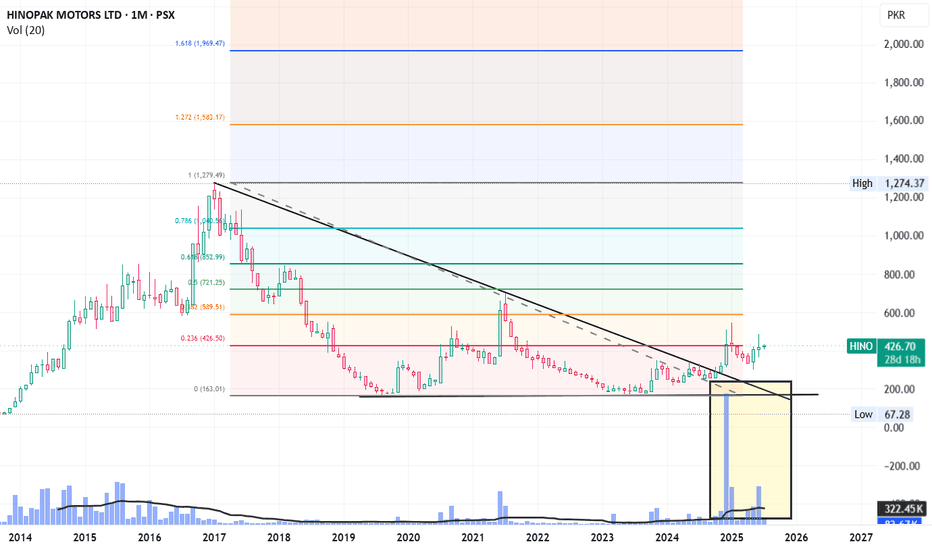

HINO LongHino broke its downward channel line in November 24. It posted a high of 545 in Jan 25 and came back to retest the level which broke the downward channel (~300).

Now it is exactly at its Fib 0.236 level, crossing which, it will pace up and move towards its next levels.

Next levels are: 545, 589, 721 and 853 in short to medium term.

Long terms target can be its all-time high level of 1274.

Its not a buy / sell call, just my personal opinion.

Daily, weekly and Monthly RSI are all at or around 60 that show positive momentum.

Moreover, the increasing volumes since it broke downward channel showing active players ;)

One thing to note that its free float is very low, that will cause its very fast move upward (whenever it may be)

