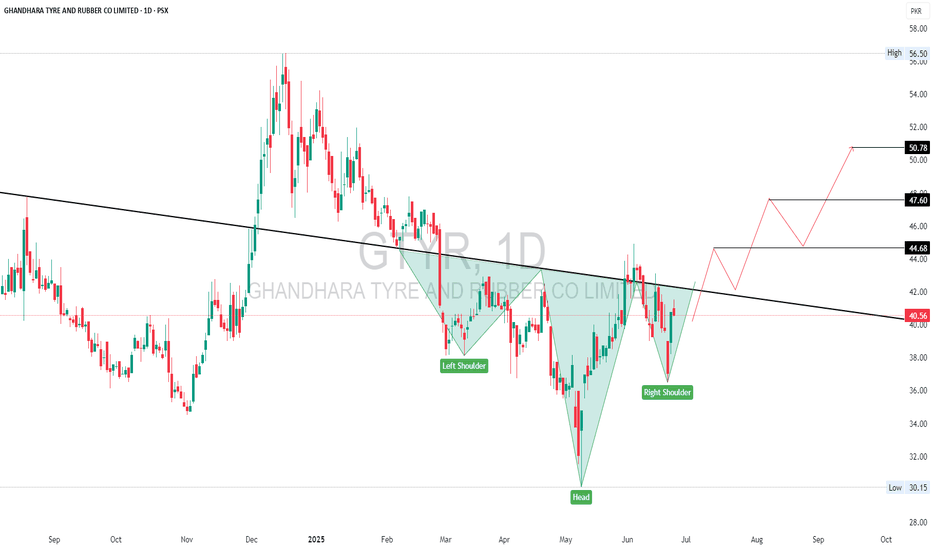

GTYR | Inverse Head & Shoulder PatternGTYR on the daily timeframe shows a classic Inverse Head and Shoulders pattern forming, indicating a potential bullish reversal. The pattern is well-defined with the left shoulder, head, and right shoulder, and price is currently testing the neckline resistance around PKR 41. A successful breakout above the neckline could trigger a strong upward move, with projected targets around 44.68, 47.60, and ultimately 50.78. Confirmation of breakout and sustained volume will strengthen the bullish case.

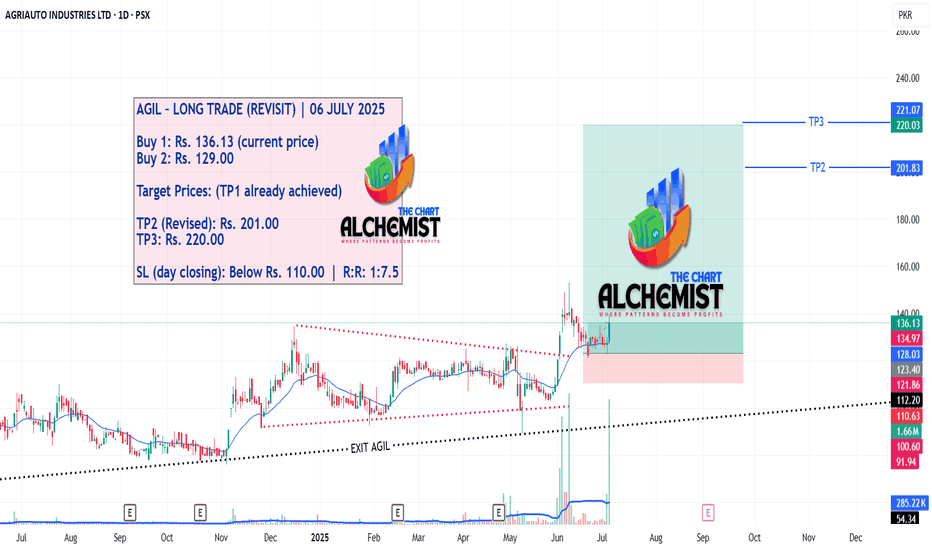

AGIL LON TRADE REVISIT CALL - FRESH ENTRY 06/07/2025AGIL – LONG TRADE (REVISIT) | 06 JULY 2025

Buy 1: Rs. 136.13 (current price)

Buy 2: Rs. 129.00

Target Prices: (TP1 already achieved)

TP2 (Revised): Rs. 201.00

TP3: Rs. 220.00

SL (day closing): Below Rs. 110.00 | R:R: 1:7.5

AGIL – LONG TRADE (REVISIT) | 06 JULY 2025

Our previous call on AGIL successfully hit TP1, followed by a corrective pullback that now seems complete. The price action supports a continuation of the uptrend, presenting a fresh high-potential entry with an excellent reward-to-risk ratio.

