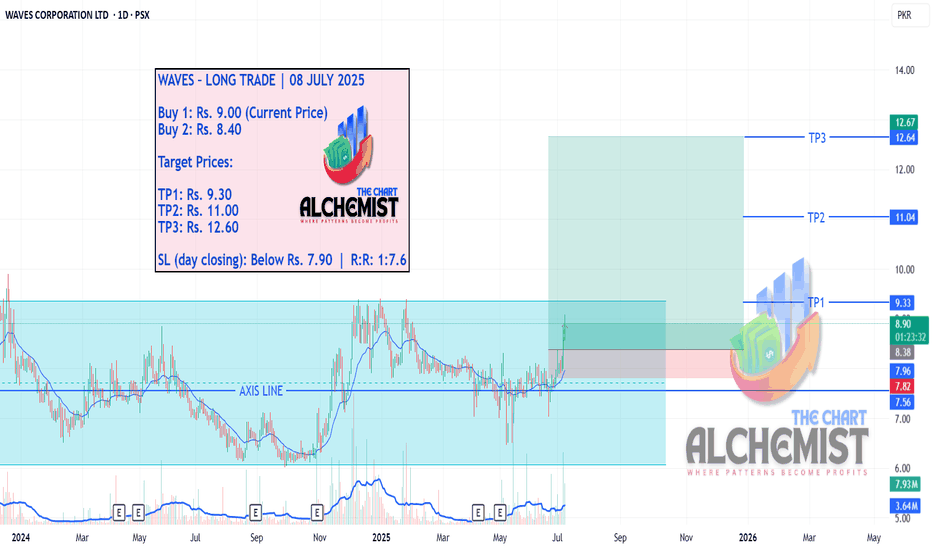

WAVES LONG TRADE 08-07-2025WAVES – LONG TRADE | 08 JULY 2025 (STRIKE ONE REVISIT – RECALL SIGNAL)

WAVES has been consolidating since June 2023 in a broad range. The recent bullish price action indicates strength and potential for breakout, marking a recall signal of the original Strike One opportunity. With multiple targets in play and a strong risk-reward ratio, this setup presents a favorable long entry.

TELE LONG TRADE 08-07-2025TELE – LONG TRADE | 08 JULY 2025

Buy 1: Rs. 8.53 (Current Price)

Buy 2: Rs. 8.10

Target Prices:

TP1: Rs. 9.30

TP2: Rs. 10.00

SL (day closing): Below Rs. 7.70 | R:R: 1:5

TELE has been trading in a range since June 2023. It recently completed a spring pattern by briefly breaking below the range and marking a low of Rs. 5.40. The current reversal from this zone indicates a strong potential for an upward move, making this a high-probability Second Strike opportunity.

📌 Execution Strategy: Please buy in 3 parts within the buying range. Close at least 50% of your position at TP1 and trail the stop loss to protect profits in case of unforeseen market conditions.

📢 Disclaimer: Do not copy or redistribute signals without prior consent or proper credit to The Chart Alchemist (TCA).

✨ Kindly support our efforts by boosting and sharing this idea!

