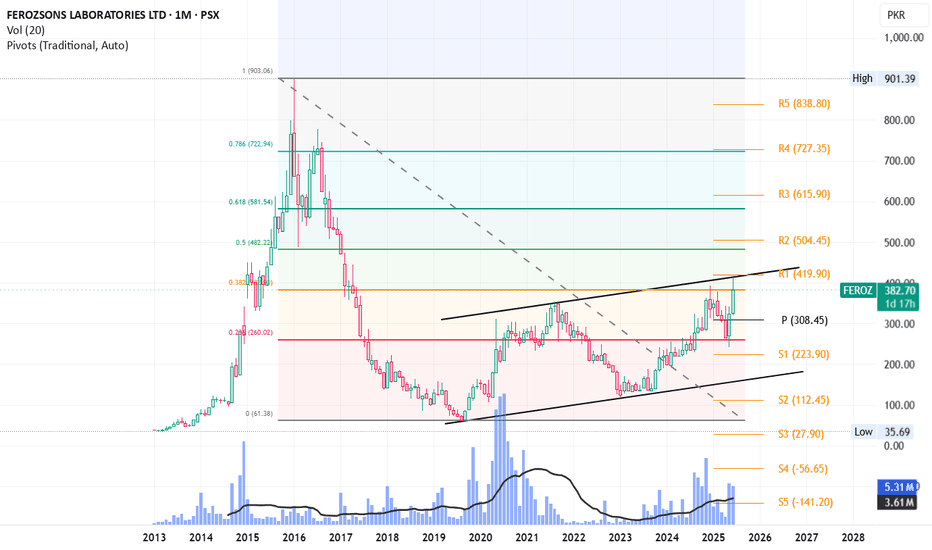

FEROZ LongFEROZ just touched its channel top this month and breaking it (410) will open up its way to further upside targets of 482, 581 and then 722 in medium term.

Further, a beautiful inverse head and shoulders formation is already complete... Breakout expected next month insha Allah.

Its my personal opinion, not a buy / sell call

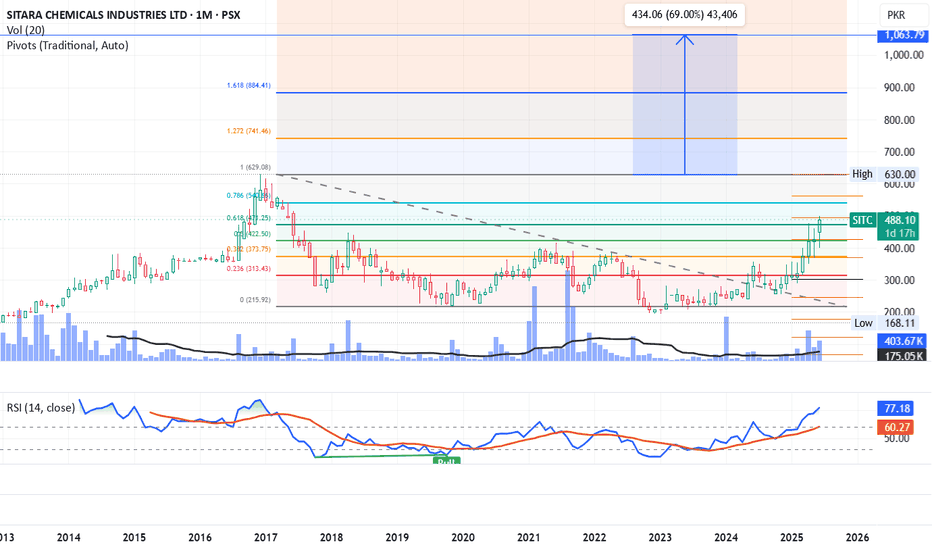

SITC Long Trade - Breakout almost confirmedSITC has given a breakout from Fib 0.618 of previous all-time high level on monthly time frame which will be confirmed on monthly closing.

Next targets are 540 (Fib 0.786) and then previous all time high 630.

Crossing it will open up gates to 1,000+

RSI is in bullish zone. Volumes of last two days confirm the breakout as well.

Its my personal analysis, not a buy / sell call.