📢 Disclaimer: Do not copy or redistribute signals without prior consent or proper credit to The Chart Alchemist (TCA).

✨ Kindly support our efforts by boosting and sharing this idea!

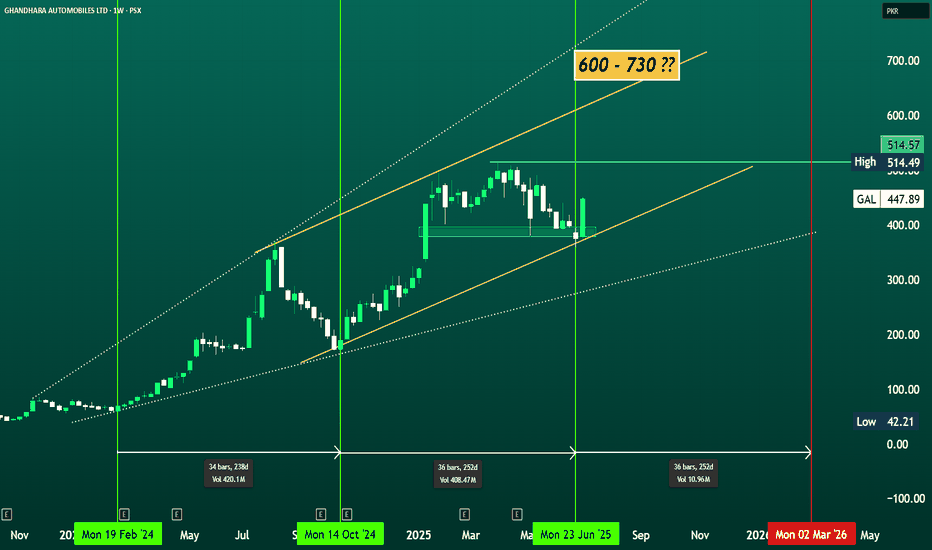

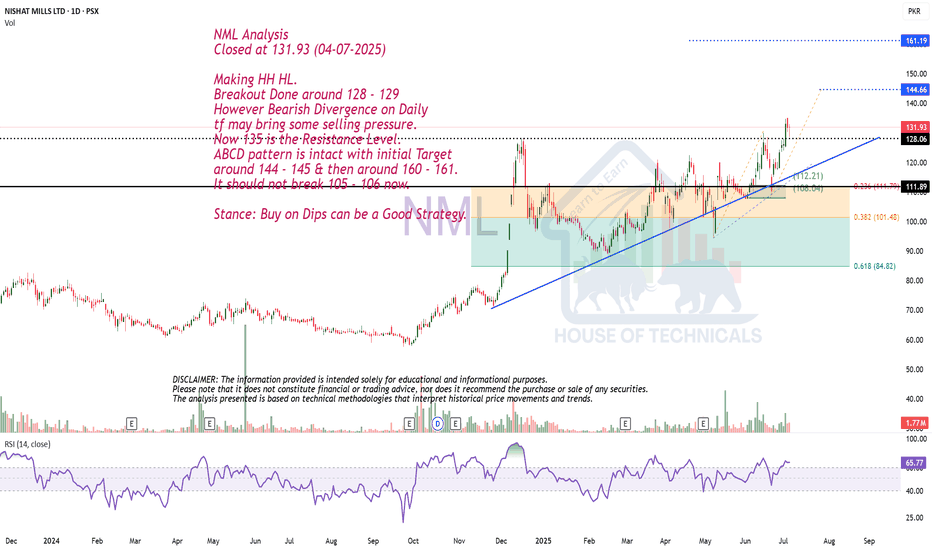

GAL (WEEKLY): Targeting 600 – 730 by Q1 2026#GAL (WEEKLY): Targeting 600 – 730 by Q1 2026

CMP: 447.89

#GAL seems to follow a cyclical rhythm of ~34–36 weeks (approx. 8–9 months) between impulsive rallies.