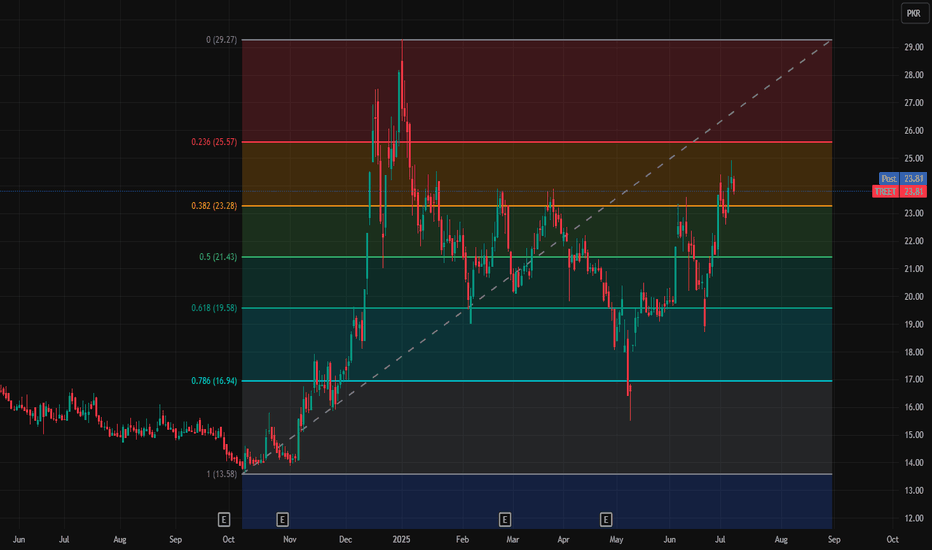

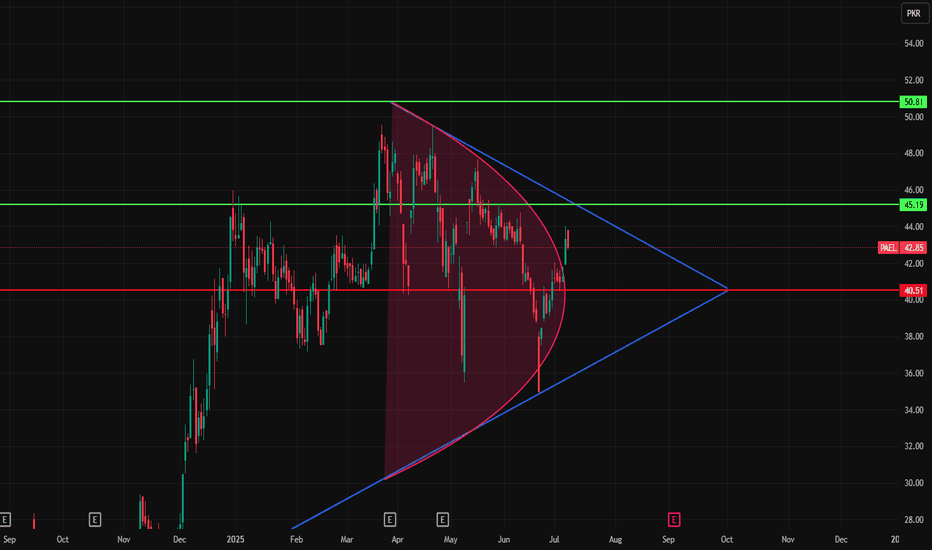

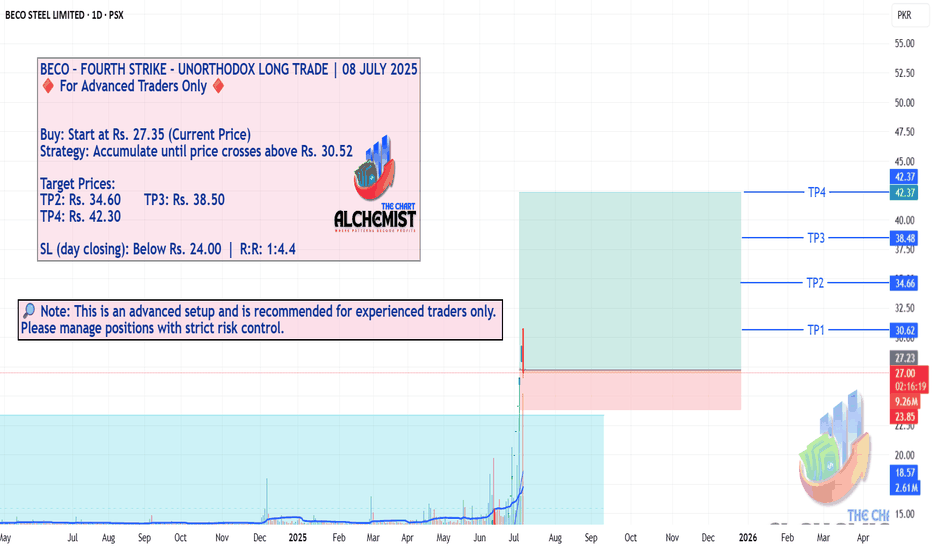

BECO – FOURTH STRIKE - UNORTHODOX LONG TRADE | 08 JULY 2025BECO – FOURTH STRIKE - UNORTHODOX LONG TRADE | 08 JULY 2025

🔶 For Advanced Traders Only 🔶

Buy: Start at Rs. 27.35 (Current Price)

Strategy: Accumulate until price crosses above Rs. 30.52

Target Prices:

TP2: Rs. 34.60 TP3: Rs. 38.50

TP4: Rs. 42.30

SL (day closing): Below Rs. 24.00 | R:R: 1:4.4

BECO achieved TP1 in its previous Third Strike call. Following a healthy pullback, the stock has revisited key support levels while maintaining its bullish structure. This offers a new opportunity for re-entry as part of the ongoing upward trajectory. A breakout above Rs. 30.50 will reconfirm bullish continuation.