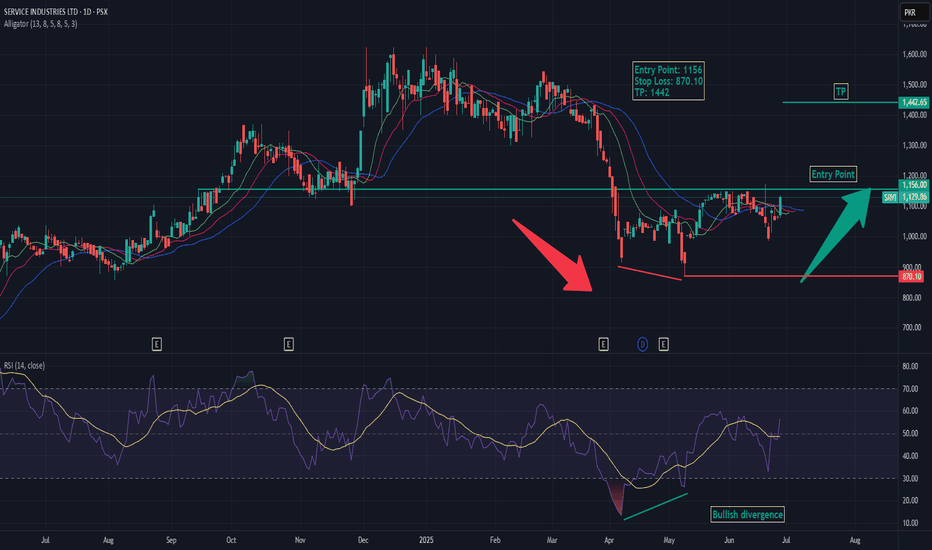

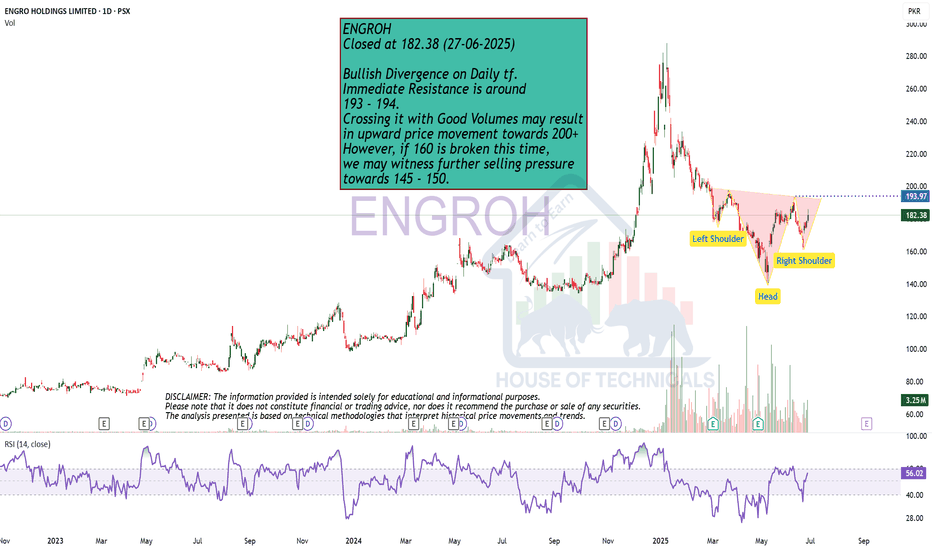

Bullish Divergence on Daily tf.ENGROH

Closed at 182.38 (27-06-2025)

Bullish Divergence on Daily tf.

Immediate Resistance is around

193 - 194.

Crossing it with Good Volumes may result

in upward price movement towards 200+

However, if 160 is broken this time,

we may witness further selling pressure

towards 145 - 150.

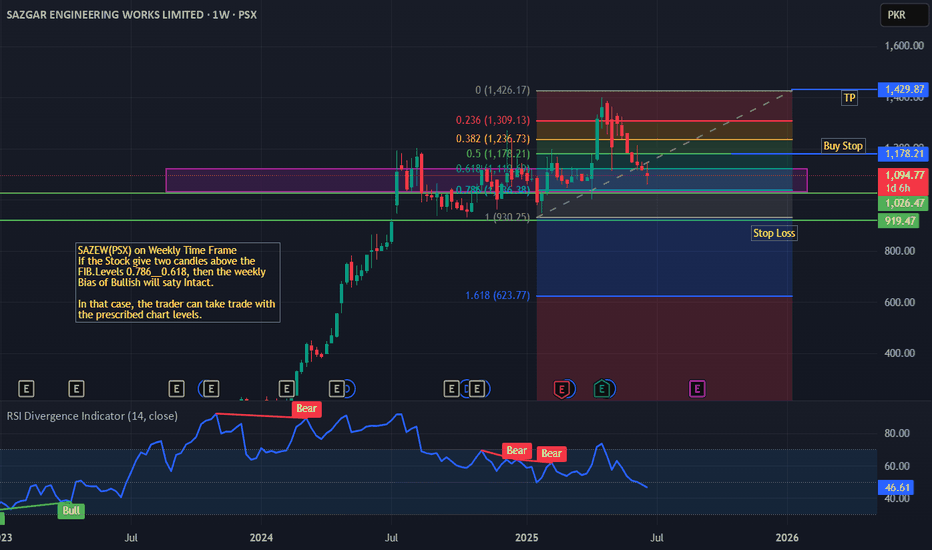

SAZEW (PSX) – Weekly Time Frame Technical AnalysisThe chart represents a Fibonacci retracement-based setup for a potential bullish continuation, provided key levels are respected.

Current Price: PKR 1,094.77

The price is hovering between the critical Fibonacci levels of 0.618 (PKR 1,178.21) and 0.786 (PKR 1,138.38).

If the stock closes two consecutive weekly candles above these Fib levels, the bullish bias will remain intact, signaling a continuation of the upward trend.

Trade Setup:

Buy Stop: Above PKR 1,178.21

Stop Loss: PKR 919.47 (below key support and Fib retracement zone)

Take Profit (TP): PKR 1,429.87, aligned with the 0-level from the previous swing high

RSI Indicator (14):

RSI is at 46.61, showing a neutral-to-weak bias with recent bearish divergence signals.

However, a break above resistance with volume may invalidate the bearish pressure.

Summary:

The chart suggests a conditional long setup. Traders should wait for confirmation through two weekly bullish closes above the 0.618–0.786 retracement zone. If confirmed, the path toward the 1,430 PKR target remains technically feasible, with a clearly defined stop loss to manage risk.