After strong rallies from Feb 2024 to Oct 2024, and again Oct 2024 to Jun 2025, a similar cycle is now in motion.

The most recent bounce near trendline support aligns with the next cycle start (June 2025).

Based on the channel’s slope and volume breakout, GAL may attempt a move toward 600–730 by early March 2026 (next cycle completion).

The dotted upper trendline and past Fibonacci-based extensions both validate this upside zone.

If momentum sustains and GAL holds above trendline support (around 400), the chart suggests a third impulsive wave could be underway. While speculative, the pattern rhythm and price geometry point toward 600–730 as a realistic upper zone into early 2026 — barring major macro disruptions.

This analysis is for educational and informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security. Always conduct your own research or consult with a licensed financial advisor before making investment decisions. Past performance is not indicative of future results. #kse100 #psx #tradeflow #GAL #pakistan

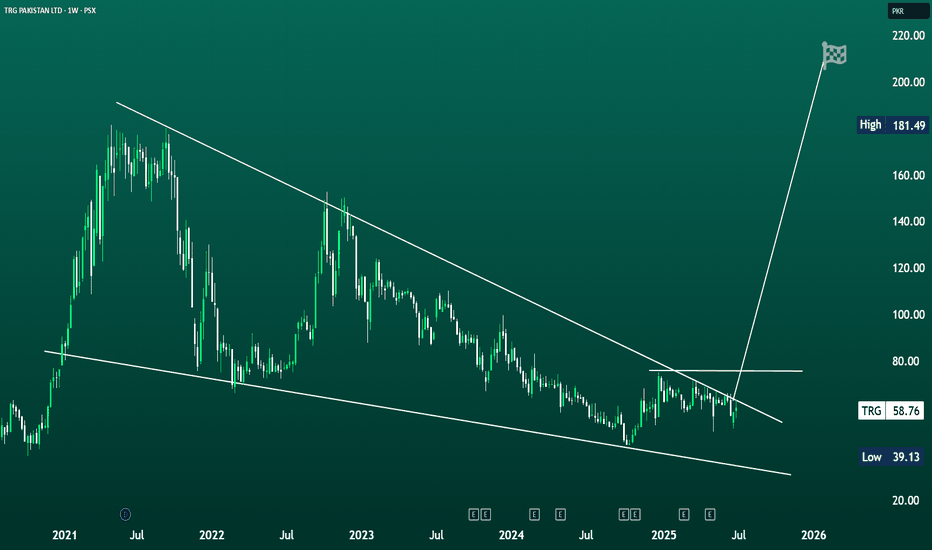

TRG FALLING WEDGE 2x... 3X...4X...?TRG ELITE KATCHRA💎

CMP: 58.76

From forgotten junk to potential multi-bagger 2x... 3X...4X...? will see what unfolds...

TRG is showing signs of a potential long-term reversal after a multi-year downtrend. Price action is compressing within a large falling wedge pattern, typically a bullish formation. A breakout above the upper trendline (~60–62) with volume could trigger a major upside move 110 - 120, with a long-term price target potentially reaching 153 - 200+.

Watch closely for confirmation abv 76.00 on weekly.

This analysis is for educational and informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security. Always conduct your own research or consult with a licensed financial advisor before making investment decisions. Past performance is not indicative of future results.