📢 Disclaimer: Do not copy or redistribute signals without prior consent or proper credit to The Chart Alchemist (TCA).

✨ Kindly support our efforts by boosting and sharing this idea!

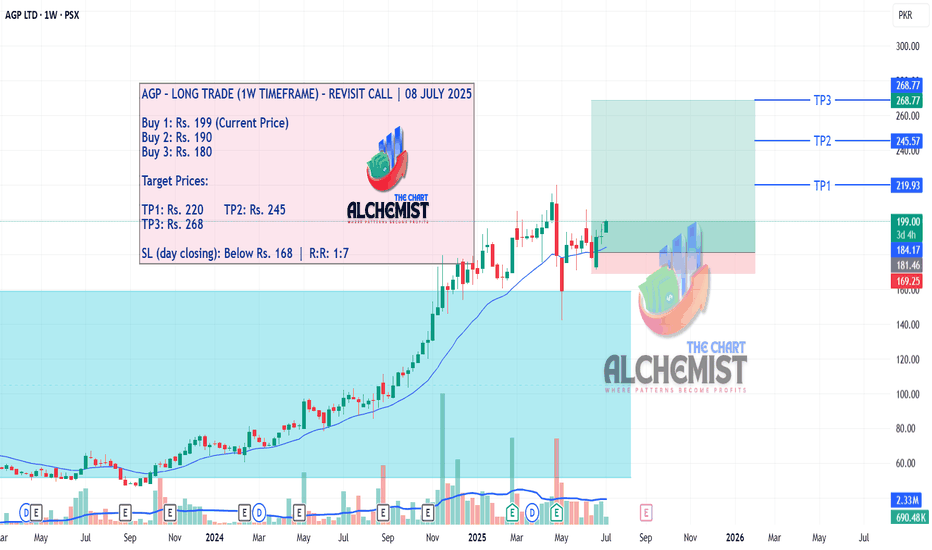

AGP LONG TRADE 08-07-2025AGP – LONG TRADE (1W TIMEFRAME) – REVISIT CALL | 08 JULY 2025

AGP previously broke out of a multi-year accumulation range between Rs. 158 and Rs. 53 (July 2021 to Nov 2024), rallying to a high of Rs. 220. After a structured pullback, the stock has now reversed upward. This revisit call comes as the second leg of the uptrend begins to take shape, backed by solid price action on the weekly timeframe.

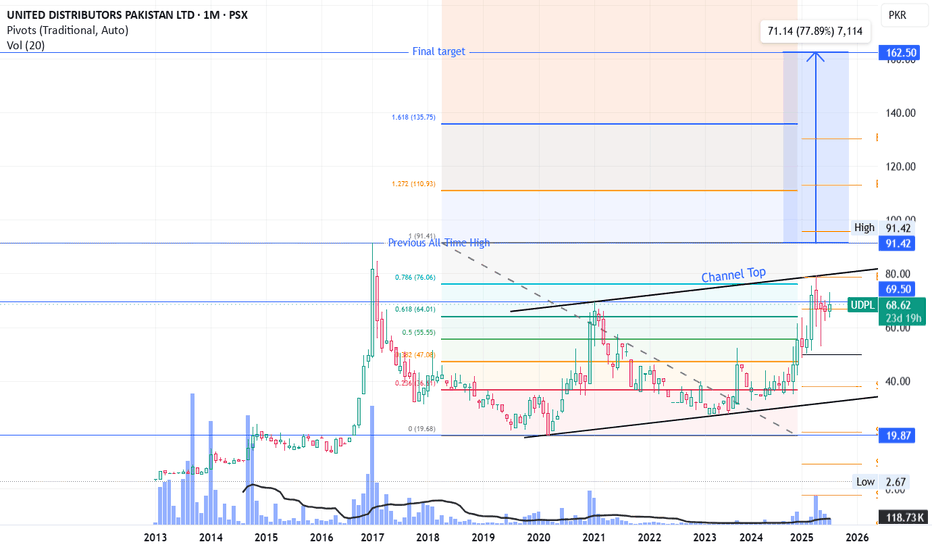

UDPL LongUDPL has very strong fundamentals (P/E: 2.3, EPS: ~30)

Its a dividend paying stock as well.

It is building cup and handle formation with the channel top line working as major resistance.

It took a correction from Fib 0.786 level of previous all-time high.

Once 80 (Channel top line) is broken, we can see it moving towards 91 which is its previous all-time high.

Ultimate targets are shown in the chart.