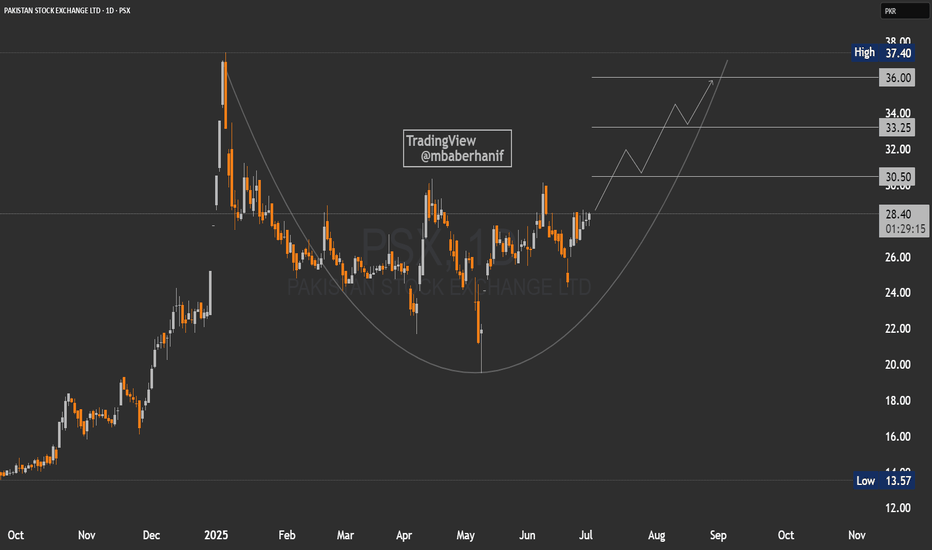

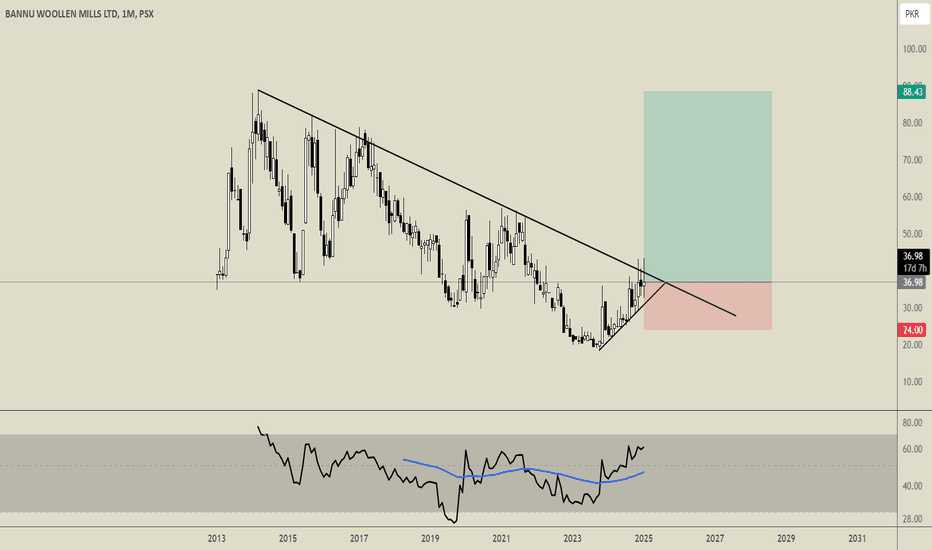

PSX | Bullish Trend🚀 Stock Alert: PSX

Pakistan Stock Exchange Limited

📈 Investment View: Technically Bullish 📈

🔍 Quick Info:

📈 Buying Level: 28.00

🎯 First Target: 30.50

🎯 Second Target: 33.25

🎯 Third Target: 36.00

⚠ Stop Loss: 25.33

⏳ Nature of Trade: Mid Term Trade Setup

📉 Risk & Reward Ratio: 1 : 3

☪ Shariah Compliant: NO

💰 Dividend Paying: NO

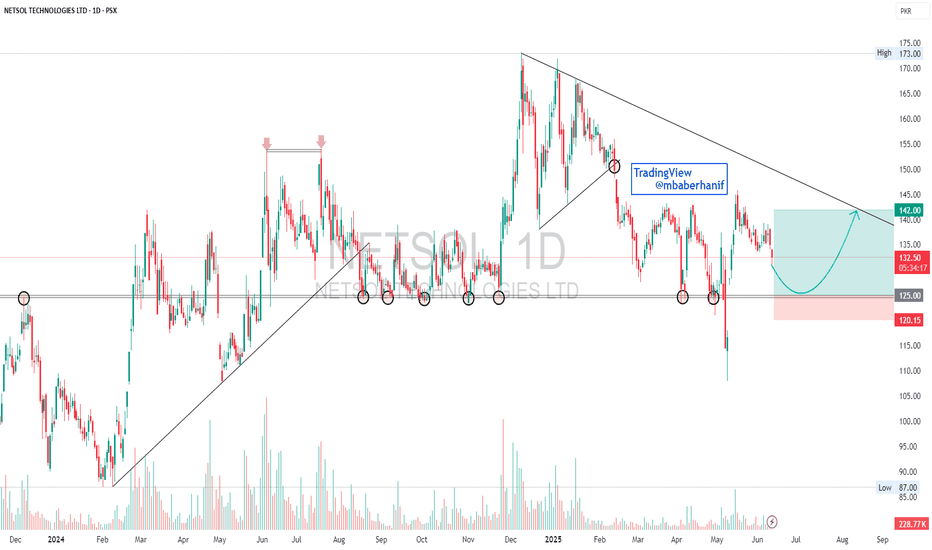

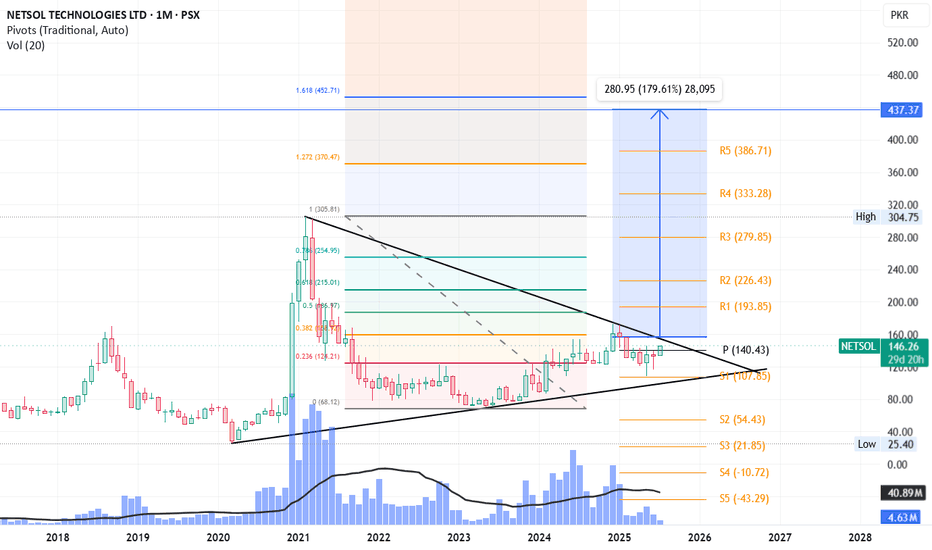

NETSOL | Swing Trade SetupTrading Note: NETSOL Technologies Ltd. (NETSOL) - Long Position Recommendation

Date: June 13, 2025

Subject: Potential Long Opportunity from Major Support Level

Overview:

This note recommends considering a long position on NETSOL from its significant major support level around 125. Recent price action suggests a compelling opportunity for a bounce from this historically pivotal zone.

Analysis of the 125 Support Level:

The price level of 125 stands out as a critical major support for NETSOL. This level has consistently acted as a strong demand zone, where buying interest has historically emerged to halt downward momentum and initiate price reversals. Looking at past performance, the price has made several notable pullbacks from this area. Each time NETSOL has approached 125, leading to a rebound in price. This repeated rejection of lower prices at 125 underscores its importance as a robust psychological and technical barrier, indicating strong underlying demand. The recent sharp drop and subsequent bounce reinforce the continued relevance of this level.

Recommendation:

Based on the strong historical significance and recent price action, a long position is recommended from the major support level around 125. Traders should consider entry points near this level, potentially with a stop-loss placed just below the immediate lower support marked by the red zone on the chart (around 120) to manage risk.

Target:

Initial targets could be set towards the previously established resistance around the 142 range, aligning with the potential for a rebound towards the upper boundary of the indicated channel.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own due diligence and consult with a qualified financial advisor before making any investment decisions.

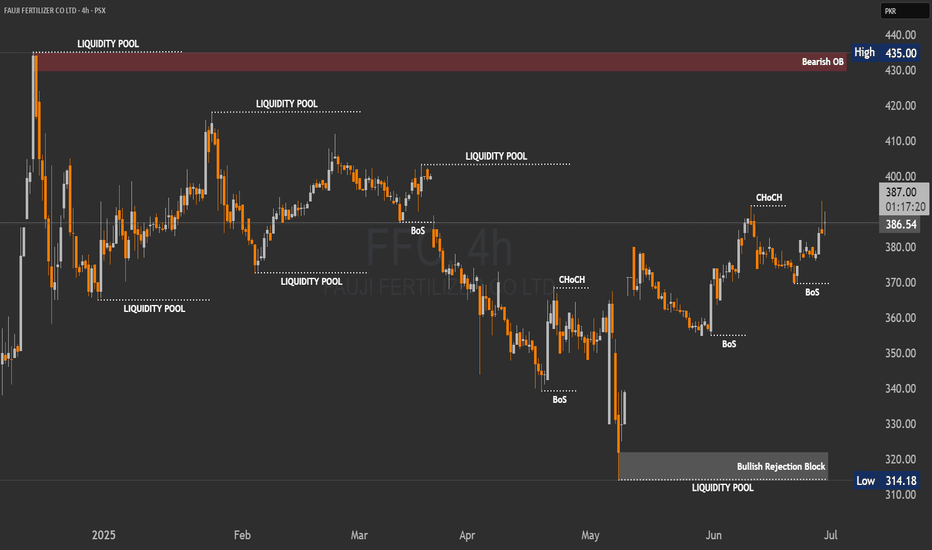

FFC | Ready for More Upside Before Another Fall?By analyzing the FFC chart on the 4-hour timeframe, we can see that price initially followed our bullish scenario, climbing 23 rupees up to 393. However, after hitting that level, price reversed and currently trading around 389 and eventually finding support around 376.

This area acted as a strong demand zone. Currently, FFC is trading around 389, and as long as price holds above the marked demand zone, we may expect another bullish move towards 390 and 400.