#kse100 #psx #tradeflow #trg #pakistan

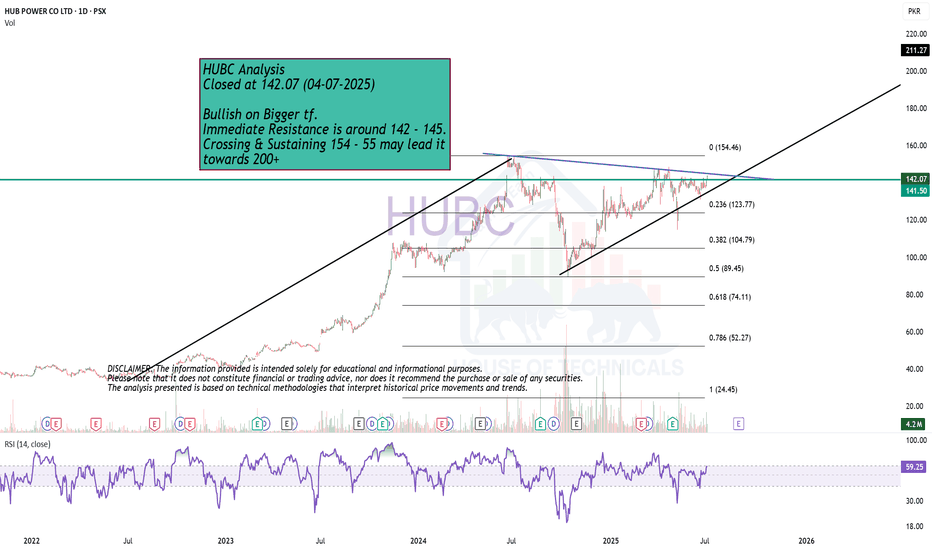

ABCD PatternGHNI Analysis

Closed at 738.08 (04-07-2025)

Monthly Closing above 648 would be

a positive sign.

784 - 785 is the Resistance for now.

It has the potential to touch 1000 - 1100

if it Crosses & Sustains 785 with Good Volumes.

On the flip side, 680 - 682 & then 657 - 660 may

act as a Support.