Monthly RSI is ~70 and ADX in 30s, showing a building momentum.

Its not a buy / sell call, just my personal opinion.

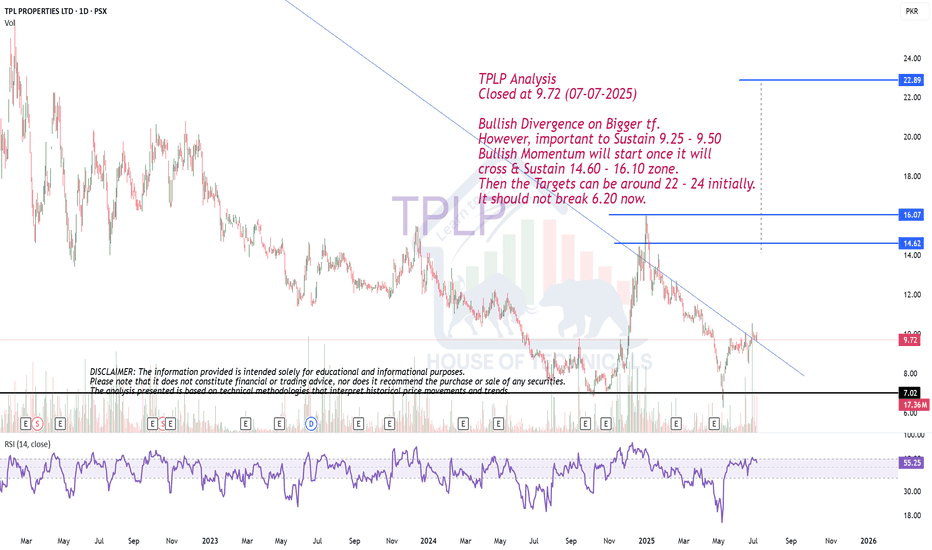

Bullish Divergence on Bigger tf.TPLP Analysis

Closed at 9.72 (07-07-2025)

Bullish Divergence on Bigger tf.

However, important to Sustain 9.25 - 9.50

Bullish Momentum will start once it will

cross & Sustain 14.60 - 16.10 zone.

Then the Targets can be around 22 - 24 initially.

It should not break 6.20 now.

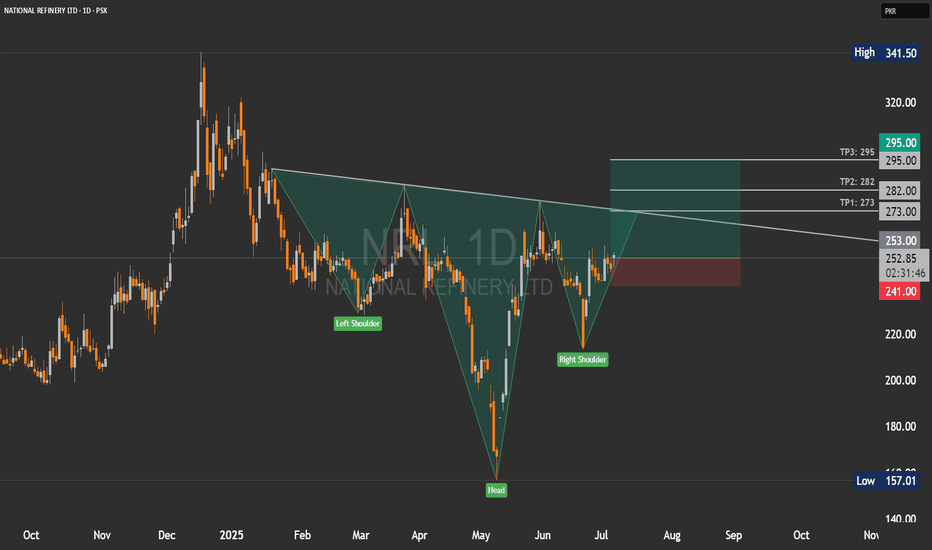

NRL | Inverse Head & ShoulderNRL on the daily timeframe displays a well-formed Inverse Head and Shoulders pattern, which is a classic bullish reversal signal. The left shoulder, head, and right shoulder are clearly identifiable, with the price now approaching the neckline resistance around the 273 level. A breakout above this neckline with strong volume could trigger an upward move, with potential targets marked at 282, and 295, aligning with prior resistance zones. Notably, similar patterns have been observed across several PSX stocks recently, many of which experienced sharp rallies post-breakout. If this pattern follows the broader market behavior, NRL may also see a strong bullish continuation upon confirmation.