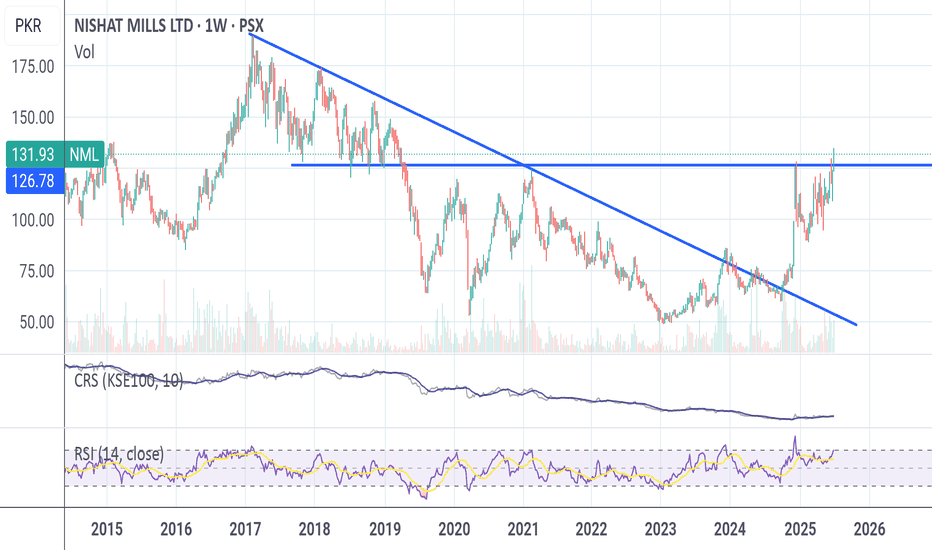

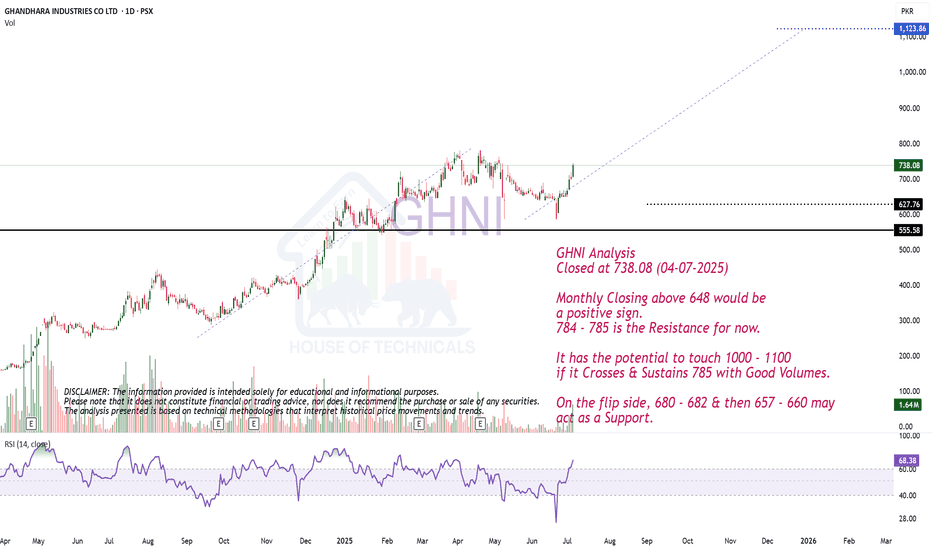

Making HH HL.NML Analysis

Closed at 131.93 (04-07-2025)

Making HH HL.

Breakout Done around 128 - 129

However Bearish Divergence on Daily

tf may bring some selling pressure.

Now 135 is the Resistance Level.

ABCD pattern is intact with initial Target

around 144 - 145 & then around 160 - 161.

It should not break 105 - 106 now.

Stance: Buy on Dips can be a Good Strategy.

GAL | When To, How To?The weekly chart of GAL shows a strong bullish reversal after a prolonged correction phase. The stock has surged by nearly 19% this week, indicating renewed buying interest and potential trend continuation. Key resistance zones lie at 610 (mid-term target) and 730 (final target), while support rests near the breakout area of 446. Sustaining above this level may lead to further upside, though minor pullbacks could occur as part of healthy profit-taking. Overall, the chart structure favors a bullish outlook with a medium- to long-term perspective.

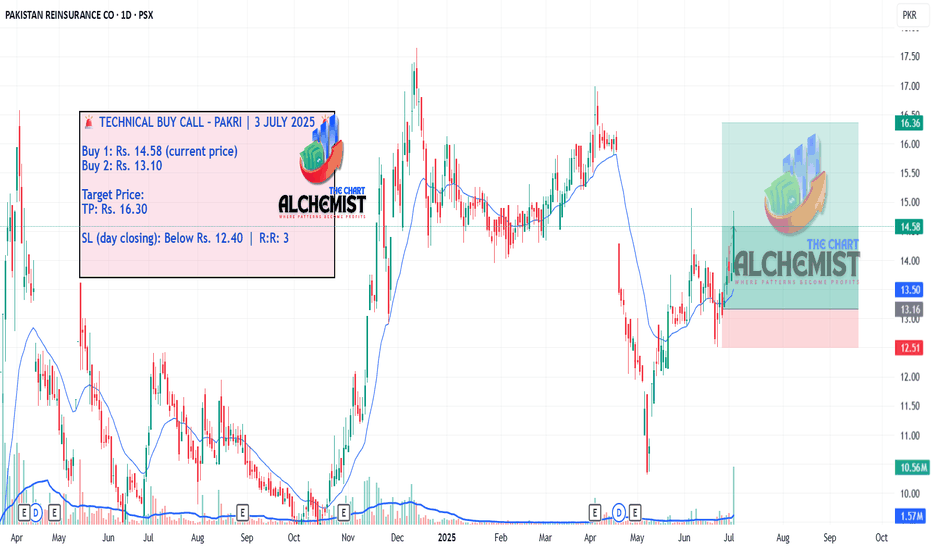

PAKRI LONG TRADE 03/07/2025PAKRI – LONG TRADE | 3 JULY 2025

After forming a selling climax at Rs. 10.30, PAKRIA gradually reversed and consolidated in a sideways range for several days. The latest price structure indicates a likely breakout move, suggesting renewed bullish momentum with a high probability of reaching the projected target.

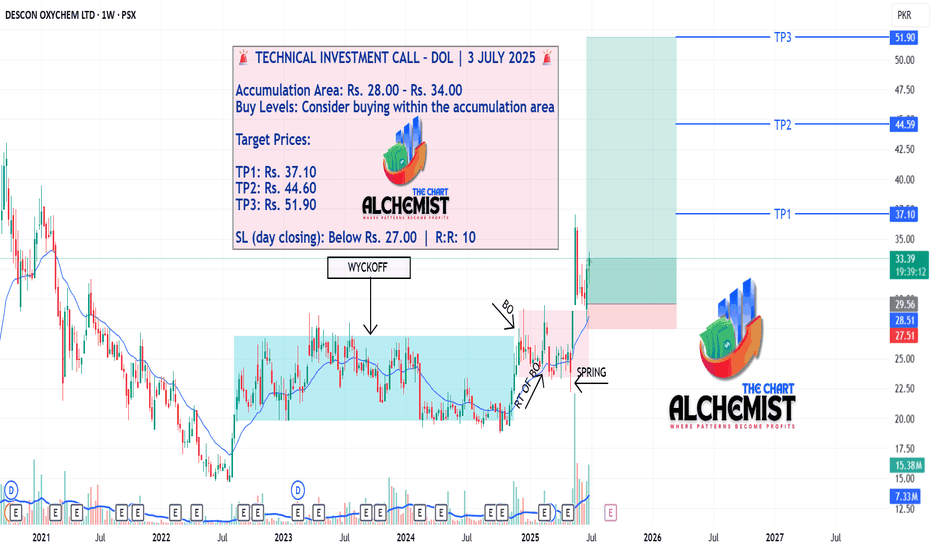

DOL LONG TRADE 03/07/2025DOL – LONG TRADE | 3 JULY 2025

DOL has moved through multiple trading ranges (highlighted with different colors) and has now completed its accumulation phase. Following a breakout from this zone, the stock has displayed solid momentum by achieving prior targets. The current technical structure indicates a high-probability investment setup, with potential for continued upside over the coming weeks.

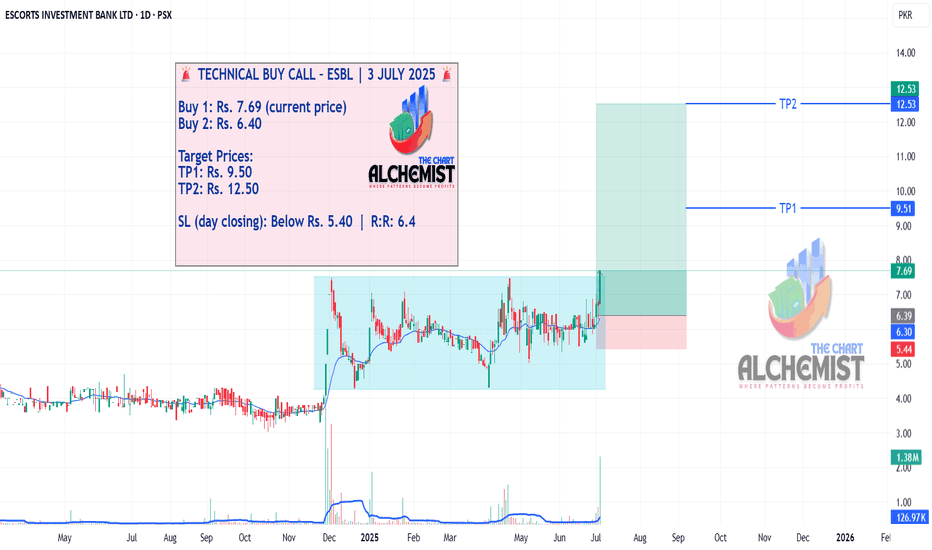

ESBL LONG TRADE 03/07/2025ESBL – LONG TRADE | 3 JULY 2025

ESBL is currently trading within a light blue range-bound channel, and today’s closing price action strongly indicates that this range is evolving into a Bull Flag pattern. This setup supports the expectation of a breakout move, with the potential to hit multiple quantified displacement targets.